- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific Fiber Optics Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Fiber Optics Market Size, Share & Trends Report]()

Asia Pacific Fiber Optics Market Size, Share & Trends Analysis Report By Type (Multi-Mode, Plastic Optical Fiber), By Application (Telecom, Oil & Gas), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-100-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Asia Pacific Fiber Optics Market Trends

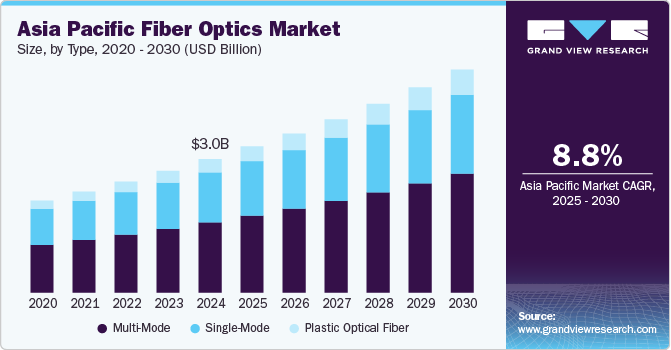

The Asia Pacific fiber optics market size was estimated at USD 3.04 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2030. The Asia Pacific fiber optics industry is expanding rapidly due to the increasing demand for high-speed internet and advanced telecommunication networks. Urbanization and the growing digital economy in countries such as China, India, and Japan are driving the adoption of fiber optics. National broadband initiatives and government investments are strengthening infrastructure, ensuring reliable connectivity for citizens and businesses.

The region's focus on digital transformation has created a surge in demand for robust communication systems. Fiber optics is becoming the backbone of these developments, offering superior bandwidth and speed. This growth is further supported by rising consumer expectations for uninterrupted, high-quality internet services.

Technological advancements, such as the rollout of 5G and the proliferation of IoT, are key contributors to the market's expansion. These technologies rely on fiber optics for high-bandwidth and low-latency connectivity, making them integral to modern networks. Industries like healthcare, finance, and manufacturing are increasingly adopting fiber optics to enhance data transfer and operational efficiency. The region is also seeing a boom in cloud computing and data center development, further fueling the need for optical fiber networks. As businesses prioritize digital solutions, the demand for reliable and scalable fiber optic infrastructure continues to grow. These developments underscore the transformative impact of fiber optics on connectivity and innovation.

Asia Pacific's role as a major manufacturing hub for electronics and telecom equipment positions it as a leader in fiber optics production and deployment. The region benefits from a skilled workforce and a strong industrial base, enabling cost-efficient manufacturing of optical fiber. Key market players are heavily investing in research and development, leading to innovations in fiber optic technology. Enhanced performance, durability, and cost-effectiveness are making fiber optics increasingly accessible across diverse applications. Strategic partnerships and collaborations are driving further market growth, especially in underserved rural and remote areas.

Type Insights

The multi-mode segment dominated the market in 2024 with a market share of 52.5% due to its widespread application in data centers and enterprise networks. Its ability to support high-speed data transmission over short-to-medium distances makes it a preferred choice for many industries. The segment's growth is bolstered by increasing investments in cloud computing and high-performance computing infrastructure. Multi-mode fibers are cost-effective and easier to deploy, which adds to their market dominance. As digital transformation accelerates across industries, the demand for reliable and efficient multi-mode fiber solutions continues to rise.

Plastic Optical Fiber (POF) is experiencing significant growth in the fiber optics industry due to its lightweight and flexible properties. Its affordability and ease of installation make it suitable for residential and automotive applications. POF is increasingly adopted in home networking and smart lighting systems, driven by the rising demand for connected devices. Advances in material technology are improving the performance and durability of POF, broadening its use cases. This growth shows the expanding role of POF in providing cost-effective and user-friendly optical solutions.

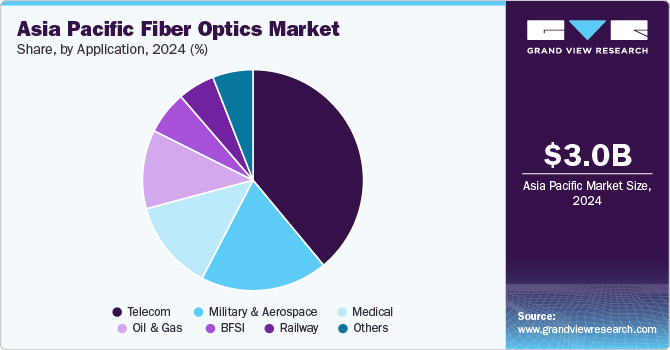

Application Insights

The telecom sector dominated the fiber optics industry in 2024, driven by the continuous demand for high-speed internet and enhanced connectivity. The expansion of 5G networks and the increasing reliance on cloud-based services have bolstered the adoption of fiber optics in telecom. Its capacity to handle high bandwidth and ensure low latency makes it essential for modern communication systems. Governments and private firms are heavily investing in upgrading telecom infrastructure, further consolidating the sector's position. The reliance on fiber optics for seamless communication and data transmission underpins the telecom market's leadership. As digital transformation progresses, telecom continues to drive significant growth in the fiber optics industry.

The medical sector is witnessing growing adoption of fiber optics due to advancements in minimally invasive surgical techniques and diagnostic imaging. Fiber optics is essential for delivering precise lighting and imaging solutions in endoscopies and laser surgeries. The rise in telemedicine and remote healthcare has also increased the need for reliable, high-bandwidth communication networks powered by fiber optics. Emerging technologies, such as fiber-optic sensors for real-time monitoring, are expanding the role of fiber optics in healthcare. Increasing demand for innovative medical devices and diagnostics is accelerating its adoption in the sector. This growth highlights the expanding application of fiber optics in improving healthcare delivery and patient outcomes.

Country Insights

China Fiber Optics Market Trends

China fiber optics market led the Asia Pacific region, accounting for a revenue share of 24.3% in 2024, driven by its large-scale investments in 5G deployment and national broadband initiatives. The country's rapidly growing digital economy and increasing internet penetration have fueled demand for advanced communication networks. China’s robust manufacturing ecosystem and innovation in optical fiber technologies have strengthened its market leadership. Significant government support and partnerships with private enterprises have accelerated the deployment of fiber optics in urban and rural areas. This dominance reflects China's strategic focus on building a comprehensive digital infrastructure to support its technological ambitions.

Laos Fiber Optics Market Trends

Laos fiber optics market is experiencing notable growth as it focuses on improving its telecommunication infrastructure. The government's initiatives to enhance internet connectivity in rural and underserved areas are driving adoption. Increasing foreign investments and regional collaborations are helping Laos build modern fiber optic networks. The growing demand for better internet access for education, businesses, and public services is further accelerating the market's expansion. Laos’ efforts to integrate into regional digital frameworks underline its commitment to advancing connectivity across the country.

Key Asia Pacific Fiber Optics Company Insights

Some of the key companies in the Asia Pacific fiber optics industry include AFL, Birla Furukawa Asia-Pacific Fiber Optics Limited, Corning Incorporated, Finolex Cables Limited, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Corning Incorporated has significantly contributed to the development of fiber optics in Asia Pacific by expanding its manufacturing capacity to meet growing regional demand. The company has focused on producing high-performance optical fibers that support advancements in 5G, broadband, and data centers. Strategic partnerships with local telecom providers have enabled Corning to deliver customized solutions for diverse connectivity needs.

-

Prysmian Group has strengthened its presence in Asia Pacific by developing innovative fiber optic solutions tailored to the region's expanding telecommunications and energy sectors. The company has established production facilities and supply chains to cater to the growing demand for high-speed connectivity and smart grids. Collaboration with local governments and enterprises has allowed Prysmian to participate in large-scale infrastructure projects.

Key Asia Pacific Fiber Optics Companies:

- AFL

- Birla Furukawa Asia-Pacific Fiber Optics Limited

- Corning Incorporated

- Finolex Cables Limited

- Huawei Technologies Co., Ltd.

- OFS Fitel, LLC

- Optical Cable Corporation (OCC)

- Prysmian Group

- Sterlite Technologies Limited

- VNPT Group

- Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC)

View a comprehensive list of companies in the Asia Pacific Fiber Optics Market

Recent Developments

-

In April 2024, Huawei Technologies Co., Ltd. launched its F5G Advanced (F5G-A) products and solutions at the Global Optical Summit 2024 in Bangkok, emphasizing advancements like Fiber-in Copper-out and optical sensing to enable industrial intelligence in the Asia Pacific. The company also initiated a global OptiX Club recruitment to foster collaboration and accelerate all-optical network applications across industries.

-

In November 2024, VNPT Group, in partnership with Qualcomm Technologies, Inc., a U.S.-based Semiconductor company, launched Vietnam's first XGS-PON WiFi 7-based Internet service, integrating Qualcomm's 10G Fiber Gateway platform for high-speed, low-latency connectivity. This milestone positions VNPT as a regional leader in advanced fiber optic and WiFi technology deployment.

Asia Pacific Fiber Optics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,326.3 million

Revenue forecast in 2030

USD 5,068.6 million

Growth rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Type, application, region

Country scope

China, Japan, India, Singapore, Thailand, Malaysia, Cambodia, Indonesia, Laos, Brunei

Key companies profiled

AFL, Birla Furukawa Asia-Pacific Fiber Optics Limited, Corning Incorporated, Finolex Cables Limited, Huawei Technologies Co., Ltd., OFS Fitel, LLC, Optical Cable Corporation (OCC), Prysmian Group, Sterlite Technologies Limited, VNPT Group, Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Fiber Optics Market Report Segmentation

This report offers revenue growth forecasts at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific fiber optics market report based on type, application, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-mode

-

Multi-mode

-

Plastic Optical Fiber

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

BFSI

-

Medical

-

Railway

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

Singapore

-

Thailand

-

Malaysia

-

Cambodia

-

Indonesia

-

Laos

-

Brunei

-

Frequently Asked Questions About This Report

b. The Asia Pacific fiber optics market size was estimated at USD 3.04 billion in 2024 and is expected to reach USD 3,326.3 million in 2025.

b. The Asia Pacific fiber optics market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 5,068.6 million by 2030.

b. China is estimated to lead the Asia Pacific fiber optics market with a share of 24.3% in 2024. This is attributable to the increasing adoption of high-speed internet, advanced technologies, and data-centric applications that have fueled the country's need for reliable and high-bandwidth connectivity.

b. Some key players operating in the Asia Pacific fiber optics market include AFL, Birla Furukawa Asia-Pacific Fiber Optics Limited, Corning Incorporated, Finolex Cables Limited, OFS Fitel, LLC, Optical Cable Corporation (OCC), Prysmian Group, Sterlite Technologies Limited, YOFC, Opcom Holdings Berhad, and Telekom Malaysia Berhad.

b. Key factors that are driving the market growth include increasing internet usage and data traffic, the growing demand for advancements in the telecommunication sector, and emerging government initiatives in infrastructure development

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."