- Home

- »

- Next Generation Technologies

- »

-

Augmented Reality & Virtual Reality In Manufacturing Market Report 2030GVR Report cover

![Augmented Reality & Virtual Reality In Manufacturing Market Size, Share & Trends Report]()

Augmented Reality & Virtual Reality In Manufacturing Market (2023 - 2030) Size, Share & Trends Analysis Report by Component (Hardware, Software, services), By Technology, By Device, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-979-4

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Augmented Reality & Virtual Reality In Manufacturing Market Summary

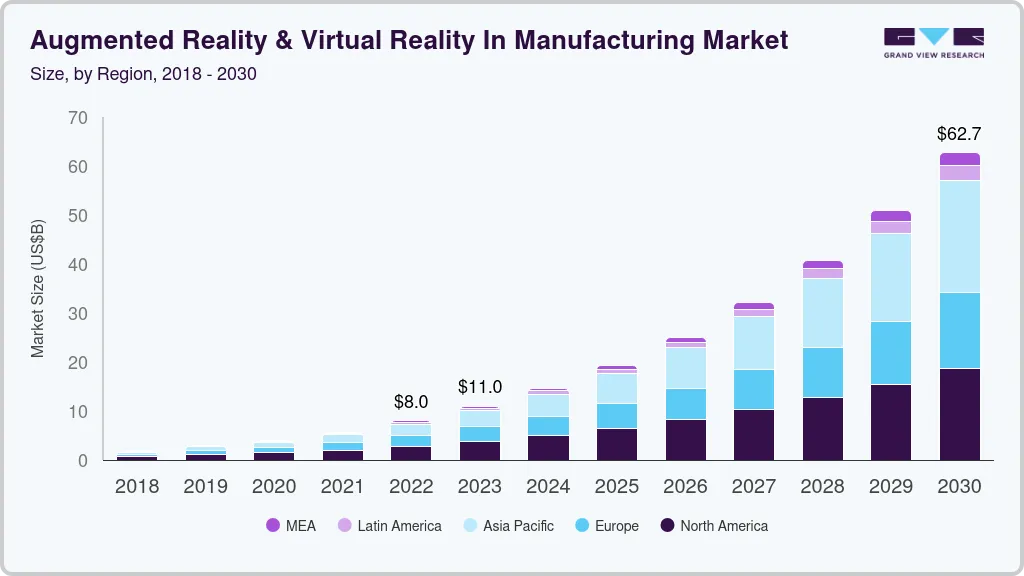

The global augmented reality & virtual reality in manufacturing market size was estimated at USD 8,010.8 million in 2022 and is projected to reach USD 62,707.8 million by 2030, growing at a CAGR of 29.3% from 2023 to 2030. AR and VR are highly compatible technologies that provide an immersive 360-degree content view in a highly simulative environment and are driven by actionable analytical insights.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, U.S. is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, hardware accounted for a revenue of USD 4,554.4 million in 2022.

- Services is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 8,010.8 Million

- 2030 Projected Market Size: USD 62,707.8 Million

- CAGR (2023-2030): 29.3%

- North America: Largest market in 2022

The market experiences a rise in demand among manufacturers for AR VR devices for simulative applications. Furthermore, the rise in applications of AR VR for manufacturing plant improvisation, and workforce training, among others catalyzes the augmented reality and virtual reality in the manufacturing market growth.

Advancements in augmented reality and virtual reality headset technology for capturing images and sound have led to its adoption during the last few years. Further, the availability of various electronic products compatible with AR VR technology, such as tablets, headsets, and other smart devices, has led to a significant increase in the market opportunities. For instance, In January 2022, Microsoft Corporation Inc. launched its new and advanced AR HoloLens 2 headsets in India. The newly launched mixed reality headsets are expected to support the user tasks faster and more efficiently.

The rise in the trend for the application of industrial robots in manufacturing drives the demand for AR and VR technologies. Inducing AR in manufacturing and production processes provides various capabilities, such as identifying an error and offering virtual support in real-time, all of which reduce production downtime. Thereby creating demand in the manufacturing process.

The adoption of AR & VR to eliminate physical trials assists organizations in cutting down R&D costs. Furthermore, VR solutions help reduce training costs and help organizations redistribute resources for enhanced outputs. The capability mentioned above helped manufacturers during COVID-19 to address the problem related to the shortage of workforce, which also created demand for AR VR in the manufacturing industry.

Technological adoptions due to the onset of Industrial Revolution 4.0 have increased the penetration of augmented and virtual reality in manufacturing. The harmonious integration of VR, AR, and mixed reality (MR) is expected to make several experiences more engaging and interactive. The narrowing supply-demand gap of raw materials and components between suppliers and manufacturers is expected to overwhelm the market with new AR, VR, and MR products. Hence, the availability of new products is expected to grow augmented reality and virtual reality in the manufacturing market.

Component Insights

The hardware segment accounted for the largest revenue share of around 56.0% in 2022 and is expected to continue dominating the market over the forecast period. The growing adoption of AR & VR devices across various industries contributes to hardware in the market. Technological developments, networking, and connectivity advancements are expected to fuel the market demand for augmented reality & virtual reality headsets over the forecasted period.

The services segment is expected to grow at the highest CAGR of around 29.0% over the forecast period. The significant growth observed in the services segment is due to an increase in immersive technology-related consulting and service offerings like maintenance, training, and security services, which will continue to grow in the forecasted period. The service segment is a new market with many key augmented and virtual reality technology companies investing in service firms. For instance, in February 2022, ESI Group and CIMPA consulting and services, a significant player in product life cycle management, collaborated to provide manufacturers with integrated VR solutions with existing product lifecycle management processes.

Technology Insights

The augmented reality (AR) technology segment accounted for the highest revenue share of around 71.0% in 2022. This growth is due to the preference for AR technology that enables manufacturers to access manual processes and automated data simultaneously. Further, the application of AR technology for production training, enhancing process efficiency, and the well-being of employees drive AR in manufacturing market growth. Furthermore, using AR for maintenance in manufacturing plants contributes to the surge in market growth.

The virtual reality technology segment is anticipated to grow at the highest CAGR of around 31.0% from 2023 to 2030. This growth can be attributed to the widespread adoption of virtual reality and the rising popularity of industrial IoT, industrial robots, and smart factories that have offered a primary platform for VR applications in the manufacturing industry. The ability of VR to provide a 360-degree content view experience in a highly stimulating environment and analytical in modern production creates many opportunities for market growth.

Device Insights

The Head-mounted display (HMD) segment accounted for the highest revenue share of 60.0% in 2022. The increasing demand for head-mounted displays and smart glasses for industrial & enterprise applications. The HMD segment is expected to maintain its dominance in the device segment over the forecasted period. The use of HMD devices for product enhancement drives market growth.

The handheld devices segment is anticipated to grow at the highest CAGR of 29.0% from 2023 to 2030. The segment is projected to gain traction due to the emerging demand for high-quality immersive technology. Hand-held AR & VR devices allow users to freely enjoy technological advances while roaming without having to mount devices on their heads or sit next to any project or display terminal. The growing popularity and increase in user base numbers are expected to further the market drive demand.

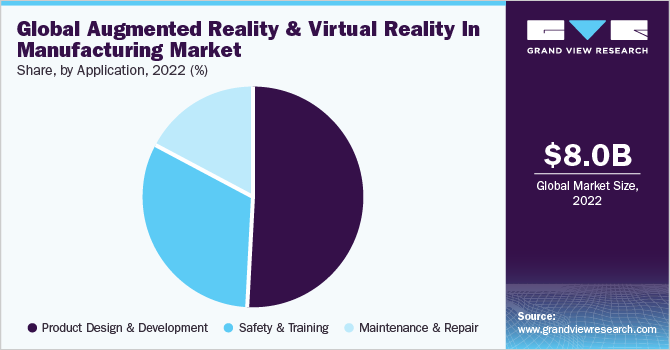

Application Insights

The product design & development segment accounted for the largest revenue share of around 51.0% in 2022 and is expected to continue dominating the augmented reality and virtual reality in the manufacturing market over the forecast period. Manufacturers have increased market competition by using AR and VR technology in product design and development applications. Therefore, the convenience of using AR VR technology for product design & development application drive the market growth.

The safety & training segment is expected to grow significantly with a CAGR of around 27.0% over the forecast period. The need for effective enterprise maintenance & repair tools across organizations is the driving force of the maintenance & repair segment. AR & VR in security & training has been gaining momentum due to the adoption of advanced technologies in training programs.

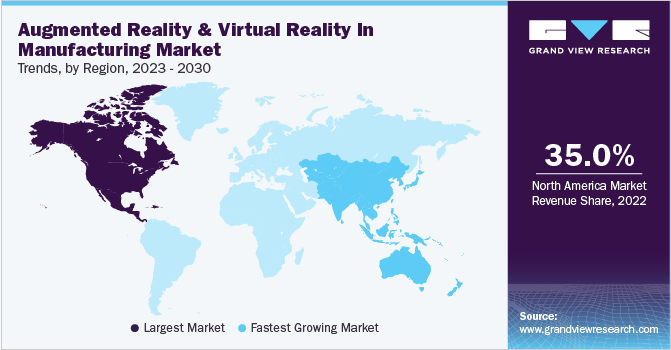

Regional Insights

North America accounted for the largest revenue share of around 35.0% in 2022 and is anticipated to account for a significant market share over the forecast period. The U.S. has the largest market share of the North American augmented and virtual reality manufacturing market. The surge in penetration of Industrial Revolution 4.0 in the U.S. manufacturing market drives the market growth in the region.

The Asia Pacific is predicted to emerge as the fastest-growing regional augmented and virtual reality segment in the manufacturing market over the forecast period, with the highest CAGR of 31.0% from 2022-2030. Countries such as Japan and China have dominated the Asia-Pacific market, leveraging a large customer base. Further, the continued rollout of 5G networks in the Asia Pacific is also expected to catalyze the growth of augmented and virtual reality technology in the manufacturing sector.

Key Companies & Market Share Insights

Augmented reality and virtual reality in manufacturing market players have adopted market strategies such as product launches, product development, partnerships, strategic alliances, acquisitions & mergers to advance technological developments despite the competition. For instance, In July 2023, Vuzix Corporation announced a purchase order for engineering services and waveguide and display engine products. With this order, the company intended to design a new customized head-mounted display solution for multi-discipline applications. Some key companies operating in the global augmented reality and virtual reality in manufacturing market are:

-

Microsoft Corporation

-

Google LLC

-

Samsung Group

-

Vuzix Corporation

-

SkillReal

-

Ediiie

-

EON Realty, Inc.

-

Kaon Interactive Inc.

-

Worldviz, Inc.

-

SoluLab

-

ESI Group

Augmented Reality & Virtual Reality In Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.98 billion

Revenue forecast in 2030

USD 62.71 billion

Growth Rate

CAGR of 28.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, device, technology, application, region

Regional scope

North America, Europe, Asia Pacific, South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Argentina, South Africa

Key companies profiled

Microsoft Corporation; Google LLC; Samsung Group; Vuzix Corporation; SkillReal; Ediiie; EON Reality, Inc.; Kaon Interactive Inc.; Worldviz, Inc.; SoluLab; ESI Group.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Augmented Reality & Virtual Reality In Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global augmented reality & virtual reality in manufacturing market report based on component, technology, device, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmented Reality

-

Virtual Reality

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Head-mounted Display

-

Head-up Display

-

Handheld Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Design & Development

-

Safety & Training

-

Maintenance & Repair

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Frequently Asked Questions About This Report

b. The global augmented reality & virtual reality in manufacturing market size was estimated at USD 8.01 billion in 2022 and is expected to reach USD 10.98 billion in 2023

b. The global augmented reality & virtual reality in manufacturing market is expected to grow at a compound annual growth rate of 28.3% from 2023 to 2030 to reach USD 62.71 billion by 2030.

b. North America dominated the AR and VR in manufacturing market with a share of over 35% in 2022. Established IT infrastructure has given traction to the early adoption of advanced technologies in the region and has contributed to the market growth.

b. Some key players operating in the augmented reality & virtual reality in manufacturing market include Microsoft Corporation, Google LLC, Samsung Group, Vuzix Corporation, ESI Group etc.

b. The advent of new technologies, as well as increased demand for reducing operating costs, increasing automation, and quality control, are key drivers driving the augmented reality and virtual reality in manufacturing market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.