- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Automotive Ceramics Market Size, Industry Report, 2030GVR Report cover

![Automotive Ceramics Market Size, Share & Trends Report]()

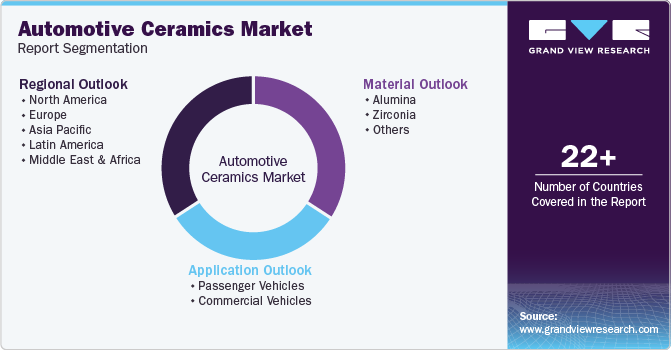

Automotive Ceramics Market Size, Share & Trends Analysis Report By Material (Alumina, Zirconia), By Application (Passenger Vehicles, Commercial Vehicles), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-696-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Automotive Ceramics Market Size & Trends

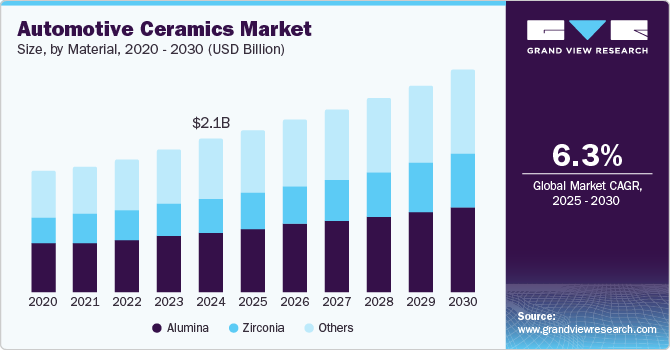

The global automotive ceramics market size was valued at USD 2.07 billion in 2024 and is anticipated to grow at a CAGR of 6.3% from 2025 to 2030. This growth is attributed to the increasing demand for lightweight materials, which enhance fuel efficiency and reduce emissions, particularly in electric vehicles. In addition, advancements in ceramic manufacturing technology improve ceramic components' performance and cost-effectiveness. Furthermore, stringent environmental regulations push manufacturers to use ceramics for durability and endurance. Moreover, the growing integration of ceramics in automotive electronics and engine parts further propels market growth, reflecting the industry's shift towards sustainable and efficient materials.

Automotive ceramics refer to advanced structural materials utilized in producing various automotive components, known for their durability, lightweight characteristics, and high thermal and electrical resistance. The rising consumer preference for alternatives to traditional metals and plastics significantly influences the automotive sector. As automakers face challenges in sourcing raw materials and meeting performance standards, there is a growing focus on lightweight components to enhance fuel efficiency. Substituting heavy steel and iron with advanced composites such as ceramics, aluminum, and magnesium improves vehicle performance and aligns with the demand for environmentally friendly solutions.

Furthermore, the push for low-cost production technologies is fostering market growth. Manufacturers are keen on developing affordable innovations to cater to the increasing need for lightweight vehicles. Due to their high melting points and durability, ceramics are integrated into various automotive applications, including knock sensors, valve systems, and exhaust components.

Moreover, technological advancements in production methods are also key drivers of this market expansion. The combination of superior mechanical properties and cost-effectiveness makes ceramics an attractive option for automotive manufacturers aiming to produce lighter vehicles without compromising safety or performance. As research continues to evolve, the role of ceramics in automotive manufacturing is set to increase, supporting the industry's transition towards more sustainable practices while meeting consumer demands for efficient and reliable vehicles.

Material Insights

Alumina materials dominated the market and accounted for the largest revenue share of 39.6% in 2024, primarily driven by their exceptional thermal and electrical properties, which make them ideal for various automotive applications, including sensors and engine components. In addition, the increasing demand for lightweight materials to enhance fuel efficiency and reduce emissions further propels the use of alumina. Furthermore, its superior wear resistance also contributes to lower vibrations and noise levels in electric and hybrid vehicles, enhancing overall performance and safety.

The zirconia materials are expected to grow at a CAGR of 8.1% over the forecast period, driven by their unique properties. Zirconia ceramics are known for their high strength, toughness, and thermal stability, making them suitable for critical automotive applications such as fuel cells and advanced electronic components. In addition, the rising adoption of electric vehicles drives demand for zirconia due to its effectiveness in high-temperature environments. Furthermore, advancements in manufacturing technologies are enhancing the cost-effectiveness of zirconia ceramics, encouraging their integration into more automotive applications, thus supporting the overall growth of this segment in the automotive ceramics market.

Application Insights

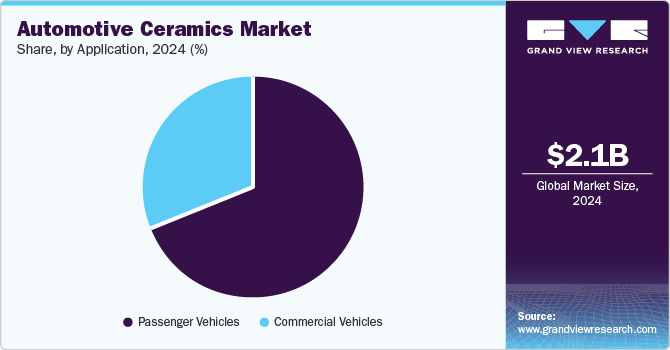

The passenger vehicles segment led the market and accounted for the largest revenue share of 69.3% in 2024. This growth is attributed to increasing consumer demand for safer, more efficient, and environmentally friendly vehicles. As manufacturers strive to meet stringent emission regulations, they incorporate more ceramic components to enhance vehicle performance and compliance. The trend towards lightweight materials to improve fuel efficiency also supports using ceramics in passenger vehicles. Furthermore, the rise of electric and hybrid passenger cars necessitates advanced materials for batteries and electronic systems, significantly boosting the adoption of ceramics in this segment.

The commercial vehicle application segment is expected to grow at a CAGR of 5.9% from 2025 to 2030, owing to the expanding logistics and transportation sectors that require durable and efficient vehicles. In addition, with rising demands for fuel efficiency and lower emissions, manufacturers increasingly turn to automotive ceramics for their lightweight properties and thermal stability. Furthermore, ceramics are utilized in various components such as exhaust, braking, and engine parts, enhancing overall vehicle performance. Moreover, the transition towards electric commercial vehicles drives the need for advanced ceramic materials in power electronics and battery systems, further propelling growth in this segment of the automotive ceramics market.

Regional Insights

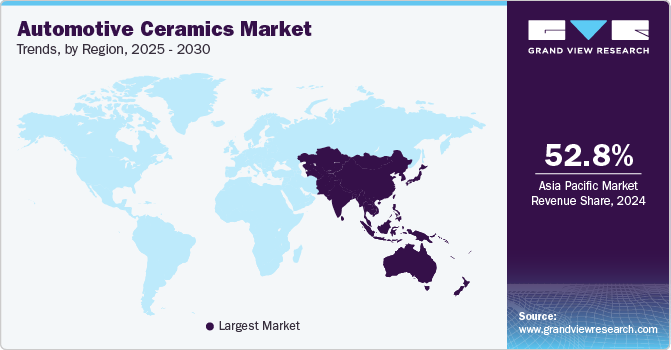

The Asia Pacific automotive ceramics market dominated the global market and accounted for the largest revenue share of 52.8% in 2024. This growth is attributed to its robust automotive manufacturing base, particularly in countries such as China, Japan, and South Korea. In addition, the region benefits from rising disposable incomes and urbanization, which lead to increased vehicle demand. Furthermore, stringent emission regulations are pushing manufacturers to adopt advanced materials, including ceramics, for improved fuel efficiency and performance. Moreover, the commitment to innovation and the shift towards electric vehicles further enhance the market's expansion in this region.

China Automotive Ceramics Market Trends

The automotive ceramics market in China held the dominant position within the Asia Pacific market and accounted for the largest revenue share in 2024, driven by rapid economic growth and a burgeoning middle class. In addition, this increasing demand for both conventional and electric vehicles drives the need for advanced materials. Furthermore, china's heavy investment in manufacturing technologies and adherence to strict emission standards support the adoption of ceramic components, making it a key player in the automotive ceramics landscape.

Middle East & Africa Automotive Ceramics Market Trends

The Middle East and Africa automotive ceramics market is expected to grow at a CAGR of 6.3% over the forecast period, owing to increasing investments in infrastructure and transportation. As countries in this region focus on diversifying their economies beyond oil dependency, there is a growing interest in developing local automotive industries. Furthermore, the adoption of advanced materials such as ceramics is gaining traction due to their lightweight properties and ability to enhance vehicle performance. Moreover, government initiatives to boost local manufacturing capabilities also contribute to market growth.

North America Automotive Ceramics Market Trends

The automotive ceramics market in North America is expected to grow significantly over the forecast period, primarily driven by the advancements in electric vehicle technology. In addition, the presence of major automotive manufacturers and a strong consumer preference for fuel-efficient vehicles drive demand for ceramic components. Furthermore, rising fuel prices have also increased interest in energy-efficient solutions, further propelling the market.

The U.S. automotive ceramics market led the North American market and accounted for the largest revenue share in 2024. This growth is attributed to technological advancements by companies such as Tesla and traditional automakers innovating toward electric vehicles. In addition, with high living standards and disposable incomes, consumers increasingly opt for energy-efficient vehicles. Furthermore, the recent surge in fuel prices has further heightened this trend, prompting manufacturers to integrate ceramic components that enhance performance and reduce weight, thereby supporting the overall growth of the automotive ceramics market.

Europe Automotive Ceramics Market Trends

The growth of Europe automotive ceramics market is expected to be driven by stringent environmental regulations aimed at reducing emissions. The region's commitment to sustainable transportation solutions drives demand for lightweight materials such as ceramics that improve fuel efficiency. Furthermore, the rise of electric vehicles necessitates advanced materials for battery systems and electronic components. Moreover, the presence of leading automotive manufacturers focused on innovation further enhances the adoption of ceramics across various applications within this market.

Key Automotive Ceramics Company Insights

Key players in the global automotive ceramics market are adopting various strategies to enhance their competitive edge. These strategies include launching innovative products that meet evolving consumer demands and regulatory standards. In addition, partnerships and collaborations with technology firms are being pursued to leverage advanced manufacturing techniques and improve product offerings. Furthermore, companies are also focusing on expanding their geographic presence through strategic acquisitions and investments, ensuring they can cater to diverse markets while enhancing their research and development capabilities for future advancements in automotive ceramics.

-

CoorsTek produces various ceramic components, such as sensors, engine parts, and thermal management solutions. Operating within the automotive ceramics segment, the company focuses on delivering high-performance materials that enhance vehicle efficiency, safety, and durability. Their extensive portfolio includes alumina, zirconia, and silicon carbide products tailored to meet the specific needs of automotive manufacturers and promote innovation in vehicle design.

-

CeramTec offers advanced ceramic materials and components designed for high-performance applications. The company manufactures engine parts, exhaust systems, and electronic components that leverage ceramics' unique properties. Operating primarily in the automotive ceramics segment, CeramTec provides solutions that improve fuel efficiency, reduce emissions, and enhance overall vehicle performance.

Key Automotive Ceramics Companies:

The following are the leading companies in the automotive ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- Morgan Advanced Materials

- CoorsTek

- NGK Spark Plug Co., Ltd.

- CeramTec

- Kyocera

- Corning Incorporated

- Ceradyne

- IBIDEN Co. Ltd.

- Saint Gobain Ceramic Materials

View a comprehensive list of companies in the Automotive Ceramics Market

Recent Developments

-

In May 2023, CeramTec introduced the Rubalit ZTA, a high-performance ceramic substrate tailored for electromobility and power generation applications with exceptional flexural strength, thermal conductivity, and electrical insulation. This Zirconia-Toughened Alumina substrate boasts a 40% increase in flexural strength compared to traditional aluminum oxide, enhancing the durability of power electronic modules. With thermal conductivity exceeding 26 W/mK and dielectric strength of 25 kV/mm, Rubalit ZTA is positioned as a superior alternative in automotive ceramics and other electrified industries.

-

In March 2023, Zircotec launched the Primary Gunmetal Grey, an affordable ceramic coating designed for automotive applications, particularly exhaust systems. This innovative product offers up to 25% reduction in surface temperatures and operates at a maximum of 900°C. It combines thermal barrier properties with corrosion resistance, making it suitable for daily drivers and show cars. The coating enhances aesthetics while providing effective heat protection, reinforcing Zircotec's reputation in automotive ceramics for over 25 years.

Automotive Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.19 billion

Revenue forecast in 2030

USD 2.97 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Germany, France, UK, Russia, China, India, Japan, South Korea, Brazil, South Africa, Iran

Key companies profiled

Morgan Advanced Materials; CoorsTek; NGK Spark Plug Co., Ltd.; CeramTec; Kyocera; Corning Incorporated; Ceradyne; IBIDEN Co. Ltd.; Saint Gobain Ceramic Materials

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Ceramics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global automotive ceramics market report based on material, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Alumina

-

Zirconia

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

Iran

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."