- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Automotive Wrap Films Market Size, Industry Report, 2033GVR Report cover

![Automotive Wrap Films Market Size, Share & Trends Report]()

Automotive Wrap Films Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Trucks, Buses, Passenger Cars), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-674-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Wrap Films Market Summary

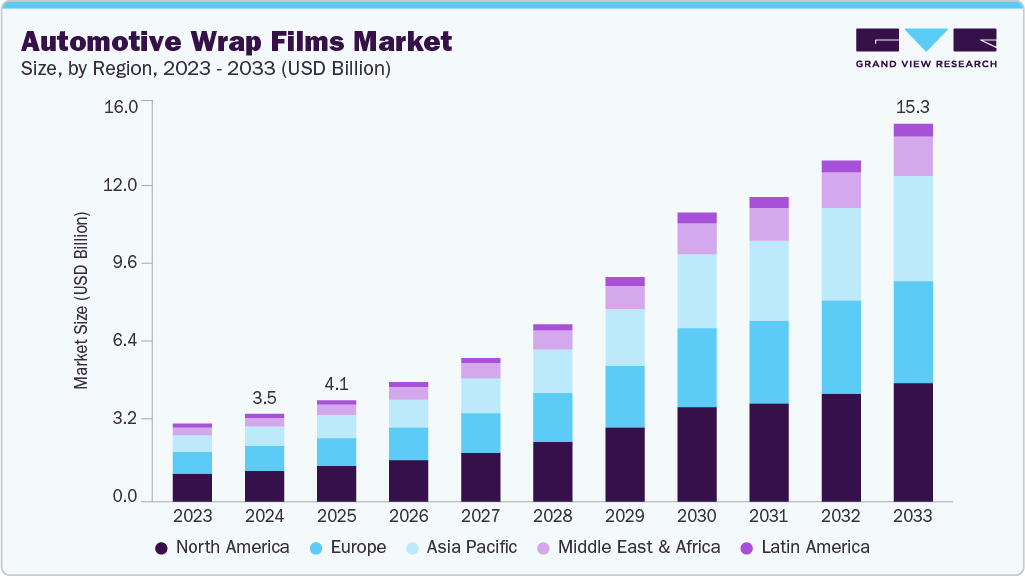

The global automotive wrap films market size was estimated at USD 3.54 billion in 2024 and is projected to reach USD 15.32 billion by 2033, growing at a CAGR of 18.0% from 2025 to 2033. The market growth is driven by the rising demand for vehicle customization and aesthetic personalization, along with increasing awareness of paint protection and durability.

Key Market Trends & Insights

- North America dominated the automotive wrap films market with the largest revenue share of over 35.0% in 2024.

- By country, the U.S. automotive wrap films industry led North America, with the largest revenue share of over 86.0% in 2024.

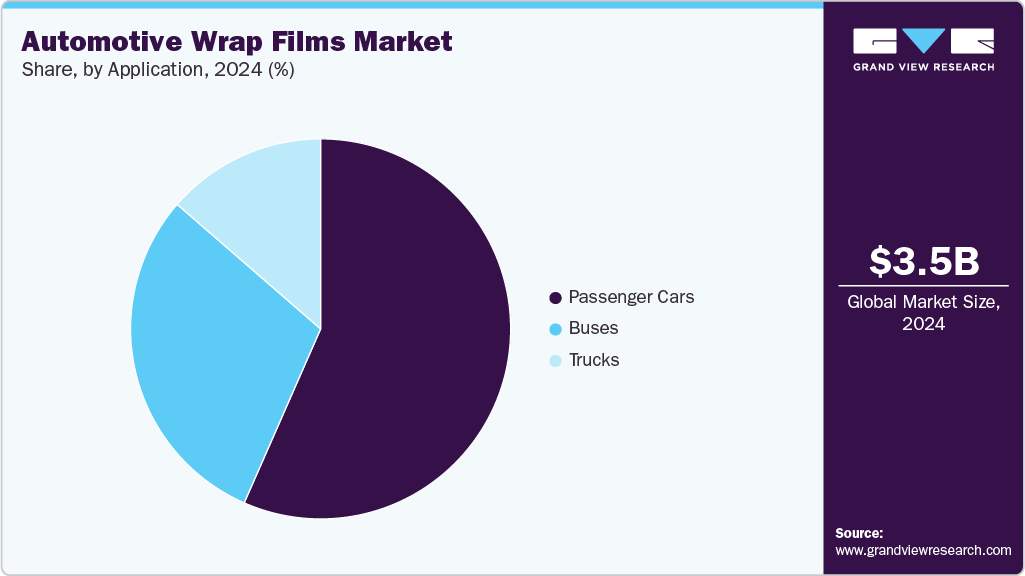

- By application, the passenger cars segment led the market with the largest revenue share of over 56.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.54 Billion

- 2033 Projected Market Size: USD 15.32 Billion

- CAGR (2025-2033): 18.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, growing automotive sales and trends in fleet branding and advertising boost market adoption. Consumers increasingly prefer unique vehicle aesthetics over standard paint finishes, seeking custom colors, textures, and designs. Automotive wraps provide a cost-effective and reversible alternative to traditional painting, enabling individuals and businesses to refresh or transform a vehicle’s appearance without permanent modifications. This trend is particularly strong among luxury vehicle owners, car enthusiasts, and commercial fleets looking for brand visibility through customized vehicle graphics.Another significant factor is the cost-effectiveness and protection offered by wrap films. Automotive wraps not only enhance appearance but also act as a protective layer against minor scratches, UV radiation, and environmental damage. This protection helps maintain the resale value of vehicles, which encourages more consumers and fleet operators to adopt wrap films. Compared to a full paint job, wraps are less expensive and require less downtime, making them an attractive solution for budget-conscious customers and businesses seeking fleet branding.

The growing automotive aftermarket industry, especially in regions like North America and Europe, is also fueling the growth of the automotive wrap films industry. As car ownership increases and consumers invest more in vehicle aesthetics and maintenance, demand for aftermarket customization products such as wrap films continues to rise. Commercial applications, including branding for taxis, delivery vehicles, and company fleets, also contribute significantly to market expansion. Additionally, the proliferation of specialized wrap service providers and online platforms has made these products more accessible, further boosting adoption.

Moreover, technological advancements in wrap film materials and finishes are driving market adoption. Innovations such as air-release adhesives, high-durability polymers, textured finishes (like carbon fiber, matte, and metallic), and eco-friendly films enhance ease of installation, longevity, and visual appeal. These technological improvements reduce installation errors and maintenance issues, making wraps more appealing to both professional installers and DIY enthusiasts. As manufacturers continue to innovate, offering new colors, textures, and environmentally friendly solutions, the market for automotive wrap films is expected to sustain steady growth globally.

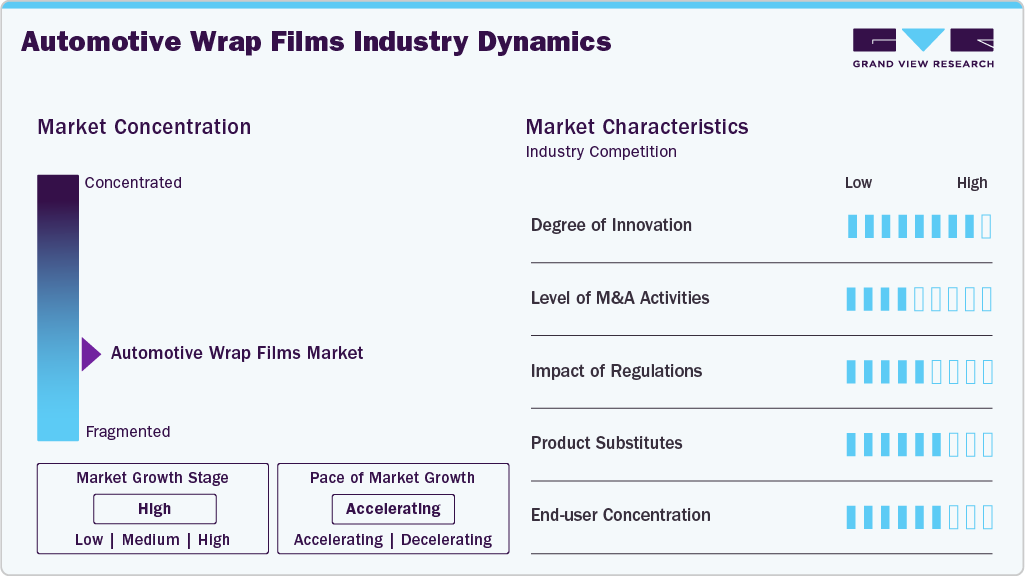

Market Concentration & Characteristics

The automotive wrap films market is innovation-driven, with constant technological advancements in film materials, finishes, adhesives, and installation techniques. Companies invest in R&D to develop films that are more durable, scratch-resistant, UV-stable, and easier to install or remove. Innovations such as self-healing films, eco-friendly PVC-free wraps, and specialty textures (matte, satin, carbon fiber, and metallic) have expanded product offerings and increased consumer adoption. The rapid pace of innovation ensures that market participants must continuously adapt to evolving consumer preferences and regulatory requirements.

The industry has a moderate-to-high entry barrier for new players due to the need for technical expertise, high-quality raw materials, and specialized installation skills. While raw film manufacturing requires significant capital investment and precision machinery, the installation and customization segment has lower barriers, attracting small local players. Regulatory compliance related to VOC emissions, environmental standards, and safety also plays a role in shaping market dynamics. Despite challenges, the industry offers growth opportunities through innovation, regional expansion, and increasing consumer preference for personalization and protective solutions.

Application Insights

The passenger car segment dominated the automotive wrap films industry, with a share of over 56.0% in 2024. It is expected to grow at the fastest CAGR of 19.7% during the forecast period. Vehicle owners increasingly prefer vinyl and polyurethane wrap films as a cost-effective and customizable alternative to traditional paint jobs. Wraps are used for full-body color changes, partial wraps, and aesthetic designs, including matte, gloss, metallic, and carbon fiber finishes. Additionally, luxury and premium car owners use wraps to protect original paint from UV rays, scratches, and minor abrasions. The growth of this segment is driven by rising consumer demand for vehicle personalization and aesthetic appeal, coupled with increasing awareness about paint protection solutions.

In buses, wrap films are primarily used for large-scale graphics, advertisements, and branding. Public and private transport operators use full-body wraps to display commercial ads or corporate identities, turning buses into moving billboards. Transit advertising has become a lucrative avenue for brands due to high visibility and extended exposure time. In addition, wrap films are used by school and intercity bus fleets to standardize vehicle appearance, improve surface protection, and simplify maintenance. The increasing investment in outdoor advertising and the growing popularity of transit media are major factors propelling wrap film adoption in buses.

Regional Insights

North America recorded the largest revenue share of over 35.0% in 2024. North America dominates the premium segment of the automotive wrap films market, supported by a strong aftermarket customization culture and high consumer spending power. The U.S. and Canada are key centers for automotive restyling, where vehicle wrapping is considered both a fashion statement and a practical solution for paint protection. Car enthusiasts and professional detailing studios extensively use wrap films for color changes, texture customization, and branding. Major companies such as 3M and Arlon Graphics are headquartered in the region, ensuring continuous technological innovation, product availability, and customer education.

Europe Automotive Wrap Films Market Trends

Europe represents a mature yet innovation-driven automotive wrap films industry, underpinned by advanced automotive manufacturing and strong consumer demand for vehicle aesthetics and protection. Countries such as Germany, the UK, and France are leading adopters of high-performance wrap films made from advanced materials such as polyurethane and fluoropolymer coatings. European consumers prioritize both functionality and sustainability, prompting wrap manufacturers to introduce low-VOC, eco-friendly, and recyclable products. Moreover, premium car owners in Germany and Italy increasingly use paint protection films (PPFs) to maintain vehicle resale value.

Asia Pacific Automotive Wrap Films Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 21.0% over the forecast period. This positive outlook is due to rapid vehicle production, rising disposable incomes, and increasing consumer preference for vehicle customization. Countries such as China, Japan, and India are witnessing a surge in demand for aftermarket car modification services, including full-body wraps and protective films. Expanding automotive aftermarket networks and growing awareness about cost-effective alternatives to repainting are contributing to regional growth. The continuous growth of automotive e-commerce platforms and detailing studios across major cities such as Shanghai, Mumbai, and Bangkok also reinforces market penetration.

Key Automotive Wrap Films Company Insights

The competitive environment of the global automotive wrap films market is moderately fragmented, with a mix of large multinational players and regional manufacturers vying for market share. Key players differentiate themselves through product innovation, advanced printing technologies, customization options, and durability features such as UV resistance and scratch protection.

While established companies such as 3M, Avery Dennison, and ORAFOL dominate premium and commercial segments due to strong brand recognition and extensive distribution networks, smaller regional players compete on cost-effectiveness and localized solutions. Strategic partnerships with automotive OEMs, aftermarket installers, and e-commerce platforms are increasingly shaping competition, alongside mergers, acquisitions, and collaborations aimed at expanding geographic presence and technological capabilities.

-

In February 2025, Avery Dennison partnered with the UK-based car customizer Yianni Charalambous (Yiannimize) to launch new Supreme Wrapping Film colors in North America, previously exclusive to Europe. The Yiannimize Series features four standout shades, namely, Gloss Metallic Vibrant Violet, Gloss Pearl Tutu Pink, Gloss Pure Red, and Satin Metallic Spy Grey, designed for striking aesthetics and superior performance on vehicles like Lamborghinis and Bentleys, using Avery Dennison’s Easy Apply RS adhesive for hassle-free installation and professional results.

-

In March 2024, Arlon Graphics introduced VITAL, a groundbreaking new product line that is free from PVC. VITAL marks a major advancement in the graphics industry, establishing a new benchmark for those who seek top-notch quality, durability, and sustainability without any compromises.

Key Automotive Wrap Films Companies:

The following are the leading companies in the automotive wrap films market. These companies collectively hold the largest market share and dictate industry trends.

- Avery Dennison Corporation

- Arlon Graphics LLC

- 3M

- KPMF

- Fedrigoni S.P.A

- Vvivid Vinyl

- ORAFOL Europe GmbH

- Hexis S.A.S

- CARBINS Film

- LLumar (Eastman Performance Films, LLC)

Automotive Wrap Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.09 billion

Revenue forecast in 2033

USD 15.32 billion

Growth rate

CAGR of 18.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Belgium; Netherlands; Poland; China; India; Japan; Australia; Indonesia; Malaysia; Thailand; Philippines; New Zealand; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Avery Dennison Corporation; Arlon Graphics LLC; 3M; KPMF; Fedrigoni S.P.A; Vvivid Vinyl; ORAFOL Europe GmbH; Hexis S.A.S; CARBINS Film; LLumar

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Wrap Films Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive wrap films market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Trucks

-

Buses

-

Passenger Cars

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Belgium

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

Malaysia

-

Thailand

-

Philippines

-

New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive wrap films market was estimated at around USD 3.54 billion in the year 2024 and is expected to reach around USD 4.09 billion in 2025.

b. The global automotive wrap films market is expected to grow at a compound annual growth rate of 18.0% from 2025 to 2030 to reach around USD 15.32 million by 2033.

b. The passenger cars segment dominates the automotive wrap films market due to the rising consumer preference for vehicle personalization and aesthetic enhancement, along with increasing demand for cost-effective paint protection solutions.

b. The key players in the automotive wrap films market include Avery Dennison Corporation; Arlon Graphics LLC; 3M; KPMF; Fedrigoni S.P.A; Vvivid Vinyl; ORAFOL Europe GmbH; Hexis S.A.S; CARBINS Film; and LLumar.

b. The automotive wrap films market is driven by the growing demand for vehicle customization and cost-effective paint protection solutions. Additionally, advancements in self-healing, eco-friendly films and expanding automotive aftermarket services further boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.