- Home

- »

- Electronic & Electrical

- »

-

Asia Retail Vending Machine Market Size And Share ReportGVR Report cover

![Asia Retail Vending Machine Market Size, Share & Trends Report]()

Asia Retail Vending Machine Market Size, Share & Trends Analysis Report By Payment Mode (Cash, Cashless), By Application (Commercial Places, Offices, Public Places), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-062-2

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The Asia retail vending machine market size was valued at USD 38.60 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. Increasing demand for on-the-go snacks and beverages due to the hectic lifestyles of consumers is boosting product sales through vending machines. The growth of the vending machine market can also be attributed to the machines’ ability to deliver goods quickly, making it an extremely convenient option for consumers. The growth of the Asia vending machine market is mainly attributed to the machine’s capability to deliver goods swiftly, making it an extremely convenient and smooth experience for consumers.

Food and beverage distribution through vending machines look promising as vending machines not only offer snacks and beverages but also sell other consumables, such as cigarettes and lottery tickets. Hence, operators can generate significant revenue through vending machines by strategically placing them in corporate buildings, schools, malls, train stations, and airports, among others. Moreover, healthy lifestyle trends are becoming increasingly prominent across the region on account of growing consumer awareness regarding healthy food and beverage options.

The flexibility of the machine, in terms of location-be it indoor or outdoor, coupled with its ease of operation without any manual intervention, has made them ideal for use in offices and commercial and public areas. Technological advancements in vending machines, including interactive display systems, voice recognition, and big data integration, have made the product easier and more convenient to use and this has had a positive impact on product demand. Customers that buy from vending machines are making healthier choices and as a result, industry operators are stocking healthy food & beverage items in the vending machines to meet consumer needs.

Apart from this, many vending machine businesses are extending their offerings to include a number of cooked foods that are usually available at restaurants. Interactive screens installed within vending machines offer owners the opportunity to access the Internet of Things. They are now popping up at gas stations and even in public bathrooms as operators can make revenue weekly or monthly from advertising streams. Another feature of a screen allows the customer to get a refund wherein they can enter their information, which will enable them to get their money back.

Application Insights

Offices dominated the market with a share of over 40% in 2022. Vending machines are installed in workplaces to offer employees a convenient, affordable, and quick option for buying food. The introduction of vending machines has aided businesses in easily and automatically distributing things directly at the workplace. Employees dining at the workplace often have to spend time preparing food, going out purchasing ingredients, or ordering food. Employees can buy things on the spot in the most convenient way if such machines are provided at office premises. For example, healthy snack vending machines can provide employees with an easily accessible healthy snack or beverage that will allow them to recoup energy and increase productivity at the workplace.

Commercial places will grow at a CAGR of 4.1% over the forecast period from 2023 to 2030. Vending machines are seen as a resolution to labor shortages. Costs associated with a vending machine are less than costs incurred by an unattended retail shop. Vending machines can provide convenience store operators with the option to explore new avenues and opportunities in an otherwise crowded sector. These devices can accept a variety of payment cards as well as mobile payments. Retailers are offering a wide range of commodities with automated retail technologies to let consumers simply access their preferred products.

Payment Mode Insights

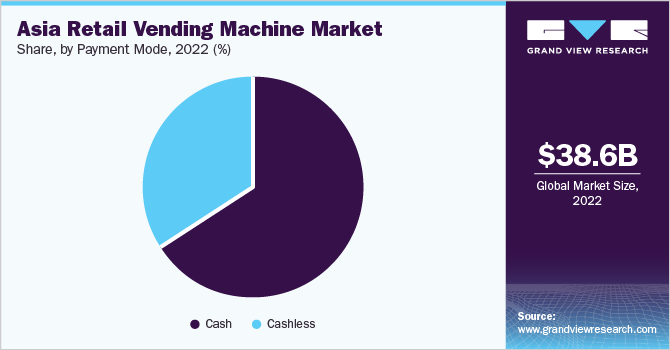

The cash segment dominated the industry with a revenue share of over 55% in 2022. Cash and credit cards can be used interchangeably at vending machines. Customers can utilize either of the methods depending on the availability of resources as these machines often contain a slot for cash as well as cards. It is ultimately up to the buyer to select a payment method. However, the cash segment is expected to decline as there are hidden charges while using cash payments.

The hidden cost of cash payment includes the cost of equipment & processing and opportunity cost. According to an article published by YFS Magazine in June 2020, although global vending machine businesses are still largely cash-based, 59% of vending machines now accept cashless payments, such as credit cards or mobile wallets. This indicates that vending machines are rapidly being driven by digitalization and technological advancements.

Regional Insights

Japan dominated the market with a revenue share of 60% in 2022. Japan has the highest density of vending machines worldwide; it has almost 1 machine for every 23 people. As of 2021, there were approximately 5 million vending machines in Japan. Japanese vending machines offer consumers a seemingly infinite variety of choices: different kinds of coffees, teas, mineral waters, juices, and even soups. It has been observed that junk food is harder to find in Japan than healthier options like fresh bananas or artisanal soup broth, which includes a whole grilled fish right inside the bottle. China has a significant product penetration and it is expected to grow over the forecast period.

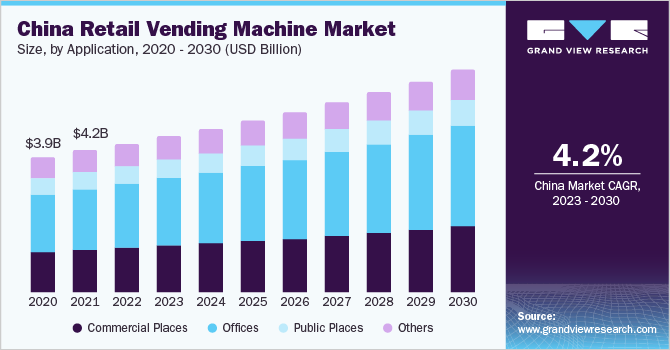

By the end of 2019, there were 490-515 thousand machines in operation in China. East China had the highest market penetration rate, where 40-43% of machines were located, followed by North China, which was home to 26-28% of vending machines. Shanghai Online New Economy Development Plan (2020-2022) released in April 2022 encourages contact-free delivery and new retail, such as smart takeout/package pickup lockers and vending machines in business parks, residential areas, school campuses, and others. This will support the regional market growth.

Key Companies & Market Share Insights

Key companies in the market are recognizing the importance and dominance of regional brands, not just in terms of scaling their businesses but also in terms of the positive impact of consistent service on customers. Some of the prominent companies operating in the Asia retail vending machine market include:

-

Azkoyen Group

-

Zummo Innovaciones Mecánicas, S.A.

-

ETEK Automation Solutions Joint Stock Company

-

Sunwon

-

TSEvending Company

-

Dropfoods

-

Guangzhou Baoda Intelligent Technology Co., Ltd.

-

Shenzhen TopGood Intelligent Technology Co., Ltd.

-

Fuji Electric Co., Ltd.

-

Guangzhou Light Industry Elec Co., Ltd

-

Panda Vending Limited

-

Shintoa Corporation

-

Roven Co., Ltd.

-

Luckin Coffee Inc.

-

Le Tach Vending Pte. Ltd.

Asia Retail Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 40,021.3 million

Revenue forecast in 2030

USD 53,520.6 million

Growth rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, payment mode, region

Regional scope

China; Japan; Australia; India

Key companies profiled

Azkoyen Group; Zummo Innovaciones Mecánicas, S.A.; ETEK Automation Solutions Joint Stock Company; Sunwon; TSEvending Company; Dropfoods; Guangzhou Baoda Intelligent Technology Co., Ltd.; Shenzhen TopGood Intelligent Technology Co., Ltd.; Fuji Electric Co., Ltd.; Guangzhou Light Industry Elec Co., Ltd.; Panda Vending Ltd.; Shintoa Corp.; Roven Co., Ltd.; Luckin Coffee Inc.; Le Tach Vending Pte. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Retail Vending Machine Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the Asia retail vending machine market based on application, payment mode, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Places

-

Offices

-

Public Places

-

Others

-

-

Payment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Cash

-

Cashless

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

China

-

Japan

-

India

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia retail vending machine market was estimated at USD 38.60 billion in 2022 and is expected to reach USD 40.02 billion in 2023.

b. The Asia retail vending machine market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach 53.52 billion in 2030.

b. The offices segment dominated the market with a share of 42.6% in 2022. This is attributed to the fact that vending machines are associated with the easy availability of food and beverages in the office, without hampering the workflow thus increasing their adoption.

b. Some of the key players operating in the Asia retail vending machine market include Azkoyen Group, Zummo Innovaciones Mecánicas, S.A., ETEK Automation Solutions Joint Stock Company, Sunwon, TSEvending Company, Dropfoods, Guangzhou Baoda Intelligent Technology Co., Ltd, Shenzhen TopGood Intelligent Technology Co., Ltd, Fuji Electric Co., Ltd., Guangzhou Light Industry Elec Co., Ltd, Panda Vending Limited, SHINTOA CORPORATION, Roven Co., Ltd, Luckin Coffee Inc., and Le Tach Vending Pte Ltd.

b. The growth of the Asia vending machine market is mainly attributed to the machine’s capability to deliver goods swiftly, making it an extremely convenient and smooth experience for consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."