- Home

- »

- Medical Devices

- »

-

Asia Pacific Medical Tourism Market, Industry Report, 2030GVR Report cover

![Asia Pacific Medical Tourism Market Size, Share & Trends Report]()

Asia Pacific Medical Tourism Market Size, Share & Trends Analysis Report By Treatment Type (Neurosurgery & Spine Surgery, ENT Surgery, Oncology, Plastic & Reconstructive Surgeries), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-280-9

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Medical Tourism Market Trends

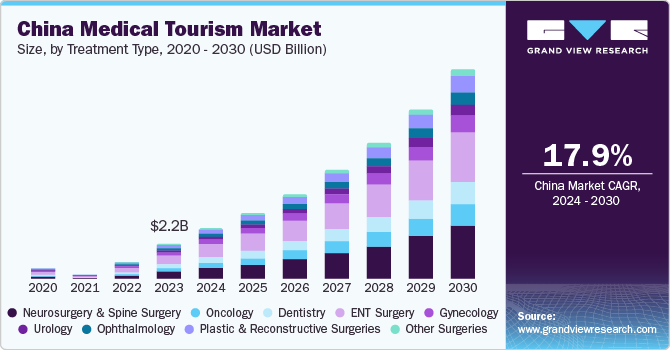

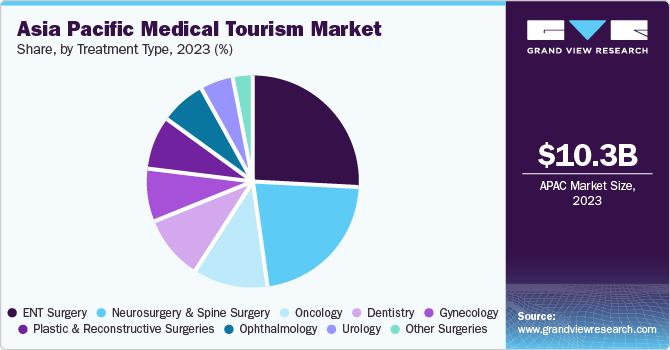

The Asia Pacific medical tourism market size was estimated at USD 10.32 billion in 2023 and is projected to grow at a CAGR of 26.4% from 2024 to 2030. The availability of skilled medical professionals for specialized treatments and improved infrastructure with access to affordable healthcare is anticipated to fuel the expansion of medical tourism in Asia Pacific. The market growth is driven by an increasing number of people traveling to the Asia Pacific region for medical treatments, including cosmetic surgeries, dental procedures, and other medical procedures. This trend is expected to continue due to the availability high-quality medical facilities at affordable costs.

One of the most significant impacts of COVID-19 on the medical tourism market in Asia Pacific was the imposition of travel restrictions. Many countries closed their borders or imposed strict quarantine measures, making it difficult for international patients to travel for medical treatment. Due to the strain on healthcare systems caused by the pandemic, many hospitals and clinics in Asia Pacific had to cancel or postpone elective procedures to prioritize COVID-19 patients. This led to a decrease in medical tourism activities in the region. The fear of contracting the virus while traveling or receiving treatment in a foreign country has also deterred many potential medical tourists from seeking healthcare services abroad. This fear has further contributed to the decline in medical tourism in Asia Pacific.

The region has a well-connected transportation network, making it easy for international patients to reach Asia Pacific. In addition, many airlines offer direct flights to major cities in the country. Moreover, the people are known for their warm hospitality and excellent customer service, which extends to the healthcare sector. The country has developed a strong healthcare system with well-trained medical professionals, state-of-the-art facilities, and advanced medical technology. This ensures that patients receive high-quality medical care.

In addition, medical procedures in countries such as India, Thailand, and Singapore are as much as 65% cheaper than in developed countries such as the U.S. or Australia. These countries offer a wide range of medical treatments, including cosmetic surgery, dental implants, breast implants, face lifts and liposuction and fertility treatments. Many hospitals and clinics in the region are accredited by international organizations such as JCI (Joint Commission International) and ISO (International Organization for Standardization). Improvement in healthcare infrastructure and availability of high-quality healthcare services at an affordable price is anticipated to propel the market growth.

Medical tourism has offered the opportunity to avoid long queues and explore various alternative for treatments by traveling abroad for diagnosis. Therefore, many international patients turned to medical tourism to save time and avoid aggravating medical problems by traveling abroad, where immediate procedures are offered. In addition, many national governments are focusing on promoting health and wellness tourism in their countries through various strategies. Therefore, strong government support is expected to stimulate market growth.

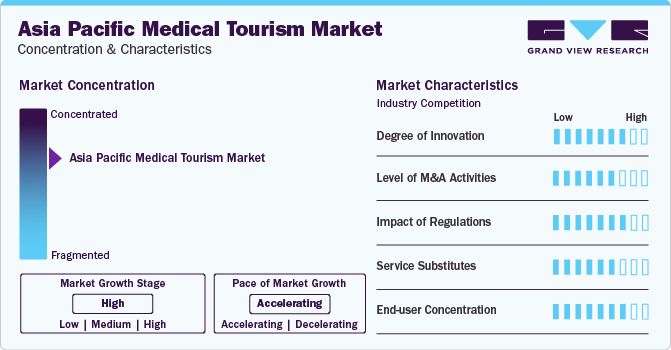

Market Concentration & Characteristics

The degree of innovation in the market is high, with a growing number of hospitals and healthcare providers investing in cutting-edge medical technologies and treatments. For instance, telemedicine and adoption of virtual reality, has become increasingly popular in the region, allowing patients to receive medical consultations and follow-up care from the comfort of their own homes. Additionally, advancements in medical robotics and artificial intelligence have led to more precise and efficient medical procedures.

Many hospitals and healthcare facilities in Asia Pacific have sought strategic partnerships with international healthcare providers to enhance their capabilities and attract more international patients. These partnerships often involve the exchange of knowledge, technology, and best practices. Some M&A activities in the market have aimed to strengthen the competitive position of participating entities. By consolidating resources and expertise, organizations can enhance their market presence and competitive advantage.

Moreover, the governments of Asia Pacific region have been imparting supportive policies to support the medical tourism in the country. For instance, in February 2024, Thailand announced USD 14,000 medical coverage for travelers in case of accidents. This step reassured the patient’s safety in the Asian country, ensuring proper care.

The regulatory framework in the Asia Pacific region varies significantly from country to country. Some countries have well-established regulatory bodies that oversee and monitor healthcare facilities catering to international patients. These regulations often focus on ensuring quality standards, patient safety, and ethical practices in the medical tourism industry.

There are limited direct product substitutes in industry because of the emerging trends in service substitutes that cater to the needs of patients seeking healthcare solutions outside their home countries. One of the key service substitutes that have gained traction in the region is telemedicine. It allows patients to consult with healthcare providers remotely, eliminating the need for physical travel for medical consultations. This substitute is particularly beneficial for patients who require follow-up consultations, routine check-ups, or minor medical advice.

End-user concentration is a significant factor in this market as several factors contribute to end-user concentration in the medical tourism market, including the quality of healthcare services, cost-effectiveness, reputation of healthcare providers, ease of travel, and government policies. Countries with renowned hospitals and healthcare facilities tend to attract a higher concentration of end-users seeking specialized medical care.

Treatment Type Insights

Based on the type of treatment, oncology dominated the market and accounted for a share of over 25% in 2023. The rising number of highly skilled oncologists and medical professionals in the region and high-quality healthcare infrastructure at lower cost is fueling the growth of oncology treatments in market. Moreover, the approach to oncology treatment in Asia Pacific often emphasizes holistic care, including complementary and alternative therapies, psychological support, and personalized treatment plans tailored to individual patient needs.

The neurosurgery and spine surgery segment is expected to register the fastest CAGR of 25.7% during the forecast period. The advancements in medical technology, availability of skilled healthcare professionals, and cost-effectiveness of treatments compared to the Western countries, increasing prevalence of neurological and spinal disorders in the region, and the rise in medical tourism infrastructure and facilities in countries including India, Thailand, and Singapore is expected to fuel the market. The hospitals in Asia Pacific are equipped with the latest technology and internationally trained neurosurgeons to provide the highest level of brain surgery care. They specialize in world-class neuro-oncology and offer exceptional treatment for brain tumors.

Country Insights

The market is driven by various factors such as affordable treatment costs, comprehensive health packages that offer a range of medical services to patients. These packages provide a one-stop solution for patients seeking medical treatments, including travel, post-operative care, accommodation, rehabilitation and other medical services. The convenience and affordability of these packages have made medical tourism a popular choice for patients in the Asia Pacific region. India, Thailand, and Singapore are the most popular medical tourism destinations in the Asia Pacific region.

India Medical Tourism Market Trends

India medical tourism market dominated the regional industry and accounted for around 30% share in 2023. According to the International Healthcare Research Center, India stands at the Global ranking of 10 out of 46 Destinations ranked within the 2020-2021 Medical Tourism Index. Indian medical practices have their roots in ancient systems such as Ayurveda, Yoga, and Siddha which combines traditional practices with contemporary medical science, making the region a significant contributor to the market.

Singapore Medical Tourism Market Trends

Singapore medical tourism market is expected to register the fastest CAGR during the forecast period. According to the Medical Tourism Index 2020-2021 for global medical tourism, Singapore was ranked second after Canada globally. The country attracts more than 500,000 international patients across the world for various specialties, including cancer treatment, complex orthopedic procedures, and heart surgery.

Thailand Medical Tourism Market Trends

The medical tourism market in Thailand ranked 5th globally in October 2023, according to the Nation Thailand. It generated approximately 11.9 billion baht in revenue from foreign patients which accounts for over 47% increase as compared to the pre-COVID phase. In October 2023, Thailand waived off visa requirements for the foreign travelers from India. This move is aimed to attract more foreign travelers to the country for treatments and tourism.

Key Asia Pacific Medical Tourism Company Insights

Some of the key companies operating in the Asia Pacific medical tourism market include Bumrungrad International Hospital; Mount Elizabeth Hospitals, Gleneagles Hospital and Apollo Hospitals; among others.

-

Singapore General Hospital is the biggest and most established hospital in Singapore, offering a wide range of medical services in different fields. SGH has a special International Patients Centre to help medical tourism.

Key Asia Pacific Medical Tourism Companies:

- Singapore General Hospital

- Mount Elizabeth Hospital

- Gleneagles Hospital

- Apollo Hospitals

- Bumrungrad International Hospital

- Raffles Medical Group

- Fortis Hospitals

- Asan Medical Center

- Seoul National University Hospital

Recent Developments

-

In November 2023, PlacidWay, a global medical health destination marketplace announced its partnership with Vega Stem Cell Clinic in Thailand. This partnership was aimed to expand health tourism and to revolutionize the landscape of regenerative medicine in the region.

-

In November 2022, TravoCure Healthcare based in India partnered with Ethiopian Airlines and announced a new collaboration to assist travelers from Africa who are seeking medical treatment in India. Both organizations aim to work together to promote India as a medical tourism destination, showcasing its modern medical technologies and internationally accredited hospitals and clinics through joint promotional activities.

-

In December 2021, Raffles Hospital, a wholly owned subsidiary of Raffles Medical Group, announced a strategic partnership with Myongji Hospital to provide a Travel Medicine Pass for travelers between Singapore and South Korea.

Asia Pacific Medical Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.86 billion

Revenue forecast in 2030

USD 60.66 billion

Growth rate

CAGR of 26.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, country

Regional scope

Asia Pacific

Country scope

China, Australia, Indonesia, Malaysia, Thailand, Singapore, South Korea, India, Taiwan

Key companies profiled

Singapore General Hospital; Mount Elizabeth Hospital; Gleneagles Hospital; Apollo Hospitals; Bumrungrad International Hospital; Raffles Medical Group; Fortis Hospitals; Asan Medical Center; Seoul National University Hospital

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Medical Tourism Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific medical tourism market report based on treatment type and countries:

-

Treatment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Neurosurgery and Spine Surgery

-

ENT Surgery

-

Dentistry

-

Oncology

-

Gynecology

-

Urology

-

Ophthalmology

-

Plastic & Reconstructive Surgeries

-

Other Surgeries

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

China

-

Australia

-

Indonesia

-

Malaysia

-

Thailand

-

Singapore

-

South Korea

-

India

-

Taiwan

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific medical tourism market size was valued at USD 10.32 billion in 2023 and is expected to reach USD 14.86 billion in 2024.

b. The Asia Pacific medical tourism market is projected to grow at a compound annual growth rate (CAGR) of 26.4% from 2024 to 2030 to reach USD 60.66 billion by 2030.

b. The oncology dominated the market and accounted for a share of over 25% in 2023. The rising number of highly skilled oncologists and medical professionals in the region and high-quality healthcare infrastructure at lower cost are fueling the growth of oncology treatments in the Asia Pacific medical tourism market.

b. Some key players in the Asia Pacific medical tourism market include Singapore General Hospital; Mount Elizabeth Hospital; Gleneagles Hospital; Apollo Hospitals; Bumrungrad International Hospital; Raffles Medical Group; Fortis Hospitals

b. The availability of skilled medical professionals for specialized treatments and improved infrastructure with access to affordable healthcare is anticipated to fuel the expansion of medical tourism in Asia Pacific. The market growth is driven by an increasing number of people traveling to the Asia Pacific region for medical treatments, including cosmetic surgeries, dental procedures, and other medical procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."