- Home

- »

- IT Services & Applications

- »

-

Autonomous Driving Software Market Size Report, 2030GVR Report cover

![Autonomous Driving Software Market Size, Share & Trends Report]()

Autonomous Driving Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Level of Autonomy (L1, L2), By Propulsion (ICE, Electric Vehicles), By Vehicle Type, By Software Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-440-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Driving Software Market Summary

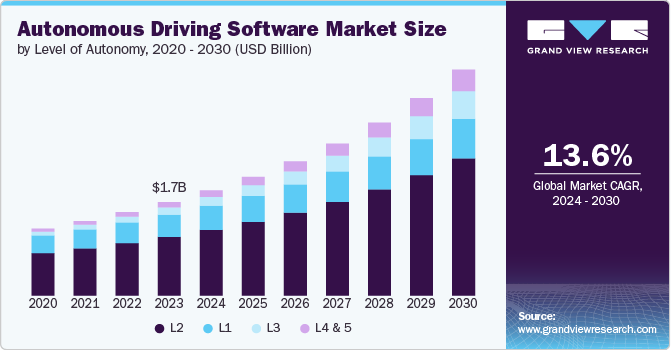

The global autonomous driving software market size was estimated at USD 1.74 billion in 2023 and is projected to reach USD 4.21 billion by 2030, growing at a CAGR of 13.6% from 2024 to 2030. The market is experiencing rapid growth, driven by advancements in Artificial Intelligence (AI), machine learning, and sensor technologies.

Key Market Trends & Insights

- The North America dominated the autonomous driving software market with a revenue share of 38.28% in 2023.

- Based on level of autonomy, the L2 segment led the market in 2023, accounting for over 62.76% share of the global revenue.

- Based on propulsion, the ICE segment accounted for the largest market revenue share in 2023.

- Based on vehicle type, the passenger vehicles accounted for the largest market revenue share in 2023.

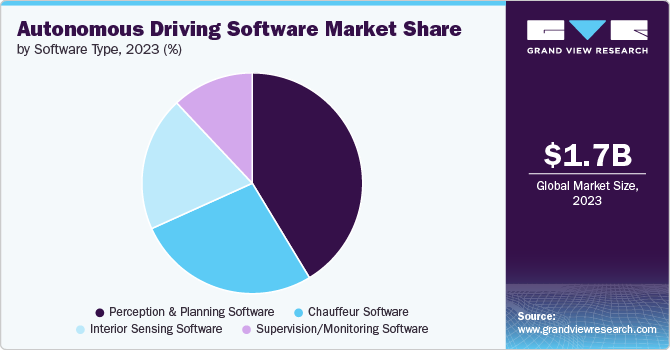

- Based on software type, the perception & planning software accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.74 Billion

- 2030 Projected Market USD 4.21 Billion

- CAGR (2024-2030): 13.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As automotive companies, tech giants, and startups invest heavily in developing self-driving vehicles, the demand for advanced software capable of handling complex driving environments is surging. This software integrates various technologies, including computer vision, deep learning, sensor fusion, and mapping, to enable vehicles to navigate and make decisions without human intervention.

The increasing demand for safer and more efficient transportation solutions is a key factor driving market growth. As stricter global safety regulations come into play, automotive manufacturers are required to integrate advanced safety technologies into their vehicles. Autopilot driving software has emerged as a direct response to these changes, helping manufacturers meet safety standards by using complex algorithms and real-time data processing to enhance vehicle safety. In addition, the rising adoption of electric vehicles (EVs) aligns well with the development of autonomous driving technologies, as these systems can be seamlessly integrated into the electronic architectures of EVs.

The advancement of Advanced Driver Assistance Systems (ADAS) technology has driven increased demand for software-based solutions in the automotive industry. ADAS encompasses various safety and automation features, such as adaptive cruise control and lane-keeping assistance. However, recent advancements have enabled innovative applications that utilize existing sensors and AI capabilities. One notable example is automated parking systems, which extend beyond basic parking assistance by enabling vehicles to navigate parking lots and confined spaces autonomously. These systems employ a variety of sensors, including cameras and ultrasonic sensors, to detect obstacles, estimate parking spaces, and execute precise parking maneuvers. Another significant development is the 'Active Lane Keep Assist' system, which alerts drivers when they drift out of their lanes and actively steers the vehicle back to maintain lane position. As these technologies evolve, the demand for high-performance autonomous driving software is expected to grow.

Level of Autonomy Insights

The L2 segment led the market in 2023, accounting for over 62.76% share of the global revenue. L2 systems offer significant safety improvements by assisting with lane keeping, adaptive cruise control, and collision avoidance tasks. Consumers are increasingly looking for these features as standard in new vehicles. Moreover, various features such as automated parking, highway driving assistance, and traffic jam assist provide drivers with a more comfortable and less stressful driving experience, which drives consumer interest in vehicles equipped with L2 autonomy.

The L4 & L5 segment is predicted to foresee the highest growth in the coming years. L4 and L5 systems require vast amounts of data to be processed by sensors and external sources. AI advancements enable these vehicles to analyze data quickly and accurately, improving safety and efficiency. Moreover, continuous sensor technology improvement, including LiDAR, radar, and high-resolution cameras, is essential for developing L4 and L5 vehicles. These sensors provide the detailed environmental data necessary for autonomous systems to operate safely without human intervention.

Propulsion Insights

The ICE segment accounted for the largest market revenue share in 2023. Internal combustion engines still power a significant portion of the global vehicle fleet. Automakers and software developers recognize the opportunity to enhance these vehicles with autonomous driving capabilities to maintain their competitiveness in the market. Moreover, ICE vehicles have a long operational life, especially in commercial fleets. Integrating autonomous driving software into these vehicles extends their usefulness and adds value, supporting market growth.

The electric vehicles (EVs) segment is anticipated to witness the highest growth in the coming years. Governments worldwide are enforcing stricter emissions regulations and offering incentives for zero-emission vehicles. As EVs naturally align with these goals, their adoption is encouraged, and the development of autonomous software for EVs is prioritized to meet future regulatory requirements. Moreover, the growing infrastructure for EVs, including smart charging stations and vehicle-to-everything (V2X) communication networks, supports deploying autonomous driving software. These systems enable EVs to interact with their surroundings, optimize charging, and improve overall efficiency.

Vehicle Type Insights

Passenger vehicles accounted for the largest market revenue share in 2023.Various factors, such as technological advancements, consumer demand for safety and convenience, supportive regulatory frameworks, and significant investment in research and development, are primarily contributing to the segment's growth. Moreover, urbanization, economic benefits, technological infrastructure, and increasing consumer awareness drive the segment's growth.Successful deployment and positive experiences with autonomous features in passenger cars build consumer trust and encourage further adoption.

Commercial vehicles is anticipated to exhibit the highest CAGR over the forecast period. Governments are developing regulations and standards to support the safe deployment of autonomous commercial vehicles. These regulations provide a framework for testing and implementing autonomous systems, driving market growth. Moreover, automation of tasks such as highway driving, parking, and load management enhances the efficiency of commercial operations and reduces the need for manual intervention. Furthermore, numerous industries, such as logistics, transportation, and delivery services, drive demand for autonomous commercial vehicles to improve efficiency and reduce costs. The need for faster, more reliable transportation solutions fuels the adoption of autonomous technologies.

Software Type Insights

Perception & planning software accounted for the largest market revenue share in 2023. AI and machine learning algorithms are continuously evolving, allowing perception software to better interpret complex driving environments, recognize objects, and predict the behavior of other road users. Furthermore, perception and planning software are foundational to ADAS, such as adaptive cruise control, lane-keeping assist, and automated parking. The growing demand for these features drives the development and adoption of advanced perception and planning technologies.

The interior sensing software segment is anticipated to exhibit the highest CAGR over the forecast period. Advanced interior sensors are increasingly integrated with other vehicle systems, such as autonomous driving software and in-car entertainment, creating a more cohesive and intelligent vehicle environment. The growing emphasis on health and wellness features in vehicles drives the development of interior sensing software that can monitor occupant health parameters, such as heart rate and stress levels. Furthermore, due to advancements in autonomous driving and driver assistance technologies, regulatory bodies are setting standards for interior monitoring and safety features. Compliance with these regulations drives the adoption and development of advanced interior sensing technologies.

Regional Insights

North America dominated the autonomous driving software market with a revenue share of 38.28% in 2023. The growth of urban mobility solutions and ride-hailing services creates a demand for autonomous vehicles to enhance transportation efficiency and reduce congestion in the region. Furthermore, partnerships between automotive manufacturers, technology companies, and research institutions facilitate the region's development and integration of autonomous driving software.

U.S. Autonomous Driving Software Market Trends

The autonomous driving software market in the U.S. is expected to grow at a CAGR of 11.8% from 2024 to 2030. Increased consumer interest in ADAS and autonomous driving features drives demand for autonomous driving software. Moreover, significant investment from venture capital and established automotive companies accelerates developing and deploying autonomous driving technologies.

Europe Autonomous Driving Software Market Trends

The autonomous driving software market in Europe is expected to grow significantly over the forecast period. Europe has been at the forefront of developing regulations and standards for autonomous driving. Various initiatives, such as the European Union’s Vision Zero and the Road Safety Strategy, support the safe deployment of autonomous technologies.Various governments across the EU offer incentives, grants, and funding for research and development in autonomous driving technologies, encouraging innovation and adoption.

Asia Pacific Autonomous Driving Software Market Trends

The autonomous driving software market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. Rapid urbanization and growing urban populations in the Asia Pacific region create a need for efficient and intelligent transportation solutions, driving demand for autonomous vehicles. Moreover, rapid economic growth in key Asia Pacific markets, such as China and India, supports the expansion of the automotive sector and the adoption of advanced technologies.

Key Autonomous Driving Software Company Insights

Key autonomous driving software companies include Aptiv, Aurora Innovation Inc., and Baidu, Inc. Companies active in the market focus aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in January 2024, Lotus Technology Inc., a global luxury electric vehicle maker, introduced Lotus Robotics, its intelligent driving arm. At the 2024 Consumer Electronics Show (CES) in Las Vegas, U.S., it will present a wide array of proprietary, advanced software and hardware solutions for autonomous driving.

Key Autonomous Driving Software Companies:

The following are the leading companies in the autonomous driving software market. These companies collectively hold the largest market share and dictate industry trends.

- Aptiv

- Aurora Innovation Inc.

- Baidu, Inc.

- Continental AG

- Huawei Technologies Co., Ltd.

- Mobileye

- Nvidia Corporation

- Pony.ai

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

Recent Developments

-

In August 2024, Uber Technologies, Inc. partnered with Wayve, a provider of embodied AI for self-driving, to utilize Wayve’s AI to enable a range of automated driving capabilities.With Uber's extra funding and backing, Wayve plans to fast-track its collaborations with global OEMs to upgrade consumer vehicles by incorporating Level 2 advanced driver assistance systems and Level 3 automation capabilities. Moreover, Wayve aims to advance the development of globally scalable Level 4 autonomous vehicles for future use on the Uber platform.

-

In May 2024, PlusAI, Inc., a generative AI-based autonomous driving software provider, launched PlusProtect, an AI-based technology to enhance safety systems. This scalable technology enables global Tier 1 automotive suppliers and vehicle manufacturers to significantly improve the safety features in their forthcoming safety systems.

-

In April 2024, Horizon Robotics, a provider of ADAS and autonomous driving (AD) solutions, launched the Horizon SuperDrive full-stack AD solution. Utilizing Horizon Robotics' distinctive software and hardware co-optimization features, the Horizon SuperDrive is engineered for safe and dependable autonomous driving in every situation, including urban, highway, and parking environments.

Autonomous Driving Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.96 billion

Revenue forecast in 2030

USD 4.21 billion

Growth rate

CAGR of 13.6% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Level of autonomy, propulsion, vehicle type, software type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Mobileye; Nvidia Corporation; Qualcomm Technologies, Inc.; Huawei Technologies Co., Ltd.; Aurora Innovation Inc.; Aptiv; Continental AG; Robert Bosch GmbH; Baidu, Inc.; Pony.ai

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Driving Software Maret Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global autonomous driving software market report based on level of autonomy, propulsion, vehicle type, software type, and region:

-

Level of Autonomy Outlook (Revenue, USD Billion, 2017 - 2030)

-

L1

-

L2

-

L3

-

L4 & L5

-

-

Propulsion Outlook (Revenue, USD Billion, 2017 - 2030)

-

ICE

-

Electric Vehicles

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Software Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Perception & Planning Software

-

Chauffeur Software

-

Interior Sensing Software

-

Supervision/Monitoring Software

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global autonomous driving software market size was estimated at USD 1.74 billion in 2023 and is expected to reach USD 1.96 billion in 2024.

b. The global autonomous driving software market is expected to grow at a compound annual growth rate of 13.6% from 2024 to 2030 to reach USD 4.21 billion by 2030.

b. North America dominated the autonomous driving software market with a share of 38.3% in 2023. The growth of urban mobility solutions and ride-hailing services creates a demand for autonomous vehicles to enhance transportation efficiency and reduce congestion in the region.

b. Some key players operating in the autonomous driving software market include Mobileye, Nvidia Corporation, Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd., Aurora Innovation Inc., Aptiv, Continental AG, Robert Bosch GmbH, Baidu, Inc., Pony.ai

b. Key factors that are driving the autonomous driving software market growth include increasing advancements in the ADAS technology, and advancements in the autonomous commercial vehicle technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.