- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Interior Leather Market, Industry Report, 2033GVR Report cover

![Automotive Interior Leather Market Size, Share & Trends Report]()

Automotive Interior Leather Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Genuine And Synthetic), By Vehicle Type, By Car Class, By Applications, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-524-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Interior Leather Market Summary

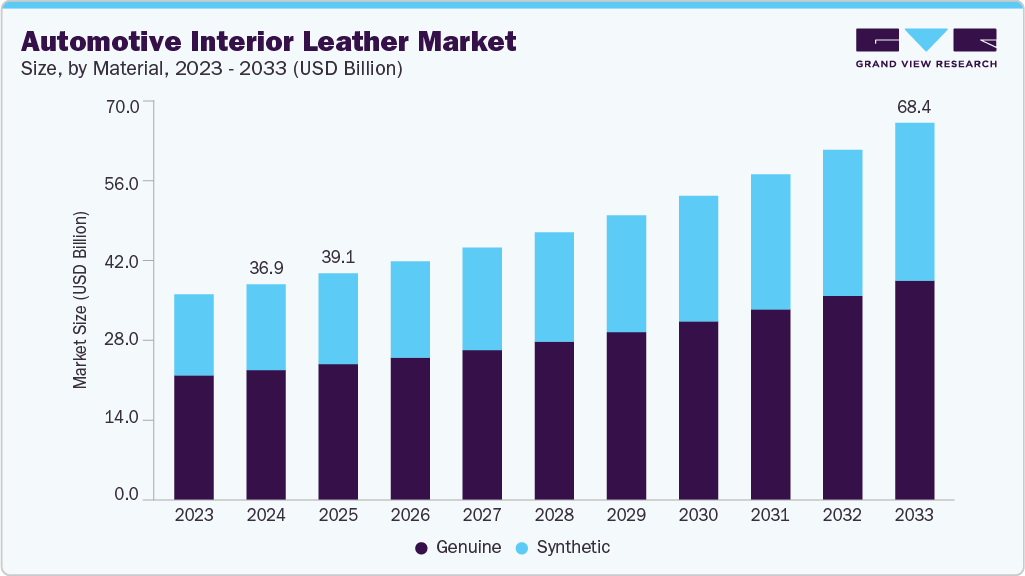

The global automotive interior leather market size was estimated at USD 36.95 billion in 2024 and is projected to reach USD 68.44 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. Growing demand for leather in upholstery application is likely to contribute to the automotive interior leather market demand.

Key Market Trends & Insights

- Asia Pacific dominated the automotive interior leather market with the largest revenue share of 42.30% in 2024.

- The automotive interior leather market in India is expected to grow at a substantial CAGR of 9.2% from 2025 to 2033.

- By material, the synthetic segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033.

- By vehicle type, the passenger car segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033.

- By car class, the luxury car segment is expected to grow at a considerable CAGR of 6.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 36.95 Billion

- 2033 Projected Market Size: USD 68.44 Billion

- CAGR (2025-2033): 6.4%

- Asia Pacific: Fastest growing & largest market in 2024

The automotive interior leather market in the U.S. is predicted to experience significant growth in recent years, with several factors driving this expansion. Consumer desire for high-quality and elegant interior materials is likely to drive market expansion in the country throughout the forecast period. A significant increase in demand for automobile synthetic leather upholstery is likely to push the entire industry in the U.S. Initiatives to enhance the supply chain are expected to benefit the market in the U.S. over the forecast period.

Drivers, Opportunities & Restraints

Rising demand for premium vehicles in emerging economies is driving growth in leather upholstery applications. As middle- and upper-income households grow, automakers are responding with improved cabin features to set their models apart. Meanwhile, original equipment manufacturers are using leather interiors as a value-added option to justify higher prices. This strategic approach strengthens leather’s position as a key competitive advantage.

The accelerating shift toward electric vehicles offers a compelling opportunity for leather suppliers to innovate with sustainable and lightweight materials. By developing low-emission tanning processes and bio-based alternatives, leather producers can collaborate with automakers aiming to reduce their overall vehicle carbon footprints. Additionally, the rising trend of shared mobility services creates new avenues for interior refurbishment and replacement, extending leather’s lifecycle value.

Despite its strong appeal, the leather segment faces headwinds from fluctuating raw-hide costs and tightening environmental regulations on processing chemicals. Price volatility in upstream markets can erode profit margins for tier-one suppliers, while compliance requirements add to operational complexity. Furthermore, growing consumer awareness about animal welfare is prompting some brands to explore synthetic substitutes, challenging traditional leather’s market share.

Market Concentration & Characteristics

The growth stage of the automotive interior leather market is moderate, with the pace picking up. The market shows fragmentation, with major players dominating the industry. Key companies like GST Autoleather Inc, Eagle Ottawa, CTL Leather, Alphaline Auto, DK Leather Corporation, Scottish Leather Group, Wollsdorf Leder Schmidt & Co Ges, Classic Soft Trim, Katzkin Leather Inc, Kuraray Plastics, Alfatex Italia, Seiren Co Ltd, Lear Corporation, Bader GmbH & Co. KG, BOXMARK Leather GmbH & Co KG, and others play a crucial role in shaping the market dynamics. These leading companies often push innovation, launching new products, technologies, and applications to meet changing industry needs.

In response to evolving consumer values and cost pressures, automakers are increasingly turning to advanced synthetic leathers and textile‐composite fabrics as alternatives to traditional hides. These substitutes offer tailored performance characteristics such as enhanced abrasion resistance and ease of maintenance while reducing dependence on animal‐derived inputs. Suppliers are investing in micro-fiber and bio-polymer blends that closely mimic the look and feel of genuine leather. This shift is driven by a desire to balance cabin refinement with scalable, cost-effective materials.

Stringent environmental and animal welfare regulations are transforming production methods and material choices within the automotive leather industry. Regulations aimed at reducing chemical runoff and emissions from tanning compel suppliers to implement closed-loop systems and use environmentally friendly agents. At the same time, tighter import controls on animal products in key markets demand better traceability and certification throughout the supply chain. While compliance costs are increasing, they also promote innovation in cleaner manufacturing and sourcing practices.

Material Insights

Genuine material led the installation segment, capturing over 59.67% of revenue in 2024, and is expected to grow at a 6.0% CAGR during the forecast period. Premium positioning and heritage appeal support genuine leather’s dominance in automotive interiors. Established automakers use authentic hides to showcase craftsmanship and durability, strengthening brand prestige. Long-standing supply chains and proven durability performance build OEM confidence. As consumers value tactile authenticity and long-term cabin comfort, genuine leather remains the top choice for both flagship and mainstream models alike.

Rapid advances in bio-polymer chemistry and micro-fiber weaving are fueling the swift uptake of synthetic leather. The segment is anticipated to grow at a substantial CAGR of 7.0%. Manufacturers prize its consistent quality, lighter weight, and simplified maintenance, which align with modern design and sustainability agendas. Cost-efficient production scales and shorter lead times further incentivize OEMs to specify synthetics. This material’s evolving eco-credentials and design versatility are accelerating its adoption across vehicle lines.

Vehicle Type Insights

The passenger car vehicle type held the largest revenue share of over 64.65% in 2024 and is projected to grow at a 6.5% CAGR during the forecast period. The extensive global passenger car fleet provides the main market for interior leather, driven by economies of scale based on volume. Both mainstream and premium automakers use leather trim to differentiate trim levels and justify price tiers. Consumer expectations for refinement in family sedans and compact SUVs support leather’s widespread use. Consistent replacement cycles and aftermarket upholstery services also help maintain leather demand in this key segment.

Growth in last-mile delivery fleets and ride-hailing vans is spotlighting driver comfort and brand image, boosting leather uptake in light commercial vehicles leading to an expectation of substantial growth at 6.4% throughout the forecast period. Operators seek durable yet professional cabin styling to enhance driver retention and corporate identity. Leather surfaces deliver easy cleaning and perceived quality during high-utilization duty cycles. This operational-driven focus is propelling rapid leather integration into vans and small trucks.

Car Class Insights

The luxury car segment held the largest revenue share, dominating with over 70.55% in 2024, and is projected to grow at a 6.8% CAGR during the forecast period. A strong focus on bespoke interiors maintains leather’s dominance in the luxury car market. High-end brands utilize full-grain hides and artisanal stitching to create an emotional ownership experience. Custom color options and tactile personalization enhance exclusivity, further emphasizing leather’s symbolic value. Consequently, luxury OEMs continue to base cabin design strategies around genuine leather as a sign of sophistication.

The mid segment car is expected to augment at a significant volume CAGR of 4.8% from 2025 to 2033. Mid-segment models are elevating perceived value by extending leather trim from entry-level to premium-adjacent variants. Automakers strategically introduce partial leather or leather-touch points to bridge the gap between fabric and full leather cabins. This mix-and-match approach meets cost targets while offering aspirational features to price-sensitive buyers. The tactic strengthens trim-level differentiation and drives upsell opportunities.

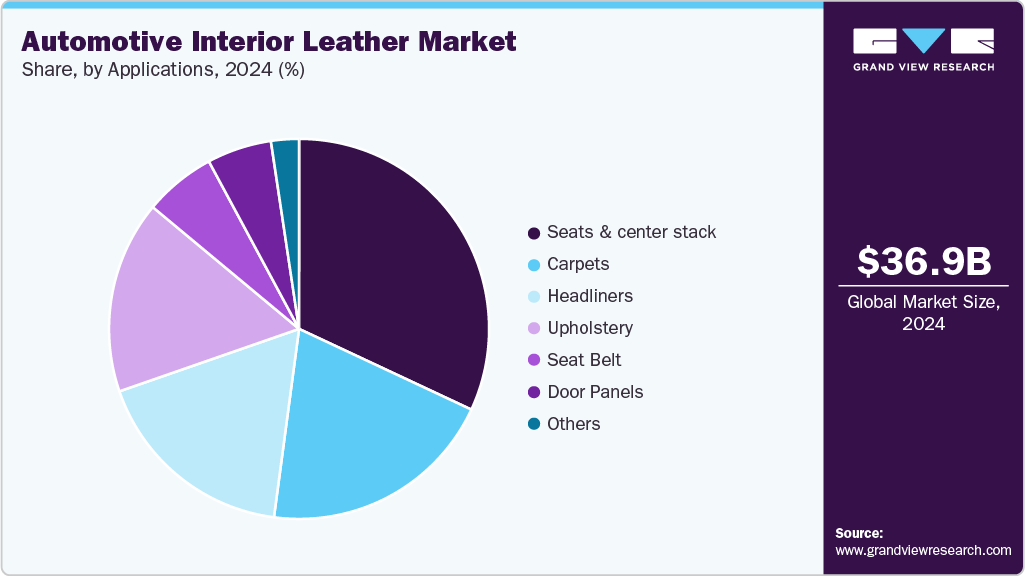

Applications Insights

The seats & center stack dominated the applications segment and accounted for the largest market share of over 31.98% in terms of revenue in 2024 and is expected to grow at 7.4% CAGR over the forecast period. Leather upholstery on seats and the center stack remains the focal point for visual and tactile cabin luxury.

OEMs concentrate high-wear, high-view areas on premium materials to maximize perceived quality during every touchpoint. Ergonomic shaping and integrated heating or cooling further enhance comfort, leveraging leather’s thermal responsiveness. This strategic material placement ensures leather’s impact is both seen and felt by occupants.

Carpets are emerging as a niche yet growing applications, expected to grow at 6.6% CAGR over the forecast period, blending underfoot comfort with enhanced stain resistance. By incorporating leather trim around footwells and door sills, automakers deliver a cohesive luxury aesthetic that extends beyond seating surfaces. This approach also improves durability in high-traffic areas, reducing lifecycle maintenance costs. As interior design languages evolve, leather-accented flooring adds a subtle premium touch.

Regional Insights

Asia Pacific held the largest share of 42.30% in terms of revenue of the automotive interior leather market in 2024. Rapid urbanization and rising disposable incomes across Asia Pacific are expanding the addressable market for vehicles equipped with premium interiors. Local OEMs in markets like India and Thailand are upgrading cabin finishes with leather accents to capture upwardly mobile buyers. Simultaneously, joint ventures with global luxury brands introduce novel leather treatment techniques, elevating regional production capabilities. These combined factors are accelerating leather adoption throughout the region.

China Automotive Interior Leather Market Trends

China’s aggressive push toward new energy vehicles offers leather suppliers a strategic growth avenue, as domestic EV makers seek to match Western luxury benchmarks. Government incentives for locally sourced materials incentivize partnerships between OEMs and indigenous tanneries, fostering supply-chain localization. Additionally, an emerging middle-class with sophisticated taste profiles is driving demand for dual-tone and perforated leather designs, further diversifying the market.

North America Automotive Interior Leather Market Trends

In North America, the ongoing shift toward electrification and connected vehicles is driving demand for leather interiors that integrate seamlessly with advanced infotainment and comfort systems. OEMs are leveraging premium leather to enhance the perceived value of electric and hybrid models as they compete for early adopters. Concurrently, a strong aftermarket upholstery sector sustains replacement and custom retrofit opportunities. The combination of technological integration and aftermarket vitality underpins leather’s resilience in this region.

U.S. Automotive Interior Leather Market Trends

The U.S. automotive interior leather market is driven by the country’s robust luxury vehicle market and sustained consumer preference for personalized cabins are fueling leather uptake. Domestic automakers and import brands alike are introducing exclusive leather colorways and bespoke stitching patterns to cater to affluent demographics. At the same time, growing penetration of subscription-based vehicle services elevates the need for durable, easily maintainable leather surfaces. These dynamics reinforce leather’s role as a key differentiator in a crowded market.

Europe Automotive Interior Leather Market Trends

Europe’s stringent sustainability mandates and circular economy initiatives are steering leather producers toward eco-friendly tanning methods and full-traceability supply chains. Premium European automakers are responding by specifying certified low-impact hides in high-end sedans and SUVs, aligning interior materials with broader environmental commitments. This regulatory-driven pivot not only safeguards market access but also bolsters brand equity among increasingly eco-conscious consumers.

Key Automotive Interior Leather Market Company Insights

The automotive interior leather market is highly competitive, with several key players dominating the landscape. Major companies include GST Autoleather Inc, Eagle Ottawa, CTL Leather, Alphaline Auto, DK Leather Corporation, Scottish Leather Group, Wollsdorf Leder Schmidt & Co Ges, Classic Soft Trim, Katzkin Leather Inc, Kuraray Plastics, Alfatex Italia, Seiren Co Ltd, Lear Corporation, Bader GmbH & Co. KG, and BOXMARK Leather GmbH & Co KG.

The automotive interior leather market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Automotive Interior Leather Companies:

The following are the leading companies in the automotive interior leather market. These companies collectively hold the largest market share and dictate industry trends.

- GST Autoleather Inc

- Eagle Ottawa

- CTL leather

- Alphaline auto

- DK leather corporation

- Scottish leather group

- Wollsdorf leder schmidt & Co Ges

- Classic soft trim

- Katzkin Leather inc

- Kuraray plastics

- Alfatex Italia

- Seiren Co Ltd

- Lear Corporation

- Bader GmbH & Co. KG

- BOXMARK Leather GmbH & Co KG

Recent Developments

-

In January 2025, Jaguar Land Rover and Maserati joined the Leather Working Group (LWG) in early 2025, marking a significant step for sustainability and responsible sourcing in the automotive leather industry. By becoming members of LWG, a globally recognized organization certifying leather manufacturers on environmental compliance and supply chain transparency, both luxury car makers demonstrated their commitment to aligning with global sustainability standards.

-

In March 2024, Dow introduced a new polyolefin elastomer (POE)-based artificial leather in March 2024, aimed at the automotive industry's shift towards animal-free leather alternatives. The material, commercialized by Dow's partner HIUV Materials Technology in China, has been qualified for use in electric car seatings.

Automotive Interior Leather Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.06 billion

Revenue forecast in 2033

USD 68.44 billion

Growth rate

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Report updated

August 2025

Quantitative units

Revenue in USD Million/Billion, Volume in Million Sq.Ft, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Material, vehicle type, car class, applications, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

GST Autoleather Inc; Eagle Ottawa; CTL leather; Alphaline auto; DK leather corporation; Scottish leather group; Wollsdorf leder schmidt & Co Ges; Classic soft trim; Katzkin Leather inc; Kuraray plastics; Alfatex Italia; Seiren Co Ltd; Lear Corporation Bader GmbH & Co. KG; BOXMARK Leather GmbH & Co KG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Interior Leather Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the automotive interior leather market report on the basis of material, vehicle type, car class, applications, end use, and region:

-

Material Outlook (Volume, Million Sq. Ft; Revenue, USD Million; 2021 - 2033)

-

Genuine

-

Synthetic

-

PU

-

PVC

-

Others

-

-

-

Vehicle Type Outlook (Volume, Million Sq. Ft; Revenue, USD Million; 2021 - 2033)

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Car Class Outlook (Volume, Million Sq. Ft; Revenue, USD Million; 2021 - 2033)

-

Economy Car

-

Mid-Segment Car

-

Luxury Car

-

-

Applications Outlook (Volume, Million Sq. Ft; Revenue, USD Million; 2021 - 2033)

-

Seats & center stack

-

Carpets

-

Headliners

-

Upholstery

-

Seat Belt

-

Door Panels

-

Others

-

-

Regional Outlook (Volume, Million Sq. Ft; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive interior leather market size was estimated at USD 36.95 billion in 2024 and is expected to reach USD 39.06 billion in 2025.

b. The global automotive interior leather market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2033 to reach USD 68.44 billion by 2033.

b. The passenger car segment dominated the automotive interior leather market with a share of 64.65% in 2024. This is attributed to the rising demand for individual vehicles in emerging countries and the growing need for safe and comfortable travel.

b. Some of the key players operating in the Automotive Interior Leather market includes: GST Autoleather Inc, Eagle Ottawa, CTL leather, Alphaline auto, DK leather corporation, Scottish leather group, Wollsdorf leder schmidt & Co Ges, Classic soft trim, Katzkin Leather inc, Mayur uniquoters, Kuraray plastics, Alfatex Italia, Seiren Co Ltd, Lear Corporation, and Bader GmbH & Co. KG

b. Key factors that are driving the market growth include the rising popularity of synthetic leather owing to the low cost and increasing demand for lightweight passenger cars.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.