- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Silicone Market Size, Industry Report, 2033GVR Report cover

![Automotive Silicone Market Size, Share & Trends Report]()

Automotive Silicone Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Rubber, Adhesives and Sealants, Coatings), By Application (Interior and Exterior Parts, Engine & Drive Train System, Electrical System), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-726-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Silicone Market Summary

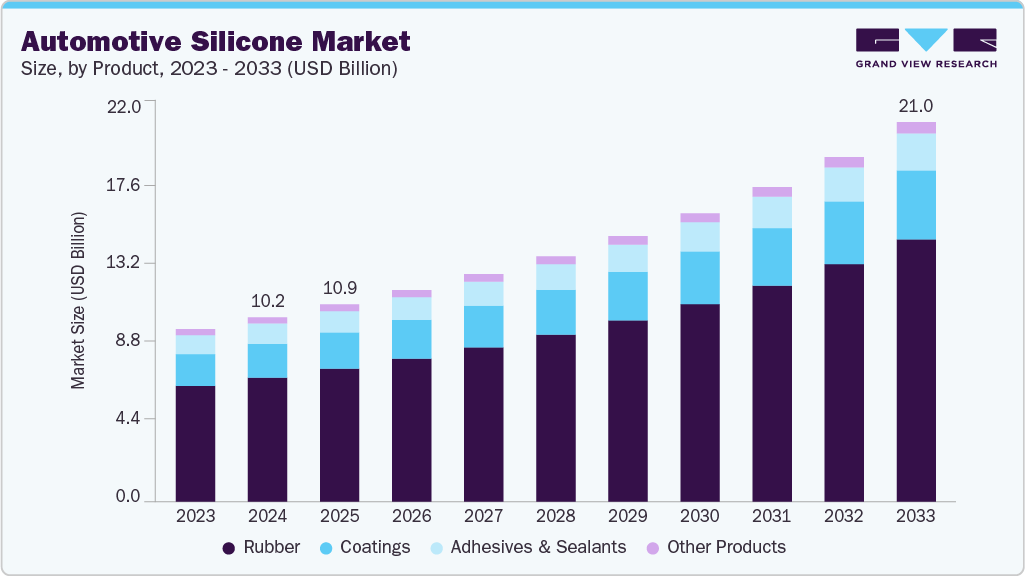

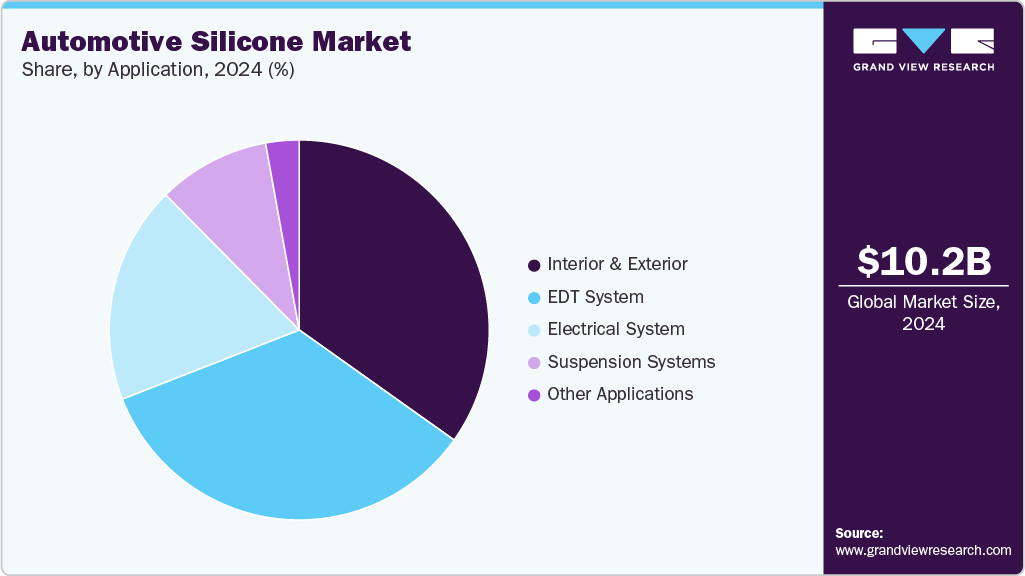

The global automotive silicone market size was estimated at USD 10.21 billion in 2024 and is projected to reach USD 21.03 billion by 2033, growing at a CAGR of 8.5% from 2025 to 2033. Factors such as the growth in demand for silicones in various automotive applications and government regulations on vehicle emissions are expected to boost the market in the forecast period.

Key Market Trends & Insights

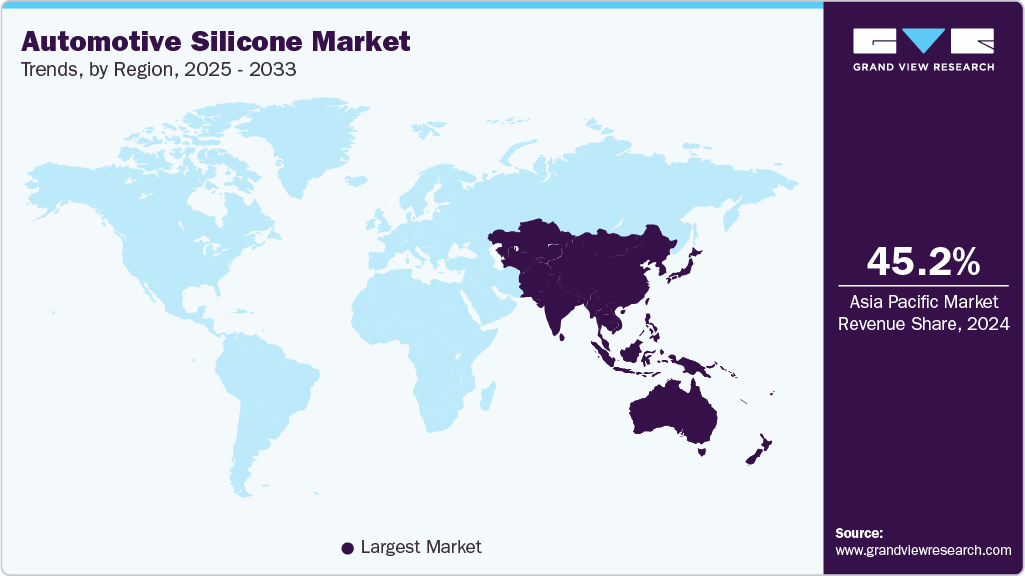

- Asia Pacific dominated the automotive silicone market with the largest revenue share of 45.18%in 2024.

- The automotive silicone market in Latin America is expected to grow at a substantial CAGR of 7.4% from 2025 to 2033.

- By product, rubber dominated the product segment with a revenue market share of over 67% in 2024.

- By application, the electrical system segment is expected to grow at the fastest CAGR of 9.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 10.21 Billion

- 2033 Projected Market Size: USD 21.03 Billion

- CAGR (2025-2033): 8.5%

- Asia Pacific: Largest market in 2024

The automotive silicone industry is set to experience steady growth, fueled by a rising demand for high-performance materials that improve vehicle efficiency, durability, and safety. The outstanding thermal stability, electrical insulation, and weather resistance of silicone render it crucial for various automotive applications such as gaskets, hoses, seals, lighting, electronics, and interior components. As original equipment manufacturers (OEMs) seek to lessen vehicle weight and enhance fuel efficiency, silicone’s adaptability and capacity to replace traditional heavier materials make it a favored option for both internal combustion engine and electric vehicle platforms.

The automotive silicone industry is set to experience steady growth, fuelled by a rising demand for high-performance materials that improve vehicle efficiency, durability, and safety. The outstanding thermal stability, electrical insulation, and weather resistance of silicone render it crucial for various automotive applications such as gaskets, hoses, seals, lighting, electronics, and interior components. As original equipment manufacturers (OEMs) seek to lessen vehicle weight and enhance fuel efficiency, silicone’s adaptability and capacity to replace traditional heavier materials make it a favoured option for both internal combustion engine and electric vehicle platforms.

Drivers, Opportunities & Restraints

The automotive silicone industry is expected to experience steady growth, fueled by the rising demand for high-performance materials that improve durability, safety, and efficiency in vehicles. The properties of silicone, such as heat resistance, electrical insulation, flexibility, and weatherproofing, make it crucial for various automotive uses, including seals, gaskets, hoses, cables, lighting systems, and interior parts. The transition towards electric mobility and advanced electronics is further increasing the adoption of silicone for battery protection, thermal management, and sensor integration. As the automotive sector continues to emphasize lightweight materials and long-lasting reliability, silicone is becoming more essential in fostering innovation in both traditional and electric vehicle platforms.

Due to the increasing emphasis on sustainability and circular economy practices, new opportunities are likely to arise. The development of low-emission, durable, and recyclable silicone formulations is gaining momentum, particularly in regions such as Europe and North America. Furthermore, the shift toward electric and hybrid vehicles, growing integration of in-vehicle electronics, and advancements in autonomous driving technologies are creating fresh prospects for silicone applications, especially in thermal management, electrical insulation, and lightweight sealing systems.

The market is anticipated to encounter challenges arising from heightened environmental issues associated with the production and disposal of silicone products, as well as mounting regulatory pressures concerning certain additives and processing agents. Variations in raw material costs and disruptions in the supply chain could also affect manufacturing expenses and product availability. Moreover, competition from other materials and stringent compliance requirements with automotive safety and emissions regulations might restrict the use of silicone in particular vehicle parts.

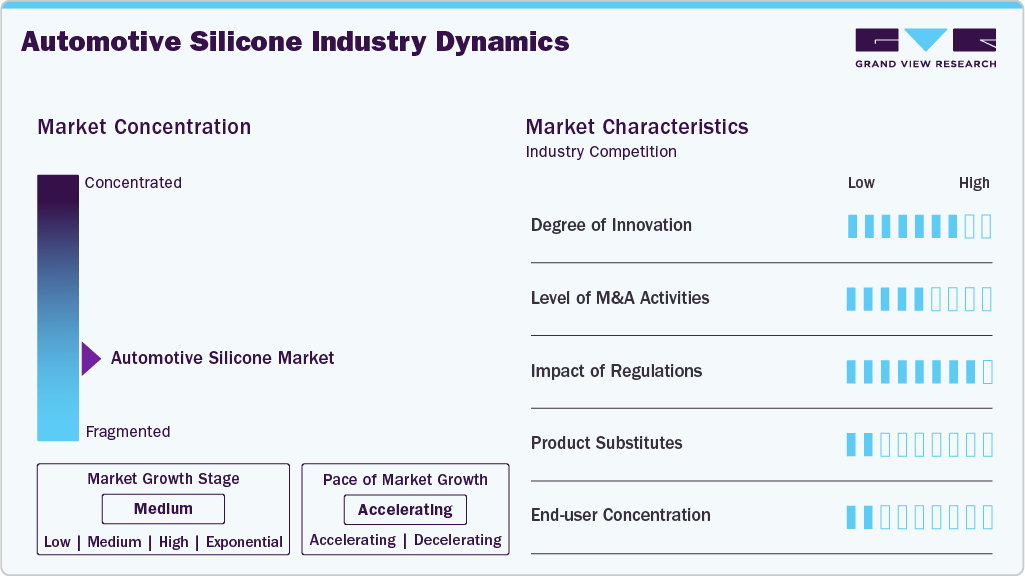

Market Concentration & Characteristics

The automotive silicone industry is presently experiencing moderate growth, with increasing momentum attributed to its expanding use in electric vehicles, cutting-edge electronics, and lightweight automotive parts. Although the market is still relatively fragmented, several major global companies exert considerable influence over the competitive environment. Prominent firms such as Henkel AG & Co. KGaA, 3M Company, Permatex, Elkem ASA, Basildon Chemicals, Specialty Silicone Products, Inc., Dow, ACC Silicones Ltd., and Wacker Chemie AG play a crucial role in directing market developments. These companies are fostering innovation by creating advanced silicone solutions, such as low-VOC, heat-resistant, and electrically conductive materials, to comply with changing automotive standards and the rising need for performance, safety, and sustainability in next-generation vehicle designs.

The automotive silicone industry is experiencing major changes due to mergers and acquisitions, with leading companies acquiring specialized firms to boost their technological expertise, expand their geographic reach, and diversify their product lines. These strategic moves are driving innovation in eco-friendly silicone solutions in response to stricter environmental regulations and industry demands. Regulations, especially in Europe and North America, are influencing material choices by encouraging the use of low-emission, durable, and recyclable silicone compounds. The rising costs of compliance and the push for greener mobility are prompting increased investments into cleaner manufacturing methods, improved materials, and high-performance additives.

The automotive silicone industry faces moderate competition from substitute materials such as thermoplastics, polyurethane-based compounds, and elastomers; however, silicones maintain a strong position due to their excellent thermal stability, weather resistance, and electrical insulation properties. There is a high level of concentration among end users, particularly among leading automotive OEMs and Tier 1 suppliers, who significantly influence procurement decisions and material specifications. This concentration shapes product development priorities and demand patterns, making the market responsive to changes in vehicle design preferences, regulatory updates, and technological advancements in the automotive sector.

Product Insights

Rubber-based silicone has led the market in revenue, accounting for 67.24% in 2024. This segment is expected to grow steadily due to its widespread use in applications such as gaskets, seals, hoses, vibration-dampening components, and weatherproofing systems. Its excellent flexibility, thermal resistance, and durability in harsh environmental conditions make it suitable for both internal combustion and electric vehicles. A major factor behind this dominance is the growing demand for durable, high-performance materials that improve vehicle efficiency, safety, and reliability, especially in regions such as North America, Europe, and Asia, where automotive advancements and regulatory standards are rapidly changing.

In addition, the growing popularity of electric vehicles is generating a demand for lightweight, durable, and heat-resistant materials, leading to an increased use of silicone-based coatings in automotive parts. These coatings offer crucial protection against extreme temperatures, moisture, and chemical exposure, making them ideal for engine components, battery casings, and electronic assemblies. Although the automotive silicone coatings segment is witnessing moderate growth, rising concerns for sustainability are driving innovation toward low-VOC and eco-friendly formulations. As manufacturers aim to comply with changing regulatory standards and performance demands, silicone coatings are becoming recognized as dependable solutions for improving vehicle durability and efficiency.

Application Insights

In 2024, the interior and exterior application category led the market, accounting for a 34.84% revenue share. The automotive silicone sector is expected to see steady growth throughout the forecast period, driven by its increasing use in enhancing the durability, performance, and efficiency of vehicles. This segment extensively uses silicone for weatherstripping, seals, trims, and vibration-damping components, thanks to its excellent flexibility, UV resistance, and long-lasting durability. As automotive designs grow more sophisticated and the industry emphasizes lightweight materials and passenger comfort, the demand for silicone in both interior and exterior automotive parts is likely to increase steadily.

The electrical systems segment is expected to be the fastest-growing part of the market, with a projected CAGR of over 9% during the forecast period. The increasing electrification of vehicles and the rising adoption of advanced electronics significantly drive the demand for silicone in wiring, connectors, sensors, and control modules. Silicone's outstanding thermal stability, electrical insulation properties, and resistance to moisture and vibrations make it ideal for protecting delicate electronic components. As vehicle manufacturers shift toward electric and autonomous technologies, the demand for high-performance silicone solutions in electrical systems is rapidly increasing, especially in key regions such as North America, Europe, and Asia-Pacific.

The EDT (Electrical, Data, and Telecommunication) system sector is expected to experience significant growth, driven by the increasing integration of advanced electronic architectures and communication technologies in modern vehicles. Silicone materials are widely used in connectors, sensors, cables, and circuit protection components because of their excellent electrical insulation, thermal stability, and ability to resist moisture and vibrations. The shift toward electric and connected vehicles is further boosting the demand for reliable, high-performance materials that preserve signal integrity and protect sensitive electronics. In addition, the growing need for vehicle-to-everything (V2X) communication, infotainment systems, and Advanced Driver Assistance Systems (ADAS) is encouraging original equipment manufacturers (OEMs) to adopt advanced silicone-based solutions in EDT systems to meet strict safety, durability, and performance standards.

Regional Insights & Trends

The automotive silicone industry in North America is expected to experience significant growth, fueled by strong demand from the region's established automotive production sector and the rapid shift towards electric vehicles. An increasing focus on vehicle safety, performance, and regulatory compliance related to emissions is leading to a higher utilization of silicone in applications such as gaskets, seals, thermal insulation, and electronic components.

Furthermore, advancements in Advanced Driver Assistance Systems (ADAS) technologies and onboard electronics are enhancing the demand for high-performance silicone materials that offer exceptional thermal stability and electrical insulation. Growing regulatory pressures for sustainability and energy efficiency are also motivating Original Equipment Manufacturers (OEMs) and Tier 1 suppliers to implement silicone-based solutions across various vehicle systems.

U.S. Automotive Silicone Market Trends

The U.S. automotive silicone industry is anticipated to experience steady growth, propelled by innovations in electric vehicle production, strict regulatory requirements, and an increasing need for lightweight, durable, and high-performance materials. The growing consumer emphasis on vehicle safety, comfort, and efficiency is also boosting the use of silicone in important automotive applications.

Asia Pacific Automotive Silicone Market Trends

The Asia Pacific automotive silicone industry accounted for the largest revenue share of 45.18% in 2024. This area is anticipated to experience significant growth, fueled by rapid industrial development, urbanization, and increasing automotive production in nations such as China, India, Indonesia, and Vietnam. A strong presence of automotive original equipment manufacturers (OEMs), the rising popularity of electric vehicles, and an increased demand for advanced electronics are essential factors driving the use of silicone in applications like sealing systems, gaskets, thermal insulation, and electronic components. Moreover, government initiatives aimed at promoting energy efficiency and enforcing stricter emission regulations are fostering the use of high-performance, durable, and low-emission materials such as silicone in both conventional and electric vehicle markets.

Europe Automotive Silicone Market Trends

The automotive silicone industry in Europe is expected to be driven by the stringent energy efficiency regulations, the rise of green mobility initiatives, and a strong focus on the circular economy. There is increasing demand for recyclable, low-emission silicone materials, particularly in applications such as sealing systems, thermal management, and interior components for electric and hybrid vehicles.

The automotive silicone industry in China is expected to grow quickly, fueled by a surge in vehicle manufacturing, greater uptake of electric vehicles, and a heightened need for sophisticated automotive materials. Government investments in infrastructure and clean transportation, coupled with the growth of the domestic automotive and electronics industries, are boosting the application of silicone in areas such as sealing, thermal insulation, and protection of electronic components for both traditional and new-energy vehicles.

Key Automotive Silicone Company Insights

The automotive silicone industry is intensely competitive, with several key players shaping the industry through innovation, product diversification, and strategic expansion. Companies such as Henkel AG & Co. KGaA, 3M Company, Permatex, and among others are at the forefront of advancing silicone technologies for automotive applications. These firms are heavily investing in research and development to improve performance attributes such as thermal stability, electrical insulation, and environmental resistance. The competitive landscape is further defined by collaborations with OEMs, new product launches, and the development of low-VOC, recyclable silicone solutions to meet evolving regulatory standards and the growing demand for sustainable, high-performance materials in both conventional and electric vehicle platforms.

Key Automotive Silicone Companies:

The following are the leading companies in the automotive silicone market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- 3M Company

- Permatex

- Elkem ASA

- Basildon Chemicals

- Specialty Silicone Products, Inc.

- Dow

- ACC Silicones Ltd.

- Wacker Chemie AG

- Shin-Etsu Chemical Co.

- Laur Silicone, Inc.

- CSL Silicones Inc.

Recent Developments

-

In January 2025, KCC Silicone announced the merger with Momentive Performance Materials (Momentive) Korea, a well-known global manufacturer of silicone. This achievement not only opens new growth opportunities in the domestic market but also positions the company for a significant advance in the international market. The merger is a strategic choice aimed at fulfilling KCC Group's future vision and has been acknowledged as a transformative move that will redefine the global silicone industry's landscape.

-

In June 2024, BRB Silicones introduced BRB SF 1802, a specialized silicone for automotive maintenance. BRB SF 1802 is an aminoalkyl functional polydimethylsiloxane. This silicone is non-reactive and curable with amino groups, demonstrating enhanced storage stability when compared to reactive alternatives.

Automotive Silicone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.92 billion

Revenue forecast in 2033

USD 21.03 billion

Growth rate

CAGR of 8.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Henkel AG & Co. KGaA; 3M Company; Permatex; Elkem ASA; Basildon Chemicals; Specialty Silicone Products, Inc.; Dow; ACC Silicones Ltd.; Wacker Chemie AG; Shin-Etsu Chemical Co.; Laur Silicone, Inc.; CSL Silicones Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Silicone Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the automotive silicone market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Rubber

-

Adhesives & Sealants

-

Coatings

-

Other products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Interior & Exterior Parts

-

EDT System

-

Electrical System

-

Suspension System

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.