- Home

- »

- Pharmaceuticals

- »

-

Astaxanthin Market Size And Share, Industry Report, 2033GVR Report cover

![Astaxanthin Market Size, Share & Trends Report]()

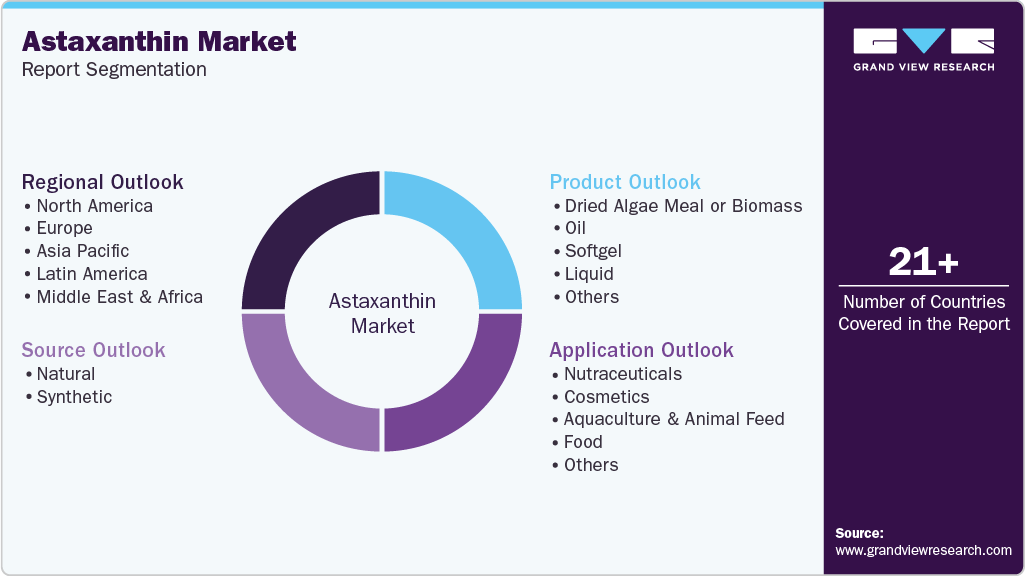

Astaxanthin Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Oil, Softgel, Liquid, Dried algae meal or Biomass), By Source (Natural, Synthetic), By Application (Cosmetics, Nutraceuticals, Food), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-957-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Astaxanthin Market Summary

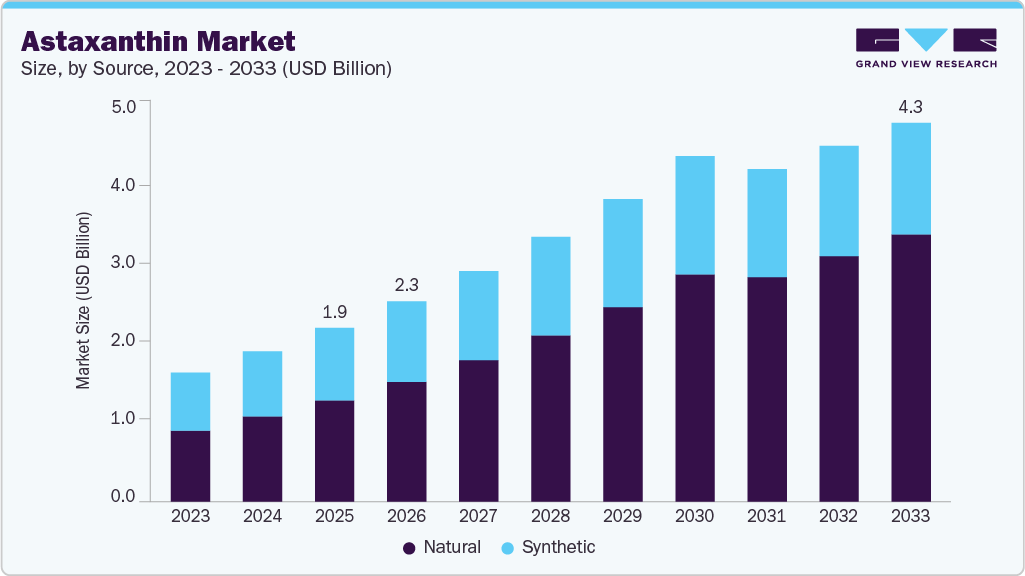

The global astaxanthin market size was estimated at USD 1.96 billion in 2025 and is anticipated to reach USD 4.27 billion by 2033, growing at a CAGR of 9.54% from 2026 to 2033. The growing demand for astaxanthin is being fueled by its increasing use in various industries, including aquaculture, animal feed, nutraceuticals, cosmetics, pharmaceuticals, and food and beverages, among others.

Key Market Trends & Insights

- The North America astaxanthin market accounted for the largest share of 35.01% in 2025.

- The U.S. astaxanthin market is expanding, driven by the rising demand for natural antioxidants.

- By source, the natural segment held the largest revenue share of 58.37% in 2025.

- By product, dried algae meal or biomass accounted for the largest share of 24.95% in 2025.

- By application, the aquaculture & animal feed segment held the largest share of 45.74% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.96 Billion

- 2033 Projected Market Size: USD 4.27 Billion

- CAGR (2026-2033): 9.54%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rising awareness about nutrition for a healthy lifestyle and the increasing preference for dietary supplements owing to the high hospitalization cost are projected to drive the demand for nutraceuticals & natural antioxidants. The market players are significantly increasing their production capacities to compete with the growing demand for nutraceutical products. For instance, in April 2023, Algalif announced that its 12,500 m² sustainable natural astaxanthin production facility in Iceland was progressing as planned. The USD 30 million expansion, initiated in summer 2021, is expected to be fully operational by the end of 2023. This significant investment underscores. Furthermore, in April 2022, Beijing Gingko Group announced a second expansion of its pristine region’s astaxanthin farm capacity in the last 2 years, which would maximize its production capacity. Algatech Ltd. increased its production capacity threefold for FucoVital, a product derived from brown algae, to fulfill the increasing demand for the dietary supplements market.

The introduction of advanced technologies to increase astaxanthin production is expected to boost market growth. For instance, in March 2024, Kuehnle AgroSystems (KAS) secured USD 3 million in Series A2 funding, led by S2G Ventures. This investment aims to accelerate the commercialization of KAS’s innovative approach to producing natural astaxanthin. Utilizing a patented dark fermentation process, KAS offers a solution that delivers higher yields, lower costs, and reduced resource consumption compared to conventional methods. This advancement supports the shift from synthetic to natural, addressing a market valued at USD 3.7 billion and driven by increasing consumer preference for natural, sustainable products.

Increasing concerns about the adverse effects of chemicals and the growing use of synthetic additives in edible products and topical applications are some of the factors responsible for the increasing adoption of natural alternatives. In August 2024, a study published in the Journal of Ovarian Research highlighted that astaxanthin (AST) supplementation could enhance assisted reproductive technology (ART) outcomes. The research found that AST improves oocyte quality and reduces oxidative stress (OS) in reproductive organs, supporting its role in promoting reproductive health. Astaxanthin's demonstrated ability to enhance oocyte quality and minimize oxidative damage reinforces its potential for pharmaceutical applications. As oxidative stress is a key factor in many health conditions, astaxanthin could see broader adoption in treatments for reproductive and other oxidative stress-related disorders.

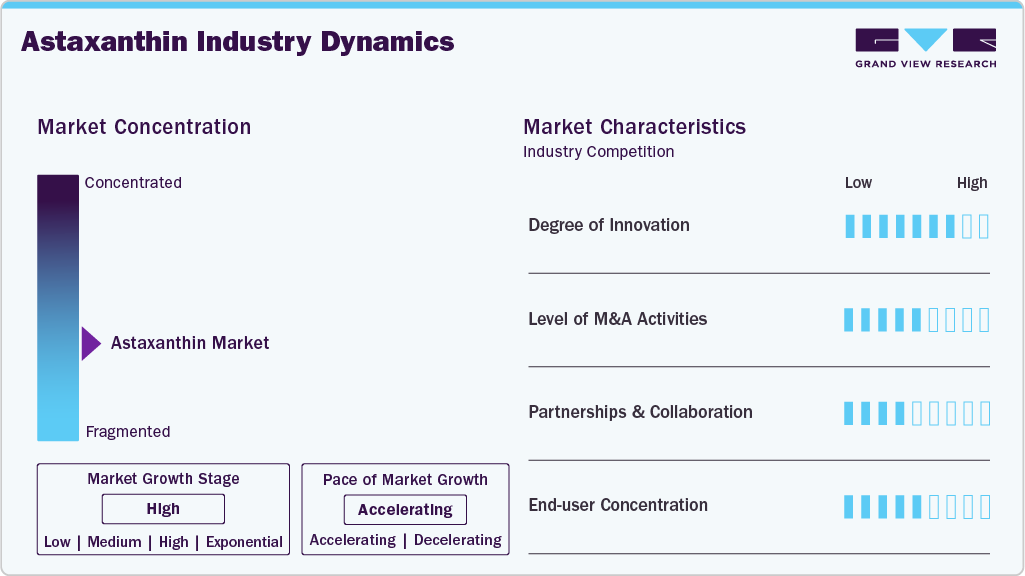

Market Concentration & Characteristics

The astaxanthin industry showcases a high degree of innovation, with companies developing novel formulations and sustainable production methods. For example, Sirio Europe (SIRIO) revealed in August 2023 its plan to introduce two new softgel products targeting the pharmaceutical sector during the CPHI Barcelona 2023 event.

The astaxanthin industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. In January 2022, ENEOS Corporation disclosed its acquisition of Ecocert Inputs Attestation, a globally recognized certification organization. This strategic move strengthens ENEOS' position in the astaxanthin industry, particularly for Panaferd-AX. The merger reflects the company's commitment to quality and international standards, contributing to the evolution of the sector.

The astaxanthin industry is also subject to regulatory scrutiny. Under DSHEA, dietary supplements such as astaxanthin are considered to be food products rather than drugs and therefore do not require premarket approval by the FDA. However, supplement manufacturers are still required to ensure that their products are safe and accurately labeled. The FDA has the authority to take enforcement action against any supplement product that is found to be unsafe or misbranded.

The market is witnessing innovation as dietary lutein emerges as a potential substitute. Companies are exploring the incorporation of lutein-rich sources into formulations, tapping into their antioxidant properties. This shift underscores a trend towards diversification and the exploration of alternative natural compounds within the dynamic astaxanthin industry.

End-user concentration in the astaxanthin industry is evident in the rising demand from sectors like nutraceuticals, cosmetics, and aquaculture. For instance, cosmetic companies are increasingly incorporating astaxanthin for its skin health benefits, showcasing a targeted approach by end-users to leverage the unique properties of this potent antioxidant for specific applications.

Source Insights

The natural segment held the largest revenue share of 58.37% in 2025 and is anticipated to grow at a rapid rate during the forecast period, owing to advantages such as high efficacy and sustainability. Currently, it is used to treat hypercholesterolemia, stroke, Parkinson’s disease, Alzheimer’s disease, and cancer. Moreover, natural astaxanthin has very good effects on the skin and eyes, as many studies reported the use of these products in the treatment of ophthalmic diseases such as cataract, uveitis, & glaucoma, and skin photo-aging treatments, as it has 10 times higher free radical inhibitory action than other antioxidants. Moreover, ongoing research activities to enhance the quality and usage of yeast-derived products are expected to boost segment growth. For instance, in February 2023, according to research by China Medical University Hospital, National Chung Hsing University, and National Taiwan Ocean University, genetically modified yeast could be a promising source of astaxanthin for shrimp feeds.

Synthetic is expected to grow during the forecast period due to its high purity, batch consistency, and cost-effectiveness, meeting large-scale production demands. Advancements in production methods and regulatory support will further drive adoption. The aquaculture industry, particularly shrimp farming, relies on synthetic variants to improve feed efficiency, growth performance, pigmentation, and product quality. A study in Aquaculture Reports (December 2023) confirmed synthetic variants’ superior performance over natural ones in enhancing shrimp growth and pigmentation, promoting them as a sustainable, economical feed additive. This positions synthetic products as a key driver for market expansion.

Product Insights

Dried algae meal or biomass accounted for the highest share of 24.95% in 2025 due to its high yield and cost-effectiveness. A December 2024 study in the International Journal of Biological Macromolecules demonstrated that using an alginate hydrogel membrane (AHM) with cotton gauze for cultivating Haematococcus pluvialis increased productivity by 70.8%, with a 55.2% improvement over conventional methods. This advanced technique optimizes cultivation parameters, such as light intensity and inoculum density, enhancing biomass yield and reducing production costs. The segment's scalability and efficiency make it crucial for meeting rising demand in industries such as supplements, animal feed, and cosmetics. In addition, dried biomass simplifies downstream extraction, ensuring high-quality products, reinforcing its market dominance.

The softgel segment is projected to grow at a high rate during the forecast period due to its ability to enhance bioavailability and simplify consumption. The segment benefits from increased demand for dietary supplements and the rising use of the ingredient in nutraceutical applications, including eye and skin health. The format’s capability to protect the ingredient from oxidation supports its market acceptance. In addition, the growing awareness of its functional properties, particularly its role in antioxidant support, is expected to drive the segment's growth, making it a significant contributor to the overall market.

Application Insights

The aquaculture & animal feed segment accounted for the highest share of 45.74% in 2025, owing to its extensive use as a feed additive. Natural variants are used as feed to induce reddish pigmentation in salmon, trout, and shrimp, which is an important factor driving consumer preference. The oil can also increase feed uptake, resulting in faster growth of shrimp. Thus, the increasing adoption of these products in the aquaculture industry for improving seafood quality is contributing to the segment’s significant share in the market. In addition, key players are introducing novel products for animal feed with medical benefits. For instance, in July 2022, AstaReal introduced Novasta, an ingredient designed for use in animal feed. This product launch expands the potential for health-enhancing applications in the field of animal nutrition.

Nutraceutical is projected to grow rapidly due to increasing demand for natural variants and continuous product innovations by key players. In October 2023, Divi’s Nutraceuticals collaborated with Algalif to introduce highly concentrated beadlets. In addition, the European Commission approved the use of oleoresin-rich products in food supplements for younger age groups, with dosage guidelines ranging from 2.3 mg/day for children to 8 mg/day for adults. These advancements address rising consumer interest in preventative health solutions, driving the adoption of these products in nutraceutical applications across diverse age groups.

Regional Insights

North America held the largest astaxanthin market share, accounting for 35.01% in 2025. Consumers in the region show a high preference for premium wellness products that improve immunity and skin health. Expanding applications in functional foods is creating steady growth potential. Investments in algae-based cultivation facilities are improving supply stability. The presence of key nutraceutical brands is strengthening regional competitiveness. Rising interest in sports nutrition is further enhancing product adoption.

U.S. Astaxanthin Market Trends

The astaxanthin market in the U.S. holds a major share of the North American market due to high awareness of natural ingredients. The country shows strong consumption in supplement formats aimed at eye health and cellular protection. Growth in the beauty from within trend is increasing demand for oral beauty products. Innovation in microalgae production technologies is improving product quality. Online retail channels are expanding access to premium formulations. The presence of strict quality standards supports consumer trust.

Europe Astaxanthin Market Trends

The astaxanthin market in Europe demonstrates steady progress driven by rising preference for natural carotenoids in health and wellness. Regulatory support for clean label ingredients is improving market visibility. Demand is growing in the food and beverage sector through fortified products. Expansion of sustainable algae farming projects is improving regional output. Increasing focus on preventive healthcare is strengthening long-term consumption. The region also benefits from strong distribution networks across member countries.

The UK astaxanthin market is supported by rising interest in antioxidant-rich supplements for healthy aging. Consumers are shifting toward natural marine-based ingredients in daily nutrition. Product launches in the sports health category are driving new opportunities. Growth in vegan and plant-based consumption patterns is strengthening demand. Retailers are expanding their supplement offerings through both physical stores and digital platforms. A strong scientific research culture is increasing awareness of astaxanthin benefits.

The astaxanthin market in Germany shows strong adoption due to the rising use of premium dietary supplements focused on eye, heart, and skin health. The country has a well-established nutraceutical industry that encourages high-quality products. Manufacturers are investing in natural carotenoid research to enhance product efficacy. Demand in the functional food sector is gradually expanding. Interest in algae cultivation technologies is improving raw material availability. Strong consumer trust in evidence-based health products is supporting stable market growth.

France astaxanthin market exhibits a rising demand for astaxanthin through beauty, wellness, and healthy aging applications. The popularity of premium skincare supplements is boosting market performance. French consumers show a strong interest in natural marine-sourced ingredients. Investments in algae-based biotechnology firms are expanding production capabilities. Retail pharmacies are driving consistent sales through specialized supplement channels. The country's focus on holistic wellness continues to support long-term uptake.

Asia Pacific Astaxanthin Market Trends

The astaxanthin market in the Asia Pacific is the fastest-growing region due to expanding health awareness and rising income levels. Supplement manufacturers are increasing their focus on antioxidant-based formulations. The region is becoming a major production hub for microalgae cultivation. Food and beverage producers are incorporating Astaxanthin into fortified products. Sports nutrition demand is advancing rapidly among younger populations. Strong retail expansion is improving access to both domestic and imported brands.

Japan astaxanthin market maintains a strong demand driven by aging population needs and an advanced supplement culture. The country shows high consumption of marine-derived antioxidant products. Strict quality regulations support premium product development. Consumer interest in eye health and skin nourishment solutions remains strong. Food firms are exploring new functional beverages infused with astaxanthin. Innovation in microencapsulation methods is enhancing product stability.

The astaxanthin market in China shows rapid market expansion supported by rising health consciousness and strong algae production capacity. Local manufacturers are increasing investments in advanced cultivation systems. Demand in the beauty supplements category is driving significant volume growth. Functional beverages formulated with natural antioxidants are gaining consumer attention. E-commerce platforms are becoming key distribution channels. Government support for biotechnology innovation is strengthening the overall ecosystem.

Latin America Astaxanthin Market Trends

The astaxanthin market in Latin America is witnessing rising interest in natural antioxidants for general wellness. The growing use of dietary supplements is expanding market opportunities. Countries in the region are adopting algae farming projects to support local sourcing. Beauty and wellness brands are promoting Astaxanthin-based products for skin benefits. Distribution through pharmacies and specialty stores is increasing market reach. Consumer education initiatives are improving product acceptance.

Brazil astaxanthin market leads the Latin American market due to strong nutraceutical demand and growing adoption of marine-based ingredients. Health-conscious consumers are driving the shift toward natural antioxidant supplements. Investments in algae cultivation projects are improving the domestic supply. Sports health products infused with Astaxanthin are gaining popularity. Local companies are expanding product lines targeting skin vitality and immune support. Retail expansion through digital channels is supporting faster market penetration.

Middle East & Africa Astaxanthin Market Trends

The astaxanthin market in the Middle East and Africa region shows gradual growth supported by rising interest in health supplements. Urban consumers are demonstrating stronger demand for natural antioxidant products. Importers are expanding the availability of premium formulations from global brands. The beauty sector is incorporating Astaxanthin into oral beauty products. Retail pharmacies are strengthening distribution across major cities. Increasing awareness campaigns are improving the understanding of product benefits.

Saudi Arabia astaxanthin market displays steady demand driven by a rising focus on preventive healthcare. Consumers are adopting high-quality supplements for skin, eye, and immune health. Government initiatives supporting health and wellness are improving market conditions. Pharmacies and health stores are widening their premium supplement offerings. The presence of a young population is increasing the uptake of sports nutrition products. Growing digital retail platforms are enhancing product accessibility.

Key Astaxanthin Company Insights

Some of the key players operating in the market include Algatech Ltd, Cyanotech Corporation, and ALGAMO. The market is highly competitive, with key players emphasizing sustainability, innovation, and quality. Algatech Ltd leads with its sustainable algae cultivation methods and large-scale production. Cyanotech Corporation, known for its Hawaiian-sourced microalgae, excels in product quality and environmental responsibility. Key players are focusing on innovation, sustainability, and quality by prioritizing advanced cultivation methods, expanding distribution, and forming strategic partnerships.

Key Astaxanthin Companies:

The following are the leading companies in the astaxanthin market. These companies collectively hold the largest market share and dictate industry trends.

- Algatech Ltd.

- Cyanotech Corporation

- Algalíf Iceland ehf

- Beijing Gingko Group (BGG)

- PIVEG, Inc.

- Fuji Chemical Industries Co., Ltd

- ENEOS Corporation

- Atacama Bio Natural Products S.A.

- E.I.D. - Parry (India) Limited

- ALGAMO

Recent Developments

-

In March 2024, Nutrex-Hawaii, Inc., a subsidiary of Cyanotech Corporation, introduced a sugar-free gummy version of its top-selling BioAstin Hawaiian Astaxanthin dietary supplement, featuring an impressive 12mg of natural Hawaiian astaxanthin per daily serving. This innovative product is likely to strengthen Cyanotech's market position by catering to the growing demand for convenient, health-focused supplements.

-

In April 2023, Algalif announced that construction of its 12,500 m² sustainable natural astaxanthin production facility in Iceland was progressing as planned. The USD 30 million expansion, initiated in summer 2021, is expected to be fully operational by the end of 2023. This significant investment underscores Algalif's commitment to meeting the growing global demand for high-quality astaxanthin.

-

In April 2023, Algalíf and Divis Nutraceuticals announced a partnership that resulted in the launch of AstaBead, a groundbreaking astaxanthin product. The collaboration has now introduced an improved version of AstaBead, reflecting ongoing innovation and advancements. This enhanced product is poised to elevate quality standards in the market further, offering consumers improved benefits and expanding its applications in health and wellness, thereby driving increased competitiveness and market growth.

Astaxanthin Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.26 billion

Revenue forecast in 2033

USD 4.27 billion

Growth rate

CAGR of 9.54% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Algatech Ltd; Cyanotech Corporation; Algalíf Iceland ehf; Beijing Gingko Group (BGG); PIVEG, Inc.; Fuji Chemical Industries Co., Ltd.; ENEOS Corporation; Atacama Bio Natural Products S.A.; E.I.D. - Parry (India) Limited; ALGAMO

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Astaxanthin Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the astaxanthin market based on source, product, application, and region:

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Yeast

-

Krill/Shrimp

-

Microalgae

-

Others

-

-

Synthetic

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dried algae meal or Biomass

-

Oil

-

Softgel

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Nutraceuticals

-

Cosmetics

-

Aquaculture and animal Feed

-

Food

-

Functional foods and beverages

-

Other traditional food manufacturing applications

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global astaxanthin market size was estimated at USD 1.96 billion in 2025 and is expected to reach USD 2.26 billion in 2026.

b. The global astaxanthin market is expected to grow at a compound annual growth rate of 9.54% from 2026 to 2033 and is expected to reach USD 4.27 billion by 2033.

b. The natural astaxanthin segment is expected to dominate the astaxanthin market with a share of 58.37% in 2025 due to its great demand in feed, food, pharmaceutical, and nutraceutical applications coupled with a high yield of carotenoid, increasing demand for natural food supplements, and low maintenance costs.

b. Some key players operating in the astaxanthin market include Algatech Ltd, Cyanotech Corporation, Beijing Gingko Group (BGG), Algalíf Iceland ehf, and Fuji Chemical Industries Co., Ltd among others.

b. Increasing demand for nutraceuticals and natural antioxidants, introduction of advanced technologies, increase in adoption of natural cosmetics, nutraceuticals, and pharmaceuticals, and increased use in aquaculture and coloring of fish are the major factors driving the astaxanthin market growth over the forecast period.

b. North America held the largest share of 35.01% in 2025 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the increasing adoption of natural nutraceutical products, presence of strong market players, and increasing awareness among people.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.