- Home

- »

- Food Safety & Processing

- »

-

Metal Cans Market Size And Share, Industry Report, 2033GVR Report cover

![Metal Cans Market Size, Share & Trends Report]()

Metal Cans Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Aluminum, Steel), By Product (2-Piece Drawn And Ironed, 2-Piece Draw Redraw (DRD), 3-Piece), By Closure Type, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-150-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Cans Market Summary

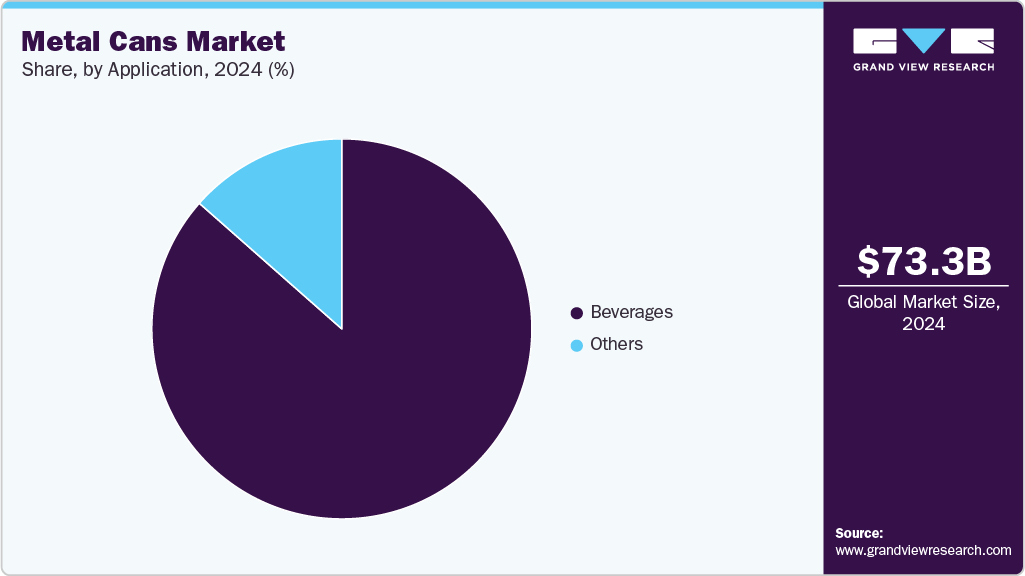

The global metal cans market size was estimated at USD 73.34 billion in 2024 and is projected to reach USD 127.75 billion by 2033 to grow at a CAGR of 6.4% from 2025 to 2033. The global market is driven by increasing demand for sustainable and recyclable packaging, especially in the food and beverage sector.

Key Market Trends & Insights

- North America dominated the metal cans market with the largest revenue share of 32.2% in 2024.

- U.S. metal can market growth stems from high packaged food and drink consumption, robust recycling, and rising demand for sustainable packaging.

- By material, the aluminum segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

- By product, the 2- piece drawn and ironed segment is expected to grow at a considerable CAGR of 6.7% from 2025 to 2033 in terms of revenue.

- By closure type, the easy- open end (EOE) segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 73.34 Billion

- 2033 Projected Market Size: USD 127.75 Billion

- CAGR (2025-2033): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, rising urbanization and consumer preference for convenient, ready-to-eat products are boosting market growth. The push for sustainable packaging is a major catalyst for market growth. Metal, especially aluminum, is infinitely recyclable and retains material quality through repeated cycles. Aluminum cans use about 90% less energy when made from recycled content. Beverage industry giants such as Coca‑Cola and PepsiCo are scaling up recycled-aluminum usage in response to consumer and regulatory pressure.In India, for instance, in May 2024, Ball Corporation partnered with CavinKare to introduce retort two-piece aluminum cans for CavinKare’s popular milkshakes in India, marking a significant move towards sustainable and convenient dairy packaging. Both companies emphasize that this collaboration not only delivers superior product quality but also significantly reduces environmental impact, supporting a shift towards 100% sustainable packaging and reinforcing their leadership in eco-conscious innovation within the Indian beverage sector.

In addition, urban lifestyles and busier schedules are fueling demand for ready-to-drink (RTD) yogurt, soups, beverages, and on-the-go meals. Metal cans offer durability, portability, extended shelf life, and strong barrier properties, ideal for these applications. A growing number of brands, from Nespresso’s canned coffee to craft beer, are adopting metal, supported by innovations such as resealable tops, embossed branding, and lightweighting.

Beverages, particularly soft drinks, energy drinks, beer, and alcoholic RTDs, account for around 77% of the metal can market. The craft beer movement and premium drinks market are driving demand for eye-catching designs, slimmer cans, and specialty coatings. In July 2023, Effingut, a craft brewing company, announced the launch of its signature craft beers in 500-ml cans.

Despite strong demand, the market is sensitive to global metal costs and policy shifts. Aluminum and steel price fluctuations, amplified by U.S. tariffs such as the recent 25-50% levies, are raising production costs and potentially nudging some manufacturers toward cheaper plastic alternatives. For example, U.S. canned food producers face price increases of 9-15%, which could impact demand. However, a stronger recycling infrastructure and lightweighting efforts offer long-term mitigation by reducing dependence on virgin aluminum.

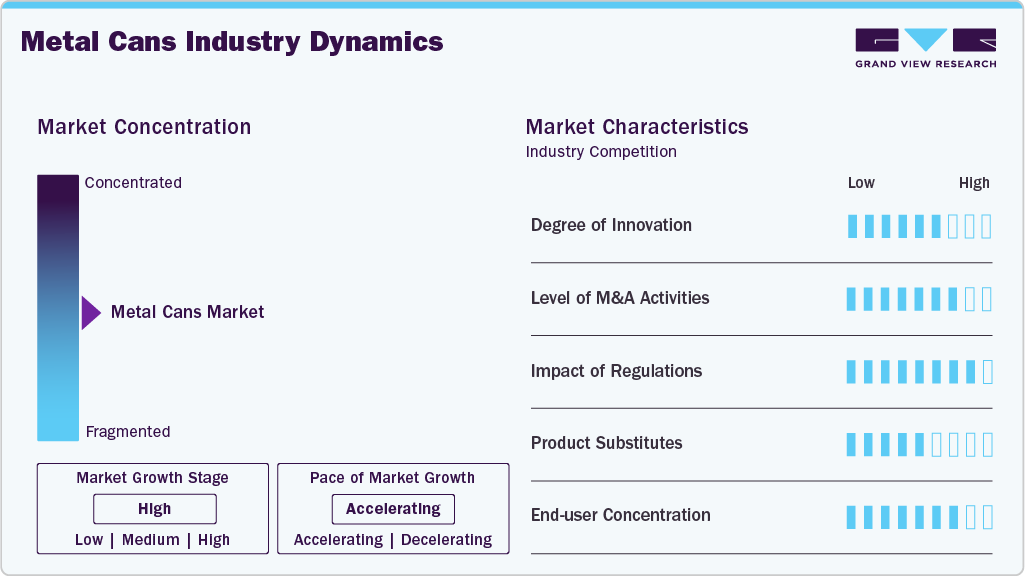

Market Concentration & Characteristics

The metal cans industry requires significant capital investment in high-speed can manufacturing lines, coating/printing systems, and recycling infrastructure. Companies also invest in R&D for innovations such as BPA-free linings, light-weighting technologies, and advanced forming techniques. Automation and quality control technologies (e.g., AI-based inspection) are increasingly adopted to reduce waste and boost throughput.

Metal cans are regulated under food safety and packaging directives such as the FDA (U.S.), EFSA (Europe), and REACH compliance. Environmental regulations, such as extended producer responsibility (EPR) schemes and single-use packaging bans, encourage the use of recyclable materials. Sustainability is both a requirement and a value proposition, with aluminum being among the most recycled materials globally, with recycling rates over 70% in many regions.

Material Insights

The aluminum segment recorded the largest revenue share of over 74.0% in 2024 and is expected to grow at the fastest CAGR of 6.6% during the forecast period. Aluminum is the most widely used material for beverage cans due to its lightweight, corrosion resistance, and excellent barrier properties. Aluminum cans are primarily used for carbonated soft drinks, energy drinks, and beer, offering excellent shelf life and sustainability credentials. The demand for aluminum cans is driven by growing consumer and regulatory pressure for sustainable packaging. The near-infinite recyclability of aluminum with minimal degradation and lower energy use during recycling is a key advantage.

Steel cans are predominantly used in food packaging due to their strength, rigidity, and ability to withstand heat sterilization. These cans often have a thin coating of tin to resist corrosion (commonly referred to as tinplate). Steel offers strong protection for acidic and perishable foods such as tomatoes, soups, pet foods, and canned vegetables. Its magnetic properties also make it easier to sort and recycle during waste processing, supporting closed-loop recycling systems. Steel cans are primarily driven by demand in the food industry, particularly for long shelf-life and shelf-stable products.

Product Insights

The 2- piece drawn and ironed segment recorded the largest revenue share of over 66.0% in 2024 and is anticipated to grow at the fastest CAGR of 6.7% during the forecast period. D&I cans are predominantly used for beverage packaging, such as beer, soft drinks, and energy drinks, due to their lightweight, high-speed production capabilities, and seamless structure that improves shelf life by reducing leakage risks. The high-speed manufacturing process of D&I cans offers cost-efficiency at scale, making them a preferred choice for major beverage brands focusing on sustainability and mass distribution.

2-piece draw redraw (DRD) cans are made using a drawing process that creates thicker-walled containers suitable for holding heavier and solid products. Unlike D&I cans, DRD cans are more rigid and can accommodate retort processing, making them ideal for food products such as soups, sauces, pet foods, and nutritional products that require heat sterilization and longer shelf lives. Their superior structural integrity and resistance to internal pressure changes make them ideal for vacuum-sealed or retort-processed products.

Closure Type Insights

The easy-open end (EOE) segment recorded the largest revenue share of over 78.0% in 2024 and is expected to grow at the fastest CAGR of 6.6% during the forecast period. Easy-Open End (EOE) closures are metal can lids that can be easily removed by pulling a ring or tab, eliminating the need for a can opener. These ends are commonly used in food and beverage cans such as soups, vegetables, soft drinks, and beer. EOEs enhance user convenience and are widely adopted across various can sizes and materials. The primary driver for EOEs is consumer convenience, as they allow quick access to the contents without additional tools.

Peel-off ends (POE) are closures that feature a foil or membrane sealed onto the can’s top, which is peeled away to access the contents. These are typically used for products that require extra hygiene or easy sterilization, such as infant formula, pharmaceutical items, and dairy products. POE closures are driven by the need for hygienic packaging solutions, especially in sectors such as infant nutrition and pharmaceuticals. Their ability to maintain sterility while being easy to open makes them ideal for sensitive applications. Additionally, the rise in premium packaging and increasing health and safety awareness among consumers has led to growing demand for POEs in niche but high-value product categories.

Application Insights

The beverages segment recorded the largest revenue share of over 77.0% in 2024 and is expected to grow at the fastest CAGR of 6.6% during the forecast period. The beverage segment is the largest application segment for metal cans and includes both alcoholic and non-alcoholic drinks such as beer, carbonated soft drinks, energy drinks, juices, and sparkling water. This dominance is due to their lightweight, recyclability, and efficient chilling properties. Beverage brands often favor metal cans for their aesthetic appeal and ability to retain carbonation and freshness over extended periods. The growing popularity of on-the-go beverage formats, especially in urban centers and during outdoor events, also propels demand. Additionally, global awareness and regulatory pressures regarding plastic waste have encouraged beverage companies to transition to fully recyclable metal cans.

The food segment includes metal cans used for packaging canned vegetables, fruits, ready-to-eat meals, pet food, soups, sauces, and seafood. Metal cans provide a long shelf life, protect food from contamination, and maintain nutritional value due to their airtight sealing and light barrier properties. They are widely adopted for both household and institutional food applications, especially in regions with high urbanization and busy lifestyles that demand convenience and long-lasting storage. The primary drivers for metal cans in the food segment are increasing demand for ready-to-eat and convenience food products, rising pet ownership (boosting demand for canned pet food), and strong consumer preference for sustainable packaging. Growing exports of canned food items, particularly from developing countries, also contribute to market expansion.

Regional Insights

North America metal cans market dominated the global market and accounted for the largest revenue share of over 32.0% in 2024. This positive outlook is due to high consumption of canned beverages (beer, soda) and processed foods. The U.S. and Canada have well-established recycling infrastructures, making metal cans an eco-friendly choice. Craft beer and energy drink trends have further boosted demand, companies such as Crown and Ball Corporation supply billions of cans annually to brands such as Coca-Cola and Pepsi. Moreover, the shift from plastic to metal packaging in products such as aerosols and pet food supports market growth.

U.S. Metal Cans Market Trends

The U.S. growth in metal cans market is due to a combination of high consumption rates of packaged food and beverages, strong recycling infrastructure, and increasing demand for sustainable packaging. With a well-established food and beverage industry and a large consumer base that favors convenience products like ready-to-drink beverages, canned soups, and pet foods, the U.S. accounts for a significant share of global metal can usage.

Europe Metal Cans Market Trends

Europe metal cans market is a mature yet growing market, driven by strict sustainability regulations and high recycling rates. Germany, the UK, and France lead in canned food and beverage consumption, with a strong preference for eco-friendly packaging. The beer industry, particularly in Germany, relies heavily on metal cans for export and domestic sales. Additionally, the rise of canned wines and premium beverages has expanded the market. Companies such as Ardagh Group S.A. and CANPACK are investing in lightweight, recyclable cans to meet EU circular economy goals.

Asia Pacific Metal Cans Market Trends

The Asia Pacific metal cans market is expected to grow at the fastest CAGR of 6.9% over the forecast period. This outlook is due to rapid urbanization, a growing middle class, and increasing demand for packaged food and beverages. Countries such as China, India, and Japan are major contributors, with the food & beverage industry expanding significantly. The rise of ready-to-eat meals, canned seafood, and energy drinks has fueled demand for metal packaging.

Additionally, sustainability concerns are pushing manufacturers toward recyclable metal cans. For example, in India, companies such as Ball Corporation and Hindustan Tin Works Ltd are investing in sustainable metal packaging solutions to cater to the booming beverage industry. The region’s e-commerce growth also drives demand for canned goods due to longer shelf life and durability during transportation.

Key Metal Cans Company Insights

The competitive environment of the global metal cans market is characterized by the presence of several well-established players operating across a highly consolidated and moderately fragmented landscape. Key companies such as Ball Corporation, Crown, Ardagh Group S.A., Silgan Containers, and CANPACK dominate due to their extensive product portfolios, global manufacturing footprint, and strong relationships with end-users. Competition is driven by pricing pressure, innovation in lightweight and recyclable designs, and growing demand for sustainable packaging. Additionally, new entrants face high capital requirements and stringent environmental regulations, giving established players a competitive edge. Strategic partnerships, mergers, and acquisitions are common tactics to gain market share and expand into emerging economies.

-

In May 2025, VulCan Packaging launched North America’s first commercial-scale aTULC (aluminum Toyo Ultimate Can) manufacturing unit, introducing a new era of sustainable beverage packaging to the region. This innovation, developed in partnership with Stolle Machinery Company, is designed to enhance shelf life, improve brand visibility, and meet the growing demand for eco-friendly packaging among beverage brands across North America.

-

In December 2024, Ball Corporation partnered with Dabur India Limited to launch Réal Bites juice in fully recyclable aluminum cans, marking a significant step toward eco-friendly packaging in India.

Key Metal Cans Companies:

The following are the leading companies in the metal cans market. These companies collectively hold the largest market share and dictate industry trends.

- Sonoco Products Company

- Toyo Seikan Co., Ltd.

- Ball Corporation

- Crown

- CANPACK

- Ardagh Group S.A.

- Hindustan Tin Works Ltd

- Trivium Packaging

- Silgan Containers

- Ohio Art Metal Pack, LLC

- Mauser Packaging Solutions

- Envases Group

- Nampak Ltd.

Metal Cans Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 77.79 billion

Revenue forecast in 2033

USD 127.75 billion

Growth rate

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in million units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, closure type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK;

Italy; Spain; China; India; Japan; Australia; South Korea; Indonesia; Thailand; Vietnam; Philippines; Malaysia; Singapore; Brazil; Saudi Arabia

Key companies profiled

Sonoco Products Company; Toyo Seikan Co., Ltd.; Ball Corporation; Crown; CANPACK; Ardagh Group S.A.; Hindustan Tin Works Ltd; Trivium Packaging; Silgan Containers; Ohio Art Metal Pack, LLC; Mauser Packaging Solutions; Envases Group; Nampak Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Cans Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global metal cans market report based on material, product, closure type, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Aluminum

-

Steel

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

2- Piece Drawn and Ironed

-

2- Piece Draw Redraw (DRD)

-

3- Piece

-

-

Closure Type Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Easy- Open End (EOE)

-

Peel- off End (POE)

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Food

-

Beverages

-

Others

-

-

Regional Outlook ((Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

Vietnam

-

Philippines

-

Malaysia

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.