- Home

- »

- Plastics, Polymers & Resins

- »

-

Electric Vehicle Plastics Market Size & Share Report, 2030GVR Report cover

![Electric Vehicle Plastics Market Size, Share & Trends Report]()

Electric Vehicle Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Resin (PP, PU), By Application (Interior, Exterior), By Vehicle Type (BEV, HEV/PHEV), By Components (Battery, Bumper), And Segment Forecasts

- Report ID: GVR-4-68039-975-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Plastics Market Trends

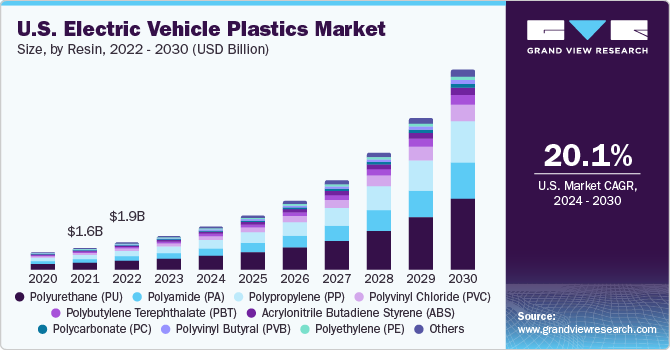

The global electric vehicle plastics market size was estimated at USD 2.37 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of 28.0% from 2024 to 2030. A rapidly rising demand for weight reduction in Battery Electric Vehicle (BEV)/ Plug-in Hybrid Vehicle (PHEV) and Hybrid Electric Vehicle (HEV), along with the enhanced performance of these products under extreme conditions, are expected to drive plastics demand in the e-vehicle manufacturing segment. Moreover, growing environmental concerns, stringent emission norms to encourage electrification and weight reduction, and an expanded usage of anti-microbial plastics in EVs, are poised to drive market expansion.

The U.S., China, the U.K., Japan, India, Germany, and Canada are some of the leading nations showcasing strong growth potential. Rising carbon dioxide (CO2) emissions, as well as growing environmental concerns, have compelled governments to impose strict regulations with regard to emissions. Thus, increasing global regulations are anticipated to drive a strong demand for EVs in the coming years, which is poised to create a healthy demand for plastics.

EVs’ heat generation is less compared to traditional internal combustion engines (ICE), therefore manufacturers can use resins in place of expensive metals. These factors, along with custom capabilities, formability, low price, performance, and natural fit of plastics, make them suitable for utilization in EVs. Key attributes of plastics include low weight, part consolidation, molding components that fit in non-linear spaces, and noise & vibration damping.

Market Dynamics

Stringent emission standards & banning of fossil fuel-powered vehicles and beneficial attributes exhibited by plastics support market growth. A steadily growing use of fossil fuel-powered vehicles has resulted in the emission of carbon dioxide and greenhouse gases, such as hydrofluorocarbons (HFCs), nitrous oxide (N2O), and methane (CH4). These gases have extensively impacted the temperature & atmosphere quality, leading to respiratory health issues and climatic changes. To counter the rising impact of fossil fuel-powered vehicle emissions, strict emission standards have been implemented by countries globally.

These stringent policies and regulations are anticipated to compel automakers to develop EVs and lower fossil fuel-powered vehicle production. For example, as of January 2023, the United States government has implemented a tax credit on e-vehicle purchases. This regime incorporates that the tax credit amount is equal to less than 15% of the vehicle purchase price for plug-in hybrid vehicles and 30% for EVs and fuel cell EVs.

Travel range shows the distance that an EV can cover with a fully charged battery. Hence, vehicle weight reduction and increasing travel range in a single charge are critical factors for EV manufacturers. Plastics exhibit higher impact resistance, lightweight characteristics, good electrical insulation, chemical resistance, and the ability to operate in high and low temperatures. This makes them an essential material to be included in various EV equipment, such as lithium-ion batteries, interior components, and external components. Lithium-ion batteries are power sources for EVs and plastic components are included in their assembly.

Resin Insights

In terms of resins, the global market has been segmented into Polyamide (PA), Polypropylene (PP), Polyethylene (PE), Polycarbonate (PC), Polyurethane (PU), Polyvinyl Butyral (PVB), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Polybutylene Terephthalate (PBT), and Polyethylene Terephthalate (PET), among others. The polyurethane segment led the market in 2023 with a share of over 28.0% of the total revenue. It has enhanced water resistance, radiation resistance, toughness, chemical resistance, and others. Polyurethane boosts power and promotes crash safety in EV batteries.

Furthermore, it is used in insulation panels, suspension bushings, foam seating, cushions, electrical compounds, and others. These factors are expected to drive demand for plastics in EVs from 2024 to 2030. In addition, the PP segment is estimated to register the fastest CAGR of 34.2% from 2024 to 2030. Polypropylene manufacturers are developing different grades of PP for weight reduction of vehicles, which would help extend the range of EVs. Its application includes both interior and exterior parts as well as structural and non-structural parts. Furthermore, it is used in cable insulation, carpet fibers, bumpers, tailgates, and others.

Vehicle Type Insights

The battery electric vehicle (BEV) type segment dominated the global market in 2023 and accounted for a maximum share of more than 75.0% of the overall revenue. The growing population and stringent emission regulations are boosting product demand in the EV space. Plastics are used for overall weight reduction of vehicles, BEV is focused on reducing the weight of vehicles, which would help increase the range of EVs. Manufacturers are concentrating on the safety and strength of vehicles and using cost-effective plastics for battery compartment areas. These trends are expected to create demand for plastics over expensive metals.

Along with BEV, other variants of EVs include plug-in hybrid vehicles (PHEV) and hybrid electric vehicles (HEV). PHEVs have batteries to power electric motors and an alternative fuel source to power ICE. Vehicles automatically switch over to ICE during low battery situations. However, BEVs are preferred over PHEVs as they are more efficient and have low maintenance costs. HEVs incorporate an ICE coupled with an electric motor that uses energy stored in batteries. In addition, power generated by an electric motor might allow a smaller ICE and further, reduce engine idling when the vehicle is stopped. These factors provide enhanced performance and offer better fuel economy.

Application Insights

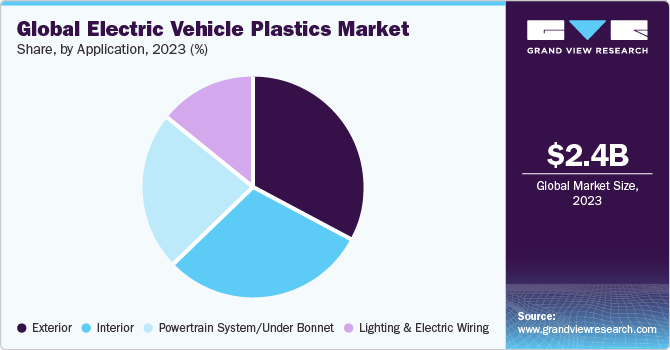

The exterior application segment dominated the industry in 2023 and accounted for a maximum share of more than 33.3% of the overall revenue. A rise in plastic usage as a replacement for metals in different parts of vehicles, including bumper, lighting, door assembly, and others is contributing to an increase in demand for plastics. The use of plastics lowers accident risks, as these plastics act as absorbing bodies. In addition, plastics help reduce the overall vehicular weight, enhance vehicle aesthetics, and provide the required strength. Plastics have physical and electrical properties, such as resistance to heat, chemicals, and abrasion, which are expected to drive segment growth.

Under-the-hood components of vehicles were traditionally made of metals, which are now being replaced by plastics as they help reduce overall vehicular weight. Nylon, PP, and polyphenylene sulfide are some of the major plastics used in vehicles that provide benefits including parts consolidation, corrosion resistance, sound dampening, cost savings, and others. Nylon is the most widely used thermoplastic in engine compartments as it has high strength and can withstand high temperatures. Polyethylene has low density, high impact resilience, & solid durability and can be used where moisture resistance is required. It can be used to make low-cost electrical insulations.

Components Insights

The interior trim segment dominated the industry in 2023 and accounted for the largest share of more than 17.0% of the overall revenue. The components segment includes steering & dashboards, car upholstery, bumper, door assembly, exterior trim, connector and cables, battery, lighting, electric wiring, and interior trim. Acrylonitrile butadiene styrene (ABS) is one of the major plastics used for manufacturing steering and dashboards as it offers tensile strength, surface hardness, heat resistance, chemical resistance, etc. Polymethyl Methacrylate (PMMA) is used in car upholstery as it offers a transparent & glossy finish, hardness, and resistance to scratching, etc.

Interior component segment includes door lining, roof lining, seat trim, steering cover, and others. Interior trim provides comfort and a suitable environment inside the vehicle. Exterior trim includes wheel covers, headlights, fenders, and others that giveg vehicles an aesthetic look. Plastics reduce the cost of production of batteries and eventually replace metallic components. Plastics, such as PP, have enhanced shock absorption abilities and prevent damage to batteries from accidental shocks. Furthermore, PET is a good insulator that prevents short-circuiting and acts as a separator.

Regional Insights

Asia Pacific was the dominant region in 2023 and accounted for more than 55.9% of the global revenue share. China, Japan, South Korea, and India are a few major countries in the region with high production capacity. This is supported by easy availability of raw materials and skilled & low-cost manpower. China has one of the largest EV sales in the region. A rise in disposable income and increasing demand for EVs from the middle-class population across emerging economies, such as China and India, is anticipated to boost market growth over the forecast period.

Chemical companies in Europe are manufacturing plastics for EVs on a large scale. Tax exemption, subsidies, and supportive policies are boosting regional market growth. Volkswagen, a leading global automotive manufacturer, plans to invest USD 7.1 billion to add 25 new EVs to its existing electric vehicle portfolio in the North American region. Moreover, the manufacturer expects 55% of its vehicle sales in the country to be accounted for by EVs in years to come.

Key Companies & Market Share Insights

The global market is highly fragmented due to the presence of a large number of global and regional players. Key players are facing competition from regional players, who have robust distribution networks and an adequate understanding of suppliers and regulations. For instance, General Motors Company (GMC), a U.S.-based automotive manufacturer, has a higher market captivation in terms of EVs, posing a challenge for global automotive manufacturers, such as Audi and BMW, to expand their EV market across the U.S. Major players are involved in research & development for production of superior-quality resins that provide improved features.

Furthermore, companies undertake strategic initiatives, such as mergers & acquisitions, joint ventures, production expansion, and technological collaborations, to maintain higher market share. For instance, in October 2023, LyondellBasell Industries Holdings B.V. launched its new range of translucent polypropylene compounds, namely, Hifax and Hostacom. This new product portfolio has been launched to cater to the rising demand for aesthetic light effects from EV manufacturers. In May 2022, LG Chem, a Korean polymer manufacturer, developed an advanced plastic that prevents thermal runaway in EV batteries. The product is made from different composites, including polyamide (PA) and polyphenylene oxide (PPO) resin.

Key Electric Vehicle Plastics Companies:

- BASF SE

- SABIC

- LyondellBasell Industries Holdings B.V.

- Evonik Industries

- Covestro AG

- Dupont

- Sumitomo Chemicals Co. Ltd.

- LG Chem

- Asahi Kasei

- LANXESS

- INEOS Group

- Celanese Corp.

- AGC Chemicals

- EMS-Chemie Holding

- Mitsubishi Engineering Plastics Corp.

Electric Vehicle Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.97 billion

Revenue forecast in 2030

USD 13.33 billion

Growth rate

CAGR of 28.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Resin, application, component, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

BASF SE; SABIC; LyondellBasell Industries Holdings B.V.; Evonik Industries; Covestro AG; Dupont; Sumitomo Chemicals Co. Ltd.; LG Chem; Asahi Kasei; LANXESS; INEOS Group; Celanese Corp.; AGC Chemicals; EMS-Chemie Holding; Mitsubishi Engineering Plastics Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Plastics Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2024 to 2030. For this study, Grand View Research has segmented the electric vehicle plastics market report based on resin, application, components, vehicle type, and region:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polyethylene (PE)

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyvinyl Butyral (PVB)

-

Polybutylene Terephthalate (PBT)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Interior

-

Exterior

-

Powertrain System/Under Bonnet

-

Lighting & Electric Wiring

-

-

Components Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Steering & Dashboards

-

Car Upholstery

-

Bumper

-

Door Assembly

-

Exterior Trim

-

Interior Trim

-

Connector and Cables

-

Battery

-

Lighting

-

Electric Wiring

-

Others

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle plastics market is expected to grow at a compound annual growth rate of 28.5% from 2024 to 2030 to reach USD 13.33 billion by 2030.

b. Asia Pacific region dominated the electric vehicle plastics market with a share of 55.92% in 2023. In the Asia Pacific, China is expected to be the leader in plastics for electric vehicles due to the rising government mandates regarding carbon emissions and promoting the incentives for the adoption of electric vehicles.

b. Some of the key players operating in the electric vehicle plastics market include SABIC, BASF SE, LyondellBasell Industries Holdings B.V., Evonik Industries, Covestro AG, Solvay, INEOS Group, Arkema, and Mitsubishi Engineering Plastics Corporation.

b. Rising environmental concerns along with rigorous emission rules to push electrification and weight reduction, as well as the increased usage of anti-microbial plastics in electric vehicles, are key factors driving the electric vehicle plastics market.

b. The global electric vehicle plastics market size was estimated at USD 2.37 billion in 2023 and is expected to reach USD 2.97 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.