- Home

- »

- Automotive & Transportation

- »

-

Automotive Start-Stop System Market Size Report, 2030GVR Report cover

![Automotive Start-Stop System Market Size, Share & Trends Report]()

Automotive Start-Stop System Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Two wheelers, Passenger Cars), By Propulsion Type, Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-409-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Start-Stop System Market Summary

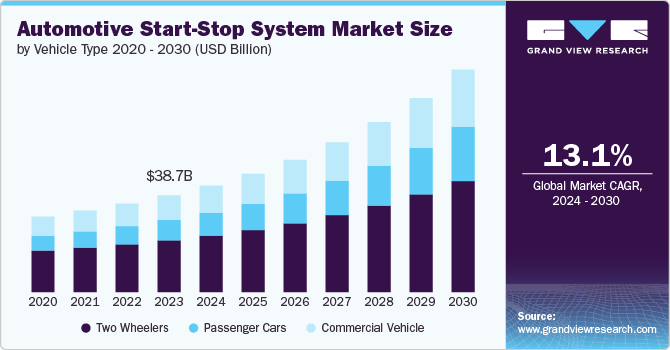

The global automotive start-stop system market size was estimated at USD 38.71 billion in 2023 and is expected to reach USD 89.06 billion by 2030, growing at a CAGR of 13.1% from 2024 to 2030. Growing concerns about environmental sustainability and the need to reduce fuel consumption and greenhouse gas emissions is driving the automotive start-stop system market.

Key Market Trends & Insights

- Europe region dominated the market and was accounted for a share of 34.72% in 2023.

- Asia Pacific Automotive Start-Stop System Market accounted for a revenue share exceeding 31% in 2023.

- By type, the two wheelers segment accounted for the largest market share, exceeding 46% in 2023.

- By propulsion type, the ICE segment held the largest market share of 75.5% in 2023.

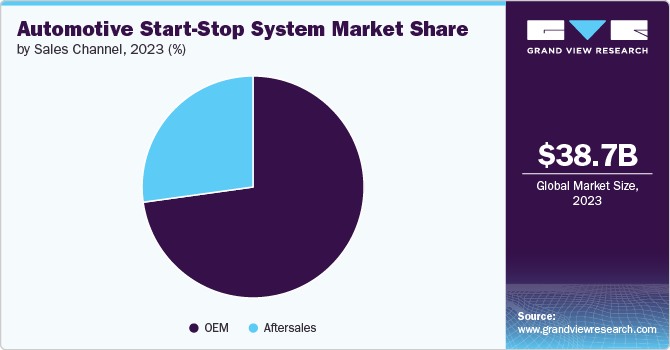

- By sales channel, the OEM segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 38.71 Billion

- 2030 Projected Market Size: USD 89.06 Billion

- CAGR (2024-2030): 13.1%

- Europe: Largest market in 2023

As fuel prices continue to fluctuate, consumers and businesses are increasingly seeking ways to enhance vehicle efficiency. Start-stop systems offer a solution by automatically shutting off the engine when the vehicle is idle, thereby reducing fuel consumption and emissions. Additionally, stringent emission regulations and fuel economy standards set by governments globally are pushing automakers to incorporate start-stop technology into their vehicles to meet these requirements.Technological advancements in automotive start-stop systems are making them more efficient and user-friendly. Innovations such as integrated starter generators (ISG), advanced battery technologies, and enhanced control algorithms are improving the system's reliability and responsiveness. Moreover, the integration of these systems with other vehicle technologies, such as hybrid powertrains and regenerative braking systems, is further optimizing fuel efficiency. The development of start-stop systems that can work seamlessly with advanced driver assistance systems (ADAS) and autonomous driving technologies is also contributing to the overall improvement and adoption of this technology.

Government initiatives worldwide are playing a significant role in the adoption of automotive start-stop systems. Many governments are offering incentives, such as tax rebates and subsidies, to encourage consumers and manufacturers to adopt fuel-efficient technologies. In addition, regulatory bodies are imposing stricter emission standards and fuel economy targets, compelling automakers to incorporate start-stop systems into their vehicles. These initiatives are aimed at reducing the carbon footprint of the transportation sector, improving air quality, and promoting the use of environmentally friendly automotive technologies.

Automotive manufacturers are increasingly focusing on the development and integration of start-stop systems in their vehicle offerings. This focus is driven by the need to meet regulatory requirements, respond to consumer demand for more fuel-efficient vehicles, and stay competitive in the market. Automakers are investing in research and development to enhance the performance and durability of start-stop systems, ensuring they function seamlessly in various driving conditions. Moreover, manufacturers are collaborating with technology providers to integrate start-stop systems with other advanced vehicle technologies, enhancing the overall driving experience.

The automotive start-stop system market presents several key opportunities, particularly in countries with stringent emission regulations and high fuel prices. As the demand for fuel-efficient vehicles continues to grow, there is significant potential for start-stop systems in both passenger and commercial vehicles. The increasing adoption of electric and hybrid vehicles, where start-stop systems can be effectively integrated, also provides growth opportunities. Additionally, advancements in battery technology and energy management systems are likely to create new avenues for the development and adoption of start-stop systems in the automotive industry.

Type Insights

The two wheelers segment accounted for the largest market share, exceeding 46% in 2023. This prominence is largely driven by the increasing demand for fuel efficiency and emission reduction in urban areas, where two-wheelers are a popular mode of transportation. The integration of start-stop systems in two-wheelers helps in minimizing idle time fuel consumption, thereby reducing carbon emissions. Furthermore, the growing adoption of advanced technologies in scooters and motorcycles, coupled with government regulations aimed at curbing vehicular pollution, has further accelerated the market penetration of start-stop systems in this segment. Manufacturers are increasingly focusing on enhancing the efficiency and reliability of these systems, which is expected to sustain the high market share of two-wheelers in the coming years.

The commercial vehicle segment is expected to witness significant CAGR from 2024 to 2030. reflecting the sector's shift towards more sustainable and cost-effective solutions. This growth is primarily fueled by the rising emphasis on reducing fuel costs and meeting stringent emission standards, which are critical considerations for fleet operators and logistics companies. The adoption of start-stop systems in commercial vehicles, including trucks and buses, helps in conserving fuel during frequent stops and starts, especially in urban and congested routes. Additionally, the increasing focus on green transportation and the development of hybrid and electric commercial vehicles have further spurred the demand for these systems. As a result, the commercial vehicle segment is poised to see continued expansion, driven by technological advancements and regulatory pressures.

Propulsion Type

The ICE segment held the largest market share of 75.5% in 2023. This dominance is largely due to the widespread prevalence of ICE vehicles, which still constitute the majority of the global automotive fleet. Start-stop systems are particularly beneficial in ICE vehicles as they help reduce fuel consumption and emissions by automatically shutting off the engine during idle periods, such as at traffic lights, and restarting it when the driver is ready to move again. The established infrastructure for ICE vehicles and the relatively lower cost of these vehicles compared to their electric counterparts also contribute to the sustained demand for start-stop systems in this segment. Furthermore, many countries have implemented stringent emission regulations, which have encouraged automakers to adopt start-stop technology to meet these standards.

The electric segment is anticipated to witness significant growth from 2024 to 2030 due to the rapid adoption of electric vehicles worldwide, driven by increasing environmental concerns, government incentives, and advancements in battery technology. Although traditional start-stop systems are not directly applicable to pure electric vehicles, similar energy-saving mechanisms are employed in hybrid vehicles, which combine ICE and electric powertrains. The growing hybrid vehicle market, which serves as a bridge between traditional ICE vehicles and fully electric models, has bolstered the demand for start-stop systems. Additionally, the shift towards electrification in the automotive industry has prompted innovations in start-stop technology, making it more efficient and compatible with a broader range of powertrain configurations.

Sales Channel Insights

The OEM segment held the largest revenue share in 2023, due to their integration of these systems into new vehicle models. As fuel efficiency and emission reduction have become crucial factors for automotive manufacturers, OEMs are increasingly adopting start-stop technology to meet regulatory standards and consumer demand. This system, which automatically stops and restarts the engine to reduce idling time, has become a standard feature in many new cars, particularly in regions with stringent emission norms. OEMs benefit from economies of scale and the ability to incorporate advanced Start-Stop systems seamlessly into their vehicles' design, thereby securing a dominant position in the market.

The aftermarket segment of the market is expected to grow at fastest CAGR of 14% over the forecast period. This is driven by the increasing demand for retrofitting existing vehicles with this fuel-saving technology. As consumers become more aware of the benefits of start-stop systems, such as improved fuel efficiency and reduced carbon emissions, there is a growing interest in upgrading older vehicles. The aftermarket segment is capitalizing on this trend by offering a range of start-stop system solutions that are compatible with various vehicle models. Additionally, advancements in technology and the availability of cost-effective aftermarket options are making it easier for vehicle owners to access these systems. This surge in demand is expected to continue as more drivers seek to enhance the efficiency and environmental friendliness of their vehicles without purchasing new ones.

Regional Insights

TheNorth America Automotive Start-Stop System Marketis expected to grow at a CAGR of 13.0% from 2024-2030. The growth of the automotive start-stop system market in North America is driven by stringent fuel efficiency regulations and emissions standards set by government bodies like the Environmental Protection Agency (EPA). Additionally, increasing consumer demand for fuel-efficient vehicles due to rising fuel prices and environmental concerns is pushing automakers to integrate start-stop systems into their vehicles. The presence of a well-established automotive industry and the growing popularity of hybrid and electric vehicles further support market growth in the region.

U.S. Automotive Start-Stop System Market Trends

In the U.S., the Automotive Start-Stop System Market is driven by the Corporate Average Fuel Economy (CAFE) standards, which compel automakers to enhance fuel efficiency across their fleets. Additionally, growing awareness among consumers about the benefits of start-stop systems, such as reduced fuel consumption and lower emissions, is contributing to market expansion. The market is also supported by advancements in automotive technology, including more efficient and reliable battery systems that enable the widespread adoption of start-stop technology in a variety of vehicle segments.

Asia Pacific Automotive Start- stope System Market Trends

Asia Pacific Automotive Start-Stop System Marketaccounted for a revenue share exceeding 31% in 2023. The Asia Pacific region is experiencing rapid growth in the automotive start-stop system market due to the booming automotive industry, particularly in countries like China, Japan, and India. Rising urbanization and increasing vehicle ownership rates are driving the demand for fuel-efficient technologies to combat traffic congestion and reduce fuel costs. Government policies aimed at reducing vehicular emissions and the growing adoption of electric and hybrid vehicles are also significant drivers. Furthermore, the presence of major automotive manufacturers and a strong focus on technological innovation in this region are propelling market growth.

Europe Automotive Start-Stop System Market Trends

Europe region dominated the market and was accounted for a share of 34.72% in 2023, owing to the region's stringent emissions regulations and the European Union's commitment to reducing carbon footprints. European consumers are increasingly adopting start-stop systems due to their environmental benefits, including reduced CO2 emissions and improved fuel efficiency. The region's strong automotive industry, characterized by the presence of leading car manufacturers and a high rate of technological innovation, also supports market growth. Additionally, the rising demand for hybrid and electric vehicles, which are often equipped with start-stop systems, further fuels the market in Europe.

Key Automotive Start-Stop System Company Insights

The market key players are focusing on developing new products, partnerships and collaborations, to achieve a competitive edge over their competitors.

Key Automotive Start-Stop System Companies:

The following are the leading companies in the automotive start-stop system market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- BorgWarner Inc.

- Hitachi Ltd

- Volvo Cars Corporation

- Valeo

- Maxwell technologies Inc.

- Schaeffler Technologies AG & Co. KG

Recent Developments

-

In September 2023, Ford Motor Company has announced the plan to launch Ford F-150 truck, launching in early 2024, is built with advanced features and technology to tackle tough challenges. Its Built Ford Tough® capability and new Pro Access Tailgate offer enhanced utility and a rugged design.

-

In March 2018, BorgWarner, one of the prominent player in clean and efficient technology solutions for combustion, hybrid, and electric vehicles, enhances vehicle efficiency for Ford with its Eco-Launch stop/start solenoid valve and hydraulic accumulator. Designed for quick and smooth engine restarts, this award-winning solution is integrated into Ford's 8-speed, front-wheel drive (FWD), mid-torque transmission used in various vehicles across North America

Automotive Start-Stop System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.62 billion

Revenue forecast in 2030

USD 89.06 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, propulsion type, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, Mexico, U.A.E., Saudi Arabia, South Africa

Key companies profiled

Continental AG, Denso Corporation, Robert Bosch GmbH, BorgWarner Inc., Hitachi Ltd, Volvo Cars Corporation, Valeo, Maxwell technologies Inc., SEG Automotive Germany GmbH, and Schaeffler Technologies AG & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Start-stop System Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global automotive start-stop system market report based on the vehicle type, propulsion type, sales channel, and region.

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Two wheelers

-

Passenger Cars

-

Commercial Vehicle

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftersales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive start-stop system market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030, reaching USD 89.06 billion by 2030.

b. The two-wheelers segment accounted for the largest market share, exceeding 46% in 2023. This prominence is largely driven by the increasing demand for fuel efficiency and emission reduction in urban areas, where two-wheelers are a popular mode of transportation. The integration of start-stop systems in two-wheelers helps in minimizing idle time fuel consumption, thereby reducing carbon emissions.

b. Some of the players operating in the automotive start-stop system market include Continental AG, Denso Corporation, Robert Bosch GmbH, BorgWarner Inc., Hitachi Ltd, Volvo Cars Corporation, Valeo, Maxwell technologies Inc., SEG Automotive Germany GmbH, and Schaeffler Technologies AG & Co. KG among others.

b. Growing concerns about environmental sustainability and the need to reduce fuel consumption and greenhouse gas emissions is driving the automotive start-stop system market. As fuel prices continue to fluctuate, consumers and businesses are increasingly seeking ways to enhance vehicle efficiency.

b. The global automotive start-stop system market size was estimated at USD 38.71 billion in 2023 and is expected to reach USD 42.62 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.