- Home

- »

- Advanced Interior Materials

- »

-

Black Mass Recycling Market Size, Industry Report, 2033GVR Report cover

![Black Mass Recycling Market Size, Share & Trends Report]()

Black Mass Recycling Market (2025 - 2033) Size, Share & Trends Analysis Report By Battery Type (Lithium-Ion, Nickel-Based), By Recovered Metals (Cobalt, Lithium), By Battery Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-645-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Black Mass Recycling Market Summary

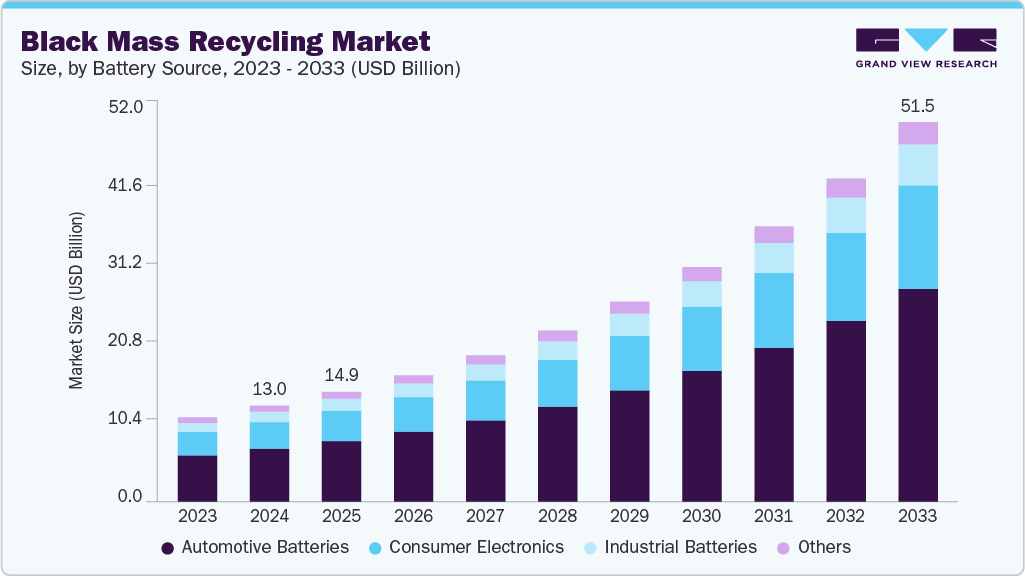

The global black mass recycling market size was estimated at USD 13.04 billion in 2024 and is projected to reach USD 51.53 billion by 2033, growing at a CAGR of 16.8% from 2025 to 2033. The accelerating global shift toward electric mobility and renewable energy storage is a major market driver.

Key Market Trends & Insights

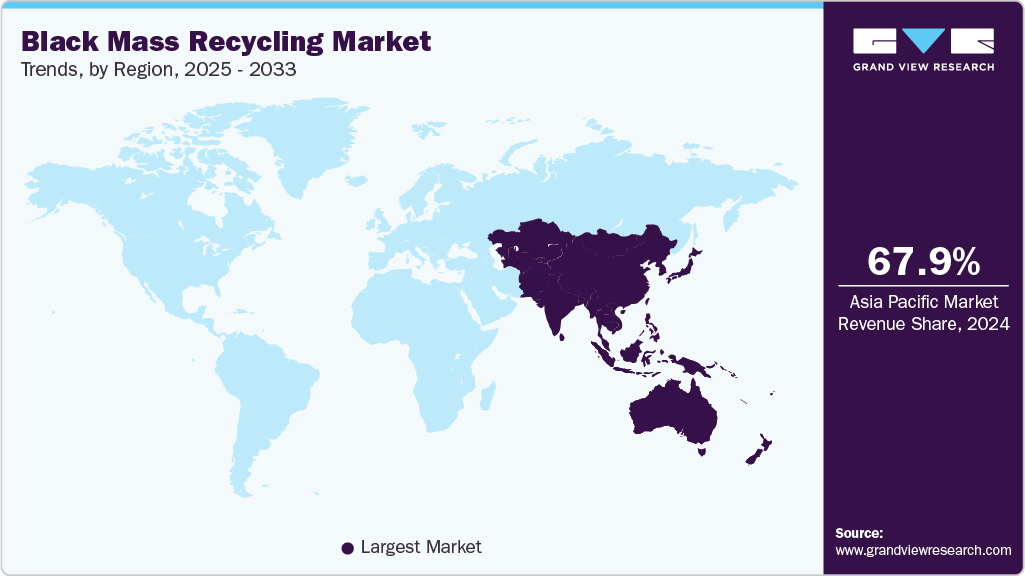

- Asia Pacific dominated the black mass recycling market with the largest market revenue share of 67.9%.

- Black mass recycling market in the U.S. is expected to grow at a substantial CAGR of 17.8% from 2025 to 2033.

- By battery type, nickel-based batteries segment is anticipated to register the fastest CAGR of 17.1% from 2025 to 2033.

- By battery source, automotive batteries accounted for the largest market revenue share of over 55.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.04 Billion

- 2033 Projected Market Size: USD 51.53 Billion

- CAGR (2025-2033): 16.8%

- Asia Pacific: Largest market in 2024

As electric vehicle (EV) sales continue to rise, surpassing 17 million units globally in 2024, the demand for lithium-ion batteries is surging. These batteries require significant volumes of critical raw materials such as lithium, cobalt, nickel, and manganese. However, primary mining of these materials poses environmental, economic, and geopolitical challenges. As a result, black mass recycling offers a sustainable alternative to reclaim these valuable metals from end-of-life batteries, helping to meet the raw material demand while reducing the ecological footprint of battery production. Government policies and regulatory frameworks across North America, Europe, and Asia reinforce the market growth. Several jurisdictions have introduced extended producer responsibility (EPR) schemes, mandatory recycling targets, and subsidies for battery recycling infrastructure. The European Union, for example, has mandated minimum recycled content in new batteries under its Battery Regulation, coming into effect gradually from 2025 onwards. Similarly, the U.S. Department of Energy and China's Ministry of Industry and Information Technology support domestic recycling initiatives to reduce dependency on imported critical minerals and boost supply chain resilience.Technological advancements in hydrometallurgical and direct recycling processes have significantly improved the efficiency, safety, and economic viability of recovering metals from black mass. Traditional pyro metallurgical methods often result in material loss and high emissions, whereas modern hydrometallurgical processes enable selective recovery of metals at lower energy consumption. The ability to extract high-purity materials with minimal waste attracts investments from both governments and the private sector.

The rise in battery manufacturing facilities, or "gigafactories," globally contributes to the increased availability of battery scrap and production waste, which also feeds into the black mass stream. As these facilities scale up, off-spec batteries and electrode materials discarded during manufacturing are recycled. This trend ensures a continuous supply of black mass for processing, even before large volumes of EV batteries reach end-of-life. Integrating recycling units near battery manufacturing plants enhances logistical efficiency and reduces raw material procurement costs for producers.

Moreover, environmental concerns and corporate sustainability goals push automotive OEMs and battery manufacturers to invest in circular economy models. Consumers, investors, and regulators increasingly demand transparency in sourcing and carbon footprint reduction across the battery supply chain. Black mass recycling directly contributes to lower emissions and reduced environmental degradation than mining. It also supports ESG (Environmental, Social, Governance) metrics, making it an essential part of long-term sustainable development strategies for stakeholders across the battery ecosystem.

Drivers, Opportunities & Restraints

With critical raw materials such as lithium, cobalt, and nickel becoming increasingly scarce and expensive, recycling black mass offers a viable solution to recover these metals sustainably. Government mandates and international regulations pushing for battery recycling targets and EPR schemes further encourage manufacturers and recyclers to invest in advanced recycling processes. In addition, growing environmental concerns over mining practices and carbon emissions are compelling companies to adopt circular economy strategies, where black mass recycling plays a pivotal role.

Significant opportunities lie in commercializing next-generation recycling technologies, such as hydrometallurgical and direct recycling methods, which offer higher recovery rates and lower environmental impact than traditional techniques. Establishing regional battery recycling hubs, particularly in North America and Europe, creates attractive investment landscapes. Emerging economies in Asia and Latin America are also beginning to develop local capabilities, opening new frontiers for partnerships and capacity expansion.

The complex chemistries of various battery types and formats require tailored recycling approaches, increasing operational complexity and cost. High initial capital investment and the need for specialized equipment and skilled labor further limit the entry of new players, especially in developing countries. Finally, insufficient collection infrastructure and consumer awareness about battery disposal remain major bottlenecks in ensuring a consistent and clean supply of used batteries for black mass recovery.

Battery Type Insights

Lithium-ion batteries contain valuable metals such as lithium, cobalt, nickel, and manganese, which are critical for battery production but are limited in global reserves. Recycling black mass from lithium-ion batteries efficiently recovers these materials, reduces dependence on primary mining, lowers carbon emissions, and supports sustainable manufacturing. Moreover, regulatory policies, such as the European Union’s Battery Regulation mandating recycled content and safe disposal of lithium-ion batteries, are accelerating investment in recycling technologies tailored specifically to this battery chemistry.

Nickel-based batteries is anticipated to register the fastest CAGR over the forecast period due to the increasing relevance of nickel in high-energy-density battery chemistries, particularly in electric vehicles and industrial applications. Nickel is a key component in NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum) batteries, both of which are widely used in modern EVs due to their higher energy output and longer life cycles. As battery manufacturers continue to shift toward higher nickel content to improve performance and reduce cobalt dependency, the demand for nickel recovery from end-of-life batteries is expected to rise sharply.

Battery Source Insights

The automotive batteries segment represents the largest and fastest-growing source of black mass in the recycling market, driven by the exponential rise in EV production and adoption worldwide. As EVs transition from early adoption to mainstream transportation, a growing volume of lithium-ion batteries reaches end-of-life, creating a substantial secondary source of critical metals such as lithium, cobalt, and nickel.

Consumer electronics is anticipated to register the fastest CAGR over the forecast period. Consumer electronics play a significant role as a consistent and widespread source of end-of-life lithium-ion batteries. Devices such as smartphones, laptops, tablets, power tools, and wearables use compact, rechargeable batteries that, when discarded, collectively contribute to a considerable volume of recyclable black mass. With the rapid pace of technological obsolescence and frequent product upgrades, the turnover rate of these devices remains high, leading to a steady accumulation of battery waste.

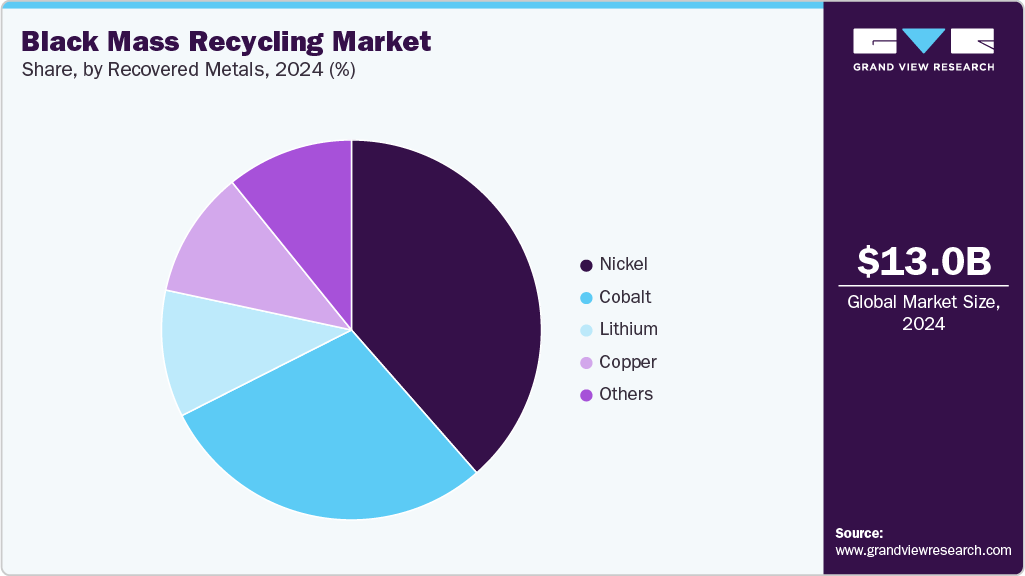

Recovered Metals Insights

With the electric vehicle industry increasingly favouring high-nickel cathodes to improve range and reduce reliance on cobalt, the demand for nickel has surged substantially. Recycling nickel from black mass helps meet this growing demand and offers significant environmental and economic benefits by reducing dependency on energy-intensive primary nickel mining. Moreover, nickel recovered through advanced hydrometallurgical processes retains high purity, making it suitable for direct reuse in battery manufacturing.

Lithium is anticipated to grow significantly over the forecast period. Primary lithium extraction is geographically concentrated and environmentally taxing, often involving significant water usage and land disruption. Recycling lithium from black mass provides a sustainable solution to reclaim this high-value metal from end-of-life batteries and production scrap, easing pressure on natural resources. Technological advancements in hydrometallurgical recycling now enable the recovery of battery-grade lithium compounds suitable for reuse in cathode production.

Regional Insights

Asia Pacific is witnessing strong growth in the market, mainly due to the rapid expansion of electric vehicle production and battery manufacturing across countries like China, Japan, South Korea, and India. As these nations lead in EV adoption and lithium-ion battery usage, the volume of end-of-life batteries and production scrap is increasing significantly. This growing battery waste is creating a large and steady supply of black mass, which serves as a valuable source for recovering critical metals like lithium, cobalt, and nickel.

North America Black Mass Recycling Market Trends

The black mass recycling market in North America is experiencing a rapid expansion in black mass recycling, driven largely by a fast-growing domestic EV market and supportive federal policies. Major U.S. players are leading the charge with vertically integrated recycling models, turning used batteries into critical cathode materials and reducing dependency on global supply chains. Federal incentives under the Inflation Reduction Act and DOE-backed loans (for companies like Li-Cycle and Redwood) fuel investments in new recycling facilities across Nevada, New York, and Kentucky. This surge in infrastructure is critical for positioning North America as a strategic hub in the battery materials circular economy.

The U.S. black mass recycling market dominated the North American market in 2024. The Government support is also critical to driving the market. Federal policies encourage investment in domestic recycling infrastructure through various funding programs and incentives. These efforts are helping the U.S. transition away from sending black mass to other countries for processing and instead focus on building in-house capabilities. The shift toward local recycling boosts supply chain security and aligns with environmental goals by reducing emissions and waste. These factors shape the U.S. into a major player in the global black mass recycling ecosystem.

Europe Black Mass Recycling Market Trends

The black mass recycling market in Europe is experiencing strong momentum in black mass recycling, primarily driven by regulations like the EU Battery Directive and the newer Battery Regulation. These regulations require increased lithium, cobalt, and nickel recovery from spent batteries, encouraging battery producers and recyclers to invest in advanced recovery systems. Increasing electric vehicle adoption and the growth of domestic battery gigafactories are boosting the supply of end-of-life batteries and manufacturing scrap. This steady influx of waste materials supports efficient recycling and strengthens regional circular supply chains.

Latin America Black Mass Recycling Market Trends

The black mass recycling market in Latin America is gradually emerging as a promising region for black mass recycling, thanks to rising awareness of sustainable battery disposal and recovery methods. In countries like Costa Rica, pioneering initiatives by companies such as Fortech are turning used lithium-ion batteries into “urban mine” resources, extracting valuable metals by creating black mass powder. These local programs are supported by growing consumer and corporate interest in environmental stewardship, helping to establish the foundation for a circular battery materials economy in the region.

Middle East & Africa Black Mass Recycling Market Trends

The black mass recycling market in the Middle East & Africa region is starting to embrace black mass recycling, driven by increasing awareness of the value of end-of-life lithium-ion batteries. In countries like the UAE and Saudi Arabia, growing investments enable the recovery of materials such as lithium, cobalt, and nickel from discarded batteries. This focus on recycling supports sustainability goals and helps address raw material shortages, emphasizing the importance of recycling over importing new resources.

Key Black Mass Recycling Company Insights

Some of the key players operating in the market include Anglo American, BASF, and others

-

Anglo American is a globally diversified mining company headquartered in London, United Kingdom. It operates across the mining and minerals value chain, focusing on platinum group metals, diamonds, copper, iron ore, and coal. The company has invested in innovation and partnerships to secure ethical and sustainable sources of critical minerals like cobalt and nickel, key components recovered from black mass. It actively engages with emerging recycling technologies and urban mining solutions, supporting the development of closed-loop systems for battery raw materials.

-

BASF, headquartered in Ludwigshafen, Germany, is one of the world’s largest chemical companies, with a strong presence across industrial solutions, performance materials, and battery chemicals. The company has positioned itself as a major player in battery materials, particularly through its Battery Materials division, which focuses on cathode active materials (CAM) and precursor CAM (pCAM) production. BASF is directly involved in establishing its battery recycling facility in Schwarzheide, Germany. This plant is designed to recover lithium, nickel, cobalt, and manganese from black mass using hydrometallurgical processes.

Key Black Mass Recycling Companies:

The following are the leading companies in the black mass recycling market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American

- Aqua Metals

- BASF

- Boliden

- Epiroc

- Fortum

- Glencore

- Heraeus Holding

- Redwood Materials

- Tenova

- Umicore

Recent Development

-

In June 2025, BASF officially commenced commercial production at its state-of-the-art black mass recycling facility in Schwarzheide, Germany. This advanced plant, among the largest in Europe, is designed to process end-of-life lithium-ion batteries and production scrap, mechanically transforming discarded batteries into metal-rich black mass containing critical metals such as lithium, nickel, cobalt, and manganese.

Black Mass Recycling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.30 billion

Revenue forecast in 2033

USD 51.33 billion

Growth rate

CAGR of 16.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Battery source, recovered metal, battery type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Brazil

Key companies profiled

Anglo American; Aqua Metals; BASF; Boliden; Epiroc; Fortum; Glencore; Heraeus Holding; Redwood Materials; Tenova; Umicore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Black Mass Recycling Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global black mass recycling market report based on battery type, battery source, recovered metals, and region:

-

Battery Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Lithium-Ion Batteries

-

Nickel-Based Batteries

-

-

Battery Source Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Automotive Batteries

-

Consumer Electronics

-

Industrial Batteries

-

Others

-

-

Recovered Metals Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Nickel

-

Cobalt

-

Lithium

-

Copper

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global black mass recycling market size was estimated at USD 13.04 billion in 2024 and is expected to reach USD 14.90 billion in 2025.

b. The global black mass recycling market is expected to grow at a compound annual growth rate of 16.8% from 2025 to 2033 to reach USD 51.53 billion by 2033.

b. The lithium ion batteries segment dominated the market with a revenue share of 71.4% in 2024.

b. Some of the key players of the global black mass recycling market are Anglo American, Aqua Metals, BASF, Boliden, Epiroc, Fortum, Glencore, Heraeus Holding, Redwood Materials, Tenova, Umicore, and others.

b. The key factor that is driving the growth of the global black mass recycling market is driven by the increasing demand for critical battery materials such as lithium, cobalt, and nickel amid the rapid adoption of electric vehicles and energy storage systems, coupled with the need for sustainable and circular solutions to reduce dependency on primary mining.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.