- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Fluoropolymer Coating Market Size, Industry Report, 2033GVR Report cover

![Fluoropolymer Coating Market Size, Share & Trends Report]()

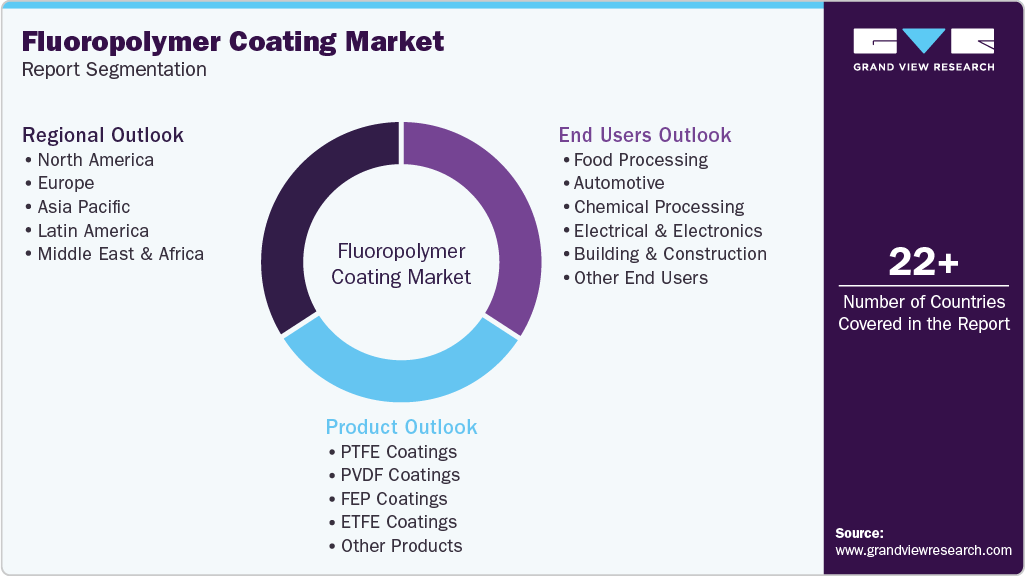

Fluoropolymer Coating Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (PTFE Coatings, PVDF Coatings, FEP Coatings, ETFE Coatings), By End Users (Food Processing, Automotive, Chemical Processing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-638-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluoropolymer Coating Market Summary

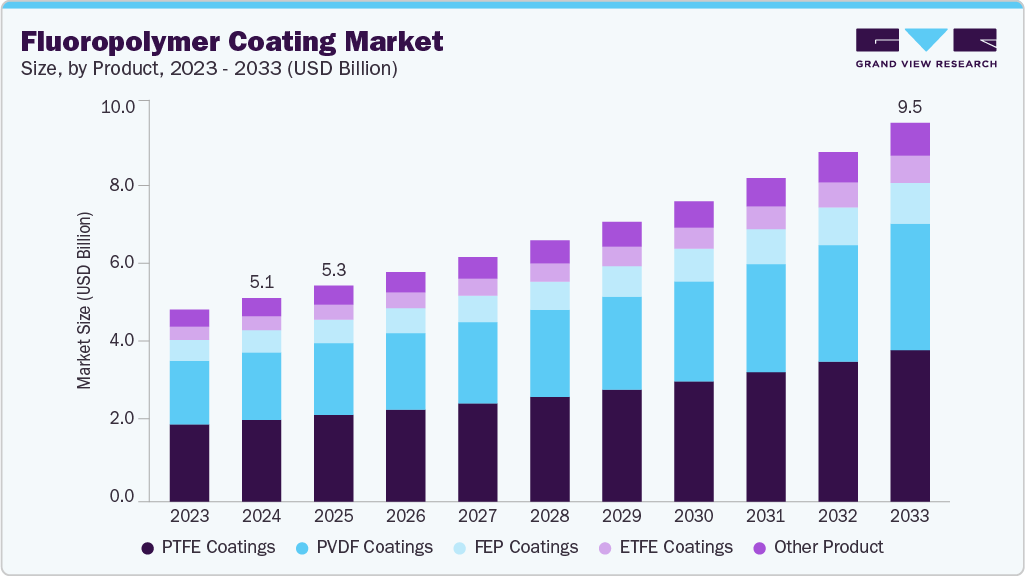

The global fluoropolymer coating market size was estimated at USD 5,122.04 million in 2024 and is projected to reach USD 9,534.11 million by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The market's growth is mainly fueled by rising demand for high-performance coatings offering chemical resistance, thermal stability, and low friction across sectors such as chemical processing, aerospace, electronics, and renewable energy sectors.

Key Market Trends & Insights

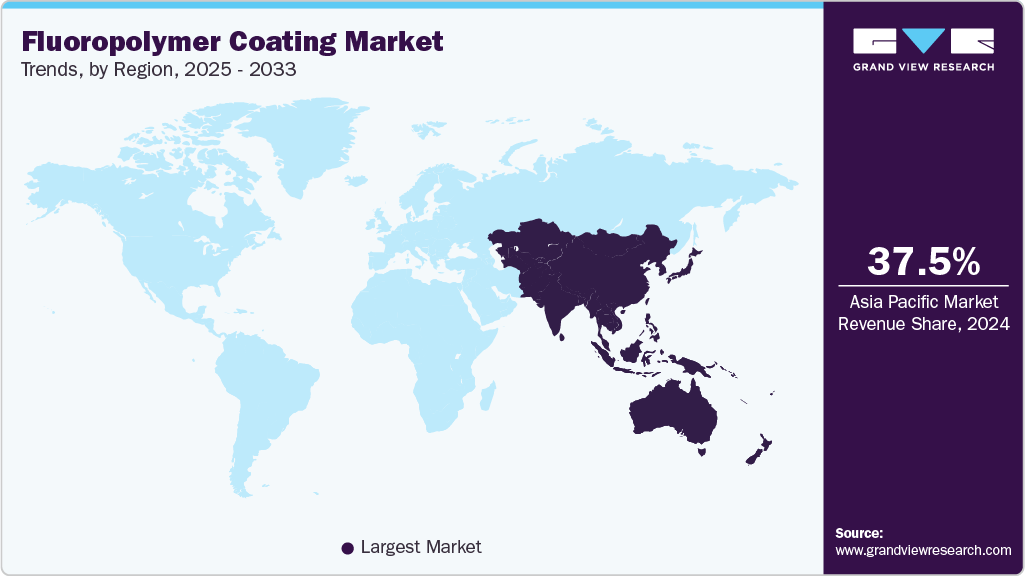

- Asia Pacific dominated the global fluoropolymer coating market with the largest revenue share of 37.5% in 2024.

- The fluoropolymer coating market in the U.S. is expected to grow at a substantial CAGR of 6.6% from 2025 to 2033.

- By product, the ETFE coatings segment is expected to grow at a considerable CAGR of 7.7% from 2025 to 2033 in terms of revenue.

- By end users, the electrical & electronics segment is expected to grow at a considerable CAGR of 8.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 5,122.04 Million

- 2033 Projected Market Size: USD 9,534.11 Million

- CAGR (2025-2033): 7.3%

- North America: Largest market in 2024

Applications in offshore wind turbines, electric vehicle (EV) powertrains, and lithium-ion battery plants are expanding, accelerating adoption worldwide. Infrastructure growth in Asia Pacific and adoption of low-volatile organic compound (VOC) formulations drive further momentum.The global fluoropolymer coating market is driven by its unmatched chemical and corrosion resistance, low friction characteristics, and thermal stability. These superior properties make it indispensable across diverse industries such as building and construction, oil and gas, automotive, electronics, and industrial equipment. For instance, the growing offshore wind sector relies on fluoropolymer coatings for anti-corrosion tower protection and ice-phobic surfaces. Demand for corrosion-resistant, durable coatings in Electric Vehicle (EV) powertrain components and battery facilities further bolsters uptake. Safety regulations on volatile organic compounds, especially in North America and Europe, favor waterborne and powder fluoropolymer formulations, creating a market upswing. Increased infrastructure projects in Asia Pacific and expanding electronics industries contribute to robust growth prospects.

Despite its benefits, high raw material costs remain a significant hurdle for fluoropolymer coatings. Production depends heavily on specialized resins and complex processes, often sourced from fluorospar and hydrofluoric acid, whose volatile supply and pricing can disrupt value chains. In addition, intense competition from cheaper conventional coatings limits fluoropolymer penetration in lower-tier applications. Regulatory pressures related to Polyfluoroalkyl Substances (PFAS) use including pending restrictions in Europe pose further compliance challenges and potential formulation reformulations for manufacturers. These constraints slow adoption rates in price-sensitive segments, and unless technological advances reduce production costs or improve raw material stability, fluoropolymer coatings may continue to face adoption headwinds.

The fluoropolymer coating industry stands at the cusp of several promising opportunities. Increasing environmental regulations drive the development of low-Volatile Organic Compound (VOC), eco-friendly waterborne and powder coatings creating strong demand in regulated regions such as California, the European Union (EU), and North America. Growth in green energy sectors such as hydrogen pipelines, Electric Vehicle (EV) battery manufacturing, and offshore wind installations opens niche applications for specialty coatings such as Ethylene Tetrafluoroethylene (ETFE), Fluorinated Ethylene Propylene (FEP), and Polyvinylidene Fluoride (PVDF). In addition, the Asia Pacific region’s accelerating infrastructure build-out and rising electronics and automotive manufacturing provide a fertile ground for market expansion. Investment in Research and Development (R&D) on Per- and Polyfluoroalkyl Substances (PFAS) alternatives and adhesive technologies for composite materials could further unlock new industrial verticals, boosting demand through the next decade.

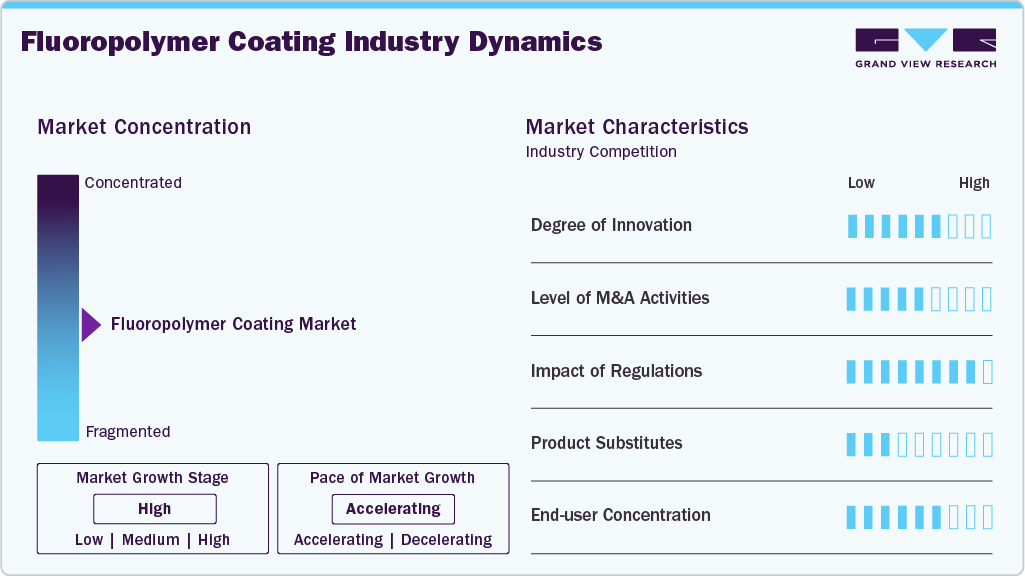

Market Concentration & Characteristics

The global fluoropolymer coating market exhibits moderate concentration, with a handful of major players commanding substantial influence but leaving space for mid-sized and regional participants. Industry leaders such as Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, The Chemours Company, DAIKIN INDUSTRIES, Ltd., and others hold prominent market shares through established distribution networks and proprietary resin technologies. These firms focus on strategic capacity investments, securing raw material supply, and achieving compliance with environmental regulations. Despite their dominance, competitive pressure persists from emerging players and niche specialists, contributing to a balanced structure that encourages both consolidation and innovation.

Fluoropolymer coatings are traded across a diverse spectrum of resin types such as Polytetrafluoroethylene, Polyvinylidene Fluoride, and Fluorinated Ethylene Propylene each differentiated by specialized end-use performance. Geographically, Asia Pacific leads demand through infrastructure expansion, while North America benefits from strong uptakes in aqueous, low‑Volatile Organic Compound(VOC) formulations. Characteristics such as long product lifecycles, high switching costs, and the need for technical service elevate supplier differentiation. Continuous research and targeted product launches reinforce specialty coating penetration across industries.

Product Insights

Polytetrafluoroethylene (PTFE) coatings segment led the market and accounted for the largest revenue share of 40.2% in 2024. This growth is driven due to their unrivaled combination of low friction, chemical inertness, and thermal resilience. These properties make PTFE coatings ideal for applications ranging from non-stick cookware to industrial machinery and aerospace components. The superior performance in wire and cable insulation further supports market leadership, particularly in regions with high demand for durable electrical products. Technological enhancements, including filled PTFE for improved wear resistance in automotive and chemical sectors, reinforce its dominant revenue share.

Ethylene tetrafluoroethylene (ETFE) coatings segment is expected to grow fastest with a CAGR of 7.7% from 2025 to 2033 during the forecast period. This segment is propelled due to their exceptional corrosion resistance, impact toughness, and long-term durability in harsh environments. Adoption is accelerating in aerospace, semiconductor fabrication, and industrial processing, particularly across Asia Pacific, where chemical manufacturing and electronics hubs are expanding. ETFE also benefits from usage in architectural films and liner applications. Increasing investments in sectors requiring lightweight, UV‑stable, high‑performance coatings drive its robust market trajectory.

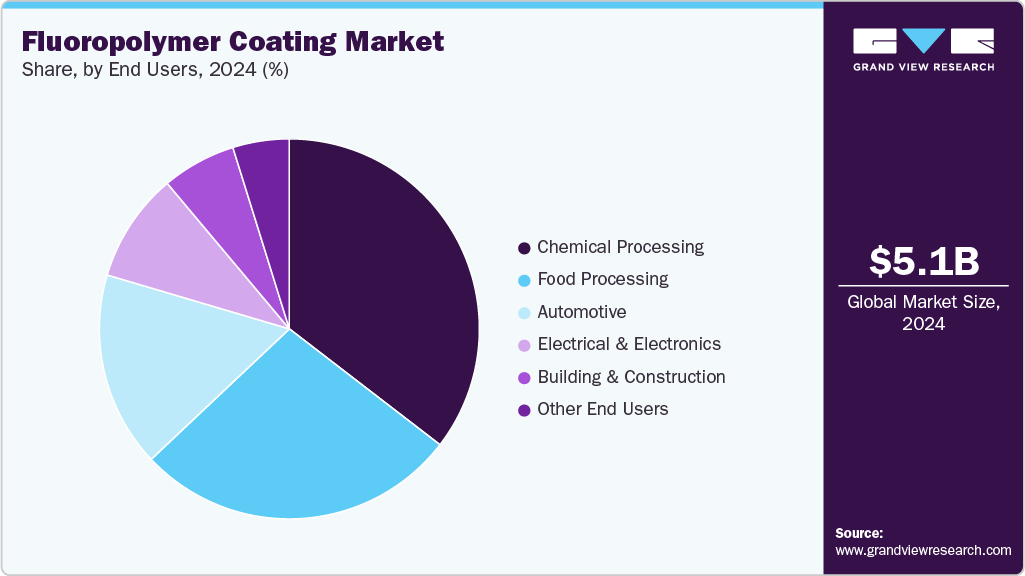

End Users Insights

The chemical processing segment led the market and accounted for the largest revenue share of 35.4% in 2024. This growth is driven by stringent equipment demands that resist aggressive chemicals and extreme temperatures. PTFE-lined pipes, vessels, and gaskets are essential for ensuring reliability, purity, and safety in chemical plants and pharmaceutical facilities. Rapid industrialization in Asia Pacific, Middle East & Africa, combined with global trends towards high-purity, low-maintenance systems, further reinforce this segment’s prominence and sustained demand for advanced fluoropolymer coatings.

The electrical & electronics segment is expected to grow fastest with a CAGR of 8.4% from 2025 to 2033 during the forecast period. This growth is propelled by rising demand for high-performance insulation, thermal stability, and dielectric protection in sectors such as consumer electronics, telecommunications, and automotive electronics. PTFE and ETFE coatings are extensively used in wire insulation, printed circuit boards, and connector assemblies, delivering safety and efficiency in high-frequency and high-temperature environments. The surge in EV production and smart device manufacturing underpins continued expansion in this segment.

Regional Insights

Asia Pacific market dominated the global landscape with a revenue share of 37.5% in 2024. It is primarily attributed to the region's robust growth driven by rapid industrialization and expansive infrastructure initiatives. Strong growth in China, India, and Southeast Asia propels demand for high-performance protective coatings in power plants, electronics fabrication, and urban construction projects. Increasing adoption of low-Volatile Organic Compound (VOC) waterborne systems, spurred by environmental regulations, enhances fluoropolymer uptake. Meanwhile, the region's surging wind farm installations and electric vehicle powertrain manufacturing augment resilience and demand for non-stick coatings. This combination cements AsiaPacific's leading role in the market.

China fluoropolymer coating market accounted for the largest share owing to higher consumption of fluoropolymer coating and films in AsiaPacific. Its advanced chemical, electronics, and automotive manufacturing ecosystems drive significant demand. Government‑backed initiatives supporting high‑tech sectors and environmental standards enhance uptake of premium fluoropolymer coatings, including PTFE and PVDF. In particular, rapid expansion in lithium-ion battery facilities and semiconductor production lines fuels specialty resin consumption, cementing China’s crucial role in global fluoropolymer coating growth.

Middle East And Africa Fluoropolymer Coating Market Trends

The Middle East and Africa is the second fastest growing market with a CAGR of 7.5% during the forecast period. It is experiencing rapid fluoropolymer coating growth, led by strong electrical & electronics demand and large-scale construction activity. Increasing infrastructure projects across urban and industrial hubs elevate the need for corrosion‑ and weather‑resistant coatings. Regional expansion of data centers and solar and telecommunication facilities further drives the adoption of specialty coatings. This broadening usage across both emerging and advanced economies positions the Middle East & Africa as a fast-growing market for fluoropolymer coatings.

Saudi Arabia fluoropolymer coating market growth is driven by increasing demand for fluoropolymer coatings, primarily due to petrochemical and infrastructure investments. Expanding oil & gas processing facilities and offshore and onshore pipeline projects require robust anti-corrosion and high-temperature resistant surfaces. The nation's Vision 2030 economic diversification, including new renewable energy and construction ventures, further encourages deploying advanced fluoropolymer formulations in industrial coatings.

North America Fluoropolymer Coating Market Trends

North America accounted for the market share of 29.5% in 2024 in terms of revenue. It holds a strong share in the global fluoropolymer coating market owing to stringent environmental regulations and advanced industrial activity. Adoption of low-VOC and waterborne fluoropolymer systems is high, particularly in aerospace, chemical processing, and food equipment applications. Significant growth in offshore wind farms, Electric Vehicle (EV) manufacturing, and lithium-ion battery gigafactories drive regional demand. At the same time, innovation in PFAS (Per‑ and Polyfluoroalkyl Substances) alternatives supports the expansion of sustainable coatings.

U.S. fluoropolymer coating market growth is driven by robust aerospace and semiconductor sectors that require ultra-reliable thermal and electrical insulation. Regulatory pressure from the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) accelerates the shift to low-VOC waterborne fluoropolymer technologies. Moreover, high demand from EV powertrain and data center infrastructure clusters strengthens market expansion for specialty fluoropolymer coatings.

Europe Fluoropolymer Coating Market Trends

Europe's region is growing at a CAGR of 6.7% during the forecast period. The market is increasing steadily due to strict low‑VOC standards and investment in renewable energy infrastructure. Offshore wind energy expansion and hydrogen pipeline initiatives create niche demands for durable fluoropolymer coatings with corrosion and embrittlement resistance. These coatings are also used in aerospace and automotive industries seeking energy-efficient and sustainable solutions, supporting Europe's consistent regional market growth.

Germany’s fluoropolymer coating market is experiencing consistent growth, driven by the implementation of stringent low-VOC standards and increased investments in renewable energy infrastructure. This positive trend reflects a commitment to sustainable practices and environmental considerations. It leads Europe in fluoropolymer coatings, backed by its strong automotive, chemical, and machinery manufacturing sectors. Tier‑1 car part suppliers rely heavily on Polytetrafluoroethylene (PTFE) coatings and Polyvinylidene Fluoride (PVDF) coatings for lightweight, high-durability applications. Government policies promoting energy-efficient technologies and industrial digitization further drive the adoption of advanced fluoropolymer products in mechanical and electrical systems.

Latin America Fluoropolymer Coating Market Trends

Latin America is emerging as a key fluoropolymer coating market, driven by growing infrastructure development and food-processing industries. Demand for non-stick and corrosion-resistant coatings in commercial kitchens, processing equipment, and automotive parts is rising. Investment in oil & gas pipelines and renewable energy across Brazil and Mexico also elevates demand for weather-resistant fluoropolymer solutions, supporting steady regional market growth.

Key Fluoropolymer Coating Company Insights

Some of the key players operating in the market include Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, The Chemours Company and others.

-

Akzo Nobel N.V. is a Dutch multinational headquartered in Amsterdam that produces decorative paints and performance coatings globally. Its strategy centers on focused portfolio management, production close to consumers, sustainable innovation, and operational discipline. The firm aims to halve carbon emissions by 2030 and optimize efficiency via local manufacturing. Akzo Nobel’s fluoropolymer coatingssuch as liquid and powder-based solutionssupport corrosion resistance, durability, and weather protection across industrial applications.

-

PPG Industries, Inc., headquartered in Pittsburgh, is a global supplier of coatings, paints, and specialty materials headquartered in Pittsburgh. It operates manufacturing facilities in more than 70 countries, supporting automotive, aerospace, construction, and marine sectors. PPG's business strategy emphasizes innovation, operational productivity, and digital service delivery. The company maintains a diversified product portfolio and is expanding its domestic production capacity to strengthen North American operations. PPG's fluoropolymer coatings, such as Coraflon and Duranar, are designed for architectural metals and provide UV, chemical, and corrosion resistance under stringent industry specifications.

ENDURA COATINGS, Orion Industries, and HaloPolymer, OJSC. are some of the emerging market participants in the fluoropolymer coating market industry.

-

HaloPolymer, OJSC, is a Russian producer of fluoropolymers, which holds approximately nine percent of the global market. It’s also Russia’s sole producer of specialized melt‑processable fluoroplastics and fluoroprenes. The company’s vertically integrated operations include production facilities in Perm and Kirovo‑Chepetsk and trading subsidiaries that manage both domestic and export sales. It also produces fluorinated gases, freons, inorganic chemicals, and hydrofluoric acid. Its strategic focus remains on expanding specialized polymer lines and growing exports. HaloPolymer’s fluoropolymer coatings leverage PTFE and FEP technologies to serve high‑purity, high‑temperature applications in filtration, chemical processing, electronics insulation, and other industrial systems.

Key Fluoropolymer Coating Companies:

The following are the leading companies in the fluoropolymer coating market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Axalta Coating Systems, LLC

- The Chemours Company

- DAIKIN INDUSTRIES, Ltd.

- Arkema

- Solvay

- HaloPolymer, OJSC

- Coating Systems, Inc. (Whitford Corporation)

- ENDURA COATINGS

- Orion Industries

Recent Development

-

In May 2025, PPG Industries, Inc. introduced ENVIROLUXE Plus powder coatings, formulated without PTFE fluoropolymer and incorporating recycled plastic. The launch targets reduced carbon footprint while maintaining performance, aligning with PPG’s sustainability priorities. This innovation adds a fluoropolymer-free option in durable powder coatings, with implications for architectural and industrial markets.

-

In May 2023, PPG Industries, Inc. invested in upgrading powder coating capacity at multiple facilities. The upgrades aimed to increase the production of high-performance, sustainably advantaged powder coatings specifically reducing reliance on solvent-based systems. This expansion supports the rising demand for global durable fluoropolymer and PFAS-free powder coatings.

Fluoropolymer Coating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,436.23 million

Revenue forecast in 2033

USD 9,534.11 million

Growth rate

CAGR of 7.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end users, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Akzo Nobel N.V.; PPG Industries, Inc.; The Sherwin-Williams Company; Axalta Coating Systems, LLC; The Chemours Company; DAIKIN INDUSTRIES, Ltd.; Arkema; Solvay; HaloPolymer; OJSC; Coating Systems, Inc. (Whitford Corporation); ENDURA COATINGS; Orion Industries

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluoropolymer Coating Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global fluoropolymer coating market report based on product, end users, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

PTFE Coatings

-

PVDF Coatings

-

FEP Coatings

-

ETFE Coatings

-

Other Products

-

-

End Users Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Food Processing

-

Automotive

-

Chemical Processing

-

Electrical & Electronics

-

Building & Construction

-

Other End Users

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fluoropolymer coating market size was estimated at USD 5,122.04 million in 2024 and is expected to reach USD 5,436.23 million in 2025.

b. The global fluoropolymer coating market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 9,534.11 million in 2033.

b. Asia Pacific dominated the global landscape with a revenue share of 37.5% in 2024. The region led the global market due to rapid industrialisation, infrastructure growth, and strong demand from China, India, and Southeast Asia. Expanding electronics, power, and EV sectors, along with rising adoption of low–Volatile Organic Compound (VOC) waterborne systems, drive high-performance coating demand across the region.

b. Some key players operating in the fluoropolymer coating market include Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Axalta Coating Systems, LLC, The Chemours Company, DAIKIN INDUSTRIES, Ltd., Arkema, Solvay, HaloPolymer, OJSC, Coating Systems, Inc. (Whitford Corporation), ENDURA COATINGS, Orion Industries

b. The global fluoropolymer coating market is expanding due to rising demand for high-performance coatings offering thermal stability, chemical resistance, and low friction across automotive, electronics, aerospace, and other sectors. Increasing applications in renewable energy, especially for Electric Vehicle (EV) batteries and wind energy, further support long-term growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.