- Home

- »

- Homecare & Decor

- »

-

Baby Bottle Market Size And Share, Industry Report, 2033GVR Report cover

![Baby Bottle Market Size, Share & Trends Report]()

Baby Bottle Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Plastic, Silicone, Glass, Stainless Steel), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-863-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Bottle Market Summary

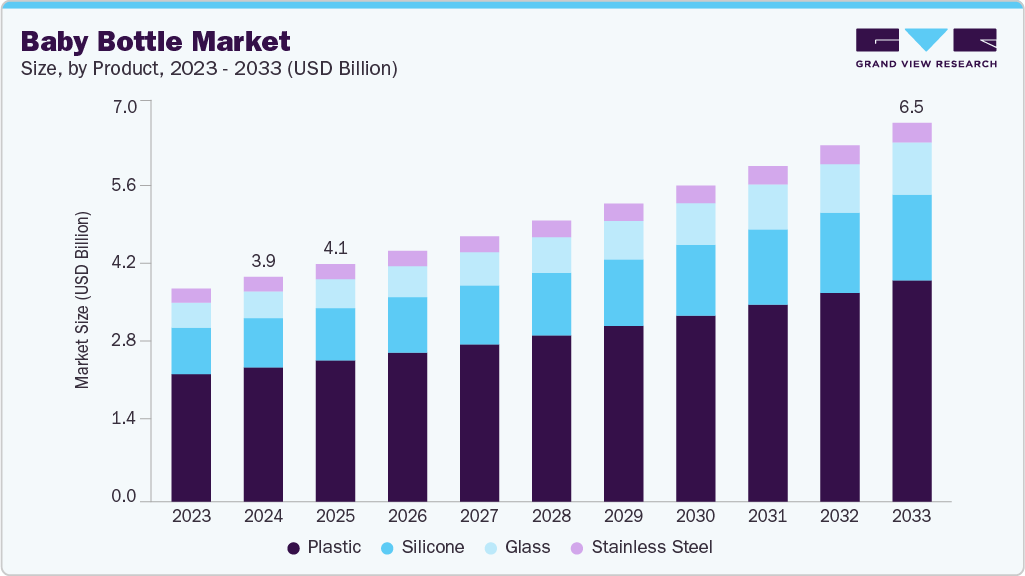

The global baby bottle market size was estimated at USD 3.86 billion in 2024 and is projected to reach USD 6.50 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. A foundational growth driver in the global baby bottle market is the tightening regulatory landscape governing material safety and chemical exposure, particularly concerning endocrine-disrupting substances.

Key Market Trends & Insights

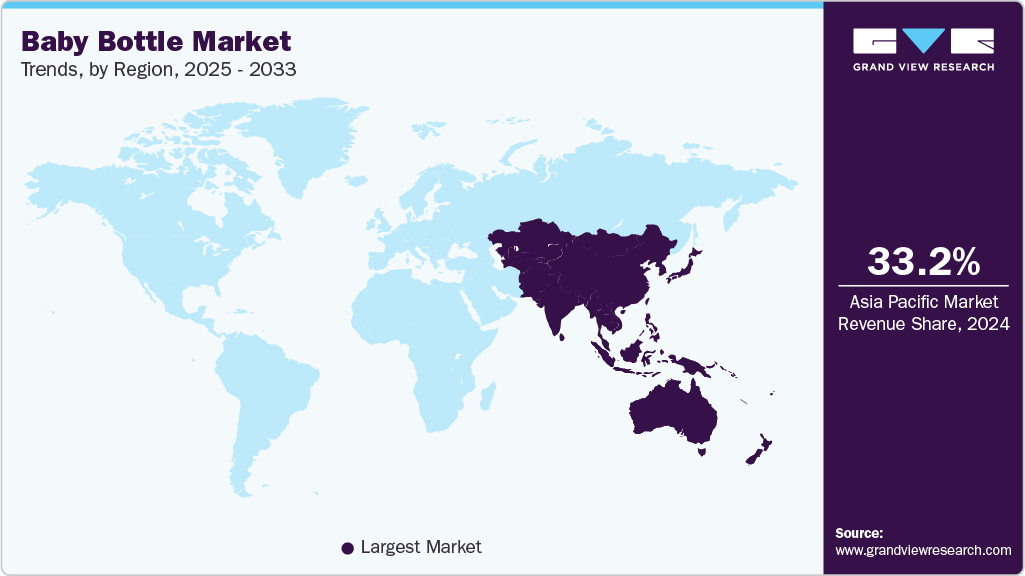

- Asia Pacific’s baby bottle market held the largest share of 33.2% of the global market in 2024.

- The baby bottle industry in the Middle East is expected to grow at the fastest CAGR over the forecast period.

- By product, plastic baby bottles held the largest market share of 59.7% in 2024.

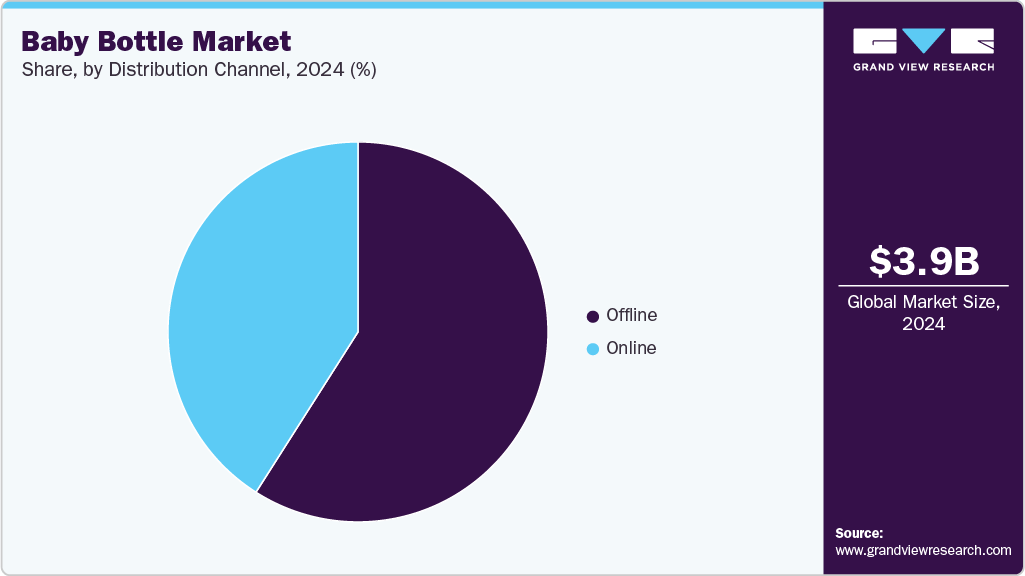

- By distribution channel, the offline segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.86 Billion

- 2033 Projected Market Size: USD 6.50 Billion

- CAGR (2025-2033): 6.0%

- Asia Pacific: Largest market in 2024

Regulatory authorities across multiple jurisdictions continue to refine safety standards and enforce stringent compliance requirements for infant-contact feeding materials. For instance, the Indian Standard IS 14625 (2015) explicitly prohibits the use of polycarbonate materials, which may potentially release Bisphenol-A (BPA) when exposed to heat or repeated use.As a direct consequence, manufacturers have been compelled to transition toward certified, non-toxic substrates such as polypropylene (PP), medical-grade silicone, borosilicate glass, and stainless-steel-based alternatives. Concurrently, heightened parental awareness and scrutiny regarding chemical migration, microplastic risks, and long-term infant health outcomes continue to drive market traction for BPA-free, phthalate-free, and food-grade certified baby bottle solutions, making material transparency a critical factor in brand competitiveness.

Another key demand catalyst is the rising emphasis on infant feeding efficacy and developmental alignment, which has expanded the market for performance-engineered bottle designs. Modern caregivers increasingly seek products that address functional feeding challenges, including colic, reflux, nipple confusion, aerophagia, and incorrect latch formation. Consequently, manufacturers are prioritizing advanced venting technologies, orthodontic and breast-mimicking nipple geometries, and age-appropriate flow control engineering to support smoother digestion and feeding comfort. A notable example is Dr. Brown’s anti-colic vent-based system, which remains well-recognized in the global market for its ability to minimise air ingestion and reduce irritability, thereby positioning its portfolio at the premium end of the performance-centric segment. This trend highlights a shift from basic feeding utility to medically informed, evidence-based design innovation.

Operational convenience and system compatibility also serve as significant market drivers, particularly as contemporary parents demand streamlined, hygienic, and time-efficient feeding solutions. Manufacturers are increasingly integrating bottles into broader feeding ecosystems that comprise breast pumps, storage containers, sterilization platforms, nipple variants, and modular accessories. This integration reduces repetitive milk handling, expedites cleaning cycles, and simplifies coordination among multiple caregivers. A pertinent reference is Philips Avent, whose ecosystem-based portfolio allows direct breast-to-bottle milk transfer through pump compatibility across its bottle and container formats. Such interoperable product ecosystems not only improve end-user efficiency but also foster higher brand retention, cross-category adoption, and increased lifetime customer value.

In addition, digital-first retail transformation and direct-to-consumer (D2C) business models have reshaped access, awareness, and evaluation behaviour within the baby bottle segment. E-commerce platforms and social-commerce ecosystems enable rapid product discovery, comparative assessment, experiential review sharing, and influencer-driven recommendation cycles. These channels have created fertile ground for emerging premium, eco-conscious, and design-focused challenger brands that may not rely on traditional brick-and-mortar distribution, but instead scale through community-driven validation. As a result, the category is experiencing heightened innovation velocity, brand fragmentation, and consumer experimentation, particularly among digitally oriented, millennial, and Gen-Z parent cohorts.

At a macro level, the market is further supported by shifting socioeconomic and demographic dynamics, particularly the rise in female workforce participation, the prevalence of dual-income households, and the emergence of shared parenting structures. These lifestyle transitions have increased reliance on expressed breastmilk feeding, mixed-feeding models, and on-the-go infant nourishment, thereby driving sustained adoption of portable, sterilizer-friendly, heat-resistant, and travel-compatible bottle formats. In highly urbanised environments, where time scarcity, childcare outsourcing, and compact living spaces prevail, baby bottles are perceived not merely as a feeding necessity but as an essential caregiving infrastructure item, ensuring long-term, resilient market demand.

Consumer Insights

Material Safety, Regulatory Compliance, and Health Assurance: The foremost decision criterion for caregivers is the demonstrated safety of bottle materials in direct contact with infant nutrition. Factors such as BPA-free certification, phthalate-free composition, FDA-approved polymers, food-grade silicone, borosilicate glass composition, and heat-stability testing outcomes strongly influence purchasing behaviour. Increasing parental awareness of risks associated with chemical leaching, microplastics, and endocrine disruptors heightens demand for medical-grade and transparently certified products, making regulatory and safety labeling a decisive differentiator.

Feeding Performance and Infant Comfort Features: Consumers increasingly prioritise bottle attributes that deliver measurable outcomes related to smooth feeding and reduced digestive distress. Anti-colic vent technology, controlled-flow nipples, orthodontic nipple geometry, breast-simulation design, and latch-supporting textures significantly influence purchase choice. Bottles perceived as enhancing feeding continuity, reducing reflux, and preventing nipple confusion are favoured by parents adopting breast-bottle combination feeding or seeking clinically rationale-driven products.

Product Usability, Hygiene, and Maintenance Efficiency: Ease of cleaning, assembly, disassembly, and sterilisation safety form another major determinant for purchase intent. Features such as wide-neck openings, minimalist part architecture, dishwasher/UV-sterilizer compatibility, anti-retention internal surfaces, and thermal shock resistance enhance user convenience and increase decision confidence. Given the time constraints experienced by modern caregivers, low-maintenance, quick-clean, and residue-resistant bottles are preferred.

Ecosystem Integration and Accessories Compatibility: Decision-making is increasingly shaped by compatibility with breast pumps, milk storage solutions, warming systems, and travelling accessories. Parents prefer modular, cross-functional, and brand-ecosystem-compatible products because they enable workflow continuity, reduced handling steps, and operational efficiency. Brands offering an interoperable portfolio across feed preparation, feed storage, and feed delivery systems can secure longer-term customer loyalty and repeat business.

Product Insights

Plastic baby bottles accounted for a market share of 59.69% in the year 2024, driven by their affordability and widespread availability. Plastic baby bottles continue to gain strong adoption due to their significantly lower production and retail costs compared to premium materials such as glass, stainless steel, or silicone. Their affordability makes them accessible across middle- and lower-income households as well as institutional buyers (e.g., daycare centres, maternity hospitals), thereby supporting high-volume, price-sensitive, and replacement-cycle-driven consumption. The lightweight nature of plastic bottles, combined with their impact-resistant and non-breakable properties, makes them preferred for outdoor, travel, and daycare use. Unlike glass alternatives, plastic bottles minimize the risk of breakage-related injury and are easier for infants and toddlers to grasp independently, thereby boosting utilization in early developmental feeding stages.

Demand for glass baby bottles is projected to grow at the fastest CAGR of 7.7% over the forecast period. Glass baby bottles are strongly preferred among health-conscious and premium-segment consumers due to their inherent non-porous, non-leaching, and chemically inert properties, which eliminate concerns related to BPA, phthalates, microplastics, and thermal-induced chemical migration. Their alignment with clean-label, toxin-free, and medical-grade feeding trends positions glass bottles as the material of choice for parents prioritising long-term safety over price and convenience.

As sustainability and eco-ethical purchasing gain relevance, glass bottles benefit from being perceived as environmentally responsible, long-life, reusable, and recyclable feeding solutions. This perception aligns closely with emerging high-income, millennial, and eco-lifestyle consumer cohorts, enabling glass bottles to occupy premium and aesthetically elevated brand positioning, often bundled with silicone sleeves or stainless-steel accessories. Glass bottles, particularly borosilicate-grade formats, offer superior heat resistance, making them compatible with microwave heating, boiling, steaming, bottle warmers, and UV sterilisation without risk of material degradation. This thermal resilience appeals to parents seeking rigorous, high-frequency sterilisation routines, common among newborn and NICU discharge infants whose feeding items require strict hygiene protocols.

Distribution Channel Insights

Offline sales accounted for a revenue share of 77.60% in 2024. Parents, especially first-time buyers, prefer offline retail environments for tactile evaluation of products, including weight, grip ergonomics, nipple texture, sleeve fit, and bottle durability. The ability to physically examine material quality and compare variants instantly enhances confidence in safety, suitability, and long-term usability, making offline platforms a preferred channel for premium, medical assurance, or first-purchase decisions. Offline stores - particularly pharmacies, maternity boutiques, paediatric hospitals, and lactation centres - offer professional assistance, enabling caregivers to make informed choices supported by clinical, practical, or medically aligned advice. Staff recommendations, in-store demonstrations, and paediatric referrals elevate offline stores as high-credibility purchase environments, especially for newborn and early-feeding stage products.

Offline channels address urgent replacement needs, such as lost bottles, damaged nipples, sterilisation failures, or sudden travel requirements, where instant access outweighs price sensitivity. This immediacy advantage sustains consistent foot traffic and repeat micro-purchases across accessories, nipples, sterilization components, and bottle-cleaning products.

Online sales for baby bottles are projected to grow at a CAGR of 6.9% from 2025 to 2033. Online platforms offer broader SKU availability, covering niche, imported, eco-premium, and innovation-led baby bottle brands that may not be stocked in regional offline retail. Parents benefit from being able to compare material types, flow variants, designs, sizes, and cross-brand ecosystems within a single browsing journey, enabling informed and personalised selection. Verified reviews, ratings, parent forums, influencer content, and usage videos significantly influence online purchasing behavior. These digital trust signals have become a key accelerant of category growth, especially for parents seeking evidence-driven decisions and reassurance from real-world user experiences.

E-commerce platforms are preferred for time-efficient shopping, repeat replenishment, doorstep delivery, scheduled subscriptions, and hassle-free returns. For working, urban, and new-parent households, the ability to repurchase compatible parts and accessories without store visits is a significant driver of ongoing channel stickiness.

Regional Insights

The baby bottle market in North America held 22.6% of the global revenue in 2024. The growth of the regional market is underpinned by a mature consumer base with high purchasing power, as well as strong awareness of infant health and safety. Parents in this region place a premium on products that are rigorously tested, BPA-free, and compliant with stringent U.S. and Canadian regulations. This regulatory consciousness drives demand for premium materials, including medical-grade silicone, glass, and advanced plastics. The region also benefits from innovation, with anti-colic designs, ergonomic shapes, and smart-feeding solutions widely accepted, as manufacturers respond to a sophisticated, safety-first consumer. For instance, in North America, there is significant uptake of eco-friendly bottles, leveraging both sustainability demand and health concerns.

Moreover, the prevalence of dual-income households in the U.S. and Canada further reinforces demand for baby bottles. Working parents often rely on expressed breast milk or formula feeding, which increases the frequency and recurrence of bottle purchases. Innovations around convenience (such as compatibility with breast pumps) and sterilisation compatibility align strongly with these parents’ needs. The ease of access to baby gear through a robust retail infrastructure-spanning established big-box chains, pharmacies, and premium baby boutiques-ensures that new-generation, high-quality bottles are within reach. This combination of high income, health awareness, and product innovation has made North America a core contributor to the global baby bottle market.

U.S. Baby Bottle Market Trends

The baby bottle market in the U.S. is anticipated to grow at a CAGR of 5.8% from 2025 to 2033. Both safety concerns and convenience-oriented design heavily influence the U.S. market, as parents seek advanced anti-colic vent systems, interchangeable nipples, and bottles that integrate with breast pumps. In addition, socioeconomic dynamics such as strong female labor force participation and a high proportion of dual-income households fuel consistent demand for feeding accessories. Parental willingness to invest in premium and high-functionality bottles is also tied to value perception: features such as eco-friendly materials, long-lasting usage, and comprehensive feeding systems justify higher price points. This combination of buyer sophistication, strong consumer infrastructure, and innovation orientation ensures that the U.S. remains a key engine for global baby bottle revenue.

Europe Baby Bottle Market Trends

The European baby bottle industry accounted for a revenue share of 26.9% in 2024. A confluence of stringent regulation, environmental consciousness, and premiumization drives the market. European parents are particularly sensitive to the origins and safety of baby products due to well-established regulatory frameworks such as REACH and those governing materials in food-contact products. These regulations, coupled with consumer demand for non-toxic and sustainable materials, strongly favor the use of glass, stainless steel, and high-grade silicone bottles. In countries like Germany, widespread formula- or mixed-feeding practices (supported by data showing high percentages of formula- or mixed-fed infants) further drive bottle adoption.

At the same time, a growing green parenting movement in Western Europe promotes eco-conscious alternatives to conventional plastics. European premium brands (such as MAM, NUK, and others) are capitalizing on this by launching eco-certified bottles and recyclable or mono-material packaging. The result is a strong and stable regional demand, rooted in both regulation and values, that supports high-value bottle segments and underpins Europe’s disproportionately large global share.

Asia Pacific Baby Bottle Market Trends

The Asia Pacific’s baby bottle market held the largest share of 33.2% of the global market in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2033.Large and growing populations in key markets, such as China, India, and Southeast Asia, continue to drive demand. As more urban families form, the need for reliable, high-quality feeding accessories increases. Rising disposable incomes in these markets are enabling more parents to trade up to premium baby bottles, especially those made from safer or more durable materials. Simultaneously, urbanization and the rise of dual-income households are driving greater reliance on expressed breast milk and formula feeding. This has propelled demand for multifunctional and sterilizable bottle systems. For instance, Hegen, a Singapore-based brand, has gained strong traction across the Asia Pacific with its “Express-Store-Feed” bottle system, which integrates pumping, storage, and feeding-a model ideally suited to working parents in the region.

Key Baby Bottle Company Insights

The competitive landscape of the baby bottle market is characterised by a blend of global incumbents, regional specialists, agile direct-to-consumer challengers, and private-label suppliers. Market participants compete across multiple vectors beyond price - notably material safety credentials, feeding-performance engineering, ecosystem compatibility (pump/storage/sterilizer integration), brand trust, and channel coverage. This multidimensional competitive intensity has produced a layered market structure in which premium, mid-market, and value tiers coexist, each driven by distinct consumer priorities and procurement behaviors.

Market concentration is moderate: a set of long-standing multinational companies (for example, established baby-care brands with extensive R&D, regulatory resources, and retail partnerships) dominate headline revenue and shelf presence, while a large number of small and mid-sized firms occupy niche positions. Incumbents leverage brand recognition, clinical endorsements, and scale-driven distribution agreements with major retailers, hospitals, and institutional buyers. In parallel, specialist manufacturers-often regionally based-utilize local regulatory knowledge, cultural food preferences, and supply-chain proximity to capture a share in national markets.

Key Baby Bottle Companies:

The following are the leading companies in the baby bottle market. These companies collectively hold the largest market share and dictate industry trends.

- Pigeon Corporation

- Medela AG

- Goodbaby International Holdings Limited

- Koninklijke Philips N.V.

- Handi-Craft Company

- Artsana S.p.A

- Comotomo

- Richell Corporation

- Munchkin, Inc.

- Nanobebe US LTD

Recent Developments:

-

In April 2025, Momtech Inc. announced the expansion of its mōmi baby-bottle portfolio, introducing multiple new formats engineered to replicate natural breastfeeding behaviour. The newly released lineup included 4-ounce standard bottles, 9-ounce borosilicate glass variants, and 10-ounce BPA-free plastic configurations, all equipped with the company’s proprietary babypace nipple technology designed to simulate the suck-swallow-breathe rhythm observed during natural nursing. This launch strengthened the brand’s positioning in the premium biomimetic feeding segment, targeting parents seeking continuity between breast and bottle feeding.

-

In 2024, Munchkin introduced the Bond silicone-coated glass baby bottle, featuring a borosilicate glass interior to minimize direct milk-to-plastic contact while maintaining a tactile, impact-resistant silicone exterior shell. The bottle also featured an integrated all-silicone anti-colic valve, designed to reduce digestive discomfort in infants while enhancing post-feeding satisfaction outcomes. This launch underscored Munchkin’s strategic focus on hybrid-material innovation, balancing chemical-free feeding with durability, grip comfort, and reduced breakage concerns.

-

In 2024, Philips Avent unveiled a new glass-based iteration of its Natural Response baby bottle series, featuring a wide-neck borosilicate glass construction, complemented by a Natural Response nipple designed to release milk only when actively drawn by the infant. This model also integrated anti-colic venting architecture, supporting smoother feeding cycles and reduced gastrointestinal stress. The launch represented Philips Avent’s continued transition toward premium, safe-material compliance, catering to the growing consumer preference for non-plastic, clinically aligned feeding solutions.

Baby Bottle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.07 billion

Revenue forecast in 2033

USD 6.50 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; The Middle East & Africa

Country scope

U.S.; Canada; France; Germany; UK; Spain; Italy; Norway; Sweden; China; India; Japan; Brazil; Argentina; South Africa; UAE

Key companies profiled

Pigeon Corporation; Medela AG; Goodbaby International Holdings Limited; Koninklijke Philips N.V.; Handi-Craft Company; Artsana S.p.A; Comotomo; Richell Corporation; Munchkin, Inc.; Nanobebe US LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Bottle Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the baby bottle market based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Silicone

-

Glass

-

Stainless Steel

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global baby bottle market was estimated at USD 3.86 billion in 2024 and is expected to reach USD 4.07 billion in 2025.

b. The global baby bottle market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 6.50 billion by 2033.

b. Asia Pacific dominated the baby bottle market with a share of 33.2% in 2024. This is attributable to the presence of an abundant number of manufacturers in the region, particularly in China, and an increasing number of working women in the region.

b. Some of the key players operating in the baby bottle market include Pigeon Corporation; Medela AG; Goodbaby International Holdings Limited; Koninklijke Philips N.V.; Handi-Craft Company; Artsana S.p.A; Comotomo; Richell Corporation; Munchkin, Inc.; Nanobebe US LTD

b. Key factors that are driving the baby bottle market growth include that Parents are becoming more safety conscious, leading to an increased demand for high-quality baby bottles made from materials such as BPA-free plastic, glass, silicone, and steel.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.