- Home

- »

- Plastics, Polymers & Resins

- »

-

Bag-in-Box Container Market Size & Trends Report, 2030GVR Report cover

![Bag-in-Box Container Market Size, Share & Trends Report]()

Bag-in-Box Container Market Size, Share & Trends Analysis Report By Application (Food & Beverage, Industrial Liquids, Household Products), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-655-4

- Number of Report Pages: 162

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Bag-in-Box Container Market Size & Trends

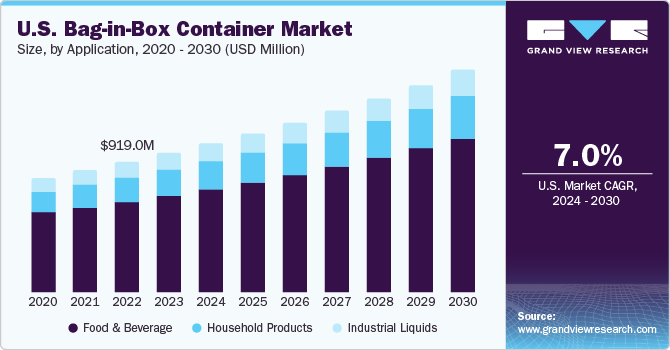

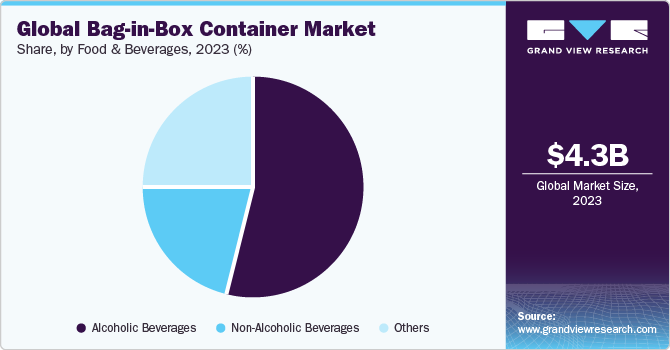

The global bag-in-box container market size was estimated at USD 4,265.5 million in 2023 and is expected to grow at a compounded annual growth rate (CAGR) of 6.9% from 2024 to 2030. The growth of the industry can be attributed to the increasing demand from various industries such as food & beverages and household products and increasing preference for packaged natural food products among consumers is expected to drive the market growth over the forecast period.

The demand for bag-in-box containers in the food & beverage sector is expected to grow in the U.S. market owing to the increasing demand for beverages. The country is one of the largest exporters of alcoholic beverages. For instance, in 2022 the country accounted for over USD 1 billion in revenue from wine exports. Consumer concern for health coupled with increasing demand for packaged natural products and liquid diet products is increasing the market growth for bag-in-box container products in the country.

The increasing consumption of bag-in-box container products by various wine brands, especially in three-liter sizes is likely to propel the growth of BIB containers over the forecast period. The U.S. economy is one of the largest wine producers. In addition, the manufacturers are exhibiting increasing demand for the product on account of the advantages offered by the container in wine packaging including easier dispensing, storage, extended freshness, and reduced cost per unit volume. In addition, the large surface area offered by the bag-in-box container offers more space coupled with colorful text and graphics than the conventional bottle labels and is expected to propel the market growth over the forecast period.

Furthermore, the Development of innovative and unique packaging technologies in different segments including soft drinks, food, and household segments is expected to fuel the market growth. The focus of manufacturers for creating sustainable packaging by using bio-degradable materials to make them environmentally friendly is anticipated to benefit them over the forecast period.

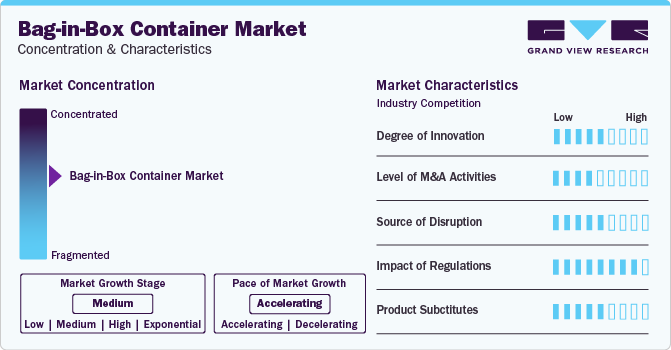

Market Concentration & Characteristics

The market for bag-in-box container is characterized by the presence of a large number of major players such as Amcor Ltd, Smurfit Kappa Group, DS Smith, Scholle IPN, and Liquibox. The companies operate their business through vast portfolios of products that are often customized in accordance with the client requirements. Key market players are involved in the implementation of advanced design features and technologies to tap into the rising consumer demand and strengthen their presence in the market.

Bag-In-box containers thus produced are then distributed across various countries through dedicated distribution channels. The companies are involved in extensive product customization in an attempt to increase market share and augmented revenues. The companies also introduce new and advanced products in order to attract new customers and retain the existing ones. Companies are striving to replace the raw materials with eco-friendly materials to reduce the carbon footprint, meet government standards and expand their customer base.

The companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations for the production of an advanced product with superior performance characteristics to increase the company revenues.

The companies are also involved in the production of customized products in order to cater to the demand-supply gap as demonstrated by the consumers. The introduction of such product is generally limited to a particular area (serving as test area), with the main focus on improving the companies’ market share and limiting the sales and revenue of the competitors.

Application Insights

Based on application, the bag-in-box market is segmented into food & beverages, household products, and industrial liquid. Food & beverages accounted for the highest market share of over 65% in 2023 owing to an improved lifestyle, higher disposable income, and growing awareness about healthier products among consumers. Moreover, the increasing base of the young population, and rising per capita income, coupled with the rising prevalence of alcohol consumption and innovations in packaging design are expected to increase the market growth over the forecast period.

The household products segment is expected to grow at a CAGR of more than 7.6% over the forecast period 2024-2030. Rising demand for household products such as fabric softeners and surface cleaners is expected to drive the demand for this product in the household products segment. The product is made available at low prices and provides ease of handling, which is expected to drive the market growth of bag-in-box containers. The use of bag-in-box containers in various applications, including fabric care, floor cleaners, kitchen cleaners, and bathroom cleaners, are likely to drive market growth over the forecast period.

The demand for bag-in-box containers in the industrial liquid segment on account of ease of product handling and usage is expected to drive market growth over the forecast period. The special performance characteristics of plastics such as chemical resistance, rigidity, and strength for packaging products such as oils and lubricants are expected to drive the market growth of the bag-in-box container over the forecast period.

Capacity Insights

Based on capacity, the bag-in-box market is segmented into <1 liter, 1-5 liter,5-10 liter, 10-20 liter, and > 20 liter. The 5-10-liter segment dominated the space on account of increasing demand from ready to eat food and restaurants. The <1 liter segment is projected to grow on account of demand from disposal juices segment.

Also, advances in ready to consume products coupled with the rising trend of packaged liquid products like juices and wines fueld by increasing urban population are all factors that have contributed to this development of the segment. Thus, the 5-10 litres segment dominated the market in the year 2023.

Material State Insights

Based on material state, the bag-in-box market is segmented into semi-liquid and liquid state products. The semi-liquid state products dominated the market with them including industrial products such as industrial fluids and petroleum products. Furthermore, household cleaners, liquid detergents, dairy products and others are also present in the semi liquid state.

The semi liquid state materials in industrial applications has higher shelf life compared to liquid state products, hence, the prior are expected to dominate the market over the forecast period.

Tap Insights

Based on tap, the bag-in-box market is segmented into with tap and without tap. The with tapwith-tap segment is projected to hold a higher market share, its usability in the beverage segment. The beverage segment is projected to grow based on the rready-to-consumerrages such as wines and others.

In addition, the with tap segment also finds use in the industrial sector for industrial liquids packaging and petroleum products packaging. Since the with tap segment offers better features in terms of use across different points in the production line.

Component Insights

Based on component, the bag-in-box market is segmented into bag, box, and fitment segment. The bag segment is projected to dominate the market, since the box and fitments maybe be resued depending on the material packaged inside the container.

The bag further consists of barrier films which enable to increase the shelf life of the product which packaged using the bag. However, in cases of sticky liquid and semi liquid material it becomes challenging to reuse the bag. Therefore the market share of bag is likely to remain higher over the forecast period.

Regional Insights

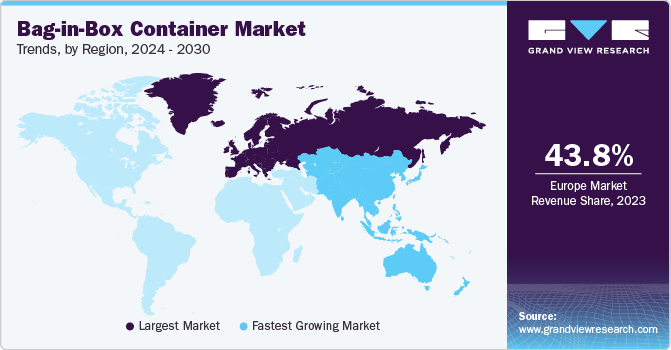

Europe recorded the largest market share of over 43.8% in 2023 owing to the growth of the product in the food & beverage industry. Changing consumption preferences of consumers, growing urbanization coupled with the growing popularity of such packaging solutions is expected to increase market growth over the forecast period. The demand for the food industry is anticipated to increase in countries such as Germany, the U.K., and Russia. The changing consumer eating patterns and shift toward healthy and organic foods have led to increasing demand for natural substitutes in food products. These factors are expected to increase the demand for bag-in-box container packaging in the food & beverages industry during the forecast period.

Asia Pacific is anticipated to expand at the fastest CAGR of 7.9% during the forecast period 2024-2030 owing to the increased per capita income, coupled with industrialization. The rapid growth of bag-in-box containers in end-use industries household, food & beverage, and industrial liquids industries is expected to drive the market over the forecasted period. It is one of the key regions of development for the manufacturing sector owing to factors including burgeoning economies, greater spending power, more youthful populations, increased urbanization, growth of the FMCG markets, and a rising interest in health and wellness is expected to increase the market growth for bag-in-box container industry over the forecasts period.

China is one of the major consumer markets for food and beverage products across the globe owing to the increasing population and high disposable incomes. The shift in Chinese consumer behavior, growing local competition, fragmented distribution, rising dual income, growing concerns for healthy food, and a growing taste for foreign foodstuff have contributed to the growth of the food & beverage sector.

Central & South America has been witnessing significant growth in the food & beverages market over the past few years owing to high investments in the manufacturing sector of the country, which is likely to have a positive impact on the bag-in-box container market over the forecast period. In addition, growing urbanization and increasing spending capacities the consumers in countries including Brazil and Argentina are expected to increase the market share over the forecast period.

The Middle East & Africa region countries such as South Africa are one of the largest importers of food & beverage products. Growth in population coupled with rising consumer disposable income in the region has resulted in high demand for quality and organic food. However, the manufacturing sector in the region is growing at a slower pace compared to other regions owing to unfavorable geography and lack of raw material availability. As a result, the demand for bag-in-box containers in the region is expected to grow at a slower rate compared to other regions over the projected period.

Key Companies & Market Share Insights

Companies such as Smurfit Kappa Group, D S Smith, DuPont, and Amcor Ltd. are involved in the production of bag-in-box containers on a large scale through high-capacity production lines and many production facilities spread across the regions. The companies operate a large product portfolio comprising products across multiple application segments. The companies procure raw materials from major raw material suppliers in North America including The Dow Chemical Company and Arkema Group.

Companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations to produce an advanced product with superior performance characteristics to increase revenue. For instance, in February 2023, Sealed Air announced that it has completed the acquisition of Liquibox. With this acquisition, Sealed Air is expected to expand its product portfolio and serve its customers with more sustainable and innovative packaging solutions. Some prominent players in the global bag-in-box container market include:

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In Oct 2023, Amcor Launched circular connector as part of sustainable packaging solution offerings which would enable the sourcing teams of Walmart and other retailers to lower its carbon footprint. It offers 70% lower carbon footprint compared with the existing products in the market.

-

In November 2023, Smurfit Kappa introduced a recyclable film to replace nylon which is used in bag in box container. The recyclable film is developed using polyethylene offering properties similar to nylon with benefit of recyclability.

Key Bag-in-Box Container Companies:

- Amcor Ltd.

- Smurfit Kappa

- DS Smith

- Liquibox

- Scholle IPN

- CDF Corporation

- Arlington Packaging (Rental) Limited

- CENTRAL PACKAGE & DISPLAY

- Accurate Box Company, Inc

- TPS Rental System Ltd

- Optopack Ltd

- Zarcos America

- Aran Group

- BiBP SP. z O.O

- SLF INDUSTRY AND TRADE CO., LTD

Bag-in Box Container Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4,546.6 million

Revenue forecast in 2030

USD 6.77 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application and Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, Japan, India, Brazil

Key companies profiled

Amcor Ltd., Smurfit Kappa, DS Smith, Liquibox, Scholle IPN, CDF Corporation, Arlington Packaging (Rental) Limited, CENTRAL PACKAGE & DISPLAY, Accurate Box Company, Inc, TPS Rental System Ltd., Optopack Ltd, Zarcos America, Aran Group

BiBP SP. z O.O, Hangzhou Hansin New Packing Material Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bag-in Box Container Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global bag-in-box container market on the basis of application and region:

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Food & Beverage

-

Alcoholic Beverages

-

Wine

-

Beer

-

Others

-

-

Non-Alcoholic Beverages

-

Soft Drinks

-

Juices & Flavored Drinks

-

Water

-

-

Others

-

Tomato Products

-

Milk & Dairy Products

-

Liquid Eggs

-

Edible Oil

-

Others

-

-

Industrial Liquids

-

Oils

-

Industrial Fluids

-

Petroleum Products

-

-

Household Products

-

Household Cleaners

-

Liquid Detergents

-

Liquid Soaps & Hand wash

-

Others

-

-

-

Capacity Outlook (Revenue, USD Million; 2018 - 2030)

-

< 1 Liter

-

1-5 Liter

-

5-10 Liter

-

10-20 Liter

-

6-20 Liter

-

> 20 Liter

-

-

Material State Outlook (Revenue, USD Million; 2018 - 2030)

-

Liquid

-

Semi Liquid

-

-

Tap Outlook (Revenue, USD Million; 2018 - 2030)

-

With Tap

-

Without Tap

-

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Bags

-

Box

-

Fitments

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The bag-in-box container market was valued at USD 4.0 billion in the year 2022 and is expected to reach USD 4.2 billion in 2023.

b. The bag-in-box container market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 6.7 billion by 2030.

b. Food and Beverages emerged as a dominating application segment with a value share of over 65% in the year 2022 due to improved lifestyle, higher disposable income, and growing awareness about healthier products among consumers.

b. The key market player in the Bag-in-box container market includes Amcor Ltd., Smurfit Kappa, DS Smith, Liquibox, Scholle IPN, CDF Corporation, Arlington Packaging (Rental) Limited, CENTRAL PACKAGE & DISPLAY, Accurate Box Company, Inc, TPS Rental System Ltd., Optopack Ltd, Zarcos America, Aran Group, BiBP SP. z O.O, Hangzhou Hansin New Packing Material Co., Ltd, and others.

b. The key factors that are driving the global bag-in-box containers market include, increasing consumption of the alcoholic beverages by developing and developed economies and increasing consumption of the household cleaners such as surface deodorizers, surface cleaners is expected to drive the demand for the bag-in-box container.

b. Asia Pacific dominated the global bag-in-box container market, owing to the rising demand form the countries such as South Korea and Australia due to the growing industrialization and increased alcohol consumption by young population.

Table of Contents

Chapter 1. Bag-in-Box Container Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Bag-in-Box Container Market: Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Bag-in-Box Container Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook: Flexible Packaging Market

3.2.2. Related Market Outlook: Flexible Intermediate Bulk Container Market

3.3. Penetration and Growth Prospect Mapping

3.4. Industry Value Chain Analysis

3.4.1. Raw Material Trends

3.4.2. Raw Material Analysis

3.4.2.1. Low-Density Polyethylene (LDPE)

3.4.2.2. Ethylene Vinyl Acetate (Eva)

3.4.2.3. Ethylene Vinyl Alcohol

3.4.2.4. Procurement Best Practices

3.5. Manufacturing Trends

3.5.1. Technology Trends

3.5.2. Outsourcing and Contract Manufacturing Trends

3.6. Cost Structure and Profit Margin Analysis

3.6.1. Profit Margin and Cost Analysis

3.6.2. Average Selling Price Analysis

3.7. Sales Channel Analysis

3.8. Vendor Selection Criteria Analysis

3.9. Technology Overview

3.9.1. Technology Timeline

3.9.1.1. Blown Film

3.9.1.2. Cast Film

3.9.1.3. Co-Extrusion

3.9.1.4. Bioplastic Manufacturing

3.10. Regulatory Framework

3.10.1. Food and Drugs Act

3.10.2. Consumer Packaging and Labelling Act

3.11. Market Dynamics

3.11.1. Market Driver Analysis

3.11.1.1. Growth of the Food & Beverage Industry

3.11.1.2. Growing Demand for Household Products

3.11.2. Market Restraint Analysis

3.11.2.1. High Demand for Substitute Products

3.11.3. Industry Challenges

3.11.3.1. Volatile Raw Material Prices

3.12. Business Environment Analysis: Bag-In Box Containers Market

3.12.1. Industry Analysis – Porter’s Five Force Analysis

3.12.1.1. Supplier Power

3.12.1.2. Buyer Power

3.12.1.3. Substitution Threat

3.12.1.4. Threat from New Entrant

3.12.1.5. Competitive Rivalry

3.12.2. PESTEL Analysis

3.12.2.1. Political Landscape

3.12.2.2. Economic Landscape

3.12.2.3. Social Landscape

3.12.2.4. Technological Landscape

3.12.2.5. Environmental Landscape

3.12.2.6. Legal Landscape

Chapter 4. Bag-in-Box Market: Application Outlook Estimates & Forecasts

4.1. Definition & Scope

4.2. Application Movement & Market Share Analysis, 2022 & 2030

4.3. Food & Beverages

4.3.1. Bag-In-Box Containers Market Estimates and Forecasts, In Food & Beverages, 2018 - 2030 (USD Million)

4.4. Household Products

4.4.1. Bag-In-Box Containers Market Estimates and Forecasts, In Household Products, 2018 - 2030 (USD Million)

4.5. Industrial Liquid

4.5.1. Bag-In-Box Containers Market Estimates and Forecasts, In Industrial Liquid, 2018 - 2030 (USD Million)

Chapter 5. Bag-in-Box Market: Capacity Outlook Estimates & Forecasts

5.1. Definition & Scope

5.2. Capacity Movement & Market Share Analysis, 2022 & 2030

5.3. < 1 Liter

5.4. Bag-In-Box Containers Market Estimates and Forecasts, In < 1 Liter, 2018 - 2030 (USD Million)

5.5. 1-5 Liter

5.5.1. Bag-In-Box Containers Market Estimates and Forecasts, In 1-5 Liter, 2018 - 2030 (USD Million)

5.6. 5-10 Liter

5.6.1. Bag-In-Box Containers Market Estimates and Forecasts, In 5-10 Liter, 2018 - 2030 (USD Million)

5.7. 10-20 Liter

5.8. Bag-In-Box Containers Market Estimates and Forecasts, In 10-20 Liter, 2018 - 2030 (USD Million)

5.9. >20 Liter

5.9.1. Bag-In-Box Containers Market Estimates and Forecasts, In >20 Liter, 2018 - 2030 (USD Million)

Chapter 6. Bag-in-Box Market: Material Outlook Estimates & Forecasts

6.1. Definition & Scope

6.2. Material Movement & Market Share Analysis, 2022 & 2030

6.3. Liquid

6.3.1. Bag-In-Box Containers Market Estimates and Forecasts, In Liquid, 2018 - 2030 (USD Million)

6.4. Semi-Liquid

6.4.1. Bag-In-Box Containers Market Estimates and Forecasts, In Semi-liquid, 2018 - 2030 (USD Million)

Chapter 7. Bag-in-Box Market: Tap Outlook Estimates & Forecasts

7.1. Definition & Scope

7.2. Tap Movement & Market Share Analysis, 2022 & 2030

7.3. With Tap

7.3.1. Bag-In-Box Containers Market Estimates and Forecasts, In Tap, 2018 - 2030 (USD Million)

7.4. Without Tap

7.4.1. Bag-In-Box Containers Market Estimates and Forecasts, In Without Tap, 2018 - 2030 (USD Million)

Chapter 8. Bag-in-Box Market: Component Outlook Estimates & Forecasts

8.1. Definition & Scope

8.2. Component Movement & Market Share Analysis, 2022 & 2030

8.3. Bags

8.4. Bag-In-Box Containers Market Estimates and Forecasts, In bags, 2018 - 2030 (USD Million)

8.5. Box

8.5.1. Bag-In-Box Containers Market Estimates and Forecasts, In box, 2018 - 2030 (USD Million)

8.6. 5-10 Fitment

8.6.1. Bag-In-Box Containers Market Estimates and Forecasts, In fitment, 2018 - 2030 (USD Million)

Chapter 9. Bag-in-Box Market: Regional Outlook Estimates & Forecasts

9.1. Regional Snapshot

9.2. Bag-in-Box Market: Regional Movement Analysis, 2023 & 2030

9.3. North America

9.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.3.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.3.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.3.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.3.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.3.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.3.7. U.S.

9.3.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.3.7.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.3.7.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.3.7.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.3.7.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.3.7.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.3.8. Canada

9.3.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.3.8.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.3.8.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.3.8.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.3.8.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.3.8.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.3.9. Mexico

9.3.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.3.9.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.3.9.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.3.9.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.3.9.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.3.9.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.4. Europe

9.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.4.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.4.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.4.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.4.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.4.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.4.7. UK

9.4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.4.7.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.4.7.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.4.7.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.4.7.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.4.7.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.4.8. Germany

9.4.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.4.8.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.4.8.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.4.8.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.4.8.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.4.8.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.4.9. France

9.4.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.4.9.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.4.9.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.4.9.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.4.9.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.4.9.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.4.10. Spain

9.4.10.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.4.10.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.4.10.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.4.10.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.4.10.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.4.10.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.4.11. Turkey

9.4.11.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.4.11.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.4.11.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.4.11.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.4.11.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.4.11.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.4.12. Russia

9.4.12.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.4.12.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.4.12.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.4.12.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.4.12.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.4.12.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.5. Asia Pacific

9.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.5.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.5.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.5.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.5.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.5.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.5.7. China

9.5.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.5.7.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.5.7.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.5.7.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.5.7.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.5.7.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.5.8. Japan

9.5.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.5.8.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.5.8.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.5.8.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.5.8.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.5.8.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.5.9. India

9.5.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.5.9.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.5.9.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.5.9.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.5.9.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.5.9.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.5.10. Australia

9.5.10.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.5.10.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.5.10.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.5.10.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.5.10.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.5.10.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.5.11. South Korea

9.5.11.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.5.11.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.5.11.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.5.11.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.5.11.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.5.11.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.6. Middle East & Africa

9.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.6.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.6.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.6.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.6.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.6.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.6.7. UAE

9.6.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.6.7.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.6.7.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.6.7.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.6.7.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.6.7.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.6.8. Saudi Arabia

9.6.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.6.8.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.6.8.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.6.8.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.6.8.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.6.8.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.6.9. South Africa

9.6.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.6.9.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.6.9.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.6.9.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.6.9.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.6.9.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.7. Central & South America

9.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.7.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.7.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.7.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.7.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.7.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.7.7. Brazil

9.7.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.7.7.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.7.7.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.7.7.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.7.7.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.7.7.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

9.7.8. Argentina

9.7.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

9.7.8.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million)

9.7.8.3. Market estimates and forecast, by capacity, 2018 - 2030 (USD Million)

9.7.8.4. Market estimates and forecast, by material, 2018 - 2030 (USD Million)

9.7.8.5. Market estimates and forecast, by tap, 2018 - 2030 (USD Million)

9.7.8.6. Market estimates and forecast, by component, 2018 - 2030 (USD Million)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company Categorization

10.3. Company Ranking

10.4. Heat Map Analysis

10.5. Market Strategies

10.6. Vendor Landscape

10.6.1. List of raw material supplier, key manufacturers, and distributors

10.6.2. List of prospective end-users

10.7. Strategy Mapping

10.8. Company Profiles/Listing

10.8.1. Amcor Ltd.

10.8.1.1. Company Overview

10.8.1.2. Financial Performance

10.8.1.3. Product Benchmarking

10.8.2. Smurfit Kappa

10.8.2.1. Company Overview

10.8.2.2. Financial Performance

10.8.2.3. Product Benchmarking

10.8.3. DS Smith

10.8.3.1. Company Overview

10.8.3.2. Financial Performance

10.8.3.3. Product Benchmarking

10.8.4. Liquibox

10.8.4.1. Company Overview

10.8.4.2. Financial Performance

10.8.4.3. Product Benchmarking

10.8.5. Scholle IPN

10.8.5.1. Company Overview

10.8.5.2. Financial Performance

10.8.5.3. Product Benchmarking

10.8.6. CDF Corporation

10.8.6.1. Company Overview

10.8.6.2. Financial Performance

10.8.6.3. Product Benchmarking

10.8.7. Arlington Packaging (Rental) Limited

10.8.7.1. Company Overview

10.8.7.2. Financial Performance

10.8.7.3. Product Benchmarking

10.8.8. CENTRAL PACKAGE & DISPLAY

10.8.8.1. Company Overview

10.8.8.2. Financial Performance

10.8.8.3. Product Benchmarking

10.8.9. Accurate Box Company, Inc.

10.8.9.1. Company Overview

10.8.9.2. Financial Performance

10.8.9.3. Product Benchmarking

10.8.10. TPS Rental Systems Ltd.

10.8.10.1. Company Overview

10.8.10.2. Financial Performance

10.8.10.3. Product Benchmarking

10.8.11. Optopack Ltd.

10.8.11.1. Company Overview

10.8.11.2. Financial Performance

10.8.11.3. Product Benchmarking

10.8.12. Zarcos America

10.8.12.1. Company Overview

10.8.12.2. Financial Performance

10.8.12.3. Product Benchmarking

10.8.13. Aran Group

10.8.13.1. Company Overview

10.8.13.2. Financial Performance

10.8.13.3. Product Benchmarking

10.8.14. BiBP SP. z O.O.

10.8.14.1. Company Overview

10.8.14.2. Financial Performance

10.8.14.3. Product Benchmarking

10.8.15. Hangzhou Hansin New Packing Material Co., Ltd.

10.8.15.1. Company Overview

10.8.15.2. Financial Performance

10.8.15.3. Product Benchmarking

List of Tables

Table 1. Bag-in-box containers market estimates and forecasts, 2018 - 2030 (USD Million)

Table 2. Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 3. Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 4. Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 5. Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 6. Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 7. Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 8. Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 9. Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 10. Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 11. Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 12. Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 13. Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 14. Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 15. Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 16. Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 17. Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 18. Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 19. North America Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 20. North America Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 21. North America Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 22. North America Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 23. North America Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 24. North America Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 25. North America Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 26. North America Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 27. North America Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 28. North America Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 29. North America Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 30. North America Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 31. North America Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 32. North America Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 33. North America Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 34. North America Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 35. North America Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 36. U.S. Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 37. U.S. Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 38. U.S. Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 39. U.S. Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 40. U.S. Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 41. U.S. Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 42. U.S. Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 43. U.S. Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 44. U.S. Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 45. U.S. Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 46. U.S. Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 47. U.S. Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 48. U.S. Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 49. U.S. Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 50. U.S. Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 51. U.S. Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 52. U.S. Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 53. Canada Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 54. Canada Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 55. Canada Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 56. Canada Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 57. Canada Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 58. Canada Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 59. Canada Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 60. Canada Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 61. Canada Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 62. Canada Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 63. Canada Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 64. Canada Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 65. Canada Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 66. Canada Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 67. Canada Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 68. Canada Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 69. Canada Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 70. Mexico Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 71. Mexico Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 72. Mexico Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 73. Mexico Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 74. Mexico Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 75. Mexico Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 76. Mexico Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 77. Mexico Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 78. Mexico Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 79. Mexico Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 80. Mexico Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 81. Mexico Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 82. Mexico Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 83. Mexico Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 84. Mexico Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 85. Mexico Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 86. Mexico Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 87. Europe Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 88. Europe Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 89. Europe Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 90. Europe Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 91. Europe Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 92. Europe Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 93. Europe Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 94. Europe Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 95. Europe Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 96. Europe Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 97. Europe Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 98. Europe Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 99. Europe Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 100. Europe Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 101. Europe Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 102. Europe Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 103. Europe Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 104. UK Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 105. UK Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 106. UK Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 107. UK Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 108. UK Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 109. UK Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 110. UK Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 111. UK Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 112. UK Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 113. UK Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 114. UK Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 115. UK Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 116. UK Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 117. UK Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 118. UK Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 119. UK Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 120. UK Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 121. Germany Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 122. Germany Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 123. Germany Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 124. Germany Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 125. Germany Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 126. Germany Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 127. Germany Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 128. Germany Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 129. Germany Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 130. Germany Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 131. Germany Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 132. Germany Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 133. Germany Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 134. Germany Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 135. Germany Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 136. Germany Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 137. Germany Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 138. France Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 139. France Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 140. France Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 141. France Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 142. France Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 143. France Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 144. France Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 145. France Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 146. France Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 147. France Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 148. France Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 149. France Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 150. France Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 151. France Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 152. France Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 153. France Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 154. France Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 155. Spain Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 156. Spain Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 157. Spain Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 158. Spain Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 159. Spain Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 160. Spain Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 161. Spain Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 162. Spain Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 163. Spain Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 164. Spain Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 165. Spain Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 166. Spain Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 167. Spain Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 168. Spain Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 169. Spain Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 170. Spain Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 171. Spain Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 172. Russia Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 173. Russia Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 174. Russia Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 175. Russia Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 176. Russia Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 177. Russia Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 178. Russia Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 179. Russia Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 180. Russia Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 181. Russia Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 182. Russia Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 183. Russia Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 184. Russia Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 185. Russia Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 186. Russia Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 187. Russia Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 188. Russia Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 189. Turkey Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 190. Turkey Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 191. Turkey Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 192. Turkey Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 193. Turkey Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 194. Turkey Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 195. Turkey Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 196. Turkey Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 197. Turkey Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 198. Turkey Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 199. Turkey Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 200. Turkey Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 201. Turkey Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 202. Turkey Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 203. Turkey Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 204. Turkey Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 205. Turkey Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 206. Europe Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 207. Asia Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 208. Asia Pacific Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 209. Asia Pacific Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 210. Asia Pacific Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 211. Asia Pacific Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 212. Asia Pacific Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 213. Asia Pacific Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 214. Asia Pacific Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 215. Asia Pacific Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 216. Asia Pacific Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 217. Asia Pacific Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 218. Asia Pacific Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 219. Asia Pacific Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 220. Asia Pacific Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 221. Asia Pacific Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 222. Asia Pacific Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 223. Asia Pacific Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 224. China Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 225. China Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 226. China Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 227. China Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 228. China Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 229. China Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 230. China Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 231. China Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 232. China Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 233. China Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 234. China Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 235. China Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 236. China Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 237. China Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 238. China Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 239. China Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 240. China Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 241. Japan Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 242. Japan Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 243. Japan Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 244. Japan Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 245. Japan Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 246. Japan Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 247. Japan Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 248. Japan Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 249. Japan Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 250. Japan Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 251. Japan Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 252. Japan Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 253. Japan Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 254. Japan Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 255. Japan Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 256. Japan Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 257. Japan Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 258. India Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 259. India Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 260. India Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 261. India Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 262. India Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 263. India Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 264. India Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 265. India Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 266. India Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 267. India Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 268. India Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 269. India Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 270. India Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 271. India Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 272. India Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 273. India Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 274. India Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 275. Australia Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 276. Australia Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 277. Australia Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 278. Australia Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 279. Australia Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 280. Australia Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 281. Australia Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)

Table 282. Australia Bag-in-box containers market estimates and forecasts, by capacity in 1-5 liter, 2018 - 2030 (USD Million)

Table 283. Australia Bag-in-box containers market estimates and forecasts, by capacity in 5-10 liter, 2018 - 2030 (USD Million)

Table 284. Australia Bag-in-box containers market estimates and forecasts, by capacity in >20 liter, 2018 - 2030 (USD Million)

Table 285. Australia Bag-in-box containers market estimates and forecasts, by material, by liquid, 2018 - 2030 (USD Million)

Table 286. Australia Bag-in-box containers market estimates and forecasts, by material, by semi liquid, 2018 - 2030 (USD Million)

Table 287. Australia Bag-in-box containers market estimates and forecasts, by tap, with tap, 2018 - 2030 (USD Million)

Table 288. Australia Bag-in-box containers market estimates and forecasts, by tap, without tap, 2018 - 2030 (USD Million)

Table 289. Australia Bag-in-box containers market estimates and forecasts, by component, by bags, 2018 - 2030 (USD Million)

Table 290. Australia Bag-in-box containers market estimates and forecasts, by component, by box, 2018 - 2030 (USD Million)

Table 291. Australia Bag-in-box containers market estimates and forecasts, by component, by fitment, 2018 - 2030 (USD Million)

Table 292. Middle East & Africa Bag-in-box containers market estimates and forecasts, by application in food & beverage, 2018 - 2030 (USD Million)

Table 293. Middle East & Africa Bag-in-box containers market estimates and forecasts, by application in alcoholic beverages, 2018 - 2030 (USD Million)

Table 294. Middle East & Africa Bag-in-box containers market estimates and forecasts, by application in non-alcoholic beverages, 2018 - 2030 (USD Million)

Table 295. Middle East & Africa Bag-in-box containers market estimates and forecasts by application in other food applications, 2018 - 2030 (USD Million)

Table 296. Middle East & Africa Bag-in-box containers market Estimates and Forecasts, by application in household products, 2018 - 2030 (USD Million)

Table 297. Middle East & Africa Bag-in-box containers market estimates and forecasts, by application in industrial liquid, 2018 - 2030 (USD Million)

Table 298. Middle East & Africa Bag-in-box containers market estimates and forecasts, by capacity in <1 liter, 2018 - 2030 (USD Million)