- Home

- »

- Next Generation Technologies

- »

-

Autonomous Trucks Market Size, Share, Industry Report 2033GVR Report cover

![Autonomous Trucks Market Size, Share & Trends Report]()

Autonomous Trucks Market (2026 - 2033) Size, Share & Trends Analysis Report By Propulsion (Diesel, Electric, Hybrid), By Vehicle Type, By Level Of Autonomy, By Sensor Type (Camera, Radar, Lidar, Ultrasonic), By Application, By ADAS Feature, By Region And Segment Forecasts

- Report ID: GVR-4-68040-695-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Trucks Market Summary

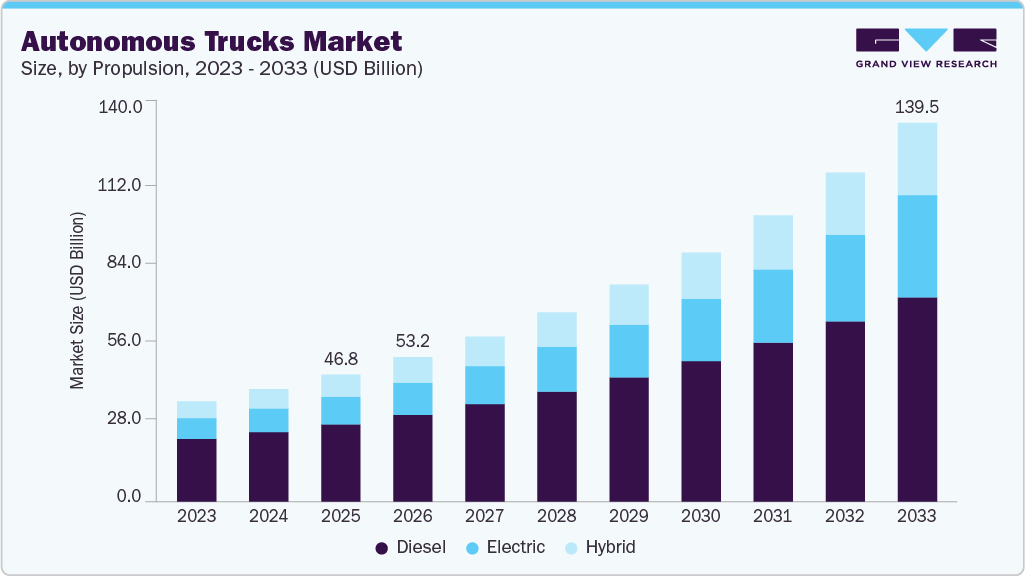

The global autonomous trucks market size was estimated at USD 46.77 billion in 2025 and is projected to reach USD 139.49 billion by 2033, growing at a CAGR of 14.8% from 2026 to 2033. The increasing driver shortages, rapid advancements in AI and sensor technologies, and rising demand for cost-efficient logistics in e-commerce and freight transportation drive this growth.

Key Market Trends & Insights

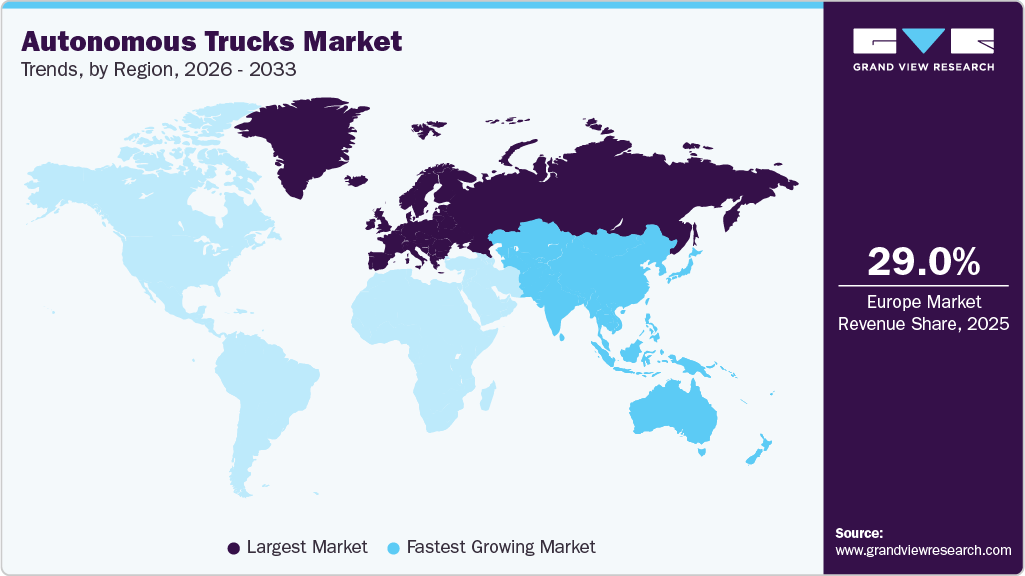

- Europe dominated the global autonomous trucks market with the largest revenue share of 29% in 2025.

- The autonomous truck market in Germany led the European market and held the largest revenue share in 2025.

- By propulsion, the diesel segment dominated the market with a share of over 60% in 2025.

- By level of autonomy, L1 led the market, holding the largest revenue share of 33.5% in 2025.

- By ADAS feature, the Adaptive Cruise Control (ACC) segment held the dominant position in the market.

Market Size & Forecast

- 2025 Market Size: USD 46.77 Billion

- 2033 Projected Market Size: USD 139.49 Billion

- CAGR (2026-2033): 14.8%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

The increasing need to reduce operating costs, enhance road safety, and address driver shortages using advanced automation technologies is significantly driving the autonomous truck industry. Rapid advancements in AI, sensor technology, and vehicle connectivity shape the current market state. Logistics and freight companies are increasingly seeking automated solutions to enhance efficiency, safety, and overall productivity as road freight volumes continue rising globally. Market participants invest heavily in AI-powered driving systems, real-time data processing, and integrated vehicle-to-everything (V2X) communication to enable trucks to operate with minimal human intervention. The ongoing shortage of qualified drivers and high labor costs further motivate industry stakeholders to accelerate the adoption of autonomous trucking technology, thereby driving autonomous truck industry growth.

Furthermore, heightened demand for faster and more cost-effective long-haul logistics encourages expanded use of autonomous trucks, especially as e-commerce and just-in-time delivery requirements intensify. Regulatory support in multiple regions helps establish frameworks for safe testing and operation of driverless freight vehicles, which gives industry players more confidence to scale solutions. Faster improvements in AI algorithms, cloud-based fleet management, and advances in sensor fusion continue to reduce technical barriers related to navigation, obstacle detection, and reliable long-distance operation. The development of Level 4 and Level 5 autonomous platforms signals growing readiness for limited human intervention and fully driverless transport solutions.

Moreover, the use of real-time data analytics, cloud-based fleet management platforms, and predictive maintenance solutions enables companies to optimize vehicle uptime and overall fleet efficiency. Ethical AI deployment, cybersecurity, and compliance with new safety regulations are growing areas of focus, ensuring that technological progress aligns with industry standards and public trust. As logistics providers and manufacturers work together to refine operational models, autonomous trucks are expected to play a key role in reshaping the freight and transportation landscape through improved reliability, cost efficiency, and enhanced service offerings. These factors are expected to drive the growth of the autonomous truck industry in the coming years.

Propulsion Insights

The diesel segment dominated the market with a share of over 60% in 2025, owing to existing infrastructure, established supply chains, and the longstanding reliance of freight and mining operations on high-power diesel engines. Diesel technology supports extended range, heavy payload capacity, and reliable operation across long distances, key requirements for commercial, long-haul autonomous trucking. Many fleets have invested heavily in diesel platforms, and retrofitting these vehicles with autonomous systems is often more economical than transitioning to newer propulsion models in the short term. The efficiency and power density of diesel engines and widespread service and refueling networks further reinforce their large market share among autonomous truck deployments.

The electric segment is predicted to experience the fastest growth of over 17% from 2026 to 2033, driven by environmental regulations and sustainability initiatives that motivate fleets and shippers to reduce emissions. Advances in battery technology, including higher energy density and faster charging capabilities, are making electric trucks more viable for everyday logistics and select long-haul applications. The combination of lower operational costs, government incentives, and improved range accelerates investments in electrified autonomous trucks. Increasing consumer and enterprise pressure for greener supply chains is prompting OEMs and fleet operators to transition to electric platforms, positioning this segment for considerable expansion as infrastructure matures.

Sensor Type Insights

The radar segment accounted for the largest market revenue share in 2025. Radar-based sensing solutions are widely adopted in autonomous trucks for their reliability, large object-detection range, and proven utility in adverse weather conditions. Truck manufacturers rely on radar as a key component in adaptive cruise control, collision avoidance, and automated emergency braking systems. Their ability to provide real-time speed and distance data makes radar indispensable for highway autonomy, supporting safe lane keeping and traffic management. The established ecosystem of radar suppliers, alongside continued enhancements in cost and performance, secures this segment’s leadership in sensor technology adoption.

The LiDAR segment is expected to grow at the fastest CAGR from 2026 to 2033. LiDAR technology is advancing rapidly, providing high-resolution, three-dimensional environmental mapping crucial for safe and precise navigation in complex, dynamic traffic scenarios. Although historically more expensive, recent cost reductions and performance improvements are making LiDAR increasingly accessible for commercial truck OEMs and integrators. LiDAR enhances perception capability beyond what cameras and radar offer, especially in low-visibility situations such as night driving or heavy precipitation. The role of high-fidelity object detection for higher-level autonomous applications is driving fast growth as fleets pursue greater automation and safety assurance.

Application Insights

The mining trucks segment accounted for the prominent market revenue share in 2025, as early adopters of autonomous truck technology were due to the controlled, predictable nature of mine sites and the constant demand for high-capacity material transport. Automation delivers substantial productivity gains, operational safety improvements, and reduced human resource dependency, key challenges in remote and hazardous environments. Fleet managers in mining benefit from real-time monitoring, optimized routing, and 24/7 operation, all enabled by autonomous systems. The proven performance in cost reduction and operational efficiency ensures mining trucks retain a prominent market share.

The last-mile delivery trucks segment is anticipated to grow at a significant CAGR from 2026 to 2033, driven by continued expansion in e-commerce, where fast, flexible, and affordable delivery service is now a baseline expectation. Autonomous technology is being deployed in small, nimble vehicles suited for urban environments, where traffic density and operational complexity are high. Advanced navigation, obstacle avoidance, and automated loading/unloading capabilities are making last-mile autonomy more feasible. Retailers and logistics providers are actively piloting and scaling their fleets to optimize delivery speeds and reduce labor costs, fueling the rise of this segment.

Level of Autonomy Insights

The L2 & L3 segment accounted for a significant market revenue share in 2025, as truck OEMs and fleets integrate driver-assist technologies such as adaptive cruise control, lane keep assist, and automated braking into existing models. These systems enhance safety, reduce fatigue, and provide a technological bridge to higher autonomy levels. Regulations currently require a human driver to monitor or intervene, making L2 and L3 systems the primary commercial solution for many routes. Their relative maturity, cost-effectiveness, and compatibility with current regulatory frameworks sustain their large market share.

The L5 segment is expected to experience significant growth from 2026 to 2033, driven by several key factors. Level 5 automation represents full self-driving capability, where trucks operate without human intervention, addressing ongoing labor shortages and rising operational costs in the logistics and freight industry. Recent advancements in AI, sensor technology, and real-time data processing are making L5 systems increasingly feasible for commercial use, especially with ongoing pilot programs and major investments from leading OEMs and technology firms. Logistics providers see strong business value in eliminating the need for drivers, achieving continuous operation, and optimizing fuel and route efficiency on long-haul transport routes.

ADAS Feature Insights

The Adaptive Cruise Control (ACC) segment accounted for the largest market revenue share in 2025. ACC is a foundational ADAS feature that has seen broad acceptance and deep integration into both semi-autonomous and fully autonomous truck platforms. ACC automates speed control, maintains safe following distances on highways, and reduces driver input while improving energy efficiency. The system’s strong track record in enhancing safety and reducing accident risks ensures high inclusion rates in new autonomous truck models. Its operational benefits and compatibility with other advanced driver assistance features make it a market leader among ADAS technologies.

The Lane Keep Assist (LKA) segment is anticipated to grow at the highest CAGR from 2026 to 2033. It enables vehicles to maintain proper lane discipline, a crucial requirement for autonomous operation on highways and urban corridors. This feature reduces accidents due to unintended lane departures and helps meet evolving regulatory safety standards. Advances in vision processing and sensor fusion are making LKA systems more accurate and responsive, even in adverse conditions. Fleets seeking further automation increasingly specify LKA to supplement or replace manual steering corrections, contributing to this segment’s expansion.

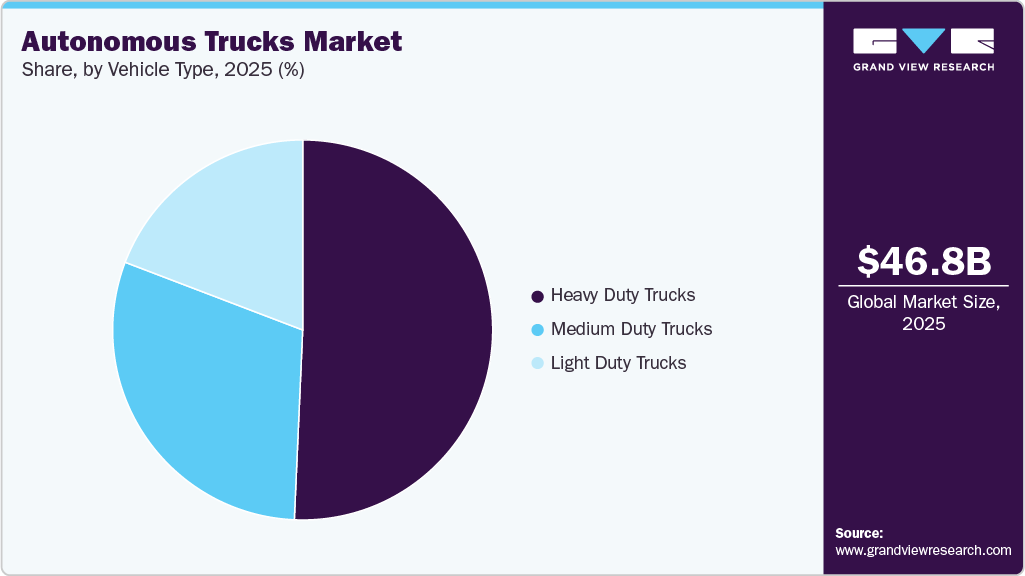

Vehicle Type Insights

The heavy-duty trucks segment accounted for the largest market revenue share in 2025. Heavy-duty trucks, including Class 8 vehicles, remain the primary workhorses of freight transport and thus lead the autonomous truck sector. These trucks deliver maximum operational savings from automation due to their high fuel consumption and labor costs. Autonomous technology allows for around-the-clock operation, higher productivity, and reduced downtime for these vehicles. Heavy-duty models are especially beneficial in applications such as long-haul freight, mining, and large-scale construction, where operational efficiency and payload capacity are paramount.

The light duty trucks segment is expected to grow at a significant CAGR from 2026 to 2033, as e-commerce drives demand for fast, frequent, and flexible delivery services. The adoption of autonomous systems in these vehicles benefits from simplified integration of sensors and perception technology, making them well-suited for navigating city streets and residential areas. They are agile, easier to test and deploy autonomously in controlled zones, and more quickly approved by regulators. The expansion of urban delivery networks and local transport applications is a major catalyst spurring this segment’s rapid growth trajectory.

Regional Insights

The North America autonomous truck market is anticipated to grow at a significant CAGR due to strong investment in technology, supportive regulatory frameworks, and extensive freight movement networks. The region benefits from a concentration of major OEMs, technology startups, and logistics companies engaged in ongoing development and large-scale pilot programs. Government and industry collaboration has accelerated infrastructure upgrades to accommodate autonomous vehicles on highways and logistics hubs.

U.S. Autonomous Trucks Market Trends

The autonomous truck market in the U.S. is expected to grow significantly in 2025 as leading companies deploy and scale autonomous truck fleets across key freight corridors. Government agencies are focused on updating safety standards, allowing for more extended and flexible testing of driverless vehicles. High consumer demand for expedited shipping and freight reliability strengthens the business case for automation among logistics companies. R&D investments, strategic alliances among automakers and tech firms, and a competitive regulatory environment all contribute to this acceleration in the U.S. autonomous truck sector.

Europe Autonomous Trucks Market Trends

The autonomous truck market in Europe dominated the autonomous truck industry with a revenue share of over 29.0% in 2025, driven by coordinated industry initiatives, advancements in cross-border freight logistics, and increasing emphasis on road safety and decarbonization. The European Union encourages collaboration in pilot projects and alignment of regulatory requirements, allowing smoother expansion of autonomous technology. Investments in energy-efficient transport infrastructure and digital logistics platforms further support fleet upgrades.

The UK autonomous trucks market is expected to grow rapidly in the coming years. The market's expansion is driven by acute driver shortages, government-backed pilot programs on highways and logistics hubs, and rapid advancements in AI, sensors, and V2X connectivity that enable efficient freight automation amid e-commerce demands and strict emissions regulations.

The autonomous trucks market in Germany held a significant market share in 2025. This growth can be attributed to the robust infrastructure investments, collaborations between OEMs such as Daimler and tech firms, chronic labor shortages in logistics, and progressive EU regulations supporting Level 4 autonomy for long-haul and port operations to optimize costs and safety.

Asia Pacific Autonomous Trucks Market Trends

The autonomous truck market in the Asia Pacific region is anticipated to grow at the fastest CAGR from 2026 to 2033. Asia Pacific stands out for its rapid urbanization, expanding manufacturing base, and increasing need for efficient logistics and mining transport solutions. Several countries in the region are prioritizing smart infrastructure investments and trial deployments of autonomous trucks in mining and controlled-access freight corridors. Local technology companies are partnering with global OEMs to adapt autonomous solutions to regional challenges, such as high-density traffic and diverse road conditions.

China autonomous trucks market is expected to grow rapidly in the coming years. The market's expansion can be attributed to massive government investments in smart infrastructure and 5G networks, aggressive R&D by tech giants like Baidu and Huawei, acute labor shortages in logistics, and rapid pilot deployments on freight corridors enabling cost reductions and 24/7 operations amid booming e-commerce.

The autonomous trucks market in Japan held a significant market share in 2025. This growth is driven by the chronic driver shortages, collaborations between Toyota and Isuzu with tech firms, stringent safety regulations favoring Level 4 tech, and infrastructure upgrades for hub-to-hub trials to enhance freight efficiency on aging highways.

Key Autonomous Trucks Company Insights

Some key companies in the autonomous truck industry are Daimler Truck AG, AB Volvo, PACCAR Inc., and Tesla.

-

Daimler Truck AG is a major player in the market, focusing on developing and deploying trucks with advanced safety and automation features. The company works with partners such as Torc Robotics to integrate autonomous driving technology into its vehicles, especially for long-haul freight transport. Daimler’s strategy includes offering ready-to-operate autonomous truck platforms to logistics and fleet customers.

-

AB Volvo offers a portfolio that includes production-ready autonomous trucks such as the Volvo VNL Autonomous. By integrating its expertise in heavy-duty vehicles with technology partners such as Aurora Innovation and Waabi, AB Volvo delivers autonomous solutions tailored for both on-highway freight and specialized use cases in mining and logistics.

Key Autonomous Trucks Companies:

The following are the leading companies in the autonomous trucks market. These companies collectively hold the largest market share and dictate industry trends.

- Daimler Truck AG

- AB Volvo

- PACCAR Inc.

- Tesla

- Waymo LLC

- Aurora Innovation, Inc.

- CreateAl Holdings Inc.

- PlusAI, Inc.

- Applied Intuition, Inc.

- Nuro, Inc.

Recent Developments

-

In July 2025, Aeva Inc. expanded its collaboration with Daimler Truck North America LLC (DTNA) to advance the series production of its 4D LiDAR technology for autonomous vehicles. As part of this enhanced collaboration, DTNA is providing additional funding to accelerate Aeva Inc.'s progress toward large-scale production. To address rapidly increasing demand, Aeva Inc. plans to establish annual production capacity for up to 200,000 units of 4D LiDAR in North America, targeting support for multiple customers, including DTNA, in deploying advanced sensing technology for autonomous vehicle applications.

-

In July 2025, Pronto.ai, a company specializing in autonomous driving systems for haulage trucks and off-road vehicles, acquired its competitor Safe AI. This acquisition aims to strengthen Pronto.ai’s technological capabilities and expand its talent pool by integrating Safe AI’s 12-member engineering team and intellectual property. The consolidation enhances Pronto.ai’s position in the autonomous haulage systems market, supporting its strategy to accelerate the deployment of advanced self-driving technologies for commercial and industrial applications.

-

In July 2025, ORIX Corporation announced an investment in RoboTruck Inc., a company focused on autonomous vehicle technologies for logistics. Concurrently, ORIX Corporation entered into a strategic business alliance with RoboTruck Inc. to collaborate on the development and deployment of autonomous driving solutions within the logistics sector. This partnership aims to accelerate innovation in automated freight transportation and enhance operational efficiency across logistics networks.

Autonomous Trucks Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 53.22 billion

Revenue forecast in 2033

USD 139.49 billion

Growth rate

CAGR of 14.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, ADAS feature, sensor type, propulsion, vehicle type, level of autonomy, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Daimler Truck AG; AB Volvo; PACCAR Inc.; Tesla; Waymo LLC; Aurora Innovation, Inc.; CreateAl Holdings Inc.; PlusAI, Inc.; Applied Intuition, Inc.; Nuro, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Trucks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global autonomous truck market report based on propulsion, vehicle type, sensor type, application, ADAS feature, level of autonomy, and region:

-

Propulsion Outlook (Revenue, USD Million, 2021 - 2033)

-

Diesel

-

Electric

-

Hybrid

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Light Duty Truck

-

Medium Duty Truck

-

Heavy Duty Truck

-

-

Sensor Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Camera

-

Radar

-

Lidar

-

Ultrasonic

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Last Mile Delivery Truck

-

Mining Truck

-

Shuttles

-

-

ADAS Feature Outlook (Revenue, USD Million, 2021 - 2033)

-

Adaptive Cruise Control (ACC)

-

Automatic Emergency Braking (AEB)

-

Blind Spot Detection (BSD)

-

Intelligent Park Assist (IPA)

-

Lane Keep Assist (LKA)

-

Traffic Jam Assist (TJA)

-

Highway Pilot (HP)

-

Others

-

-

Level of Autonomy Outlook (Revenue, USD Million, 2021 - 2033)

-

L1

-

L2 & L3

-

L4

-

L5

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous truck market size was estimated at USD 46.77 billion in 2025 and is expected to reach USD 53.22 billion in 2026.

b. The global autonomous truck market is expected to grow at a compound annual growth rate of 14.8% from 2026 to 2033 to reach USD 139.49 billion by 2033.

b. Europe dominated the autonomous trucks market with a share of 29.8% in 2025, driven by coordinated industry initiatives, advancements in cross-border freight logistics, and increasing emphasis on road safety and decarbonization.

b. Some key players operating in the autonomous trucks market include Daimler Truck AG, AB Volvo, PACCAR Inc., Tesla, Waymo LLC, Aurora Innovation, Inc., CreateAl Holdings Inc., PlusAI, Inc., Applied Intuition, Inc., Nuro, Inc.

b. Key factors driving market growth include reducing operating costs, enhancing road safety, and addressing driver shortages through advanced automation technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.