- Home

- »

- Advanced Interior Materials

- »

-

Automotive Lightweight Material Market Size Report, 2030GVR Report cover

![Automotive Lightweight Material Market Size, Share & Trends Report]()

Automotive Lightweight Material Market Size, Share & Trends Analysis Report By Product (Metals, Composites, Plastics, Elastomers), By End Use (Passenger Cars, Light Commercial Vehicle), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-050-4

- Number of Report Pages: 170

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

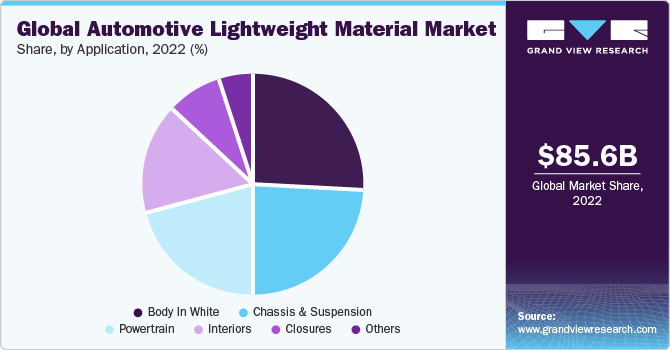

The global automotive lightweight material market size was valued at USD 85.63 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2030. High demand for weight reduction in performance vehicles is expected to increase the demand for lightweight materials for vehicle manufacturing. Moreover, increasing demand for fuel economy and vehicle stability is likely to support market growth. The positive growth of the automobile industry in major regions, like North America, Europe, and Asia Pacific, is likely to accelerate the market growth significantly.

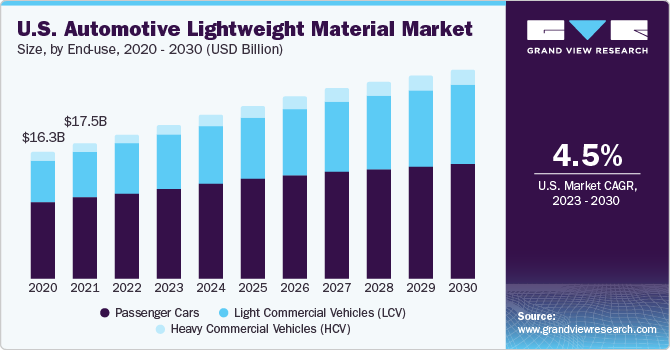

In the U.S., the rise in the sale of passenger cars and the growing trend of using mini trucks as family cars in the country are expected to support the demand for the products. Moreover, the growing demand for fuel-efficient cars in the country is likely to support market growth.

Increasing demand for vehicle stability on roads, coupled with the durability and performance of the vehicles for efficient fuel consumption across major regions, has propelled the market growth. Furthermore, stringent pollution norms in North America and Europe have compelled the manufacturers to use lightweight materials in the manufacturing process, thus supporting the market growth.

Technological developments and innovations in the automobile industry, coupled with the rise in demand for alternative fuel technologies, have introduced electric vehicles (EVs) in the market. The addition of passenger cars, luxury cars, and trucks in this category has accelerated the demand for lightweight materials to increase the performance of EVs. Upcoming electric vehicles from prominent car makers, including Toyota, and General Motors, are expected to increase the demand for lightweight materials in the estimated period.

Product Insights

The composites segment accounted for the largest revenue share of 65.8% in 2022. It offers durability and lightweight properties to the vehicles without affecting the design and dynamics. The composites offer robust properties to the vehicles and are easy to mold, thus gaining traction in vehicle manufacturing. The rise in the production of electric vehicles is expected to influence the demand for composites.

The elastomers segment is expected to grow at the fastest CAGR of 4.9% during the forecast period due to their increasing utilization of passenger cars and commercial vehicles. The rise in demand for passenger cars and premium sedan cars is anticipated to increase the demand for the products over the forecast period.

Metallic structures in the vehicle offer stability and durability, and thus are used for increasing the rigidity of the vehicles. Passenger safety concerns and the rise in the adoption of the highest safety-rated vehicles in Europe and the Asia Pacific are expected to support the demand for metallic materials.

End Use Insights

The passenger cars segment accounted for the largest revenue share of around 83.8% in 2022 and is anticipated to witness significant growth over the forecast period. Increasing the middle-class population, high-income levels, and spending capacity in Asia Pacific and Central and South America are expected to augment the growth of the passenger car segment, thus driving the market for lightweight vehicles.

The growth of the passenger cars segment, which includes a hatchback, premium hatchback, sedan, SUV, and multi-utility vehicles, is attributed to rising demand from end consumers. Inclination towards high-performance and fuel-efficient vehicles has compelled the players to use lightweight materials, thus supporting the segment growth.

The light commercial vehicles (LCVs) segment is estimated to register the fastest CAGR of 5.3% over the forecast period due to an increase in the consumption of light components on account of end-user demand for fuel efficiency and on-road stability. The growing trend of using mini trucks as family cars in North American and European countries is expected to increase their demand in the upcoming years, thus influencing segment growth.

Application Insights

The body in the white segment held the largest revenue share of 25.6% in 2022 and is expected to witness significant growth over the forecast period. The use of materials in the cross and side beams, under-body floors, front-end structures, panels, and passenger compartment frames is expected to increase their penetration in vehicle manufacturing, thereby supporting ent growth.

The others segment is expected to grow at the fastest CAGR of 5.2% over the forecast period on account of increasing applications in the instrument panel, trim, seats, insulation, airbags, hood, front and rear doors, lift gate, windows, lighting, electrical components, and others. These are manufactured using metal, composite, plastics, and elastomers.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 36.5% in 2022. The presence of multinational carmakers, along with prominent suppliers of the said materials in the region, has surged the market growth. Moreover, high spending on R&D by the players is expected to support market growth. Stringent norms regarding vehicle pollution and inclination towards passenger safety in the region are expected to increase the demand for light composite materials. Consumer preference for safe-rated vehicles is expected to increase the consumption of materials, thus supporting the regional market growth.

North America is expected to grow at the fastest CAGR of 4.7% during the forecast period. The North American automotive market is anticipated to witness technological introductions in the electric vehicle segment. Pollution control norms and high demand for fuel-efficient vehicles are expected to raise the demand for light components, thereby driving the market for lightweight automotive components.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach.

Key Automotive Lightweight Material Companies:

- BASF SE

- Toray Industries, Inc.

- LyondellBasell

- Novelis Inc

- ArcelorMittal

- Alcoa Corporation

- Owens Corning

- Stratasys Ltd.

- Tata Steel

- POSCO

Recent Developments

-

In August 2021, BASF SE, Stellantis, and L&L Products joined forces in a collaborative effort to create the lightweight transmission mounting system (TMS). Among its components, the composite tunnel reinforcement (CTR) is positioned underneath the vehicle, forming an integral part of the TMS. This innovative lightweight solution is set to enhance BASF SE's product engineering capabilities.

-

In March 2023, ArcelorMittal collaborated and signed a memorandum of understanding (MoU) with the KIRCHHOFF Automotive GmbH to develop and produced complex metal and hybrid structures for body-in-white and chassis. With this initiative, ArcelorMittal is expected to penetrate the automotive lightweight materials market.

Automotive Lightweight Material Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 90.54 billion

Revenue forecast in 2030

USD 112.50 billion

Growth Rate

CAGR of 3.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in Kilo Tons, Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central And South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa.

Key companies profiled

BASF SE; Toray Industries, Inc.; LyondellBasell; Novelis Inc.; ArcelorMittal; Alcoa Corporation; Owens Corning; Stratasys Ltd.; Tata Steel; POSCO

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Lightweight Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive lightweight material market based on product, end-use, application, and region:

-

Product Outlook (Volume in Kilo Tons And Revenue in USD Million, 2018 - 2030)

-

Metals

-

Composites

-

Plastics

-

Elastomers

-

-

End-use Outlook (Volume in Kilo Tons And Revenue in USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles (LCV)

-

Heavy Commercial Vehicles (HCV)

-

-

Application Outlook (Volume in Kilo Tons And Revenue in USD Million, 2018 - 2030)

-

Body in White

-

Chassis and Suspension

-

Powertrain

-

Closures

-

Interiors

-

Others

-

-

Regional Outlook (Volume in Kilo Tons And Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive lightweight material market is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach USD 112.50 billion by 2030.

b. Composites dominated the automotive lightweight material market with a share of 65.8% in 2022, owing to its high strength and durability.

b. Some of the key players operating in the automotive lightweight material market include BASF SE; Toray Industries, Inc.; LyondellBasell; Novelis Inc.; ArcelorMittal; Alcoa Corporation; Owens Corning; Stratasys Ltd.; Tata Steel; and POSCO.

b. Key factors that are driving the automotive lightweight material market include the high demand for weight reduction in performance vehicles is expected to increase the demand for lightweight materials for vehicle manufacturing.

b. The global automotive lightweight material market size was estimated at USD 85.63 billion in 2022 and is expected to reach USD 90.54 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."