- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Metal Cans Market Size & Share Report, 2030GVR Report cover

![Asia Pacific Metal Cans Market Size, Share & Trends Report]()

Asia Pacific Metal Cans Market Size, Share & Trends Analysis Report By Material (Aluminum, Steel), By Product Type (2-Piece Draw Redraw (DRD), 3-Piece), By Closure Type, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-985-2

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

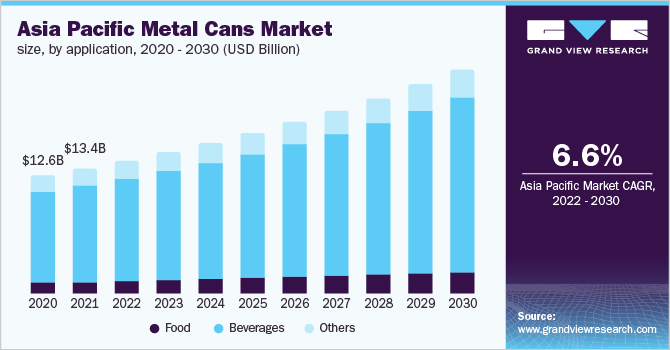

The Asia Pacific metal cans market was estimated at USD 13.40 billion in 2021 and is expected to expand at a CAGR of 6.6% from 2022 to 2030. A number of factors, including the environmental benefits of metal cans and their easy and quick recycling, along with increasing demand for the canned products are anticipated to positively affect growth of the metal cans market in Asia Pacific during the forecast period. Increasing government restrictions on the use of plastic packaging products for the packing of vegetables, soups, noodles, meat, etc. create an opportunity for growth of the market. Metal cans market in Asia Pacific is expected to witness substantial growth during the forecast period owing to an increase in the recycling rate of used metal cans. Growing demand for the optimum utilization of natural resources in the region has accelerated recycling activities and increased the reuse of metals in Asia Pacific. There are significant variations in the recycling rate of aluminum cans across the countries in Asia Pacific. For instance, Japan has one of the most organized networks of the aluminum scrap recycling.

Metal recycling has garnered increased support from the government agencies such as the Food Safety and Standards Authority of India (FSSAI) and Asia Pacific Partnership on Clean Development and Climate (APP) in the region. Moreover, the metal recycling market in the region is also expected to be benefitted from the municipal recycling programs initiated in the countries such as Indonesia, Malaysia, Australia, and India.

The increasing awareness among manufacturers and consumers about aluminum recycling and surging demand for metal cans as packaging products from Asia Pacific are the factors expected to fuel growth of the metal cans market in the region. According to the Observatory of Economic Complexity (OEC), South Korea imported scrap aluminum worth USD 88.1 million in the financial year 2019-2020. Other countries of the region, including India, China, and Malaysia imported scrap aluminum worth USD 74.2 million, USD 553 million, and USD 204 million, respectively in the same financial year.

Aluminum is a circular material that can be recycled unlimited times during manufacturing of the metal sheets. Thus, the development of the recycling infrastructures by the leading players in Asia Pacific, along with establishment of the segregation and collection units for aluminum scrap is further projected to drive growth of the metal cans market in Asia Pacific from 2022 to 2030.

Material Insights

Based on material, aluminum accounted for the revenue share of 84.3% in 2021 and the segment is likely to expand at a higher CAGR of 7.0% in terms of value, during the forecast period from 2022 to 2030. The segment is expected to gain growth owing to the added benefits offered by it to packaged beverages in the form of their extended shelf life. The usage of aluminum as a raw material for making cans, used for the packaging beverages has increased in Asia Pacific as it can be easily cooled and heated for sterilization. Moreover, aluminum maintains the structure and integrity of the products packaged in cans manufactured from it.

Aluminum is the most versatile packaging material as it offers an excellent combination of barrier properties; physical protection; decorative potential and formability; consumer acceptance; and recyclability. It is commonly used to put a barrier layer in beverage cans to protect odor and gases from leaking and prevent beverages from getting exposed to light.

Aluminum cans are the most recycled beverage containers in the world. Average aluminum cans contain approximately 70.0% recycled metal. These cans are lightweight and stackable resulting in a reduction in overall carbon emissions during their transportation. They also improve storage and shipping efficiency of the logistic companies. Moreover, these can be customized in terms of colors and 3D prints, as well as can be embossed, making them aesthetically appealing to consumers. Thus, demand for aluminum cans is increasing under the category of sustainable packaging in Asia Pacific.

Product Type Insights

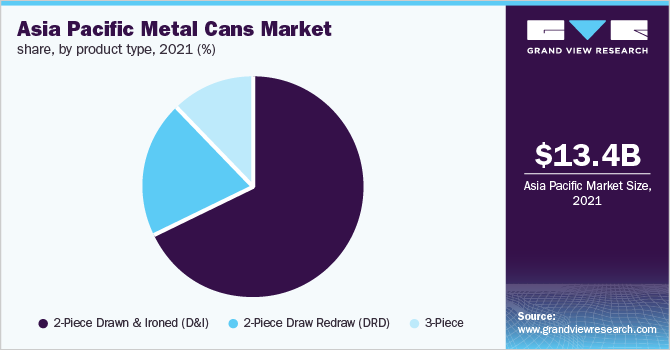

Based on product, 2-Piece draw and ironed (D&I) accounted for the maximum revenue share of 67.6% in the year 2021 and the segment is also projected to maintain its dominance throughout the forecast period. These cans are manufactured with the use of drawing and ironing of the metal sheets, which involves several processes including shearing, cupping, redrawing, drawing & ironing, trimming, necking, and flanging of cans.

Additionally, 2-Piece draw and ironed segment are also estimated to experience the fastest growth with a CAGR of 7.4% during the forecast period. Pressure-packed beverages including beer, juices, soft drinks, and carbonated beverages are often stored in these cans as they have to be consumed immediately after opening the packaging. A strong internal pressure compensates for the rigidity of the thin can wall when used for beer packaging.

Aluminum is mostly used for the manufacturing of these cans because aluminum offers excellent gas barrier characteristics, opacity, and sealing properties that ensure the quality of the beer stored in the 2-piece draw and ironed cans is maintained. Aluminum also enables metal cans to be filled at a high speed while using the time-consuming isobaric filling method. However, 2-piece draw and ironed aluminum cans have high requirements regarding material properties, can-making technology, and can-making equipment.

Closure Type Insights

Based on closure type, easy-open-end closure types are leading the market with maximum revenue share and the segment is also expected to maintain its dominance throughout the forecast timeframe. The segment accounted for a revenue share of 77.9% in 2021. In EOE, the metal tab is attached at a partially cut shell end for easy opening of the cans, this easy-open end is widely available in carbonated and beer cans.

Over the past decade, the adoption of EOE has significantly increased, owing to the clean design of EOE with high-quality metal which prevents rusting and can be opened easily without the use of any tools. Additionally, the increasing consumption of beverages in major economies across the Asia Pacific is further supporting the growth of the segment.

Asia’s alcohol consumption and retail expenditure have increased significantly. This is because of the increasing stress level, alcohol availability, and boredom due to the nuclear families ‘concept of living alone. Thus, the increasing trend of alcohol consumption in Asia Pacific is driving demand for aluminum cans with EOE for packaging spirits and beer.

Application Insights

Based on the application, the beverages segment accounted for the largest share of 67.9% of metal cans market in 2021 in terms of value. This segment is projected to maintain its dominance in the market from 2022 to 2030. Metal cans used for packaging beverages are convenient, unbreakable, and lightproof. They offer excellent barrier properties against oxidation and temperature.

Aluminum- and tin-plated steel are majorly used for developing metal cans required for packaging the beverages, such as carbonated soft drinks, alcoholic beverages, herbal teas, energy drinks, in addition to fruit and vegetable juices. Almost three-fourths of the total metal cans used for packaging beverages are produced from aluminum across the globe.

The beverages segment is further bifurcated into carbonated soft drinks, alcoholic beverages, fruit and vegetable juices, and other beverages. The alcoholic beverages segment is dominating the Asia Pacific beverages metal cans market with a maximum revenue share of 39.6% in 2021. Moreover, the segment is also projected to maintain its dominance throughout the forecast period with a maximum revenue CAGR of 7.2% from 2021 to 2030.

However, tin metal cans are ineffective in preserving acid-based citric fruits and vegetable juices. This is expected to hamper the demand for these metal cans in Asia Pacific in the coming years. In addition, companies such as The Coco-Cola Company and PepsiCo have formed various alliances with bio-based chemical manufacturers such as Gevo and Virent for development of the bio-based plastics, used for the manufacturing of packaging products. This is expected to act as a challenge to the growth of the metal cans market in Asia Pacific during the forecast period.

Regional Insights

China dominated the market with a maximum revenue share of 43.8% in 2021 and the country is expected to maintain its dominance from 2022 to 2030. In terms of volume, the county dominated Asia Pacific metal cans market. This is because China accounts for the majority of global aluminum and steel production and is characterized by the manufacturing of large quantities of metals at low cost as compared to its competitors in Europe and North America. In addition, the availability of skilled labor at a low cost distinguishes the Chinese market from its competitors in manufacturing metal cans.

The production of aluminum in China is driven by the presence of Special Economic Zones (SEZ), which provide resources such as electricity and tax reduction facilities that benefit aluminum manufacturers in the country. The presence of major aluminum manufacturers such as Aluminum Corporation of China Limited, Luneng Jinbei - Yuan ping Alumina Refinery, Shandong Weiqiao Aluminum and Power Co., Ltd., and Shandong Xinfa Aluminum Group in the country has led to an abundance in the supply of the metal, thus making it available at affordable prices for the manufacturers of metal cans.

The beverages segment accounted for a maximum revenue share of 80.9% in the regional market in 2021. The segment is estimated to maintain its dominance throughout the forecast period. According to China Beverage Industry Association (CBAI), China soft drink retail market was worth USD 142.0 billion in 2019, accounting for one of the highest shares in the Chinese beverage market. Further, in recent years, there has been a steady uptick in the consumption of sparkling water, soda water, and tea, as well as zero-sugar and zero-calorie beverages, due to rising health-conscious consumers in China.

Key Companies & Market Share Insights

Asia Pacific metal cans market is highly competitive with the presence of a large number of small and big companies majorly including such as Ball Corporation, CROWN Holdings, Inc, CPMC Holdings Limited, ORG Packaging Co. Ltd, Sunrise Group Co., Ltd. (Shengxing Group), and BWAY Corporation. The metal cans market in Asia Pacific is characterized by expansions of the production capacities and the innovations in products being offered, along with the strategy of mergers & acquisitions adopted by the companies to increase their share in the market.

For instance, in January 2022, Ball Corporation invested approximately USD 131.4 million (INR 1,000 Crore) in the development of two manufacturing plants for the production of aluminum cans and bottles in India. Similarly, in 2020, Crown Holdings, Inc. expanded its production capacity for metal cans in countries such as the U.S., Spain, Canada, and Thailand. The company expanded its production capacity by adding manufacturing lines to its existing facilities. The markets within Asia Pacific are expanding due to the surging demand for sustainable packaging solutions. Some of the prominent players in Asia Pacific metal cans market include:

-

Swan Industries (Thailand) Limited

-

Ball Corporation

-

Crown Holdings, Inc.

-

CPMC Holdings Limited

-

Kian Joo Can Factory Berhad

-

BWAY Corporation

-

Silgan Containers

-

Dongwon Group

-

Lohakij Rung Charoen Sub Co., Ltd.

-

Poonsub Can Co., Ltd.

-

Sunrise Group Co., Ltd.

-

ORG Technology Co., Ltd

-

Delta Seikan Corporation

-

CANPACK

-

Baosteel Group

Asia Pacific Metal Cans Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 14.23 billion

Revenue forecast in 2030

USD 23.87 billion

Growth Rate

CAGR of 6.6% from 2021 to 2030

Base year for estimation

2021

Historical data

2017 - 2021

Forecast period

2022 - 2030

Quantitative units

Volume in million units, revenue in USD million and CAGR from 2022 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Material, Product, Type, Closure Type, Application

Country Scope

China, Japan, South Korea, Indonesia, Thailand, Vietnam, Philippines, Malaysia, Singapore

Key companies profiled

Swan Industries (Thailand) Limited, Ball Corporation, Crown Holdings, Inc, CPMC Holdings Limited, Kian Joo Can Factory Berhad, BWAY Corporation, Silgan Containers, Dongwon Group, Lohakij Rung Charoen Sub Co., Ltd., Poonsub Can Co., Ltd., Sunrise Group Co., Ltd., ORG Technology Co., Ltd, Delta Seikan Corporation, CANPACK, Baosteel Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Metal Cans Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific metal cans market report based on the material, product type, closure type, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030) )

-

Aluminum

-

Steel

-

-

Product Type Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

2-Piece Draw Redraw (DRD)

-

2-Piece Drawn and Ironed (D&I)

-

3-Piece

-

-

Closure Type Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Easy-open End (EOE)

-

Peel-off End (POE)

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Food

-

Vegetables

-

Fruits

-

Soups & miscellaneous foods

-

Other Foods

-

-

Beverages

-

Carbonated soft drinks

-

Alcoholic beverages

-

Fruit and vegetable juices

-

Other Beverages

-

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

China

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

Vietnam

-

Philippines

-

Malaysia

-

Singapore

-

Frequently Asked Questions About This Report

b. The Asia Pacific metal cans market was estimated at USD 13.4 billion in 2021 and is expected to reach USD 14.23 billion in 2022.

b. The Asia Pacific metal cans market is expected to grow at a compound annual growth rate of 6.6% from 2021 to 2030 to reach USD 23.87 billion by 2030.

b. The beverage segment dominates the Asia Pacific metal cans market with a revenue share of 67.9% in 2021 owing to the presence of a large number of beverage manufacturers, increasing demand for alcoholic beverages, and the rising spending power of consumers.

b. Some key players operating in the Asia Pacific metal cans market include Swan Industries (Thailand) Limited; Ball Corporation; Crown Holdings, Inc; CPMC Holdings Limited; Kian Joo Can Factory Berhad; BWAY Corporation; Silgan Containers; Dongwon Group; Lohakij Rung Charoen Sub Co., Ltd.; Poonsub Can Co., Ltd.; Sunrise Group Co., Ltd.; ORG Technology Co., Ltd; Delta Seikan Corporation; CANPACK; Baosteel Group.

b. Key factors that are driving the market growth include increasing demand for sustainable packaging, strict regulations on the use of plastic packaging, increasing recycling of aluminum, and increasing demand for beverages in Asian countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."