- Home

- »

- Electronic Devices

- »

-

Aviation Connector Market Size, Share, Industry Report, 2030GVR Report cover

![Aviation Connector Market Size, Share & Trends Report]()

Aviation Connector Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (PCB, High Power, High-Speed, Fiber Optics, RF), By Aircraft (Commercial, Military), By Application (Avionics, Engines), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-872-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aviation Connector Market Size & Trends

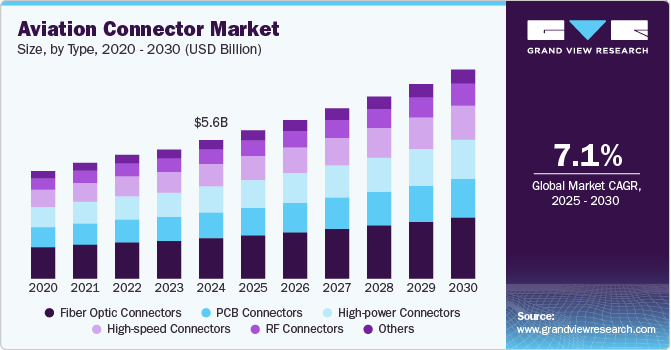

The global aviation connector market size was estimated at USD 5.6 billion in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2030. The increasing demand for advanced avionics systems and expanding commercial and military aircraft fleets are the major driving factors promoting market growth. Developments such as lightweight, high-speed, and high-power connectivity solutions enhance operational efficiency, further supporting their adoption across the aviation industry.

The widespread application of aviation connectors across aircraft lighting, user power systems, seat actuators, and intelligent peripheral devices is driving the market. These connectors ensure reliable power and data transmission across critical aircraft systems. Leading manufacturers are introducing rugged connectors to withstand harsh operating conditions, including extreme temperatures, vibration, and environmental hazards. For instance, lightweight modular connectors with coaxial, high-speed Ethernet, and optical contacts are being integrated into aircraft cabin and avionics systems to enhance reliability and performance. In addition, the growing procurement of military and defense aircraft has increased the demand for sturdy, vibration-resistant connectors that ensure stable electrical connections for avionics and engine functionality.

Advancements in connector technology are improving performance, miniaturization, and durability, making them an essential part of modern aircraft systems. Aviation connectors support critical components such as power distribution, cockpit controls, in-flight entertainment systems, and avionics architecture, ensuring seamless functionality. The growing emphasis on passenger experience, particularly in business class, has further encouraged the demand for connectors in infotainment and communication systems. In addition, integrating avionics, power systems, landing gear, and control panels with advanced connectors ensures safety and operational efficiency. With the ongoing expansion of commercial and defense aviation sectors, the adoption of aviation connectors is expected to grow steadily.

Type Insights

Fiber optic connectors dominated the aviation connector market, accounting for a 29.6% share in 2024. These connectors are essential for high-speed data transmission, particularly in modern aviation systems requiring enhanced communication and avionics performance. Their ability to overcome bandwidth and distance limitations makes them a preferred choice in next-generation aircraft. In addition, the adoption of fiber optic connectors in telecommunication technologies, such as FTTx applications, further supports market expansion. Owing to the progressive reliance of aircraft on advanced networking solutions, the demand for fiber optic connectors is expected to remain strong.

High-power connectors are projected to register the highest growth rate over the forecast period. These connectors play a crucial role in power distribution within aircraft, supporting critical applications such as engines, avionics, and lighting systems. The rising need for high-efficiency electrical systems and power management technology advancements drive the demand for high-power connectors. In addition, their ability to withstand extreme environmental conditions, such as high temperatures and vibrations, makes them essential for commercial and military aircraft. With increasing electrification trends in aviation, this segment is expected to grow substantially.

Aircraft Insights

The commercial aircraft segment dominated the market in 2024. The increasing production and procurement of commercial aircraft, driven by rising air passenger traffic and fleet expansion, supports this segment’s dominance. Aviation connectors are an essential part of integrating avionics, power distribution, and in-flight entertainment systems, ensuring high operational efficiency and passenger safety. In addition, advancements in connectivity solutions and the demand for modernized aircraft cabins continue to drive growth within this segment.

Business and general aviation aircraft are expected to witness notable growth over the forecast period. The increasing adoption of private jets and charter aircraft, fueled by rising corporate travel and personal air mobility trends, contributes to the segment demand. Aviation connectors play a critical role in optimizing avionics, communication systems, and power management within these aircraft. Furthermore, the emphasis on high-speed data transmission and enhanced cabin experiences continues to support growth in the business and general aviation sector within the aviation connector industry.

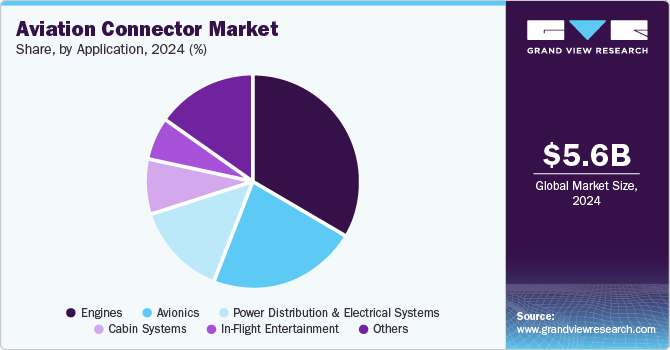

Application Insights

The engines segment dominated the aviation connectors industry in 2024. Aviation connectors are crucial in engine control systems and ensure reliable power distribution and data transmission for optimal performance. The increasing focus on fuel efficiency, emission reduction, and advanced propulsion technologies drives demand for durable and high-performance connectors in this segment. In addition, the adoption of next-generation aircraft engines with enhanced electronic controls further supports the growth of aviation connectors in engine applications.

In-flight Entertainment (IFE) systems are expected to register the highest CAGR over the forecast period. The rising demand for enhanced passenger experience, particularly in long-haul flights, is driving the adoption of advanced infotainment solutions in commercial aircraft. Aviation connectors enable seamless connectivity for high-speed data transmission, supporting features such as touchscreen displays, internet access, and multimedia streaming. With airlines focusing on upgrading cabin technologies and incorporating next-generation IFE systems, the demand for aviation connectors is projected to grow significantly in this segment.

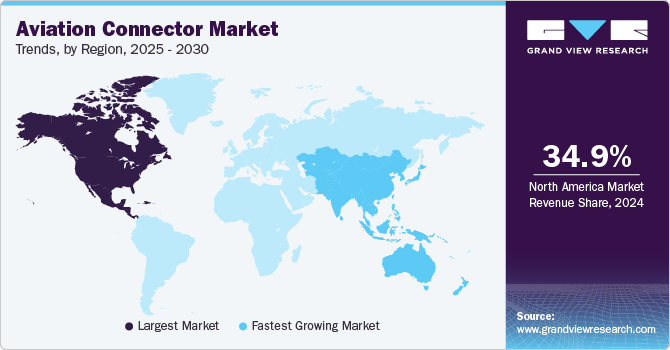

Regional Insights

North America market dominated the aviation connector industry, accounting for a 34.9% share in 2024. The strong presence of leading aircraft manufacturers, ongoing fleet modernization programs, and significant defense spending contribute to the region's market leadership. Advancements in avionics, in-flight entertainment systems, and power distribution networks across commercial, business, and military aircraft further drive the demand for aviation connectors.

The increasing procurement of next-generation aircraft and retrofit programs in the U.S. and Canada continue to support market growth. The U.S. Air Force has been actively upgrading its fleet with modernized avionics and communication systems, requiring high-performance connectors for secure and efficient data transmission. For instance, the Avionics Modernization Program Increment 2 (AMP Inc 2) enhancing the C-130H Hercules fleet by transitioning from analog to digital systems, significantly improving avionics and navigation capabilities. In addition, the Electronic Warfare and Avionics Program Office is modernizing radios across various aircraft to enhance warfighter capabilities, further driving the demand for advanced aviation connectors. The expansion of commercial aviation, including the rising adoption of electric and hybrid aircraft, is also expected to drive the regional demand for aviation connectors.

U.S. Aviation Connector Market Trends

The U.S. aviation connector market dominated the regional market in 2024. This growth is driven by the increasing demand for advanced avionics, expanding commercial and military aircraft fleets, and rising investments in aerospace infrastructure. The growing adoption of high-speed data transmission and power distribution solutions in next-generation aircraft fuels the need for reliable aviation connectors. In addition, the development of lightweight and high-performance connectors to improve aircraft efficiency and durability further supports market expansion. The presence of key aircraft manufacturers and defense contractors continues to reinforce the growth of the U.S. market.

Europe Aviation Connector Market Trends

Europe aviation connector market is experiencing growth, driven by the increasing adoption of advanced interconnect solutions in commercial and military aircraft. The region's strong aerospace manufacturing sector, supported by the presence of major aircraft OEMs, contributes to the demand for high-performance connectors. Efforts to enhance avionics systems, improve data transmission capabilities, and support electrification initiatives further drive market expansion. In addition, investments in next-generation aircraft technologies and collaborations between industry players and research institutions strengthen the development of innovative connector solutions, driving the aviation connector industry. Countries such as Germany, France, and the U.K. remain key contributors to the region's growth, benefiting from robust aerospace infrastructure and technological advancements.

Asia Pacific Aviation Connector Market Trends

Asia Pacific aviation connector market is expected to grow at the highest CAGR of 9.9% over the forecast period. The expansion of commercial aviation, driven by increasing air passenger traffic and rising aircraft procurement, is a key factor contributing to market growth. Countries such as China, India, and Japan are investing in the modernization of their aviation infrastructure, leading to a higher demand for advanced avionics and connectivity solutions. In addition, the growing defense budgets in the region accelerated the military aircraft acquisitions, further boosting the need for rugged and high-performance aviation connectors. The increasing adoption of in-flight entertainment systems and data-driven avionics in commercial aircraft also impels demand, positioning Asia Pacific as a significant market for aviation connectors.

China Aviation Connector Market Trends

China dominated the market in 2024. The country's expanding commercial and military aviation sectors drive the demand for advanced connectivity solutions. For instance, in January 2025, the Commercial Aircraft Corporation of China (COMAC) announced its plans to boost its production capacity for its C919 aircraft to 50 units, targeting the manufacturing of 30 planes in the same year. In addition, the growing defense budget has led to the procurement and manufacturing of advanced military aircraft, further supporting the demand for durable and high-speed connectors in avionics and power distribution systems. The integration of in-flight entertainment and data-driven avionics in passenger aircraft also contributes to market expansion.

Middle East & Africa Aviation Connector Market Trends

The Middle East & Africa aviation connector market is experiencing growth, driven by expanding aviation infrastructure, increasing aircraft procurement, and advancements in avionics technology. Governments in the region are investing in modernizing their commercial and military aviation sectors, fueling the demand for high-performance connectors. For instance, Saudi Arabia's Vision 2030 initiative aims to transform the Kingdom into a global aviation hub, with plans to increase air passenger traffic to 300 million by 2030. In addition, the integration of advanced in-flight entertainment systems and the growing adoption of digital avionics in countries such as the UAE and South Africa further contribute to market expansion.

Key Aviation Connector Company Insights

Some of the key companies operating in the aviation connector industry are Amphenol Corporation,TE Connectivity, and Eaton. These companies are expanding their market presence by launching new products, collaborating, and adopting various other strategies.

-

Amphenol Corporation is a key player in the industry, offering a wide range of high-performance connectors for commercial, military, and aerospace applications. It specializes in ruggedized interconnect solutions designed to withstand extreme environmental conditions, ensuring reliable power and data transmission in aircraft systems. The company strengthens its market presence through continuous innovation, advanced manufacturing capabilities, and strategic partnerships.

-

TE Connectivity is a key player in the industry, offering high-performance interconnection solutions for commercial and military aircraft. The company specializes in lightweight, durable connectors designed to withstand extreme conditions, ensuring reliable power distribution, avionics functionality, and communication systems. Through continuous innovation and adherence to industry standards, TE Connectivity supports advancements in aerospace technology and enhances aircraft efficiency.

Key Aviation Connector Companies:

The following are the leading companies in the aviation connector market. These companies collectively hold the largest market share and dictate industry trends.

- Amphenol Corporation

- TE Connectivity

- Eaton

- Smiths Group plc

- Radiall

- ITT Inc.

- Bel Fuse Inc.

- IEH Corporation

- Apollo Aerospace Components

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

Recent Developments

-

In May 2024, Amphenol acquired Carlisle Interconnect Technologies (CIT) from Carlisle Companies Incorporated. This acquisition strengthened Amphenol's position in the aviation connectors industry by expanding its portfolio of engineered interconnect solutions for harsh environments. The integration of CIT's capabilities into the company is expected to enhance product offerings for commercial aerospace, defense, and industrial applications, supporting the demand for high-performance connectivity solutions.

-

In May 2024, TE Connectivity launched NanoRF 75 Ohm coax/optical hybrid modules developed to address the growing demand for high-speed and high-density connectivity in modern video transmission systems. These modules improve signal quality and reliability across aerospace, defense, and marine applications, reinforcing advanced connectivity solutions in the aviation connector industry.

Aviation Connector Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.9 billion

Revenue forecast in 2030

USD 8.5 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, aircraft, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Columbia, Saudi Arabia, and UAE

Key companies profiled

Amphenol Corporation; TE Connectivity; Eaton; Smiths Group plc; Radiall; ITT Inc.; Bel Fuse Inc.; IEH Corporation; Apollo Aerospace Components; Rosenberger Hochfrequenztechnik GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

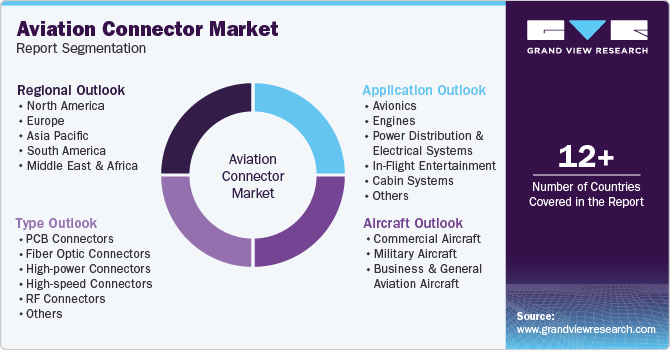

Global Aviation Connector Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Aviation connector market report based on type, aircraft, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

PCB Connectors

-

Fiber Optic Connectors

-

High-power Connectors

-

High-speed Connectors

-

RF Connectors

-

Others

-

-

Aircraft Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aircraft

-

Military Aircraft

-

Business and General Aviation Aircraft

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Avionics

-

Engines

-

Power Distribution and Electrical Systems

-

In-Flight Entertainment

-

Cabin Systems

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

South America

-

Brazil

-

Columbia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.