- Home

- »

- Advanced Interior Materials

- »

-

Autoclave Aerated Concrete Market Size, Share Report, 2030GVR Report cover

![Autoclave Aerated Concrete Market Size, Share & Trends Report]()

Autoclave Aerated Concrete Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Block, Panel), By Application (Residential, Commercial), By Region (North America, EU, APAC), And Segment Forecasts

- Report ID: GVR-4-68040-242-5

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autoclave Aerated Concrete Market Summary

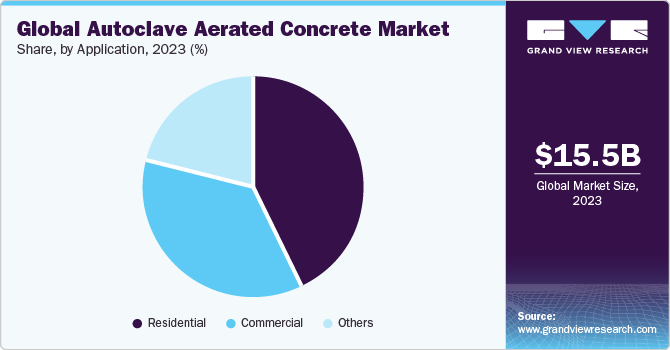

The global autoclave aerated concrete market size was estimated at USD 15.50 billion in 2023 and is projected to reach USD 22.87 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. This industry is expected to witness exponential growth due to increasing emphasis on green and soundproof buildings.

Key Market Trends & Insights

- The autoclave aerated concrete market in North America accounted with the largest revenue share of 49.2% in 2023.

- Based on product, the blocks segment led the market with the largest revenue share of 44.4% in 2023.

- Based on application, the residential segment led the market with the largest revenue share of 42.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.50 Billion

- 2030 Projected Market Size: USD 22.87 Billion

- CAGR (2024-2030): 6.0%

- North America: Largest market in 2023

In addition, factors such as lightweight, texture and versatile applicability of this product are expected to drive its usage. Growth in demand for the material in building & construction industry can be attributed to its superior properties such as higher thermal insulation capacity, and superior molding ability compared to conventional materials like cement bricks and burnt clay blocks.

High adoption of AAC by the construction companies on account of its characteristics such as resistance against seismic fluctuations, extreme temperatures, and pests. In addition, factors like low water requirement during construction coupled with superior insulation properties provided by the material are expected to propel the product use over the coming years.

The main factor driving the autoclave aerated concrete (AAC) market is industrialization, especially in the developing countries. Increased purchasing power, rise in urbanization, growing population and requirement for affordable housing are expected to drive the demand. AAC is manufactured using fly-ash which is generated as a byproduct in thermal power plants and is available in abundance. It comprises gypsum, limestone, cement, and aluminium traces which are economical than their alternatives, sand and anhydrite used in conventional concrete products. This precast, light weight, and foam concrete construction material provides insulation, structure, mold and fire resistance which spurs its usage in commercial and residential construction.

The U.S. autoclave aerated concrete industry is expected to be driven on account of growing construction activities in the urban and sub-urban regions in the country. Rising demand for the expansion of floor space in various industries has led to the growth in new construction and renovation projects in the country. In addition, an increasing number of large-scale infrastructure investment projects, including hotels and hospitals in New York, Missouri, and Los Angeles, is likely to boost construction industry growth and drive the demand for this product in the U.S.

AAC is a lightweight, eco-friendly building material made from natural raw materials such as sand, cement, lime, and aluminum powder. Its production process involves minimal energy consumption and emits fewer greenhouse gases compared to traditional building materials like concrete or brick. As sustainability and environmental concerns become more prevalent, there is increasing demand for green building materials like AAC that offer energy efficiency, recyclability, and reduced carbon footprint.

AAC offers excellent thermal insulation properties, helping reduce heat transfer through walls and floors. Buildings constructed with AAC panels or blocks require less energy for heating and cooling, leading to lower energy bills and improved indoor comfort. As energy efficiency regulations become more stringent worldwide, there is growing demand for building materials that contribute to energy savings and sustainable building practices.

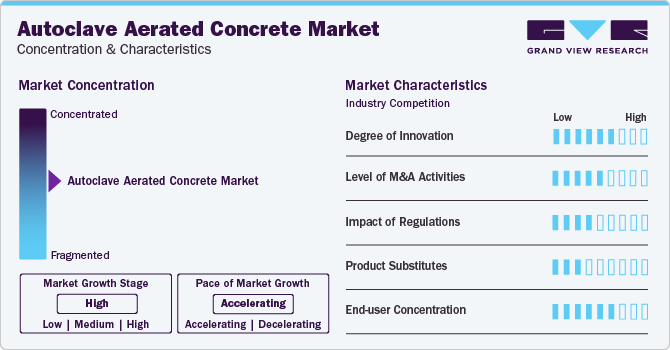

Market Concentration & Characteristics

Industry growth stage is high, and pace of the industry growth is accelerating. Furthermore, the market is moderately fragmented in nature owing to the presence of several large players operating in the market. Some prominent manufacturers of autoclave aerated concrete are focused on increasing the production capacities and strengthening their industry presence by increasing their geographical reach.

Prominent manufacturers have been adopting various strategies including investments, agreements, partnerships, contracts, production capacity expansion, joint ventures, and collaborations to enhance their industry presence and to cater to the changing requirements of application industries.

The industry is subject to scrutiny by regulations approved by several bodies such as American Section of the International Association for Testing Materials (ASTM). ASTM is the major body that defines the technical standards for the products. These standards defined by these bodies are followed by a majority of the industry players across the globe.

The top market players are investing heavily in research and development activities in order to develop low cost and high-value products. The regulatory guidelines which promote green, and energy efficient buildings are expected to drive the demand for the market. With the increase in focus on eco-friendliness and energy efficiency the companies are investing towards the development of green building products.

Major players are involved in technological innovations for developing new products in order to consolidate their presence in the market. Rising consumer demand and a shift in consumer preference toward high-quality products are projected to open up growth avenues for the new entrants in the market over the forecast period.

Product Insights

Based on product, the blocks segment led the market with the largest revenue share of 44.4% in 2023. AAC blocks are one of the primary building materials used for external as well as internal construction applications. Moreover, these blocks are made from natural raw materials such as sand, cement, lime, and aluminum powder. There production process involves a low energy consumption compared to traditional building materials like concrete or clay bricks. In addition, AAC manufacturing emits fewer greenhouse gases, contributing to lower carbon emissions. As sustainability and environmental concerns become more prevalent, this segment is expected to grow at the rapid CAGR over the forecast period.

AAC panels also accounted for a significant revenue share in the global autoclave aerated concrete industry. This is attributed to their high thermal insulation, excellent strength and fire resistance characteristics. Due to this, these panels are increasingly replacing conventional products in wall, roof and flooring applications.

Application Insights

Based on application, the residential segment led the market with the largest revenue share of 42.5% in 2023. The growing awareness regarding sustainability and energy efficiency is has resulted in end-users switching from conventional materials to autoclave aerated concrete (AAC) products due to its high thermal insulating properties. Such products help in reducing the electric consumption for heating and cooling in residential buildings. These products also contribute in making living spaces more cost efficient to the end-users over the period of time.

The commercial application segment is expected to grow at the significant CAGR over the forecast period. Commercial building structures include shopping malls, supermarkets, hypermarkets, departmental stores, hospitals & clinics, restaurants & hotels, resorts, and others. Commercial constructions are generally large buildings or a cluster of buildings that requires speedy construction with durable materials for protection against extreme load and weather conditions. Autoclave aerated concrete offers design flexibility and versatility, allowing architects and builders to create a wide range of architectural styles and configurations. AAC blocks or panels can be easily customized to meet specific design requirements, such as curved walls, intricate shapes, or large openings. The lightweight nature of autoclave aerated concrete also enables the construction of taller buildings with reduced structural loads, expanding the scope of design possibilities.

Regional Insights

The autoclave aerated concrete market in North America accounted with the largest revenue share of 49.2% in 2023. This is attributed to the increasing demand for this product in residential and commercial construction buildings, due to increase in awareness regarding benefits of green building solutions over conventional products.

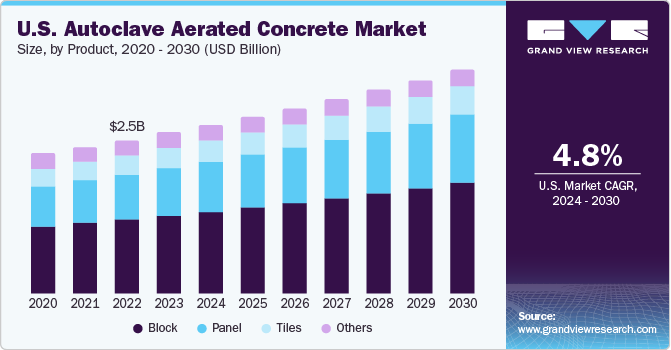

U.S. Autoclave Aerated Concrete Market Trends

The U.S. autoclave aerated concrete market is dominated by growing demand for autoclave aerated concrete panels in the country. This product segment is expected to grow at the fastest CAGR of 5.3% over the forecast period. AAC panels offer excellent thermal insulation properties, helping to reduce heat transfer through walls and maintain consistent indoor temperatures. This energy efficiency can lead to lower heating and cooling costs for buildings, which is especially appealing in regions with extreme temperatures. As energy efficiency becomes a priority for building owners and developers, the demand for AAC panels as a sustainable building material is increasing.

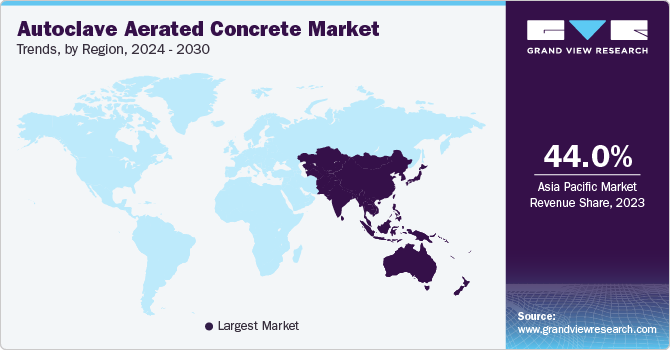

Asia Pacific Autoclave Aerated Concrete Market Trends

Asia Pacific dominated the autoclave aerated concrete market with the largest revenue share of 44.0% in 2023. The industry growth in Asia Pacific region is expected to be driven by the increasing urbanization and industrialization in the region. Due to availability of inexpensive labor and raw materials, several companies around the world are investing in establishing their manufacturing facilities in the region, further driving the demand for construction materials. This is expected to propel the demand for AAC products in the region over the coming decade.

The China autoclave aerated concrete market is expected to be driven by increased demand for cost effective construction materials in the country. Moreover, the high paced industrialization in the country if further triggering demand for autoclave aerated concrete ( AAC) products such as blocks, panels and tiles.

Europe Autoclave Aerated Concrete Market Trends

The autoclave aerated concrete market in Europe accounted with the largest revenue share of 43.6% in 2023. AAC blocks comply with building codes and standards in Europe, ensuring that they meet safety, structural, and performance requirements. As building regulations evolve to prioritize energy efficiency, sustainability, and resilience, AAC blocks offer a viable solution that meets regulatory requirements and industry standards.

The Germany autoclave aerated concrete market is anticipated to grow at the significant CAGR over the forecast period. This is on account of its characteristics such as energy efficiency and durability & longevity, which are expected to promote adoption of AAC in different applications.

Central & South America Autoclave Aerated Concrete Market Trends

The autoclave aerated concrete market in Central & South America is expected to grow at the rapid CAGR over the forecast period, on account of increasing inclination of sustainable products in construction industry. The demand for AAC panels is forecasted to grow at a fastest CAGR of 4.2% over the forecast period.

The Brazil autoclave aerated concrete market is expected to grow at the fastest CAGR during the forecast period. This is on account of growing construction investments in the country along with government initiatives to support construction industry in the country.

Middle East & Africa Autoclave Aerated Concrete Market Trends

The autoclave aerated concrete market in Middle East & Africa is expected to grow at the significant CAGR of 5.1% over the forecast period. This is on account of growing construction and infrastructural development investments in the region.

The Saudi Arabia autoclave aerated concrete market is expected to grow at the fastest CAGR during the forecast period, on account of increasing economic development and building construction activities in this country.

Key Autoclave Aerated Concrete Company Insights

Some key players operating in this industry include Xella International, and Aercon Florida LLC

-

Xella International is involved in building and insulation materials under its brands such as Ytong, Silka, and Hebel

-

Aercon Florida LLC is engaged in the manufacturing of autoclave aerated concrete in the U.S. This company also produces AAC products such as blocks and panels for residential and commercial constructions. This company also provides technical support and training to architects, engineers, contractors, and builders

Bauroc AS, and Buildmate Projects Private Limited. are some of the emerging market participants in the industry.

-

Bauroc AS is a manufacturer of AAC products based in Northern Europe, with manufacturing capacities in different countries including Iceland, Poland, Germany and Switzerland

-

Buildmate Projects Private Limited is a manufacturer, supplier and exporter of construction materials including autoclaved aerated concrete. This company has its production plants located in India and exports to several countries and regions including Saudi Arabia, Kenya, Middle East, Asian Countries and East Africa

Key Autoclave Aerated Concrete Companies:

The following are the leading companies in the autoclave aerated concrete market. These companies collectively hold the largest market share and dictate industry trends.

- Xella International

- Aercon Florida LLC

- Bauroc AS

- Buildmate Projects Private Limited.

- H+H International

- SOLBET

- ACICO

- Isoltech Srl

- Broco

- Cematix

- Aircrete

Recent Developments

-

In February 2022, BigBloc Construction announced in investment of USD 9.1 million to expand its manufacturing capacity by installing a Greenfield project of AAC blocks in Maharashtra, India

-

On January 11th, 2022: Xella international to sell its insulation Business Unit URSA to Etex, This sale includes 13 production sites, located in Spain, France, Belgium, Italy, Germany, Poland, Slovenia, and Russia

Autoclave Aerated Concrete Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.12 billion

Revenue forecast in 2030

USD 22.87 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Xella International; Aercon Florida LLC; Bauroc AS; Buildmate Projects Private Limited; H+H International; SOLBET; ACICO; Isoltech Srl; Broco; Cematix; Aircrete

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autoclave Aerated Concrete Market Report Segmentation

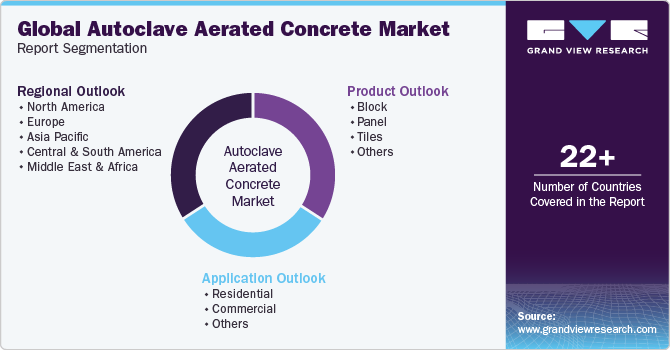

This report forecasts revenue and volume growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the autoclave aerated concrete market based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Block

-

Panel

-

Tiles

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global autoclave aerated concrete market size was estimated at USD 15.50 billion in 2023 and is expected to reach USD 16.12 billion in 2024.

b. The global autoclave aerated concrete market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 22.87 billion by 2030.

b. Blocks product segment led the market and accounted for over 44.4% share of the revenue in 2023. This is on account of growing demand for growing demand for green building products in the residential and commercial construction projects.

b. Some of the key players operating in the autoclave aerated concrete market include Xella International, Aercon Florida LLC , Bauroc AS, Buildmate Projects Private Limited., H+H International, SOLBET, ACICO, Isoltech Srl, Broco, Cematix, and Aircrete

b. The key factors that are driving the global autoclave aerated concrete market include growing construction activities in the developing countries in Asia Pacific

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.