- Home

- »

- Next Generation Technologies

- »

-

Automated Guided Vehicle Market Size & Share Report 2030GVR Report cover

![Automated Guided Vehicle Market Size, Share & Trends Report]()

Automated Guided Vehicle Market Size, Share & Trends Analysis Report By Vehicle Type, By Navigation Technology, By Application, By End-use Industry, By Component, By Battery Type, By Mode Of Operation, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-153-5

- Number of Report Pages: 213

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Automated Guided Vehicle Market Trends

The global automated guided vehicle market size was estimated at USD 4.79 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030. Automated guided vehicle (AGV) systems assist in moving and transporting items in manufacturing facilities, warehouses, and distribution centers without any permanent conveying system or manual intervention. It follows configurable guide paths for optimizing storage, picking, and transport functions in the environment of premium space. AGVs are being highly adopted owing to several benefits, such as reduced labor costs, reduced product damage, increased productivity, and scale to support automation processes. These notable advantages encourage transportation and logistics firms to deploy AGVs to boost the efficiency of their operations.

For instance, in May 2021, AUDI AG stated that they use AGVs in their manufacturing centers, which helps them indirectly plan the production process to know which component is out of stock and needs to be available. Further, it also helps in carrying items supply trolleys which helps them maintain safety.

Retailing and other logistics-related companies are collaborating and partnering with tech giants to transform the material handling industry. For instance, in November 2021, OTSAW Digital Pte Ltd, an autonomous mobile robot solution, partnered with Swisslog Healthcare to develop automated guided vehicles for the healthcare sector to enable better patient care. Further, this partnership would expand their business by deploying AGV in Asia Pacific, Europe, and MEA.

Besides, in February 2022, Siemens, a Germany-based industrial manufacturer, partnered with Parmley Graham Ltd. and AR Controls to build, design, and manufacture automated guided vehicles. The partnership and the launch of AGV would bring a lot of advantages, such as low labor costs, reduced risk of workplace injury, logistics management, and faster delivery. Furthermore, retail and commerce-based companies and businesses are deploying collaborative robots in their warehouses and expanding their businesses through acquisitions of large-scale cobot providers.

For instance, in February 2022, SAVE MART SUPERMARKETS, a grocery store company, partnered with Starship Technologies, a provider of autonomous delivery vehicles. The initiative aims to deliver groceries using the Starship robot, a combination of artificial intelligence and machine learning. With the installation of the starship robot, SAVE MART SUPERMARKETS expanded its delivery area. Besides, in January 2023, Barcoding, Inc., a prominent player in supply chain efficiency, connectivity, and accuracy, announced the acquisition of FRED AGV, an automated guided vehicle manufacturer. The acquisition illustrates continuous investment and expansion in industrial automation for Barcoding, Inc.

Automated guided vehicles are used in various end-use industries, such as logistics, automotive, healthcare, manufacturing, food & beverages, and others. Increased productivity and reduced labor costs are the key factors driving the need for industrial equipment. The demand for AGVs is expected to grow owing to the increasing automation in industries. Increasing industrialization has led to the continuous need for customized material handling and transport solutions for fuel efficiency.

For instance, in February 2023, The SSI Schaefer Group, a prominent supplier of systems, components, and software for warehouse automation, acquired DS AUTOMOTION GmbH, a global supplier of automated guided vehicles and autonomous mobile robotics. The acquisition intends to expand the minority interest of SSI Schaefer to reminisce the growing significance of AGV and autonomous and mobile robotics business in intralogistics.

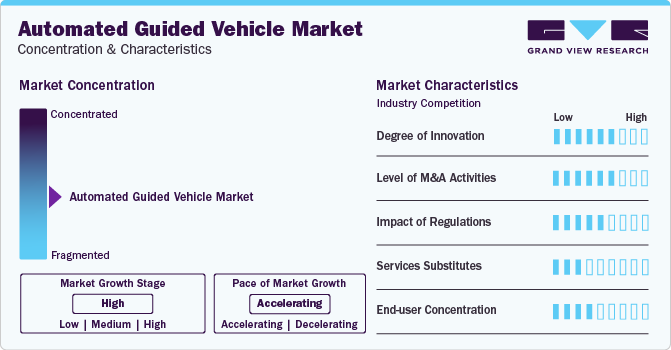

Market Concentration & Characteristics

The degree of innovation is high and the pace of the market growth is accelerating. The increasing development of next-generation AGVs by integration of AI and ML technologies has been observed to drive innovation, research, and development of the global market. The adoption of smart AGVs is expected to rise significantly owing to the growing flexibility of the AGVs in adapting to the environment automatically, irrespective of predefined paths.

The global AGV market is characterized by a moderate level of merger and acquisition (M&A) activity, reflecting the industry's rapid evolution. Prominent players are strategically acquiring startups to enhance their technological portfolios and gain a competitive edge, thereby enhancing their global market share. However, with consistent growth in research & development (R&D) in the industry, the global market is expected to remain slightly fragmented over the forecast period.

The growing focus of government authorities on ensuring safety and security at workplaces with heavy machinery has allowed enterprises to adopt smart, automated guided vehicles in their workplaces. Moreover, the growing support of several developing governments for international investors has also bolstered investments in the automated guided vehicle sector, thereby enabling considerable market growth.

Increasing developments in the robotics field coupled with rising integration of AI technologies are observed to produce smarter AGVs over the forecast period. However, the high cost of AGV development limits the vision of enterprises in exploring the robotics field, thereby leaving few chances for the emergence of substitutes in the industry.

The end-user concentration is observed to be limited to heavy industries and large-scale enterprises. The application of AGV is prevalent in the manufacturing, inventory, packaging, and logistics sectors, thereby allowing supply chain authorities to deploy smart AGV solutions. However, the growing need for seamless business operations and reducing time to market while maintaining safety and security at the workplace is expected to propel the adoption of AGVs in other sectors at a considerable growth rate over the forecast period.

COVID-19 Impact Insights

The COVID-19 outbreak created economic turmoil for almost every industry at the global level. Many organizations have suffered or are suffering losses due to a shortfall in productivity as governments worldwide inflicted nationwide lockdowns to control the epidemic's spread. The pandemic has resulted in a vast decline in profits and revenue for the manufacturing industry. Businesses have experienced a significant cut down in their staff resulting in an overall loss to manufacturing activities. SMEs (Small and Medium Enterprises) have been the worst hit due to substantial layoffs, financial crises, and attritions. Industrial automation and deployment of AGVs hold a crucial role in ensuring that businesses meet certain production levels during such turmoil.

The pandemic has brought numerous opportunities for the AGV industry as it helps industries continue their production operations. For instance, in February 2022, AEROTECH US launched the AGV-XPO galvo scanner, a laser scan head that helps in high precision production of complex components in medical technology. Further, it enables minimal consequential errors and faster execution of aggressive paths. Besides WEWO, Techmotion provides AGVs in healthcare and pharma to transport medicines, foods, medical equipment, laundry, and sterile goods. These AGVs are also used for cleaning rooms, controlled material validation, and flows.

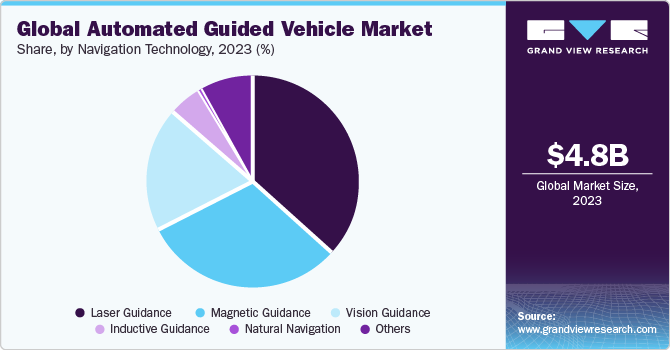

Navigation Technology Insights

The laser guidance segment dominated the market in 2023 and accounted for a revenue share of over 36% owing to the adoption of technological advancements in the automotive sector. For instance, two vehicles use laser guidance technology to navigate. Further, laser targets are positioned all over the warehouse to identify the precise location of each vehicle. These vehicles' software effectively coordinates the movements based on incoming instructions and vehicle traffic. The AGV system has been connected with the existing management systems for warehousing center operations to offer two-way communication of product movement.

The natural navigation segment is expected to register the fastest CAGR over the forecast period. The vision guidance segment is expected to witness healthy growth during the study period. The need for intelligent and efficient routing contributes to the increasing adoption of automated vehicles. Computer vision and related software solutions allow AGVs to analyze the environment in real-time better, thereby boosting the demand for AGVs for operations in challenging environments, such as maneuvering significant components through narrow aisles. For instance, in April 2021, Toyota Industries Corporation launched a global autonomous vehicle software company, “T-Hive,” to add solutions to all the vehicles produced by Toyota Industries Corporation.

Camera-based vision available in AGVs, complemented by the LiDAR sensors and computer systems, helps ensure accurate navigation within production facilities and warehouses. The cameras installed on these vehicles can assist with obtaining information and detecting obstacles. It can also help analyze the infrastructure in real time within the facilities. The information provided by the LiDAR sensors and the cameras can help create a 3D image of the operational area. For instance, in July 2021, ElephantRobotics, a Chinese company specializing in robotics design, production, development, and smart manufacturing services, launched MyAGV with an A-5-megapixel camera with an 8-meter identification range, which would help detect obstacles and obtain information.

Vehicle Type Insights

The tow vehicle segment dominated the market in 2023 and accounted for a revenue share of over 39%, owing to high requirements for bulk movement of products into and out of warehouse areas. AGV towing vehicles are used in various applications, including moving bulk products into and out of warehouse areas. Side path spurs are placed in shipping or receiving areas to facilitate loading or unloading goods from trains off the main line.

For instance, in March 2021, Bastian Solutions, LLC launched a Raymond courier vision-guided tow tractor vehicle to provide automated solutions and optimize the warehouse. The tow tractor VGV can carry a payload capacity of up to 10,000 lbs with a maximum speed of 2.6mph and a route capacity of up to 1.5 miles. Further, a single operator could control multiple tow tractor VGVs, increasing the impact of both the workforce and fleet of trucks without increasing the labor costs.

The unit load carrier segment is expected to grow at the fastest CAGR from 2024 to 2030. Unit load AGVs are used for delivering pallets, large containers, and roll handling. Also, it allows scheduling tasks efficiently by reducing aisle traffic and product damage. For instance, in September 2021, Addverb Technologies Private Limited, a robotics and automation firm, announced its business expansion across Australia, Europe, and Singapore markets. This initiative was initiated in response to the growing need for unit load AGVs, robotics, and automation solutions in the global market.

Application Insights

The logistics and warehousing segment dominated the market in 2023 and accounted for a revenue share of over 40%. The logistics & warehousing segment has been further divided into transportation, cold storage, wholesale & distribution, and cross-docking. Enterprises upgrading their existing facilities and building new facilities are aggressively adopting modern retrieval and automated storage systems and other material handling equipment to save on labor costs and boost efficiency and productivity. For instance, in March 2023, Rocla AGV, a Mitsubishi Logisnext company, launched a new automated compact truck designed to lift heavy loads in narrow spaces. The new truck works between the warehouse and loading docks and fits easily in the existing warehouse setting with minimal rack modifications.

The assembly segment is expected to grow at the fastest CAGR over the forecast period. Modern retrieval and automated storage systems, as well as other material handling equipment, are rapidly adopted by businesses renovating their current facilities and establishing new ones to reduce labor costs and increase productivity and efficiency. For instance, in February 2021, SAFELOG GmbH, an automated transportation company, launched warehouse robots, SafeLogAGV L1 lifts which load up to 15000kg. This model would enable cost-effective and efficient operation, operating in a swarm or individually.

Mode Of Operation Insights

The indoor segment dominated the market in 2023 and accounted for a revenue share of over 75%. The growth can be attributed to increased warehouse automation powered by AGVs. AGVs have seen heightened demand in warehouses and distribution centers, driven by the necessity for efficient material handling to meet the rising demands of e-commerce and inventory management. Enhanced safety features and operational efficiency offered by AGVs, facilitated by advancements in sensor technology and navigation systems, further maintain indoor environments.

The outdoor segment is poised for significant growth in the coming years. Advancements in technology, especially in navigation systems and durability, are expanding the applications of AGVs beyond traditional indoor settings to outdoor environments such as agriculture, construction, and logistics. The rising demand for autonomous solutions across industries, associated with infrastructure development efforts and the surge in e-commerce, further propels the adoption of outdoor AGVs. Ongoing technological advancements, along with regulatory support for automation initiatives, are driving the rapid expansion of the outdoor AGV market.

End-use Industry Insights

The manufacturing segment dominated the market in 2023 and accounted for a revenue share of over 76%. The manufacturing industry is further sub-segmented into aerospace & defense, automotive, electronics, pharmaceuticals, chemicals, plastics, FMCG, and tissue. The wholesale and distribution sector segment is expected to expand at the fastest CAGR over the forecast period. Also, the wholesale & distribution sector is further sub-segmented into e-commerce, grocery stores, retail chains/conveyance stores, and hotels & restaurants. The growing adoption of AGVs across various industries can be attributed to the benefits of AGVs in terms of productivity, safety, and accuracy.

Automated guided vehicles are equipped with cameras, laser heads, and other sensors, which help them operate safely around machinery, structures, and employees. While operators can make errors that can lead to accidents and mishaps in a manufacturing or distribution facility, AGVs can help improve the accuracy of the workflows, thereby reducing waste and augmenting productivity. For instance, in March 2021, GIDEON, an automation and AI company, installed its AGVs in a prominent regional food industries company Atlantic Grupa d.d., This installation would allow the company to have paperless operations and further increase the throughput of the central facility.

Aerospace & defense manufacturing facilities tend to be massive owing to the size of the components, such as fuselages, nacelles, engine pods, and wings, among others. However, the paths through which these components are moved within the facility tend to be narrow. While moving heavy elements through such narrow pathways, natural errors could lead to mishaps and accidents. Aerospace & defense companies are deploying automated guided vehicles so that heavy components can be moved within the facility on predefined routes and human errors can be avoided. For instance, in July 2021, Lodige Industries, a German-based automation company, installed its AGV at the Swissport with a loading capacity of 6,800kg. The AGV installed would eliminate the ground transportation routes and improve flexibility, safety, and efficiency.

Component Insights

The hardware segment dominated the market in 2023 and accounted for a revenue share of over 69%. The growth can be attributed to the increasingly deployed collaborative robots for reduced human labor and repetitive tasks in manufacturing or distribution facilities. For instance, in June 2021, Amazon.com, Inc. designed new autonomous mobile robots, including Scooter, Ernie, Bert, and Kermit, to reduce human labor tasks and warehouse injuries. These robots would complete tasks such as physical labor and transporting totes. The service segment is expected to grow at the fastest CAGR over the forecast period. The growth can be attributed to the growing demand among the end-users for various services, which include preventive and corrective maintenance, vehicle and software health checks, and training employees involved directly or indirectly with the operation of AGVs.

The service segment is predicted to foresee significant growth in the coming years. This growth can be attributed to the rising demand for various services, which include preventive and corrective maintenance, vehicle and software health checks, and training employees directly or indirectly with the operation of AGVs. Several manufacturing plants and warehouses deploy material handling equipment (hardware) for various activities, such as locating stock, picking orders, and moving products and raw materials. Transportation and logistics firms mainly focus on deploying such equipment to boost the efficiency of their operations in line with the growing demand for their services.

Battery Type Insights

The lead battery segment dominated the market in 2023 and accounted for a revenue share of over 61%. These batteries have low-cost advantages over other battery types. Besides, it offers good reversibility, stable voltage, and long service life and is suitable for various applications. The lithium-ion battery segment is expected to grow at the fastest CAGR over the forecast period. The AGV market is witnessing a progressive switch from lead-acid to lithium-ion batteries.

Compared to lead-acid batteries, lithium-ion batteries have higher costs. Lithium-ion batteries support high-power charge and discharge. Also, it meets different industry conditions of user demand, including excellent temperature performance, high energy density, and a long life cycle. These advantages of lithium-ion batteries are anticipated to encourage AGV manufacturers to adopt lithium-ion among battery types. For instance, in July 2021, Flux Power, a manufacturing company for rechargeable lithium energy solutions, stated that lithium batteries used in AGV would help maintain high voltage levels. These batteries are highly efficient, high performing, low maintenance, and fast charging.

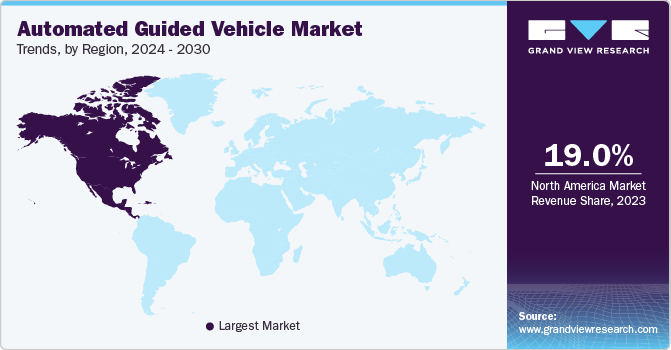

Regional Insights

North America held a dominant revenue share of over 19% in 2023. The region's growing adoption of automated guided vehicles is propelled by its strong manufacturing and logistics sector, which is reliant on automation for efficient material handling. With the aging workforce and a shrinking labor pool, companies are turning to automation to increase efficiency and productivity. Additionally, e-commerce has led to a significant increase in the demand for automated guided vehicles. These systems can handle large volumes of orders efficiently, reducing the need for manual labor. There is also a growing emphasis on workplace safety, and automated guided vehicles can significantly improve safety by reducing the risk of accidents and injuries.

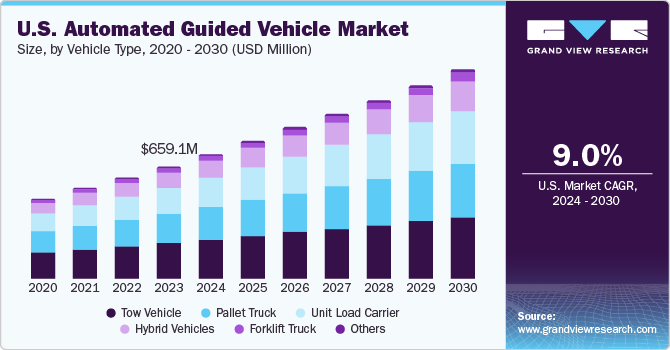

U.S. Automated Guided Vehicle Market Trends

The U.S. AGV market is expected to grow at a CAGR of 9.0% from 2024 to 2030. The U.S. is the major producer of AGV for warehouse automation, including fulfillment centers. The production of such equipment is rapidly increasing, fueled by advancements in technology and increased investments in automation.

Europe Automated Guided Vehicle Market Trends

The AGV market in Europe is expected to witness significant growth over the forecast period. The growth is primarily driven by the demand for material handling equipment by the incumbents of the manufacturing industry. Automation in every sector has also augmented the market’s growth. Adding more automated vehicles would reduce labor costs, increase productivity, and help assemble the order of shoes and clothing in the distribution center.

The Germany automated guided vehicle market held a significant share in Europe. Germany's AGV market is growing due to the increasing demand for automation and optimization of material handling processes in various industries such as automotive, e-commerce, food and beverage, pharmaceuticals, and logistics. Germany represented the highest growth rate in e-commerce turnover in Europe, which is expected to boost the demand for AGV.

Asia Pacific Automated Guided Vehicle Market Trends

The AGV market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. The e-commerce industry has been growing considerably in emerging economies of Asia Pacific, such as China and India. For instance, in February 2023, Mitsubishi Electric Asia, a subsidiary of Mitsubishi Electric Corporation, launched a new Integrated Solutions Centre. The new center showcases the company’s advanced and comprehensive digital technologies to facilitate co-creation with clients and create next-generation integrated solutions.

The India AGV market held a significant revenue share in the Asia Pacific region. The warehousing sector in India is developing quickly and is progressing towards palletized loads, which can be stored at heights. Logistics operations and larger warehouses will require advanced storage and handling solutions, boosting the demand for automated guided vehicles in India.

Key Automated Guided Vehicle Company Insights

Key automated guided vehicle companies include Swisslog Holding AG; Daifuku Co., Ltd.; JBT; Seegrid Corporation; TOYOTA INDUSTRIES CORPORATION; Hyster-Yale Materials Handling, Inc.; and Kollmorgen. Increasing collaborations and mergers & acquisitions are expected to maximize the environmental and economic benefits for the market players by enabling them to share ideas and enhance their internal skills and technologies. For instance, in March 2022, Seegrid Corporation, an autonomous mobile robot provider, partnered with ROBEX. This initiative towards partnership would allow Seegrid Corporation to expand its business, and clients of ROBEX would also be introduced to Seegrid Corporation products. Further, this would help grow the demand for automation in supply chain management. It would also make it easier to supply clients and partners with complete end-to-end warehouse management solutions.

Key Automated Guided Vehicle Companies:

The following are the leading companies in the automated guided vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Swisslog Holding AG

- Egemin Automation Inc.

- Bastian Solutions, Inc.

- Daifuku Co., Ltd.

- Dematic

- JBT

- Seegrid Corporation

- TOYOTA INDUSTRIES CORPORATION

- Hyster-Yale Materials Handling, Inc.

- BALYO

- E&K Automation GmbH

- Kollmorgen

- KMH Fleet Solutions

- ELETTRIC80 S.P.A.

- Fetch Robotics, Inc.

- inVia Robotics, Inc.

- Locus Robotics

- Schaefer Systems International, Inc.

- System Logistics Spa

- Transbotics (A division of Scott Systems International Incorporated)

Recent Developments

-

In November 2023, Movella, Inc., an American sensor technology provider, collaborated with Taiwanese industrial IoT-provided Advantech to develop advanced automated guided vehicles and autonomous mobile robot systems. By developing these systems, the companies aim to simplify material deployment for their customers, thereby minimizing solution compatibility issues and expediting time to market.

-

In October 2023, Align Production Systems, an American material handling solution provided collaborated with Kollmorgen, a vehicle control solution provider, to develop and offer efficient and reliable automated guided vehicle systems designed by Align Production Systems and comprising of Kollmorgen’s NDC solutions. This partnership aims to revolutionize the manufacturing sector by enabling manufacturers to move large and heavy products across their facilities.

-

In March 2023, Mitsubishi Logisnext Americas group announced the launch of their new AGV product, Jungheinrich EKX 516ka / 516a Automated High-Rack Stacker, initially planned to deploy for their U.S.-based customers. With very narrow aisle operations and greater storage density, this product allows users to gain maximum efficiency and productivity in their business operations.

Automated Guided Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.34 billion

Revenue forecast in 2030

USD 9.18 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, navigation technology, application, end-use industry, component, battery type, mode of operation, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Swisslog Holding AG; Dematic; Bastian Solutions, Inc.; Daifuku Co., Ltd.; JBT; Seegrid Corporation; TOYOTA INDUSTRIES CORPORATION; Hyster-Yale Materials Handling, Inc.; BALYO; E&K Automation GmbH; Kollmorgen; KMH Fleet Solutions; ELETTRIC80 S.P.A.; Fetch Robotics, Inc.; inVia Robotics, Inc.; Locus Robotics; Schaefer Systems International, Inc.; System Logistics Spa; Scott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Guided Vehicle Market Report Segmentation

This report provides forecasts for revenue growth at the global, regional, and country levels and analyses of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automated guided vehicle market report based on vehicle type, navigation technology, application, end-use industry, component, battery type, mode of operation, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Tow Vehicle

-

Unit Load Carrier

-

Pallet Truck

-

Forklift Truck

-

Hybrid Vehicles

-

Others

-

-

Navigation Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Laser Guidance

-

Magnetic Guidance

-

Vision Guidance

-

Inductive Guidance

-

Natural Navigation

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Logistics and Warehousing

-

Transportation

-

Cold Storage

-

Wholesale & Distribution

-

Cross-docking

-

-

Assembly

-

Packaging

-

Trailer Loading and Unloading

-

Raw Material Handling

-

Others

-

-

End-use Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Manufacturing Sector

-

Automotive

-

Aerospace

-

Electronics

-

Chemical

-

Pharmaceuticals

-

Plastics

-

Defense

-

FMCG

-

Tissue

-

Others

-

-

Wholesale and Distribution Sector

-

E-commerce

-

Retail Chains/Conveyance Stores

-

Grocery Stores

-

Hotels and Restaurants

-

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Battery Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Lead Battery

-

Lithium-Ion Battery

-

Nickel-based Battery

-

Others

-

-

Mode of Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

Regional Outlook (Revenue, USD Million,2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automated guided vehicle market size was estimated at USD 4.79 billion in 2023 and is expected to reach USD 5.34 billion in 2024.

b. The global automated guided vehicle market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 9.18 billion by 2030.

b. Europe dominated the automated guided vehicle market in 2023 and accounted for a revenue share of over 39%.

b. Some key players operating in the AGV market include Swisslog Holding AG; Dematic; Bastian Solutions, Inc.; Daifuku Co., Ltd.; JBT; Seegrid Corporation; Hyster-Yale Materials Handling, Inc.; Kollmorgen; and KMH Fleet Solutions.

b. The lead battery segment dominated the AGV market in 2023 and accounted for a revenue share of over 61%.

b. The tow vehicle segment dominated the AGV market in 2023 and accounted for a revenue share of over 39%.

Table of Contents

Chapter 1. Methodology And Scope

1.1 Market Segmentation & Scope

1.2 Market Definition

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR’s Internal Database

1.3.3 Secondary Sources & Third-Party Perspectives

1.3.4 Primary Research

1.4 Information Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

Chapter 2. Executive Summary

2.1 AGV - Industry Snapshot & Key Buying Criteria, 2017 - 2030

2.2.1 Global Automated Guided Vehicle Market, 2017 - 2030

2.2 Segmental Outlook

2.2.1 Vehicle Type Outlook

2.2.2 Navigation Technology Outlook

2.2.3 Application Outlook

2.2.4 End-Use Industry Outlook

2.2.5 Component Outlook

2.2.6 Battery Type Outlook

2.2.7 Regional Outlook

Chapter 3. AGV Industry Outlook

3.1 Market Segmentation

3.2 Market Size And Growth Prospects

3.3 Future Of AGV

3.4 Case Studies

3.4.1 Case Study 1

3.4.2 Case Study 2

3.5 AGV - Value Chain Analysis

3.5.1 Raw Material Trends

3.5.1.1 Major Raw Materials Market Analysis

3.5.2 Key End-Users

3.6 Vendor Landscape

3.6.1 Key Takeaways

3.6.1.1 Swisslog Holding AG

3.6.1.2 Dematic

3.6.1.3 Bastian Solutions, Inc.

3.6.1.4 Daifuku Co., Ltd.

3.6.1.5 JBT

3.6.1.6 Seegrid Corporation

3.6.1.7 TOYOTA INDUSTRIES CORPORATION

3.6.1.8 Hyster-Yale Materials Handling, Inc.

3.6.1.9 BALYO

3.6.1.10 E&K Automation Gmbh

3.6.1.11 Kollmorgen

3.6.1.12 KMH Fleet Solutions

3.6.1.13 ELETTRIC80 S.P.A.

3.6.1.14 Fetch Robotics, Inc.

3.6.1.15 Invia Robotics, Inc.

3.6.1.16 Locus Robotics

3.6.1.17 Schaefer Systems International, Inc.

3.6.1.18 System Logistics Spa

3.6.1.19 Scott

3.7 AGV Market Dynamics

3.7.1 Supplier/Vendor Trends

3.7.2 Buyers/Application Trends

3.7.3 Technology Trends

3.7.4 Regulatory Trends

3.8 Market Driver Analysis

3.8.1 Increasing Demand For Automation And Material Handling Equipment In Various Process Industries

3.8.2 Replacement Of Conventional Batteries With Lithium-Ion Batteries

3.8.3 High Labor Costs

3.8.4 Manufacturers Introducing Vision Guided Vehicles And Mobile Robots

3.8.5 Rapidly Growing E-Commerce Industry

3.8.6 Enhanced Safety At Workplaces

3.9 Market Restraint Analysis

3.9.1 High Initial Cost

3.9.2 Singular Use And Lack Of Flexibility

3.10 Market Opportunity Analysis

3.10.1 Manufacturers Providing Intelligent AGV

3.11 Industry Analysis - Porter’s Five Forces Analysis

3.11.1 Supplier Power

3.11.2 Buyer Power

3.11.3 Substitution Threat

3.11.4 Threat From New Entrant

3.11.5 Competitive Rivalry

3.12 AGV - PEST Analysis

3.12.1 Political Landscape

3.12.2 Economic Landscape

3.12.3 Social Landscape

3.12.4 Technology Landscape

3.12.5 Legal Landscape

3.13 Technology Overview

3.13.1 Technology Evolution

3.13.2 Wire Guidance

3.13.3 Magnetic Guidance

3.13.4 Laser Guidance (Laser Triangulation Navigation System)

3.13.5 Vision Guidance

3.14 Major Deals & Strategic Alliances Analysis

3.14.1 Mergers And Acquisitions

Chapter 4. AGV Market: Vehicle Type Estimates And Trend Analysis

4.1 AGV Market Share By Vehicle Type, 2023 & 2030

4.1.1 Tow Vehicle

4.1.2 Unit Load Carrier

4.1.3 Pallet Truck

4.1.4 Forklift Truck

4.1.5 Hybrid Vehicles

4.1.6 Others

Chapter 5. AGV Market: Navigation Technology Estimates & Trend Analysis

5.1 AGV Market Share By Navigation Technology, 2023 & 2030

5.1.1 Heat Map For Choosing Navigation

5.1.2 Laser Guidance

5.1.3 Magnetic Guidance

5.1.4 Vision Guidance

5.1.5 Inductive Guidance

5.1.6 Natural Navigation

5.1.7 Others

Chapter 6. AGV Market: Application Estimates & Trend Analysis

6.1 AGV Market Share By Application, 2023 & 2030

6.1.1 Logistics And Warehousing

6.1.2 Assembly

6.1.3 Packaging

6.1.4 Trailer Loading & Unloading

6.1.5 Raw Material Handling

6.1.6 Others

Chapter 7. AGV Market: End-Use Industry Estimates & Trend Analysis

7.1 AGV Market Share By End-Use Industry, 2023 & 2030

7.1.1 Manufacturing Sector

7.1.2 Wholesale And Distribution Sector

Chapter 8. AGV Market: Component Estimates & Trend Analysis

8.1 AGV Market Share By Component, 2023 & 2030

8.1.1 Hardware

8.1.2 Software

8.1.3 Service

Chapter 9. AGV Market: Battery Type Estimates & Trend Analysis

9.1 AGV Market Share By Battery Type, 2023 & 2030

9.1.1 Lead Battery

9.1.2 Lithium-Ion Battery

9.1.3 Nickel-Based Battery

9.1.4 Others

Chapter 10. AGV Market: Mode Of Operation Estimates & Trend Analysis

10.1 AGV Market Share By Mode Of Operation, 2023 & 2030

10.1.1 Indoor

10.1.2 Outdoor

Chapter 11. AGV Market: Regional Estimates And Trend Analysis

11.1 AGV Market Share By Region, 2023 & 2030

11.1.1 North America

11.1.1.1 U.S. AGV Market, 2017 - 2030

11.1.1.2 Canada AGV Market, 2017 - 2030

11.1.2 Europe

11.1.2.1 UK AGV Market, 2017 - 2030

11.1.2.2 Germany AGV Market, 2017 - 2030

11.1.2.3 France AGV Market, 2017 - 2030

11.1.3 APAC

11.1.3.1 China AGV Market, 2017 - 2030

11.1.3.2 Japan AGV Market, 2017 - 2030

11.1.3.3 India AGV Market, 2017 - 2030

11.1.3.4 Australia AGV Market, 2017 - 2030

11.1.3.5 South Korea AGV Market, 2017 - 2030

11.1.4 Latin America

11.1.4.1 Brazil AGV Market, 2017 - 2030

11.1.4.2 Mexico AGV Market, 2017 - 2030

11.1.5 MEA

11.1.5.1 Kingdom Of Saudi Arabia (KSA) AGV Market, 2017 - 2030

11.1.5.2 UAE AGV Market, 2017 - 2030

11.1.5.3 South Africa AGV Market, 2017 - 2030

Chapter 12. Competitive Landscape

12.1 Swisslog Holding AG

12.1.1 Company Overview

12.1.2 Financial Performance

12.1.3 Product Benchmarking

12.1.4 Recent Developments

12.2 Dematic

12.2.1 Company Overview

12.2.2 Financial Performance

12.2.3 Product Benchmarking

12.2.4 Recent Developments

12.3 Bastian Solutions, Inc.

12.3.1 Company Overview

12.3.2 Product Benchmarking

12.3.3 Recent Developments

12.4 Daifuku Co., Ltd.

12.4.1 Company Overview

12.4.2 Financial Performance

12.4.3 Product Benchmarking

12.4.4 Recent Developments

12.5 JBT

12.5.1 Company Overview

12.5.2 Financial Performance

12.5.3 Product Benchmarking

12.5.4 Recent Developments

12.6 Seegrid Corporation

12.6.1 Company Overview

12.6.2 Product Benchmarking

12.6.3 Recent Developments

12.7 TOYOTA INDUSTRIES CORPORATION

12.7.1 Company Overview

12.7.2 Financial Performance

12.7.3 Product Benchmarking

12.7.4 Recent Developments

12.8 Hyster-Yale Materials Handling, Inc.

12.8.1 Company Overview

12.8.2 Financial Performance

12.8.3 Product Benchmarking

12.8.4 Recent Developments

12.9 BALYO

12.9.1 Company Overview

12.9.2 Product Benchmarking

12.9.3 Recent Developments

12.10 E&K Automation Gmbh

12.10.1 Company Overview

12.10.2 Product Benchmarking

12.10.3 Recent Developments

12.11 Kollmorgen

12.11.1 Company Overview

12.11.2 Product Benchmarking

12.11.3 Recent Developments.

12.12 KMH Fleet Solutions

12.12.1 Company Overview

12.12.2 Product Benchmarking

12.12.3 Recent Developments

12.13 ELETTRIC80 S.P.A.

12.13.1 Company Overview

12.13.2 Product Benchmarking

12.13.3 Recent Developments

12.14 Fetch Robotics, Inc.

12.14.1 Company Overview

12.14.2 Product Benchmarking

12.14.3 Recent Developments

12.15 Invia Robotics, Inc.

12.15.1 Company Overview

12.15.2 Product Benchmarking

12.15.3 Recent Developments

12.16 Locus Robotics

12.16.1 Company Overview

12.16.2 Product Benchmarking

12.16.3 Recent Developments

12.17 Schaefer Systems International, Inc.

12.17.1 Company Overview

12.17.2 Product Benchmarking

12.17.3 Recent Developments

12.18 System Logistics Spa

12.18.1 Company Overview

12.18.2 Product Benchmarking

12.18.3 Recent Developments

12.19 Scott

12.19.1 Company Overview

12.19.2 Financial Performance

12.19.3 Product Benchmarking

12.19.4 Recent Developments

List of Tables

Table 1 AGV - Industry snapshot & key buying criteria, 2017 - 2030

Table 2 Global AGV market, 2017 - 2030 (USD Million)

Table 3 Global AGV market by region, 2017 - 2030 (USD Million)

Table 4 Global AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 5 Global AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 6 Global AGV market, by application, 2017 - 2030 (USD Million)

Table 7 Global AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 8 Global AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 9 Global AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 10 Global AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 11 Global AGV market, by component, 2017 - 2030 (USD Million)

Table 12 Global AGV market, by battery type, 2017 - 2030 (USD Million)

Table 13 Global AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 14 List of key vendors

Table 15 AGV - Key market driver impact

Table 16 AGV - Key market restraint impact

Table 17 AGV - Key market opportunity impact

Table 18 Global tow vehicle AGV market by region, 2017 - 2030 (USD Million)

Table 19 Global unit load carrier AGV market by region, 2017 - 2030 (USD Million)

Table 20 Global pallet truck AGV market by region, 2017 - 2030 (USD Million)

Table 21 Global forklift truck AGV market by region, 2017 - 2030 (USD Million)

Table 22 Global hybrid vehicles AGV market by region, 2017 - 2030 (USD Million)

Table 23 Global others AGV market by region, 2017 - 2030 (USD Million)

Table 24 Global laser guidance AGV market by region, 2017 - 2030 (USD Million)

Table 25 Global magnetic guidance AGV market by region, 2017 - 2030 (USD Million)

Table 26 Global vision guidance AGV market by region, 2017 - 2030 (USD Million)

Table 27 Global inductive guidance AGV market by region, 2017 - 2030 (USD Million)

Table 28 Global natural navigation AGV market by region, 2017 - 2030 (USD Million)

Table 29 Global others AGV market by region, 2017 - 2030 (USD Million)

Table 30 Global logistics and warehousing AGV market by region, 2017 - 2030 (USD Million)

Table 31 Global assembly AGV market by region, 2017 - 2030 (USD Million)

Table 32 Global packaging AGV market by region, 2017 - 2030 (USD Million)

Table 33 Global trailer loading & unloading AGV market by region, 2017 - 2030 (USD Million)

Table 34 Global raw material handling AGV market by region, 2017 - 2030 (USD Million)

Table 35 Global others AGV market by region, 2017 - 2030 (USD Million)

Table 36 Global manufacturing sector AGV market by region, 2017 - 2030 (USD Million)

Table 37 Global wholesale and distribution AGV market by region, 2017 - 2030 (USD Million)

Table 38 Global hardware AGV market by region, 2017 - 2030 (USD Million)

Table 39 Global software AGV market by region, 2017 - 2030 (USD Million)

Table 40 Global service AGV market by region, 2017 - 2030 (USD Million)

Table 41 Global lead battery AGV market by region, 2017 - 2030 (USD Million)

Table 42 Global lithium-ion battery AGV market by region, 2017 - 2030 (USD Million)

Table 43 Global nickel-based battery AGV market by region, 2017 - 2030 (USD Million)

Table 44 Global others AGV market by region, 2017 - 2030 (USD Million)

Table 45 Global indoor AGV market by region, 2017 - 2030 (USD Million)

Table 46 Global outdoor AGV market by region, 2017 - 2030 (USD Million)

Table 47 North America AGV market, 2017 - 2030 (USD Million)

Table 48 North America AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 49 North America AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 50 North America AGV market, by application, 2017 - 2030 (USD Million)

Table 51 North America AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 52 North America AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 53 North America AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 54 North America AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 55 North America AGV market, by component, 2017 - 2030 (USD Million)

Table 56 North America AGV market, by battery type, 2017 - 2030 (USD Million)

Table 57 North America AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 58 US AGV market, 2017 - 2030 (USD Million)

Table 59 US AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 60 US AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 61 US AGV market, by application, 2017 - 2030 (USD Million)

Table 62 US AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 63 US AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 64 US AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 65 US AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 66 US AGV market, by component, 2017 - 2030 (USD Million)

Table 67 US AGV market, by battery type, 2017 - 2030 (USD Million)

Table 68 US AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 69 Canada AGV market, 2017 - 2030 (USD Million)

Table 70 Canada AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 71 Canada AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 72 Canada AGV market, by application, 2017 - 2030 (USD Million)

Table 73 Canada AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 74 Canada AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 75 Canada AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 76 Canada AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 77 Canada AGV market, by component, 2017 - 2030 (USD Million)

Table 78 Canada AGV market, by battery type, 2017 - 2030 (USD Million)

Table 79 Canada AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 80 Europe AGV market, 2017 - 2030 (USD Million)

Table 81 Europe AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 82 Europe AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 83 Europe AGV market, by application, 2017 - 2030 (USD Million)

Table 84 Europe AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 85 Europe AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 86 Europe AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 87 Europe AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 88 Europe AGV market, by component, 2017 - 2030 (USD Million)

Table 89 Europe AGV market, by battery type, 2017 - 2030 (USD Million)

Table 90 Europe AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 91 UK AGV market, 2017 - 2030 (USD Million)

Table 92 UK AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 93 UK AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 94 UK AGV market, by application, 2017 - 2030 (USD Million)

Table 95 UK AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 96 UK AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 97 UK AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 98 UK AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 99 UK AGV market, by component, 2017 - 2030 (USD Million)

Table 100 UK AGV market, by battery type, 2017 - 2030 (USD Million)

Table 101 UK AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 102 Germany AGV market, 2017 - 2030 (USD Million)

Table 103 Germany AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 104 Germany AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 105 Germany AGV market, by application, 2017 - 2030 (USD Million)

Table 106 Germany AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 107 Germany AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 108 Germany AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 109 Germany AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 110 Germany AGV market, by component, 2017 - 2030 (USD Million)

Table 111 Germany AGV market, by battery type, 2017 - 2030 (USD Million)

Table 112 Germany AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 113 France AGV market, 2017 - 2030 (USD Million)

Table 114 France AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 115 France AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 116 France AGV market, by application, 2017 - 2030 (USD Million)

Table 117 France AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 118 France AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 119 France AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 120 France AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 121 France AGV market, by component, 2017 - 2030 (USD Million)

Table 122 France AGV market, by battery type, 2017 - 2030 (USD Million)

Table 123 France AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 124 Asia Pacific AGV market, 2017 - 2030 (USD Million)

Table 125 Asia Pacific AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 126 Asia Pacific AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 127 Asia Pacific AGV market, by application, 2017 - 2030 (USD Million)

Table 128 Asia Pacific AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 129 Asia Pacific AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 130 Asia Pacific AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 131 Asia Pacific AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 132 Asia Pacific AGV market, by component, 2017 - 2030 (USD Million)

Table 133 Asia Pacific AGV market, by battery type, 2017 - 2030 (USD Million)

Table 134 Asia Pacific AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 135 China AGV market, 2017 - 2030 (USD Million)

Table 136 China AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 137 China AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 138 China AGV market, by application, 2017 - 2030 (USD Million)

Table 139 China AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 140 China AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 141 China AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 142 China AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 143 China AGV market, by component, 2017 - 2030 (USD Million)

Table 144 China AGV market, by battery type, 2017 - 2030 (USD Million)

Table 145 China AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 146 Japan AGV market, 2017 - 2030 (USD Million)

Table 147 Japan AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 148 Japan AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 149 Japan AGV market, by application, 2017 - 2030 (USD Million)

Table 150 Japan AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 151 Japan AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 152 Japan AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 153 Japan AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 154 Japan AGV market, by component, 2017 - 2030 (USD Million)

Table 155 Japan AGV market, by battery type, 2017 - 2030 (USD Million)

Table 156 Japan AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 157 India AGV market, 2017 - 2030 (USD Million)

Table 158 India AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 159 India AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 160 India AGV market, by application, 2017 - 2030 (USD Million)

Table 161 India AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 162 India AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 163 India AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 164 India AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 165 India AGV market, by component, 2017 - 2030 (USD Million)

Table 166 India AGV market, by battery type, 2017 - 2030 (USD Million)

Table 167 India AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 168 Australia AGV market, 2017 - 2030 (USD Million)

Table 169 Australia AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 170 Australia AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 171 Australia AGV market, by application, 2017 - 2030 (USD Million)

Table 172 Australia AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 173 Australia AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 174 Australia AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 175 Australia AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 176 Australia AGV market, by component, 2017 - 2030 (USD Million)

Table 177 Australia AGV market, by battery type, 2017 - 2030 (USD Million)

Table 178 Australia AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 179 South Korea AGV market, 2017 - 2030 (USD Million)

Table 180 South Korea AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 181 South Korea AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 182 South Korea AGV market, by application, 2017 - 2030 (USD Million)

Table 183 South Korea AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 184 South Korea AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 185 South Korea AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 186 South Korea AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 187 South Korea AGV market, by component, 2017 - 2030 (USD Million)

Table 188 South Korea AGV market, by battery type, 2017 - 2030 (USD Million)

Table 189 South Korea AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 190 Latin America AGV market, 2017 - 2030 (USD Million)

Table 191 Latin America AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 192 Latin America AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 193 Latin America AGV market, by application, 2017 - 2030 (USD Million)

Table 194 Latin America AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 195 Latin America AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 196 Latin America AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 197 Latin America AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 198 Latin America AGV market, by component, 2017 - 2030 (USD Million)

Table 199 Latin America AGV market, by battery type, 2017 - 2030 (USD Million)

Table 200 Latin America AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 201 Brazil AGV market, 2017 - 2030 (USD Million)

Table 202 Brazil AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 203 Brazil AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 204 Brazil AGV market, by application, 2017 - 2030 (USD Million)

Table 205 Brazil AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 206 Brazil AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 207 Brazil AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 208 Brazil AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 209 Brazil AGV market, by component, 2017 - 2030 (USD Million)

Table 210 Brazil AGV market, by battery type, 2017 - 2030 (USD Million)

Table 211 Brazil AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 212 Mexico AGV market, 2017 - 2030 (USD Million)

Table 213 Mexico AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 214 Mexico AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 215 Mexico AGV market, by application, 2017 - 2030 (USD Million)

Table 216 Mexico AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 217 Mexico AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 218 Mexico AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 219 Mexico AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 220 Mexico AGV market, by component, 2017 - 2030 (USD Million)

Table 221 Mexico AGV market, by battery type, 2017 - 2030 (USD Million)

Table 222 Mexico AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 223 MEA AGV market, 2017 - 2030 (USD Million)

Table 224 MEA AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 225 MEA AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 226 MEA AGV market, by application, 2017 - 2030 (USD Million)

Table 227 MEA AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 228 MEA AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 229 MEA AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 230 MEA AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 231 MEA AGV market, by component, 2017 - 2030 (USD Million)

Table 232 MEA AGV market, by battery type, 2017 - 2030 (USD Million)

Table 233 MEA AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 234 Kingdom of Saudi Arabia (KSA) AGV market, 2017 - 2030 (USD Million)

Table 235 Kingdom of Saudi Arabia (KSA) AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 236 Kingdom of Saudi Arabia (KSA) AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 237 Kingdom of Saudi Arabia (KSA) AGV market, by application, 2017 - 2030 (USD Million)

Table 238 Kingdom of Saudi Arabia (KSA) AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 239 Kingdom of Saudi Arabia (KSA) AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 240 Kingdom of Saudi Arabia (KSA) AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 241 Kingdom of Saudi Arabia (KSA) AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 242 Kingdom of Saudi Arabia (KSA) AGV market, by component, 2017 - 2030 (USD Million)

Table 243 Kingdom of Saudi Arabia (KSA) AGV market, by battery type, 2017 - 2030 (USD Million)

Table 244 Kingdom of Saudi Arabia (KSA) AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 245 UAE AGV market, 2017 - 2030 (USD Million)

Table 246 UAE AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 247 UAE AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 248 UAE AGV market, by application, 2017 - 2030 (USD Million)

Table 249 UAE AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 250 UAE AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 251 UAE AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 252 UAE AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 253 UAE AGV market, by component, 2017 - 2030 (USD Million)

Table 254 UAE AGV market, by battery type, 2017 - 2030 (USD Million)

Table 255 UAE AGV market, by mode of operation, 2017 - 2030 (USD Million)

Table 256 South Africa AGV market, 2017 - 2030 (USD Million)

Table 257 South Africa AGV market, by vehicle type, 2017 - 2030 (USD Million)

Table 258 South Africa AGV market, by navigation technology, 2017 - 2030 (USD Million)

Table 259 South Africa AGV market, by application, 2017 - 2030 (USD Million)

Table 260 South Africa AGV application market, by logistics and warehousing, 2017 - 2030 (USD Million)

Table 261 South Africa AGV market, by end-use industry, 2017 - 2030 (USD Million)

Table 262 South Africa AGV end-use industry market, by manufacturing sector, 2017 - 2030 (USD Million)

Table 263 South Africa AGV end-use industry market, by wholesale and distribution sector, 2017 - 2030 (USD Million)

Table 264 South Africa AGV market, by component, 2017 - 2030 (USD Million)

Table 265 South Africa AGV market, by battery type, 2017 - 2030 (USD Million)

Table 266 South Africa AGV market, by mode of operation, 2017 - 2030 (USD Million)

List of Figures

Fig. 1 Research process

Fig. 2 Market formulation

Fig. 3 Market segmentation and scope

Fig. 4 AGV market, 2017 - 2030

Fig. 5 Key opportunity analysis

Fig. 6 Value chain analysis

Fig. 7 AGV market dynamics

Fig. 8 Industry analysis - Porter’s Five Forces Analysis

Fig. 9 AGV - PEST analysis

Fig. 10 Technology evolution

Fig. 11 Technology evolution - Wire Guidance

Fig. 12 Technology evolution - Magnetic guidance

Fig. 13 Technology evolution - Laser guidance

Fig. 14 Technology evolution - Vision Guidance

Fig. 15 AGV market share by vehicle type, 2023 & 2030

Fig. 16 AGV market share by navigation technology, 2023 & 2030

Fig. 17 AGV market share by application, 2023 & 2030

Fig. 18 AGV market share by end-use industry, 2023 & 2030

Fig. 19 AGV market share by component, 2023 & 2030

Fig. 20 AGV market share by battery type, 2023 & 2030

Fig. 21 AGV market share by mode of operation, 2023 & 2030

Fig. 22 AGV market share by region, 2023 & 2030

Fig. 23 North America marketplace: Key takeaways

Fig. 24 Europe marketplace: Key takeaways

Fig. 25 Asia Pacific marketplace: Key takeaways

Fig. 26 Latin America marketplace: Key takeaways

Fig. 27 MEA marketplace: Key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Automated Guided Vehicle (AGV) Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- Automated Guided Vehicle (AGV) Navigation Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- Automated Guided Vehicle (AGV) Application Outlook (Revenue, USD Million, 2017 - 2030)

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- Automated Guided Vehicle (AGV) End-Use Industry Outlook (Revenue, USD Million, 2017 - 2030)

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- Automated Guided Vehicle (AGV) Component Outlook (Revenue, USD Million, 2017 - 2030)

- Hardware

- Software

- Service

- Automated Guided Vehicle (AGV) Battery Type Outlook (Revenue, USD Million, 2017 - 2030)

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- Automated Guided Vehicle (AGV) Mode of Operation Outlook (Revenue, USD Million, 2017-2030)

- Indoor

- Outdoor

- Automated Guided Vehicle (AGV) Regional Outlook (Revenue, USD Million,2017 - 2030)

- North America

- North America AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- North America AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- North America AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- North America AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- North America AGV Market, By Component

- Hardware

- Software

- Service

- North America AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- North America AGV Market, By Mode of Operation

- Indoor

- Outdoor

- U.S.

- U.S. AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- U.S. AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- U.S. AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- U.S. AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- U.S. AGV Market, By Component

- Hardware

- Software

- Service

- U.S. AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- U.S. AGV Market, By Mode of Operation

- Indoor

- Outdoor

- Canada

- Canada AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- Canada AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- Canada AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- Canada AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- Canada AGV Market, By Component

- Hardware

- Software

- Service

- Canada AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- Canada AGV Market, By Mode of Operation

- Indoor

- Outdoor

- Canada AGV Market, By Vehicle Type

- North America AGV Market, By Vehicle Type

- Europe

- Europe AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- Europe AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- Europe AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- Europe AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- Europe AGV Market, By Component

- Hardware

- Software

- Service

- Europe AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- Europe AGV Market, By Mode of Operation

- Indoor

- Outdoor

- Germany

- Germany AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- Germany AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- Germany AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- Germany AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- Germany AGV Market, By Component

- Hardware

- Software

- Service

- Germany AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- Germany AGV Market, By Mode of Operation

- Indoor

- Outdoor

- Germany AGV Market, By Vehicle Type

- U.K.

- U.K. AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- U.K. AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- U.K. AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- U.K. AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- U.K. AGV Market, By Component

- Hardware

- Software

- Service

- U.K. AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- U.K. AGV Market, By Mode of Operation

- Indoor

- Outdoor

- U.K. AGV Market, By Vehicle Type

- France

- France AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- France AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- France AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- France AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- France AGV Market, By Component

- Hardware

- Software

- Service

- France AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- France AGV Market, By Mode of Operation

- Indoor

- Outdoor

- France AGV Market, By Vehicle Type

- Europe AGV Market, By Vehicle Type

- Asia Pacific

- Asia Pacific AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- Asia Pacific AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- Asia Pacific AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- Asia Pacific AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

- Asia Pacific AGV Market, By Component

- Hardware

- Software

- Service

- Asia Pacific AGV Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

- Asia Pacific AGV Market, By Mode of Operation

- Indoor

- Outdoor

- China

- China AGV Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

- China AGV Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Natural Navigation

- Others

- China AGV Market, By Application

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

- China AGV Market, By End-Use Industry

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce