- Home

- »

- Consumer F&B

- »

-

Premium Bottled Water Market Size, Industry Report, 2030GVR Report cover

![Premium Bottled Water Market Size, Share & Trends Report]()

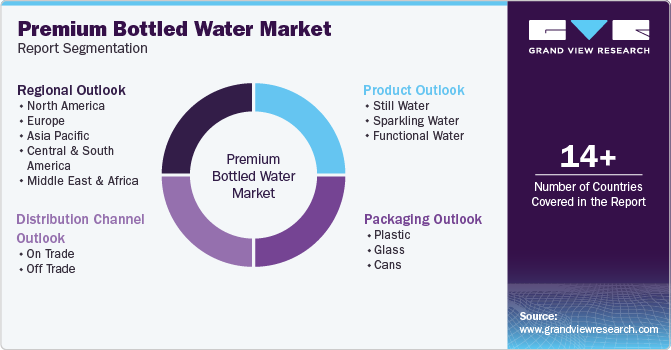

Premium Bottled Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Still Water, Sparkling Water, Functional Water), By Packaging (Plastic, Glass, Cans), By Distribution Channel, By Region, Segment Forecasts, And Brand Share Analysis

- Report ID: GVR-4-68038-265-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Premium Bottled Water Market Summary

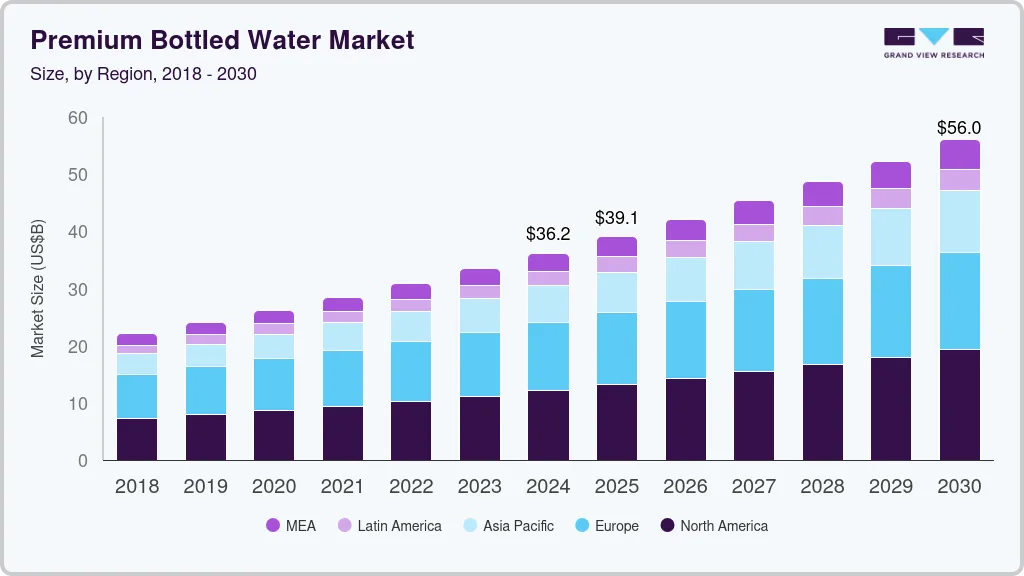

The global premium bottled water market size was estimated at USD 36,188.9 million in 2024 and is projected to reach USD 56,010.2 million by 2030, growing at a CAGR of 7.5% from 2025 to 2030. The growing demand for premium bottled water serves as a significant market driver.

Key Market Trends & Insights

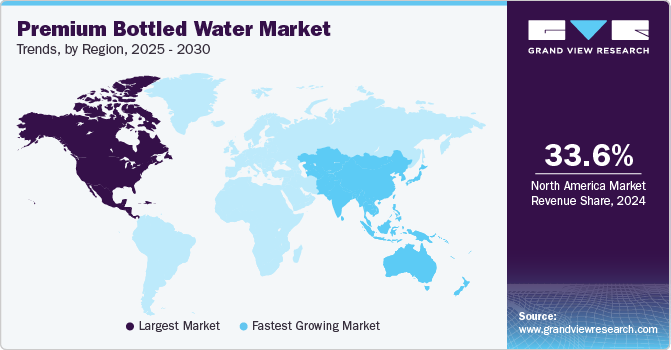

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, mineral water accounted for a revenue of USD 15,102.2 million in 2024.

- Sparkling water is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 36,188.9 Million

- 2030 Projected Market Size: USD 56,010.2 Million

- CAGR (2025-2030): 7.5%

- North America: Largest market in 2024

These products distinguish themselves from the mass market with unique selling points that appeal to a specific group of consumers, allowing them to command a higher price. Increasing consumer awareness of high-quality drinking water is the primary factor propelling this demand.

Consumers are increasingly seeking premium mineral water sourced from natural and pristine environments. The trend leans toward minimally processed water that retains its natural mineral composition, aligning with the desire for pure, authentic, and additive-free products.

With rising awareness about maintaining a healthy lifestyle, many individuals are shifting from regular bottled water to premium options. Products such as mineral and sparkling water, rich in minerals like sodium, magnesium, and calcium, are gaining popularity. These waters offer additional health benefits, such as aiding digestion and potentially relieving constipation. Furthermore, research suggests that glacier and natural premium waters are less harmful to dental and bone health compared to sodas. Consequently, many consumers view carbonated water as a healthier alternative to sugary and soda-based beverages.

Over recent years, commercial advertisements have played a pivotal role in increasing the visibility of premium bottled water brands. These campaigns emphasize the hydration benefits, superior quality, taste, and convenience of sparkling and natural water. For example, Nestlé’s Pure Life brand uses the tagline "Drink Better. Live Better" to promote its zero-calorie, zero-sweetener sparkling water, available in Original and a variety of fruit flavors.

Restaurants in countries such as Brazil encourage customers to drink mineral-rich or premium bottled water. This trend is expected to drive the product demand during the forecast period. Mineral content, source of the water, and additional composition are some of the unique selling points, which create a premium image of bottled water.

The growing preference for premium bottled water over other beverages, including coffee, tea, and soft drinks, especially in the Europe and North America region, is attributed to several factors such as supposed naturalness, apparent better taste than tap water, added minerals content, and impurity-free product of bottled water, which is expected to drive the demand for premium bottled water over the forecast period.

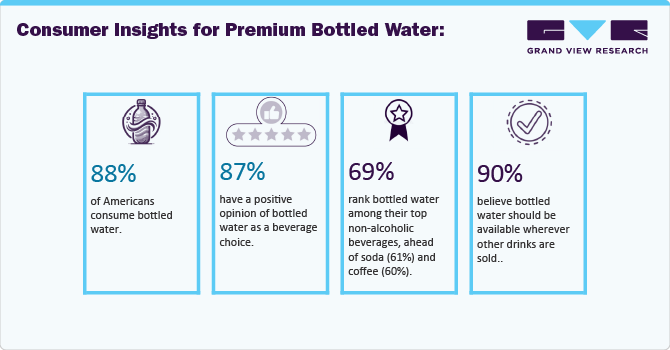

Consumer Insights for Premium Bottled Water

The findings from the September 2024 survey conducted by The Harris Poll on behalf of the International Bottled Water Association (IBWA) highlight a significant shift in consumer behavior that directly contributes to the growth of the premium bottled water market. With 88% of Americans consuming bottled water and 87% holding a positive opinion of it as a beverage choice, there is a clear preference for bottled water over other beverages like soda (61%) and coffee (60%). This growing inclination towards bottled water aligns with the rising demand for premium options, such as mineral-rich, alkaline, and functional water. As 89% of Americans rank water as their most preferred beverage, the popularity of luxury bottled water is benefiting from this broader trend, with 69% of respondents listing it as one of their top non-alcoholic beverages. This preference, combined with the fact that bottled water has been the leading beverage in the U.S. by volume for the past eight years, underscores the continued market expansion within the high-end bottled water industry.

Furthermore, premium bottled water has several advantages; it helps improve digestion and may help relieve constipation. In addition, various studies have suggested that premium glacier/natural water is not as harmful as sodas for dental and bone health. Hence, several consumers consider carbonated water as a healthier alternative to soda and sugary carbonated drinks.

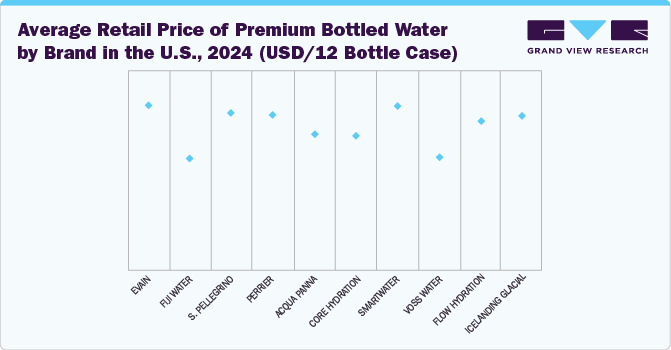

Pricing Analysis

In 2024, premium bottled water brands in the U.S. show a pricing range from USD 22.73 for Fiji Water to USD 33.45 for Evian per 12-bottle case. Evian remains the highest-priced brand, reflecting its premium image, while Fiji Water offers a slightly more affordable option. Other major brands like S.Pellegrino (USD 32.00), Perrier (USD 31.65), and Smartwater (USD 33.35) follow closely in price, maintaining their status as high-end choices. Acqua Panna (USD 27.98) and Core Hydration (USD 27.45) are priced more moderately but still cater to the premium segment.

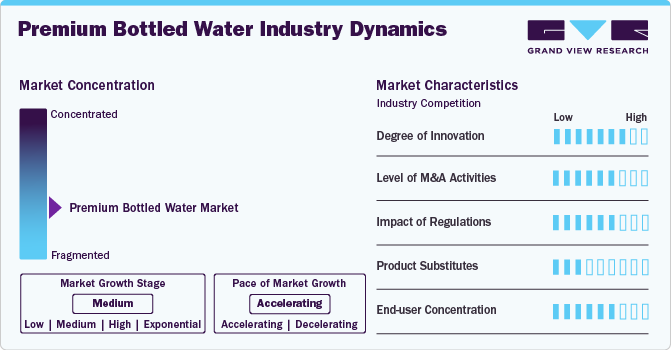

Market Concentration & Characteristics

The degree of innovation in the premium bottled water industry is significant, driven by the need to differentiate products and cater to evolving consumer preferences. Companies are investing in advanced purification techniques, such as reverse osmosis, UV filtration, and mineral enhancement, to ensure high-quality water with unique health benefits. Innovations in packaging also play a critical role, with brands introducing eco-friendly materials like biodegradable bottles, aluminum cans, and glass packaging to appeal to environmentally conscious consumers.

The level of mergers and acquisitions (M&A) in the premium bottled water industry has been significant, reflecting the industry's rapid growth and the strategic importance of premium water in the beverage sector. Major companies are actively acquiring premium bottled water brands to diversify their product offerings, capture a larger share of the health-conscious consumer base, and expand into new markets. For example, Coca-Cola acquired Topo Chico, a premium sparkling water brand, to strengthen its portfolio and meet the growing demand for sparkling water.

The regulatory landscape of the premium bottled water industry is stringent, driven by the need to ensure product safety, quality, and transparency for consumers. Governments and regulatory bodies worldwide have implemented strict standards for bottled water production, labeling, and packaging to maintain health and safety compliance.

The availability of product substitutes poses a significant challenge to the premium bottled water market as consumers increasingly explore alternative hydration options that offer similar benefits. One prominent substitute is reusable water bottles paired with home water purification systems, such as Brita and PUR filters, which allow consumers to enjoy clean and filtered water without the recurring cost or environmental impact of bottled water. These options appeal to eco-conscious consumers seeking sustainable and cost-effective alternatives.

The end-user concentration in the premium bottled water industry is diverse, with demand stemming from various consumer groups and sectors. A significant portion of the market is driven by health-conscious individuals and affluent consumers who prioritize high-quality, minimally processed water with unique sourcing and mineral content. For instance, brands like Evian and Fiji Water cater to these segments by emphasizing their pristine origins and premium positioning.

Product Insights

Premium still bottled water accounted for a share of 71.9% of the global revenue in 2024. Premium still water usually contains a higher content of ingredients like calcium, magnesium, sodium, and zinc with innovative and elegant packaging. The growing awareness regarding the health benefits, coupled with the increased spending on premium products, is likely to boost the mineral water demand over the forecast period.

The sparkling bottled water segment is projected to grow at a CAGR of 7.9% from 2025 to 2030. With the growing trend of leading a healthy lifestyle among people of all ages, individuals across the world are gradually turning to healthier and more inventive drinks, such as sparkling water, sodas, and sugary carbonated drinks. Sparkling water offers numerous health benefits, such as improving digestion, weight loss, and keeping the body more hydrated.

Packaging Insights

The plastic segment accounted for a share of more than 65.8% of the global revenue in 2024. The market growth is shaped by several key factors, including cost-effectiveness, convenience, and advancements in packaging technology. Plastic, particularly polyethylene terephthalate (PET), remains the dominant packaging material due to its lightweight nature, durability, and lower production costs compared to alternatives like glass.

The glass segment is projected to grow at a CAGR of 8.1% from 2025 to 2030. The glass premium bottled water industry is influenced by several key factors, with sustainability and luxury perception being primary drivers. Glass is widely regarded as an eco-friendly packaging material due to its 100% recyclability and non-toxic properties, appealing to environmentally conscious consumers. For instance, premium brands like Voss and San Pellegrino use sleek, reusable glass bottles to emphasize sustainability and reduce their carbon footprint.

Distribution Channel Insights

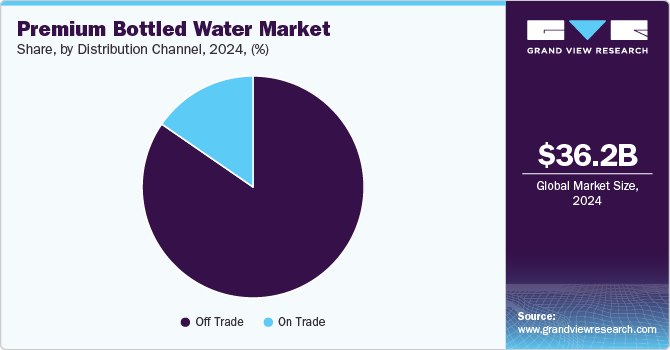

The off-trade channels segment accounted for a share of around 84% of the global revenue in 2024.The market is mainly drivendue to wider accessibility and consumer preference for at-home and on-the-go consumption. Supermarkets, hypermarkets, convenience stores, and specialty retailers provide multiple touchpoints for premium water brands, allowing consumers to purchase single-serve or bulk packs for everyday hydration. E-commerce and direct-to-consumer (D2C) platforms have further accelerated off-trade sales, with brands offering subscription-based deliveries and exclusive online product lines.

Physical verification of the product, along with expert assistance, is a key factor that drives the growth of this segment. In addition, shoppers often purchase products impulsively at the checkout points of hypermarkets & supermarkets. Carrefour, Walmart, Woolworths, and Magnit are among the leading supermarket chains across the globe.

Premium bottled water sales through on-trade channels are projected to grow at a CAGR of 8.2% from 2025 to 2030. The growth is mainly supported by primarily driven by luxury hospitality, fine dining, and high-end entertainment venues, where premium water is positioned as a status symbol and part of an exclusive experience. High-end hotels, Michelin-starred restaurants, and luxury resorts often offer premium bottled water as part of their elevated dining and guest services, sometimes featuring artisanal or rare water sources. The hospitality and tourism sector plays a crucial role, particularly in markets like the UAE, France, and the U.S., where affluent travelers seek premium hydration options. Additionally, premium water is commonly served in bars, nightclubs, and corporate events, where it is either paired with fine spirits or presented as a sophisticated non-alcoholic alternative. The increasing demand for wellness and functional water industry also drives sales in spas, fitness centers, and wellness retreats, where hydration is marketed as part of a holistic health approach.

Regional Insights

North America premium bottled water market accounted for a share of 33.6% of the global revenue in 2024. The market is driven by a combination of health trends, increasing consumer awareness, and an expanding variety of high-quality water products. The demand for premium bottled water in the U.S. and Canada is influenced by consumers' growing preference for healthier beverage alternatives over sugary drinks, such as soda. Premium bottled brands such as Fiji Water, Voss, and San Pellegrino are particularly popular in the region, benefiting from their perception as high-end, pure, and premium hydration options.

U.S. Premium Bottled Water Market Trends

The premium bottled water market in the U.S. is projected to grow at a CAGR of 8.0% from 2025 to 2030.In the highly competitive market, brands are strategically focusing on differentiation strategies to set themselves apart from the competition. This includes leveraging premium packaging designs, introducing innovative bottle shapes, and crafting brand stories that evoke a sense of exclusivity, exceptional quality, and sophistication. These efforts are aimed at capturing the attention of discerning consumers in the U.S. market who prioritize both the visual appeal and the perceived value of premium bottled water products.

Europe Premium Bottled Water Market Trends

The premium bottled water market in Europe is projected to grow at a CAGR of 6.0% from 2025 to 2030. The market is mainly driven by factors such as increasing health awareness, sustainability concerns, and a preference for high-quality, naturally sourced water. Consumers in Europe are increasingly shifting toward healthier beverages, with bottled water positioned as a better alternative to sugary drinks. This is particularly true in countries like the UK, Germany, and France, where sparkling, mineral-rich, and flavored premium waters are in high demand. Brands like Evian, Perrier, and San Pellegrino dominate the market, known for their quality, unique sourcing, and premium positioning.

The UK premium bottled water market is projected to grow at a CAGR of 5.7% from 2025 to 2030. As U.K. consumers increasingly turn away from sugary beverages and carbonated soft drinks, bottled water has become a preferred choice, particularly premium options that offer unique health benefits. Brands like Evian, Fiji, Voss, and San Pellegrino are prominent players in the market, renowned for their purity, mineral content, and luxury positioning.

The premium bottled water market in Germany is projected to grow at a CAGR of 5.9% from 2025 to 2030. The market is driven by a strong consumer preference for natural and high-quality mineral water, driven by health consciousness and sustainability concerns. Germany has a long tradition of mineral water consumption, with consumers valuing water sourced from natural springs rich in minerals. The increasing demand for functional and wellness-focused water, such as alkaline, electrolyte-enriched, and oxygenated water, is also propelling market growth.

Asia Pacific Premium Bottled Water Market Trends

The premium bottled water market in Asia Pacific is projected to grow at a CAGR of 9.1% from 2025 to 2030. The market has a significant scope in the region, especially in countries such as India and China, due to increasing population, rising living standards, and growing prevalence of diseases caused by contaminated water. The shift in consumers’ propensity to opt for bottled water instead of tap water is expected to drive the demand.

In the rapidly growing Asia Pacific premium bottled water market, consumers are actively seeking out premium bottled water that goes beyond basic hydration and offers additional health benefits. This trend has fueled the emergence of functional and enhanced water products in the region, featuring added vitamins, minerals, electrolytes, and other ingredients that cater to specific health needs. Brands in the Asia Pacific market are capitalizing on this demand by offering innovative and specialized premium bottled water options that align with consumers' evolving preferences and wellness goals.

According to recent data released by the United Nations in 2023, India has emerged as the 12th largest consumer of bottled water worldwide in terms of market value. This highlights the significant demand for premium bottled water in the Indian market, reflecting the country's growing population, increasing urbanization, and changing consumer preferences.

China premium bottled water market accounted for a share of 48.4% of the global revenue in 2023. Consumers are increasingly opting for sparkling, mineral, and natural waters, with premium brands like Nongfu Spring, Evian, and Voss becoming more popular among affluent urban dwellers.

The premium bottled water market in Australia is projected to grow at a CAGR of 8.3% from 2025 to 2030. Consumers are increasingly opting for sparkling, mineral, and natural waters, with premium brands like Nongfu Spring, Evian, and Voss becoming more popular among affluent urban dwellers.A significant driver for the market is the rising preference for sparkling water and mineral water, which are perceived as healthier, more refreshing alternatives to sodas and other sugary drinks. Consumers are increasingly turning to these products for hydration, digestion benefits, and enhanced mineral content.

Central & South America Bottled Water Market Trends

The premium bottled water market in Central & South America is projected to grow at a CAGR of 7.2% from 2025 to 2030. The growing tourism industry in countries like Brazil, Argentina, and Mexico is also contributing to the demand for premium bottled water. The hospitality industry, including hotels, resorts, and restaurants catering to international and local tourists, is increasingly offering premium water brands as part of their luxury offerings. This has become an important sales channel for premium bottled water, particularly in high-end resorts or urban luxury dining.

Middle East & Africa Bottled Water Market Trends

The premium bottled water market in the Middle East & Africa is projected to grow at a CAGR of 7.7% from 2025 to 2030. In several countries in the MEA region, water quality and safety are significant concerns, especially in areas where access to clean tap water is limited or inconsistent. Premium bottled water brands, which emphasize their natural and pristine sources, are perceived as a safer and more reliable option, especially in countries where water contamination or pollution is a concern.

Moreover, The GCC premium bottled water market outlook remains strong, driven by rising health consciousness, increasing disposable income, and a growing preference for luxury hydration options. Consumers in countries like Saudi Arabia, the UAE, and Qatar are increasingly opting for premium and functional bottled water, including alkaline, mineral-rich, and electrolyte-enhanced variants. The region's hospitality and tourism industry, particularly in high-end hotels, fine dining restaurants, and luxury resorts, further fuels demand for premium bottled water.

Key Brand Share Analysis

The market is characterized by the presence of some exclusive companies with a strong presence across the U.S. and Europe. Several players have been introducing premium bottles to expand their consumer base in this niche market. These developments and innovation strategies have had a positive impact on the market. An increasing number of companies have also been introducing new products to gain a competitive edge.

Key Premium Bottled Water Companies:

The following are the leading companies in the premium bottled water market. These companies collectively hold the largest market share and dictate industry trends.

- Evian (Danone)

- Volvic (Danone)

- Voss (Reignwood Group)

- Fiji Water (The Wonderful Company)

- Perrier (Nestlé)

- San Pellegrino (Nestlé)

- Acqua Panna (Nestlé)

- Gerolsteiner (Gerolsteiner Brunnen GmbH & Co.)

- Highland Spring (Highland Spring Group)

- Icelandic Glacial (Icelandic Water Holdings)

- Hildon (Hildon Ltd.)

- Badoit (Danone)

- Ty Nant (Ty Nant Spring Water Ltd.)

- Belu (Belu Water Ltd.)

- Iskilde (Iskilde ApS)

- Bling H2O (Bling H2O, LLC)

- Waiakea (Waiakea Inc.)

- Smartwater (The Coca-Cola Company)

- Rochetta (Rocchetta S.p.A.)

- Ferrarelle (Ferrarelle Società Benefit S.p.A.)

Premium Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.07 billion

Revenue forecast in 2030

USD 56.01 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in thousand titers; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution channel, region

Regional scope

North America, Europe, Asia Pacific,Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain: China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Evian, Voss Water, Fiji Water, Nestle Water, Gerolsteiner, BLK Water, The Coca-Cola Company, Svalbarði, Mountain Valley Spring Water, Hildon Natural Mineral Water

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Premium Bottled Water Market Report Segmentation

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the premium bottled water market report on the basis of product, packaging, distribution channel, and region.

-

Product Outlook (Volume Thousand Liters; Revenue, USD Billion, 2018 - 2030)

-

Still Water

-

Flavored

-

Unflavored

-

-

Sparkling Water

-

Flavored

-

Unflavored

-

-

Functional Water

-

-

Packaging Outlook (Volume Thousand Liters; Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Glass

-

Cans

-

-

Distribution Channel Outlook (Volume Thousand Liters; Revenue, USD Billion, 2018 - 2030)

-

On Trade

-

Hotels

-

Restaurants, Bars and Pubs

-

Others

-

-

Off Trade

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Volume Thousand Liters; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Switzerland

-

Netherlands

-

Belgium

-

Sweden

-

Austria

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

Vietnam

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global premium bottled water market size was estimated at USD 36.19 billion in 2024 and is expected to reach USD 39.07 billion in 2025.

b. The global premium bottled water market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 56.01 billion by 2030.

b. Europe dominated the premium bottled water market with a share of 33.74% in 2024. Increasing awareness about health and wellness among consumers in countries including Germany, France, Spain, and Italy is one of the major factors driving the market growth in Europe.

b. Some of the key players currently working in the global premium bottled water market are Bling water, ROI, Beverly Hills 9OH2O, NEVAS, Lofoten, MINUS181, Alpine Glacier Water Inc., BLVD, Berg Water, Uisge Water, and VEEN.

b. Growing consumer awareness regarding the health benefits of consuming premium bottled water containing minerals and pure elements is projected to drive market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.