- Home

- »

- Next Generation Technologies

- »

-

Automated Test Equipment Market Size, Industry Report, 2030GVR Report cover

![Automated Test Equipment Market Size, Share & Trends Report]()

Automated Test Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Non-Memory ATE, Memory ATE, Discrete ATE), By Type, By Vertical, By Region And Segment Forecasts

- Report ID: 978-1-68038-176-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Test Equipment Market Summary

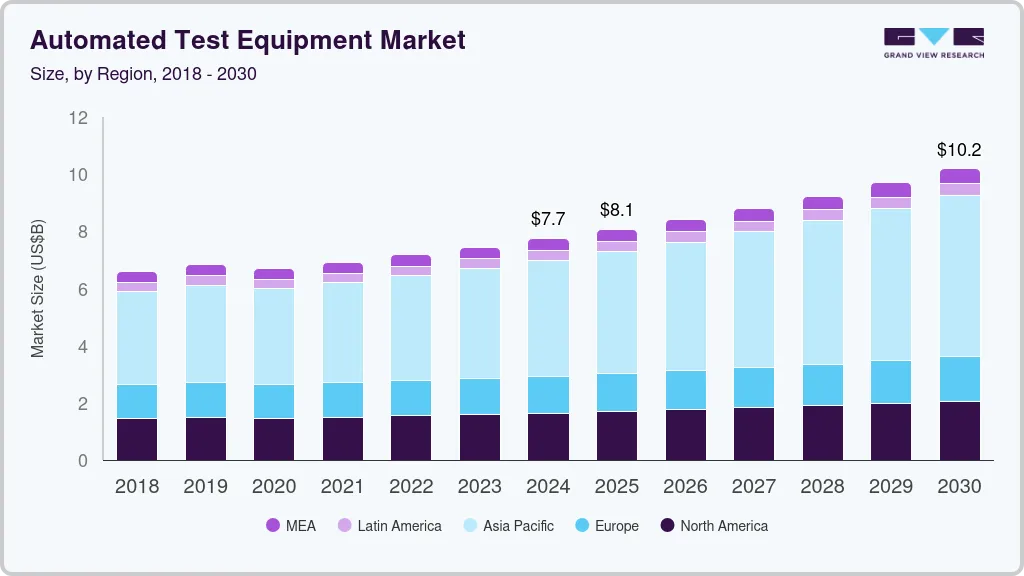

The global automated test equipment market size was estimated at USD 7,749.8 million in 2024 and is projected to reach USD 10,192.4 million by 2030, growing at a CAGR of 4.8% from 2025 to 2030. Growth is primarily driven by the increasing complexity and volume of semiconductors used across various industries, including consumer electronics, automotive, telecommunications, and industrial automation.

Key Market Trends & Insights

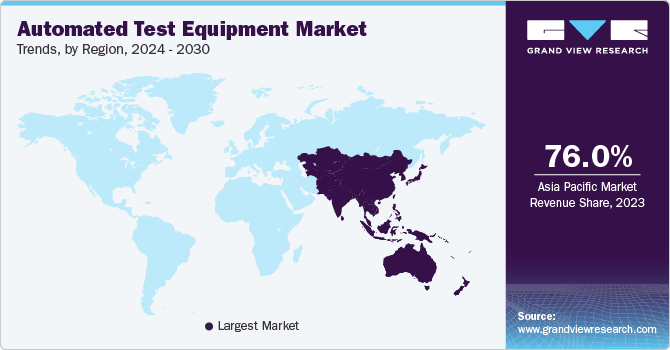

- Asia Pacific dominated the automated test equipment market with the largest revenue share of 52.32% in 2024.

- By product, the Non-Memory ATE segment led the market with the largest revenue share of 60.77% in 2024.

- By vertical, the power generation segment accounted for the largest revenue share in 2024.

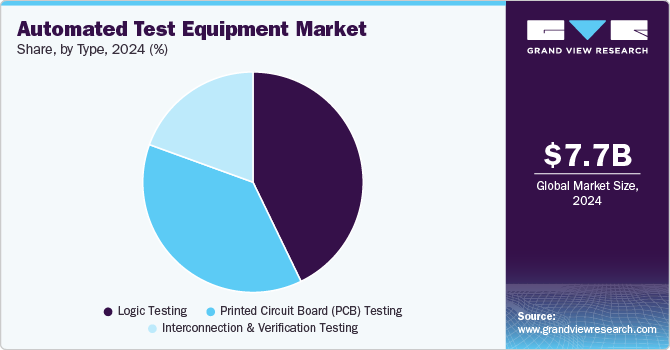

- By type, the logic testing automated test equipment segment accounted for a largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7,749.8 Million

- 2030 Projected Market Size: USD 10,192.4 Million

- CAGR (2025-2030): 4.8%

- Asia Pacific: Largest market in 2024

As electronic devices become more compact and functionally dense, there is a growing demand for faster, more precise, and cost-effective testing solutions. Companies are increasingly adopting ATE to enhance testing throughput and product quality while minimizing time-to-market. In addition, the rising need for high-performance chips in AI, 5G, and IoT applications is further accelerating the adoption of automated testing systems in semiconductor production and assembly lines.

The growing electrification and digitization of the automobile sector is a key trend impacting the worldwide ATE market. The growth of electric vehicles (EVs), autonomous driving technologies, and software-defined vehicles has led to an increased demand for testing of sophisticated electronic control units (ECUs), battery management systems, and sensor networks. As a result, automated testing solutions are becoming crucial for ensuring safety, performance, and compliance with stringent automotive standards. This trend is prompting automotive original equipment manufacturers (OEMs) and Tier 1 suppliers to invest more in scalable, modular ATE systems that can adapt to the evolving complexities of in-vehicle electronics.

The growing need for high-speed, high-density semiconductor goods for usage in data centers, artificial intelligence (AI) systems, and next-generation communications is another new trend. The shift towards 5G and cloud computing has intensified the need for logic and memory devices that undergo rigorous testing. In response, semiconductor manufacturers are integrating ATE systems with predictive analytics and machine learning algorithms to optimize test coverage while reducing testing costs. Furthermore, ATE is playing a vital role in quality control as chipmakers pursue smaller process nodes and heterogeneous integration.

Major players in the automated test equipment industry, such as Advantest, Teradyne, and Cohu, are actively expanding their technology portfolios through strategic acquisitions, increased research and development (R&D) spending, and collaborations. These companies are focused on creating AI-based and software-centric ATE platforms to enhance testing efficiency and flexibility. In addition, some companies are adjusting their product offerings to align with trends in edge computing, automotive electronics, and power semiconductors. Their expansion plans also include targeting specific regions, particularly Asia-Pacific and Europe, to meet growing local demands and improve customer support in high-growth manufacturing hubs.

Product Insights

The Non-Memory ATE segment led the market with the largest revenue share of 60.77% in 2024. This segment is crucial for testing logic and mixed-signal semiconductors, which are essential components in various applications, including consumer electronics, automotive systems, telecommunications, and industrial automation. The market's dominance is primarily driven by the increasing complexity of integrated circuits (ICs), which necessitate advanced testing capabilities to ensure performance, reliability, and compliance with stringent industry standards. In addition, the growing adoption of System-on-Chip (SoC) solutions and rising investments in 5G and IoT infrastructure are contributing to a steady demand for Non-Memory Automatic Test Equipment (ATE) systems.

On the other hand, the memory ATE segment is anticipated to experience at the fastest CAGR of 6% from 2025 to 2030. This growth is further accelerated by the rising production of memory devices such as DRAM, NAND, and new-generation non-volatile memories. Key factors driving this growth include the rapid expansion of hyperscale data centers, higher deployment rates of artificial intelligence (AI) and machine learning applications, and the increased prevalence of smartphones and other memory-intensive consumer electronics. Moreover, advancements in high-bandwidth memory (HBM), DDR5, and 3D NAND technology are making memory devices more complex, thus raising the demand for more sophisticated and high-throughput testing solutions. As a result, the Memory ATE segment is expected to capture a significantly larger share of industry investments in the future.

Vertical Insights

Based on vertical, the power generation segment accounted for the largest revenue share in 2024, primarily due to the growing demand for reliable and effective testing systems that confirm the performance, safety, and regulatory compliance of electronic components used in energy infrastructure. Test solutions that incorporate automation are increasingly being adopted for testing power control modules, converters, and grid management electronics, especially in renewable energy projects such as solar and wind. The ongoing modernization of power systems and the global shift towards smart energy systems are further fueling the demand for Automated Test Equipment (ATE) in this sector. In addition, the rise of distributed energy resources (DERs) and the integration of digital control systems into traditional power plants are creating new testing requirements that automated systems are well-equipped to address.

On the other hand, the automotive segment is projected to grow at the fastest CAGR from 2025 to 2030. Driven by the growing popularity of electric vehicles (EVs), autonomous driving technology, and advanced driver-assistance systems (ADAS), is substantially increasing the complexity and quantity of electronic components in modern vehicles. This trend is leading to a similar demand for high-performance, scalable ATE solutions that can support intricate test routines with speed and accuracy. Moreover, stricter safety regulations and a heightened focus on performance and reliability in automotive electronics are prompting Tier 1 suppliers and original equipment manufacturers (OEMs) to invest heavily in new testing technologies. In addition, the emergence of software-defined vehicles and the electrification of powertrains are expanding the testing landscape across the automotive sector.

Type Insights

Based on type, the logic testing automated test equipment segment accounted for a largest revenue share in 2024. This dominance is attributed to the increasing complexity of integrated circuits employed in digital applications, including microprocessors, application-specific integrated circuits (ASICs), and logic-based controllers. These are key components in industries such as consumer electronics, telecommunications, automotive electronics, and industrial automation. With the increasing complexity of logic devices with higher numbers of pins and increased processing rates, the need for reliable and scalable logic ATE systems has grown. The segment is aided by steady investments in next-generation node technologies, especially in the domains of 5G chipsets, AI accelerators, and high-performance computing systems, all of which demand high-throughput and precise functional testing.

The printed circuit board (PCB) testing automated test equipment segment is projected to experience at the fastest CAGR from 2025 to 2030. This expansion is primarily driven by the increasing global need for miniature, multilayer, and high-density circuit boards utilized in a broad range of electronic devices. Since PCBs are the backbone of all electronics, their integrity and functionality are of utmost importance. Growing miniaturization, increasingly sophisticated circuit designs, and the inclusion of high-speed signal paths have dramatically increased the challenge of testing accuracy. Automated PCB test equipment assists manufacturers in identifying faults, including open circuits, shorts, and component misplacements, effectively during in-circuit and functional test phases. In addition, the fast growth in consumer electronics, EV production, and medical electronics is further driving the demand for cutting-edge PCB testing technologies that provide speed, precision, and reliability in high-volume production settings.

Regional Insights

The automated test equipment market in North America is experiencing steady growth, driven by advancements in semiconductor technology, telecommunications, and consumer electronics. The increasing complexity of electronic components, such as system-on-chip (SoC) devices and field-programmable gate arrays (FPGAs), is fueling the demand for sophisticated testing solutions. In addition, the proliferation of electric vehicles (EVs) and the expansion of 5G infrastructure are contributing to the rising need for reliable and efficient ATE systems. The region's strong emphasis on research and development and its robust manufacturing capabilities further support the market's expansion.

U.S. Automated Test Equipment Market Trends

The automated test equipment market in the U.S. is witnessing growth, particularly in sectors such as aerospace, defense, and telecommunications. The increasing adoption of advanced technologies, including AI, IoT, and autonomous systems, is driving the need for precise and high-performance testing equipment. The U.S. government's investments in infrastructure development and defense modernization are also contributing to the demand for ATE solutions. Furthermore, the presence of leading ATE manufacturers and a strong focus on technological innovation position the U.S. as a key player in the North American market.

Asia-Pacific Automated Test Equipment Market Trends

Asia Pacific dominated the automated test equipment market with the largest revenue share of 52.32% in 2024, due to the high presence of the electronics manufacturing, automotive, and semiconductor industries in the region. As the use of sophisticated electronic products increases, industries including telecommunication, automotive, and consumer electronics are becoming more dependent on ATE solutions for quality assurance and performance verification. With increasing technological growth in segments such as 5G, Internet of Things (IoT), and electric vehicles, the demand for more accurate and effective testing equipment is gaining prominence. Governments of all countries in the region are also encouraging the creation of high-tech infrastructure, thereby enhancing the demand for ATE in the market.

The automated test equipment market in China is at the center of the Asia Pacific ATE market, especially in the semiconductor and electronics production industries. With continuous advancements in the semiconductor industry, the demand for automated testing equipment to ensure product quality and compliance with international standards is increasing. The country is also investing in research and development to further upgrade its domestic testing capabilities, especially in fields such as 5G and automobile technology. As China focuses on reducing dependency on foreign technologies, there is an increasing shift toward homegrown solutions for automated testing, driving the local ATE market forward.

The India automated test equipment market is experiencing steady growth, propelled by the expansion of its electronics manufacturing and digital technology sectors. The "Make in India" program of the Indian government has opened the way for more local manufacturing, especially in sectors such as semiconductors, consumer electronics, and automobiles. The use of newer technologies such as electric vehicles, IoT, and renewable energy is also driving the demand for better and more accurate testing equipment. As India assumes a larger role in the world electronics supply chain, the ATE market is expected to grow further, fueled by domestic demand as well as foreign collaborations.

Europe Automated Test Equipment Market Trends

The automated test equipment market in Europe is witnessing steady progress, backed by the region's positive emphasis on automotive innovation, aerospace development, and industrial automation. The increase in vehicle electrification, 5G network rollout, and high-reliability electronics demand have all spelled growing complexity in testing, hence driving the demand for ATE. Moreover, the EU's focus on sustainability and energy efficiency is stimulating the manufacture of smarter, more resilient electronic components that need sophisticated test methods. Government campaigns to encourage manufacturing innovation and digital transformation through industries also promote the use of automated test solutions throughout the region.

The UK automated test equipment industry is driven mainly by defense system modernization, telecom infrastructure replacement, and expansion of electronics manufacturing bases in the Midlands region. The adoption of Industry 4.0 concepts has compelled UK manufacturers to employ more intelligent testing approaches through automation and data analysis. In addition, the escalating deployment of robotics and AI in production environments is generating new testing problems that are being addressed by more versatile and responsive ATE solutions. The UK's focus on R&D, especially in aerospace and clean tech industries, is also driving the consistent demand for cutting-edge test equipment.

The automated test equipment market in Germany continues to be among the most technologically innovative ATE markets in Europe because of its dominance in automotive engineering and industrial electronics. The large number of electric vehicle developments, including power electronics and battery systems, has generated a high demand for real-time, multi-channel test systems. Germany also has many semiconductor fabs and electronics design centers, which boost the demand for precision testing equipment. Moreover, the marriage of AI and digital twins within manufacturing infrastructure is now driving German businesses to transition toward more intelligent, software-based ATE platforms. Public and private funding of industrial automation continues to drive demand for scalable, customizable testing infrastructure.

Middle East & Africa Automated Test Equipment Market Trends

The automated test equipment market in the Middle East and Africa is witnessing incremental growth as a result of technological improvements in industries such as telecommunications, automotive, and electronics manufacturing. The growth in the adoption of 5G technology and the development of infrastructure in the region is resulting in the need for advanced testing solutions. Also, increasing emphasis on quality assurance and the necessity of efficient production processes are encouraging industries to invest in automated test equipment. Although the market is still evolving relative to other parts of the world, these factors are establishing the foundation for future growth.

The UAE automated test equipment market is experiencing consistent growth, underpinned by the nation's investments in infrastructure and technology. The UAE's strategic plans to develop its telecommunications and electronics industries are fueling the need for sophisticated testing solutions. As the country continues to upgrade its industrial base and incorporate smart technologies, the demand for efficient and trustworthy automated testing equipment is becoming increasingly urgent. This trend is expected to continue as the UAE establishes itself as a regional innovation and technological hub.

The automatic test equipment market in Saudi Arabia is expected to grow with the influence of the Vision 2030 strategy of the country, which is based on diversification and technology growth. The development of sectors including automotive, aerospace, and electronics is in focus by the government, hence increasing the need for advanced testing solutions. Furthermore, the growing need for automation and digitalization across various industries is further boosting the use of automated test equipment. With continued investment by Saudi Arabia in innovation and infrastructure, the ATE market will be growing, and opportunities for local and international players will exist.

Key Automated Test Equipment Company Insights

Some of the key players operating in the market are Aemulus Corporation, Chroma ATE Inc., VIAVI Solutions Inc., and ADVANTEST CORPORATION, among others.

-

Aemulus Corporation offers modular and flexible test systems for analog and mixed-signal semiconductor devices. Its platforms have extensive applications in consumer electronics, automotive IC testing, and power management components. Aemulus prioritizes low-cost, high-efficiency solutions suitable for both volume production and R&D purposes. Aemulus also works with fabless semiconductor companies and foundries in Southeast Asia to further develop its product line.

-

Chroma ATE Inc. provides automated test solutions in power electronics, EV components, and LED drivers. Its ATE systems are used in industrial and research environments to provide accurate testing of electrical parameters in actual operating conditions. The integration of software automation and real-time data analysis by the company facilitates testing of high-voltage, high-efficiency devices, particularly in the expanding electric vehicle and renewable energy markets.

-

VIAVI Solutions Inc. provides smart test solutions for wireless communications, network, and optical components infrastructure testing. It specifically plays an important role in backing the build-out and roll-out of 5G with products that confirm RF and optical interfaces. Protocol and performance testing of VIAVI supports telecom service providers, chip providers, and operators of data centers, allowing it to drive quicker deployment of the next-generation network.

-

ADVANTEST CORPORATION produces semiconductor test systems that cover memory, logic, SoC, and RF chip applications. In addition, ADVANTEST produces supporting automation solutions such as handlers and device interfaces for mass production environments. Its T2000 and V93000 product series are used extensively by world-class semiconductor manufacturers, including large IDM and foundry customers, and are optimized for AI, mobile, and automotive semiconductors.

Star Technologies Inc., Danaher, and TESEC Corporation are some of the emerging market participants in the automated test equipment industry.

-

STAr Technologies Inc. offers a range of SoC, memory, and logic semiconductor test systems, including wafer-level and burn-in test solutions. STAr Technologies Inc. serves OSATs and semiconductor fabs, and it has enhanced its presence in Asia-Pacific markets through partnerships and localized engineering support.

-

Danaher, in its subsidiaries such as Tektronix and Keithley Instruments, supplies high-precision instruments for semiconductor and electronics testing. They have signal analyzers, source measurement units, and parametric testers that are employed in validation labs and R&D centers in a variety of sectors ranging from consumer electronics to aerospace.

-

TESEC Corporation designs advanced high-power ATE systems targeting power semiconductor devices such as MOSFETs, IGBTs, and SiC/GaN-based devices. Its systems are optimized for high-performance testing in demanding electrical environments, catering to EV, industrial automation, and energy storage markets.

Key Automated Test Equipment Companies:

The following are the leading companies in the automated test equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Aemulus Corporation

- Chroma ATE Inc.

- VIAVI Solutions Inc.

- Astronics Corporation

- ADVANTEST CORPORATION

- Cohu, Inc

- Teradyne Inc.

- STAr Technologies Inc.

- TESEC Corporation

- Roos Instruments

- Marvin Test Solutions, Inc.

- Danaher

Recent Developments

-

In 2025, Teradyne and Infineon Technologies signed a strategic partnership to drive power semiconductor testing forward. Under this partnership, Teradyne will acquire Infineon's Automated Test Equipment (ATE) division in Regensburg, Germany, with 80 employees. The acquisition is meant to strengthen Teradyne's position in the power semiconductor business by combining Infineon's resources and experience.

-

In 2025, Advantest Corporation launched the T5801 Ultra-High-Speed DRAM Test System. This state-of-the-art platform is designed to accommodate the most recent developments in high-speed memory technologies such as GDDR7, LPDDR6, and DDR6. T5801 is crafted to address the increasing needs of artificial intelligence (AI), high-performance computing (HPC), and edge applications by providing unparalleled speed, performance, and accuracy in memory testing.

-

In January 2024, Rohde & Schwarz and Analog Devices, Inc. (ADI) announced their latest automated test solution for wireless battery management systems (wBMS). It is specifically designed for wireless device test verification and mass production tests based on existing activities for wBMS RF robustness testing.

Automated Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,075.5 million

Revenue forecast in 2030

USD 10,192.4 million

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Aemulus Corporation; Chroma ATE Inc.; VIAVI Solutions Inc.; Astronics Corporation; ADVANTEST CORPORATION; Cohu, Inc; Teradyne Inc.; STAr Technologies Inc.; TESEC Corporation; Roos Instruments; Marvin Test Solutions, Inc.; Danaher

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Test Equipment Market Report Segmentation

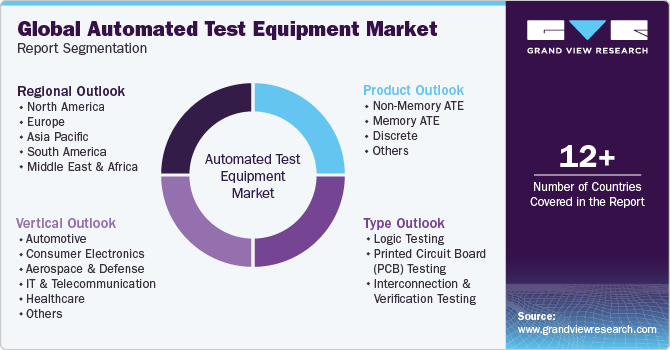

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automated test equipment market report based on product, type, vertical, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Memory ATE

-

Memory ATE

-

Discrete ATE

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Logic Testing

-

Linear or mixed Signal Equipment

-

Passive Component ATE

-

Discrete ATE

-

-

Printed Circuit Board (PCB) Testing

-

Interconnection and Verification Testing

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Aerospace & Defense

-

IT & Telecommunication

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automated test equipment market size was estimated at USD 7.75 billion in 2024 and is expected to reach USD 8.08 billion in 2025.

b. The global automated test equipment market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 10.19 billion by 2030.

b. The Asia Pacific automated test equipment market accounted for more than 52% revenue share in 2024. This dominance is driven by the strong presence of semiconductor manufacturing hubs in countries like China, Taiwan, South Korea, and Japan. Growing investments in consumer electronics, 5G infrastructure, and automotive electronics have further fueled demand. Additionally, government initiatives supporting advanced manufacturing and the regional expansion of chipmakers contribute to sustained growth.

b. The key players in the automated test equipment market include Aemulus Corporation, Chroma ATE Inc., VIAVI Solutions Inc., Astronics Corporation, ADVANTEST CORPORATION, Cohu, Inc., Teradyne Inc., STAr Technologies Inc., TESEC Corporation, Roos Instruments, Marvin Test Solutions, Inc., Danaher, among others.

b. Key factors that are driving market growth include expansion of 5G and IoT technologies, growth in automotive electronics and electric vehicles (EVs), adoption of AI and ML in testing processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.