- Home

- »

- Pharmaceuticals

- »

-

Australia Nicotine Replacement Therapy Market Report, 2030GVR Report cover

![Australia Nicotine Replacement Therapy Market Size, Share & Trends Report]()

Australia Nicotine Replacement Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Nicotine Replacement Therapy, E-Cigarettes), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-167-9

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

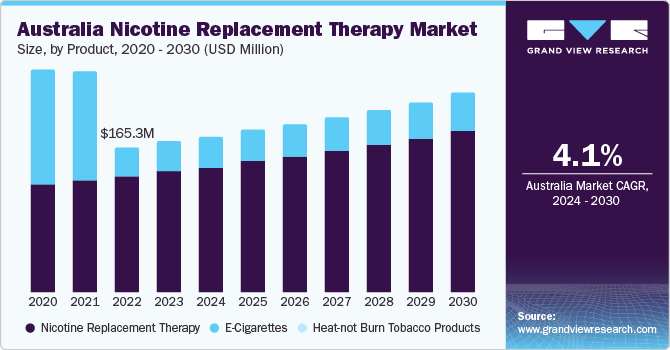

The Australia nicotine replacement therapy market size was estimated at USD 171.13 million in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 4.10% from 2024 to 2030. Increasing technological advancements in nicotine replacement therapy (NRT),rising awareness about ill effects of smoking, and growing number of people undergoing smoking cessation are key factors driving the market growth. For instance, in August 2022, an Australia-based startup, Mindset Health, announced the launch of its new hypnosis-based DTx app, which will aid smoking cessation.

Technological advancements in the Nicotine Replacement Therapy (NRT) market are ongoing, which has led to a rise in the number of people switching to advanced products. These advancements, such as flavored chewing gums & lozenges, are expected to act as drivers for the adoption of NRT. Although, traditional pharmaceutical products are available from brands such as Pfizer, Johnson & Johnson, and GlaxoSmithKline, to gain a strong foothold in the market, tobacco giants such as British American Tobacco have come up with alternatives that are smokeless & less harmful. These advanced products offer a range of benefits and are accepted in society when compared to traditional cigarettes, driving their adoption & aiding market growth.

Increasing awareness about the effects of smoking in Australia has been a significant public health initiative. The Australian government, along with health organizations, has undertaken extensive efforts to educate the population about the dangers of smoking. May 31st is celebrated as the No Tobacco Day and organizations such as The Australian Council of Smoking and Health (ACOSH) and Australian Government Department of Health and Aged Care work towards raising awareness about the medical conditions that arise due to smoking. According to a study published by Victoria state government, two out of three lifetime smokers die due to smoking-related diseases in Australia.

Furthermore, the reach of smoking cessation therapies has also increased extensively in Australia. Healthcare professionals are actively integrated into smoking cessation efforts. They engage patients in discussions about quitting, offering guidance, resources, and support to help individuals overcome nicotine addiction and improve their overall health. According to a study published by the Australian Institute of Health and Welfare in 2023, people aged 40 years and above are likely to smoke 20+ cigarettes per day in the country. However, after understanding its negative impact on health, people are opting for smoking cessation therapies. For instance, according to a study published by the government of Australia in 2023, the volume of cigarettes consumed in 2023 was much less than in 2017.

Product Insights

The nicotine replacement therapy segment held the largest revenue share of 79.55% in 2023. Increasing prevalence of health conditions, which are associated with tobacco consumption is prominently driving the acceptance & awareness of NRTs in Australia. The government is actively implementing programs & strategies to promote the adoption of nicotine replacement products such as gums, inhalers, patches, etc. The Australian government launched the National Tobacco Campaign in 1997 to reduce smoking rates in the country. This has led to a rise in public awareness campaigns and accessibility of NRT products, both over-the-counter and through prescription, making them more widely available to those looking to quit smoking.

Moreover, the Government of Australia is also focusing on economic factors, which are likely to positively impact the acceptance of NRT. For instance, the government subsidizes the cost of pharmaceutical drugs that are required for smoking cessation under the Pharmaceutical Benefits Scheme. Such factors are also projected to accelerate the growth of the Australia NRT market during the forecast period.

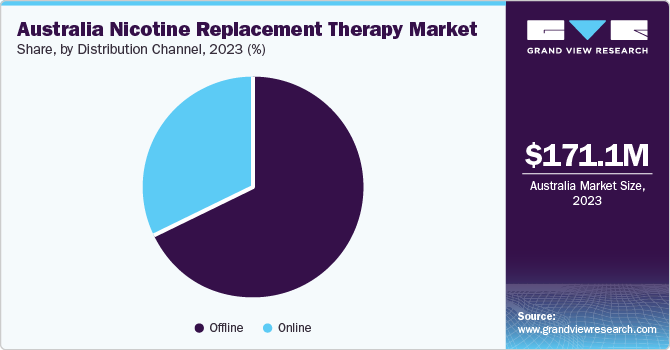

Distribution Channel Insights

The offline segment held the largest revenue share of 68.28% in 2023. The offline distribution channel for NRT market in Australia remains a critical avenue for reaching a diverse range of consumers seeking to quit smoking. Offline distribution channels allow an individual to interact directly with trained professionals. Moreover, consumers often feel more confident purchasing NRT products from reputable sources with licensed professionals who can provide accurate information and advice.

The online distribution channel segment is expected to grow significantly at a CAGR of 5.87% during the study period. The growth can be attributed to consumer preferences, user-friendly platforms, faster shipping, and optimum prices. The online NRT market has significantly improved accessibility for individuals seeking to quit smoking. Online platforms often offer comprehensive information about various NRT options, allowing consumers to make informed decisions based on their preferences and needs. This wealth of information empowers consumers to choose the most suitable NRT product for their quit-smoking journey. These capabilities are expected to drive the segment growth.

Key Companies & Market Share Insights

-

The key companies operating in Australia nicotine replacement therapy industry are attempting to enhance their product portfolio by upgrading their products and exploring acquisitions and government authorizations to increase their client base and obtain a larger market share.

-

In 2023, Philip Morris International, entered into deals with Australian Pharmacies to supply E-cigarettes below the cost. Such initiatives in the country are anticipated to propel the market growth.

-

In August 2022, Mindset Health, an Australia-based startup, announced the launch of its new hypnosis-based DTx app, which aids smoking cessation. Furthermore, the company raised USD 12 million in March 2023 to expand the reach of its application

Key Australia Nicotine Replacement Therapy Companies:

- Philip Morris Products S.A. (Altria Group)

- British American Tobacco p.l.c.

- Haleon Group of Companies

- Johnson & Johnson

- Liber Pharmaceuticals Pty Ltd

- Alphapharm Pty Limited

- Perrigo Company plc

- Amcal

- GSK plc

Australia Nicotine Replacement Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 177.42 million

Revenue forecast in 2030

USD 226.74 million

Growth rate

CAGR of 4.10% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Philip Morris Products S.A. (Altria Group); British American Tobacco plc; Haleon Group of Companies; Johnson & Johnson; Liber Pharmaceuticals Pty Ltd; Alphapharm Pty Limited; Perrigo Company plc; Amcal;GSK plc

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Nicotine Replacement Therapy Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Australia nicotine replacement therapy market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nicotine Replacement Therapy

-

Inhalers

-

Gum

-

Transdermal Patches

-

Sublingual Tablets

-

Lozenges

-

Others

-

-

E-Cigarettes

-

Heat-not burn Tobacco Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Frequently Asked Questions About This Report

b. The Australia nicotine replacement therapy market size was estimated at USD 171.13 million in 2023 and is expected to reach USD 177.42 million in 2024.

b. The Australia nicotine replacement therapy market is expected to grow at a compound annual growth rate of 4.10% from 2024 to 2030 to reach USD 226.74 million by 2030.

b. The nicotine replacement therapy segment dominated the market in 2023 and captured the maximum share of 79.55% of the overall revenue. Increasing prevalence of health conditions which are associated with tobacco consumption is prominently driving the acceptance & awareness of NRTs in Australia

b. Some key players operating in the australia nicotine replacement therapy market include Philip Morris Products S.A. (Altria Group), British American Tobacco p.l.c., Haleon Group of Companies, Johnson & Johnson, Liber Pharmaceuticals Pty Ltd, Alphapharm Pty Limited, Perrigo Company plc, Amcal, GSK plc

b. Increasing technological advancements in nicotine replacement therapy (NRT), rise in awareness about ill effects of smoking, and growing number of people undergoing smoking cessation are key factors driving the Australia nicotine replacement therapy market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.