- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Baking Ingredients Market Size, Share, Trends Report, 2030GVR Report cover

![Baking Ingredients Market Size, Share & Trends Report]()

Baking Ingredients Market Size, Share & Trends Analysis Report By Product, By End-use (Bread, Cakes & Pastries, Rolls & Pies), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-520-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Baking Ingredients Market Size & Trends

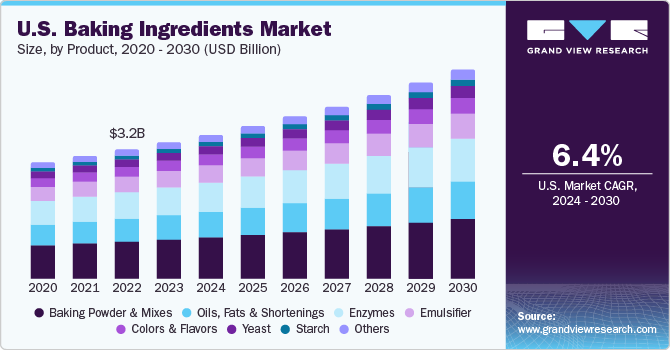

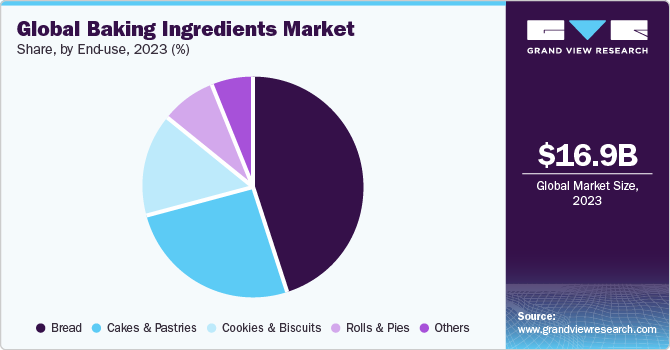

The global baking ingredients market size was estimated at USD 16.88 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030, owing to changing preferences for a variety of baked goods among consumers. The rise in demand for multi-cuisine bakery products, as well as the increasing demand for baking ingredients that reduce fermentation time, is expected to drive the market growth. Baking ingredients such as enzymes, emulsifiers, baking powders, and yeast are commonly used in the production of bakery products such as pastries, bread, cakes, rolls, tarts, pies, and many more.

Growing urbanization is leading to changes in lifestyle, leaving less or no time to cook. This is driving food & beverage companies to introduce diverse baked products that serve as breakfast and snack items. The availability of products with extended storage life and accessibility to freezer storage conditions in retail bakeries is leading to a trend of one-time purchases of baked goods.

Many manufacturers have developed innovative methods that maintain the freshness of the product throughout the extended shelf life, along with baked products that combine freshness and flavor through natural ingredients and enzymes containing low levels of sugar. Natural methods that inhibit mold growth in bakery products extend the life of the product while maintaining a favorable taste. Thus, these factors are expected to propel the market growth in the forecast period.

In-store bakery products are becoming increasingly popular in retail and grocery stores due to their accessibility and ease of purchase. Moreover, online retail stores are gaining traction in emerging economies owing to the ease of availability and convenience of buying products from home. The future of the bakery industry will be defined by taste, freshness, health, and variety. Consumers prioritize the taste of bakery products, ingredients such as salt, sweeteners, and fat improve the taste of the product by adding ethnic flavor.

Individual contributions from end-use segments such as bread, cakes & pastries, cookies & biscuits, and rolls & pies drive the global baking ingredients market. New end-uses and innovations in developed economies to produce high-quality baked goods are expected to fuel the demand further. However, in developing economies, the customer’s proximity to affordable bakery products is positively impacting the market growth. Rising urbanization in transition economies is increasing the consumption of baked goods.

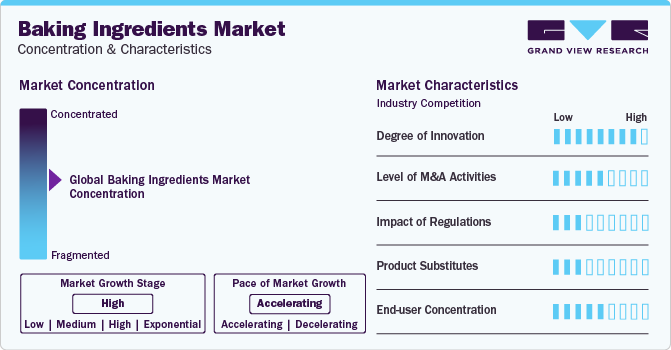

Market Concentration & Characteristics

The market demonstrates a medium-to-high degree of innovation, with companies consistently adopting newer products to cater to evolving consumer preferences. For instance, there is a growing emphasis on sustainability in the bakery industry, leading to the development of sustainable and environment-friendly bakery ingredients, including sustainable fats and oils.

Mergers and acquisitions are in the range of medium to high in the baking ingredients market. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions aiming to gain a competitive edge and achieve economies of scale in the market.

Regulatory authorities enforce precise labeling standards to ensure transparency and accurate information for consumers when it comes to the bakery. Providers must comply with food safety regulations to ensure that their ingredients are safe for consumption. This includes adherence to Good Manufacturing Practices (GMP), sanitation standards, and hazard analysis and critical control points (HACCP) principles.

There are no direct substitutes for bakery ingredients. Consequently, the market may witness a demand for alternative snack products in the future.

Product Insights

The baking powders & mixes segment led market share in the product segment in 2023, accounting for over 27% of the global revenue. It is a source of proteins, vitamins, and carbohydrates that are widely consumed as a primary ingredient in bakery products around the world. Wheat-based baking powder, which has lower saturated fat and cholesterol content, is gaining popularity, owing to rising consumer awareness of organic products.

The emulsifiers segment is anticipated to grow as the expanding baking goods industry necessitates products with a longer shelf life and appeal to consumers. When food acids like tartaric acid, acetic acid, and lactic acid react with hydroxylic groups, they form emulsifiers. These emulsifiers extend the shelf life of the product, which, in turn, boosts market growth.

End-use Insights

The bread segment dominated the market in 2023. Bread is considered a staple food in many countries around the world. Bread’s affordability and nutritional content accounted for its steady growth. Changing consumer preferences have made manufacturers invest in innovation to deliver baked goods that satisfy consumer tastes. Manufacturers are developing bread with a balanced nutritional and flavor content to capture a sizable market share.

Baking ingredient consumption in the cakes & pastries segment is expected to grow at the fastest rate over the forecast period. Market expansion is attributed to rising snack consumption as well as the availability of freezers for storing frozen processed foods like cookies and pastries in retail establishments. Additionally, food processing companies looking to expand their product portfolio by getting into the cookies and biscuits manufacturing business are the main drivers of the cookies and biscuits segment.

Pies have a unique market positioning where people buy pies for special occasions. To bridge the link between occasions and pies, manufacturers are attempting to maximize the size of the pies to accommodate servings in large numbers. The new size formats are in the range of 8-inch, 9-inch, and 12-inch. Due to changes in the size formats of the pies, the global pies market provides more opportunities for the use of sweeteners, salts, acids, and other ingredients.

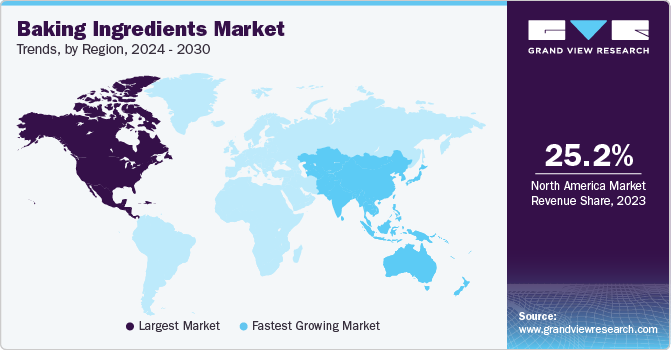

Regional Insights

North America held a share of over 25.2% in 2023 and is anticipated to grow at a CAGR of 6.4% over the forecast period. The on-the-go food lifestyle in countries like Canada and the U.S. is anticipated to drive up demand throughout the forecast period. The convenience and easy-to-carry options provided by bakery manufacturers, such as pocket wraps and rolls, among others, are also driving growth. Gluten-free food is one of the trends that is prevailing in the market, and the trend is anticipated to continue throughout the projected period.

Changing lifestyles have created a demand for alternatives to traditional home food, driving the demand for processed and packaged foods. The increasing working population is looking for food that consumes less time than conventional food. In addition, perceptions linked to health and well-being are driving consumers to opt for a healthy diet. The continuing revolution in the food-processing industry is resulting in the development of new packaged foods to meet the growing demand for convenience foods from North American consumers.

The Asia Pacific segment is expected to grow at the fastest rate over the forecast period. China and India are the most populous countries in the world, with their population expected to grow further. Many businesses tend to boost their production volume and use new production techniques to produce high-quality products because the urban population in the Asia Pacific region is increasingly shifting toward Western foods. Production of high-quality products provides opportunities for baking ingredients manufacturers to supply emulsifiers, enzymes, baking powders, oils, and fats. This is expected to increase the demand for baking ingredients in the forecast period.

Key Baking Ingredients Company Insights

The baking Ingredients market is fragmented in nature with the key players intended to achieve optimum market growth and widen their market presence through various market expansion strategies. These expansion plans include joint ventures, third-party agreements for supply and distribution, acquisitions, and capacity addition in new geographies.

Key Baking Ingredients Companies:

The following are the leading companies in the baking ingredients market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these baking ingredients companies are analyzed to map the supply network.

- Flower Foods Inc

- Hostess Brands LLC

- George Weston Ltd

- Grupo Bimbo S.A.B. de C.V.

- Nestle S.A.

- Finsbury Food Group

- Aryzta AG

- Britannia Industries Ltd

- Tiger Brands Company

- Goodman Fielder

- Uniferm GmbH & Co.

- General Mills Inc

- Bread Talk Co. Ltd

- Mckee Foods Corporation

- Mondelez International

- Yamazaki Baking Co. Ltd

- Monginis Food Pvt. Ltd.

- Koninklijke DSM V.V.

- Associated British Foods plc

Recent Developments

-

In September 2023, Moyu, a U.S.-based baking mix brand, announced the launch of better-for-you bakery mix. The bakery features konjac-based mixes under the better-for-you baked goods category.

-

In June 2023, Ardent Mills, a flour-milling and ingredient company, announced the launch of the Ardent Mills Egg Replace and Ancient Grains Plus Baking Flour Blend. These products aim to meet the evolving consumer preferences and address supply chain challenges. Ardent Mills Egg Replace is a gluten-free and vegan alternative to whole eggs, while Ancient Grains Plus Baking Flour Blend is a protein-rich, plant-based, and gluten-free flour blend.

-

In June 2023 , the Kerry Group announced the launch of enzyme solutions that help bakers reduce their egg use by 30% in a variety of bakery products. The move comes as the European Commission is expected to propose legislation to phase out cages in animal agriculture by 2027, a proposal that has gathered support from some heavyweights in the industry for several years now.

Baking Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.86 Billion

Revenue forecast in 2030

USD 25.92 Billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands; Poland; Portugal; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Flower Foods Inc; Hostess Brands LLC; George Weston Ltd; Grupo Bimbo S.A.B. de C.V.; Nestle S.A.; Finsbury Food Group; Aryzta AG; Britannia Industries Ltd; Tiger Brands Company; Goodman Fielder; Uniferm GmbH & Co.; General Mills Inc; Bread Talk Co. Ltd; Mckee Foods Corporation; Mondelez International; Yamazaki Baking Co. Ltd; Monginis Food Pvt. Ltd; Koninklijke DSM V.V.; Associated British Foods plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baking Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global baking ingredients market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Emulsifier

-

Yeast

-

Enzymes

-

Baking Powder & Mixes

-

Oils, Fats & Shortenings

-

Colors & Flavors

-

Starch

-

Preservatives

-

Others

-

-

End-use Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Bread

-

Cakes & Pastries

-

Cookies & Biscuits

-

Rolls & Pies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Poland

-

Portugal

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global baking ingredients is expected to grow at a compounded growth rate of 6.4% from 2024 to 2030 to reach USD 25.92 billion by 2030.

b. Baking powders & mixes had the largest market share in the product segment in 2023, accounting for over 27.2% of global revenue. It is a source of proteins, vitamins, and carbohydrates that are widely consumed as a primary ingredient in bakery products around the world. Wheat baking powder, which has lower saturated fat and cholesterol content, is gaining popularity owing to rising consumer awareness of organic products.

b. Some of the key players operating in the market include Flower Foods Inc, Hostess Brands LLC, George Weston Ltd, Grupo Bimbo S.A.B. de C.V, Nestle SA, Finsbury Food Group, Aryzta AG, Britannia Industries Ltd, Tiger Brands Company, Goodman Fielder, Uniferm GmbH & Co., General Mills Inc, Bread Talk Co. Ltd, and Mckee Foods Corporation

b. Growing urbanization is leading to changes in lifestyle leaving less or no time to cook. This is driving the food & beverage companies to introduce diverse baked products that serve as breakfast and snack items. Availability of products with extended storage life and accessibility to freezer storage conditions in retail bakeries is leading to a trend of one-time purchases of baked goods.

b. The global baking ingredients size was estimated at USD 16.88 billion in 2023 and is expected to reach USD 17.86 billion in 2024.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."