- Home

- »

- Alcohol & Tobacco

- »

-

Asia Pacific Draught Beer Market Size, Industry Report, 2033GVR Report cover

![Asia Pacific Draught Beer Market Size, Share & Trends Report]()

Asia Pacific Draught Beer Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Keg Beer, Cask Beer), By Category (Super Premium, Premium, Regular), By End Use, By Production Type, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-715-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Draught Beer Market Summary

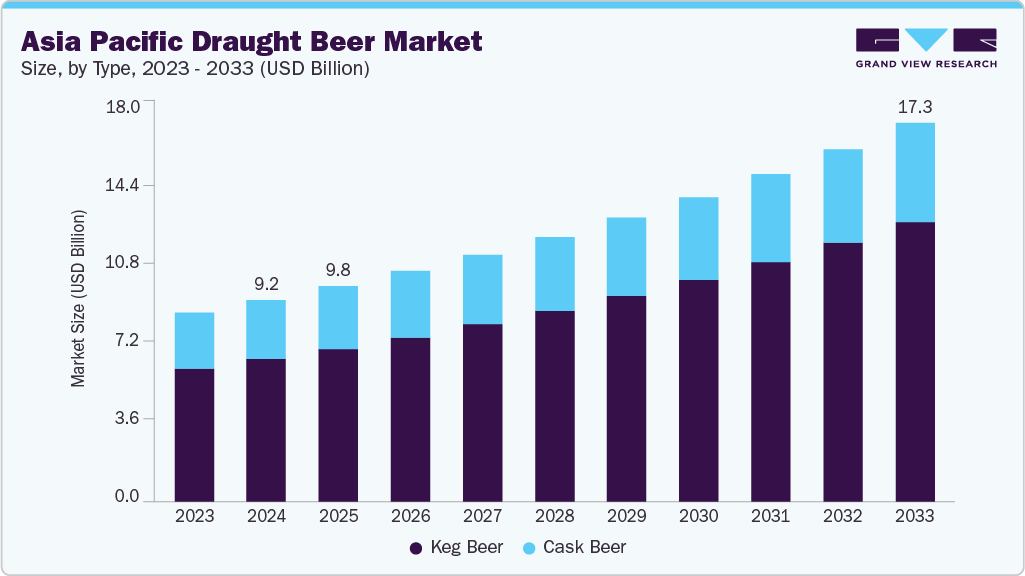

The Asia Pacific draught beer market size was estimated at USD 9.19 billion in 2024 and is projected to reach USD 17.30 billion in 2033, growing at a CAGR of 7.3% from 2025 to 2033. Innovation and unique business strategies opted by manufacturers and sellers are driving the market growth.

Key Market Trends & Insights

- China dominated the Asia Pacific draught beer market in 2024 with a revenue share of 36.5%.

- India's draught beer market is expected to grow at the fastest CAGR from 2025 to 2033.

- Based on type, the keg segment accounted for a share of 70.7% in 2024.

- By category, the premium draught beer segment dominated the market with a revenue share of 49.2% in 2024.

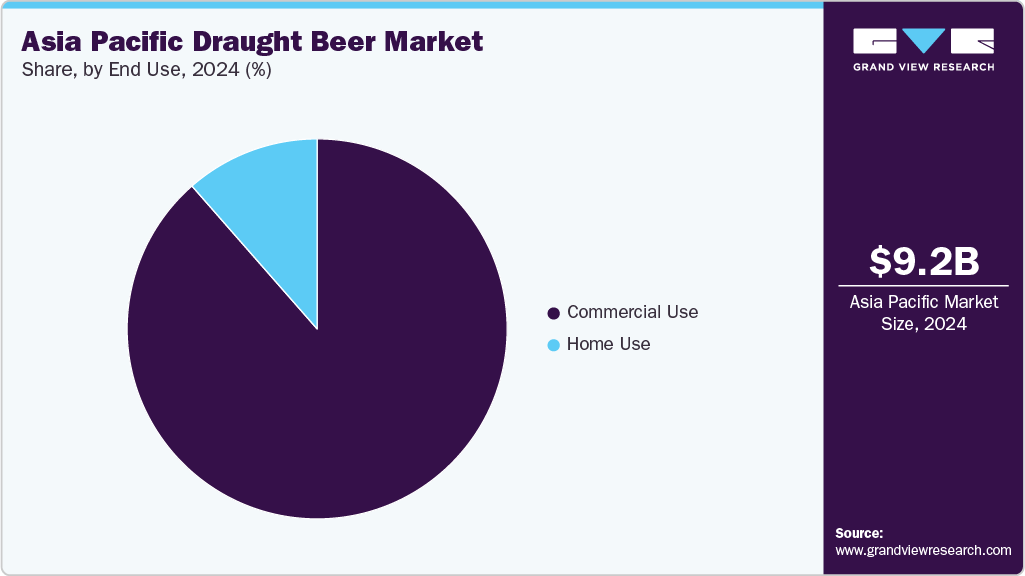

- By end use, the commercial segment dominated with the largest market share of 88.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.19 Billion

- 2033 Projected Market Size: USD 17.30 Billion

- CAGR (2025-2033): 7.3%

- China: Largest market in 2024

- India: Significantly Growing Market

Consumers across the region, especially the younger, more affluent demographics, are increasingly seeking unique, high-quality, and authentic beer experiences over mass-produced lagers. This trend manifests in a surge of microbreweries and brewpubs offering diverse, experimental, and locally sourced craft ales and lagers on tap. Moreover, favorable government policies in emerging nations have also led to an increased product demand in the region. For instance, in March 2055, the government of Australia announced a two-year freeze on the excise tax increase on draught beer. It is a major government policy shift offering a reprieve to pubs, clubs, and breweries in Australia, which in turn would fuel the growth of the Asia Pacific draught beer industry over the forecasted period.

The keg type of beer is often consumed in beer-serving places such as beer bars, beer cafes, pubs, clubs, and restaurants as well. The increasing number of breweries in the region is a major factor driving the growth of the market. Additionally, many companies are collaborating to increase the sales of draught beer through different distribution channels. For instance, in July 2024, Carlsberg Breweries A/S Asia collaborated with foodpanda to use its cloud grocery stores in order to make its beer easily accessible to its customers. The Pandamart is a cloud delivery channel that would help Carlsberg Breweries A/S target its customers in the Asia Pacific.

The changing food habits of consumers are enabling breweries to serve high-quality beer with different flavors. Breweries usually use premium-quality ingredients and conventional brewing techniques, which produce distinctive and varied flavored drinks for customers. Their goal is to enhance and motivate a wide range of individuals through innovative beer with each brewing. Thus, consumers' focus on drinking different-flavored and quality draught beer is a major factor aiding the growth of the Asia Pacific draught beer industry.

Increasing urbanization, growing disposable incomes, changing customer preferences, an upsurge in demand for Keg Beer, expanding hospitality sectors across the world, and increasing demand experienced in tourism sectors are some of the factors that have been driving the industry. The draught beer industry is primarily influenced by factors such as consumption by teenagers, expanding online distribution channels, creative marketing techniques adopted by the manufacturers, and more.

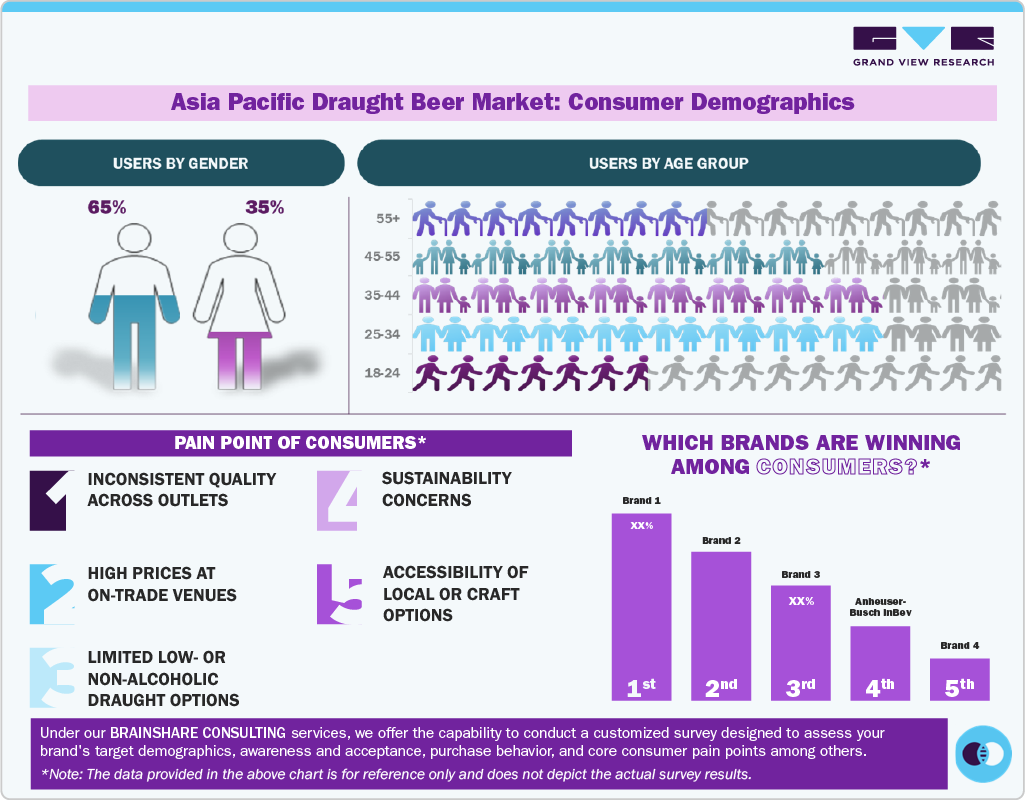

Consumer Insights for Asia Pacific Draught Beer

The changing lifestyle and food habits of millennials in the region are fueling the growth of the Asia Pacific draught beer market. Premium quality draught beer is witnessing increasing demand and availability in different flavors in various regions. There is a growing demand for draught beer, especially in the age group of 25-55. Moreover, the growing focus of consumers on sustainability is a major trend in the market. The draught beer manufacturers are using PET as a major packaging solution for keg beer packaging. It not only lowers the overall packaging cost but also lowers the carbon footprint, which has a positive impact on the buying choice of customers. Health-conscious trends have also increased demand for low-alcohol and alcohol-free draught variants. In addition, consumers seek immersive experiences, leading to the rising popularity of brewpubs and taproom venues offering fresh, on-tap beer directly from the source.

Consumption habits in the Asia Pacific are heavily tied to social and cultural experiences. Beer companies and beverage distributors are employing new marketing techniques in order to expand the sales of draught beer in the region. The countries such as China, Australia, and New Zealand dominate draught beer sales due to the expansion of pubs in the region. Meanwhile, the draught beer industry in India is expanding at a high rate due to the growing urban bar scene. Festivals, sports events, and live music venues also drive consumption. However, economic uncertainties and inflation have made value-for-money offerings more appealing, influencing brand switching and demand for mid-range options.

Type Insights

In 2024, keg beer accounted for a share of 70.7% in the Asia Pacific draught beer industry. Keg beer is known for being pasteurized and filtered and supplied in small barrels. Typically, the regular keg beer undergoes filtration and carbonation to approximately 2.4 volumes of carbon dioxide and is dispensed from the keg using carbon dioxide pressure. The most common type of keg in China is 20 liters, which small breweries use. Trends indicate a significant shift towards premium and craft keg offerings, as an increasingly affluent and discerning consumer base in urban centers seeks out diverse styles-from crisp lagers to hoppy IPAs and rich stouts-promising a fresh, high-quality pour every time. This aligns with the region's burgeoning F&B sector, where pubs, restaurants, and hotels prioritize efficiency, reduced waste, and reliable product delivery.

The demand for cask beer is expected to grow at a CAGR of 6.0% from 2025 to 2033. Cask beer, a distinct and more traditional style of draught, is experiencing an emerging, albeit niche, resurgence within the Asia Pacific market. Unlike its keg counterpart, cask beer is unpasteurized and unfiltered, undergoing a secondary fermentation within the cask itself, resulting in a "living" beer that is naturally carbonated and served at cellar temperature, often via a hand pump or gravity. As consumers become more educated and adventurous in their beer choices, there's a growing desire for unique, low-intervention products that offer a distinctive mouthfeel and evolving flavors. Small, independent craft breweries are key drivers, championing cask ale as a means to differentiate their offerings and showcase their brewing prowess.

Category Insights

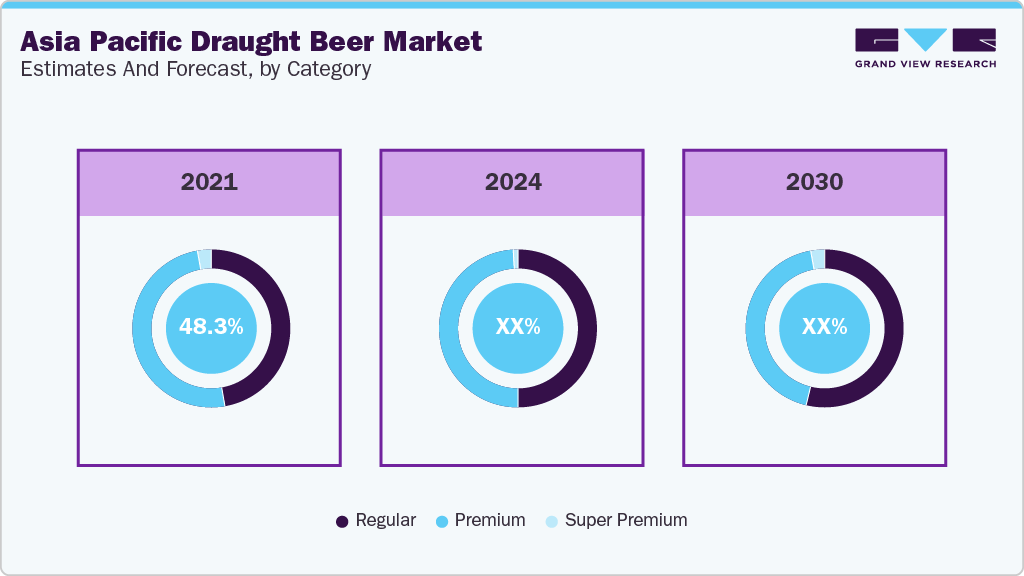

In 2024, premium draught beer accounted for a revenue share of 49.2% in the Asia Pacific draught beer market, driven by an expanding middle class with increasing disposable incomes and a burgeoning interest in higher-quality alcoholic beverages. Consumers view premium draught beer as an affordable luxury, offering a sense of sophistication and status without the high price tag of other premium alcohol categories. Moreover, the rising popularity of food pairing culture and the integration of beer into fine dining experiences further stimulate demand. Additionally, effective marketing campaigns that highlight brand heritage, brewing craftsmanship, and unique ingredient sourcing contribute significantly.

The demand for super premium draught beer is expected to grow at a CAGR of 8.9% from 2025 to 2033. Key trends include a focus on ultra-exclusive international imports, limited-edition or seasonal releases from renowned breweries, and highly innovative, often barrel-aged or specialty-fermented local craft beers. These products command a significantly higher price point, reflecting their rarity, intricate brewing processes, unique ingredients, and often, higher alcohol content. Moreover, consumers in this category are often beer enthusiasts or collectors willing to pay a premium for exceptional quality, rare flavors, and an elevated social statement. Furthermore, the rising influence of beer sommeliers and expert recommendations in elite dining and drinking establishments helps to educate and guide consumers towards these high-value offerings, establishing them as a status symbol among a sophisticated clientele.

Production Type Insights

Macro-breweries led the Asia Pacific draught beer market with a revenue share of 82.3% in 2024, driven by their ubiquitous availability across pubs, restaurants, and hotels, making them the default choice for many consumers. The industry has a significant impact on macrobreweries since these breweries produce draught beers on a large scale, catering to the demand from the mass market. The resurgence of social events, dining out, and tourism post-pandemic has directly fueled demand for these widely available and consistently dispensed options, as consumers return to their preferred casual drinking occasions and reliable choices.

The demand for draught beer from microbreweries is expected to grow at a CAGR of 8.7% from 2025 to 2033, driven by the increasing consumer demand for diverse and experimental beer styles, moving beyond traditional lagers to embrace IPAs, stouts, sours, and locally-inspired concoctions. The appeal of supporting local businesses, combined with a willingness to pay a premium for unique, high-quality, and often freshly brewed options, fuels this segment. Furthermore, the increasing interest in food pairing and the influence of social media in highlighting unique craft offerings contribute to the rising demand for microbrewed draught options. Additionally, many microbreweries are investing in unique taproom experiences, collaborating with local food vendors, fostering a strong community feel, and transforming beer consumption into an experiential and social activity.

End Use Insights

The commercial end-use segment accounted for a revenue share of 88.5% in the Asia Pacific draught beer industry in 2024, fueled by the ability of commercial establishments to offer a dynamic and rotating selection of beers on tap, appealing to adventurous palates and fostering a sense of discovery. Beyond taste, the social aspect of sharing a pint with friends or colleagues remains a core driver, along with the perceived environmental benefits of reduced packaging waste associated with kegs. As urban centers continue to grow and tourism flourishes across APAC, the demand for diverse draught beer offerings in hospitality venues will only intensify, pushing establishments to invest in advanced dispensing technologies and curated tap lists to meet evolving consumer expectations.

Draught beer for home consumption is anticipated to grow at a CAGR of 7.9% from 2025 to 2033, primarily driven by a desire for convenience, freshness, and the personalized indulgence of enjoying draught beer in private settings. The trend of "at-home entertainment" has gained significant traction, especially following the pandemic, with consumers investing in personal kegerators, mini-keg systems, and frequently refilling growlers or crowlers from local breweries. This allows enthusiasts to access brewery-fresh beer, maintain optimal freshness for longer durations, and enjoy a curated selection without leaving their homes. As technology makes home dispensing systems more affordable and user-friendly, coupled with breweries increasingly offering direct-to-consumer options for smaller kegs or refills, the home-use market is poised for continued expansion, catering to a sophisticated consumer base that values both quality and convenience.

Country Insights

China Draught Beer Market Trends

China held a revenue share of 36.5% of the Asia Pacific draught beer market in 2024, characterized by rapid urbanization and the rise of a sophisticated middle class, particularly in tier-1 and tier-2 cities, who are increasingly favoring premium and imported beverages. This demographic is driving demand for better quality and more diverse beer styles beyond traditional lagers, viewing draught beer as a fresh, social, and higher-status option. Moreover, the growth of Western-style pubs, restaurants, and dedicated craft beer bars, coupled with a booming nightlife culture, provides the ideal environment for draught beer consumption. According to research conducted by Co-Operatives China in October 2023, there has been a remarkable increase in community-owned pubs over the past five years in China.

Australia & New Zealand Draught Beer Market Trends

The draught beer market in Australia & New Zealand is expected to grow at a CAGR of 6.9% from 2025 to 2033. Consumers are increasingly discerning, prioritizing local sourcing, unique flavor profiles, and the artisanal quality associated with independent breweries. The popularity of draught beer in Australia & New Zealand has been fueled by the numerous beer festivals held in the country, which is coupled with favorable government policy, aiding the growth of the market. Additionally, increasing pubs and breweries are also aiding the growth of the market. While traditional pub culture remains strong, there's a clear shift away from mainstream lagers towards a diverse array of ales, IPAs, stouts, and experimental styles, with draught being the preferred format for experiencing these nuanced offerings.

India Draught Beer Market Trends

The draught beer market in India is expected to grow at a CAGR of 9.3% from 2025 to 2033, primarily driven by a youthful demographic, rising disposable incomes, and evolving social lifestyles in urban centers. The increasing number of pubs, bars, and microbreweries in metropolitan and tier-1 cities like Bangalore, Mumbai, and Delhi-NCR is creating significant on-premise opportunities for draught beer, which is perceived as a fresher, more premium, and sophisticated alternative to bottled options. Moreover, the burgeoning "pub culture" among aspirational consumers contributes significantly to this demand. Additionally, companies are adopting innovative strategies, such as price mix, in order to enhance the sale of beer in India. For instance, Heineken adopted a price mix strategy, which has increased its business by 20% in the fiscal year of 2024.

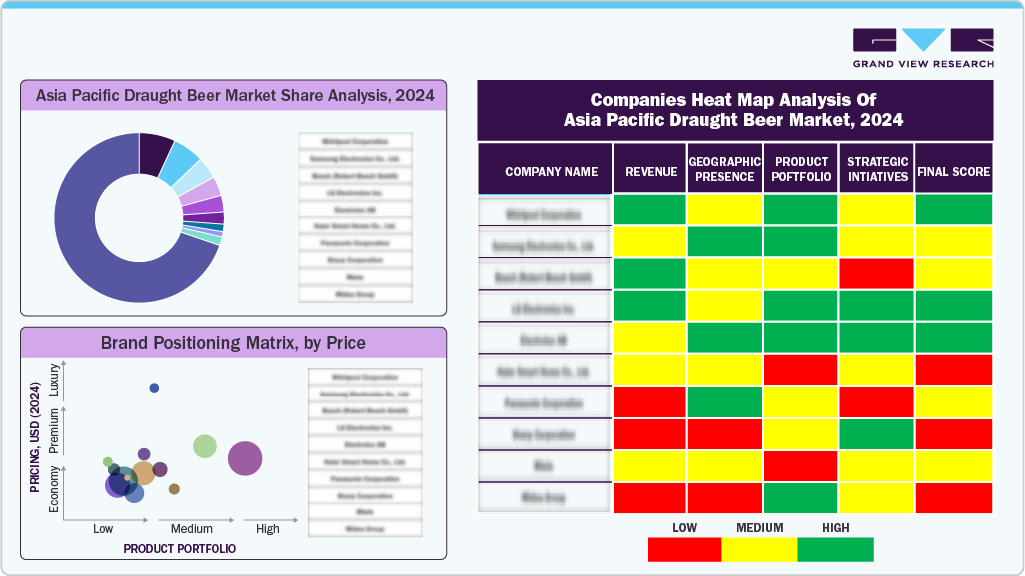

Key Asia Pacific Draught Beer Company Insights

The Asia Pacific draught beer market is characterized by the existence of global brands as well as local breweries, which has resulted in a high intensity of competitive rivalry. The world is also experiencing an upsurge in demand for tourism, international travel, and business trips, which is assisting these key market participants in generating greater demand for their vast product portfolios.

Key Asia Pacific Draught Beer Companies:

- Anheuser-Busch InBev

- Asahi Group Holdings, Ltd.

- Diageo

- Carlsberg Breweries A/S

- China Resources Snow Breweries

- Heineken International B.V.

- Kirin Brewery Company, Limited

- San Miguel Corporation

- The Brewerkz Company.

- Tsingtao Brewery Co., Ltd.

Recent Developments

-

In June 2025, Heineken announced to invest around (USD 292.03 Million to USD 350.44 Million) in Hyderabad, India, to set up a new Global Capability Center (GCC) to expand its business operations in the Asia Pacific.

-

In January 2023, Asahi introduced its innovative 'Draught Beer In A Can' Nama Jokki Edition in Singapore, offering consumers a unique drinking experience. This product featured a patented interior coating designed to produce luxurious, creamy foam on top of the beer.

Asia Pacific Draught Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.82 billion

Revenue forecast in 2033

USD 17.30 billion

Growth rate

CAGR of 7.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, category, end use, production type, country

Country scope

India; China; Australia & New Zealand; Japan; South Korea

Key companies profiled

Anheuser-Busch InBev; Asahi Group Holdings, Ltd.; Diageo; Carlsberg Breweries A/S; China Resources Snow Breweries; Heineken International B.V.; Kirin Brewery Company, Limited; San Miguel Corporation; The Brewerkz Company; Tsingtao Brewery Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Asia Pacific draught beer market report based on type, category, end use, production type, and country:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Keg Beer

-

Cask Beer

-

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Use

-

Home Use

-

-

Production Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific draught beer market size was estimated at USD 9.19 billion in 2024 and is expected to reach USD 9.82 billion in 2025.

b. The Asia Pacific draught beer market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 17.30 billion by 2033.

b. The China dominated the Asia Pacific draught beer market with a share of 36.6% in 2024. This is attributable to the increasing penetration of community-owned pubs and the growing brewing culture in the country.

b. Some key players operating in the Asia Pacific draught beer market include Anheuser-Busch InBev, Asahi Group Holdings, Ltd., Diageo, Carlsberg Breweries A/S, China Resources Snow Breweries, Heineken International B.V., Kirin Brewery Company Limited, San Miguel Corporation, The Brewerkz Company, and Tsingtao Brewery Co., Ltd.

b. Key factors that are driving the market growth include the growing number of consumers prefer high-quality and well brewed beers, inventive dispensing alternatives, and upsurge in demand for on - premise consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.