- Home

- »

- Homecare & Decor

- »

-

Baby Bottle Market Size, Share And Trends Report, 2030GVR Report cover

![Baby Bottle Market Size, Share & Trends Report]()

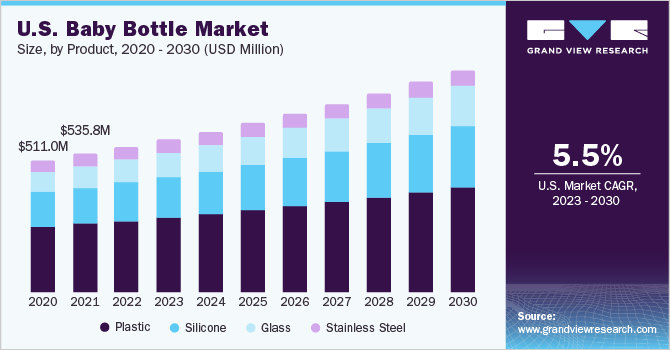

Baby Bottle Market Size, Share & Trends Analysis Report By Product (Plastic, Silicone, Glass, Stainless Steel), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-863-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

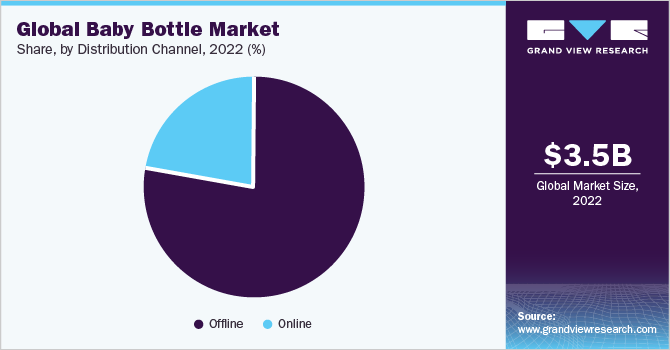

The global baby bottle market size was estimated at USD 3.46 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Rising promotional activities for baby bottles and increased adoption of infant formula are expected to fuel the growth of the market. The introduction of BPA-free baby bottles is a key trend observed in the market. Bisphenol A (BPA) is known to cause severe health conditions like thyroid, brain abnormalities, prostate and breast cancer, infertility, and heart diseases. Looking to capitalize on the growing demand for baby bottles, many players operating in the market are concentrating on expanding their businesses by offering advanced and BPA-free products.

Compared to plastic bottles, glass bottles are BPA-free. Several research studies done on the effect of BPA have highlighted that this chemical results in several unfavorable hormonal responses. It also alters sperm parameters, which ascertains its adverse effects on the reproductive system. Some investigative studies have also proved that it contributes to cancer in both males and females. Thus, the adoption of glass bottles is expected to remain high during the forecast period. Moreover, the increasing popularity of online platforms and smartphones has been driving consumers toward online shopping. Consumers prefer online sales as they offer convenience, ease of payment, and hassle-free home delivery. Thus, online shopping has become a key trend in the market worldwide.

Furthermore, over the past few years, government bodies in several countries have been emphasizing the importance of breastfeeding. Public health policies in these countries are focusing on normative standards for baby nutrition and feeding, which are breastfeeding and human milk. The American Academy of Pediatrics recommends that infants should be exclusively breastfed for about the first 6 months, with continued breastfeeding while introducing complementary foods for at least 1 year, according to the CDC's Breastfeeding Report Card, 2020, which provides data on breastfeeding practices.

In addition, according to a Brookings Institution study published in 2021, both recessions and public health emergencies have traditionally been linked to lower birth rates. As a result, the COVID-19 pandemic, which contained both characteristics, had the potential to cause a large baby bust. The estimations reveal 60,000 missing births between October 2020 and February 2021, roughly corresponding to conceptions that would have occurred between January and May 2020. In March 2021, birth rates reverted to pre-pandemic levels, implying that conception rates recovered to pre-pandemic levels in June 2020.

Product Insights

The plastic segment dominated the baby bottle market in 2022 with a revenue share of 59.9%. Plastic baby bottles are made from raw materials such as Polypropylene (PP), polyphenyl sulfone (PPSU), Polyethersulphone (PES), and polycarbonate. Among the aforementioned raw materials, PP-based bottles are the most common type of plastic feeding bottles owing to their durability and flexibility. Furthermore, these bottles are very economical. PP bottles are available in clear as well as colored forms, which makes them attractive to kids.

Glass baby bottle is expected to be the fastest-growing category and is projected to exhibit a CAGR of 7.6% over the forecast period. The rapid growth can be majorly attributed to the growing popularity of the material owing to its health-related benefits and safety. The material is known for its ability to withstand heat, chemical exposure, and constant moisture. Moreover, glass bottles are easy to clean and have longer shelf lives as compared to plastic, thereby contributing to the growth of the market.

Furthermore, due to widespread awareness of the harmful effects of BPA and other impurities present in plastic bottles, glass-based bottles are gaining popularity in developed countries such as the U.S., the UK, and Canada, favoring the growth of glass bottles in the coming years.

Distribution Channel Insights

The offline distribution channel segment dominated the global baby bottle market with a revenue share of around 77.9% in 2022. An increasing presence of major players such as Mothercare and FirstCry across the Asia Pacific region is a major factor contributing to the growth. In addition, specialty stores tailor their strategies and operations according to the demand in the market. As a result, these retailers may keep a better selection and preserve a competitive advantage over department stores. Specialty baby stores sell a wide range of products necessary for baby care and rearing. This provides parents with a one-stop buying experience.

The online distribution channel segment is anticipated to register the fastest CAGR of 6.6% from 2023 to 2030. In the market, e-commerce has been increasing at a rapid rate. Distributors and retailers have been employing a variety of techniques to combat increased market competition, including forming relationships with e-commerce merchants to sell products in many countries. This allows them to expand their distribution network, reach new markets, boost product availability and exposure, and diversify their product and service offerings. Amazon; Walmart; eBay; and Alibaba Group Holding Ltd. are some of the industry's biggest online merchants.

Regional Insights

The Europe baby bottle market made the largest contribution to the global market with over 27.3% of the revenue share in 2022. This can be attributed to the rising awareness related to the harmful effects of plastic on the human body. Moreover, nutritionists and pediatricians are encouraging caretakers to adopt glass bottles over plastic ones, which would result in a boost in demand for glass bottles over the forecast period.

The Middle East & Africa baby bottle industry is expected to witness a CAGR of 6.1% over the forecast period. The regional market is currently in the growth phase and is characterized by increasing breastfeeding problems among women and the growing number of working women. In addition, innovations in product material and packaging will also boost the market growth in the upcoming years. Parents in emerging economies such as South Africa, UAE, and Saudi Arabia have become increasingly conscious regarding the health and hygiene of their babies and are willing to spend more on high-quality products. This is driving demand for baby bottles in the region.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of the baby bottle industry. Key players are diversifying their service offerings to maintain market share. For instance:

-

In January 2022, Munchkin, Inc. and Smart Plastic Technologies signed an exclusive joint development agreement to create baby lifestyle products using Smart Plastic’s patent ECLIPSE technology.

-

In November 2021, Chicco, a subsidiary of Artsana S.p.A., announced that its ChiccoDUO Hybrid Baby Bottle was named to TIME’s list of the 100 Best Inventions of 2021. The hybrid baby bottle offers a unique combination of the wellness benefits of pure glass and the convenience of plastic. By integrating micro-thin inner layers made of 100% pure Invinci-glass with a lightweight outer layer crafted from premium plastic, the bottle offers exceptional durability, as it is resistant to breakage, shattering, chipping, and staining. It also prevents the accumulation of odors or an unwanted aftertaste.

Some prominent players in the global baby bottle industry include:

-

Pigeon Corporation

-

Medela AG

-

Goodbaby International Holdings Limited

-

Koninklijke Philips N.V.

-

Handi-Craft Company

-

Artsana S.p.A

-

comotomo

-

Richell Corporation

-

Munchkin, Inc.

-

Nanobebe US LTD

Baby Bottle Industry Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.65 billion

Revenue forecast in 2030

USD 5.42 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; France; Germany; UK; Spain; Italy; Norway; Sweden; China; India; Japan; South Africa; UAE; Brazil; Argentina

Key companies profiled

Pigeon Corporation; Medela AG; Goodbaby International Holdings Limited; Koninklijke Philips N.V.; Handi-Craft Company; Artsana S.p.A; Comotomo; Richell Corporation; Munchkin, Inc.; Nanobébé US LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Bottle Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the baby bottle market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Plastic

-

Silicone

-

Glass

-

Stainless Steel

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global baby bottle market was estimated at USD 3.46 billion in 2022 and is expected to reach USD 3.65 billion in 2023.

b. The global baby bottle market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 5.42 billion by 2030.

b. Asia Pacific dominated the baby bottle market with a share of 33% in 2022. This is attributable to the presence of an abundant number of manufacturers in the region, particularly in China, and an increasing number of working women in the region.

b. Some of the key players operating in the baby bottle market include Pigeon Corporation; Medela AG; Goodbaby International Holdings Limited; Koninklijke Philips N.V.; Handi-Craft Company; Artsana S.p.A; Comotomo; Richell Corporation; Munchkin, Inc.; Nanobébé US LTD.

b. Key factors that are driving the baby bottle market growth include that Parents are becoming more safety conscious, leading to an increased demand for high-quality baby bottles made from materials such as BPA-free plastic, glass, silicone, and steel.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."