- Home

- »

- Consumer F&B

- »

-

Asia Pacific Premium Bottled Water Market, Industry Report 2030GVR Report cover

![Asia Pacific Premium Bottled Water Market Size, Share & Trends Report]()

Asia Pacific Premium Bottled Water Market Size, Share & Trends Analysis Report By Product (Spring Water, Mineral Water, Sparkling Water), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-222-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

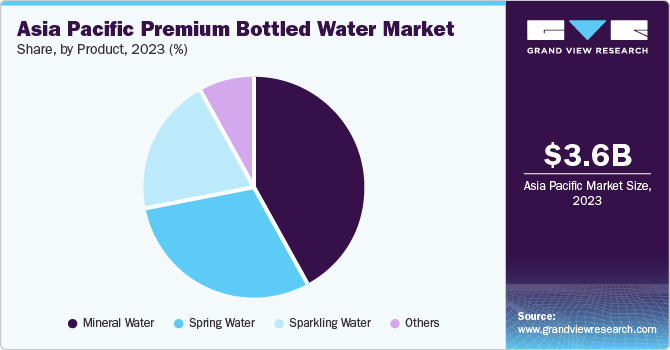

The Asia Pacific premium bottled water market size was estimated at USD 3.60 billion in 2023 and it is expected to grow at a CAGR of 8.8% from 2024 to 2030. The market is considered specialised market as the product is developed according to needs and preference of specific group of customers who prefer to adopt premium bottled water consumption to regular. Projected market growth is driven by variety of aspects such as increasing awareness about consumption of premium bottled water, which is derived from special sources and has extra amounts of minerals naturally.

Asia Pacific premium bottled water market accounted for 17.4% of the global premium bottled water market revenue in 2023. In addition, growing use of these products in hospitality and tourism industry, rising adoption of premium bottled water by sport clubs and franchise, easier accessibility through efficient distribution channels, and encouraging product specifications such as low-calorie content, presence of essential calcium, magnesium, sodium contents are some other factors which most likely to fuel growth patterns for Asia Pacific premium bottled water market.

The global business scenarios have been changing as the nations and industries move to post pandemic era. Premium bottled water market is no exception to this. The industry is set to grow at rapid pace owing to increasing growth experienced by the hospitality and tourism industry, growing inclusion of premium bottled waters by restaurant menus and value added services list at luxury hotels, rising number of global events held in the region in presence of political leaders and global celebrities, changing preferences of group of consumers leading to greater demand of products such as sparkling water and more.

Innovation strategies adopted by manufacturers and improved perceived value associated with the product is helping this market grow in the region. In countries like India, where water was never perceived as premium range consumer product in the past, companies are generating valuable demands through premium sections of the market. Presence of global brands in the regional market coupled with existence of local companies operating in this niche market adds to revenue generation. For instance, Tata Consumer Products Limited (TCPL), one of the reputed FMCG brands from India, launched its premium bottled water brand, (natural mineral) in United Kingdom which now being sold there through supermarkets and hypermarkets.

Market Concentration & Characteristics

The Asia Pacific premium bottled water market is growing at accelerating pace and growth stage is identified as high. The market is characterised by presence of global as well as domestic brands which have been in the business since a while. The regional scenario of the market is characterised by extremely competitive atmosphere, as the response for premium bottled water market is comparatively less in Asia Pacific than regions such as North America or Europe. The market is fragmented in the nature owing to presence of multiple key companies who hold significant share of the revenue.

Degree of innovation is moderate in the market. To develop a competitive edge over others, key market participants primarily use innovation as strategy. One of the classic examples of this in the regional market is Bisleri. In 2017, the company introduced regional language labels for its mineral water bottles across India. It was one of the first companies to do so, which was later followed by other participants. Additionally, it is one of the very few brands to accomplish vertical integration of a value chain.

The level of M&A (mergers & acquisitions) is moderate in the market. One of the most discussed acquisition from Asia Pacific premium bottled water market was proposed acquisition of Bisleri by Tata Consumer Groups. However, both the parties called it off after series of discussion.

Threat of substitutes is at medium level. The price range of premium bottled water products are different and not many products fall under this category. This make it very safe from potential threat of substitutes. However, presence of energy drinks, carbonated soft drinks and similar products do present minor threat to the market.

Product Insights

The premium mineral water market in Asia Pacific accounted for revenue share of 41.58% in 2023. Calcium, magnesium, sodium, and zinc are some of the common contents of bottled mineral water, which are preferred by consumers over regular bottled water. In Asia Pacific, the bottled mineral water has been receiving overwhelming response owing to sense of safety and superiority it provides. The key companies in the market have launched range of mineral water products in last few decades, which has been attracting huge number of customers.

Premium sparkling water market in Asia Pacific is expected to grow at CAGR of 9.4 % from 2024 to 2030. The expected growth can be attributed to increasing introduction of range of sparkling of water products to consumers in the region, inclusion of sparkling water alternatives in offerings by luxury lounges and hotels, increasing adoption of healthy choices of beverages by consumers over carbonated drinks and other products such as sodas or colas.

Distribution Channel Insights

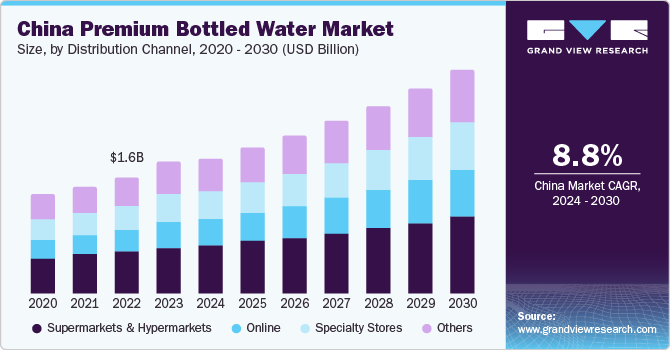

The sales generated through supermarket & hypermarkets in Asia Pacific premium bottled water market accounted for revenue share of 36.93% in 2023. With extremely populated countries such as China and India in the region, the supermarkets and hypermarkets play vital role in the potential growth of the market. Sheer number of these distribution channels makes it stand out and generate greater revenue than other channels. In urbanised and densely populated areas, supermarkets and hypermarkets with shelves filled with premium range products generate huge amount of impulse buy as well as repeated purchases. This factor results in growing numbers in terms of revenue derived from this channel.

With unparalleled penetration of internet and enhanced information accessibility in Asia Pacific, the online distribution channel has been developing effective results for the market. Therefore, the revenue generated by online channel in Asia Pacific premium bottled water market is expected to grow at CAGR of 10.8% from 2024 to 2030.

Country Insights

China Premium Bottled Water Market Trends

China premium bottled water market accounted for revenue share of 48.38% in 2023. The market has been experiencing unprecedented growth in the country due to changing lifestyle of potential consumers, growing disposable income and growing awareness about the benefits provided by the premium bottled water that are distinguished in nature. In addition, detailed labelling provided by key companies, entailing ingredients and minerals present in the product generate demand and repeat purchases from conscious group of customers. After pandemic period, many people around the China are most likely to shift their dietary preferences as well as change their lifestyles to healthier versions of it. This is expected to assist the market to generate greater growth in upcoming years.

India Premium Bottled Water Market Trends

On the other hand, India premium bottled water market is expected to grow at CAGR of 8.8% from 2024 to 2030. This market is one of the most untapped space for this industry and intense competitive landscape of the market is expected to generate increasing demand through influence created by aggressive marketing and diligent brandings.

Key Asia Pacific Premium Bottled Water Company Insights

The market is characterized by the presence of some exclusive companies with a strong presence across the globe. Several players have been introducing premium bottles to expand their consumer base in this niche market. These developments and innovation strategies have had a positive impact on the market. An increasing number of companies have also been introducing new products to gain a competitive edge.

-

With more than 122 operational plants and huge network of 4500 distributors, Bisleri is region’s one of the leading bottled water company. The company was launched in Mumbai in 1965. Later, in 1969 Parle acquired it from Italian entrepreneur. In 2006, it launched Natural Himalayan Spring Water in the market.

-

Branded as untouched and unprocessed, Hiamalayan is one of the early starters from Indian continent in premium bottled water market. The company states that their water source is located in Shivalik ranges of the Himalayas. It serves water, which is derived from glacial melts. It is believed that this water starts its journey from upper ends of Himalayas and reaches down after nearly 20 years of filtering through layers of Himalayan Rocks.

Key Asia Pacific Premium Bottled Water Companies:

- Pepsico Inc.

- The Coca-Cola Company

- TATA Group (Himalayan)

- Nestlé S.A.

- Suntory Beverage & Food Ltd

- Nongfu Spring

- Fine Waters

- Bisleri International Pvt. Ltd.

- Fiji Water

- VOSS

Recent Developments

-

In March 2023, Bisleri, one of the leading bottled mineral water brands from India, announced that it has entered in three-year partnership deal with Delhi Capitals, reputed cricketing franchise from Indian Premium League, as their official hydration partner.

Asia Pacific Premium Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.90 billion

Revenue Forecast in 2030

USD 6.46 billion

Growth Rate

CAGR of 8.8% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, Distribution Channel, Country

Regional scope

Asia Pacific

Country scope

China, India, Japan, Australia, South Korea

Key companies profiled

Pepsico Inc.; The Coca-Cola Company; TATA Group; Nestlé S.A.; Suntory Beverage & Food Ltd; Nongfu Spring; Fine Waters; Bisleri International Pvt. Ltd.; Himalayan; Fiji Water

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Premium Bottled Water Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the report based on Asia Pacific premium bottled water market in product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spring Water

-

Sparkling Water

-

Mineral Water

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific premium bottled market was estimated at USD 3.60 billion in 2023 and is expected to reach USD 3.90 billion in 2024.

b. The Asia Pacific premium bottled market is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 6.46 billion by 2030.

b. China dominated the Asia Pacific premium bottled market with a share of around 48.4% in 2023. The market has been experiencing unprecedented growth in the country due to the changing lifestyle of potential consumers, growing disposable income, and growing awareness about the benefits provided by premium bottled water that are distinguished in nature.

b. Some of the key players operating in the Asia Pacific premium bottled market include Pepsico Inc.; The Coca-Cola Company; TATA Group; Nestlé S.A.; Suntory Beverage & Food Ltd; Nongfu Spring; Fine Waters; Bisleri International Pvt. Ltd.; Himalayan; Fiji Water

b. Perceived value possessed by the product and growing awareness about the benefits associated with the consumption of premium quality bottled water are key driving factors behind the anticipated growth of the European premium bottled water market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."