- Home

- »

- Electronic Devices

- »

-

Audio Visual Hardware Market Size & Share Report, 2030GVR Report cover

![Audio Visual Hardware Market Size, Share & Trends Report]()

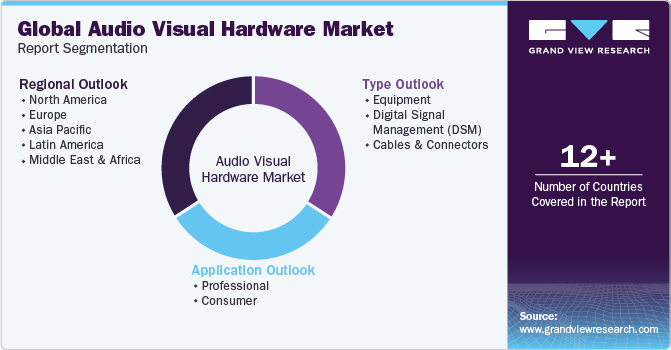

Audio Visual Hardware Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Equipment, DSM, Cables & Connectors), By Application (Professional, Consumer), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-259-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Audio Visual Hardware Market Summary

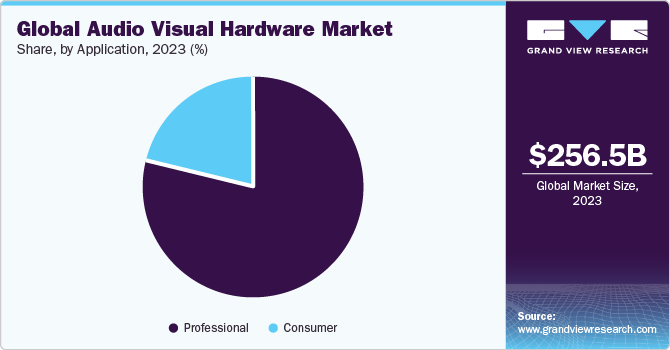

The global audio visual hardware market size was estimated at USD 256,533.1 million in 2023 and is projected to reach USD 389,210.0 million by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The market is undergoing a significant transformation with a notable surge in online sales and the adoption of direct-to-consumer (DTC) channels.

Key Market Trends & Insights

- The North America audio visual hardware market accounted for the largest revenue share of 31.9% in 2023.

- The audio visual hardware market in the U.S. is expected to grow significantly over the forecast period.

- By application, the professional segment accounted for the largest revenue share in 2023.

- By type, the equipment segment led the market and accounted for the largest share of 76.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 256,533.1 Million

- 2030 Projected Market Size: USD 389,210.0 Million

- CAGR (2024-2030): 6.1%

- North America: Largest market in 2023

E-commerce platforms are transforming the way consumers explore, compare, and purchase audio visual (AV) systems, offering unparalleled convenience and accessibility. This shift is influencing manufacturers and retailers to adapt their sales strategies, emphasizing agile approaches, global market reach, and direct customer interaction. Enhanced customer experiences, facilitated by user-friendly interfaces and secure transactions, contribute to increased satisfaction and loyalty.

Moreover, online platforms offer valuable marketing and branding opportunities, enabling businesses to utilize digital channels to showcase products, increase brand awareness, and engage with a global audience. As the market continues to embrace this digital shift, the impact of e-commerce on customer behaviors and strategic decisions within the industry remains profound. The significant growth of the speakers segment is propelling the market growth. The high demand for speakers is driven by the increasing popularity of smart homes, voice assistants, and immersive entertainment. Consumers are increasingly seeking integrated audio solutions that seamlessly connect with their smart ecosystems. Smart speakers can provide users with voice-controlled experiences, multi-room audio, and personalized listening, which can ultimately enhance convenience and offer a holistic user experience.

he growing demand is encouraging industry players to introduce innovative speakers. For instance, in May 2023, Sony Group Corp. launched two new wireless speakers: the SRS-XB100 and the SRS-XV800. The SRS-XV800 is a compact, Bluetooth-enabled speaker designed for use on the go, offering powerful sound and lighting effects. The SRS-XB100 offers portability without compromising on clear, powerful sound. These models showcase the growing demand for speakers that cater to diverse needs and preferences. The increasing demand for advanced microphones is another major factor driving the market growth. The demand for high-quality audio and video has favored the adoption of technologically advanced AV hardware, especially microphones.

As companies and educational institutions increasingly embrace remote work and learning, the need for smart solutions that enhance virtual collaboration is becoming more evident, encouraging industry players to introduce new products to cater to this demand. For instance, in May 2022, AVer Information Inc., a provider of video conferencing visualizers for business and education technology solutions, collaborated with Yamaha to develop smart solutions that can elevate the virtual meeting experience by combining Aver’s industry-renowned USB conferencing and PTZ cameras with Yamaha’s high-quality microphones. The integration would enable the cameras to gain enhanced automatic speaker tracking functionality, where the camera automatically identifies and focuses on the person speaking in the room, enhancing clarity and engagement in virtual meetings and presentations.

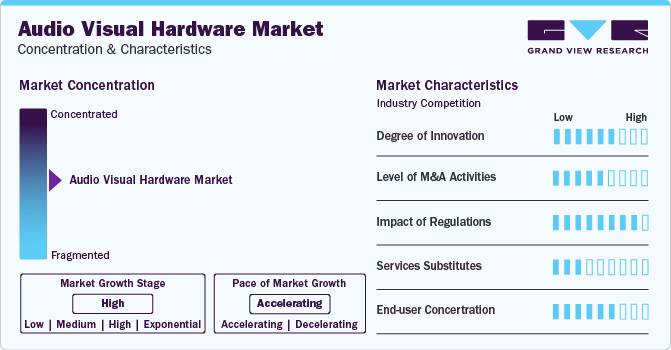

Market Concentration & Characteristics

The industry is expanding rapidly, with an emphasis on incorporating artificial intelligence (AI) capabilities into AV products. This trend allows businesses to improve decision-making, collect insights, and provide personalized experiences to people. Companies that use AI-driven AV equipment can keep their competitiveness while also maintaining trust and security in AI applications. This adoption enables enterprises to fully realize the potential of AI technologies while efficiently managing associated risks. As AI-powered AV solutions gain popularity across industries, they help create environments that inspire trust, reduce risks, and ensure security.

The market is characterized by a high level of merger and acquisition (M&A) activities. Ethical practices involve a collaborative effort of regulatory bodies, research institutions, and technology & consulting firms. For instance, in December 2023, HARMAN International completed the acquisition of FLUX SOFTWARE ENGINEERING, incorporating FLUX's immersive, processing, and analysis solutions spanning live production, installation sound, content creation, and post-production. This acquisition expands the range of offerings from HARMAN Professional, introducing top-tier immersive technology for various applications. Furthermore, the collaboration between FLUX's team & the hardware and software engineers of HARMAN Professional lays the groundwork for future innovations in the industry.

The audio visual system vendors are emphasizing the delivery of smart connectivity and immersive experiences. The suppliers are also navigating a unique landscape marked by specific regulations, diverse regional preferences, and a growing emphasis on sustainability. For instance, vendors must adapt their offerings to comply with regulations, cater to regional needs, such as multilingual content, and prioritize environmentally friendly practices. This dynamic approach ensures consumers have access to innovative and suitable AV solutions, thereby contributing to market growth.

The rising number & usage of streaming services, gaming consoles, and smart TVs that provide similar entertainment capabilities pose a substantial challenge to traditional AV devices, such as Blu-ray players and cable boxes. Consumers are increasingly choosing multi-functional gadgets that mix audio and video features, minimizing the need for specific hardware. As a result, substitutes pose a significant threat to the market.

End-user concentration is a prominent trend in this market as an increasing number of enterprises and sectors incorporate AV equipment into their operations. This trend is being driven by the rising demand for AV hardware goods and services from a variety of end-user groups, including business companies, educational institutions, healthcare facilities, retail outlets, and entertainment venues. As businesses and organizations prioritize improving communication, collaboration, and engagement using AV technology, the market's client base grows. This trend emphasizes the need to respond to the specific demands and requirements of different end-user segments, which drives innovation and diversification in the market.

Application Insights

The professional segment accounted for the largest revenue share in 2023. The professional AV systems market boasts a highly competitive landscape due to the presence of numerous domestic and international players, both large- and small-scale. Brand reputation plays a crucial role in influencing consumer preferences, as established brands are often associated with superior quality and feature-rich solutions. This grants a competitive advantage to well-recognized players in the market. Some of the industry’s major players include AVI-SPL Inc., AVI Systems Inc., Ford Audio-Video LLC, and Solotech Inc. The level of competition among leading vendors is expected to remain high and potentially increase during the forecast period.

The consumer segment is predicted to foresee significant growth in the forecast period. Consumers are opting for AV equipment that integrates seamlessly with smart homes, allowing for voice control and automated functionalities. The rise of streaming and online gaming fuels the demand for high-performance devices delivering exceptional visuals, immersive sound, and low latency. In addition, portable and user-friendly options like tablets and wireless speakers have gained popularity. The value-added features like built-in streaming or fitness tracking cater to diverse user needs, making the consumer audio visual system market a dynamic and ever-evolving landscape.

Type Insights

The equipment segment led the market and accounted for the largest share of 76.9% in 2023. Trends, such as high-resolution displays, advanced sound systems, and VR/AR integration are driving the market's demand. Manufacturers are responding with convergence, offering multi-functional devices like smart TVs, and simplifying setups with wireless solutions. In addition, user experience is prioritized through easy-to-use interfaces, voice control, and personalized features. As technology advances and user demands evolve, the market is poised for continued dynamic growth. The digital signal management (DSM) segment is projected to grow significantly over the forecast period.

The segment growth is attributed to several trends, such as the growing complexity of AV systems with diverse formats and protocols necessitating efficient signal routing, processing, and control, which DSM solutions excel at. In addition, the convergence of AV equipment and the rise of IP-based systems create a need for centralized management that DSM platforms effectively address. Furthermore, the demand for seamless user experiences is completed by DSM's ability to automate tasks and provide user-friendly interfaces. As AV technology advances, DSM's role in ensuring efficient, reliable, and user-centric audio-visual experiences will become even more crucial.

Regional Insights

The North America audio visual hardware market accounted for the largest revenue share of 31.9% in 2023. Consumers in North America are increasingly seeking convenient and flexible AV solutions. As such, although premium AV solutions are already present in the market, entry-level AV solutions offering basic features but guaranteeing flexibility are also being introduced in the market. For instance, in June 2022, Sonos launched a compact soundbar called Sonos Ray. The entry-level soundbar lacks advanced features, such as Dolby Atmos and HDMI connectivity, featured in its premium counterparts Beam and Arc. However, it frees users from using the TV’s built-in basic speakers by allowing them to hook the device to the TV using an optical audio cable.

U.S. Audio Visual Hardware Market Trends

The audio visual hardware market in the U.S. is expected to grow significantly over the forecast period. In the U.S., the growing need to improve healthcare accessibility, convenience, and patient experience is driving the trend of virtual care. AV hardware can play a vital role in supporting virtual care.

Europe Audio Visual Hardware Market Trends

The Europe audio visual hardware market is expected to witness considerable growth from 2024 to 2030 due to high the demand for smart, connected AV products, which integrate smoothly into smart home ecosystems to enable centralized control and automation using voice assistants or pre-programmed routines. However, given that Europe is a diverse regional market characterized by varying consumer preferences, vendors are tailoring product offerings and marketing strategies to these regional differences, such as local language support and broadcasting standards.

The audio visual hardware market in the UK is growing due to the rising popularity of high-quality audio & video streaming services, which is fueling the demand for advanced AV equipment, including high-resolution displays and immersive audio systems. The growing trend of remote working and virtual collaboration is also driving the demand for AV solutions integrated with AI and Machine Learning (ML) to optimize performance and enhance user experiences during virtual meetings and conferences.

The Germany audio visual hardware market held a significant share of the Europe market in 2023. There is a sustained demand for premium audio equipment, including high-end headphones, speaker systems, and home theater setups, in the country. The focus on high-performance audio solutions is not limited only to home entertainment but also extends to professional setups, such as recording studios and concert venues, which, in turn, support market growth.

Asia Pacific Audio Visual Hardware Market Trends

The audio visual hardware market in Asia Pacific is anticipated to register the fastest CAGR from 2024 to 2030. Dynamic trends are shaping the Asia Pacific regional market. The demand for smart home technology integrated with AV and home automation solutions is growing across Asia Pacific. The continued rollout of high-speed internet networks and the growing popularity of streaming services are driving the demand for high-resolution displays and immersive audio systems. Notably, AV solutions are playing an important role in remote collaboration, e-learning, and virtual meetings in academic and corporate applications. The incorporation of AI and Augmented Reality (AR) into AV hardware is helping improve user experiences. The trend reflects Asia Pacific's panorama of technological progress and evolving consumer demands.

The China audio visual hardware market is expected to grow significantly over the forecast period. Rapid urbanization and rising levels of disposable income are fueling the demand for high-end AV equipment, particularly large format displays, smart TVs, and advanced home theater systems, across China.

The audio visual hardware market in India is expected to grow substantially in the coming years. In India, consumers are increasingly investing in premium AV solutions in line with the continued launch of high-definition streaming services. Catering to this trend, Sony launched its HT-A5000 soundbar with built-in Wi-Fi and Bluetooth connectivity in the Indian market to allow users to stream high-definition music and movies wirelessly from their smartphones and other devices while guaranteeing a clutter-free and flexible environment.

Middle East & Africa (MEA) Audio Visual Hardware Market Trends

Economic growth and rapid urbanization are driving investments in educational institutions, corporate offices, and entertainment venues, all requiring advanced AV solutions that are fueling the region's growth. Government initiatives like smart city projects and e-learning programs further fuel the growth. In addition, the rising demand for high-resolution displays, immersive technologies, and cloud-based solutions highlights the rising awareness and adoption of AV hardware in countries including KSA and UAE among others.

Key Audio Visual Hardware Company Insights

Prominent firms have used product launches and developments, followed by expansions, M&As, contracts, agreements, partnerships, and collaborations, as their primary business strategies for increased market share. Companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in January 2024, Sony Electronics Inc. announced the launch of the new SRS-XV500. This speaker offers built-in lighting, a long-lasting battery, and a karaoke feature.

Key Audio Visual Hardware Companies:

The following are the leading companies in the audio visual hardware market. These companies collectively hold the largest market share and dictate industry trends.

- Amphenol Corp.

- AVI Systems Inc.

- Avidex Industries, LLC

- AVI-SPL Inc.

- Belden Inc.

- Black Box

- CCS Presentation Systems Inc.

- Conference Technologies Inc.

- Corning Inc.

- Electrosonic

- Ford Audio-Video LLC

- HARMAN International

- LG Corp.

- Samsung Electric Corp.

- Solotech Inc.

- Sony Corp.

- Switchcraft, Inc.

- TE Connectivity

- Wesco International

Recent Developments

-

In February 2024, AVI Systems Inc., the global expert in audiovisual and unified collaboration systems integration, entered into a partnership with Audio Visual Associates (AVA) of New Jersey, marking a strategic move to enhance AVI Systems Inc.’s presence in the northeastern U.S. With this collaboration, AVA becomes the 32nd location for AVI Systems in the U.S., situated in New Jersey and operating under the AVI Systems brand to better serve its clients

-

In January 2024, Samsung Electronics Co. Ltd. unveiled its most recent QLED, MICRO LED, OLED, and Lifestyle display collections in anticipation of CES 2024. The latest offerings, such as the Neo QLED 8K and 4K TVs, deliver a comprehensive experience encompassing realistic picture quality, advanced audio technology, and a diverse selection of apps and services

-

In November 2023, Solotech introduced LiveSphere, a cutting-edge white-label webcasting solution. LiveSphere presents a flexible platform that caters to various scenarios, be it corporate events, government meetings, live entertainment, or hybrid experiences. This innovative solution expands opportunities to engage with a global audience, reaching tens of thousands per event

-

In October 2023, Avidex Industries, LLC and Artisight unveiled a strategic partnership that aims to leverage the unique capabilities of both entities to deliver a comprehensive virtual care solution. As part of the agreement, Avidex will handle AV hardware installation and support, integrating its exclusive TigrPX interactive patient appointment system with Artisight's virtual care platform. The collaborative solutions will be extended to both existing and new client hospitals and health systems, ensuring an elevated virtual care experience for patients and staff

Audio Visual Hardware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 272.27 billion

Revenue forecast in 2030

USD 389.21 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Amphenol Corp.; AVI Systems Inc.; Avidex Industries, LLC; AVI-SPL Inc.; Belden Inc.; Black Box; CCS Presentation Systems Inc.; Conference Technologies Inc.; Corning Inc.; Electrosonic; Ford Audio-Video LLC; HARMAN International; LG Corp.; Samsung Electric Corp.; Solotech Inc.; Sony Corp.; Switchcraft, Inc.; TE Connectivity; Wesco International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Audio Visual Hardware Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the audio visual hardware market report based on type, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Equipment

-

Microphones

-

Speakers

-

Mixing Consoles

-

Amplifiers

-

Displays

-

Projectors

-

Cameras

-

Gaming Consoles

-

-

Digital Signal Management (DSM)

-

Matrix Switchers

-

Video Wall Processors

-

Signal Extenders

-

KVM Systems

-

Audio DSP (Digital Signal Processing)

-

-

Cables & Connectors

-

HDMI Cables

-

Displayport Cables

-

Coaxial Cables

-

Fiber Optic Cables

-

Audio Cables

-

Connectors

-

Wireless Technologies (Wi-Fi, Bluetooth)

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional

-

Corporate Offices

-

Education

-

Government Facilities

-

Healthcare

-

Hospitality

-

Retail

-

Transportation

-

Sports & Entertainment

-

Others

-

-

Consumer

-

Home Theaters

-

Gaming Setups

-

Streaming Setups

-

Smart Home Integration

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global audio visual hardware market size was estimated at USD 256.53 billion in 2023 and is expected to reach USD 272.27 billion in 2024.

b. The global audio visual hardware market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030, reaching USD 389.21 billion by 2030.

b. North America dominated the AV hardware market, with a share of 31.92% in 2023. Consumers in North America are increasingly seeking convenient and flexible audio-visual solutions. As such, although premium AV solutions are already present in the market, entry-level AV solutions offering basic features but guaranteeing flexibility are also being introduced in the market.

b. Some key players operating in the audio visual hardware market include Avidex Industries, LLC, AVI-SPL Inc., Belden Inc., Black Box, Corning Incorporated, Electrosonic, Ford Audio-Video LLC, HARMAN International, LG Corporation, Samsung Electric Corporation, Solotech Inc., Sony Corporation

b. Key factors that are driving the market growth include Rapid technological development and The evolving expectations and choices of consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.