- Home

- »

- Automotive & Transportation

- »

-

Automotive Brake System Market Size & Share Report, 2030GVR Report cover

![Automotive Brake System Market Size, Share & Trends Report]()

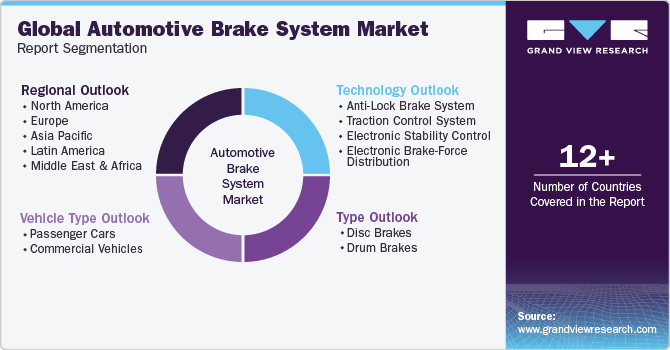

Automotive Brake System Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Disc Brake & Drum Brake), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-214-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Brake System Market Summary

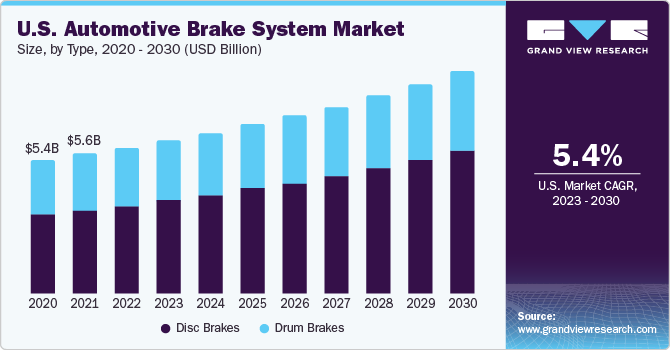

The global automotive brake system market size was valued at USD 47.75 billion in 2022 and is projected to reach USD 72.70 billion by 2030, growing at a CAGR of 5.5% from 2023 to 2030. The market for automotive brake systems is expected to rise significantly, owing to increased demand for passenger and commercial vehicles in countries such as India and China.

Key Market Trends & Insights

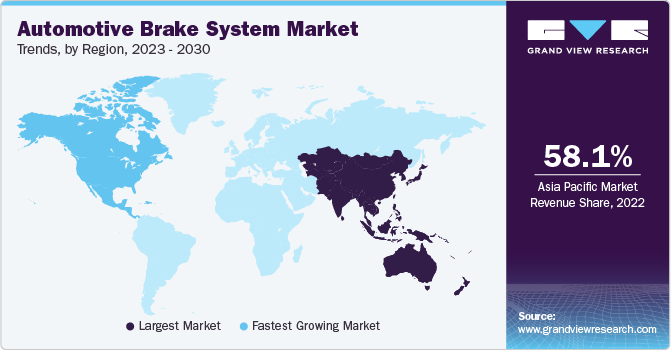

- Asia Pacific dominated the market with the largest revenue share of 58.1% in 2022.

- The automotive brake systems market in the China is expected to grow at a significant CAGR over the forecast period.

- By type, the disc brake segment held the largest market share of 61.1% in 2022.

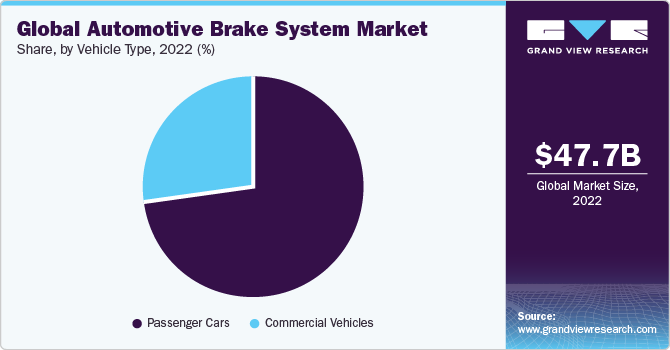

- By vehicle type, the passenger cars dominated the market, with the revenue share of 72.5% in 2022.

- By technology, electronic Stability Control (ESC) dominated the market with a revenue share of 32.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 47.75 Billion

- 2030 Projected Market Size: USD 72.70 Billion

- CAGR (2023-2030): 5.5%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

In addition, factors such as strict safety standards, the adoption of luxury automobiles, and the increased adoption of disc brakes in commercial vehicles are further propelling market growth. Also, the lifespan of brake components is restricted to a specific number of kilometers, boosting the replacement market.

In addition, concerns about road traffic collisions and the rising number of fatalities have prompted participants to incorporate robust safety systems. The automobile brake system market will continue to grow due to the stringent safety rules imposed by regulatory organizations and governments. Since 2022, the National Highway Traffic Safety Administration (NHTSA), a U.S. transportation department division, has planned to make automatic emergency braking mandatory in vehicles.

Moreover, market participants' involvement in introducing new and improved systems and developing R&D dedicated to launching new technologies contributes to market growth during the forecast period. On the other hand, the increasing adoption of electric cars and the rising focus on autonomous vehicles are expected to boost the commercial growth potential of manufacturing companies in the near future.

The sudden emergence of COVID-19 disrupted the entire global automotive industry supply chain. The subsequent shutdown of assembly factories resulted in manufacturing disruptions and halted the export of Chinese components. In addition to this, the global travel prohibitions enforced by European, Asian, and North American governments have disrupted commercial collaboration and partnership chances.

The pandemic restricted the movement of people from one place to another. Moreover, due to the restrictions of the limited workforce at the production site, the automotive brake system was also affected from the supply side. With the lifting up of the lockdown, the market has begun to gain momentum. The automotive brake market is expected to grow significantly during the forecast period as manufacturers focus on innovative technologies such as regenerative braking and ABS.

Brakes have become a crucial part of any vehicle to ensure safety when the demand for speed is increasing consistently. However, the market is now making leaps of technical advancement about increasing safety concerns and government regulation. For instance, the Government of India has mandated an advanced braking system in all large vehicles.

Similarly, the National Highway Traffic Safety Administration (NHTSA), the Insurance Institute of Highway Safety, and 20 major vehicle manufacturers have committed to making Automatic Emergency Braking (AEB) a standard feature in all new automobiles starting in September 2022. In addition, innovation and development in advanced driver assistance systems (ADAS) will drive the market owing to the expenditures on Level 4 and Level 5 autonomous cars.

Level 4 and Level 5 autonomous vehicles require some human interaction. Hence, technologically advanced braking systems will be essential to an autonomous vehicle's safe and secure functioning. Automobile makers always develop better products to make driving more fun while remaining safe. Market players such as ZF Friedrichshafen AG, Advics Co. Ltd., Haldex, and Web Co., among others, are regularly designing electronic stability control, anti-collision technologies, and advanced anti-lock braking systems to create better and safer automobiles. For instance, Continental AG developed a third-generation anti-lock braking system (ABS) that adjusts the vehicle speeds while providing safer, more regulated, and optimum braking performance.

Recent advancements in vehicle technology and aerodynamic design have enabled more efficient utilization of engine power to achieve faster speeds. Furthermore, advanced braking systems are emerging, such as Electronic Stability Control (ESC), Traction Control (TC), and Electronic Brake Force Distribution (EBD). Manufacturers across the world are investing in R&D to bring out state-of-the-art technology. This indicates a potential for manufacturers and vendors to grow throughout the forecast period.

Several constraints and roadblocks will impede overall market expansion. Electronic braking systems' expensive research, as well as their high installation and maintenance costs, are constraining market expansion. Nonetheless, technological advancements, such as regenerative braking, the advent of the brake-by-wire system, and untapped potential in emerging countries, offer growth opportunities. Moreover, high repair and maintenance costs for technologically advanced brakes are anticipated to hinder the growth of the automotive brake system market.

Type Insights

The automotive brake system market, based on type, is segmented into drum brakes and disc brakes. The disc brake segment held the largest market share of 61.1% in 2022. In recent years, the application of disc brakes has grown significantly. The growth of disc brakes is attributed to their capacity to work in adverse weather conditions without overheating or fading. Additionally, its compatibility with other advanced systems is further propelling the growth of the disc brake segment.

The drum brake segment mainly comprises multiple gas extractors and is estimated to exhibit a significant CAGR of 3.5% over the forecast period. Drum brakes have an enclosed design and employ circular components (brake shoes) to provide the necessary friction for lowering speed. In contrast, disc brakes use a narrow rotor and caliper to stop wheel movement. As a result, performance suffers. Although disc-based systems have more braking power than drum-based systems, automakers choose drums because they are more cost-effective.

Vehicle Type Insights

The market based on the vehicle is segmented into commercial vehicles and passenger cars. Passenger cars dominated the market, with the highest revenue share of 72.5% in 2022. Passenger cars are increasing due to population growth, disposable income, and urbanization.

Manufacturers tend to develop a braking system more efficiently for more safety features. The ADAS is the most important element influencing the passenger car's primary market share and growth. Furthermore, growing expenditures in ADAS are expected to influence the brake systems market due to an increase in the requirement for electromagnetic induction braking systems in automobiles, motorcycles, and other vehicles during the forecast period.

Similarly, many manufacturers are developing different variants of the braking system aimed at offering increased braking power in multiple terrain types. The manufacturers are prioritizing reducing the weight of the brake system, which has led to the development of high-performance, lighter braking systems in the market.

On the other hand, the commercial vehicles segment is expected to grow at a significant CAGR of 4.5% over the forecast period. The global demand for commercial vehicles, such as trucks, buses, and vans, has steadily increased. This growth can be attributed to expanding e-commerce, rising logistics and transportation needs, and growth in industries like construction and mining. As the commercial vehicle fleet expands, the demand for reliable and efficient braking systems also grows.

Technology Insights

The market based on technology is segmented into antilock brake systems (ABS), traction control systems, electronic stability control, and electronic brake-force distribution. Electronic Stability Control (ESC) dominated the market with the highest revenue share of 32.6% in 2022. Electronic stability control technology is becoming more widely adopted because of its perceived benefits in regaining vehicle control in an emergency. Therefore, it is expected to drive the growth of the market during the forecast period.

The ABS segment held a significant CAGR of e of 32.3% over the forecast period. The growth of ABS technology is due to the aggressive efforts of several automobile groups toward the mandated deployment of ABS in key regions.

The Traction Control System (TCS) segment is expected to witness significant growth of CAGR of 6.6%. The TCS technology provides added safety by ensuring traction in difficult driving conditions. TCS is generally used with an anti-lock braking system for efficient work. Traction control stops the wheel spin by applying brake pressure by ABS and controlling the throttle. As a result, automakers could acquire a better New Car Assessment Program (NCAP) rating for a car by including advanced braking systems.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 58.1% in 2022. Due to the availability of low-cost labor and raw materials, regional firms offer significant cost savings. Furthermore, countries such as China and India, among others, are the automotive manufacturing hub. The rising popularity of automotive brake systems and increased sales of luxury and premium automobiles are expected to drive market growth. Moreover, the increasing number of accidents and the surge in automobile sales contribute to the overall market growth.

North America is expected to grow at the fastest CAGR of 5.7% during the forecast period. The growing desire for better performance of vehicles in adverse weather, the presence of major car manufacturers, and growth in the supply of light commercial vehicles and passenger cars have driven the expansion of the market in this region. Furthermore, since 2018, the mandated installation of ESC technology in all light cars has driven regional market growth.

Key Companies & Market Share Insights

The firms are largely concerned with producing environmentally friendly, dependable, and durable braking systems. These players invest heavily in research and development to innovate new technologies for braking systems.

To increase their market share and ensure healthy growth, the major companies have made significant expenditures in research and development. Furthermore, they are aggressively working to expand its geographical footprint and increase its production capabilities. For instance, In April 2020, Veoneer announced an initial agreement to transfer its braking control business in the United States to ZF Friedrichshafen AG for global market development.

Many players are also entering the aftermarket for automotive brake systems. The brake system aftermarket has opened lucrative avenues for market growth worldwide. For instance, Ferdinand Bilstein GmbH Co. KG is a renowned aftermarket part supplier in more than 170 countries worldwide. The company offers top-quality commercial vehicle brake components based on various requirements and loads of vehicles.

Key Automotive Brake System Companies:

- AKEBONO BRAKE INDUSTRY CO., LTD.

- ZF Friedrichshafen AG

- ADVICS CO.,LTD.

- Hitachi Astemo, Ltd.

- Brembo S.p.A

- Robert Bosch GmbH

- AISIN CORPORATION

- Haldex

- The Web Co

- NISSIN KOGYO Co., Ltd

Recent Developments

-

In June 2023, EBC Brakes Racing unveiled its latest offering, fully-floating two-piece discs high-performance brake pad options, custom-designed for the new G87 BMW M2. With this release, EBC Brakes Racing takes the lead as one of the first companies to provide aftermarket performance components for this much-anticipated vehicle. Introducing these cutting-edge braking solutions showcases EBC Brakes Racing's dedication to catering to enthusiasts and performance-oriented drivers, offering top-of-the-line products to enhance their driving experience.

-

In March 2023, SSAB and MENETA have jointly announced a significant milestone in the automotive industry by introducing the world's first automotive brake components and sealing materials manufactured using fossil-free steel. The collaboration between SSAB, a global leader in high-strength steel production, and MENETA, a leading supplier of braking solutions, demonstrates their commitment to reducing carbon emissions and transitioning to more sustainable materials. By utilizing fossil-free steel, which is produced using renewable energy sources, the companies can significantly reduce the carbon footprint associated with the manufacturing of brake components and sealing materials.

-

In September 2022, Brembo introduced the ENESYS Energy Saving System, designed specifically for Light Commercial Vehicles (LCVs), in the Aftermarket segment. This innovative system aims to reduce wear and tear on brake pads and discs, offering enhanced durability and longevity. With the introduction of the ENESYS Energy Saving System, Brembo addresses the specific needs of LCVs, providing a solution that helps optimize brake performance and reduce maintenance costs.

-

In July 2022, Gold Phoenix and Brembo entered into a joint venture agreement to launch a new company called Shandong BRGP Friction Technology Co., Ltd., subject to local and antitrust requirements. The new facility will focus on developing advanced brake pads that cater to the needs of next-generation vehicles, ensuring exceptional performance, comfort, and durability. By collaborating, Brembo and Gold Phoenix aim to provide cutting-edge braking solutions for the automotive aftermarket.

-

In April 2022, Faraday Future Intelligent Electric Inc. revealed Brembo as the primary supplier of the complete brake caliper assembly for its highly advanced FF 91 electric vehicle (EV). By partnering with Brembo, Faraday Future emphasizes its commitment to integrating top-tier braking systems into its luxury FF 91 EV. Brembo's expertise in braking technology ensures that the FF 91 will benefit from high-performance and reliable braking capabilities.

Automotive Brake System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 50.06 billion

Revenue forecast 2030

USD 72.70 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, vehicle type, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AKEBONO BRAKE INDUSTRY CO., LTD.; ZF Friedrichshafen AG, ADVICS CO.,LTD., Hitachi Astemo, Ltd., Brembo S.p.A, Robert Bosch GmbH, AISIN CORPORATION, Haldex, The Web Co, NISSIN KOGYO Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Brake System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive brake system market report on the basis of type, vehicle type, technology, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Disc Brakes

-

Drum Brakes

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Anti-Lock Brake System (ABS)

-

Traction Control System (TCS)

-

Electronic Stability Control (ESC)

-

Electronic Brake-Force Distribution (EBD)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive brake system market size was estimated at USD 47.75 billion in 2022 and is expected to reach USD 50.06 billion in 2023.

b. The global automotive brake system market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 72.70 billion by 2030.

b. Asia Pacific dominated the automotive brake system market and witnessed a share of over 58% in 2022. The market for automotive brake systems is expected to rise significantly, owing to increased demand for passenger and commercial vehicles in countries such as India and China. In addition, factors such as the implementation of strict safety standards, the adoption of luxury automobiles, and the increased adoption of disc brakes in commercial vehicles are propelling the market growth.

b. Some key players operating in the automotive brake system market include Advics Co. Ltd., Akebono Brake Industry Co., Hitachi Automotive System, Aisin Seiki Co. Ltd., and Robert Bosch GmbH among others.

b. Key factors that are driving the automotive brake system market growth include the implementation of enhanced vehicle safety systems due to stringent safety regulations and the market participants' involvement in the introduction of new and improved brake systems in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.