- Home

- »

- Plastics, Polymers & Resins

- »

-

Silica Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Silica Market Size, Share & Trends Report]()

Silica Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Amorphous, Crystalline), By End-use (Building & Construction, Glass Manufacturing, Oil & Gas, Water Treatment), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-064-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Silica Market Summary

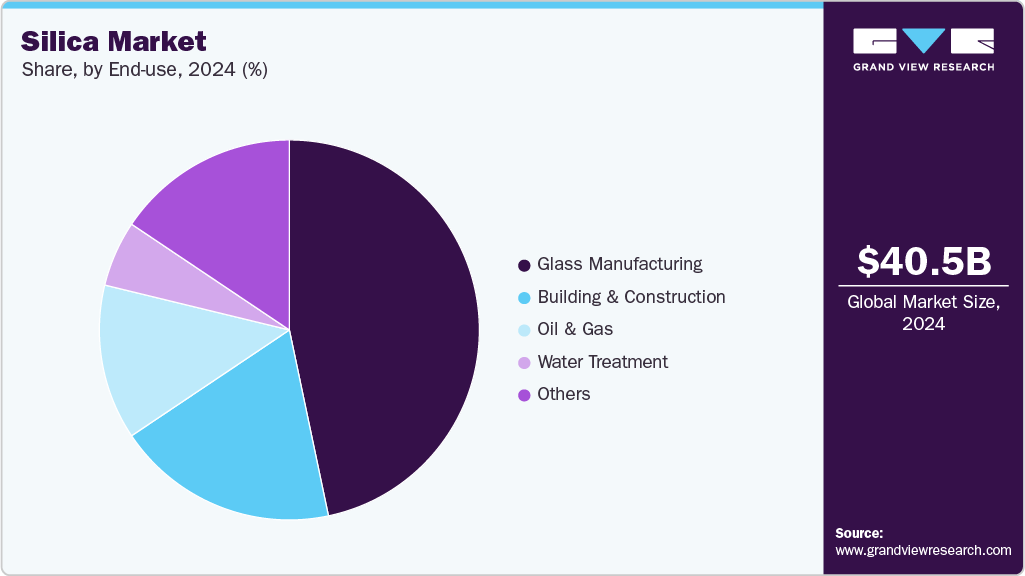

TThe global silica market size was estimated at USD 40.46 billion in 2024 and is projected to reach USD 85.86 billion by 2033, growing at a CAGR of 9.1% from 2025 to 2033. Encompasses various forms of silica, including precipitated, fumed, gels, sols, and fumes.

Key Market Trends & Insights

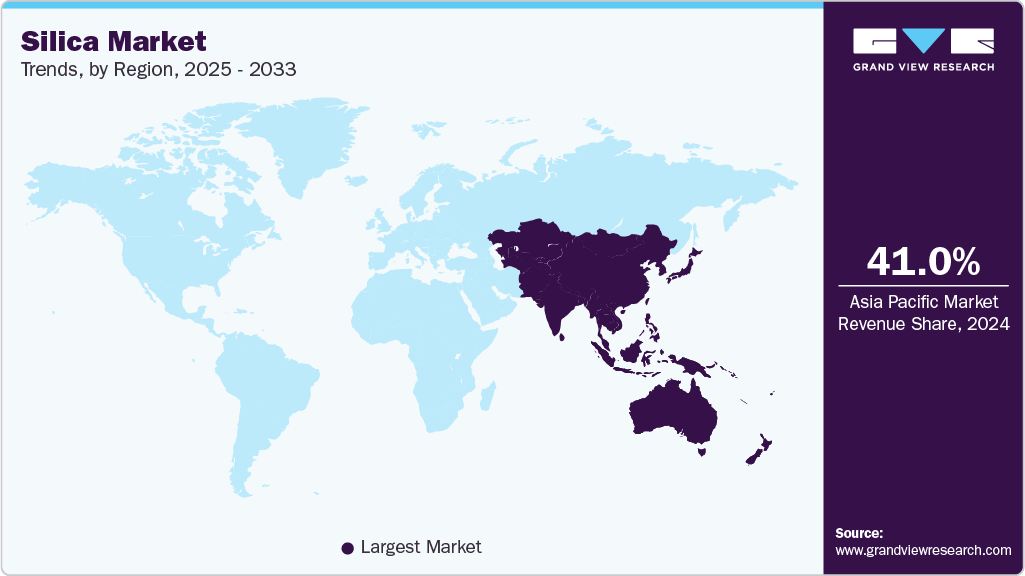

- Asia Pacific dominated the silica market with a revenue share of 41.6% in 2024.

- U.S. dominated the North America silica market with a revenue share of 78.0% in 2024.

- By product, crystalline segment dominated the market with a revenue share of over 71.0% in 2024.

- By end-use, the glass manufacturing segment held the largest share of over 46.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 40.46 billion

- 2033 Projected Market Size: USD 85.86 billion

- CAGR (2025-2033): 9.1%

- Asia Pacific: Largest market in 2024

The growing demand from the rubber industry serves as a key driver of market expansion. It plays a vital role in enhancing the performance of rubber products by providing superior abrasion resistance, tensile strength, and flex fatigue durability. Its extensive use in tire manufacturing is attributed to its ability to strengthen the bond between rubber and metallic reinforcements, thereby improving tear resistance. Rapid economic development, increased government infrastructure spending, and rising consumer preference for personal vehicles drive the automotive sector's growth and fuel its demand. For instance, Japan's preparations for Expo 2025 in Osaka have significantly accelerated construction activity, including large-scale projects such as the Yaesu redevelopment, which features a 390-meter, 61-story office tower slated for completion between 2023 and 2027.

Simultaneously, the construction industry has emerged as a significant end-user, particularly in fumes that enhance concrete strength, durability, and longevity. The growing need for high-performance construction materials is a key factor propelling market demand. In Asia Pacific, infrastructure development continues to surge, driving the paints and coatings sector and increasing the use of silica-based products. For example, in 2025, India launched the "Urban Infrastructure Development Plan" with an investment of over USD 11 billion to modernize smart cities and develop affordable housing across major urban centers.

Moreover, Southeast Asian countries are making substantial investments in infrastructure that are expected to contribute significantly to their consumption. For instance, in 2025, Vietnam unveiled a USD 10 billion infrastructure investment strategy focusing on expressways, urban transport systems, and industrial zones. These developments will strengthen demand across construction and allied sectors during the forecast period.

Drivers, Opportunities & Restraints

The market is witnessing strong growth driven by rising demand across various end use industries, particularly automotive, construction, electronics, and personal care. In the automotive sector, it is increasingly used in producing high-performance tires due to its ability to enhance fuel efficiency, grip, and overall tire durability. In construction, its fumes are vital for making high-strength, durable concrete used in modern infrastructure projects. In addition, the expanding use of precipitated form in adhesives, paints and coatings enhances product performance regarding rheological control and durability. The electronics sector is also a major driver, with its use in semiconductors and insulation materials. Rising urbanization, infrastructure modernization, and industrial expansion in emerging economies will propel demand further.

Regulatory emphasis on sustainable and low-emission products also shifts manufacturers toward silica-based solutions. These diverse applications provide a solid foundation for the market's growth trajectory. Significant opportunities in the market stem from the global push toward sustainability, particularly in the automotive industry. Green tire manufacturing is gaining momentum, and it is favored over carbon black due to its eco-friendly profile and superior performance characteristics, such as reduced rolling resistance and improved wet traction.

The rise of electric and hybrid vehicles (EVs) further strengthens their role in developing lightweight and energy-efficient components. Moreover, rapid urbanization and large-scale infrastructure investments in emerging markets like India, Vietnam, Indonesia, and African nations are expanding the scope for use in construction, paints, and coatings. The personal care and cosmetics industry is another promising segment, with increasing demand in skincare and oral care formulations due to its exfoliating and thickening properties. Nanotechnology and product customization advancements are also expected to unlock new application areas. Collaborations between R&D firms and industrial users may further accelerate innovation and market penetration.

Carbon black poses a key restraint to growth. Due to its lower cost and established global supply chains, carbon black has long been used as a reinforcing filler in rubber-based products such as tires, hoses, belts, and automotive components. Its mechanical reinforcement and UV-protection properties make it a preferred material for many manufacturers. Moreover, carbon black's dominance in traditional tire manufacturing continues to challenge its market penetration, particularly in price-sensitive markets.

Transitioning from carbon black to silica often requires re-engineering product formulations and manufacturing processes, which can increase initial costs. Furthermore, producing high-purity silica requires energy-intensive processes, potentially raising concerns around environmental impact and operational costs. However, as regulatory norms around carbon emissions tighten and consumer preferences shift toward greener alternatives, the reliance on carbon black is gradually diminishing, offering silica a long-term advantage despite current restraints.

Product Insights

The crystalline silica dominated the market with a revenue share of over 71.0% in 2024. Crystalline silica, particularly in the form of quartz, holds the largest revenue market share due to its high hardness, thermal stability, and chemical inertness. It offers excellent mechanical strength and is ideal for construction materials like concrete, mortar, and tiles. Its high melting point and weather resistance make it suitable for foundry applications, glassmaking, and ceramics. Its crystalline form also exhibits abrasive properties, enabling its use in industrial abrasives and sandblasting. However, due to its delicate particulate nature, it requires careful handling to mitigate respiratory health risks.

Amorphous silica, typically derived from diatomaceous earth, rice husk ash, and synthetic production, is known for its non-crystalline structure, high surface area, and chemical stability. It is widely used in rubber, paints and coatings, personal care, and food processing due to its reinforcing, thickening, and anti-caking properties. Its high porosity makes it effective in filtration and insulation applications, while its inert and non-toxic nature ensures safe use in pharmaceuticals and cosmetics. Its amorphous form is also critical in agriculture as a soil additive and pest control agent, promoting plant health without harmful residues.

End-use Insights

The glass manufacturing segment accounted for over 46.0% of the market revenue in 2024, making it the largest end-use sector. It is the primary raw material in glass production due to its high purity, chemical stability, and melting point. It is used extensively in the production of container glass (bottles and jars), flat glass (used in windows and mirrors), fiberglass (for insulation and reinforcement), and specialty glass for electronics, optics, and laboratory equipment. It ensures transparency, strength, and thermal resistance in glass products, making it indispensable to industrial and consumer applications. Growth in the construction, automotive, and packaging sectors continually fuels the demand for glass, thereby supporting the market.

The building & construction industry also holds a significant share in the market, driven by increasing infrastructure development and urbanization across regions. It is used as fumes and sand to enhance high-performance concrete and mortars' durability, strength, and chemical resistance. It is also a key component in ceramic tiles, adhesives, grouts, sealants, bricks, and fiber cement boards. Furthermore, its amorphous form is utilized in paints, coatings, and waterproofing agents to improve weather resistance and adhesion. The rise in sustainable and green construction practices has further driven the use of engineered materials, especially in energy-efficient buildings.

It plays a vital role in the oil and gas industry, particularly in drilling operations. It is primarily used as a proppant in hydraulic fracturing, where sand (also known as frac sand) is injected into rock formations to keep fractures open, allowing oil and gas to flow more freely. In addition, it is utilized in drilling muds to control pressure and stabilize boreholes. Its thermal stability and chemical inertness suit high-temperature and high-pressure environments encountered during exploration and production. Furthermore, silica-based materials are used in cementing operations to enhance wellbores' mechanical strength and durability.

Regional Insights

The silica market in North America accounted for a significant market revenue share in 2024. The region's growing construction sector continues to fuel demand for it across multiple applications, including concrete, paints and coatings, and adhesives and sealants. Furthermore, the surge in tire demand is significantly boosting usage in rubber applications within the U.S. According to a 2025 update from the U.S. Tire Manufacturers Association (USTMA), tire shipments for passenger vehicles and light trucks are projected to reach record levels, driven by increased vehicle usage and replacement demand. This upward trend will sustain the demand across the North American market in the coming years.

U.S. Silica Market Trends

U.S. dominated the revenue share of over 78.0% in 2024, the North America silica market. The silica market in the U.S. is experiencing steady growth, driven by strong demand from the construction, automotive, oil & gas, and glass manufacturing sectors. Industrial sand, particularly frac sand, continues to dominate due to its extensive use in hydraulic fracturing. Moreover, the growing adoption of green tires and electric vehicles has significantly boosted the demand for specialty in tire production, such as precipitated and fumed silica. Increased activity across major U.S. cities also contributes to increased consumption of high-performance concrete and eco-friendly coatings.

Asia Pacific Silica Market Trends

The silica market in Asia Pacific led in 2024, accounting for over 41.0% of the total revenue, driven by rapid industrialization, rising infrastructure investments, and growing automotive consumption. As of 2025, Asia Pacific remains dominant, supported by large-scale urban development projects and robust demand from end-use industries. According to the latest data from the International Organization of Motor Vehicle Manufacturers (OICA), Asia Pacific remains the world’s largest producer of motor vehicles, with countries such as China, India, Japan, and South Korea contributing significantly to global output.

Europe Silica Market Trends

The silica market in Europe is expected to grow significantly from 2025 to 2033 due to environmental regulations such as the Paints Directive 2004/42/EC, implemented by the European Commission to limit volatile organic compound (VOC) emissions. The shift toward low-VOC and sustainable paint formulations encourages the adoption of eco-friendly additives, including silica. In 2025, several European coatings manufacturers announced new product lines featuring low-VOC and silica-enhanced formulations in response to tightening environmental regulations. In addition, Europe's position as a leading consumer and exporter of agrochemicals, particularly in countries like France, Germany, and the Netherlands, continues to drive its demand in agricultural formulations. The region's emphasis on sustainable agriculture and crop protection will further support market growth during the forecast period.

Key Silica Company Insights

Some of the key players operating in the market include Cabot Corporation, Evonik Industries AG, Wacker Chemie AG, and Solvay SA.

-

Evonik is one of the world’s largest silica producers, offering a comprehensive range of precipitated and fumed forms under the ULTRASIL, SIPERNAT, and AEROSIL brands. Its products are widely used in automotive tires, pharmaceutical formulations, food processing, and cosmetics. With strong R&D capabilities and a global production network, Evonik continues to lead innovation in high-performance materials.

-

Cabot is a U.S.-based multinational known for its fumed silica and specialty materials. It is extensively used in rubber reinforcement, industrial sealants, coatings, and insulation technologies. Cabot focuses on sustainability and circular material practices, making it a preferred choice in eco-conscious industries.

-

Wacker produces fumed silica under the HDK brand, targeting sectors such as construction chemicals, personal care, silicone rubber, and battery systems. The company is highly invested in developing EV and energy storage applications, aligning with global clean energy trends.

-

Solvay is a major player in precipitated silica, producing energy-efficient tire-grade materials under its ZEOSIL brand. It caters to the automotive, oral care, and food industries. Solvay emphasizes reducing CO₂ emissions in its manufacturing processes and expanding its presence in Asia and North America.

Key Silica Companies:

The following are the leading companies in the silica market. These companies collectively hold the largest market share and dictate industry trends.

- Cabot Corporation

- Evonik Industries AG

- Imerys S.A.

- Nissan Chemical Corp.

- Oriental Silicas Corp.

- PPG Industries Inc.

- Solvay SA

- Tosoh Corporation

- W.R. Grace & Co.

- Wacker Chemie AG

Recent Developments

-

In 2025, Evonik announced the expansion of its silica plant in Thailand to meet rising demand for green tire materials in Southeast Asia. The company also introduced a next-generation AEROSIL product optimized for lithium-ion battery separators and cosmetic formulations, enhancing thermal stability and performance.

-

Cabot inaugurated a new fumed silica production unit in Texas, USA, to enhance its domestic supply capabilities. It also partnered strategically with an EV battery manufacturer to supply fumed silica for advanced gel electrolytes, further expanding into the energy storage space.

-

In early 2025, Wacker began commercial production at its new HDK fumed silica facility in South Korea, strategically located to serve Asia's growing electronics and coatings markets. The plant focuses on producing high-purity grades suitable for semiconductors and specialty adhesives.

-

Solvay launched a new low-carbon precipitated silica line in its plant in France as part of its “Green Materials 2030” initiative. The 2025 development includes integrating biomass-based energy into silica production, aimed at reducing emissions by 30% over the next five years.

Silica Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.92 billion

Revenue forecast in 2033

USD 85.86 billion

Growth rate

CAGR of 9.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; Turkey; China; India; Japan; South Korea; Brazil

Key companies profiled

Cabot Corporation; Evonik Industries AG; Imerys S.A.; Nissan Chemical Corp.; Oriental Silicas Corp.; PPG Industries Inc.; Solvay SA; Tosoh Corporation; W.R. Grace & Co.; Wacker Chemie AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silica Market Report Segmentation

This report forecasts revenue growth globally, nationally, and regionally from 2021 to 2033 and analyzes the latest trends in each sub-segment. For this study, Grand View Research has segmented the global silica market report by product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Amorphous

-

Crystalline

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Building & Construction

-

Oil & Gas

-

Glass Manufacturing

-

Water Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global silica market size was estimated at USD 40.46 billion in 2024 and is expected to reach USD 42.92 billion in 2025.

b. The global silica market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2033, reaching USD 85.86 billion by 2033.

b. By product, crystalline silica dominated the market with a revenue share of over 71.0% in 2024.

b. Some of the key vendors in the global silica market are Cabot Corporation, Evonik Industries AG, Imerys S.A., Nissan Chemical Corp., Oriental Silicas Corp., PPG Industries Inc., Solvay SA, Tosoh Corporation, W.R. Grace & Co., and Wacker Chemie AG.

b. The silica market is witnessing strong growth driven by rising demand across various end-use industries, particularly automotive, construction, electronics, and personal care. In the automotive sector, silica is increasingly used in producing high-performance tires due to its ability to enhance fuel efficiency, grip, and overall tire durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.