- Home

- »

- Next Generation Technologies

- »

-

Automated Parcel Delivery Terminals Market Report, 2030GVR Report cover

![Automated Parcel Delivery Terminals Market Size, Share & Trends Report]()

Automated Parcel Delivery Terminals Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment Location (Indoor, Outdoor), By End Use (Government, Retail, Shipping & Logistics, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-232-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

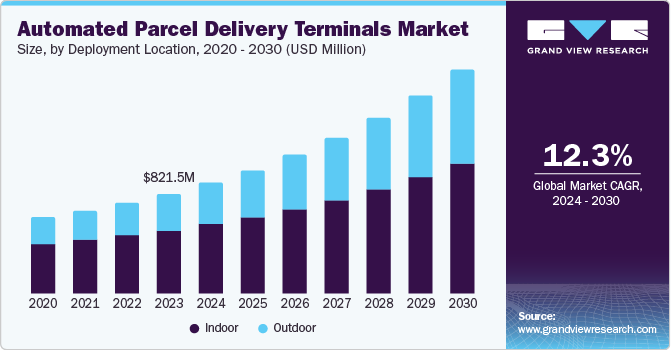

The global automated parcel delivery terminals market size was valued at USD 821.5 million in 2023 and is projected to grow at a CAGR of 12.3% from 2024 to 2030. The demand for faster, more convenient, and contactless delivery options has increased. Automated delivery parcel terminals cater to these needs by offering 24/7 access to parcels, reducing the dependency on delivery schedules. The convenience of retrieving packages at any time has become a significant selling point, especially for urban consumers with busy lifestyles. This shift towards automated delivery is driving the demand in the market.

Automated Parcel Delivery Terminals (ADPTs) provide a convenient last-mile delivery solution, allowing customers to collect their parcels at their convenience. This addresses the challenges associated with home delivery, such as missed deliveries and package theft. As e-commerce expands, the demand for efficient and secure parcel delivery solutions such as ADPTs is expected to rise.

Rapid urbanization and the development of smart cities are driving the need for innovative logistics solutions. Increasing congestion is fueling the demand for Automated Parcel Delivery Terminals. These terminals offer a space-saving and scalable alternative for integrating into urban infrastructures, such as residential complexes, shopping malls, and public transport hubs. By decentralizing the delivery process, these terminals aid in decreasing traffic congestion and improving overall delivery efficiency in densely populated areas.

Collaborations between technology providers, e-commerce companies, logistics firms, and real estate developers are essential for deploying and integrating ADPT systems. Logistics companies benefit from streamlined operations and reduced last-mile delivery costs, and real estate developers provide strategic locations for terminal installations. Such partnerships drive innovation and efficiency and ensure a positive consumer experience, accelerating the adoption of automated parcel delivery terminals globally. For instance, in August 2023, Redington Limited announced a strategic partnership with Scrut Automation. This collaboration aims to deliver advanced Governance Risk and Compliance (GRC) platforms to a wider range of customers through Redington's extensive partner network. This platform aids in simplifying and streamlining information security for cloud-native companies

Deployment Insights

The indoor segment accounted for the largest market revenue share of 62.9% in 2023. Due to limited space and security concerns, indoor ADPTs are essential for deployment in high-density residential buildings, commercial complexes, and urban offices. By situating these terminals indoors, delivery companies ensure that parcels are safely stored and easily accessible, reducing the risk of theft and damage. The compact nature of indoor ADPTs makes them suitable for modern urban environments.

The outdoor segment is expected to witness the fastest CAGR over the forecast period. Outdoor automated parcel delivery terminals offer a solution by serving as centralized pick-up points that reduce the number of delivery stops and associated costs. By placing these terminals in strategic outdoor locations, delivery companies streamline operations, improve delivery speed, and enhance overall efficiency. Additionally, it provides an efficient solution to handle this increased demand of e-commerce services. It offers a scalable and flexible delivery option in accessible locations such as shopping centers, residential areas, and transportation hubs. These factors, coupled together, are driving demand for automated parcel delivery terminals.

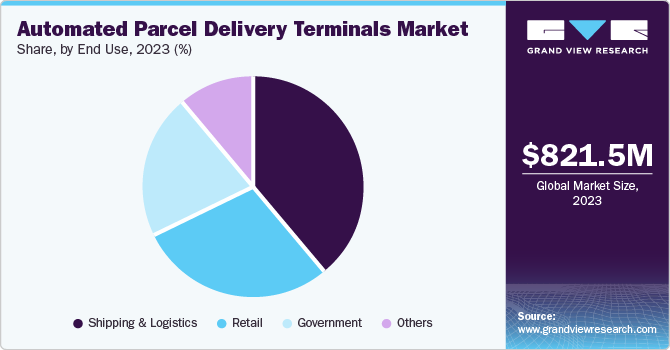

End Use Insights

The shipping & logistics segment accounted for the largest market revenue share in 2023. Failed delivery attempts lead to additional costs for shipping and logistics companies, including expenses related to repeated delivery attempts, increased fuel consumption, and extended delivery times. Automated parcel delivery terminals reduce these issues by providing centralized, secure locations for parcel drop-offs, enabling customers to recover their packages conveniently. This reduces the need for multiple delivery trips and ensures that parcels are delivered successfully on the first attempt. By facilitating the delivery process, these terminals enhance operational efficiency, lower transportation costs, and improve overall service reliability, particularly in remote areas.

The retail segment is anticipated to register the fastest CAGR over the forecast period. Automated parcel delivery terminals provide convenience and flexibility for both consumers and retailers. These terminals enable consumers to send, receive, and return packages conveniently. They also simplify the logistics process for retailers, reducing multiple delivery attempts and managing returns. This convenience is essential as e-commerce activities expand, driving higher volumes of parcel deliveries and returns. By offering a secure and accessible solution, they enhance customer satisfaction, improve operational efficiency, and support the growing demand for flexible, reliable delivery options.

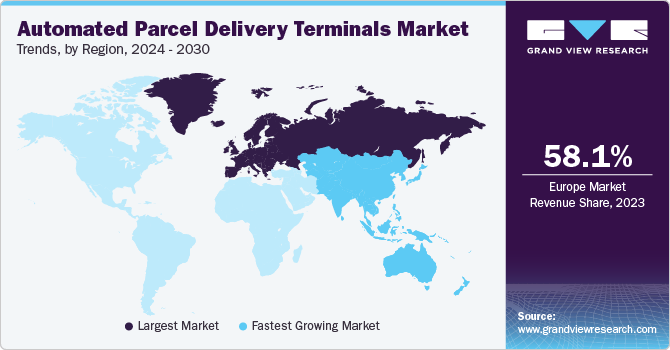

Regional Insights

The North America automated parcel delivery terminals market is expected to witness significant growth over the forecast period. IoT, AI, and automation innovations have transformed parcel delivery systems, making automated parcel delivery terminals more efficient, secure, and user-friendly. IoT enables real-time tracking and monitoring of parcels, enhancing transparency and reducing the risk of loss or theft. AI-powered systems optimize parcel sorting and storage while automation streamlines operations, reducing dependency on manual labor. These advancements enable automated parcel delivery terminals to be an effective solution for logistics providers and retailers pursuing enhancing their regional delivery capabilities.

U.S. Automated Parcel Delivery Terminals Market Trends

The U.S. automated parcel delivery terminals market accounted for the largest revenue share in 2023. The U.S. witnessed a significant increase in e-commerce activity due to changing consumer preferences and increased internet penetration. This growth in online shopping led to a corresponding rise in parcel deliveries, creating a demand for efficient and reliable delivery solutions. Automated Parcel Delivery Terminals offer a convenient alternative by providing secure pick-up locations in residential, commercial, and public areas. This improves delivery efficiency, and addresses missed deliveries and package theft.

Europe Automated Parcel Delivery Terminals Market Trends

Europe automated parcel delivery terminals market accounted for the largest revenue share of 58.1% in 2023. Consumers, businesses, and governments are increasingly focused on reducing carbon emissions and promoting sustainable practices in logistics and transportation. Automated parcel delivery terminals contribute to these efforts by optimizing delivery routes, reducing fuel consumption, and minimizing the environmental impact of parcel deliveries. Many terminals are designed with eco-friendly materials and energy-efficient technologies, promoting greener logistics solutions.

The UK automated parcel delivery terminals market is expected to witness significant growth over the forecast period. Rising demand for fast and reliable delivery services is fueling the growth of automated parcel delivery terminals. These terminals enable convenient, 24/7 access to packages, meeting immediate retrieval needs and enhancing customer satisfaction. As companies pursue demands efficiently, automated parcel delivery terminals streamline logistics, reduce delivery times, and optimize operational costs, enabling significant market expansion in the automated parcel delivery sector.

The France automated parcel delivery terminals market is expected to witness significant growth over the forecast period. An increasing number of smart cities and urban areas are implementing smart technologies to improve infrastructure, enhance services, and facilitate sustainability. Integrating Automated Parcel Delivery Terminals with smart technologies such as AI and IoT networks enables real-time delivery tracking, monitoring, and management. This integration improves operational efficiency and drives demand for Automated Parcel Delivery Terminals in France.

Asia Pacific Automated Parcel Delivery Terminals Market Trends

Asia Pacific is expected to witness the fastest CAGR over the forecast period. As consumers from Asia Pacific opt for products from international retailers, the demand for efficient cross-border delivery solutions rises. Automated delivery parcel terminals cater to this demand by offering secure, 24/7 accessible pick-up points that simplify receiving international parcels. These terminals streamline customs procedures and reduce delivery complexities, ensuring timely and reliable shipments. This capability enhances customer satisfaction by providing convenient access to purchases and supports logistics providers in optimizing their cross-border operations.

The China market is expected to witness significant growth over the forecast period. Consumers in China increasingly prioritize convenience and flexibility in their shopping and delivery experiences. Automated delivery parcel terminals cater to this demand by offering secure and accessible locations for parcel collection, allowing recipients to retrieve their packages at their convenience. The ability to avoid missed deliveries and the convenience of 24/7 access enhance customer satisfaction and loyalty. This convenience and flexibility drive the demand for automated parcel delivery terminals in China.

The Indian market is expected to witness significant growth over the forecast period. Rising population and urbanization in India created challenges such as traffic congestion, limited parking, and the need for sustainable logistics solutions. Automated delivery parcel terminals address these challenges by providing centralized pick-up points for parcels in convenient locations such as residential areas, transportation hubs, and commercial districts. By optimizing last-mile delivery routes and reducing the number of delivery vehicles on the road, automated parcel delivery terminals contribute to more efficient and environmentally friendly logistics operations in urban environments.

Key Automated Parcel Delivery Terminals Company Insights

Some key companies in the automated parcel delivery terminals market include Smartbox Ecommerce Solutions Private Ltd., KEBA, Cleveron AS, Quadient, and TZ Limited.

-

Smartbox Ecommerce Solutions Private Ltd. specializes in providing innovative automated parcel delivery solutions. Their product, Smartbox, is a network of automated parcel terminals strategically located across urban areas, residential complexes, and commercial hubs. These terminals offer secure and convenient 24/7 parcel pick-up and drop-off services, catering to the growing demands of e-commerce and retail sectors for efficient last-mile delivery solutions.

-

TZ Limited specializes in intelligent and innovative hardware and software solutions for the logistics and access control sectors. The company designs and manufactures intelligent parcel locker systems, automated access control solutions, and IoT (Internet of Things) devices.

Key Automated Parcel Delivery Terminals Companies:

The following are the leading companies in the automated parcel delivery terminals market. These companies collectively hold the largest market share and dictate industry trends.

- Smartbox Ecommerce Solutions Private Ltd.

- KEBA

- Cleveron AS

- Quadient

- TZ Limited

- winnsen.com.

- ByBox Holdings Limited

- Bell and Howell LLC.

- ENGY Company

- InPost sp. z o.o.

Recent Developments

- In June 2023, Bell and Howell reported that another tier 1 grocery chain in the U.S. installed BH QuickCollect GO! Pod to deliver last-mile efficiency. It eliminates logistical interruptions by utilizing unique automation technology, allowing grocers and guests to optimize their time independently.

Automated Parcel Delivery Terminals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 910.2 million

Revenue forecast in 2030

USD 1.83 billion

Growth Rate

CAGR of 12.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment location, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, South Arabia and UAE

Key companies profiled

Smartbox Ecommerce Solutions Private Ltd.; KEBA; Cleveron AS; Quadient; TZ Limited; winnsen.com.; ByBox Holdings Limited; Bell and Howell LLC.; ENGY Company; InPost sp. z o.o.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

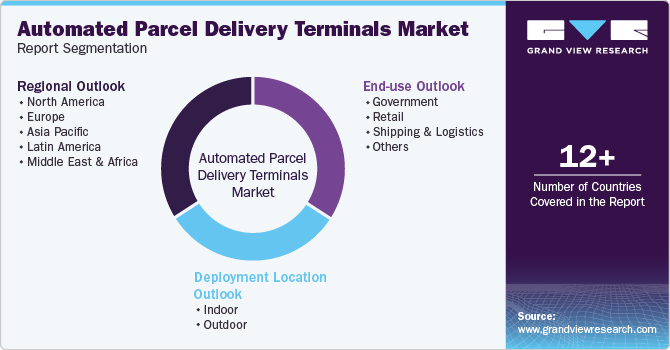

Global Automated Delivery Parcel Terminals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automated parcel delivery terminals market report based on deployment location, end use, and region.

-

Deployment Location Outlook (Revenue, USD Million; 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Government

-

Retail

-

Shipping & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

South Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.