- Home

- »

- Next Generation Technologies

- »

-

Autonomous Enterprise Market Size, Industry Report, 2030GVR Report cover

![Autonomous Enterprise Market Size, Share, & Trends Report]()

Autonomous Enterprise Market (2025 - 2030) Size, Share, & Trends Analysis Report By Component (Solution, Services), By Business Function, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-576-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Enterprise Market Summary

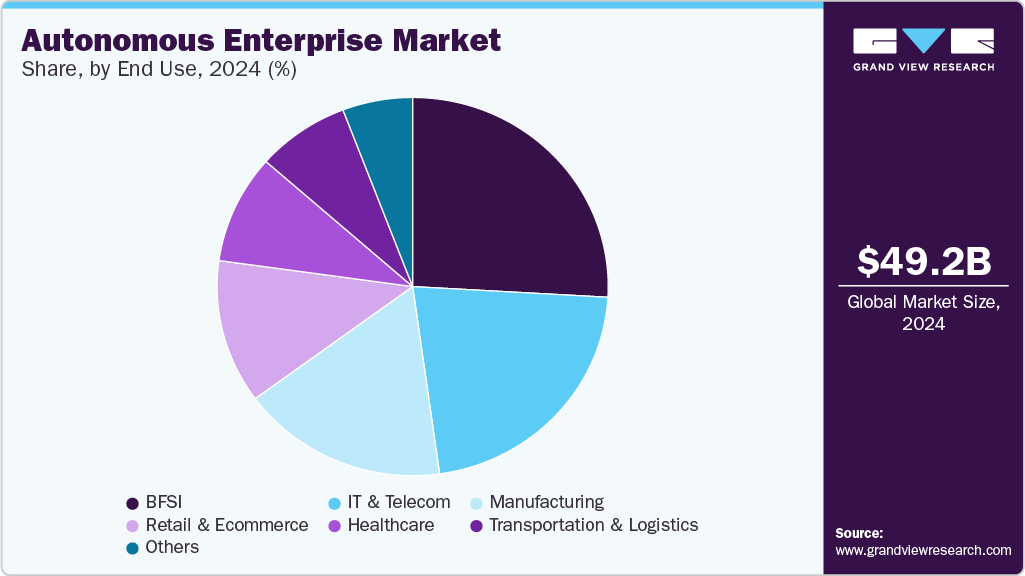

The global autonomous enterprise market size was estimated at USD 49.25 billion in 2024 and is projected to reach USD 118.18 billion by 2030, growing at a CAGR of 16.2% from 2025 to 2030. The increasing demand for automation across various business processes is driving the autonomous enterprise market growth.

Key Market Trends & Insights

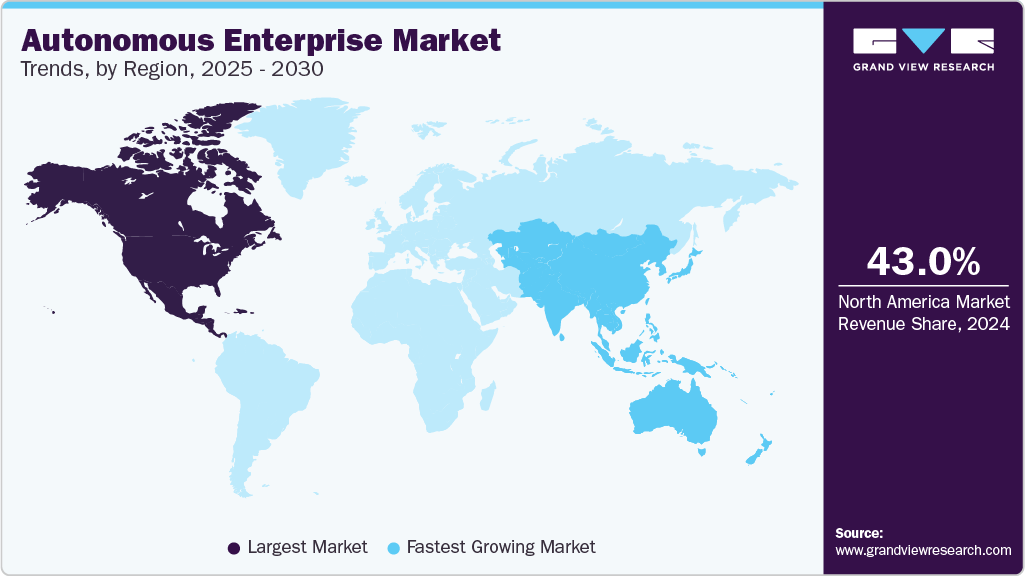

- The North America autonomous enterprise market held the major share of over 43.0% in 2024.

- Based on component, the solution segment accounted for the largest market share of over 65.0% in 2024.

- Based on business function, the IT segment dominated the market and accounted for a revenue share of over 28.0% in 2024.

- Based on application, the process automation segment dominated the market and accounted for a revenue share of over 31.0% in 2024

- Based on end use, the BFSI segment accounted for the largest market share of over 25.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 49.25 Billion

- 2030 Projected Market USD 118.18 Billion

- CAGR (2025-2030): 16.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing demand for automation across various business processes is driving the autonomous enterprise market growth. As organizations seek to enhance operational efficiency, reduce costs, and improve scalability, automation technologies have become essential. Autonomous enterprises utilize technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and advanced analytics to automate routine tasks, decision-making, and processes that human workers traditionally perform. This shift allows businesses to achieve greater efficiency and helps them to remain competitive in a rapidly changing business landscape.

The growing emphasis on data security is another critical driver of the autonomous enterprise market. As businesses increasingly rely on digital systems and automation, protecting sensitive data from cyber threats becomes paramount. Autonomous enterprise solutions often integrate robust security features, such as advanced encryption, real-time monitoring, and predictive threat detection, which help safeguard company data and prevent breaches. With the rising frequency and sophistication of cyberattacks, organizations are looking for solutions that can autonomously identify and mitigate potential security risks without requiring constant manual intervention. This drive for enhanced data security is propelling the adoption of autonomous systems within enterprises, particularly in industries like finance, healthcare, and government, where data protection is a top priority.

The growing availability of industry-specific autonomous solutions is also driving market growth. While autonomous enterprise solutions were once primarily seen as generalized technologies, there is now a shift toward more specialized applications tailored to specific industries, such as healthcare, manufacturing, logistics, and retail. These customized solutions are designed to address each sector's unique challenges and requirements, making them more attractive to businesses looking for targeted automation. For instance, in healthcare, autonomous systems can assist with patient data management, robotic surgeries, and drug distribution, while in manufacturing, they can optimize production lines, predictive maintenance, and supply chain operations. The development of industry-specific autonomous solutions is expanding the market and encouraging adoption across a wider range of sectors.

Furthermore, the increasing availability of 5G networks and IoT devices is facilitating the growth of autonomous enterprises. The low latency and high-speed connectivity offered by 5G networks enable real-time communication and data exchange between autonomous systems, making them more efficient and responsive. IoT devices, on the other hand, provide valuable data streams from sensors and connected devices that autonomous systems can use to make informed decisions. For instance, in the manufacturing industry, IoT-enabled machines can communicate with autonomous systems to optimize production schedules or predict equipment failures. The convergence of 5G, IoT, and AI is creating an ecosystem that supports the widespread implementation of autonomous systems in enterprises.

Component Insights

The solution segment accounted for the largest market share of over 65.0% in 2024 in the autonomous enterprise market. The rising need for unified platforms integrating various enterprise functions is driving market growth. Autonomous enterprise solutions typically feature modular architectures that allow for seamless integration with existing enterprise resource planning (ERP) systems, cloud infrastructures, and data analytics tools. This interoperability reduces the burden of managing disparate systems and enables a centralized approach to monitoring and managing enterprise processes. As organizations continue to adopt cloud-native and AI-driven architectures, the demand for scalable and flexible autonomous solutions is expected to grow rapidly.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing focus on data security, compliance, and governance is also driving demand for specialized services in the autonomous enterprise market. Enterprises operating in highly regulated industries such as healthcare, finance, and telecommunications require expert support to ensure their autonomous systems adhere to legal and regulatory frameworks. Professional services that include risk assessments, compliance audits, and data governance frameworks are essential to mitigating risks associated with automation and AI. These services not only provide peace of mind but also help organizations build trust with customers and regulators.

Business Function Insights

The IT segment dominated the market and accounted for a revenue share of over 28.0% in 2024 in the autonomous enterprise market. The shift toward digital transformation and cloud-first strategies has also accelerated the business function of autonomous enterprise solutions within IT. As companies migrate workloads to the cloud and adopt DevOps practices, the need for automated orchestration, configuration management, and real-time performance optimization becomes critical. Autonomous systems offer self-healing capabilities and dynamic resource allocation, ensuring optimal system performance with minimal human intervention. This improves uptime and service quality and aligns IT operations with agile business demands.

The sales & marketing segment is expected to register the highest CAGR from 2025 to 2030. Customer experience optimization is fueling demand for autonomous enterprise capabilities in sales and marketing. Businesses are leveraging chatbots, virtual assistants, and automated workflows to provide seamless, round-the-clock customer support and engagement. These tools enhance responsiveness, reduce wait times, and ensure consistent service quality, which is increasingly important in a digital-first market. Such capabilities help in building stronger brand loyalty and increasing customer lifetime value.

Application Insights

The process automation segment dominated the market and accounted for a revenue share of over 31.0% in 2024 in the autonomous enterprise industry. The widespread adoption of low-code and no-code platforms is driving market growth. These platforms empower business users beyond just IT teams to create and manage automated workflows with minimal coding knowledge. As a result, organizations can deploy automation solutions more quickly and with lower development costs. This democratization of automation tools enables faster innovation, increased responsiveness to operational challenges, and greater alignment between business needs and technological execution.

The predictive maintenance segment is expected to register the fastest CAGR of 17.5% from 2025 to 2030. Advancements in artificial intelligence and cloud computing have also contributed to the rise of predictive maintenance. AI models process large datasets in real-time to identify failure patterns and optimize maintenance schedules. IT-based platforms allow for centralized monitoring of assets across multiple locations, enabling scalability and rapid business function. These technological improvements make predictive maintenance more accessible and effective for enterprises of all sizes.

End Use Insights

The BFSI segment accounted for the largest market share of over 25.0% in 2024. The growing adoption of digital banking and mobile-first financial services is acting as a catalyst for market growth. As more consumers shift toward digital platforms for banking, investing, and insurance, there is a higher demand for autonomous, scalable backend systems that can support millions of transactions and queries in real-time. These systems enable financial institutions to maintain high levels of availability, responsiveness, and accuracy, key factors for retaining tech-savvy customers.

The manufacturing segment is anticipated to register the fastest CAGR during the forecast period. The manufacturing segment is witnessing significant momentum in adopting autonomous enterprise solutions due to the rising demand for smart factories and Industry 4.0 initiatives. As manufacturers strive to enhance operational efficiency, minimize downtime, and improve productivity, they are turning to automation, artificial intelligence (AI), and machine learning (ML) to manage complex production processes with minimal human intervention. Autonomous enterprise platforms facilitate real-time monitoring, predictive maintenance, and self-correcting systems, allowing manufacturers to respond dynamically to operational anomalies and reduce unplanned disruptions.

Regional Insights

North America autonomous enterprise market held the major share of over 43.0% in 2024. North America's robust technological ecosystem, which includes leading tech companies, research institutions, and venture capital investments, serves as a catalyst for innovation in the autonomous enterprise market. The region is home to a wide range of startups and established companies developing cutting-edge technologies and collaborating with other industries to introduce new solutions. Government initiatives aimed at promoting digital transformation and supporting the growth of emerging technologies further fuel the demand for autonomous enterprise solutions.

U.S. Autonomous Enterprise Market Trends

The U.S. autonomous enterprise market is projected to grow during the forecast period. The shift to remote and hybrid work models has significantly contributed to the adoption of autonomous enterprise solutions in the U.S. As organizations transition to digital-first strategies and operate in more decentralized environments, automation has become key to maintaining business continuity. Autonomous tools that manage IT infrastructure, customer support, and workflows remotely enable businesses to scale their operations without being limited by geographical boundaries or the availability of human resources. This shift has prompted organizations to invest in technologies that can automate administrative tasks, monitor systems for security threats, and optimize supply chain management with minimal human intervention.

Europe Autonomous Enterprise Market Trends

The autonomous enterprise market in Europe is expected to grow at a CAGR of 16.5% from 2025 to 2030. The cloud computing trend is another significant driver for the SPA market in Europe. The growing investment in smart cities and urban infrastructure across Europe further drives the demand for autonomous enterprise technologies. Governments and private sector players are investing heavily in creating smarter urban environments, which include smart transportation systems, energy-efficient buildings, and automated services. For instance, autonomous vehicles for public transportation, drones for parcel delivery, and AI-powered traffic management systems are becoming integral parts of urban development projects. As these technologies are deployed at scale, they create a ripple effect across industries, driving the adoption of autonomous enterprise solutions to enhance the management and operation of these smart infrastructures.

The autonomous enterprise industry in the Germany is grow during the forecast period. Germany’s robust IT infrastructure and high levels of digital literacy among businesses are also contributing to the growth of the autonomous enterprise market. With the increasing demand for data-driven decision-making, companies in Germany are adopting AI, machine learning, and big data analytics to optimize various business processes, such as customer service, financial management, and supply chain logistics. AI and machine learning models enable businesses to analyze vast amounts of data in real-time, providing insights that drive strategic decisions.

Asia Pacific Autonomous Enterprise Trends

The demand for autonomous enterprise in the Asia Pacific is expected to register the fastest CAGR of 18.0% from 2025 to 2030. The growing demand for smart devices and systems in the consumer electronics and automotive sectors, particularly in countries like Japan and South Korea, is driving market growth. Both these nations are heavily investing in autonomous technologies to improve the functionality and safety of consumer electronics and vehicles. The automotive industry, for example, is focused on the development of autonomous vehicles, including self-driving cars and trucks, with substantial investments in AI, sensors, and machine learning algorithms to drive vehicle automation. As consumer demand for smart, connected, and autonomous products rises, manufacturers in the region are adopting autonomous enterprise technologies to meet these needs, ensuring they stay competitive in the rapidly evolving marketplace.

The autonomous enterprise industry in China is projected to grow during the forecast period. The increasing demand for digitalization and automation in China’s urbanization efforts is another driving force behind the autonomous enterprise market. As China continues to build smart cities, there is a growing need for autonomous systems to enhance the efficiency of urban infrastructure, including traffic management, energy consumption, public transportation, and waste management. Autonomous vehicles, including self-driving cars and buses, are being introduced to improve transportation in urban areas. At the same time, AI-powered systems are being deployed to optimize energy usage, waste management, and water supply systems in smart cities. The integration of autonomous technologies into urban infrastructure is expected to create new business opportunities for autonomous enterprise solutions in the coming years.

Key Autonomous Enterprise Company Insights

Some of the companies operating in the market include Microsoft Corporation, and SAP SE, among others are some of the leading participants in the autonomous enterprise market.

-

Microsoft Corporation is a global technology company. Microsoft's Copilot Studio provides organizations with the tools to create custom AI agents tailored to their specific needs. This platform enables businesses to develop agents that can perform specialized tasks, integrate with existing systems, and adapt to evolving requirements. By component a flexible and scalable solution, Copilot Studio empowers enterprises to build their own autonomous capabilities, fostering innovation and agility.

-

SAP SE is a global company specializing in enterprise software. A cornerstone of SAP's approach is the SAP Business Technology Platform (BTP), which integrates data management, analytics, application development, and automation on a unified cloud platform. BTP enables organizations to build and deploy applications that can autonomously respond to changing business conditions, thereby enhancing agility and efficiency. This platform supports the development of intelligent applications that can make decisions, adapt to new information, and optimize processes in real-time.

Automation Anywhere, Inc., and AutomationEdge, Inc are some of the emerging market participants in the autonomous enterprise market.

-

Automation Anywhere is a provider of AI-powered automation solutions. The company specializes in robotic process automation (RPA) and has expanded its components to include agentic process automation (APA), which integrates AI and automation to transform enterprise operations. A key component of this transformation is the AI + Automation Enterprise System introduced by Automation Anywhere. This system combines the company's second-generation GenAI Process Models with AI agents to automate complex workflows across departments such as customer service, finance, IT, and HR. The AI Agent Studio, a low-code platform, empowers both developers and business users to create custom AI agents tailored to specific organizational needs, accelerating business function and reducing time to value.

-

AutomationEdge is a privately held company specializing in IT and business process automation. AutomationEdge provides a unified platform that enables organizations to achieve hyperautomation, an advanced form of automation that goes beyond traditional RPA by integrating AI and ML capabilities. This approach allows businesses to automate not only repetitive, rule-based tasks but also complex cognitive processes that require decision-making and adaptability. By leveraging technologies such as Generative AI, Conversational AI, and Document AI, AutomationEdge empowers enterprises to create self-optimizing workflows that enhance efficiency, reduce operational costs, and improve service delivery.

Key Autonomous Enterprise Companies:

The following are the leading companies in the autonomous enterprise market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- Hewlett Packard Enterprise Development LP

- Atos SE

- SAP SE

- Cisco Systems, Inc.

- Palo Alto Networks

- Blue Prism Limited

- Automation Anywhere, Inc.

- AutomationEdge

- Nice S.p.A.

- UiPath

Recent Developments

-

In May 2025, Kore.ai signed a partnership agreement with Microsoft. This collaboration combines Kore.ai’s advanced agent platform and tailored business solutions with Microsoft’s scalable infrastructure and AI capabilities, enabling global enterprises to adopt AI rapidly, securely, and at scale. The partnership underscores a shared commitment to delivering flexible, interoperable, and human-centric AI that boosts productivity and redefines the way work is accomplished across organizations.

-

In March 2025, Hewlett Packard Enterprise Development LP and NVIDIA launched new enterprise AI solutions under the NVIDIA AI Computing by HPE portfolio, aimed at accelerating the business function of generative, agentic, and physical AI. These full-stack, turnkey private cloud solutions deliver improved performance, power efficiency, and security, along with new capabilities that help organizations of all sizes efficiently train, fine-tune, and run inference on their AI models.

-

In February 2025, Cisco Systems, Inc. expanded its partnership with NVIDIA to deliver advanced AI technology solutions for enterprises. This collaboration aims to provide organizations with a choice in addressing the growing demands of AI workloads, particularly in achieving high-performance, low-latency, and energy-efficient connectivity across data centers, cloud environments, and end users. The partnership is designed to help organizations maximize the value of their AI infrastructure investments through a unified architecture that integrates seamlessly with their existing management tools and processes across both front-end and back-end networks.

-

In November 2024, Accenture and Avanade, in partnership with Microsoft Corporation, are launching a Copilot Business Transformation Practice. This new initiative, backed by Microsoft and supported through joint investment in capabilities, solutions, and training, aims to help organizations responsibly and securely transform their business functions using generative and agentic AI as well as Copilot technologies. Through this collaboration, companies will develop AI and Copilot agent templates, extensions, plugins, and connectors, enabling businesses to harness their data and generative AI to reduce costs, enhance efficiency, and drive growth.

Autonomous Enterprise Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 55.85 billion

Revenue forecast in 2030

USD 118.18 billion

Growth rate

CAGR of 16.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, business function, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Microsoft Corporation; Hewlett Packard Enterprise Development LP; Atos SE; SAP SE; Cisco Systems Inc.; Palo Alto Networks; Blue Prism Limited; Automation Anywhere, Inc.; AutomationEdge; Nice S.p.A.; UiPath

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Enterprise Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the autonomous enterprise market report based on component, business function, application, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Robotic Process Automation (RPA)

-

Autonomous Networks

-

Accounts Automation

-

Security Automation

-

Autonomous Agents

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Business Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Accounting & Finance

-

IT

-

Human Resource

-

Sales & Marketing

-

Supply Chain & Operations

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Process Automation

-

Order Management

-

Credit Evaluation and Management

-

Predictive Maintenance

-

Customer and Employee Management

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail and E-commerce

-

Healthcare

-

IT & Telecom

-

BFSI

-

Manufacturing

-

Transportation and Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous enterprise market size was estimated at USD 49.25 billion in 2024 and is expected to reach USD 55.85 billion in 2025.

b. The global autonomous enterprise market is expected to grow at a compound annual growth rate of 16.2% from 2025 to 2030 to reach USD 118.18 billion by 2030.

b. The solution segment accounted for the largest market share of over 65.0% in 2024 in the autonomous enterprise market. The rising need for unified platforms that can integrate various enterprise functions is driving market growth.

b. Some key players operating in the market include Microsoft Corporation, Hewlett Packard Enterprise Development LP, Atos SE, SAP SE, Cisco Systems, Inc., Palo Alto Networks, Blue Prism Limited, Automation Anywhere, Inc., AutomationEdge, Nice S.p.A., UiPath

b. Factors such the increasing demand for automation across various business processes and the growing emphasis on data security are anticipated to accelerate the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.