- Home

- »

- Plastics, Polymers & Resins

- »

-

APAC Electric Vehicle Plastics Market, Industry Report, 2030GVR Report cover

![Asia Pacific Electric Vehicle Plastics Market Size, Share & Trends Report]()

Asia Pacific Electric Vehicle Plastics Market Size, Share & Trends Analysis Report By Resin (PP, PU), By Application, By Vehicle Type, By Components, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-249-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The Asia Pacific electric vehicle plastics market size was estimated at USD 1.32 billion in 2023 and is anticipated to grow at a CAGR of 31.8% from 2024 to 2030. The growing electric vehicle industry especially in emerging economies such as India, China, Vietnam, Indonesia, and Thailand are expected to positively influence the growth of the market over the forecast period. Furthermore, the demand for electric vehicles plastics in Asia Pacific is increasing due to its application in the manufacturing of components such as battery enclosures and lightweight interiors.

Asia Pacific is experiencing a surging demand for electric vehicles plastics owing to the rapid pace of technological advancements taking place in this industry. The integration of features such as autonomous driving capabilities, and smart connectivity is transforming the automotive industry in the region. These innovations necessitate materials that are not only technologically advanced but are also lightweight and adaptable. Automotive plastics, including electric vehicles plastics, are versatile and conducive to various technological applications. This makes them an indispensable component for developing cutting-edge electric vehicles in Asia Pacific.

Moreover, Asia Pacific is witnessing a surge in investments and collaborations among players operating in the automotive and plastics industries to carry out technological innovations and research initiatives in production process. In November 2023, Imerys announced an investment of USD 46.1 million (EURO 43 million) for the establishment of a state-of-the-art specialty mineral polymer additive facility in Wuhu, China. Leveraging the extensive mineral expertise of Imerys, the plant is strategically positioned to meet the rising demand for premium talc solutions that are tailored to cater to the requirements of specific applications from China. The growing requirement for mineral reinforcement additives used in lightweight automotive plastics, particularly employed in electric vehicles, underscores the strategic significance of this venture. The new plant is anticipated to play a crucial role in the electric vehicles industry of China by providing critical materials essential for advancing the technological capabilities of automobiles and meeting the sustainability objectives of the industry in the country.

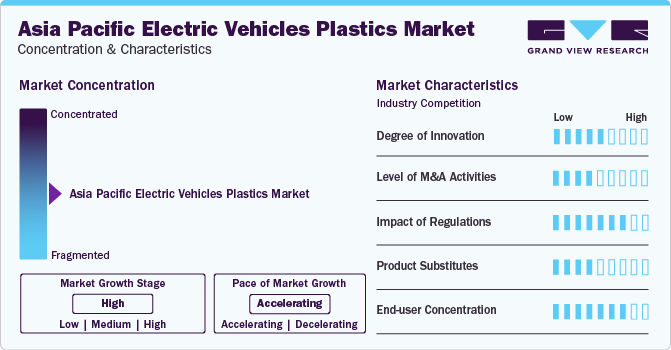

Market Characteristics & Concentration

The industry is moderately fragmented. Leading players are a combination of multinational and native companies. Since the procurement of raw materials requires heavy capital investments, entering the market is quite challenging for a new company. As plastic is involved, the market is also regulated in terms of product composition to avoid hazard at the time of disposal.

Innovation in the market is low to moderate. For instance, in October 2023, LG Chem announced LX Hausys, a special flame-retardant continuous fiber thermoplastic that can withstand 20 minutes of exposure to temperatures as high as 1500 °C. This material will help in delaying the thermal runaway of battery.

Threat of substitute is moderate to low. Natural and synthetic rubber in their hybrid forms such as copolymers holds the potential to substitute electric vehicles plastics. The hybrids possess slightly better properties than other electric vehicles plastics making them a competitor.

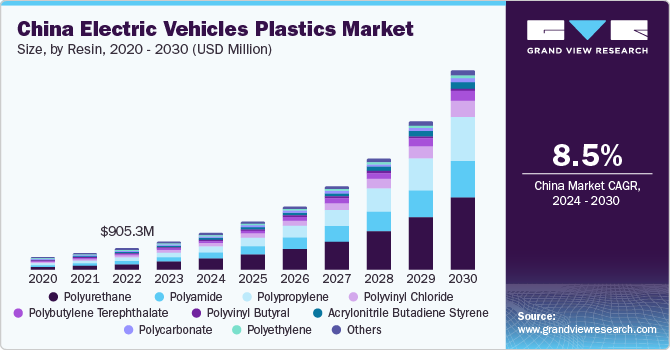

Resin Insights

Polyurethane (PU) dominated the segment with a revenue share of 29% in 2023. Compared to metal or any other plastic, PU is capable of exhibiting the characteristics of both plastics and rubber at a lower weight. Thus, it is widely used in the electric vehicles manufacturing for making parts like bumpers, interior trims and seat cushioning. The material also holds the ability to be molded into intricate shapes while providing superior insulation as compared to other polymers. Thus, the aforementioned reasons make polyurethane and ideal choice for electric vehicles plastics market.

The polypropylene (PP) resin is expected to grow at the fastest CAGR of 39% during the forecast period. Since PP can be used in both rigid and flexible packaging, it is widely used in the electric vehicles manufacturing. It is also an excellent chemical and electrical resistant even at very high temperatures. PP is seeing vast adoption as it helps in reducing the overall weight of the vehicle. The LGF composites of PP are being extensively used in the manufacturing of wheel covers, battery holders, engine insulation, and gear shift sticks.

Application Insights

Exterior furnishings segment dominated the market with the largest revenue share of 33% in 2023. Electric vehicles plastics are crucial for crafting sleek body panels and durable bumpers. Using plastics not only enhances the aesthetics of the vehicle but also provides impact resistance and protection against harsh weather conditions. Plastics also allows design creativity and other intricate detailing.

The interior furnishing segment is anticipated to witness the fastest CAGR of 36.1% during the forecast period. High performance plastics like GMT and ABS composites are being highly used in the manufacturing of load floors, seat bases, seat covers, and steering wheels. Plastics components help in reducing the noise, dampening vibrations, and minimizing harshness. Using plastics instead of metal and rubber enables the fabrication of single-piece lightweight parts. This results in reducing manufacturing costs.

Components Insights

Battery dominated the components segment with a market revenue share of over 17% in 2023. It is also expected to be the fastest growing segment with a CAGR of 39.2% during the forecast period. Plastics such as ABS (acrylonitrile-butadiene-styrene) and PC (polycarbonate) are widely used in the manufacture of batteries for electric vehicles. This is because both PC and ABS have high strength and high tolerance against impact thus protecting the battery from damage. Using plastics also helps in reducing the weight of the battery as it is one of the heaviest components in an electric vehicle.

The electric vehicles plastics market in the region is expected to benefit from the subsidies provided by the government for the manufacturing of electric vehicles. Since green energy is being promoted around the world, favorable discounts and tax redemption on purchase of electric cars is also expected to boost the market further fueling the demand for electric vehicles plastics in Asia Pacific region. For instance, under the Income Tax Act of India, Section 80EEB, electric vehicles owners can claim tax savings of up to USD 1800 on the interest paid on the loan for purchasing the vehicle. Thus, with the rising popularity of electric vehicles, the demand for batteries will also increase during the forecast period.

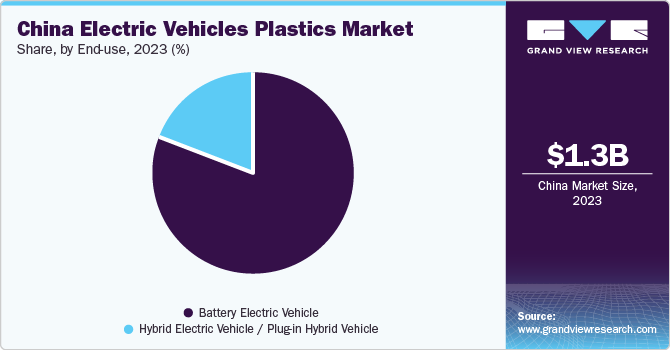

Vehicle Type Insights

The battery electric vehicle (BEV) dominated the market with a revenue share of 80% in 2023. It is also expected to witness the fastest growth during the forecast period. China’s BEV sales are predicted to witness growth in the coming years owing to government subsidies & purchase quotas on electric vehicles. Presence of major electric vehicle players, including Tesla and BMW in China is also expected to play a crucial role in the sales of BEVs.

The demand for lithium-ion batteries as energy storage systems is projected to subsequently increase owing to their low weight and limited coverage area. Altogether, the reusability of electric vehicles (EVs) batteries can cater to the further requirement of power grid storage. EVs are 97% cleaner than conventional ICE-enabled vehicles. They do not produce harmful tailpipe emissions that release hazardous particulate elements into the environment. EVs also use minimal components and parts compared to traditional gasoline-powered vehicles.

Country Insights

China dominated the market with a revenue share of 87% in 2023. China is one of the leading countries when it comes to manufacturing. The country has skilled laborers and adequate resources to establish a manufacturing unit. For instance, in October 2023, Covestro, a leading manufacturer of advanced polymer materials, commenced operations at its inaugural mechanical recycling compounding line for polycarbonates in China. The new facility represents a significant milestone for Covestro, as it marks the first time the company has integrated mechanical recycling capabilities into its production processes in the country. This dedicated line is poised to manufacture over 25,000 tons of high-quality polycarbonates and blends annually. This strategic move addresses the increasing market demand for post-consumer recycled plastics, specifically in sectors such as automotive.

India Electric Vehicles Plastics Companies Market Trends

Electric vehicles plastics companies market in India is anticipated to witness the fastest growth at a CAGR of 40.7% during the forecast period. With strong government initiatives such as ‘Make in India’ and increasing investment are also propelling the growth of the automotive industry. For instance, in February 2021, the Government of India approved the Faster Adoption and Manufacturing of Hybrid & Electric Vehicles (FAME)-II scheme with a fund allocation of USD 1.39 billion for the financial year 2022-22. In addition, the industry also witnessed foreign direct investment (FDI) worth USD 971.52 billion during the 2000-2023 period.

Key Asia Pacific Electric Vehicles Plastics Company Insights

The market is moderately competitive with multiple players leading the market. The leading players adopt different strategies like product innovation, mergers & acquisitions, collaborations and more. The competition is based on the quality of the end product. Since automotive is involved, the products are designed keeping in mind the safety of the end users.

Key Asia Pacific Electric Vehicles Plastics Companies:

- BASF SE

- SABIC

- LyondellBasell Industries Holdings B.V.

- Evonik Industries

- Covestro AG

- Dupont

- Sumitomo Chemicals Co. Ltd.

- LG Chem

- Asahi Kasei

- LANXESS Asia

- INEOS Group

- AGC Chemicals

- EMS-Chemie Holding

- Mitsubishi Engineering Plastics Corp.

Recent Developments

-

In January 2024, LG Chem and Enilive agreed upon a joint venture for setting up a biorefinery in South Korea by 2026. This biorefinery will be processing approx. 400,000 tons of renewable bio-feedstocks annually using Eni's Ecofining technology. The products produced will also contain bio-naptha which is a feedstock source for creating raw materials, like ethylene and propylene, to make plastics.

-

In April 2023, Mitsubishi Chemical Group has acquired XANTAR a high-value polycarbonate resin and NOVADURAN a polybutylene terephthalate resin businesses from Mitsubishi Engineering Plastics Corp., through a demerger. The step has been taken to accelerate business expansion and leveraging its global network capacity.

Asia Pacific Electric Vehicles Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.70 billion

Revenue forecast in 2030

USD 8.93 billion

Growth rate

CAGR of 31.8% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, Application, Component, Vehicle Type, Country

Regional Coverage

Asia Pacific

Country Coverage

China; India; Japan; South Korea; Southeast Asia

Key companies profiled

BASF; SABIC; LyondellBasell Industries Holdings B.V.; Evonik Industries; Covestro AG; Dupont; Sumitomo Chemicals Co. Ltd.; LG Chem; Asahi Kasei; LANXESS Asia; INEOS Group; AGC Chemicals; EMS-Chemie Holding; Mitsubishi Engineering Plastics Corp.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Electric Vehicle Plastics Market Report Segmentation

This report forecasts volume & revenue growth at regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2024 to 2030. For this study, Grand View Research has segmented the Asia Pacificelectric vehicle plastics market report based on resin, application, components, vehicle type, and country:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polyethylene (PE)

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyvinyl Butyral (PVB)

-

Polybutylene Terephthalate (PBT)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Interior

-

Exterior

-

Powertrain System/Under Bonnet

-

Lighting & Electric Wiring

-

-

Components Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Steering & Dashboards

-

Car Upholstery

-

Bumper

-

Door Assembly

-

Exterior Trim

-

Interior Trim

-

Connector and Cables

-

Battery

-

Lighting

-

Electric Wiring

-

Others

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

Frequently Asked Questions About This Report

b. The battery electric vehicle segment dominated the Asia Pacific electric vehicle plastics market with a revenue share of 80% in 2023.

b. Some of the key players operating in the Asia Pacific electric vehicle plastics market include BASF; SABIC; LyondellBasell Industries Holdings B.V.; Evonik Industries; Covestro AG; Dupont; Sumitomo Chemicals Co. Ltd.; LG Chem; Asahi Kasei; LANXESS Asia; INEOS Group

b. Key factors that are driving the Asia Pacific electric vehicle plastics market growth include the growing electric vehicle industry especially in emerging economies such as India, China, Vietnam, Indonesia, and Thailand are expected to positively influence the growth of the market over the forecast period

b. The Asia Pacific electric vehicle plastics market size was estimated at USD 1.32 billion in 2023 and is expected to be USD 1.70 billion in 2024.

b. The Asia Pacific electric vehicle plastics market, in terms of revenue, is expected to grow at a compound annual growth rate of 31.8% from 2024 to 2030 to reach USD 8.93 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."