- Home

- »

- IT Services & Applications

- »

-

Workplace Safety Market Size & Share, Industry Report 2030GVR Report cover

![Workplace Safety Market Size, Share & Trends Report]()

Workplace Safety Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (PPE, Workplace Safety Services), By Technology, By Deployment Mode, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-503-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Workplace Safety Market Summary

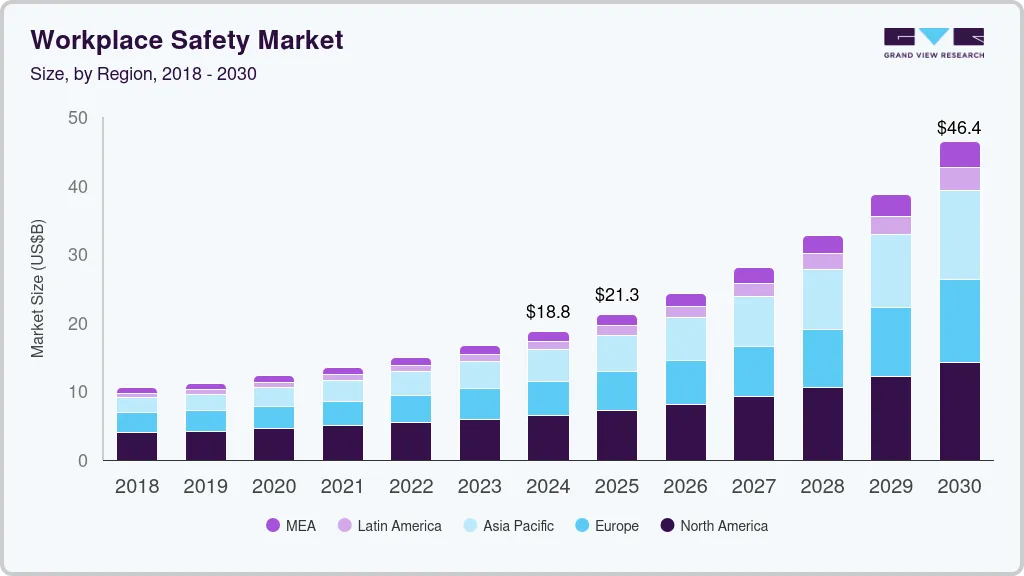

The global workplace safety market size was estimated at USD 18.79 billion in 2024 and is projected to reach USD 46.38 billion by 2030, growing at a CAGR of 16.9% from 2025 to 2030. As businesses become more aware of the importance of ensuring a safe working environment, the demand for safety solutions, including personal protective equipment (PPE), safety management systems, and employee training z, has increased.

Key Market Trends & Insights

- The workplace safety industry in North America held a largest share of nearly 35.0% in 2024.

- The workplace safety industry in the U.S. is expected to grow significantly at a CAGR of 14.0% from 2025 to 2030.

- By product type, the personal protective equipment (PPE) segment dominated the market and accounted for the revenue share of over 51.0% in 2024.

- By technology, the IoT-enabled segment accounted for a largest revenue share of over 30.0% in 2024.

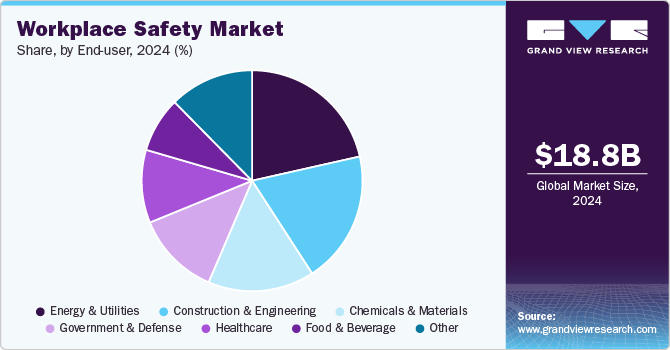

- By end user, the energy and utilities segment accounted for a largest revenue share of over 21.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.79 Billion

- 2030 Projected Market Size: USD 46.38 Billion

- CAGR (2025-2030): 16.9%

- North America: Largest market in 2024

The rise in workplace injuries and fatalities across industries has intensified the focus on workplace safety, prompting companies to implement more comprehensive safety measures and protocols. Regulatory pressure from governments and international organizations has played a critical role in the growth of the workplace safety industry. In response to rising workplace injuries and fatalities, various national and international bodies have introduced and enforced stricter safety regulations, compliance standards, and industry-specific guidelines. For instance, organizations must adhere to Occupational Safety and Health Administration (OSHA) standards in the U.S. or the European Union's directives on health and safety at work. These regulations mandate the implementation of robust safety management systems, hazard identification, and risk assessment procedures to protect employees.

Failure to comply with these regulations can lead to heavy fines, legal liabilities, and damage to a company’s reputation. As a result, businesses are increasingly investing in advanced safety solutions, such as safety monitoring technologies, training programs, and protective equipment, to ensure compliance and mitigate risk. In 2023, private industry employers in the U.S. reported 2.6 million nonfatal workplace injuries and illnesses, with a rate of 2.4 cases per 100 full-time equivalent workers, as reported by the U.S. Bureau of Labor Statistics.

Technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) are revolutionizing safety management systems. IoT devices enable real-time monitoring of workplace conditions, such as air quality, temperature, and machinery health, providing alerts for potential hazards. AI and ML can predict safety risks by analyzing historical data and identifying patterns that could lead to accidents. Additionally, wearables and smart PPE are becoming more common, offering features such as biometric monitoring to track employee health and safety metrics, enhancing proactive risk management.

In addition, the growing awareness of mental health and overall well-being is becoming an integral part of workplace safety strategies. Employers are increasingly recognizing the impact of mental health on productivity and safety, leading to the integration of mental health support programs and stress management tools within safety initiatives. This holistic approach to workplace safety is expected to continue driving market growth in the coming years.

Product Type Insights

The personal protective equipment (PPE) segment dominated the market and accounted for the revenue share of over 51.0% in 2024. The increasing presence of automation and Industry 4.0 technologies in hazardous environments has boosted demand for smart PPE. These advanced safety solutions integrate sensors and IoT technology to monitor environmental conditions and worker health in real time, enabling preventive measures. As industries continue to prioritize employee welfare and adapt to evolving workplace safety needs, the PPE segment is expected to maintain robust growth in the coming years.

The workplace safety services segment is expected to grow at a significant CAGR of 18.8% over the forecast period. Companies are increasingly investing in safety training and awareness programs to foster a culture of safety among their workforce. The growing availability of digital training platforms, virtual reality simulations, and e-learning modules has made safety training more accessible and effective, contributing to the segment’s expansion.

Technology Insights

The IoT-enabled segment accounted for a largest revenue share of over 30.0% in 2024, driven by the increasing adoption of advanced technologies to enhance safety monitoring, compliance, and real-time risk management. IoT-enabled devices, such as connected wearables, sensors, and smart safety equipment, provide continuous tracking of workers' health, environmental conditions, and equipment status. This real-time data enables proactive decision-making to prevent accidents and injuries, particularly in high-risk industries such as construction, manufacturing, and oil and gas.

The virtual reality (VR) segment is expected to grow at a significant CAGR over the forecast period. Continuous improvements in VR hardware, software, and processing power are making the technology more realistic and accessible. Enhanced graphics, haptic feedback, and motion-tracking technology create more immersive and accurate training environments, further boosting VR's effectiveness in safety training programs.

End User Insights

The energy and utilities segment accounted for a largest revenue share of over 21.0% in 2024. The transition to renewable energy sources such as solar, wind, and hydroelectric power has led to the construction of new facilities and infrastructure. These new projects require specialized safety protocols to address the unique risks associated with renewable energy technologies. As the sector grows, so does the need for robust safety solutions tailored to renewable energy operations.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. The global aging population and the rise of chronic health conditions are increasing the demand for healthcare services, leading to larger, more complex healthcare facilities. As the sector expands, there is an increased need to implement and maintain workplace safety programs to protect a growing number of employees. This includes expanding training programs, upgrading safety equipment, and improving emergency response capabilities.

Deployment Mode Insights

The cloud segment accounted for a largest revenue share of over 55.0% in 2024. Cloud-based platforms provide centralized storage for safety data, making it easier for organizations to manage and access critical information in real-time. Safety reports, compliance records, incident logs, and training materials can be securely stored and accessed from anywhere, ensuring that employees, managers, and safety officers have the updated information.

The on-premises segment is expected to grow at a significant CAGR over the forecast period. Organizations with strict data security and compliance requirements, such as those in healthcare, finance, and government sectors, often prefer on-premises solutions to maintain full control over their sensitive safety-related data. This is especially important for industries that must adhere to stringent regulations, such as HIPAA or GDPR.

Regional Insights

The workplace safety industry in North America held a largest share of nearly 35.0% in 2024. The shift toward automation and the increased use of robotics in industries like manufacturing, construction, and logistics are fueling the market growth. As automation and robotics replace certain manual tasks, ensuring the safety of workers in these evolving environments has become a critical priority.

U.S. Workplace Safety Market Trends

The workplace safety industry in the U.S. is expected to grow significantly at a CAGR of 14.0% from 2025 to 2030. In the U.S., agencies such as the Occupational Safety and Health Administration (OSHA) enforce strict safety standards across various industries. These regulations, which cover everything from equipment safety to employee training and hazard management, require businesses to invest in comprehensive safety solutions.

Europe Workplace Safety Market Trends

The workplace safety industry in Europe is anticipated to register a considerable growth from 2025 to 2030, driven by factors such as stringent regulations, technological advancements, and an increased emphasis on employee well-being. Europe is known for its robust regulatory framework governing workplace safety, with organizations such as the European Agency for Safety and Health at Work (EU-OSHA) setting high standards for safety protocols across various industries.

The UK workplace safety market is expected to grow rapidly in the coming years. The growing focus on employee health, particularly mental well-being, is also driving the growth of the market for workplace safety in the UK There is an increasing recognition that a safe workplace is not limited to physical health but also encompasses mental health and emotional well-being.

The workplace safety market in Germany held a substantial market share in 2024. Technological innovation is another key driver of the market growth in Germany. The adoption of Industry 4.0 technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and automation, is revolutionizing how workplace safety is managed. AI and machine learning algorithms are employed to analyze historical data and predict potential safety risks, allowing businesses to take proactive measures before accidents occur.

Asia Pacific Workplace Safety Market Trends

Asia Pacific is growing significantly at a CAGR of 19.6% from 2025 to 2030, driven by a combination of evolving regulatory frameworks, rising industrialization, and increasing awareness of employee health and safety. The region is diverse, with countries at different stages of economic development, but overall, there is a growing recognition of the importance of workplace safety across industries.

The Japan workplace safety market is expected to grow rapidly in the coming years. Traditional safety training methods in Japan are being supplemented or replaced by innovative solutions such as virtual reality (VR) and augmented reality (AR). These immersive training technologies allow workers to engage in simulated safety scenarios that may be too risky or difficult to replicate in real life. This approach to training enhances learning retention and better prepares workers for real-world situations, leading to safer work environments.

The workplace safety market in China held a substantial market share in 2024. The rapid industrialization and urbanization in China are also contributing to the market growth. As China continues to expand its manufacturing, construction, and infrastructure sectors, the need for effective safety solutions becomes even more urgent. High-risk industries, such as construction, oil and gas, and mining, require advanced safety measures to protect workers from accidents and injuries. The Chinese government has been actively promoting workplace safety initiatives in these sectors by providing incentives for businesses to adopt safety technologies and improve working conditions.

Key Workplace Safety Company Insights

Key players operating in the workplace safety industry are Honeywell International Inc.; 3M; Hexagon AB; Wolters Kluwer N.V.; and DuPont. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In November 2024, Honeywell International Inc. entered into an agreement to sell its Personal Protective Equipment (PPE) business to Protective Industrial Products, Inc, a U.S.-based worker safety provider. The sale aligns with the company's strategy to streamline its portfolio and focus on key growth areas, including automation, the future of aviation, and energy transition. The divested PPE business is set to gain a growth boost through expansion into new products, markets, and regions. This transaction positions both companies to capitalize on new opportunities.

-

In April 2024, HexagonAB announced the acquisition of Xwatch Safety Solutions, a UK-based company specializing in construction machinery equipment. This strategic move aims to bolster Hexagon AB's construction safety portfolio by integrating Xwatch's advanced machine control hardware and software technologies. These solutions are designed to improve safety protocols on construction sites, reinforcing Hexagon's commitment to enhancing workplace safety through innovative technology.

Key Workplace Safety Companies:

The following are the leading companies in the workplace safety market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- ABB

- ANSELL LTD

- Cintas Corporation

- Drägerwerk AG & Co. KGaA

- DuPont

- Ecolab

- Hexagon AB

- Honeywell International Inc.

- KCWW

- Lindström

- MSA

- Vector Solutions

- VIKING

- Wolters Kluwer N.V.

Workplace Safety Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.26 billion

Revenue forecast in 2030

USD 46.38 billion

Growth rate

CAGR of 16.9% from 2025 to 2030

Actual data

2018 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, deployment mode, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

3M; ABB; ANSELL LTD; Cintas Corporation; Drägerwerk AG & Co. KGaA; DuPont; Ecolab;Hexagon AB; Honeywell International Inc.; KCWW; Lindström; MSA; Vector Solutions; VIKING; Wolters Kluwer N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Workplace Safety Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global workplace safety market report based on product type, technology, end user, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal Protective Equipment (PPE)

-

Head Protection

-

Eye & Face Protection

-

Hearing Protection

-

Respiratory Protection

-

Protective Clothing

-

Fall Protection

-

-

Workplace Safety Services

-

Safety Audits & Inspections

-

Safety Training & Consultation

-

Emergency Response Services

-

-

Safety Equipment & Systems

-

Fire Safety Systems

-

Safety Signs & Labels

-

Surveillance & Monitoring Systems

-

Environmental Health & Safety (EHS) Software

-

Industrial Safety Equipment

-

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

IoT-enabled

-

Wearable

-

Automation & Robotics

-

Artificial Intelligence (AI)

-

Big Data & Predictive Analytics

-

Virtual Reality (VR)

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy & Utilities

-

Construction & Engineering

-

Chemicals & Materials

-

Government & Defense

-

Healthcare

-

Food & Beverage

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global workplace safety market size was estimated at USD 18.79 billion in 2024 and is expected to reach USD 21.26 billion in 2025.

b. The global workplace safety market is expected to grow at a compound annual growth rate of 16.9% from 2025 to 2030 to reach USD 46.38 billion by 2030.

b. The workplace safety market in North America held a largest share of nearly 35.0% in 2024. The shift toward automation and the increased use of robotics in industries like manufacturing, construction, and logistics are fueling the workplace safety market.

b. Some key players operating in the workplace safety market include 3M, ABB, ANSELL LTD, Cintas Corporation, Drägerwerk AG & Co. KGaA, DuPont, Ecolab, Hexagon AB, Honeywell International Inc., KCWW, Lindström, MSA, Vector Solutions, VIKING, Wolters Kluwer N.V.

b. As businesses become more aware of the importance of ensuring a safe working environment, the demand for safety solutions, including personal protective equipment (PPE), safety management systems, and employee training z, has increased. The rise in workplace injuries and fatalities across industries has intensified the focus on workplace safety, prompting companies to implement more comprehensive safety measures and protocols.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.