- Home

- »

- Medical Devices

- »

-

Ayurveda Market Size, Share & Growth, Industry Report 2033GVR Report cover

![Ayurveda Market Size, Share & Trends Report]()

Ayurveda Market (2026 - 2033) Size, Share & Trends Analysis Report By Form (Herbal, Mineral, Herbomineral), By Application (Medical/Therapy, Personal), By Indication, By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-263-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ayurveda Market Summary

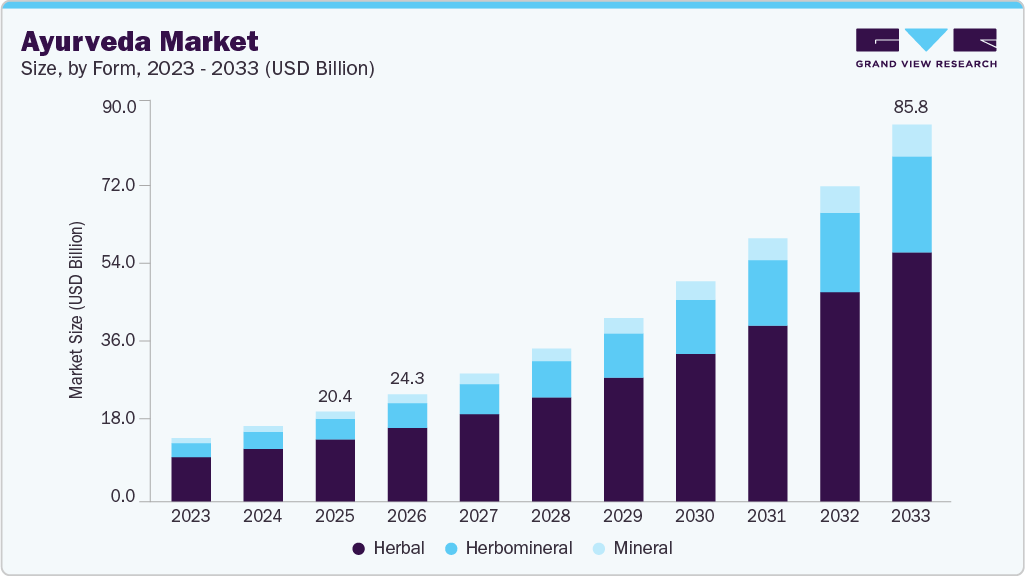

The global ayurveda market size was valued at USD 20.42 billion in 2025 and is expected to reach USD 85.83 billion by 2033, growing at a CAGR of 19.72% from 2026 to 2033. This growth is largely due to the rising prevalence of chronic diseases, increasing awareness of Ayurvedic benefits, and strong adoption and acceptance of Ayurveda across consumer groups.

Key Market Trends & Insights

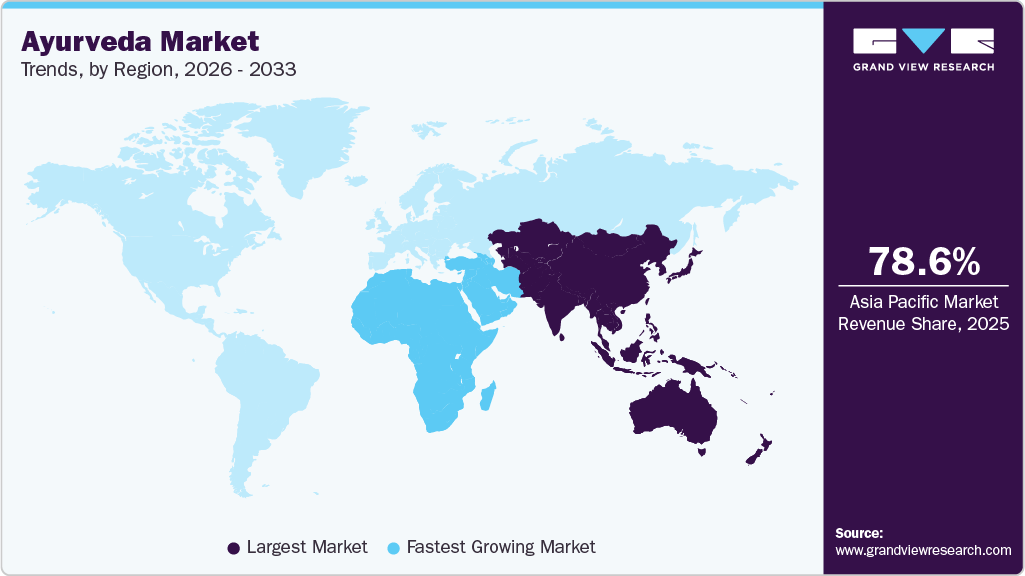

- Asia Pacific Ayurveda market held the largest share of 78.62% of the global market in 2025.

- The Ayurveda industry in India is expected to grow significantly over the forecast period.

- By form, herbals dominated the market in 2025 with a 69.16% share.

- By application, medical/therapy dominated the market in 2025 with a 60.67% share.

- By indication, the skin/hair segment held the largest market share of 25.57% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 20.42 Billion

- 2033 Projected Market Size: USD 85.83 Billion

- CAGR (2026-2033): 19.72%

- Asia Pacific: Largest market in 2025

- Middle East & Africa: Fastest growing market

Growing demand for organic and natural personal care products that use Ayurvedic ingredients such as neem, turmeric and sandalwood is also strengthening industry expansion. A key market trend involves clinical studies that highlight the health benefits of Ayurvedic supplements, which have increased scientific validation, boosted consumer trust and supported wider market uptake. Ayurvedic medicines and treatments are further preferred for their comparatively lower side effects than allopathy. For instance, from September to October 2024, the Journal of Research in Ayurvedic Sciences published an editorial explaining that centuries of empirical Ayurveda should be reassessed using rigorous scientific methods, including experimental, clinical, observational, systematic review and meta-analysis designs. The authors noted that this approach could help address psoriasis, hypertension, obesity, diabetes and musculoskeletal disorders more effectively.

For instance, Turmeric is widely used in various supplements due to its anti-inflammatory properties, which have been validated by research. The market witnessed a surge in demand due to the increasing consumer focus on preventive healthcare and immunity-boosting products during the COVID-19 pandemic. The lockdowns and social distancing measures led to a shift in consumer behavior towards natural and organic products, including Ayurvedic supplements and medicines. Moreover, the growing awareness about the benefits of Ayurveda in managing stress and anxiety levels also contributed to the market growth during COVID-19. Governments around the world are recognizing the potential benefits of Ayurveda and are taking steps to regulate and promote its use.

For instance, in India, the Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy) has been established to promote traditional medicine and alternative medicine systems. According to the Directorate General of Commercial Intelligence and Statistics (DGCI&S), India's exports of Ayurvedic and herbal products have increased from USD 479.6 million (3,967.4 crores INR) in FY21 to USD 606.2 million (5,014.3 crores INR) in FY23. On the other hand, the import of Ayurvedic and herbal products in India has also increased USD 71.4 million (590.7 crores INR) in FY21 to USD 91.1 million (753.8 crores INR) in FY23, with a compound annual growth rate of 13 %. As a result, India's trade surplus in Ayurvedic and herbal products increased from 408.2 million (3,376.7 crore INR in FY21 to USD 515.1 million (4,260.5 crore INR) in FY23.

Market Concentration & Characteristics

The industry is experiencing moderate to high innovation, driven by advancements in product formulations, standardization of manufacturing processes, and integration with modern wellness trends. Companies are focusing on developing personalized Ayurvedic solutions and expanding their product lines to cater to diverse consumer needs.

The industry has witnessed a moderate level of merger and acquisition (M&A) activity, driven by the need for brand expansion, product portfolio diversification, and entry into new geographies. Established players are acquiring smaller specialized firms to enhance capabilities in product innovation and raw material sourcing. Cross-border acquisitions are increasing as companies target global expansion and access to emerging markets. M&A activity is expected to grow as competition intensifies and consumer demand for authentic Ayurvedic solutions rises.

The industry operates under regulatory frameworks that vary by region, aiming to ensure product safety and efficacy. In India, the Ministry of AYUSH regulates Ayurvedic products, while in other countries, products must comply with local health and safety standards. Regulatory compliance is crucial for market acceptance and consumer trust.

Conventional medicine and other alternative therapies serve as substitutes for Ayurvedic products. However, Ayurveda's emphasis on holistic wellness and natural ingredients provides a unique value proposition that differentiates it from other healthcare approaches.

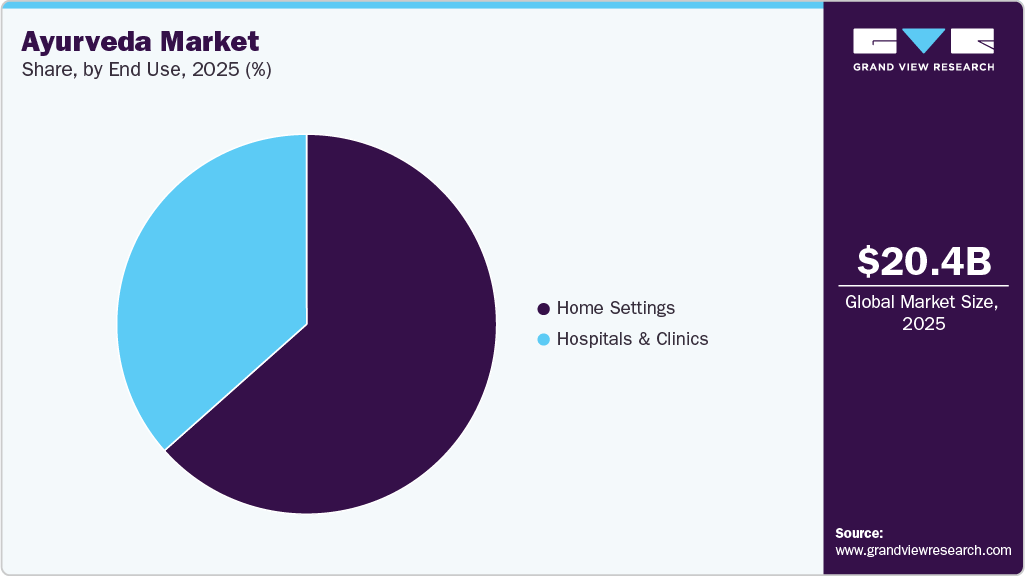

The Ayurveda industry serves a diverse end-user base, including individual consumers, wellness centers, Ayurvedic clinics, and healthcare institutions. Individual consumers constitute the largest segment due to growing home healthcare trends and self-care awareness. Wellness and spa centers are also key end-users, while hospitals and Ayurvedic clinics drive institutional adoption. End-user concentration varies by region, with higher institutional adoption in Asia and greater consumer-led demand in Western markets.

Form Insights

The herbal segment dominated the market with a revenue share of 69.16% in 2025, supported by rising consumer awareness of the benefits of herbal supplements, increasing interest in natural and organic products, and a growing focus on preventive healthcare. Herbal supplements, which include botanicals, herbs and plant-based elements, help address digestive issues, sleep disorders and stress, increasing the demand for Ayurvedic products. According to the World Health Organization, over 80% of the global population across 170 countries used traditional medicine, including Ayurveda, herbal medicine, acupressure, acupuncture, yoga and indigenous therapies. For instance, September 2025, the publication “Herbal Remedies in Ayurveda for Chronic Diseases” appeared in the volume “Growing Global Importance: The Role of Yoga and Ayurveda in Managing Non-Communicable Diseases,” where the authors noted that herbs such as Withania somnifera, Tinospora cordifolia and Curcuma longa offered adaptogenic, anti-inflammatory and antioxidant benefits that supported holistic management of chronic diseases and long term wellness.

The herbomineral segment is expected to grow at the fastest CAGR of 21.34% during the forecast period because these products combine natural herbs with essential minerals, making them appealing to health-conscious consumers. With rising awareness of healthy living, more individuals are turning to natural and herbal supplements to support overall well-being. This growing understanding of the benefits of Ayurvedic products, along with increasing adoption and acceptance of Ayurveda, continues to drive market expansion. For instance, in July 2024, Elsevier published a research article titled “Product development and characterization of the Ayurvedic herbo mineral metallic compound Hridayarnava Rasa.” In that study, the authors described the preparation and physicochemical characterization of Hridayarnava Rasa and reported quantitative parameters, including specific fractions and compositional metrics, which provided a scientific foundation for its standardization and potential therapeutic application.

Application Insights

The medical/therapy dominated the market in 2025 with a 60.67% share. The growing demand for alternative and integrative treatment options for chronic and lifestyle-related disorders, such as arthritis, diabetes, and stress-related conditions. Increasing patient dissatisfaction with conventional treatments and rising awareness of Ayurveda’s holistic healing approach are prompting more individuals to seek Ayurvedic therapies. Government support through policy initiatives, clinical research, and the integration of Ayurveda in public healthcare systems further bolsters its credibility.

The personal segment is projected to register a significant CAGR during the forecast period. Growth is driven by rising consumer preference for natural and plant-based personal care products, including skincare, haircare, and wellness supplements. Increasing awareness of preventive health, online retail expansion, and demand for chemical-free formulations are strengthening segment performance. Personalized Ayurvedic solutions and digital health platforms are further accelerating adoption in daily self-care routines, particularly among urban consumers globally.

Indication Insights

The skin/hair segment held the largest market share of 25.57% in 2025. The preference for herbal remedies and traditional healing practices has fueled the demand for Ayurvedic skincare and haircare products. Consumers are becoming more conscious of the ingredients in their skincare and haircare products, leading to a shift towards natural and Ayurvedic formulations. The endorsement of Ayurvedic products by celebrities and influencers has also contributed to the segment’s growth by increasing visibility and credibility.

The nervous system segment is expected to record the highest CAGR in the Ayurveda market under the indication category. Growth is driven by increasing demand for Ayurvedic formulations targeting stress, anxiety, insomnia, and cognitive health. Rising adoption of herbal remedies such as Ashwagandha, Brahmi, and Shankhpushpi for neurological balance supports market expansion. The segment benefits from growing awareness of mental wellness, reduced side effects compared to synthetic drugs, and wider integration of Ayurvedic therapies in holistic health management practices.

Distribution Channel Insights

The retail & institutional sales segment held the largest market share of 65.04% in 2025. Retail and institutional sales are driven by increased consumer access to Ayurvedic products through expanding channels such as pharmacies, supermarkets, specialty stores, and wellness clinics as buyers seek both convenience and expert guidance when choosing trusted, quality-assured offerings. Institutional demand driven by hospitals, ayurvedic clinics, spas, and wellness centers, supported by growing disease prevalence and governmental and academic collaborations that promote Ayurveda integration and evidence-based care

The e-sales segment is anticipated to record a significant CAGR over the forecast period. Growth is driven by the rapid expansion of e-commerce platforms, increasing smartphone penetration, and consumer preference for convenient online purchasing. Digital marketing initiatives, subscription-based models, and global availability of Ayurvedic products through online marketplaces are accelerating adoption. The segment also benefits from social media promotion, influencer-led brand awareness, and improved logistics, enabling the timely delivery of diverse Ayurvedic formulations worldwide.

End Use Insights

The home settings segment held the largest market share of 63.44% in 2025, and the segment is anticipated to grow significantly over the forecast period. The rising prevalence of chronic diseases has also spurred demand for alternative treatments that Ayurveda offers, such as stress relief and digestive support. Additionally, the integration of Ayurveda into mainstream healthcare and advancements in digital health platforms have made Ayurvedic products and consultations more accessible, even in remote areas. The growing popularity of Ayurvedic products further contributes to this growth, as consumers increasingly seek natural solutions for skincare and haircare in home settings.

The hospitals and clinics segment in the Ayurveda market is projected to register a significant CAGR during the forecast period. Growth is supported by increasing integration of Ayurvedic treatments within institutional healthcare systems and rising patient preference for complementary therapies. Expanding government support for Ayurvedic healthcare infrastructure, along with clinical validation of Ayurvedic therapies, is enhancing adoption in hospital settings. Additionally, collaborations between Ayurvedic practitioners and allopathic institutions are strengthening patient trust and driving institutional treatment uptake.

Regional Insights

North America Ayurveda market is driven by rising consumer preference for natural and plant-based healthcare solutions. Increasing awareness of preventive wellness and stress management supports product adoption. Ayurvedic dietary supplements, skincare products, and herbal formulations are gaining traction through e-commerce and wellness retail outlets. The U.S. and Canada lead regional consumption with expanding integrative medicine practices. Major brands are investing in localized product formulations and educational marketing to strengthen consumer trust. Growing recognition of Ayurveda in holistic health circles continues to drive steady market expansion across North America.

U.S. Ayurveda Market Trends

The Ayurveda market in the U.S. is growing owing to high demand for herbal supplements, beauty care, and stress-relief formulations. Rising acceptance of Ayurveda in wellness programs and yoga-based health regimens supports growth. Leading companies are collaborating with distribution partners to expand product visibility through online platforms and health stores. Consumer interest in personalized natural solutions is promoting steady adoption of Ayurvedic nutrition and skincare ranges. The government's focus on regulating herbal products enhances safety perception, strengthening long-term market development across the country.

Asia-Pacific Ayurveda Market Trends

The Ayurveda market in Asia Pacific held the largest share of 78.62% in 2025. The Asia Pacific market is experiencing significant growth, driven by several key factors. A resurgence in interest for natural and holistic health solutions is evident, with consumers increasingly turning to Ayurveda for its preventive and therapeutic benefits. This shift is further supported by government initiatives promoting traditional medicine systems, such as the establishment of the WHO Global Centre for Traditional Medicine in India and various memoranda of understanding signed to promote AYUSH globally. Cultural integration of Ayurvedic practices, as seen in countries like Thailand and Australia, also contributes to its widespread adoption. Additionally, the increasing middle-class population and rising disposable incomes in the region are fueling demand for Ayurveda products and services, making Asia Pacific a dominant force in the global Ayurveda market.

India leads the global Ayurveda market, supported by a robust domestic manufacturing base and government promotion through the Ministry of AYUSH. Rising demand for herbal supplements, natural cosmetics, and immunity-boosting products is driving sector growth. Increasing clinical validation and product standardization are improving global competitiveness. Key players are expanding exports and collaborating with wellness chains to enhance accessibility. The integration of Ayurveda into national health programs and hospital networks continues to reinforce India’s position as the global hub for Ayurvedic products and therapies.

The Ayurveda market in China is growing steadily due to rising consumer interest in holistic and herbal-based health systems. While Traditional Chinese Medicine (TCM) remains dominant, Ayurveda is gaining acceptance among urban consumers seeking alternative wellness therapies. Ayurvedic skincare and detox supplements are emerging as popular categories. Strategic partnerships between Indian manufacturers and Chinese distributors are supporting product entry and awareness. Regulatory recognition of herbal imports and online retail expansion are expected to accelerate adoption across the country.

Europe Ayurveda Market Trends

The Ayurveda market in Europe is growing due to increasing adoption of traditional wellness therapies and natural health solutions. Rising awareness of herbal products and clean-label preferences are driving demand across the region. Germany, the UK, and France represent the largest markets, supported by the presence of Ayurveda wellness centers and specialty retailers. Product demand is concentrated in dietary supplements, skincare, and aromatherapy. Collaborations between Indian exporters and European distributors are improving supply chains and certification standards. The integration of Ayurveda into holistic wellness programs strengthens the region’s contribution to global market growth.

The UK Ayurveda market is expanding as consumers increasingly adopt herbal-based health and beauty products. Demand for Ayurvedic oils, supplements, and skincare items is supported by the growth of wellness tourism and holistic therapy centers. Online retail and natural product stores are enhancing accessibility to certified Ayurvedic brands. Awareness campaigns promoting preventive health and sustainable living are further strengthening adoption. Partnerships between Indian manufacturers and UK distributors are improving product quality standards and certification compliance, reinforcing steady market expansion.

The Ayurveda market in Germany is driven by a strong focus on preventive healthcare and natural remedies. Rising acceptance of Ayurvedic formulations among wellness practitioners and spa operators is expanding distribution networks. German consumers show growing preference for herbal supplements, detox products, and natural cosmetics. The country’s regulatory clarity for herbal medicines supports the introduction of standardized formulations. Increasing partnerships with Indian exporters and domestic wellness providers enhances availability and brand visibility. Germany remains one of the leading European markets for Ayurveda-based products and services.

France Ayurveda market is expanding as awareness of holistic and plant-based health solutions grows. Consumers are adopting Ayurvedic oils, herbal teas, and skincare products as part of their daily wellness routines. Demand is supported by increasing retail penetration in pharmacies and organic product outlets. French wellness centers are integrating Ayurvedic treatments, including Panchakarma therapies, to meet the growing interest in natural health restoration. Collaborations with certified Ayurvedic practitioners are improving professional credibility, reinforcing Ayurveda’s gradual integration into mainstream wellness culture.

Latin America Ayurveda Market Trends

The Ayurveda market in Latin America is expanding as consumers increasingly shift toward herbal and organic health products. Countries such as Brazil, Mexico, and Chile are adopting Ayurvedic formulations for wellness and preventive care. Demand for skincare oils, detox drinks, and herbal supplements is growing through e-commerce and health store distribution. Local distributors are forming alliances with Indian exporters to enhance market presence. Rising awareness of holistic lifestyle management is supporting steady regional growth.

Brazil Ayurveda market is driven by growing adoption of herbal cosmetics, supplements, and oils. Consumers are increasingly embracing Ayurvedic solutions for stress management, skin care, and digestive health. The country’s expanding wellness sector supports the establishment of Ayurveda-inspired spas and therapy centers. Partnerships with Indian and European suppliers are improving supply chain efficiency and product diversity. Government initiatives promoting natural and organic healthcare products further strengthen Brazil’s position as the leading Ayurveda market in Latin America.

Middle East & Africa Ayurveda Market Trends

The Ayurveda market in the Middle East & Africa is the second fastest growing market, supported by increasing awareness of natural wellness therapies. Urban centers in the UAE, Saudi Arabia, and South Africa are witnessing rising demand for Ayurvedic oils, herbal supplements, and spa treatments. Hospitals & Clinics and wellness resorts are incorporating Ayurveda into complementary care offerings. International brands are partnering with regional distributors to enhance availability. Government recognition of alternative therapies and the rise of wellness tourism are supporting long-term market expansion.

Saudi Arabia Ayurveda market is emerging as interest in holistic health and herbal-based care increases. High-income consumers are adopting Ayurvedic products for skincare, stress relief, and immunity enhancement. Hospitals & Clinics and wellness centers are introducing Ayurveda-inspired treatments to diversify healthcare offerings. Partnerships with Indian Ayurvedic firms are expanding product imports and training initiatives. The government’s growing support for preventive healthcare aligns with Ayurveda’s principles, strengthening the country’s position as a key regional market in the Middle East.

Key Ayurveda Companies Insights

Key players operating in the Ayurveda market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Patanjali Ayurved Ltd. and Dabur India Ltd. lead product innovation in herbal supplements, personal care, and wellness formulations, focusing on standardization and quality assurance. Himalaya Wellness Company and Baidyanath Group emphasize research-driven development of nutraceuticals and immunity-boosting products to enhance therapeutic efficacy. Kerala Ayurveda Ltd. and Organic India Pvt. Ltd. concentrate on expanding organic and sustainable product portfolios to increase consumer trust and accessibility. Vicco Laboratories and Zandu Realty develop formulation innovations for skincare and digestive health. Charak Pharma Pvt. Ltd. and Sandu Pharmaceuticals focus on proprietary herbal blends and clinical validation, while global collaborations and export expansion drive adoption and growth in the Ayurveda market.

Key Ayurveda Companies:

The following are the leading companies in the ayurveda market. These companies collectively hold the largest market share and dictate industry trends.

- Kerala Ayurveda Ltd.

- Patanjali Ayurved Limited

- Dabur Ltd.

- Kerry Group (Natreon Inc.)

- Viccolabs

- Himalaya Global Holdings Ltd. (Himalaya Wellness Company)

- Emami Ltd.

- Bio Veda Action Research Co.

- Amrutanjan Health Care Limited

- Baidyanath

Recent Developments

-

In April 2025, BetterAlt partnered with The Vitamin Shoppe to launch five products in 689 stores, expanding access to its Ayurvedic wellness range.

-

In October 2024, Patanjali Foods received approval from the Competition Commission of India (CCI) for its acquisition of Patanjali Ayurved’s Home and Personal Care division.

-

In October 2024, Indian FMCG and Ayurvedic products company Dabur announced on Wednesday that it has acquired Sesa Care, a player in the Ayurvedic personal care and wellness space. In a regulatory filing, Dabur stated that the acquisition will strengthen its presence in the Ayurvedic hair oil market.

Ayurveda Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 24.35 billion

Revenue forecast in 2033

USD 85.83 billion

Growth rate

CAGR of 19.72% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, indications, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; South Arabia; UAE; Kuwait.

Key companies profiled

Kerala Ayurveda Ltd.; Patanjali Ayurved Ltd.; Dabur Ltd.; Natreon Inc.; Vicco Laboratories; Himalaya Wellness Company; Emami Group of Companies Pvt. Ltd.; Bio Veda Action Research Co.; Amrutanjan Health Care Ltd.; Baidyanath

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ayurveda Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033s. For this study, Grand View Research has segmented the global Ayurveda market report based on form, application, indications, distribution channel, end use, and region:

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Herbal

-

Mineral

-

Herbomineral

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical/Therapy

-

Personal

-

-

Indications Outlook (Revenue, USD Million, 2021 - 2033)

-

GI Tract

-

Infectious Diseases

-

Skin/Hair

-

Respiratory System

-

Nervous System

-

Cardiovascular System

-

Reproductive System

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct Sales

-

E-sales

-

Retail & Institutional Sales

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Home Settings

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

South Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Ayurveda market size was estimated at USD 20.42 billion in 2025 and is expected to reach USD 24.35 billion in 2026.

b. The global Ayurveda market is expected to grow at a compound annual growth rate (CAGR) of 19.66% from 2026 to 2033 to reach USD 85.83 billion by 2033.

b. In terms of revenue share, the herbal segment dominated with the largest market share of around 69.16% in 2025 owing to the increasing consumer awareness about the benefits of herbal supplements, a growing interest in natural and organic products, and a rising trend of preventive healthcare.

b. Some key players operating in the Ayurveda market include Kerala Ayurveda Ltd.; Patanjali Ayurved Limited; Dabur Ltd.; Natreon Inc.; Vicco Laboratories; Himalaya Wellness Company; EMAMI GROUP OF COMPANIES PVT LTD; Biotique; Amrutanjan Health Care Limited; Baidyanath Group; among others.

b. Key factors that are driving the Ayurveda market growth include the rising prevalence of chronic diseases, increasing awareness of the benefits of Ayurvedic products, and the growing adoption and acceptance of Ayurveda across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.