- Home

- »

- Medical Devices

- »

-

Asia Pacific Cannabidiol Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Cannabidiol Market Size, Share & Trends Report]()

Asia Pacific Cannabidiol Market (2024 - 2030) Size, Share & Trends Analysis Report By Source Type (Hemp, Marijuana), By Sales Type (B2B, B2C), By End-use (Medical, Personal Use), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-207-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Cannabidiol Market Trends

The Asia Pacific cannabidiol market size was estimated at USD 440.5 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 24.1% from 2024 to 2030. The cannabidiol (CBD) market in Asia Pacific is predicted to expand in line with the growing acceptance and legalization of products based on hemp,increasing awareness of potential health benefits. To cater to consumer demand, companies are creating a diverse range of products infused with cannabidiol, such as edibles, topicals, and beverages. The advent of e-commerce has enabled these companies to tap into a larger customer base and boost their sales via online platforms, which has had a positive influence on the growth forecasts for the CBD industry.

Asia Pacific is the third largest region in the global CBD market. CBD, a non-psychoactive compound found in hemp, is sold in a multitude of forms including capsules, edibles, hemp oil, and vaping e-liquid. Companies like Eos Scientific, under the umbrella term of Ambiance Cosmetics, have launched six CBD-infused cosmetic lines, featuring products like oils, balms, and moisturizers. As knowledge about CBD’s potential health benefits grows, so does investment in research and development to better comprehend its effects and develop new products. This has led to an increasingly competitive CBD market with more companies offering similar products, thereby expanding the market size.

CBD, unlike its primary produce, cannabis, is facing restrictions in many Asian and African countries. Asian countries rarely promote using cannabis-based products, even for medical purposes. These countries have strict laws and stringent punishments for those caught or found consuming CBD-based products and are not in favor of relaxing these laws or decriminalizing use of CBD. Thus, very few countries have legalized the use of cannabis for medical purposes. For instance, drug regulations in Indonesia are so stringent that they include life imprisonment, USD 1.2 million fine, and even death penalty for those found consuming illegal drugs, including cannabis. This is expected to hinder the medical cannabis market in these regions. Moreover, countries such as India have still not taken any decisions related to CBD products. Therefore, patients must rely on import of CBD-based medicines after receiving special permissions, which makes products quite expensive for consumers.

Market Concentration & Characteristics

The Asia Pacific CBD market is at a high growth stage and is expected to continue its growth trajectory from 2024 to 2030. Increasing adoption of CBD oil and infused products among the youth population for its health and wellness benefits will propel the market growth.

The region’s scientific and research capabilities are expanding, leading to intensive research on CBD’s potential applications. Companies are constantly innovating to create CBD-infused products like beverages, skincare, and pet treats. This region has witnessed various products like CBD oil, CBD concentrates and CBD isolates.

The demand for CBD products is growing rapidly in the Asia Pacific region, as consumers become more aware of its health benefits. The governments in this region are becoming more accepting of cannabis products, which creates more opportunities for the market players. For example, in 2022, Aurora Canabis acquired Austrade Herbs, an Australian hemp and CBD company. This deal gave Aurora a significant presence in the CBD market in Australia and an access to their distribution channels.

The market is poised to have significant growth in the coming years but is greatly impacted by government regulations. Strict restrictions, like bans or high THC limits, can restrict product availability and limit market access. The frequent changes in regulations create an uncertain market for business, making it difficult to plan a long-term investment. Complex regulations can lead to high compliance cost for nosiness, making it challenging for smaller companies to establish growth. But the regulatory landscape in the region is diverse for different countries. Moreover, recent trends show a shift towards more progressive regulations, driven by the increasing consumer demands and scientific evidence.

Rising awareness of CBD’s potential health benefits to alleviate symptoms of various conditions, including anxiety, pain, sleep disorders and skin problems are expected to increase the product expansion in this region. Products like CBD oils & tinctures, CBD edibles, CBD topicals, and CBD pet products are set to have potential expansion. For instance, Hemp Naturals, an Australian company, has launched a range of CBD products in Australia and New Zealand.

CBD, unlike its primary produce, cannabis, is facing restrictions in many Asian countries. Regardless, countries like China are the largest hemp cultivator in Asia and cultivates nearly half of the world’s hemp production. The country also exports nearly 90% of its products to the U.S., Germany, the UK, the Netherlands, and Japan. Many companies are getting into partnerships to expand their market in different regions. For instance, in 2020, CV Sciences, a U.S.-based CBD company, partnered with Health Science Holdings to distribute its PlusCBD oil in Thailand.

Source Type Insights

In 2023, hemp derived CBD dominated the CBD oil market with a revenue share of 77.2%. This segment is also expected to be the fastest growing segment due to rising demand from the pharmaceutical industry and growing consumer awareness of health benefits. The approval of cannabis for medical use, along with a rise in consumer spending power, is expected to boost the pharmaceutical industry’s demand for cannabidiol. The surge in demand for CBD products includes oils, tinctures, concentrates, capsules, topical solutions such as salves, lip balms, lotions, and edibles like baked goods, coffee, chocolate, gum, and candies.

Furthermore, CBD obtained from hemp is quickly becoming popular due to its anti-inflammatory, anti-aging, and antioxidant properties. Various sectors, including pharmaceuticals, personal care products, nutraceuticals, and food and beverage companies, are creating products that include CBD for health and wellness reasons. As a result of these factors, this sector is expected to experience significant growth in the future.

End-use Insights

In B2B end-use, pharmaceuticals accounted for the largest revenue share of 64.7% in 2023. The segment is expected to see substantial growth over the forecast period. The rise in clinical trials assessing the effects of CBD on various health conditions is likely to fuel the future demand for these products. In addition, numerous companies are purchasing CBD oil in large quantities and producing items infused with CBD, which are frequently used by consumers as a substitute for managing pain and stress. As a result, these products are expected to be in a phase of market growth.

The transition of cannabidiol from a component of herbal treatments to a prescribed medication is predicted to propel market expansion. Furthermore, the growing acknowledgment of the medical benefits of cannabidiol, including its therapeutic properties, is anticipated to spur the demand for these products in the pharmaceutical sector.

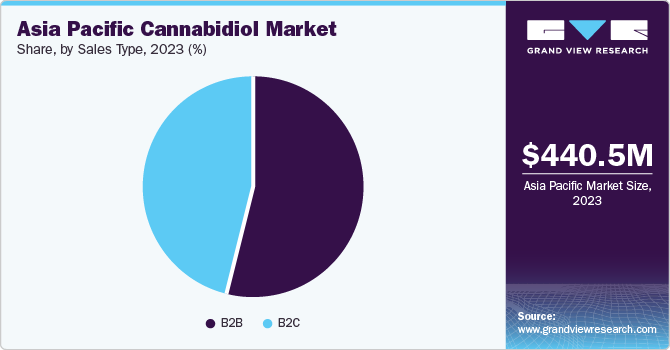

Sales Type Insights

B2B segment dominated the market and accounted for the largest revenue share of 64.7% in 2023. This segment is anticipated to grow at the fastest CAGR over the forecast period, owing to a rise in the number of wholesalers offering CBD oil and the growing demand for CBD oil as a raw material. The approval of CBD products in several countries has opened more opportunities for distribution, thanks to an expanding consumer base. This is anticipated to enhance market expansion.

The hospital pharmacies sub-segment within B2C is predicted to see substantial growth in the future. This growth is due to a rise in partnerships between companies and retail pharmacies to increase their presence and establish a specific section for customers to purchase CBD products. Moreover, the market is projected to offer a multitude of opportunities for market participants, fueled by an increase in pharmacies carrying these products, the formation of unique partnerships between companies and retail pharmacies, and a growing number of patients choosing CBD as a treatment option.

Country Insights

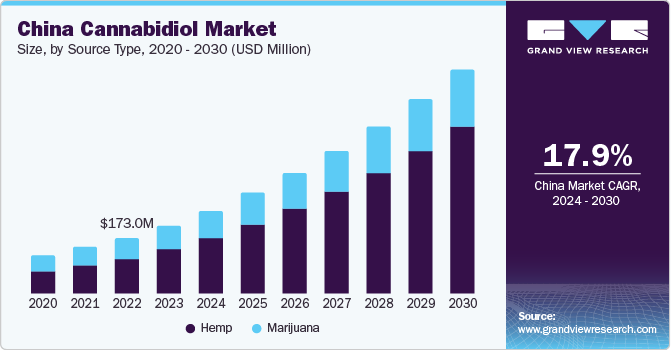

China Cannabidiol Market Trends

Cannabidiol market in China accounted for the largest revenue share of 47.7% in 2023 in the Asia Pacific. China exports nearly 90% of its products to other countries and is currently allowing the sale of hemp oil and the use of CBD in cosmetics. Therefore, China is a significant contributor in global CBD market. CBD products are provided by only four Chinese companies that hold special licenses to grow and process hemp. But as the market is booming, the number of cultivators and producers is expected to increase, which is likely to create a demand for CBD extracts such as oil, edibles, & tinctures. Moreover, growing awareness about CBD-based products and their application is expected to fuel market growth.

Australia Cannabidiol Market Trends

Cannabidiol market in Australia is expected to grow at a fastest CAGR of 34.1% from 2024 to 2030. Since the legalization of medical cannabis in Australia in 2016, the number of patients seeking a prescription for medical cannabis and its derived products has significantly increased. The number of companies operating in the medical cannabis market is also growing, with new companies being listed on the Australian Stock Exchange (ASX). Several local companies have begun applying for cultivation licenses and are being funded or acquired by major players.

India Cannabidiol Market Trends

Cannabidiol market in India is expected grow at a lucrative CAGR from 2024 to 2030, owing to the extensive use of CBD in cosmetic products, which has led to a revolution in the cosmetic industry in the country. Furthermore, various initiatives undertaken by key companies in the region are expected to boost the growth of the CBD market. For instance, in February 2023, a medical cannabis workshop was organized by Awshad, a Delhi-NCR-based cannabis wellness startup, at the PHD chamber in New Delhi. The primary objective of the workshop was to educate healthcare professionals on the application of CBD. Awshad aimed to provide valuable insights into the uses and benefits of CBD through the workshop. The event was organized to promote awareness and understanding of medical cannabis among healthcare professionals.

Key Cannabidiol Company Insights

Key cannabidiol (CBD) companies are focusing on numerous initiatives such as distribution partnerships and product innovation to maintain their position in the market. For instance, in October 2022, Charlotte's Web Holdings, Inc. announced a distribution partnership with Gopuff Retail Company. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies. Key players in the CBD medicine market offer customers diverse, technologically advanced, innovative products. Companies prominently adopt this strategy to expand their customer base.

Key Asia Pacific Cannabidiol Companies:

- Aurora Cannabis

- Tilray

- CV Sciences, Inc.

- CHARLOTTE’S WEB.

- Canopy Growth Corporation

- Maricann, Inc.

- Organigram Holding, Inc.

- Isodiol International, Inc.

- Elixinol

- NuLeaf Naturals, LLC

- Cannoid, LLC

- Endoca

Recent Developments

-

In April 2023, Aurora Cannabis, Inc. and MedReleaf Australia collaborated to introduce IndiMed Tempo 26, a line of new dried cannabis products with higher THC content for eligible patients under the MedReleaf Concession Scheme (MCS). The introduction of Tempo 26 to the product portfolio offers medical practitioners a broader range of prescription options for their cannabis patients.

-

In February 2023, a medical cannabis workshop was organized by Awshad, a Delhi-NCR-based cannabis wellness startup, at the PHD chamber in New Delhi. The primary objective of the workshop was to educate healthcare professionals on the application of CBD.

-

In June 2022, CHARLOTTE’S WEB signed a distribution agreement with Energy Hemp Biotechnology Ltd. This agreement gave Energy Hemp exclusive distribution rights for the company’s CBD products in Greater China region.

-

In March 2021, Tilray received the required approvals from New Zealand’s health ministry and the Medicinal Cannabis Agency to cater medicinal cannabis products to New Zealand markets.

Asia Pacific Cannabidiol Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.98 billion

Growth rate

CAGR of 24.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Source type, sales type, end-use, country

Regional scope

Asia Pacific

Country Scope

China; India; South Korea; New Zealand; Japan; Australia

Key Companies Profiled

Aurora Cannabis; Tilray; CV Sciences, Inc.; CHARLOTTE’S WEB.; Canopy Growth Corporation; Maricann, Inc.; Organigram Holding, Inc.; Isodiol International, Inc.; Elixinol; NuLeaf Naturals, LLC; Cannoid, LLC; Endoca

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Cannabidiol Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Aisa Pacific cannabidiol market report based on source type, sales type, end-use, and region:

-

Source Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Marijuana

-

-

Sales Type Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

By End-use

-

Pharmaceuticals

-

Wellness

-

Food & Beverages

-

Personal Care & Cosmetics

-

Nutraceuticals

-

Others

-

-

-

-

B2C

-

By Sales Channel

-

Hospital Pharmacies

-

Online

-

Retail Stores

-

-

By End-use

-

Medical

-

Chronic Pain

-

Mental Disorders

-

Cancer

-

Others

-

-

Personal Use

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Chronic Pain

-

Mental Disorders

-

Cancer

-

Others

-

-

Personal Use

-

Pharmaceuticals

-

Wellness

-

Food & Beverages

-

Personal Care & Cosmetics

-

Nutraceuticals

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

South Korea

-

New Zealand

-

Japan

-

Australia

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific cannabidiol market size was estimated at USD 440.5 million in 2023 and is expected to reach USD 543.3 million in 2024.

b. The Asia Pacific cannabidiol market is expected to grow at a compound annual growth rate of 24.1% from 2024 to 2030 to reach USD 1.98 billion by 2030.

b. The Hemp segment dominated the Asia Pacific CBD market and accounted for a revenue share of over 55.0% in 2023. This is attributable to the high availability of hemp-derived products in dispensaries, government-approved pharmacies, and stores.

b. Some key players operating in the Asia Pacific cannabidiol market include CV Sciences, Inc., VIVO Cannabis Inc., Gaia Herbs Hemp, Phoena Holdings Inc., Medical Marijuana, Inc., The Cronos Group, CHARLOTTE'S WEB, HEXO Corp., Aurora Cannabis, Canopy Growth Corporation, Jazz Pharmaceuticals, Inc., and Tilray, among others.

b. Key factors that are driving the Asia Pacific CBD market growth include increasing demand for cannabidiol (CBD) for medical and wellness purposes owing to its healing properties, growing legalization of hemp-based products, and rising recognition of therapeutic benefits of cannabidiol.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.