- Home

- »

- Next Generation Technologies

- »

-

Augmented Shopping Market Size And Share Report, 2030GVR Report cover

![Augmented Shopping Market Size, Share & Trends Report]()

Augmented Shopping Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Application (Automotive, Home Goods & Furniture, Footwear), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-019-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Augmented Shopping Market Size & Trends

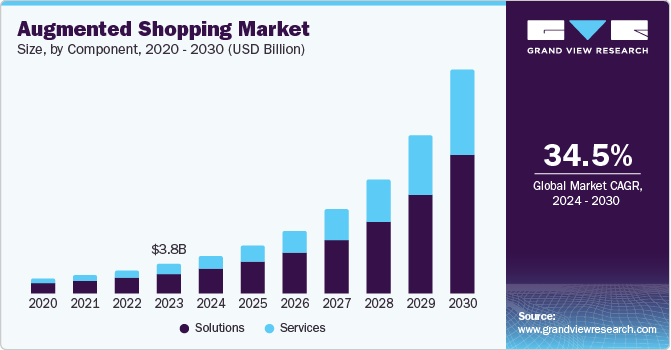

The global augmented shopping market size was valued at USD 3.81 billion in 2023 and is projected to grow at a CAGR of 34.5% from 2024 to 2030.The increasing adoption of smartphones and mobile devices, rising Internet penetration across various regions, and innovations in Augmented Reality (AR) technology have created a strong user base for AR solutions, particularly over the past decade. For instance, the International Telecommunication Union (ITU) estimated that over 5.4 billion people were using the internet in 2023. This number is growing rapidly, particularly in developing economies such as India, Brazil, and various African economies.

Anticipating the growth potential of the AR shopping market, manufacturers are incorporating AR tools into their commercial shopping applications and websites, enabling shoppers to enjoy immersive and interactive shopping experiences. These factors are expected to further fuel demand for AR solutions in the retail business over the forecast period.

Advancements in Augmented Reality (AR) technology, such as improved spatial mapping and marker-less tracking, have enhanced the quality and accuracy of AR experiences, leading to increased user engagement. Additionally, the growing demand for personalized and interactive shopping experiences has driven retailers to adopt AR solutions, allowing customers to test products virtually, visualize furniture aesthetics and positioning in their homes, and access additional product information. For instance, the IKEA Place application launched by IKEA utilizes AR technology to let customers virtually place new furniture in their homes by scanning their rooms with a LiDAR scanner on their iPhones. Various other industries, such as automotive, footwear, and cosmetics, are expected to steadily increase their usage of augmented reality solutions in the coming years, driving market growth over the forecast period.

The integration of Augmented Reality (AR) with social media platforms such as Snapchat and Instagram, along with its demand in the influencer marketing space, has expanded its reach and appeal. In addition, an increasing focus on sustainability and reduced frequency of product returns has highlighted the benefits of AR in reducing waste and improving purchasing decisions. For instance, beauty product platform Sephora's innovative mobile application allows customers to try its makeup products virtually. Sephora Virtual Artist uses facial recognition technology to display different product shades by scanning users' faces. Similar advancements by other companies are expected to create notable growth opportunities for the AR shopping industry in the coming years.

Component Insights

The solutions component dominated the market with a revenue share of 67.8% in 2023. It is attributed to the growing need for comprehensive AR solutions that can be seamlessly integrated into existing e-commerce platforms, mobile apps, and physical stores. Retailers are increasingly seeking end-to-end solutions that include content creation, software development, deployment, and constant support and maintenance. AR solutions help offer a one-stop shop for retailers, providing them with a scalable and customizable AR platform that can be tailored to their specific business needs. Furthermore, they enable retailers to leverage AR technology without requiring significant investments in in-house development and expertise, making it an attractive option for businesses of all sizes.

Meanwhile, the services component of augmented shopping is expected to register the fastest CAGR over the forecast period. This substantial growth is expected to be aided by the increasing demand for specialized services, which is expected to enable retailers to integrate AR technologies into their operations effectively. As Augmented Reality (AR) adoption accelerates, retailers require professional guidance on strategy development, content creation, and implementation to maximize the benefits of AR shopping experiences. The services component, comprising consulting, training, maintenance, and support services, has become essential for retailers to navigate the complexities of AR technology and optimize its potential.

Application Insights

The automotive sector held the highest market revenue share in 2023. The presence of complex and high-value products in this industry, coupled with the need for immersive and interactive customer experiences, has created a strong base for AR adoption. Automobile manufacturers and dealerships have leveraged AR to enable customers to virtually explore and customize vehicles, visualize features and options, and take virtual test drives. For instance, Toyota has created an AR app that leverages machine learning and Apple's ARkit. This app lets customers easily identify their car with their phone camera and virtually add accessories without needing physical markers, creating a more engaging and convenient shopping experience. Such initiatives lead to increased customer engagement and improved sales. The automobile sector's significant investment in digital transformation and customer experience initiatives has positioned AR as a key strategy for competitive differentiation.

On the other hand, the footwear segment is expected to register the fastest growth rate from 2024 to 2030. The footwear industry's emphasis on style, fit, and customization is well-suited for AR technology use, enabling customers to try on shoes virtually, visualize different colors and designs, and ensure a precise fit. Additionally, this sector's competitive landscape and high product return rates have driven retailers to invest in AR solutions to enhance customer satisfaction, reduce returns, and gain a competitive edge. For instance, the Nike app's Nike Fit feature leverages AR to enable customers to find accurate shoe sizes using their mobile camera. Many other leading footwear brands are also leveraging innovative AR solutions to engage customers, increase conversions, and drive growth.

Regional Insights

North America dominated the market with a revenue share of 59.3% in 2023. It is attributed to the region's robust e-commerce landscape, high smartphone penetration rate, and strong consumer demand for innovative technologies. North America's well-established retail infrastructure and significant investments in digital transformation and customer experience initiatives have created several growth avenues for AR adoption. Additionally, the region's competitive market dynamics have driven retailers to leverage AR as a key differentiator, enhancing customer engagement and driving sales.

U.S. Augmented Shopping Market Trends

The U.S. accounted for the largest share of the regional market in 2023. The country has been a leader in AR adoption, driven by the presence of tech-savvy consumers, established retailers, and innovative startups. For instance, Tidio, in its state of e-commerce report, estimated that around 70% of the U.S. population was shopping online in 2023. This trend is expected to bring more advancements in online shopping experience by retailers. As a result, the U.S. has emerged as a prominent market for AR shopping experiences, with leading names such as Walmart, Home Depot, and Amazon pioneering AR technology to revolutionize customer shopping experience.

Europe Augmented Shopping Market Trends

Europe held a significant market share in 2023. It is owing to the region's advanced digital infrastructure, high smartphone penetration rates, and strong e-commerce culture. European consumers have showcased a strong inclination to adopt innovative technologies, driving demand for immersive and interactive shopping experiences. Additionally, the region's competitive retail landscape has encouraged retailers to invest in AR solutions, enhancing customer engagement and driving sales. The presence of key players in the AR industry, such as the IKEA Place app, L'Oréal ModiFace makeup virtual try on, and Zara AR Display, has further solidified Europe's position in this market.

The UK augmented shopping market accounted for a significant share of the European market. Retailers in the economy are experiencing fierce competition from online stores utilizing AR solutions, such as Argos. As a result, conventional offline retail giants such as Harrods, Tesco, and IKEA have started adopting AR solutions. Moreover, various non-technological industries such as apparel, paint, and furniture have successfully leveraged AR to offer their consumers better choices and customization options. These advancements have led to faster market growth.

Asia Pacific Augmented Shopping Market Trends

Asia Pacific is expected to register the fastest growth rate over the forecast period. Rapid economic growth and an increasing middle-income urban population in countries such as China, India, and Indonesia have created lucrative growth opportunities for retailers. The emergence of AR and its incorporation by social media and retail giants, such as Taobao from Alibaba Group, JD.com, WeChat, and Douyin, have led to the increased adoption of AR solutions among retailers. As the region's economic situation improves, a proportional rise in the adoption of innovative techniques such as AR is expected in the coming years.

India augmented shopping market has witnessed a substantial surge in e-commerce customers over the past decade. The India Brand Equity Foundation (IBEF) estimated that India has approximately 350 million internet users engaged in online transactions. The e-commerce marketplace showcased an increase of 22% in its Gross Merchandise Value (GMV) in 2023 over the previous year. Additionally, prominent players such as Amazon, Google, and Flipkart are investing heavily in the economy to capture a larger share of online customers. Furthermore, Indian companies such as Lenskart have incorporated AR technology in their shopping apps, enabling customers to choose from various products. These developments have presented promising growth opportunities for the market in India.

Key Augmented Shopping Company Insights

Some key companies involved in the augmented shopping market include Zugara, Inc., Augment, and Blippar Group Limited, among others.

-

Zugara, Inc. is an Augmented Reality (AR) and Virtual Reality (VR) software technology company. The company develops AR software based on ARKit & ARCore apps, gesture recognition, facial recognition, mobile AR and geolocation, AR video conferencing, and motion capture technology. Zugara offers its Virtual Style Sense (VSS) technology to retail shops to enhance the customer buying experience through AR. Prominent brands such as Purina, Orange Silicon Valley, Novelis, Pepsi, Olay, AT&T, Hungry Jack’s, Coach, Nestle, and Toyota have incorporated Zugara’s Augmented Reality technology.

-

Augment is a France-based company that provides AR and 3D visualization and communication solutions. The company is well-known in e-commerce for its 3D solutions, which convert 2D images of objects into 3D models. These ensure better customer engagement, enhanced sales conversion, and lesser product returns on e-commerce platforms. Augment offers the AR Viewer app, which supports Apple’s ARKit and Google’s ARCore. Furthermore, its dedicated AR solution has helped improve field sales efficiency for FMCG companies such as Unilever, Mondelez, Coca-Cola, and FP International.

Key Augmented Shopping Companies:

The following are the leading companies in the augmented shopping market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Augment

- Blippar Group Limited

- Google LLC

- Holition Ltd.

- 3D Cloud

- Microsoft

- PTC

- ViewAR GmbH

- Wikitude

- Zugara, Inc.

Recent Developments

- In April 2024, Blippar Group Limited announced its strategic partnership with Arabian Business Machines (ABM) to bring advanced AR solutions to the Saudi Arabian market. This collaboration is expected to aid in the digital transformation of the regional market by enabling businesses and brands to leverage AR solutions for enhanced customer experience.

- In October 2023, 3D Cloud announced that it had received a patent for automated room designing using AI technology. The software uses LiDAR scanning to develop innovative floor designs by leveraging AI. The software is expected to have several potential uses for customers buying furniture for their homes.

Augmented Shopping Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.82 billion

Revenue Forecast in 2030

USD 28.47 billion

Growth rate

CAGR of 34.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; Australia; South Korea; India; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Apple Inc.; Augment; Blippar Group Limited; Google LLC; Holition Ltd.; 3D Cloud; Microsoft; PTC; ViewAR GmbH; Wikitude; Zugara, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Augmented Shopping Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global augmented shopping market report based on component, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Home Goods & Furniture

-

Beauty & Cosmetics

-

Apparel Fittings

-

Grocery Shopping

-

Footwear

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.