- Home

- »

- Consumer F&B

- »

-

Asia Pacific Pet Milk Replacers Market Size Report, 2030GVR Report cover

![Asia Pacific Pet Milk Replacers Market Size, Share & Trends Report]()

Asia Pacific Pet Milk Replacers Market Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Product (Medicated, Non-medicated), By Form, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-131-5

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

The Asia Pacific pet milk replacers market size was estimated at USD 80.1 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Growing awareness of pet nutrition and welfare, the rising number of pets, and the hectic lifestyles of pet owners who require convenient pet food options are shaping the pet milk replacers market in the region. Factors such as the trend of pet adoption and increased spending on pet food and pet care products have created a growth opportunity for various companies.The increasing demand for premium pet food in Asia Pacific is leading to a rise in the expansion activities by major market players. For instance, in February 2023, Nestle (Thai) Co. Ltd introduced a new Nestle PURINA PetCare factory in Rayong province. The factory is expected to carry out production of high-quality pet food products for local and export markets. Such developments are expected to contribute to the industry’s growth.

The growth of the regional market is driven by factors such as the rising concerns for animal health and nutrition, product awareness, significant demand for dairy products, and increased investment in research and development for cost-effective and efficient milk replacers by major players. Moreover, a prominent factor driving the growth is the demand for nutritional food for pets.

The need for fortified nutrients and ingredients in pet milk replacers is growing by the day, and market players are continuously working to add supplements to improve the nutritional profile of pet milk replacers.The preference for pets varies across the region. This variation is influenced by cultural factors, lifestyle, and local traditions in each country. According to a survey conducted by Rakuten Insight Global in 2021, dogs are the most popular pets. Cats come second, whereas fish rank third among the most popular types of pets.

The rising adoption of dogs as pets across Asia Pacific is a major driver for the pet milk replacers market. Dogs are among the most popular pets in many Asian countries, and pet owners are increasingly concerned about the health and well-being of their pets. As a result, there is a growing demand for high-quality pet milk replacers to provide essential nutrition to puppies, especially those orphaned or separated from their mothers. According to AZ Animals, in 2023, China had the highest number of pet dogs in Asia Pacific, with about 30 million dogs, accounting for 27.27% of Asia's total pet dog population of 110 million.

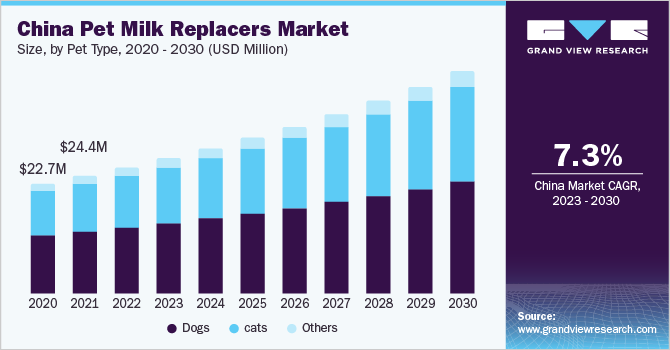

The increasing rate of pet ownership and pet humanization enabled by urbanization, rising incomes, and improved lifestyles drive the China pet milk replacers market. The younger population in the country is less willing to start a family and prefers to live alone, driving pet ownership among one-person households. The rising pet ownership among single-person households coupled with increasing income has led to a trend of treating pets as a family and investing more in their well-being. According to an article published in the Global Times in July 2022, there were more than 125 million one-person households in China, making pet companionship more prominent.

Pet milk replacers are becoming an important part of the pet food diet owing to their nutritional benefits. Moreover, increasing milk prices and the highly sensitive digestive systems of some pets, especially in most dog breeds, are expected to drive the market. According to an article published in Veterinaria Digital in November 2022, there were approximately 18.13 million dogs and cats in Japan, a number higher than the total younger population in the country, adding to the additional demand for pet food.

Pet Type Insights

In 2022, the dogs segment was valued at USD 43.1 million with a revenue share of 53.8%. Pet owners are becoming more conscious of the nutritional needs of their dogs, and they recognize that milk replacers can play a crucial role in ensuring the healthy development of puppies. This awareness has led to a surge in the consumption of pet milk replacers in Asia Pacific. The increasing awareness of the importance of proper nutrition for dogs is fueling the demand for pet milk replacers.

Pet owners are becoming more conscious of the nutritional needs of their dogs, and they recognize that milk replacers can play a crucial role in ensuring the healthy development of puppies. This awareness has led to a surge in product consumption in the Asia Pacific region. Pet owners in Japan are willing to spend a significant amount of money on their pets. For instance, a 2020 customer survey by pet insurance company Anicom found that Japanese pet owners spend an average of ¥300,000 (about USD 2,780) annually on their dogs.

Milk replacers for cats are anticipated to grow at a CAGR of 6.7% over the forecast period. Manufacturers are continuously improving the product formulations, making them more appealing and nutritionally balanced.The increasing urbanization and population density in many Asia Pacific countries have led to a rise in apartment living. According to data from Rakuten Insights, 26% of households in Asia Pacific Countries (APAC) are cat owners. Cats are often preferred over dogs in such environments due to their smaller size and ability to adapt to confined spaces. As more people move to cities and live in smaller homes, the demand for cat-related products, including milk replacers, has surged.

Product Insights

In 2022, non-medicated pet milk replacers segment was valued at USD 53.8 million with a market share of 67.2%. Non-medicated milk replacers serve a broader and more general purpose of catering to the nutritional needs of healthy young animals, including orphaned or abandoned ones. They are used as a standard source of nutrition for these animals, making them more widely applicable.The regulatory landscape in Asia Pacific also plays a crucial role in boosting the demand for non-medicated pet milk replacers. Regulatory authorities in the region are formulating stricter controls and standards for pet food products to ensure their safety and quality.

Medicated pet milk replacers are anticipated to grow at a CAGR of 5.0% over the forecast period. Veterinarians often recommend medicated milk replacers as part of a treatment plan for young pets, supporting the growth of this segment.Growing awareness and emphasis on pet health and well-being among pet owners in Asia Pacific is one of the major factors supporting the demand for medicated milk replacers. As the middle-income pet-owning population expands, there is an increasing willingness to invest in high-quality pet products to ensure the health and longevity of their pets. This shift in mindset is driving the demand for specialized products that address specific health concerns in pets, such as gastrointestinal issues or nutritional deficiencies, boosting the uptake of medicated milk replacers.

Form Insights

In 2022, the powdered pet milk replacers segment was estimated at USD 54.1 million with a revenue share of 67.4%. The growth of the Asia Pacific powder pet milk replacers market is driven by several key factors, reflecting the evolving preferences and needs of pet owners, as well as broader market dynamics. The convenience and versatility of powdered pet milk replacers are significant drivers. Powdered formulas have a longer shelf life compared to liquid alternatives, making them a practical choice for pet owners. Additionally, powdered milk replacers can be easily stored and transported, which is essential in regions with diverse climates and infrastructures. Pet owners appreciate the flexibility these products offer in terms of preparation and serving.

Liquid pet milk replacers are anticipated to grow at a CAGR of 5.8% over the forecast period. Liquid milk replacers offer numerous advantages over powdered alternatives. These ready-to-use products provide unmatched convenience by eliminating the hassle of mixing. In addition, liquid milk replacers are meticulously formulated to meet the specific nutritional requirements of young pets like puppies and kittens, ensuring proper growth and development while offering a more appealing taste that encourages consumption. Their ease of digestion proves beneficial for pets with digestive sensitivities. Furthermore, liquid replacers boast extended refrigerator storage capabilities, catering to pet owners who infrequently use the product, enhancing overall usability and versatility.

Distribution Channel Insights

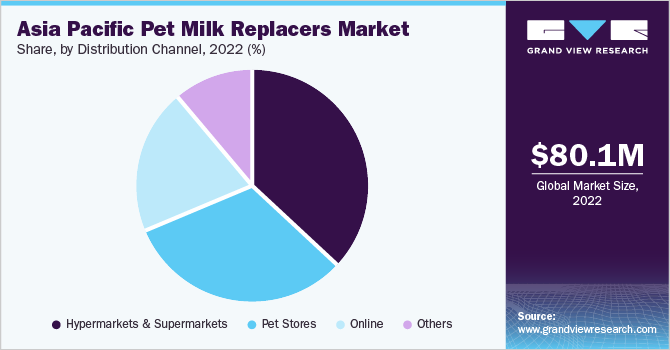

In 2022, the hypermarkets & supermarkets segment of the Asia Pacific pet milk replacers market was valued at USD 29.3 million with a revenue share of 36.6%. Extensive reach, convenient one-stop shopping experience, and the trust consumers place in these established retail chains are major factors aiding segment growth. Moreover, quality assurance and safety associated with these outlets reassure consumers, making them preferred destinations for purchasing pet milk replacers.

Sales through the online channel are projected to grow at a CAGR of 7.4% over the forecast period. These channels provide pet owners with the ease and convenience of browsing and purchasing milk replacers from the comfort of their homes, eliminating the need for physical store visits.The convenience of doorstep delivery and the availability of various payment options, including digital wallets and credit cards, have further propelled the growth of online distribution channels. This convenience factor has not only attracted individual consumers but also businesses such as pet stores and breeders, who can efficiently source bulk quantities of milk replacers online. For instance, Amazon, Flipkart, and Ubuy Co. offer pet milk replacers in Asia Pacific with easy exchange and refund options.

Regional Insights

The pet milk replacers market in Asia Pacific is expected to grow significantly. This growth can be attributed to the increasing pet adoption rate, pet humanization, and rising disposable income in the region's major economies, including India and China. According to an article published in HealthforAnimals, pet ownership in China increased by 113% between 2014 and 2019, and the country is expected to have the highest number of pets in the world by 2024.

Many countries in the region are growing economies, signifying increasing income levels, the presence of a younger population, and the expansion of the middle-income population. According to an article published in the World Economic Forum in July 2020, approximately 2 billion Asians fall into the middle-income population, which is expected to reach 3.5 billion by 2030. This is anticipated to be another driver for increasing pet adoption rates and demand for nutritious and quality pet food.

In addition, the development strategies implemented by major companies and their market expansion are expected to drive the market. For instance, in June 2023, Drools Pet Food Pvt. Ltd. secured an investment of about USD 60 million from L Catterton. This investment is likely to help Drools Pet Food Pvt. Ltd. expand its business further and drive the pet milk replacers market in India.

India's pet milk replacer market growth is largely driven by the increasing trend of nuclear families, rising income levels, and the increasing popularity of dogs as pets. According to an article published in The Economic Times in May 2023, India has a pet population of approximately 32 million, growing at the rate of 11% annually. Moreover, the changing lifestyle in the country, especially increasing health consciousness among the younger population and its extension to pets, is expected to drive this growth further. Many young pet parents have recognized the importance of a nutritious diet, leading to increasing demand for pet food compared to other pet supplies.

Key Companies & Market Share Insights

Key players are adopting various steps to increase their presence in the market. These steps include strategies such as new product launches, partnerships, mergers & acquisitions, and global expansions. Some of the initiatives include:

-

In July 2023, Woolworths Group acquired Milkrun, an instant delivery service, and commenced its operations in New Zealand. It started with grocery delivery services in Wellington and central Auckland suburbs. Woolworths Group acquired Milkrun in May 2023 and rebranded it as Metro60 in Australia. This expansion will likely bring convenient grocery delivery to a broader customer base.

-

In September 2022, India-based Drools Pet Food expanded into the Australian market. This expansion has allowed the company to tap into a new customer base in Australia. Drools Pet Food's entry into this market caters to the needs and preferences of Australian pet owners and its growing pet food industry.

-

In March 2022, the company, formerly known as Manna Pro Products, underwent a rebranding effort to become Compana Pet Brands. This rebranding significantly changed the company’s corporate identity and reflected its evolving business strategy. The name change signified the company's desire to represent a more diverse and expanded pet care and wellness product portfolio. This likely includes a wider range of products catering to pets of various sizes and species.

Some prominent players in the Asia Pacific pet milk replacers market include:

-

LILLELUND PTY LTD (Di-Vetelact)

-

Wombaroo Food Products (Wombaroo)

-

PEDIGREE

-

Apetite Foods Group Pty Ltd (Pets Own)

-

Woolworths Ltd - (Baxter’s)

-

Mars Inc. - Royal Canin SAS

-

Drools Pet Food Pvt. Ltd.

-

Pet-Ag Inc. (Esbilac)

-

NIPPON PET FOOD CO., LTD.

-

Compana Pet Brands - Manna Pro

-

K9 Natural

-

Purina - (Land ‘O Lakes)

-

ProviCo Pty. Ltd (Profelac)

-

Zeal Pet Food Ltd

-

Biolac

-

DoggyMan H.A.Co.,Ltd

-

Morinaga - (MORINYU SUNWORLD)

Asia Pacific Pet Milk Replacers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 85.1 million

Revenue forecast in 2030

USD 131.4 million

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, product, form, distribution channel, region

Regional scope

Asia Pacific

Country scope

China; Japan; India; South Korea; Australia & New Zealand; Thailand

Key companies profiled

LILLELUND PTY LTD (Di-Vetelact); Wombaroo Food Products (Wombaroo); PEDIGREE; Apetite Foods Group Pty Ltd (Pets Own); Woolworths Ltd - (Baxter’s); Mars Inc. - Royal Canin SAS; Drools Pet Food Pvt. Ltd.; Pet-Ag Inc. (Esbilac); NIPPON PET FOOD CO., LTD.; Compana Pet Brands - Manna Pro; K9 Natural; Purina - (Land ‘O Lakes); ProviCo Pty. Ltd (Profelac); Zeal Pet Food Ltd; Biolac; DoggyMan H.A.Co.,Ltd; Morinaga - (MORINYU SUNWORLD)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Asia Pacific Pet Milk Replacers Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific pet milk replacers market report based on pet type, product, form, distribution channel, and region:

-

Pet Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Medicated

-

Non-medicated

-

-

Form Outlook (Revenue, USD Million, 2017 - 2030)

-

Powder

-

Liquid

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets & Supermarkets

-

Pet Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

Thailand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific pet milk replacers market size was estimated at USD 80.1 million in 2022 and is expected to reach USD 85.1 million in 2023.

b. The Asia Pacific pet milk replacers market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 131.4 million by 2030.

b. Milk replacers for dogs accounted for a market share of 53.8% and the segment was valued at USD 43.1 million in 2022. Pet owners are becoming more conscious of the nutritional needs of their dogs, and they recognize that milk replacers can play a crucial role in ensuring the healthy development of puppies. This awareness has led to a surge in the consumption of pet milk replacers in Asia Pacific. The increasing awareness of the importance of proper nutrition for dogs is fueling the demand for pet milk replacers.

b. Some market players include LILLELUND PTY LTD (Di-Vetelact); Wombaroo Food Products (Wombaroo); PEDIGREE; Apetite Foods Group Pty Ltd (Pets Own); Woolworths Ltd – (Baxter’s); Mars Inc. - Royal Canin SAS; Drools Pet Food Pvt. Ltd.; Pet-Ag Inc. (Esbilac); NIPPON PET FOOD CO., LTD.; Compana Pet Brands – Manna Pro; K9 Natural; Purina – (Land ‘O Lakes); ProviCo Pty. Ltd (Profelac); Zeal Pet Food Ltd; Biolac; DoggyMan H.A.Co.,Ltd; Morinaga – (MORINYU SUNWORLD) among others.

b. Growing awareness of pet nutrition and welfare, the rising number of pets, and the hectic lifestyles of pet owners who require convenient pet food options are shaping the pet milk replacers market in the region. The trend of household pets and increased spending on pet food and pet care products have created a growth opportunity for various companies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."