- Home

- »

- Advanced Interior Materials

- »

-

Automatic Palletizer & Depalletizer Market Size Report, 2030GVR Report cover

![Automatic Palletizer And Depalletizer Market Size, Share & Trends Report]()

Automatic Palletizer And Depalletizer Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Palletizer, Depalletizer), By Product (Straight Moving, Curve Moving), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-328-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automatic Palletizer And Depalletizer Market Summary

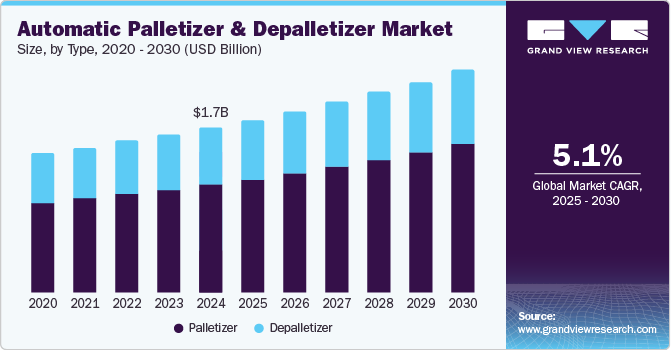

The global automatic palletizer and depalletizer market size was estimated at USD 1.70 billion in 2024 and is projected to reach USD 2.30 billion by 2030, growing at a CAGR of 5.1% from 2025 to 2030. The increasing integration of automation across various industries, coupled with the growing need to manage high stock-keeping units (SKUs) efficiently, counts, and operations of multiline production, is significantly contributing to the growth of the automatic palletizer and depalletizer market.

Key Market Trends & Insights

- North America’s automatic palletizer market dominated the global market with a revenue share of 32.5% in 2024.

- The automatic palletizer and depalletizer market in U.S. is projected to grow at the fastest CAGR of 6.3% over the forecast period.

- In terms of type, The palletizer market segment led the market and accounted for 65.6% of the global revenue share in 2024.

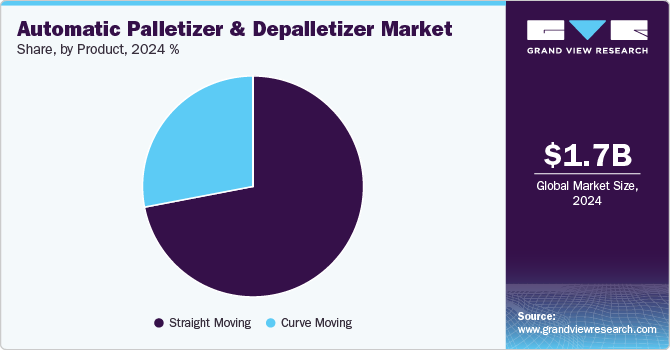

- In terms of product, The straight-moving segment market dominated the global market with a revenue share of 71.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.70 Billion

- 2030 Projected Market Size: USD 2.30 Billion

- CAGR (2025-2030): 5.1%

- North America: Largest market in 2024

The surge is further fueled by the demand for streamlined operations and improved productivity as manufacturers seek innovative solutions to enhance their production capabilities and logistical efficiency. Palletizers and depalletizers help in boosting the efficiency of a manufacturing unit to load and unload products to and from pallets and consequently, helps in boosting the overall plant efficiency. A higher rate of accuracy and consistency is achieved by this approach that minimizes the possibility of human errors and enhances the quality of packaging, which is becoming an essential part across various industries including booming e-commerce industry.As online shopping volumes grow perpetually, these automated solutions have become critical for proficient handling, sorting, and shipping products. It helps in reducing manual labor, enhances speed and accuracy in warehouse management, and supports the scaling needs of growing logistics and e-commerce businesses. Such automation is pivotal in meeting consumer expectations for swift deliveries, ultimately driving market growth. Automatic systems can also readily adjust to different product types and sizes, providing a higher degree of versatility compared to conventional palletizing and depalletizing techniques.

Frequent technological advancements and continuous launching of new products is helping the overall automatic palletizer and depalletizer industry to grow significantly. Technological advancements enhance packaging line’s efficiency, accuracy, and safety, attracting businesses seeking to optimize their operations. Moreover, integration of robotics and AI is improving the versatility and adaptability of these systems, meeting the diverse needs of various industries. This technological evolution drives demand as companies prioritize productivity and cost-effectiveness in their supply chains. The automatic palletizer and depalletizer industry brands provide products that are adaptable and accessible for system integrators. These solutions are tailored to the needs, offers hassle-free to incorporation, and are relative easy to use. It also promotes sustainability through minimizing waste and optimizing warehouse space, which aligns with the current supply chain commitments.

The growth of automatic palletizers and depalletizers industry is constrained by high upfront costs, which makes the incorporation of such systems challenging for small and medium enterprises (SMEs). In addition, the complexity of integrating such systems into existing production lines without disrupting operations poses a significant barrier in the systems’ adoption. Lack of adequate awareness and requisite skill sets, especially in developing countries, is another challenge in widening the adoption gap. However, there are consolidated growth opportunities through increased automation across multiple industries which can improve the efficiency of logistics and supply chains, reduce issues to manual labor, and enhance effectiveness and productivity. Furthermore, advancements in technologies such as robotics and artificial intelligence enable the incorporation of more sophisticated, adaptable, and efficient systems. As businesses continue to seek solutions for faster, safer, and more reliable packaging and distribution processes, adoption of these automated systems is expected to rise, fostering substantial market opportunities.

Type Insights

The palletizer market segment led the market and accounted for 65.6% of the global revenue share in 2024, as they offer a cost-effective solution by automating the stacking and organizing of products on pallets. This significantly speeds up the packaging and storage process and helps to optimize the warehouse operations. Additionally, continuously growing emphasis on workplace safety is further contributing to the market growth. Manual palletizing can pose a serious injuries risk, which are efficiently mitigated by the palletizers, ensuring a safer workplace environment. The companies are striving to optimize their operational efficiency, which enhances the significance of automated supply chain systems across global markets. Automated palletizing systems streamline goods flow, reduce bottlenecks and improve efficiency of warehouses and distribution centers, thereby fueling market growth. Moreover, advancements in palletizer type capable of handling various products and packages made the systems more adaptable and efficient. This flexibility allows businesses to respond swiftly to market changes and customer demands, further driving the adoption of palletizing solutions.

The depalletizer market segment held a substantial market share in 2024. A depalletizer is an automated machine designed to unload products from pallets efficiently. This process involves separating bulk loads into single units or smaller batches for further handling, processing and packaging. Depalletizers are key in optimizing the workflow in environments handling large volumes of goods, facilitating a smoother transition in the supply chain. The high growth rate of e-commerce industry has encouraged the need for quicker and more efficient logistic solutions, which is critical for improved product handling at fulfillment centers. By implementing a depalletizer in operations, industries such as food and beverage, pharmaceuticals, and manufacturing can significantly enhance productivity. Such systems reduce issues associated with manual labor, accelerate unloading process, decreases the risk of workplace injury, and improves overall operational efficiency.

End-use Insights

The food & beverage segment dominated the market, accounting for 35.0% in 2024. The food and beverage industry highly depends on automation systems such as palletizing and depalletizing. The palletizers efficiently stack food and beverage products on pallets, preparing them for distribution or storage. This automation speeds up the packaging line, significantly reducing the chances for manual handling and associated time and improved workplace safety. Additionally, these systems ensure precise and stable stacking, better load stability, prevention of product damage during transit, and maintain high product integrity. All these are essential activities for industry, making automation a key part of it.

The pharmaceutical & personal care sector is projected to grow at the fastest CAGR of 6.4% over the forecast period. In this segment, the automatic palletizers and depalletizers are critical for boosting efficiency. These machines automatically stack or unstack products on pallets, improving speed and accuracy over traditional methods. Pharmaceutical & personal care manufacturing requires high degree of hygiene and precision ensuring minimal product handling, thereby reducing contamination risks and safeguarding consistency in product packaging and handling. Automated palletizing systems must adhere to regulatory requirements such as GMP, FDA, and ISO to guarantee product safety and traceability. This ensures seamless transfer between production phases and adherence to industry regulations. All such factors are contributing to the growth of palletizer and depalletizer industry across pharmaceutical & personal care sector.

Product Insights

The straight-moving segment market dominated the global market with a revenue share of 71.6% in 2024. It is a reliable, ergonomic, and organized alternative to manual transport processes across food and beverage, pharmaceuticals, and other contamination-prone consumer goods. It increases throughput without complexity and is extensively used across high-speed production environments, packing boxes or cases for shipping and distribution, and stacking standardized packaging. It offers significant benefits, including increased speed and efficiency in palletizing processes. These machines are designed for precision and are capable of handling various product sizes and weights, ensuring consistency in pallet builds. These machines minimize the risk of workplace injuries associated with manual palletizing and their simple operation and easy maintenance help to reduce operational downtime and boost overall productivity.

The curve-moving segment is projected to grow at the fastest CAGR of 5.8% over the forecast period. It is an automated palletizing system in which the products are conveyed along curved conveyor systems, and the palletizing operation occurs at designated points after the products have traversed the curved path. In contrast to straight-moving palletizers, which use linear conveyor systems, curve-moving palletizers provide a more flexible product flow and can accommodate more intricate layouts within production facilities. Its primary advantage is its efficiency in maneuvering and positioning packages with precision. This system allows for seamless handling of different packages and minimizes the risk of damage during palletization. Its curved movement feature ensures smooth transitions and optimizes space by accurately stacking products compactly and uniformly. This results in faster processing times and significantly reduces possibilities of errors, enhancing overall productivity and operational efficiency.

Regional Insights

North America’s automatic palletizer market dominated the global market with a revenue share of 32.5% in 2024. The automatic palletizers and depalletizers industry in North America is experiencing substantial growth due to increasing automation across manufacturing sectors in the region. The demand for such systems is being incorporated significantly, with a focus on energy-efficient automated solutions. It reduces dependency on traditional methodologies, ensuring continuous and safe operations. These systems also help critical sectors including food & beverage and pharmaceuticals to comply with Good Manufacturing Practices (GMP) and FDA regulations, guaranteeing precise, hygienic, and safe handling of products. Key players in the market are investing in research and development to offer innovative products and gain a competitive edge. Further, the growing food & beverage industry, coupled with the rising need for effective warehouse operations, is also contributing to the market growth in the North American region.

U.S. Automatic Palletizer And Depalletizer Market Trends

The automatic palletizer and depalletizer market in U.S. is projected to grow at the fastest CAGR of 6.3% over the forecast period. The U.S.'s automatic and depalletizer industry is experiencing substantial growth due to the country's growing need for efficient and faster warehousing and distribution systems. Businesses seek ways to optimize their supply chains and reduce material handling costs. These automated systems significantly enhance end use handling operations' productivity, accuracy, and safety. Moreover, the surge in e-commerce has propelled the necessity for faster and more reliable packaging and shipping solutions, further driving their adoption.

Europe Automatic Palletizer And Depalletizer Market Trends

The European automatic palletizer and depalletizer market is witnessing substantial growth driven by technological advancements and increasing demand for solutions for achieving higher warehouses efficiency. European businesses are investigating in automated palletizing and depalletizing systems to cut costs and increase productivity. E-commerce companies are able to process a higher volume of orders while significantly reduced material handling costs and issues associated with it. This is relevant for pharmaceutical, grocery, and health products companies.

The market is significantly influenced by strict regulatory and labor safety frameworks. These regulations ensure workplaces adhere to high safety standards, promoting adoption of automation technologies to minimize manual handling and reduce workplace injuries. Consequently, companies are increasingly investing in such automated systems to comply with the regulations, enhance operational efficiency, and improve worker safety, thus, driving market growth in the region.

Asia Pacific Automatic Palletizer And Depalletizer Market Trends

The demand for automatic palletizers and depalletizers in Asia Pacific is driven by the region's booming e-commerce, increasing manufacturing activities, and growing need for efficient logistics solutions. Rapid industrialization and the adoption of smart manufacturing processes also contribute significantly to market growth. Countries such as China, India, and Japan invest heavily in automation technologies to enhance productivity. Various global electronics and automotive OEMs have outsourced their manufacturing to countries in the region, resulting in high adoption of automated solutions among APAC manufacturers. Firms in this region are also striving to become more competitive in the global market by investing in manufacturing automation to increase productivity, product and service quality, and consistency amidst growing global demand. In addition, the expanding food and beverage sector necessitates the incorporation of advanced packaging solutions, further propelling market growth.

Key Automatic Palletizer And Depalletizer Company Insights

Some key players operating in the market include ABB Ltd., Mitsubishi Electric Corporation, and KUKA AG, among others.

-

ABB Ltd. is a global leader in robotics and automation type. The company offers a wide range of solutions, including automatic palletizers and depalletizers across the packaging and end-use handling industry. These systems enhance efficiency, accuracy, and safety across different industries, including food and beverage, pharmaceuticals, and consumer goods. ABB Ltd. offers extensive expertise in robotics and automation with a strong focus on innovation and sustainability.

-

Mitsubishi Electric Corporation is a leading developer and manufacturer of automated industrial solutions. It offers a wide range of systems across its six business segments named industrial automation systems, electronic devices, energy and electric systems, information and communication systems, home appliances, and others. The company caters to different sectors including industrial manufacturing and warehouse & logistics.

Bastian Solutions LLC, Ehcolo AS and DAN-Palletiser A/S are some of the emerging market participants in the automatic palletizer and depalletizer market.

-

Bastian Solutions LLC emerged as a key player in the automatic palletizer and depalletizer market. This company holds expertise in developing innovative and efficient solutions catering to different end use industries. The company has distinguished itself by offering customized solutions for warehouse operation optimization , increase productivity, and reduce operational costs showcasing strong commitment to customer service.

-

Based in Denmark, Ehcolo AS emerged as an advanced palletizing and depalletizing solutions provider. The company designs and manufactures highly efficient, automated systems for handling various types of goods. Their products serve industries worldwide and are known for their robustness, flexibility, and precision, to optimize production line efficiencies.

Key Automatic Palletizer And Depalletizer Companies:

The following are the leading companies in the automatic palletizer and depalletizer market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Krones AG

- Brenton, LLC.

- DAN-Palletiser A/S

- Remtec Automation, LLC.

- Bastian Solutions, LLC

- Ehcolo

- Columbia Machine, Inc.

- Pester pac automation GmbH

Recent Developments

-

In March 2025, Plus One Robotics exhibited its comprehensive palletizing and depalletizing solutions at ProMat 2025. The company also unveiled a new Partner Portal to empower solution providers and system integrators. This move reflects its dedication towards promotion of automation and enhancing its partner ecosystem.

-

In January 2024, ABB Ltd. completed the acqusition of Sevensense, a Swiss-based start-up known for its advanced 3D vision navigation type for autonomous mobile robots (AMRs). Since 2018, Sevensense has established itself as a leader in its field of industrial automation sector. This strategic move is expected to enhance ABB Ltd.’s capabilities in their automatic palletizing and depalletizing machinery.

-

In May 2023, KUKA AG introduced a new KMP 600-S diffDrive mobile platform automated guided vehicle (AGV) system. This system features a collaboration between a KUKA KR IONTEC robot and Mujin in a cell designed for the efficient palletizing and depalletizing of consumer goods. The operation of the robot within the cell is precisely managed through a combination of a Mujin controller and an integrated camera system.

Automatic Palletizer And Depalletizer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.78 billion

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; Japan; China; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Mitsubishi Electric Corporation; Kawasaki Heavy Industries, Ltd.; ABB Ltd.; FANUC Corporation; Yaskawa Electric Corporation; KUKA AG; Krones AG; Brenton, LLC.; DAN-Palletiser A/S; Remtec Automation, LLC.; Bastian Solutions, LLC; Columbia Machine, Inc.; Ehcolo; Pester pac automation GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automatic Palletizer And Depalletizer Market Report Segmentation

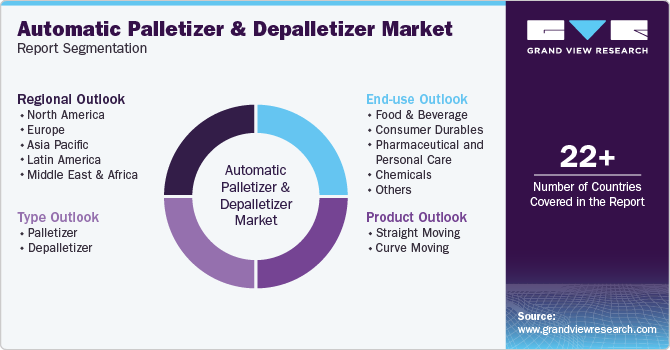

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automatic palletizer and depalletizer market report on the basis of type, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Palletizer

-

Depalletizer

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Straight Moving

-

Curve Moving

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & beverage

-

Consumer Durables

-

Pharmaceutical and Personal Care

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.