- Home

- »

- Medical Devices

- »

-

Australia Facial Injectable Market Size & Share Report, 2030GVR Report cover

![Australia Facial Injectable Market Size, Share & Trends Report]()

Australia Facial Injectable Market (2024 - 2030) Size, Share & Trends Analysis Report By Procedure Type, By Application (Aesthetics, Therapeutics), And Segment Forecasts

- Report ID: GVR-4-68038-325-6

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Facial Injectable Market Trends

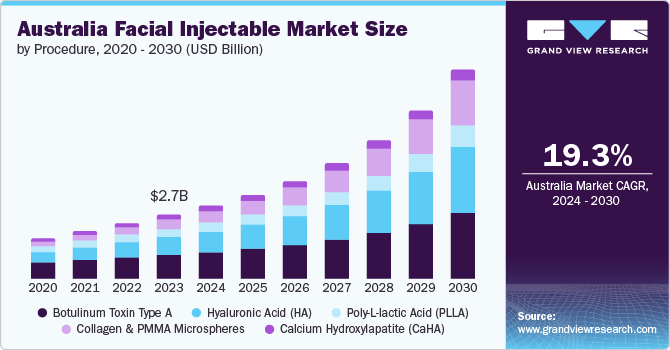

The Australia facial injectable market size was estimated at USD 2.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 19.3% from 2024 to 2030. Facial injectables have become extremely popular and widely accepted. Due to baby boomers' growing acceptance and use of injectable cosmeceutical products in recent decades, there is a rising desire for non-surgical aesthetic enhancement. Facial injectables are crucial in anti-aging treatments and are used, in particular, to stop damages like hyperpigmentation and early aging.

The most commonly used injectables are substances like botox and fillers. These are some of the most popular treatments across all socioeconomic groups, which have gained popularity. Their demand in the cosmetics industry is driven by their ease of use, transient nature, and affordability in comparison to other alternatives.

The cosmetic market has been shaped by changing customer demands. Since the majority of consumers are highly influenced by social media, there has been an increase in public awareness of anti-aging products. Therefore, offering cutting-edge and efficient products and services has become crucial for market participants. One of the major market drivers is the rising demand for anti-aging skin care products. As the millennial generation becomes older, it will continue to rise. Numerous methods and services for aesthetic enhancement have emerged as a result of technological advancements in the beauty sector.

The COVID-19 outbreak impacted all industries, including cosmetic, since there were stringent restrictions imposed by the authority bodies as a precaution. Aesthetics-related product supply chains were also impacted. The demand-supply chain across the whole medical device sector has been severely disrupted by the pandemic. Furthermore, cosmetic surgery centers and clinics were shut down due to global restrictions, and many cosmetic surgeries were canceled or postponed.

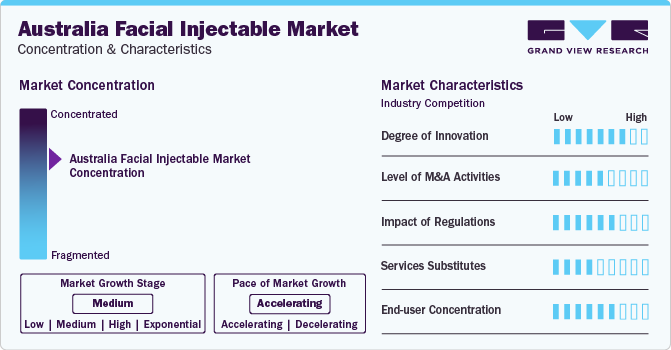

Market Concentration & Characteristics

The Australia facial injectable market is a dynamic and innovative landscape, constantly evolving with new technologies and approaches to address the demand for discreet and effective cosmetic procedures. Manufacturers actively invest in research and development, leading to continuous advancements that enhance treatment outcomes, improve patient comfort, and increase discretion. Also, service providers are continuously expanding their business to serve the rising number of patients.

Several market players, such as SILK Laser Clinics, Advanced Clinics Australia, Results Laser Clinic, Australian Skin Clinics, and Laser Clinics Australia are involved in merger and acquisition activities. Through M&A activities, these companies expand their geographic reach and enter new territories.

Following the recovery from the pandemic, the aesthetic and beauty business has grown tremendously. Client preferences for results-oriented dermal wellness procedures, using existing and new face and body rejuvenation equipment and technology advancements, are driving the industry's continuous expansion.

The Australia facial injectable market is witnessing rapid growth as consumers seek more discreet and effective solutions. Technological advancements, rising awareness, and evolving aesthetics drive the demand for facial injectables. With the growing demand for dermal wellness procedures and medical competence, medispas have thrived. There is an increasing demand for highly qualified dermal clinicians. To remain competitive, beauty and wellness businesses are embracing technology, customization, a varied menu of services with numerous revenue sources, and sustainability. The market is poised for further growth and innovation.

Procedure Type Insights

In 2023, the botulinum toxin type A segment dominated the market and accounted for 36.36% of total sales. Due to the increasing use of BoNTA in cosmetics (aesthetics), for enhancing the facial look and minimizing indications of aging, the botulinum toxin type A segment is anticipated to experience significant growth from 2024 to 2030.

The hyaluronic acid (HA) segment is likely to grow at a significant CAGR from 2024 to 2030. Cosmetic-grade HA's low molecular weight makes it easier for the substance to penetrate deeply into the epidermis, aiding in the retention of water in the cells and the release of antioxidants that slow down the aging process. Hyaluronic acid works as a moisturizer and aids in healing burns, skin ulcers, and wounds. In plastic surgery, it is also applied as a lip filler. Due to an increase in the usage of HA as a dermal filler or in cosmetic injectables, the HA sector is anticipated to grow at a rapid CAGR.

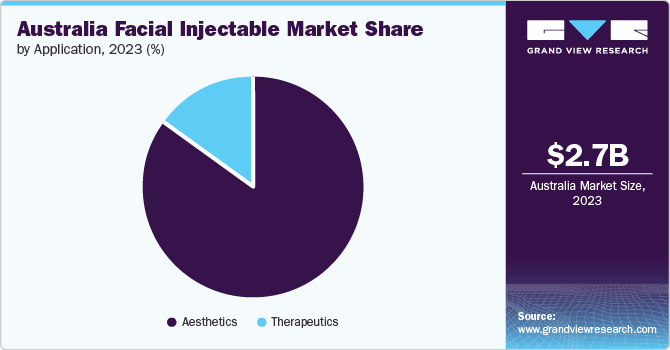

Application Insights

Due to the rising spending on aesthetic operations and expanding consumer awareness of aesthetic procedures, the aesthetics segment led the Australia facial injectables market with a revenue share of more than 85.1% in 2023. Owing to increasing awareness of aesthetic operations and rising disposable income, the aesthetics category is anticipated to see a significant CAGR from 2024 to 2030. Market expansion is augmented by a rise in the usage of cosmetic injectables for facial wrinkles, parentheses lines, lip lines, lip augmentation, lip border repair, and crow's feet lines.

Over the forecast period, the therapeutic segment is anticipated to experience a significant CAGR. The growing use of facial injectables in the treatment of strabismus or crossed eyes, blepharospasm, Meige's syndrome, hemifacial spasms (HFS), oromandibular dystonia (OMD), and focal hyperhidrosis is increasing the demand for therapeutics.

Key Companies & Market Share Insights

The facial injectables business in Australia is highly competitive, with a large number of service providers and product manufacturers. The major industry players have developed crucial business strategies, including product innovation, partnerships & collaborations, new product launches, joint ventures, contracts, and advanced service launches, to establish their industry position and acquire a sizable portion of the market share.

To get a foothold in the market, the players engage in numerous strategic alliances. For instance, in June 2021, SILK Laser Australia Limited signed a contract to buy Beauty Services Holdings Pty Ltd, a company which runs The Cosmetic Clinic in New Zealand and Australian Skin Clinics in Australia. It is believed that this acquisition will improve SILK's position in the market.

Key Australia Facial Injectable Companies:

- SILK Laser Clinics

- Advanced Clinics Australia

- Results Laser Clinic

- Australian Skin Clinics

- Laser Clinics Australia

Australia Facial Injectable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.1 billion

Revenue forecast in 2030

USD 9.08 billion

Growth rate

CAGR of 19.3% from 2024 to 2030

Base year for estimation

2023

Historic data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Procedure type, application

Regional scope

Australia

Key companies profiled

Silk Laser Clinics; Advanced Clinics Australia; Results Laser Clinic; Australian Skin Clinics; Laser Clinics Australia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Facial Injectable Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Australia facial injectable market report based on procedure type and application:

-

Procedure Type Outlook, (Revenue, USD Billion, 2018 - 2030)

-

Collagen & PMMA Microspheres

-

Hyaluronic Acid (HA)

-

Botulinum Toxin Type A

-

Calcium Hydroxylapatite (CaHA)

-

PLLA (Poly-L-lactic acid)

-

-

Application Outlook, (Revenue, USD Billion, 2018 - 2030)

-

Aesthetics

-

Therapeutics

-

Frequently Asked Questions About This Report

b. Australia facial injectable market size was estimated at USD 2.7 billion in 2023 and is expected to reach USD 3.1 billion in 2024

b. Australia's facial injectable market is expected to grow at a compound annual growth rate of 19.3% from 2024 to 2030 to reach USD 9.08 billion by 2030

b. The Botulinum Toxin Type A segment dominated the Australia facial injectable market with a share of 36.36% in 2023.

b. Some key players operating in the Australia facial injectables market include SILK Laser Clinics, Advanced Clinics Australia, Results Laser Clinic, Australian Skin Clinics, and Laser Clinics Australia

b. Key factors that are driving the Australia facial injectable market growth include Increasing awareness about aesthetic procedures among consumers and the growing geriatric population

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.