- Home

- »

- Healthcare IT

- »

-

Asia Pacific Digital Health Market Size, Industry Report 2033GVR Report cover

![Asia Pacific Digital Health Market Size, Share & Trends Report]()

Asia Pacific Digital Health Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Tele-healthcare, mHealth), By Component (Software, Hardware, Services), By Application, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-916-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Digital Health Market Summary

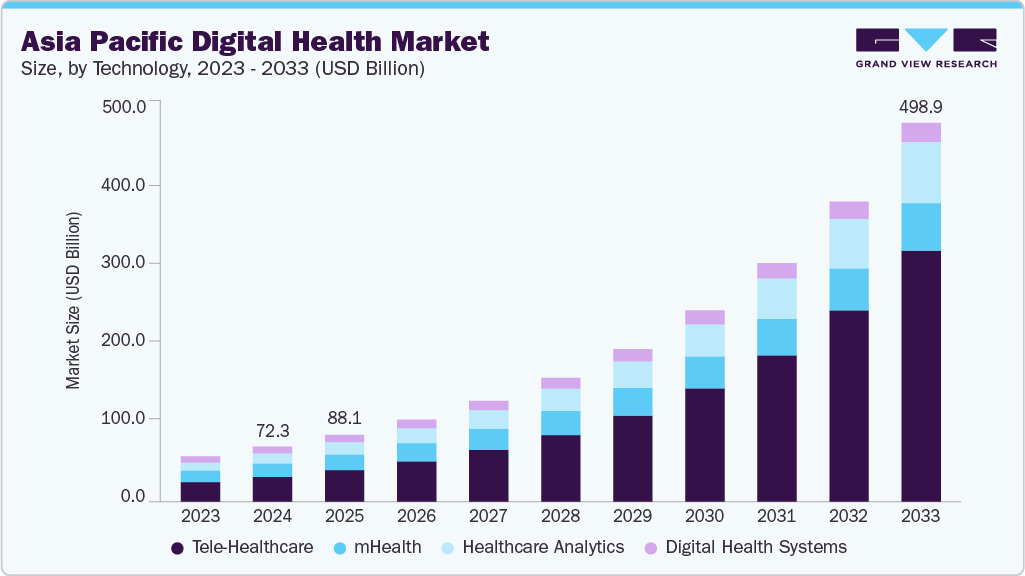

The Asia Pacific digital health market size was estimated at USD 72.28 billion in 2024 and is projected to reach USD 498.91 billion by 2033, growing at a CAGR of 24.20% from 2025 to 2033. Factors such as favorable government initiatives and increasing strategic alliances, rising penetration of smartphones and tablets, increasing focus on patient-centric healthcare solutions, growing geriatric population, and rising prevalence of chronic diseases are driving the market growth.

Key Market Trends & Insights

- The China digital health market dominated APAC with the largest revenue share of 25.31% in 2024.

- By technology, the tele-healthcare segment accounted for the largest revenue share of 44.98% in 2024

- By component, the services segment accounted for the largest revenue share of 37.89% in 2024.

- By application, the diabetes segment held the largest revenue share of 24.65% in 2024.

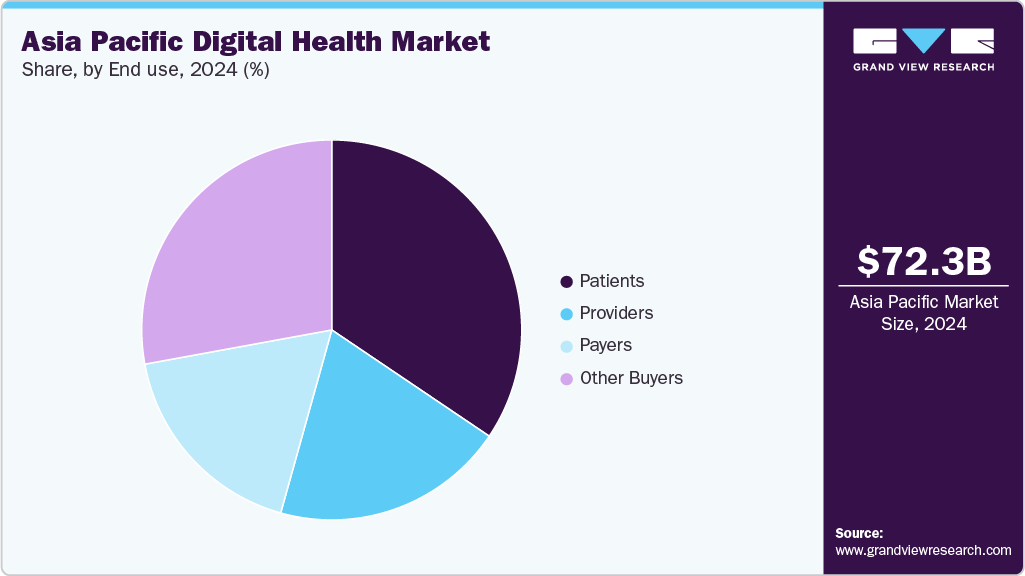

- By end use, the patients segment held the largest revenue share of 34.47% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 72.28 Billion

- 2033 Projected Market Size: USD 498.91 Billion

- CAGR (2025-2033): 24.20%

Moreover, the introduction of technologically advanced mobile devices & wearable devices is boosting the demand for digital health devices. For instance, Seiko Epson Corporation developed a wearable device (smartwatch) with a Global Positioning System (GPS) sensor and an optical heart rate motion sensor that measures sleep rate, heart rate, & stress burden without the need for a separate chest strap.

Rising smartphone penetration, improved 5G network coverage, and increasing demand for remote patient monitoring are expected to boost the adoption of digital health platforms. For instance, according to The Mobile Economy Asia Pacific 2025, GSMA reported that Asia Pacific had 1.5 billion mobile internet users in 2024, a number expected to grow to 1.8 billion by 2030. The expansion of 5G, AI, and other digital technologies is set to further accelerate connectivity, with 5G projected to cover half of the region’s mobile connections by the end of the decade. Furthermore, there are expected to be around 1.4 billion 5G connections in Asia Pacific by the end of 2030, accounting for 41% of overall mobile connections. The growing usage of smartphones and internet connectivity has increased dependency on fitness, health, and medical applications in the APAC region. This has resulted in a significant boost in market growth.

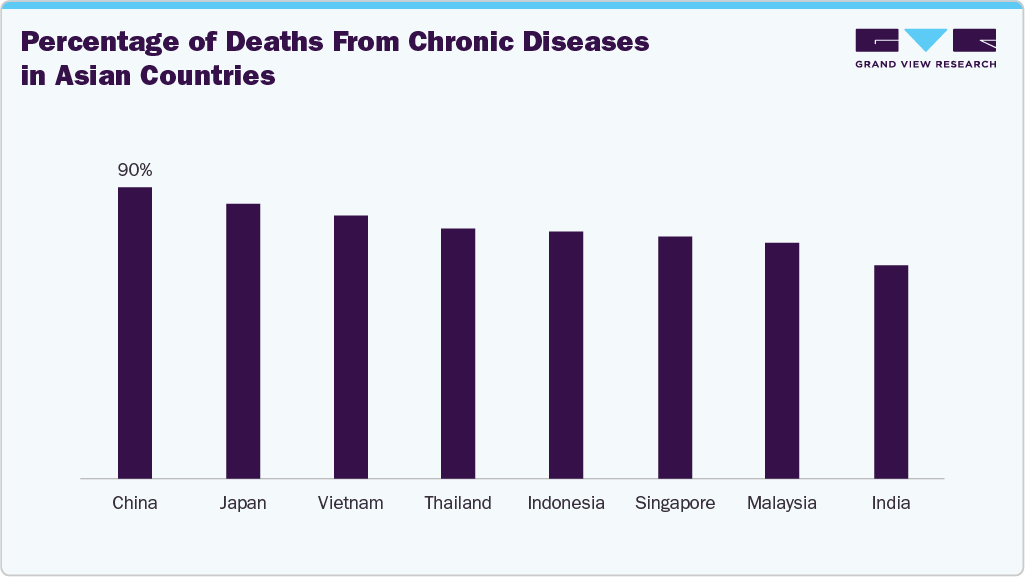

The rising incidence of chronic conditions such as diabetes, Alzheimer's, cancer, and cardiovascular diseases, and a growing demand for fitness trackers and long-term patient monitoring solutions, drive the growth of the Asia Pacific digital health industry. For instance, according to the World Cancer Research Fund International, the cancer incidence rate in men in China is 2,464,015. Similarly, in August 2025, The International Diabetes Federation (IDF) reported that 107 million adults aged 20-79 are living with diabetes in South-East Asia, with 43% undiagnosed, 146 million having impaired glucose tolerance, and 1 in 3 live births affected by hyperglycaemia in pregnancy.

Many patients, doctors, and government bodies increasingly adopt telehealth & telemedicine. Telehealth facilitates access to healthcare through specific applications & video consultations and enables communication between patients & doctors in remote locations, eliminating the need to visit hospitals or clinics. Video consultations are increasing, as they enable patients to access medical services from their medical professional over the phone, which helps avoid unnecessary doctor visits and the process of booking appointments & commuting, thereby reducing unnecessary costs. For instance, in May 2023, Telstra Health launched Australia's first Fast Healthcare Interoperability Resources (FHIR) native virtual care solution - Virtual Health Platform to enhance overall clinical efficiency.

Rising government initiatives to promote digital health solutions and the growing adoption of advanced technology for remote health management are anticipated to accelerate the market growth in the APAC region. For instance, in July 2022, a collaboration between three government agencies in Thailand led to the developing of an IT system and mobile phone application to connect healthcare services provided by 116 government hospitals. This project has enabled Thai physicians to share medical information online, providing benefits such as long-distance study in medical sciences, telepathology consultations, telecardiology, and teleradiology. Considering that Thailand has almost 900 government hospitals, the program has ample potential to expand in the coming years.

Several technologically advanced connected medical devices secured approval in recent years. This includes wearable devices, mobile apps, and iPad-based diagnostic tools. The approvals and launch of these technologically advanced devices into the market support growth. For instance, in September 2023, Lotte Healthcare, a South Korean company, entered the digital healthcare market by launching its personalized healthcare management platform, Cazzle.

Case Study: Digitally Supported Peer Support Transforming Patient-Provider Relationships in Japan

Background

The traditional patient-provider relationship in Japan has historically been paternalistic, with healthcare professionals holding dominant authority. Recent digitalization in healthcare, alongside patient empowerment movements and peer support networks, is challenging this model. This study investigates how digitalized peer support alters patient roles and reshapes their relationships with healthcare providers.

Objective

To examine how peer support, especially when digitally implemented, empowers patients and transforms traditional asymmetrical patient-provider dynamics into cooperative relationships.

Methods

-

Design: Mixed-methods approach combining quantitative surveys and qualitative observations/interviews.

-

Participants: Three patient groups (A, B, C) across northern, central, and southern Japan, involving patients, persons with disabilities, healthcare professionals, and researchers.

-

Data Collection:

-

Online surveys (May-Aug 2022) on peer support participation and benefits.

-

Trials in a virtual reality peer support space (XRCC: Cross Reality Conference Cloud) between Dec 2021-Nov 2022, observing interactions via avatars.

-

Analysis: Evaluated the impact of digital peer support on patient empowerment, communication, and patient-provider relationships.

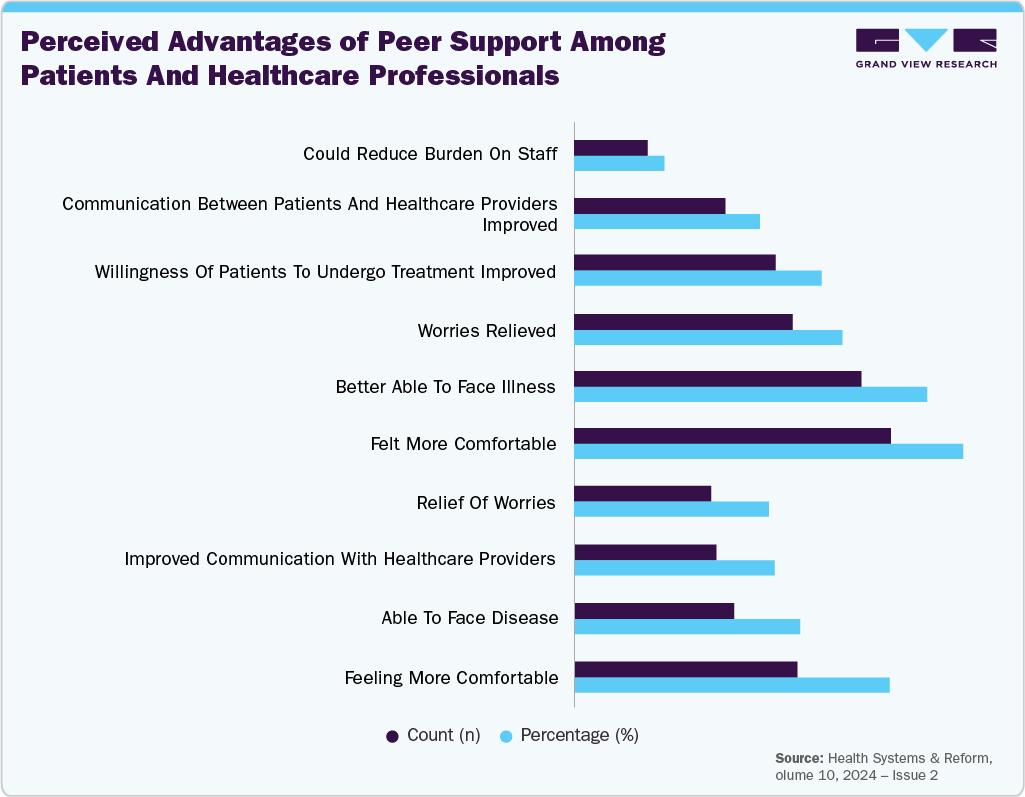

Key Findings

-

Patient Empowerment and Peer Support:

-

73% of patients surveyed participated in patient groups; 66% actively provided peer support, often online.

-

Benefits included feeling more comfortable, improved communication with providers, and relief of illness-related worries.

-

Challenges included unresolved concerns and a preference for some face-to-face interactions.

-

-

Digital Peer Support in Virtual Spaces:

-

Virtual peer support fostered anonymity, reduced stigma, and allowed participants to freely express themselves.

-

Engagement in the XRCC metaverse improved self-esteem and created a sense of equality among patients and providers.

-

Even previously reluctant participants became interested in peer support.

-

-

Transformation of Patient-Provider Dynamics:

-

Digitalized peer support shifted the traditional asymmetrical patient-provider relationship to one of mutual cooperation.

-

Healthcare professionals began recognizing patient expertise, valuing lived experiences alongside clinical knowledge.

-

Patients assumed “new sick roles,” engaging actively in healthcare decision-making and community support.

-

-

Implications for Healthcare Practice:

-

Digitalization can reduce social stigma and expand patient participation in healthcare.

-

Providers can learn from empowered patients to adopt collaborative practices.

-

Integrating digital tools in patient associations supports inclusive, participatory care environments.

-

Conclusion

Digital peer support, particularly when implemented through virtual platforms, empowers patients and reshapes patient-provider relationships in Japan. This case illustrates the potential of digitalization to foster equality, collaboration, and a more patient-centered healthcare ecosystem.

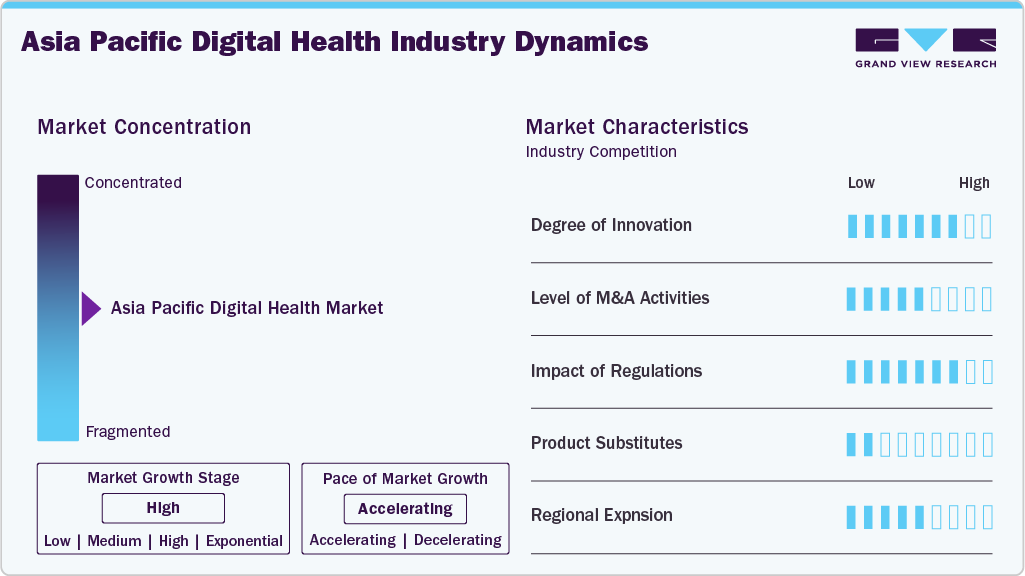

Market Concentration & Characteristics

The Asia Pacific digital health industry is characterized by a high degree of innovation. Remote Patient Monitoring (RPM) revolutionizes healthcare delivery by enabling providers to track patients’ health status without physical visits to healthcare facilities. This innovative approach expands access to healthcare services, particularly for individuals in remote areas or with limited mobility. For instance, in June 2023, Kakao Corporation, a South Korean internet company, collaborated with Dexcom to set up a global digital diabetes management service.

The Asia Pacific digital health market exhibits a medium level of mergers and acquisitions, with companies also pursuing diverse growth strategies to strengthen market positions and drive overall industry expansion. For instance, in September 2023, Health Innovations, a consortium of practicing medical doctors affiliated with the GP+ cooperative, acquired AskDr, a Singapore-based digital health startup, to enhance patient care and empower individuals to manage their health journeys actively.

Regulatory frameworks for digital health technologies vary across countries and regions within the Asia Pacific, influencing market dynamics and company strategies. These regulations can impact market access, growth, and compliance. For instance, the Ministry of Public Health regulates health matters in Thailand, including medical devices and digital health activities. In addition, the Thai FDA and its Medical Device Control Division, which enforces the Medical Device Act, are under the Ministry of Public Health. The Ministry of Digital Economy and Society also enforces the PDPA and Cybersecurity Act for digital health. Two regulatory authorities monitor digital health in Thailand.

The primary substitute for digital health services is traditional in-person healthcare, which involves physical visits to clinics, hospitals, or other healthcare facilities, often relying on paper-based medical records and face-to-face communication for sharing patient information.These substitutes, while familiar and trusted, are less efficient in terms of accessibility, convenience, and real-time data integration.

Several market players are expanding their business into new regional countries to strengthen their market position and product portfolio. For instance, in October 2023, Fujitsu, a digital transformation company, collaborated with Global Health Limited, a digital health solutions company. The collaboration aimed to make available Global Health's complete range of software solutions to 13 countries in the Asia-Pacific healthcare industry.

Technology Insights

The telehealthcare segment accounted for the largest revenue share of 44.98% in 2024 and is expected to register the fastest CAGR throughout the forecast period. The increase in the number of patients suffering from conditions requiring Long-term Care (LTC), including Alzheimer's disease, cancer, diabetes, and cardiovascular diseases, is one of the significant factors driving the growth of the telehealthcare market. In June 2025 Ant Group launched its AI healthcare app AQ in China, offering over 100 AI-powered services and connecting users to nearly 1 million doctors. The app leverages Ant’s Healthcare Large Model to support diagnosis, patient education, and medical insurance assistance. Through AQ, Ant aims to improve healthcare access, efficiency, and inclusivity amid China’s aging population.

The mHealth segment held the second-highest revenue share in 2024. The increasing trend of preventive healthcare & rising funding for mHealth startups are other factors boosting the market. Government initiatives, such as awareness programs and R&D funding for healthcare IT, are anticipated to boost the mHealth market. For instance, in February 2024, in Telangana state, the 'Health On Us' app was launched by Pawan Kalyan, a politician and Indian actor. The app provides two main services such as care at the center and care at home. Furthermore, the constant improvements in mobile app functionality by manufacturers are driving growth.

Component Insights

The services segment accounted for the largest revenue share of 37.89% in 2024. An increase in the number of companies providing outsourcing services to healthcare facilities is anticipated to drive the market over the forecast period. The growing trend of software upgrades to include a wider range of healthcare applications contributes to the growth of the services market. Services such as installations, education & training, and upgradation depend on developing these platforms. For instance, in December 2024, Thailand launched the final phase of its “30 Baht Treatment Anywhere” program, extending full healthcare coverage augmented by digital health features such as Health IDs, online referrals, and appointment reminders to all 77 provinces starting January 1, 2025, benefiting over 80,000 new users through pharmacies and private clinics.

The software segment is expected to register the fastest CAGR throughout the forecast period. Increasing demand for reducing the rising medical costs, growing need for accurate & timely information procurement, and rising patient care costs are among the key factors responsible for the growth of the software market. The adoption of various software, such as EHRs/EMRs, has significantly increased owing to the assistance provided to healthcare systems. Periodic software upgrades are necessary to keep up with digital trends.In January 2025, India accelerated digital health transformation through software-led initiatives under the Ayushman Bharat Digital Mission (ABDM), driving adoption of EHRs, telemedicine, and AI diagnostics. Over 73 crore digital health accounts and 5 lakh professionals are registered, while government-backed schemes like the Digital Health Incentive Scheme are pushing hospitals and startups toward a paperless healthcare system.

Application Insights

The diabetes segment dominated the Asia Pacific digital health market with the largest revenue share of 24.65% in 2024 and is anticipated to register the fastest CAGR over the forecast period. The increasing prevalence of diabetes and the adoption of digital health solutions, such as smartphone apps for monitoring glucose levels and wearable devices that track physical activity and provide real-time health data, enable patients to actively engage in managing their diabetes. For instance, in October 2025, the International Diabetes Federation reported that adults with diabetes in South-East Asia are projected to rise from 107 million in 2024 to 185 million by 2050. Undiagnosed diabetes remains high at 42.7%, while hyperglycaemia in pregnancy affects 27.8% of live births. For instance, MySugr, Diabetes: M, Glucose Buddy, Beat Diabetes, OneTouch Reveal, and Diabetes are some of the digital health solutions that help with diabetes monitoring.

Obesity is the second fastest-growing segment in the Asia Pacific digital health industry. Lack of physical activity and unhealthy eating behaviors are the major factors contributing to obesity. In May 2025, the WHO reported that obesity rates are rising across Asia Pacific, with 31% of adults in South-East Asia and 34% in the Western Pacific classified as overweight or obese. This growing prevalence heightens the risk of noncommunicable diseases while the region continues to face the double burden of malnutrition. Digital health technologies offer personalized interventions, including mobile applications for tracking dietary intake and wearable devices for monitoring physical activity, which have been driving the growth of this segment. For instance, MyFitnessPal, MyNetDiary, Noom, YAZIO, LoseIt, and MyPlate are some food-tracking apps that help manage diet plans.

End Use Insights

The patients segment dominated the Asia Pacific digital health industry with a revenue share of 34.47% in 2024 and is anticipated to register the fastest CAGR over the forecast period. Rising government initiatives and the launch of healthcare apps are anticipated to boost market growth. For instance, in February 2025, MediBuddy partnered with Japan’s Elecom to co-develop smart health IoT devices tailored for India. The collaboration focuses on preventive healthcare by integrating connected monitoring devices with the MediBuddy platform, enabling patients to track daily health, access personalised insights, and manage lifestyle-related diseases more effectively. The shift toward patient-centered care and increased awareness of health management apps among individuals drives the market growth.

The providers segment is expected to grow at a significant CAGR during the forecast period. Many healthcare providers are adopting digital solutions to provide remote consultations, personalized treatment plans, and evidence-based therapies. This has made it easier for healthcare providers to work together and offer care across different settings. These digital tools help providers save time on administrative tasks and communicate more effectively. Innovative technologies such as telemedicine and digital therapeutics are becoming more popular in healthcare.In January 2025, JD Health launched its LLM-powered AI suite, “AI Jingyi” for online care and “JOY DOC” for hospital applications, enhancing diagnostics, patient management, and hospital operations. Built on the medically specialized LLM “Jingyi Qianxun,” the suite includes AI Diagnosis Assistant 2.0, AI Research Assistant, and AI Doctor Digital Twin, improving clinical efficiency, electronic record handling, and 24/7 patient support while maintaining strict data privacy.

Country Insights

India Digital Health Market Trends

The India digital health market is expected to grow significantly over the forecast perioddue to the rising penetration of internet users, favorable government initiatives, and an increasing number of consumers using remote digital health services. For instance, in August 2025, India hosted its first Digital Health Expo under the Ayushman Bharat Digital Mission. The event showcased AI-driven health innovations, integrated records via ABHA IDs, and participation from over 200 companies and government solutions. With 800 million ABHA IDs created and extensive health facility and professional registries, India demonstrated rapid adoption of digital health technologies and its emergence as a global healthcare innovation leader.

China Digital Health Market Trends

China dominated the Asia Pacific digital health market with a revenue share in 2024. Increasing smartphone penetration and the growth in the number of digital health providers drive the market growth in the country. For instance, in June 2025, according to Newzoo data, China had 974.69 million smartphone users, representing 68.4% penetration of its 1.43 billion population. Tencent, an internet-based technology and cultural enterprise that operates WeChat in mainland China, is developing a network of affiliated hospitals where users can easily schedule appointments, track their follow-up medical check-ups, and settle medical bills.

Key Asia Pacific Digital Health Company Insights

Key companies in the market are adopting various strategies, including mergers & acquisitions, partnerships & collaborations, and new product launches, to increase their market share and strengthen their position in the market. For instance, in April 2025, India's AI-powered digital health platform, ekincare, secured an undisclosed strategic investment from MSD IDEA Studio Asia Pacific, part of Merck & Co.'s Global Health Innovation Fund. This funding aims to enhance ekincare's AI-driven outpatient services, expand its cashless network, and bolster preventive care and chronic disease management across India.

Key Asia Pacific Digital Health Companies:

- Oracle

- Allscripts

- Apple Inc.

- Telefonica S.A.

- McKesson Corporation

- Epic Systems Corporation

- QSI Management, LLC.

- AT&T

- Vodafone Group

- Airstrip Technologies

- Google, Inc

- Samsung Electronics Co. Ltd

- HiMS

- Orange

- Qualcomm Technologies, Inc.

- Softserve

- Computer Programs and Systems, Inc.

- IBM Corporation

- CISCO Systems, Inc.

Recent Developments

-

In July 2025, Southeast Asia was highlighted as the leader in the next stage of Asia Pacific’s digital health transformation at HIMSS25 APAC in Kuala Lumpur. Malaysia and China launched the world’s first medical device regulatory reliance program, streamlining approvals and market access. Malaysia’s “One Citizen, One Record” initiative completed its first phase, enabling millions of patients to access prescriptions, screenings, dental records, and vaccination history digitally.

-

In June 2025, MEDITECH Asia Pacific showcased its latest digital health solutions at the Digital Health Festival 2025 in Melbourne. Chris O’Brien Lifehouse highlighted safer, smarter medication practices through electronic medication management. The event brought together 8,000+ executives to explore AI, cybersecurity, and clinical innovation shaping the region’s healthcare future.

-

In June 2023, FUJIFILM India launched its mobile application, ‘FUJIFILM Connect.’ The app provides healthcare professionals with a comprehensive solution for managing the service and support of their medical diagnostic devices. In addition, it delivers real-time push notifications to keep users informed and updated.

-

In May 2023, Ora, a Singapore-based telehealth platform, raised USD 10 million in Series A funding. It is the largest telehealth Series A funding round in Southeast Asia.

-

In May 2023, Ubie, a health-tech startup in Japan, partnered with Google's Android platform, "Health Connect (Beta)," to provide better medical services to users. Ubie AI Symptom Checker enables users to receive improved disease information by sharing their blood sugar levels on Health Connect (Beta). By sharing data, users can benefit from more accurate symptom-related questions, which can help them make better medical decisions.

-

In March 2023, The Australian Digital Health Agency launched My Health, a consumer mobile application powered by My Health Record. With the app, users can easily access important health information, which enables them to have more control over their health journey and take an active role in managing their daily health activities.

Asia Pacific Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 88.11 billion

Revenue forecast in 2033

USD 498.91 billion

Growth rate

CAGR of 24.20% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end use, country

Country scope

China; Japan; India; South Korea; Thailand; Australia

Key companies profiled

Oracle; Allscripts; Apple Inc.; Telefonica S.A.; McKesson Corporation; Epic Systems Corporation; QSI Management, LLC.; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc.; Samsung Electronics Co., Ltd; HiMS; Orange; Qualcomm Technologies, Inc.; Softserve; Computer Programs and Systems, Inc.; IBM Corporation; CISCO Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Digital Health Market Report Segmentation

This report forecasts revenue growth and provides at regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the Asia Pacific digital health market report based on technology, component, application, end use, and country:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Tele-Healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables

-

Vital Sign Monitor

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep Trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal & Obstetric Devices

-

Neuromonitoring Devices

-

EEG

-

EMG

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Fitness & Nutrition

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Disease Management

-

Menopause

-

Others

-

-

Chronic Disease Management Apps

-

Obesity Management Apps

-

Mental Health Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Cancer Management Apps

-

Other Chronic Disease Management Apps

-

-

Other Chronic Disease Management Apps

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

Exercise & Fitness

-

Diet and Nutrition

-

Lifestyle and Stress

-

-

-

-

Services

-

mHealth Service, By Type

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

-

Healthcare Analytics

-

Digital Health Systems

-

EHR

-

E-prescribing systems

-

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Patients

-

Providers

-

Players

-

Other Buyers

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific digital health market size was estimated at USD 72.28 billion in 2024 and is expected to reach USD 88.1 billion in 2025.

b. The Asia Pacific digital health market is expected to grow at a compound annual growth rate of 24.2% from 2025 to 2033 to reach USD 498.91 billion by 2033.

b. Tele-healthcare dominated the Asia Pacific digital health market with a share of 45.0% in 2024. This is attributable to high internet usage, increased penetration of smartphones, and the growing adoption of digital communication and information technologies for virtual home health services.

b. Some key players operating in the Asia Pacific digital health market include Apple Inc.; AirStrip Technologies; Allscripts; Google Inc.; Orange; Qualcomm Technologies Inc.; Mqure; Samsung Electronics Co. Ltd.; Telefonica S.A.; Vodafone Group; Cerner Corporation; and McKesson Corporation.

b. Key factors that are driving the Asia Pacific digital health market growth include increasing adoption of digital healthcare, favorable initiatives, and technological advancements for developing innovative digital solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.