- Home

- »

- Advanced Interior Materials

- »

-

Automotive Stainless Steel Tube Market Size Report, 2030GVR Report cover

![Automotive Stainless Steel Tube Market Size, Share & Trends Report]()

Automotive Stainless Steel Tube Market Size, Share & Trends Analysis Report By Product (Welded Tube, Seamless Tube), By Application (Passenger Cars, Commercial Vehicles, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-244-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global automotive stainless steel tube market size was valued at USD 4.03 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030.Stainless steel has become one of the primary materials in the automotive industry on account of its high strength-to-weight ratio that helps in the overall weight reduction of the vehicle.

Stainless steel tubes are utilized in diesel spark plugs, motor block reheating, diesel particulate filters systems, fuel lines, and exhaust gas recirculation systems. Their growing demand is attributable to good corrosion resistance & dent performance, coupled with high durability.

The growth of the automotive industry is expected to be the major driver for the market. Growing vehicle demand from emerging economies such as China and India is projected to boost the industry over the forecast period. Besides, government-backed schemes & foreign investments, ingenious marketing strategies, and recovery of economies have also provided the necessary momentum to the industry.

The industry growth coupled with factors such as stringent regulations regarding vehicle safety and fuel economy in order to increase the strength of the vehicle, and at the same time, reduce its kerb weight, are expected to propel growth.

The market growth is expected to be hindered by high manufacturing costs. Utilization of expensive raw materials including chromium, nickel, and titanium adds to high costs of the product as compared to its alternatives such as aluminum. The expensive nature of the product is likely to hinder the market growth.

Investments in R&D for new grades of stainless steel are expected to benefit the market growth over the coming years. For instance, in September 2021, the Korea Institute of Materials Science (KIMS) announced the development of a lightweight grade of stainless steel (SS), which is nearly 20% lighter than the existing SS grade. The research team at the KIMS added 12% aluminum to reduce the weight while optimizing the inclusion of elements such as manganese, chromium, and carbon, to decrease the brittleness.

Stainless steel comprises a variety of alloying materials such as chromium, nickel, titanium, molybdenum, and manganese according to their specific grades and compositions. The presence of these elements results in high strength and resistance to corrosion of stainless steel, as compared to ordinary steel. Chromium, which accounts for a share of 10% to 18% among all materials in stainless steel, increases its oxidation resistance, resulting in increased corrosion resistance. Similarly, the addition of nickel, which makes up around 8% of stainless steel, helps in increasing its strength, which is important during collision and impact.

In order to be introduced in the market, vehicles have to go through a variety of tests regarding safety, fuel efficiency, and pollution emission. Rigorous safety tests are conducted in which the strength of the frame of the vehicle is tested against severe impacts, failing which, the launch of the vehicle is suspended. Manufacturers are compelled to use materials with high strength such as stainless steel tubes, which not only improve the rigidity of the vehicles but also make them lightweight, since stainless steel tubes are lighter as compared to other materials. This, in turn, decreases the curb weight of vehicles, resulting in improved fuel efficiency.

Although stainless steel tubes have numerous advantages in the automotive industry, the biggest factor that could restrain the growth of this market is the high cost. As compared to other materials such as aluminum, stainless steel tubes are proven to be stronger, but at the same time, more expensive. Since materials such as chromium, nickel, and titanium are used in making stainless steel tubes, the manufacturing costs go up.

The automotive industry is a cost-sensitive market, particularly in emerging countries such as China, India, and Brazil. The prices of vehicles are bound to go up if expensive materials such as stainless steel tubes are used. The biggest challenge faced by the automotive stainless steel tube players is controlling the manufacturing costs, which in turn, will lower the prices for end users.

Recent sluggishness across the global automotive sector has affected the component demand for market vendors including automotive stainless steel tube producers. For instance, as reported by the International Organization of Motor Vehicle Manufacturers (OICA), the global production of vehicles observed a y-o-y decline of 16% in 2020, and while 3% y-o-y decline in 2021. However, increased production in Asian countries such as China and India is likely to keep the positive momentum for industry. Notably, automotive production in China and India witnessed y-o-y growth of 3% and 30% in 2021 respectively.

Product Insights

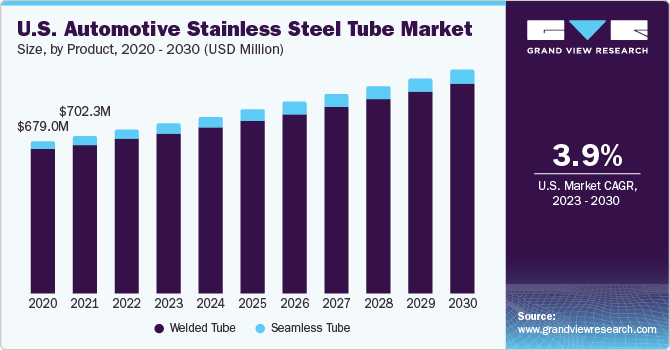

Based on product, the market is segmented into welded and seamless tubes. A welded tube is manufactured by welding the seam on the tube. Seamless products do not have a longitudinal weld seam and hence, do not crack or leak. The welded tube segment accounted for the largest revenue share of 93.3% in 2022.These are more readily available, which results in the minimum waiting period, consequently, making them cost-effective. Their wall thickness is more consistent as compared to the seamless product type. Besides, they can withstand extreme temperatures and pressures, making them ideal for critical automotive components such as exhaust systems.

Theseamless tube segment is expected to grow at the fastest CAGR of 7.7% during the forecast period. Since there is no welding, their corrosion resistance is very high. However, they are not as widely used as welded products on account of high cost.

Application Insights

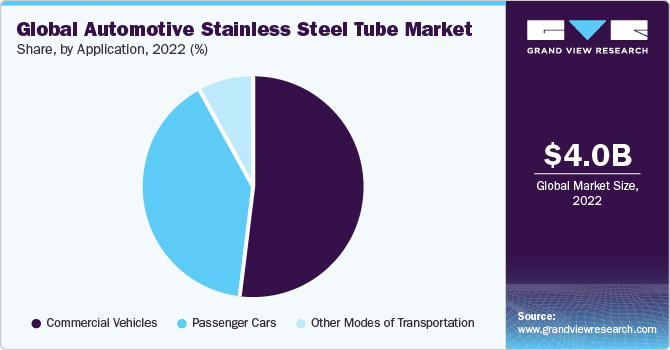

On the basis of application, the automotive stainless steel tubes market is segmented into passenger cars, commercial vehicles, and other modes of transportation. The commercial vehicles segment accounted for the largest revenue share of 52.0% in 2022. The key factor responsible for the increase in demand for automotive stainless steel tubes in commercial vehicles is their extensive use. They reduce vehicle weight, optimize vehicle designs to promote safety, and increase fuel efficiency.

The passenger cars segment is expected to grow at the fastest CAGR of 4.6% during the forecast period.Stainless steel tubing possesses qualities that render it suitable for utilization in vehicle structural construction. The material is crashworthy, meaning it can protect occupants in the event of a collision. Simultaneously, it remains lightweight, yet has the capacity to absorb impacts without transmitting them to passengers. These characteristics are propelling its adoption in passenger vehicles.

Regional Insights

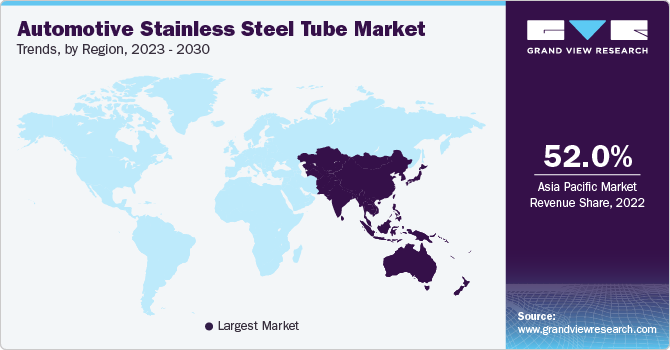

Asia Pacific dominated the market and accounted for the largest revenue share of 52.0% in 2022 and is expected to grow at the fastest CAGR of 5.0% during the forecast period. The region is likely to continue its dominance over the forecast period. Asia Pacific is considered to be the one of the emerging regions in the world. With fast growing countries such as China and India, this region is expected to be the leader in various industry sectors such as automotive, manufacturing, IT, telecom and many more. The automotive industry in this region is driven by an increase in demand for automobiles, government-backed schemes and foreign investments, ingenious marketing strategies, and recovery of economies.

China is one of the developed countries in the Asia Pacific region and has high volume production across the world. As per the OICA estimates, China held a share of over 32.5% in 2021 in global automotive production. The automotive industry has received support from the Chinese Government in the form of consumer subsidies and tax breaks, especially for electric vehicles, which has boosted the automotive stainless steel tube market. Cost competitiveness and skilled labor are some of the major factors making China the automotive manufacturing hub of the world.

Europe, which held the second-largest revenue share of 22.8% in 2022, is expected to grow at the second-fastest CAGR of 4.4% over the forecast period. Countries such as the UK and Germany have witnessed increased demand for these products, courtesy of growing automobile industries.

Germany is another major automotive hub in the world and is projected to attract significant demand for automotive stainless steel tubes. Investments in operating facilities are expected to boost production in the country. For instance, in September 2021, Mannesmann Stainless Tubes (MST) installed one of the largest mills for the production of seamless stainless tubes at its Remscheid facility in Germany. This will assist the company in producing larger pipes with an outside diameter (OD) of up to 290 mm.

The industry participants in the automotive stainless steel tubes industry are focused on various organic and inorganic growth strategies to improve their market share. For instance, in February 2021, Sandvik, a producer of stainless steel and other high-performance materials, announced an investment in a hydraulic factory at its Gujrat plant, in India. With this investment, the company aims to improve its stainless steel service capabilities across India.

North America is home to some of the major automobile manufacturers such as Ford Motors and General Motors. Other European and Asian automotive manufacturers such as Volkswagen, BMW, Honda, Hyundai, and many more operate in this region.

Key Companies & Market Share Insights

These players adopted organic and inorganic strategies such as mergers & acquisitions, expansions, new product developments, and agreements, collaborations & joint ventures in order to expand their product portfolio, geographical reach, and consequently, increase their shares. The industry is highly consolidated owing to the presence of both, small and large scale manufacturers throughout the world.

Key Automotive Stainless Steel Tube Companies:

- Sandvik AB

- NIPPON STEEL CORPORATION

- ArcelorMittal

- thyssenKrupp AG

- TUBACEX S.A.

- Handytube Corporation

- Plymouth Tube Company

- fischer Group of Companies

- Maxim Tubes Company Pvt. Ltd.

- JFE Steel Corporation

- ChelPipe

- Penn Stainless

- Bri-Steel Manufacturing

- Centravis

Recent Developments

-

In February 2023, NIPPON STEEL CORPORATION entered into a strategic agreement with Teck Resources Limited to acquire royalty interests and equity in Elk Valley Resources Ltd. The aim of this investment is to secure high-quality steel-making coal, essential for Nippon Steel's carbon-neutral goal, and to build a profitable and sustainable consolidated company portfolio through increased investment in high-quality raw materials.

-

In January 2023, Jindal Stainless announced its provision of stainless steel for a comprehensive range of applications in the Mumbai metro project, including roofs, outer panels, structural components, car bodies, underframes, and interior elements.

-

In January 2023, MARCEGAGLIA STEEL S.p.A acquired a stainless steel electric furnace factory in Sheffield, UK. This marks the company's inaugural investment in steel manufacturing. Through this move, Marcegaglia has initiated partial upstream integration in the value chain, with the objective of reducing the length and stabilizing the supply chain, while also establishing a more sustainable and competitive product portfolio.

-

In May 2023, JFE Steel Corporation announced the forthcoming installation of a new electric-arc furnace at its No. 4 steelmaking shop in the Chiba District Facility. This addition will enable the production of stainless steel by incorporating substantial amounts of scrap, leading to a reduction in CO2 emissions. The installation of the electric-arc furnace, estimated to cost over USD 100 million, is scheduled for the second half of the fiscal year commencing in April 2025.

-

In April 2021, Sandvik AB introduced super-duplex stainless steel components manufactured using 3D printing technology. Sandvik AB and its subsidiary, BEAMIT Group, unveiled their distinctive ability to additively produce components in super-duplex stainless steel—an alloy that combines mechanical strength with exceptional corrosion resistance.

-

In January 2020, Sandvik AB successfully completed the acquisition of Summerill Tube Corporation, a manufacturer specializing in high-precision nickel alloy and stainless steel tubes. This strategic move was aimed at attaining advanced technical expertise in the production of precision-enhanced tubes, further enhancing their offerings to customers.

Automotive Stainless Steel Tube Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.20 billion

Revenue forecast in 2030

USD 5.73 billion

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America ; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia; Brazil; Mexico

Key companies profiled

Sandvik AB; NIPPON STEEL CORPORATION; ArcelorMittal; thyssenKrupp AG; TUBACEX S.A.; Handytube Corporation; Plymouth Tube Company; fischer Group of Companies; Maxim Tubes Company Pvt. Ltd.; JFE Steel Corporation; ChelPipe; Penn Stainless; Bri-Steel Manufacturing; Centravis

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Stainless Steel Tube Market Report Segmentation

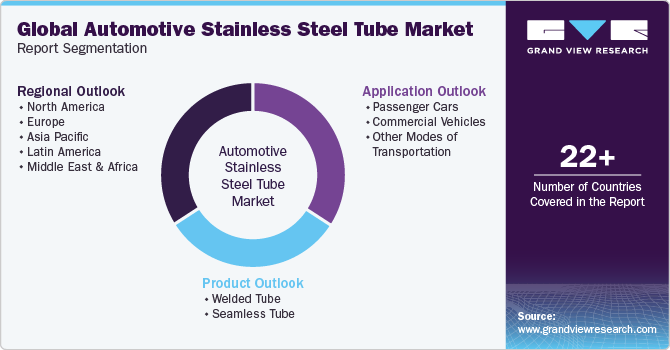

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive stainless steel tube market based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Welded Tube

-

Seamless Tube

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

Other Modes of Transportation

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

Latin America

-

Brazil

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive stainless steel tube market size was estimated at USD 4.03 billion in 2022 and is expected to reach USD 4.20 billion in 2023.

b. The global automotive stainless steel tube market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 5.73 billion by 2030.

b. Welded tubes dominated the automotive stainless steel tube market with a share of 93% in 2022. This is attributable to ready-availability, resulting in minimum waiting period, making them cost-effective and they can withstand extreme temperatures and pressures, making them ideal for critical automotive components such as exhaust systems.

b. Some key players operating in the automotive stainless steel tube market include Sandvik Group, Nippon Steel & Sumitomo Metal Corporation, ArcelorMittal, ThyssenKrupp, Tubacex, Handytube Corporation, Plymouth Tube Company, Fischer Group, Maxim Tubes Company Pvt. Ltd., JFE Steel Corporation, ChelPipe, Penn Stainless Products Inc., Bri-Steel Manufacturing, and Centravis.

b. Key factors that are driving the automotive stainless steel tube market growth include stringent regulations regarding vehicle safety and fuel economy in order to increase the strength of the vehicle and reduce its kerb weight.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."