- Home

- »

- Automotive & Transportation

- »

-

Automotive Aftermarket Size & Share, Industry Report, 2033GVR Report cover

![Automotive Aftermarket Industry Size, Share & Trends Report]()

Automotive Aftermarket Industry Size, Share & Trends Analysis Report By Replacement Part (Tire, Battery, Brake Parts, Filters), By Distribution Channel, By Service Channel, By Certification, By Region, And Segment Forecasts, 2026 - 2033

- Report ID: GVR-1-68038-363-8

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2033

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Aftermarket Industry Summary

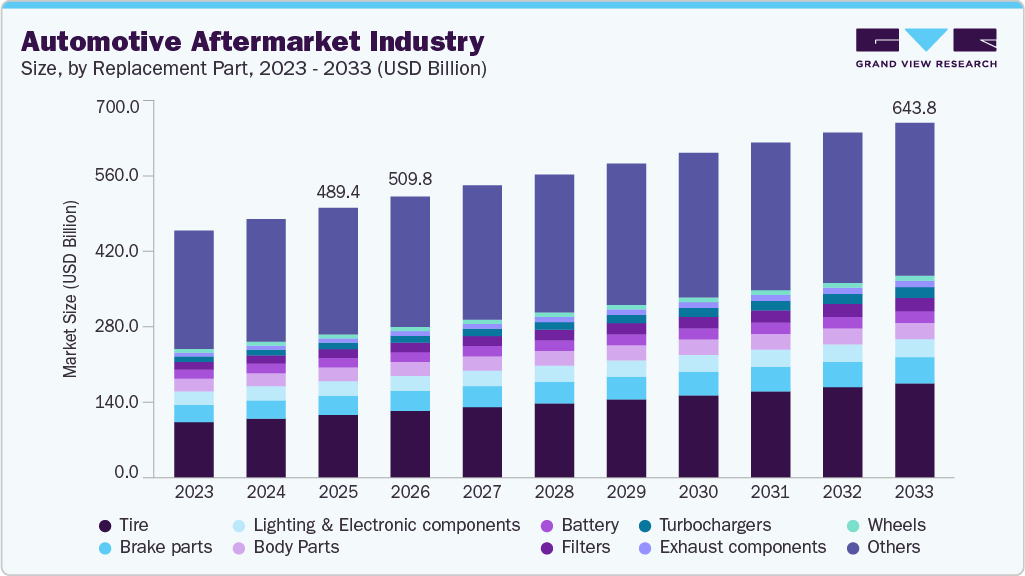

The global automotive aftermarket industry size was estimated at USD 489.45 billion in 2025 and is projected to reach USD 643.78 billion by 2033, growing at a CAGR of 3.4% from 2026 to 2033. The market growth is majorly driven by the pursuit of automobile drivers to enhance their vehicle performance in terms of exhaust sound, speed, and appearance parameters, along with many other aspects.

Key Market Trends & Insights

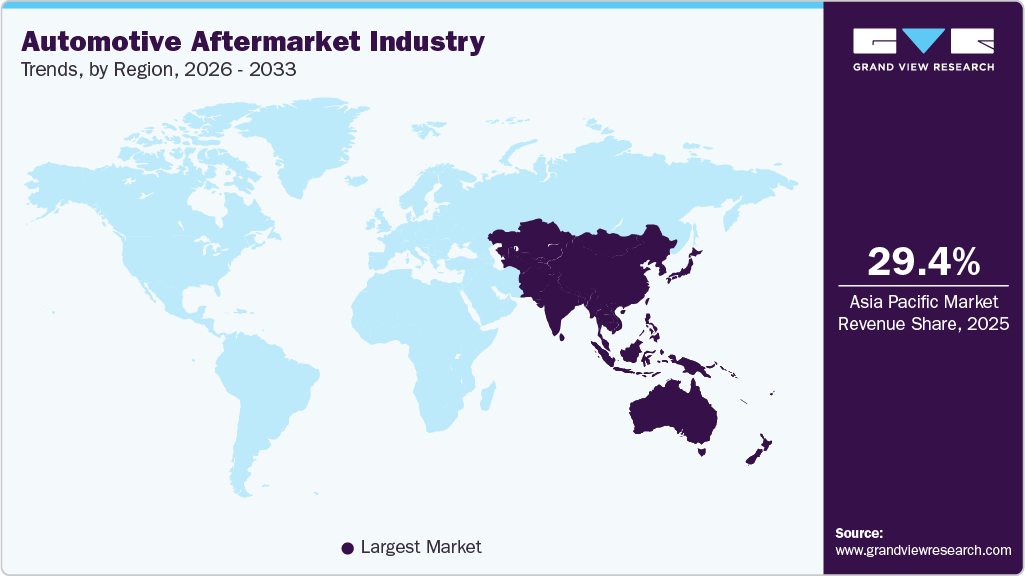

- Asia Pacific dominated the global automotive aftermarket with the largest revenue share of 29.4% in 2025.

- The automotive aftermarket in the U.S. led North America with the largest revenue share in 2025.

- By replacement part, the tire segment held significant revenue share of 23.4% in 2025.

- By distribution channel, the retail segment held the dominant market position with a revenue share of 54.2% in 2025.

- By certification, the uncertified parts segment is expected to grow at the fastest CAGR of 4.7% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 489.45 Billion

- 2033 Projected Market Size: USD 643.78 Billion

- CAGR (2026-2033): 3.4%

- Asia Pacific: Largest Market in 2025

Regional regulatory authorities, such as the Japanese Automobile Sports Muffler Association (JASMA) and the U.S. Environmental Protection Agency, monitor the established standards and environmental impacts associated with the functioning of automotive components. For instance, the noise emission levels associated with the modern-day automotive resonators and mufflers in automotive exhaust systems. Digitization of component delivery sales & services, along with the advent of an online portal distributing aftermarket components in synchrony with the global auto-part supplier groups, is expected to draw huge investments from key companies. For instance, the leading market component suppliers, such as US Auto Parts Network, Inc. and CarParts.com, are expected to drive the global demand for aftermarket during the forthcoming years.

Due to the aforementioned trade gateways, online aftermarket business arcades have high potential in developing countries. Additionally, growing online sales of automotive components are estimated to deliver significant demand for the market. Companies are now shifting to the digital platform owing to the smoother experience for the customers. In January 2020, Continental AG announced its online portal, which will feature a comprehensive portfolio of its services and information about its products for the market.

The value chain of the market comprises two primary segments: automotive replacement part suppliers and service enablers. These prime industry segments are exchanging value through the automotive sectors at several intermittent stages. Access to an elaborative component assortment coupled with the simplicity of transactions, delivered through the digitalization of the global automotive component sales, is destined to resolve the obtainability issues, thereby driving the automobile aftermarket industry. The ensuing digitalization is anticipated to have a significant impact on the industry, as a growing number of people are inclined toward Internet-of-Things (IoT) and digitization trends.

Furthermore, the technological improvements in propulsion have created numerous opportunities in the market. However, issues related to high R&D expenditure are expected to hinder market growth during the forecast period. Automobile manufacturers face specific constraints when conducting their manufacturing processes. Production cost is one of these constraints. Some automotive replacement parts, such as aftermarket filters, however, offer the opportunity to choose a part that suits the conditions in which a vehicle operates.

Replacement Parts Insights

In terms of market size, the other segment dominated the market, accounting for a 46.84% share in 2025. The tire segment is anticipated to dominate the market in terms of size over the forecast period. It is expected to remain the dominant segment on account of the low replacement cycle of tires as compared to the other component counterparts. The aftermarket replacement part suppliers comprise various accessory suppliers, lubricant suppliers, tire suppliers, and other component replacement suppliers.

Furthermore, the industry value chain comprises service enablers such as repairing services providers and entertainment service providers. The automobile industry is observing an increase in the demand for hybrid electric cars that would eventually throttle the demand for exhaust parts and specific tools for these specialized cars. This curb can be attributed to the increased prices of petrol and automobiles with petrol engines. Growth in the disposable proceeds of patrons in developing nations, such as China and Brazil, is expected to have a positive impact on the growth rate of the market.

The growing demand for locomotives is projected to trigger the demand for automobile component sales. Rigid regulatory standards of car safety across the globe are anticipated to drive market economies. The modern age production technology, such as 3D printing of automotive parts, is being extensively deployed by major companies in the industry to optimize their production costs, with 3D printing enabling efficient fabrication performance and reduction of emission toxicity.

Distribution Channel Insights

In terms of market size, the retail segment dominated the automotive aftermarket, accounting for a 54.2% share in 2025. The retail segment is anticipated to continue dominating from 2026 to 2033. The wholesale & distribution segment is expected to witness relatively fast growth in terms of revenue from 2026 to 2033. Automotive aftermarket economies are important parts of the overall automotive manufacturing & maintenance scheme, as automotive components need to be replaced on time to maintain the overall performance of the vehicle.

The increasing influence of technological advancement is transforming the market towards digitization. The aftermarket is going online, and the marketplace is transforming. Parts and services are being sold online. Every player in the value chain, including Original Equipment Manufacturers (OEMs), Original Equipment Suppliers (OESs), wholesalers, insurers, and workshops, is responding to the growing online aftermarket trend. Advanced technology usage in auto parts fabrication, the surge in consumer and passenger automobile production, and the digitalization of automotive repair & maintenance services are the few factors expected to impel the market growth.

Service Channel Insights

In terms of market size, the original equipment segment dominated the market in 2025. The OE segment is anticipated to dominate the aftermarket arena in terms of size by 2033. The DIY segment is expected to register relatively rapid growth in terms of revenue over the forecast period. DIY customers possess the technical knowledge and interest in maintaining, repairing, and upgrading their cars independently. DIFM customers purchase parts online but have them installed by a professional workshop.

The aftermarket service channel comprises members such as raw material suppliers, tier 1 distributors, automobile exhaust hubs/manufacturing units, and aftermarket units comprising jobbers and ultimately the repair shops. Repair centers are the important stakeholders in the service channel. The industry is witnessing a trend of strategic alliances and collaborations between collision repair centers and leading auto insurance companies to gain a competitive edge and capture a significant share of the market. For instance, Utica Mutual Insurance Company, State Farm Mutual Automobile Insurance Company, and Progressive Casualty Insurance Company have tie-ups with certified automotive repair shops across all the states in the U.S.

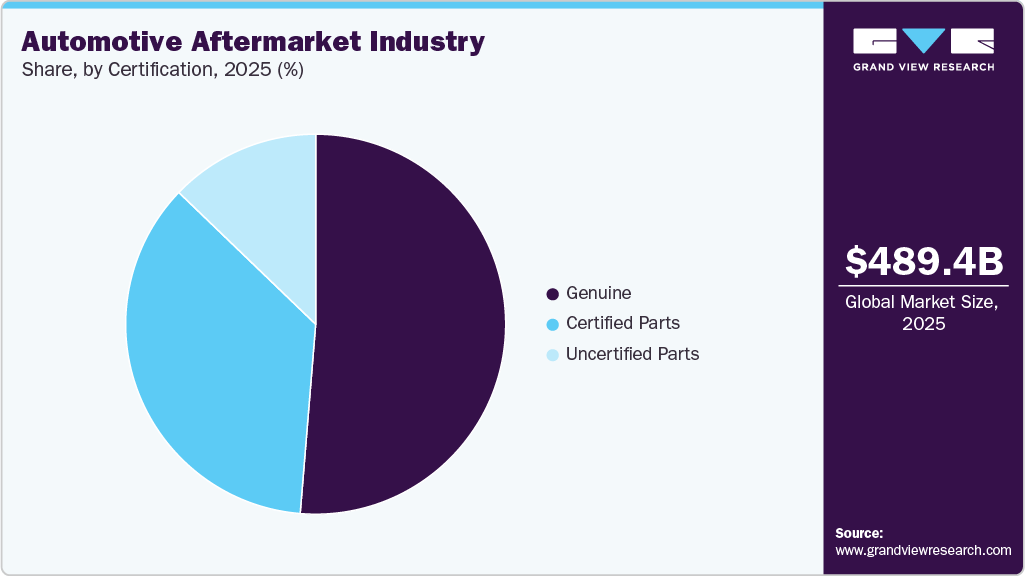

Certification Insights

In terms of market size, the genuine parts segment dominated the automotive aftermarket in 2025. The genuine parts segment is anticipated to continue dominating over the forecast period. The uncertified segment is expected to experience relatively rapid revenue growth from 2026 to 2033. Counterfeit parts are illegal, have not been tested or certified, and do not come with a warranty. Genuine parts are manufactured by car manufacturers or by OEMs, also known as subcontractors. Genuine replacement parts offer greater assurance of quality, are more diverse, easier to find, and come with a warranty. The downside of these parts is that they are expensive and must be purchased from dealers.

Certified automotive parts are tested and inspected by certified organizations. The Certified Automotive Parts Association (CAPA) is a non-profit organization that was incorporated in 1987. CAPA offers test programs to verify and guarantee the quality and suitability of automotive replacement parts. It was the brainchild of automotive insurance companies and was formed to ensure the quality of replacement parts used by collision repair shops. Certified parts are cost-effective alternatives to genuine, more expensive parts. At the same time, uncertified parts can be used as an alternative to the original automotive parts. Car makers do not approve uncertified parts. However, the low cost of uncertified parts creates significant growth opportunities for the segment in the coming years.

Regional Insights

The Asia Pacific automotive aftermarket industry held the largest revenue share in 2025. Asia Pacific is expected to continue leading from 2026 to 2033.The digitalization of automotive component delivery services is seen as a key driver of regional car sales, alongside the adoption of advanced technologies in auto parts production and rising output and sales of consumer and passenger vehicles.

The China automotive aftermarketdominated Asia Pacific in 2025. E-commerce has been booming in China, and the automotive aftermarket is no exception. Online platforms and marketplaces have gained popularity, offering a wide range of automotive products and services. Consumers in China increasingly turn to online channels for convenience, competitive pricing, and access to a vast selection of aftermarket parts and accessories.

North America Automotive Aftermarket Industry Trends

The North America automotive aftermarket is anticipated to grow at a CAGR of 2.2% from 2026 to 2033. Additionally, there is a growing trend of vehicle customization in the region, where owners modify their vehicles to reflect their unique tastes and preferences. This includes aftermarket upgrades such as performance parts, aesthetic enhancements, audio systems, lighting modifications, and more.

U.S. Automotive Aftermarket Industry Trends

The U.S. automotive aftermarket has seen a significant expansion of e-commerce channels. Online retailers and marketplaces have gained popularity due to the convenience of purchasing parts and accessories online. E-commerce offers a wide range of products, competitive pricing, and simplified shopping experiences.

Europe Automotive Aftermarket Industry Trends

The Europe automotive aftermarket is expected to reach USD 115.75 billion by 2033. Europe is at the forefront of automotive technology, which has significantly influenced the aftermarket sector. The integration of advanced technologies in vehicles, such as ADAS, electric and hybrid systems, and connectivity features, has created opportunities for aftermarket solutions and retrofits to meet the changing needs of European vehicle owners.

The automotive aftermarket in the UK is placing an increased focus on skills development and training programs. With the advancement of vehicle technologies, there is a growing need for qualified technicians and professionals who can diagnose, repair, and maintain modern vehicles. Training initiatives are being introduced to upskill the workforce and ensure they remain updated with the latest advancements. These trends reflect the unique factors shaping the growth of the automotive aftermarket in the UK.

Key Automotive Aftermarket Company Insights

Key automotive aftermarket companies include 3M Company, Continental AG, Denso Corporation, Robert Bosch GmbH, and ZF Friedrichshafen AG.

-

3M India Limited, a subsidiary of the U.S.-based 3M Company, leverages science and innovation to address practical challenges and enhance daily life. The company operates across the Safety & Industrial, Transportation & Electronics, Healthcare, and Consumer markets in India and internationally. Its product portfolio includes adhesives, abrasives, medical supplies, safety equipment, and consumer goods, distributed through direct sales, trade channels, and e-commerce. With manufacturing facilities and an R&D center in India, 3M India is committed to sustainable development, operational excellence, and long-term value creation for stakeholders.

-

Continental AG is a German multinational automotive technology and tire company founded in 1871 and headquartered in Hanover, Germany. It is one of the world’s leading tire manufacturers and automotive suppliers, offering sustainable, safe, and convenient mobility solutions to automotive manufacturers, industrial customers, and end-users globally. Continental’s product portfolio includes tires, brake systems, vehicle electronics, safety systems, and technical components that support modern mobility and transport. With a long history of innovation and a presence in over 50 countries, the company focuses on technological leadership, quality, and sustainable growth in the automotive sector.

Key Automotive Aftermarket Companies:

The following are the leading companies in the automotive aftermarket. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Continental AG

- Cooper Tire & Rubber Company

- Delphi Automotive PLC

- Denso Corporation

- Federal-Mogul Corporation

- HELLA KGaA Hueck & Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

Recent Developments

-

In August 2024, Delphi, a brand of PHINIA Inc., significantly expanded its product offerings by launching over 2,000 new parts in the first half of 2024, covering a total of 632 million vehicles globally. This includes enhancements in key categories such as Braking, Steering and Suspension, and Sensors, with a notable increase in first-to-market launches by 35% compared to the previous year. The company also introduced advanced diagnostic software and expanded its coverage of electric vehicle models, reinforcing its commitment to keeping vehicles on the road longer and more efficiently.

-

In June 2023, Continental released the UltraContact NXT series tire, which is distinguished by its high share of sustainable material usage. The tire comprises up to 65% of recycled, renewable, and ISCC PLUS mass balance-certified materials. The tires will be made available in 19 sizes.

-

In April 2023, ZF Aftermarket announced an expansion of its range of offerings for the Indian passenger car market with the introduction of three newly manufactured TRW products in India, comprising shock absorbers, brake pads, and brake discs. The company emphasizes that a crucial aspect of the independent aftermarket is the repair of brakes for passenger vehicles.

Automotive Aftermarket Industry Report Scope

Report Attribute

Details

Market size value in 2026

USD 509.84 billion

Revenue forecast in 2033

USD 643.78 billion

Growth rate

CAGR of 3.4% from 2026 to 2033

Actual data

2021 - 2033

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Replacement parts, distribution channel, certification, service channel, regions

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil

Key companies profiled

3M Company, Continental AG, Cooper Tire & Rubber Company, Delphi Automotive PLC, Denso Corporation, Federal-Mogul Corporation, HELLA KGaA Hueck & Co., Robert Bosch GmbH, Valeo Group, ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Automotive Aftermarket Industry Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2021 to 2033. For this study, Grand View Research has segmented the automotive aftermarket industry report based on replacement part, distribution channel, service channel, certification, and region:

-

Replacement Parts Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tire

-

Battery

-

Brake Parts

-

Filters

-

Body parts

-

Lighting & Electronic Components

-

Wheels

-

Exhaust components

-

Turbochargers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retailers

-

OEMs

-

Repair Shops

-

-

Wholesalers & Distributors

-

-

Service Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

DIY (Do it Yourself)

-

DIFM (Do it for Me)

-

OE (Delegating to OEMs)

-

-

Certification Outlook (Revenue, USD Billion, 2021 - 2033)

-

Genuine Parts

-

Certified Parts

-

Uncertified Parts

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive aftermarket industry size was estimated at USD 489.45 billion in 2025 and is expected to reach USD 509.84 billion in 2026.

b. The global automotive aftermarket industry is expected to grow at a compound annual growth rate of 3.4% from 2026 to 2033 to reach USD 643.78 billion by 2033.

b. The others dominated the replacement part segment of the automotive aftermarket industry with a share of around 46.84% in 2025, while the tire segment would be the second-largest in the replacement part segment.

b. The retail distribution channel segment dominated the automotive aftermarket industry with a share of around 54.2 % in 2025. The segment is anticipated to lead the market arena in terms of size by 2033.

b. The original equipment segment dominated the automotive aftermarket industry with a share of 68.4% in 2025, in terms of market size. The OE segment is anticipated to dominate the aftermarket sector by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.