- Home

- »

- Automotive & Transportation

- »

-

Automotive Engineering Services Outsourcing Market Report, 2030GVR Report cover

![Automotive Engineering Services Outsourcing Market Size, Share & Trends Report]()

Automotive Engineering Services Outsourcing Market Size, Share & Trends Analysis Report By Application, By Service (Designing, Prototyping), By Location (On-shore, Off-shore), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-635-6

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global automotive engineering services outsourcing market size was valued at USD 84.87 billion in 2022 and is expected to register a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. The rapid demand for advanced and enhanced connectivity solutions by the automotive manufacturers is driving the automotive engineering services outsourcing (ESO) market growth. The demand for enhanced connectivity solutions is rising due to its ability to offer various services, such as navigation, smart infotainment, passenger safety, and remote diagnostics.

The growing technological skills of Engineering Service Providers (ESPs) to deliver research and development (R&D) and product innovation in their offerings for vehicle positioning, connected automobiles, and guidance systems is expected to fuel the automotive ESO market growth. Furthermore, the rising initiatives by governments to deploy green vehicles for reducing harmful gas discharges are also propelling the automotive ESO market growth.

The automotive ESO industry evolved from delivering mechanical services to the integration of advanced technology solutions such as Artificial Intelligence (AI), the Internet of Things (IoT), and others. With the rapid integration of Information Technology (IT) in automobiles, an increase in advanced services was witnessed, accomplishing the commutation objectives and providing comfort, safety, and ease of use to the consumers. The IT-enabled the incorporation of various enhanced features such as Bluetooth and Wireless Local Area Network (WLAN) connectivity, navigation system, app connection, and other car information from sensors.

During the inception of procuring services from the Engineering Service Providers (ESPs), the automotive industry focused on mass production by combining standardization, synchronization, precision, continuity, and interchangeability. With the paradigm shift in the requirements of customers, companies now emphasize offering mass customization of automobile production engineering services.

The growing inclination of Original Equipment Manufacturers (OEMs) for digitalized solutions is anticipated to offer opportunities for automotive ESO market growth. This is attributed to the paradigm shift of end-users towards more technological solutions. The Autonomous, Connected, Electric, and Shared vehicles (ACES) disruptions is a digitalized model being adopted by the key players in the market to allow advanced mobility standards to enhance consumer's interaction and experience with vehicles.

Autonomous driving evolved through the Advanced Driver Assistance Systems (ADAS), including pedestrian detection, collision warning, and others. The connected systems enable processing data in the cloud and at the edge from a growing suite of endpoint sensors to enhance vehicle reliability and passenger safety, boost fleet efficiency, enable maintenance schedules, and offer information to smart city planners and other road users about the travel.

Considering the ongoing trend of convenience preferred by the end-users, automobile manufacturers have started offering lightweight vehicles to provide better driving performance, minimize environmental pollution, improve fuel efficiency, and reduce fuel cost and car repair frequency. For instance, in November 2019, FEV Group GmbH launched solutions and technologies for sustainable mobility at the Ninth Aachen Colloquium China Automobile and Engine Technology, a technical exhibition.

The company introduced a cost-efficient design kit for lightweight vehicle construction and design development for A00 vehicles with annual series production of up to 7,000 vehicles. Advanced materials, such as polymer composites, magnesium (Mg) alloys, high-strength steel, aluminum (Al) alloys, and carbon fibers, reduce the vehicle's body and chassis weight by 50 percent and support minimizing the vehicle's fuel consumption. With the use of lightweight materials in automobiles, vehicles can carry more integrated electronic systems, safety devices, and advanced emission control systems without adding to the vehicle's overall weight.

The outbreak of COVID-19 had a ripple effect on the global automotive industry. Disruptions in exports of automotive parts from China, the operations in the assembly plants were temporarily curtailed in the United States, and automotive manufacturing interruptions across Europe have resulted in the downturn in global automotive production.

According to the International Organization of Motor Vehicle Manufacturers (OICA), automotive production in 2020 was reduced to 15.8% as compared to 2019. Subsequently, the automotive Engineering Service Providers (ESPs) witnessed a decline in their sales as these companies were affected by assignment delays and postponements. The abrupt decline in the economic activities across the automobile sector as a result of customer-specific measures has created havoc in the automotive engineering service outsourcing industry in the medium and long run.

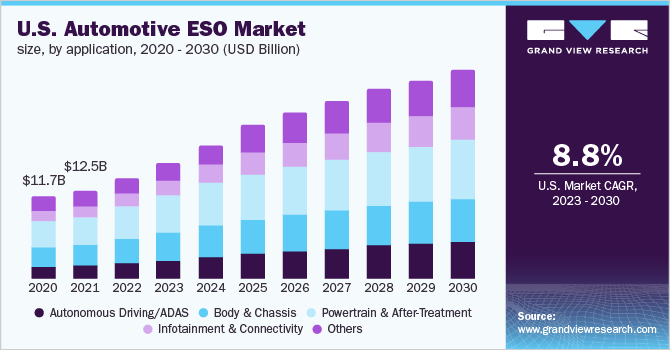

Application Insights

The powertrain and after-treatment segment registered for the largest revenue share of around 31.0% of the automotive ESO market in 2022. This is attributed to the electrification of powertrains as a replacement for Internal Combustion Engines (ICE) fueled by petroleum and gasoline that can minimize the impact of carbon emissions on the environment. The significant investments by OEMs in the powertrain technologies are anticipated to positively impact the growth of the powertrain and after-treatment segment.

Moreover, the adoption of autonomous driving/ADAS is expected to witness significant growth in the forecast period due to its ability to sense & identify its environment and offer a safe movement. ADAS comprises various sensors, including lidar, GPS, radar, inertial measurement units, and others that provide advanced sensory information and control systems to navigate paths.

The infotainment & connectivity segment is estimated to register the fastest CAGR growth of over 14.2% during the forecast period. This is attributed to the emerging needs of end-users for the incorporation of advanced digital solutions in vehicles. The connected cars offer movies, social media, music, voice control, and other features that provide suitability and ease to the user, thereby providing prospects to the ESPs.

Furthermore, the body & chassis segment accounted for substantial growth in the revenue share in 2022 due to the rapid production of green vehicles that reduce harmful emissions. The growing focus of end-users on safety and light vehicle structure is expected to drive the demand for chassis in the forecast period.

Service Insights

The prototyping segment accounted for the largest revenue share of more than 31.0% in 2022 and is expected to lead the automotive ESO market throughout the forecast period. This is attributed to the increased deployment of 3D printing technology by the automotive industry to design a prototype of an assembly, certain parts, or a model of an entire car. With the 3D printing technology, manufacturers can quickly identify loopholes in the prototype and take corrective measures timely, supporting a cost-efficient approach. Companies are increasingly deploying 3D CAD software to improve communications through documentation, increase the productivity of the design, create a database for manufacturing and improve the quality of design.

The testing segment is expected to register fastest expansion by a CAGR of more than 12% during the forecast period as ESPs are investing in the construction of new test centers in an attempt to expand and meet the increasing requirements for the automotive testing. For instance, in March 2019, Bertrandt AG expanded its high-voltage test center in Ehningen with an investment of USD 17 million to address the growing need for high-voltage test resources.

Moreover, the designing segment is anticipated to register a significant growth from 2023 to 2030. This is due to the growing investments by the manufacturers in designing research & development and collaborating with the engineering service providers to construct advanced automobile features for the consumers. To balance power-to-weight ratios, manufacturers are emphasizing production of the vehicles with elongated and spacious interiors.

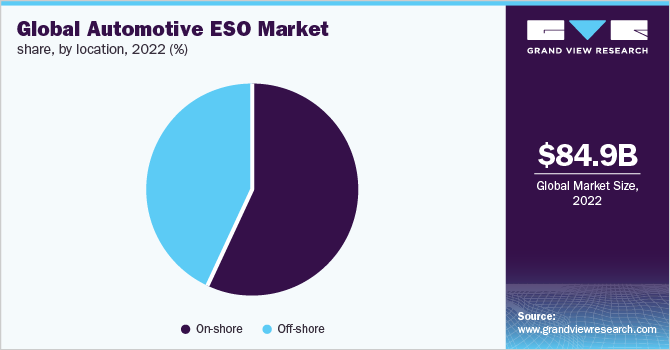

Location Insights

The on-shore segment accounted for the largest revenue share of around 58.0% of the overall market in 2022 and is expected to register the fastest growth in the forecast period. This is attributed to the emerging preferences of OEMs to collaborate with locally available ESPs. This will help in avoiding the risk as many other countries do not follow Intellectual Property protection copyright laws.

The challenges faced, such as different time zones, language barriers, imposed laws and regulations, and others, while dealing with ESPs from a foreign land, restrict OEMs to prefer outsourcing from other countries leading to significant growth in demand for the on-shore segment. Also, the increased adoption of automation technology and self-serve solutions has encouraged automobile OEMs to seek assistance from on-shore engineering service firms.

The off-shore segment is expected to register significant growth in the forecast period. This is attributed to the emerging preferences of OEMs to outsource services from low-cost countries such as India, China, Brazil, Mexico, and Ukraine. With maximum engineering graduates and appropriate skills compared to all other low-cost countries for ESO, India is majorly preferred by OEMs, driving the growth in this region. Ukraine, in Eastern Europe, is also emerging as a provider of autonomous services, especially for the American and European-based OEMs. This is owing to the availability of many ESPs or their development centers in Ukraine with low-cost software development.

Regional Insights

The Asia Pacific regional market accounted for the largest revenue share of around 42.0% of the automotive ESO market in 2022 and is expected to continue its dominance in the market during the next eight years. This is attributed to the rapid adoption of electric passenger cars in China. The government norms to minimize or reduce emissions and adopt green technology encourage the segment to grow in the forecast period.

Also, the emergence of ESPs in Asia Pacific is witnessed due to the availability of an economical and professional workforce. For instance, in May 2019, FEV Group GmbH expanded its operations in India by opening a new mobility center in Pune. The new mobility hub is expected to pave the path for breakthrough technology.

The South American region is anticipated to account for the fastest CAGR of more than 15.0% from 2023 to 2030. This is owing to the collaboration of OEMs in the region with the government agencies to develop and expand hybrid and electric vehicles due to the emergence of vehicle charging infrastructure. In addition, the rising government initiatives and the increase in budget allocation fuel the region's growth.

The MEA region witnessed a steady growth in 2022 due to the automotive manufacturers' preference for outsourcing services to minimize cost and take subassembly and component production to suppliers. This supports the manufacturers in cutting down the number of operations in the entire process.

Key Companies & Market Share Insights

The growing use of sustainable technology solutions has forced key participants to concentrate on business strategies like mergers, partnerships, and acquisitions beneficial for their businesses. The key participants focus on collaboration with OEMs to have a competitive edge over others in the market. For instance, in April 2020, Altran was acquired by Capgemini to gain a leadership position in R&D digital design, manufacturing services, strategy, product engineering, software development, and integration.

The companies also collaborated with OEMs to support advancements in autonomous systems. For instance, in September 2020, Bertrandt collaborated with Bozzio AG, a drive-by-wire system manufacturer, to support the effective development of autonomous systems.

Furthermore, ESPs collaborate with technological institutions to carry out various projects for advancements and innovation in automotive services. For instance, in June 2021, IAV launched a joint research project with the Massachusetts Institute of Technology (MIT) in the U.S. to evaluate and compare innovative drive types based on electrification, hydrogen, methane combustion, and hybridization in heavy-duty trucks.

The international research aims to establish the best driving idea for each application purpose and requirement on American and European roads, reducing CO2 emissions in heavy-duty transportation as much as feasible. In addition, major players are supporting automotive manufacturers in incorporating advanced technologies to contribute to the sustainability of the environment. For instance, in December 2020, Altran, acquired by Capgemini Engineering, partnered with Groupe PSA, an automotive manufacturer, to design and develop Citroen AMI, a 2-passenger electric quadricycle to meet environmental challenges. Some of the key players in global automotive engineering services outsourcing market include :

-

AKKA

-

Altair Engineering Inc.

-

Alten Group

-

Altran (Cap Gemini Engineering)

-

ARRK Product Development Group Ltd.

-

ASAP Holding Gmbh

-

AVL List GmbH

-

Bertrandt AG

-

EDAG Group

-

ESG Elektroniksystem- und Logistik-GmbH

-

FEV Group GmbH

-

Horiba, LTD.

-

IAV

-

ITK Engineering GmbH Kistler Group

-

P3 group GmbH

-

RLE INTERNATIONAL Group

Automotive Engineering Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 99.22 billion

Revenue forecast in 2030

USD 208.79 billion

Growth rate

CAGR of 11.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion,CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, service, location, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; France; Germany; China; India; Japan; Brazil

Key companies profiled

AKKA; Altair Engineering Inc.; Alten Group; Altran (Cap Gemini Engineering); ARRK Product Development Group Ltd.; ASAP Holding GmbH; AVL List GmbH; Bertrandt AG; EDAG Group; ESG Elektroniksystem- und Logistik-GmbH; FEV Group GmbH; Horiba, LTD.; IAV; ITK Engineering GmbH Kistler Group; P3 group GmbH; RLE International Group

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Engineering Services Outsourcing Market Segmentation

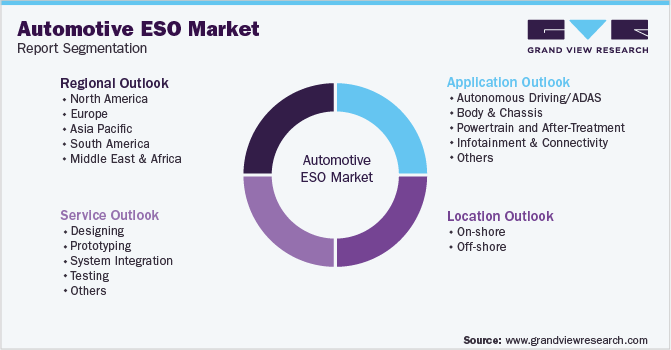

This report forecasts revenue growth at global, regional, and country levels along with provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive engineering services outsourcing market report based on the application, service, location, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autonomous Driving/ADAS

-

Body & Chassis

-

Powertrain and After-Treatment

-

Infotainment & Connectivity

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Designing

-

Prototyping

-

System Integration

-

Testing

-

Others

-

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-shore

-

Off-shore

-

-

Region Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive engineering service outsourcing market size was estimated at USD 84.87 billion in 2022 and is expected to reach USD 99.22 billion in 2023.

b. The global automotive engineering service outsourcing market is expected to grow at a compound annual growth rate of 11.2% from 2023 to 2030 to reach USD 208.79 billion by 2030.

b. Asia Pacific dominated the automotive ESO market with a share of 41.6% in 2022. This is attributable to the availability of an economical and professional workforce in countries, such as the Philippines, India, and China, major automobile OEMs are outsourcing manufacturing and government norms to minimize or reduce emissions and adopt green technology encourage the market to grow in the forecast period.

b. Some key players operating in the automotive engineering service outsourcing market include Altair Engineering Inc., AVL List GmbH, Bertrandt AG, EDAG Group, FEV Group GmbH, Horiba, LTD. and IAV among others.

b. The growing technological skills of Engineering Service Providers (ESPs) to deliver research and development (R&D) and product innovation in their offerings for vehicle positioning, connected automobiles, and guidance systems is expected to fuel the automotive ESO market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."