- Home

- »

- Next Generation Technologies

- »

-

Barrier Systems Market Size, Share & Growth Report, 2030GVR Report cover

![Barrier Systems Market Size, Share, & Trends Report]()

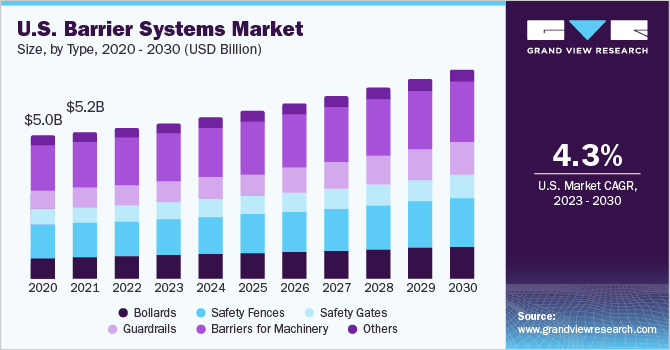

Barrier Systems Market (2023 - 2030) Size, Share, & Trends Analysis Report By Type (Bollards, Safety Fences, Safety Gates, Guardrails), By Function (Active Barriers, Passive Barriers), By Access Control Devices, By Material, By End Use And Segment Forecasts

- Report ID: GVR-4-68038-094-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global barrier systems market size was evaluated at USD 19.60 billion in 2022 and is anticipated to grow at a CAGR of 6.1% from 2023 to 2030. The market growth can be attributed to the increase in demand for several safety solutions, such as safety gates, crash barrier systems, and safety fences, among others, rapid expansion of construction and automotive industries, and rising awareness regarding road safety. Technological advancement, including the integration of smart sensors and automation, has helped improve the efficiency of industrial barrier systems resulting in increased adoption of barrier systems across several industry verticals.

Leading market players have been involved in strategic initiatives such as partnerships and mergers to gain new consumers. For instance, in April 2021, Ritehite, a manufacturer of industrial doors and safety barriers, partnered with Outrider, a company that offers autonomous yard operations for logistics hubs, to increase the adoption of yard automation. The solutions offered by Ritehite and Outsider provided large enterprises with quick and easy deployment of full yard automation function for logistic facilities. Such initiatives are expected to help bring new products to the barrier systems market, which, in turn, could attract new consumers to the market.

Barrier systems play a crucial role in property management as they are effective in preventing unwarranted access to private and commercial properties. For instance, fire and smoke controllers are used in the ventilation system of buildings to prevent from fire and smoke within the ductwork. Further, it helps residents by preventing fire and smoke from one room to the next through the ducts. Moreover, Fire safety systems use temperature sensors, which determine if a piece of equipment is overheating and trigger smoke alarms automatically. By integrating fire systems into a single network supported by cloud function, managers can overview the health and performance of their buildings and fire systems remotely through their laptops, desktops, and smartphones. Such developments are expected to help bring new products to the barrier systems market, which, in turn, could attract new consumers to the market during the forecast period.

The rising need for fencing materials, as well as the increasing availability of lightweight, inexpensive, and simple-to-install Polyvinyl Chloride (PVC) and plastic fences, are likely to drive demand for barrier systems over the projection period. Furthermore, significant institutional development investments and increased government spending to improve the security of public spaces, government buildings, and parks, among other things, are underway. For instance, in March 2023, Mezzanine Safeti-Gates, Inc., a U.S.-based protection equipment provider, announced a new design of the Roly safety gate, which protects both people and products. The roly containment design includes a high visibility netting system and high strength on the safety fence that prevents employees from getting their hands into the loading zone. These factors and developments would further supplement the growth of market during the forecast period.

Many industrial facilities, warehouses, distribution centers, and critical infrastructure sites require robust barriers to control access and prevent unauthorized entry. Industrial fences, including high-security fencing systems, can withstand cutting, climbing, and tampering attempts, protecting against trespassing and theft. Barrier systems also play a vital role in traffic management and accident prevention. In environments with heavy vehicular traffic, such as parking lots, warehouses, and distribution centers, barriers like bollards, guardrails, and drop arms help regulate traffic flow, prevent accidents, and protect pedestrians and infrastructure. These barriers provide a physical separation between vehicles and pedestrians, guiding traffic in designated areas and minimizing the risk of collisions or vehicle-related incidents. These factors would further supplement the growth of barrier systems market during the forecast period.

The upfront cost of acquiring and installing industrial barrier systems can be substantial. Depending on the type and complexity of the barriers required, businesses may need to allocate a significant portion of their budget to procure the necessary equipment and materials. Industrial-grade barriers often involve robust construction, specialized materials, and advanced security features, contributing to higher costs. For smaller businesses or those with limited financial resources, these upfront expenses can present a significant obstacle and deter them from investing in industrial barrier systems. In addition to the initial cost, ongoing maintenance and upkeep expenses also need to be considered. Industrial barrier systems, particularly those installed outdoors, are exposed to harsh environmental conditions, including extreme temperatures, moisture, and corrosive substances. Regular inspection, repairs, and replacements may be necessary to ensure their effectiveness and longevity. These maintenance costs can add up over time and pose a financial burden for businesses, especially if they need more resources or expertise to handle the upkeep internally. These factors may hinder the growth of market during the forecast period.

Type Insights

The barriers for machinery segment accounted for the largest market share of 31.24% in 2022 in barrier systems market. The growth of this segment can be attributed to the growing safety, improving Environmental Health and Safety (EHS) regulation, rising purchasing power, and improving digital infrastructure. Moreover, the increasing complexity of machinery/equipment has increased the demand for safety equipment. The use of hand guards and other barriers is not only limited to industries such as manufacturing and production. Still, it also extends to healthcare and aviation, among others. While the market is negatively impacted by the automation of industrial processes, which has created a reduced/zero need for machinery barriers, the barrier for the machinery segment is still expected to grow owing to the factors mentioned above, such as increased safety awareness, stringent EHS regulations among others in the barrier systems industry over the forecast period.

The guardrails segment is anticipated to grow at a CAGR of 8.0% during the forecast period. The growth of the guardrails segment can be attributed to the rising number of companies offering guardrails with enhanced capabilities. For instance, in November 2019, Safe Direction, a manufacturer of barrier systems, installed its RHINO-STOP guardrail barrier system in Sunshine Hospital, Melbourne, in 8 storey multi-deck carpark. The barrier system provides compliance for vehicle loading and high level of security with anti-climb restraint. Such initiatives for installation and deployment are expected to drive the growth of the guardrails segment in the market during the forecast period.

Function Insights

The passive barriers segment accounted for the largest market share of 70.79% in 2022 in barrier systems market. Passive barrier systems have no moving parts, which can stop deter threats on their own. They protect buildings or any property from vehicle interference. Further, these barrier systems provide several benefits, such as perimeter security, low maintenance, and can be integrated into any landscape and street furniture. For instance, in May 2022, Ritehite, a manufacturer of industrial barrier systems, launched a loading bay safety guide to help facility managers by providing a comprehensive overview of industrial management. It also aimed to address the future logistics industry and emerging trends by focusing on smart equipment function, increased automation, and a growing shift toward a digital future. Such initiatives are expected to drive the growth of the segment in the market during the forecast period.

The active barrier systems segment is anticipated to grow at a CAGR of 6.7% during the forecast period. They are commonly used in areas where vehicle credentials must be checked at entry points. Active barriers that are often employed include gates, traffic arms, and drop arms, among others. Active barriers are mobile and are widely used to temporarily block an area at construction sites or events. For instance, in May 2022, McCue, a barrier system provider, launched a sustainable BumperSign Solar, a high strength signage solution operated by solar energy. The solution was designed for parking lots, pedestrian traffic guidelines, online pickup, and other pickup options. The eco-friendly sign is designed using LED batteries connected with rechargeable batteries and a solar panel that generates power virtually. Such initiatives are expected to drive the growth of the segment in the market during the forecast period.

Access Control Device Insights

The token & reader function segment accounted for the largest market share of 31.82% in 2022 in barrier systems market. This function works is incorporated with access control panels, which are frequently used by emergency response professionals, law enforcement agencies, and civic disaster administrators, among others. It aids in the preservation of records pertaining to facility configuration changes, access control system activities, and user permissions. For instance, in June 2021, National Capital Region Transport Corporation (NCRTC) announced the implementation of an automatic fare collecting system for the Delhi-Ghaziabad-Meerut Regional Rapid Transit System (RRTS) line. The goal of this project is to create an automated fare collection system using vending machines, pre-paid/credit/debit card readers, and QR Code-based ticketing systems. Such initiatives are expected to drive the growth of the segment in the market during the forecast period.

The biometric systems segment is anticipated to grow at a CAGR of 7.4% during the forecast period.Biometric turnstiles and barriers at the building's entrance automatically collect visitor data. These access control devices are utilized in a variety of settings, including administrative offices, government entities, and financial institutions. Furthermore, these biometric fingerprint turnstiles are suitable for circumstances requiring a quick admission. Furthermore, they employ technology such as fingerprint identification, which is a low-cost consumer solution. These elements would contribute to the segment's growth during the forecast period.

Material Insights

The metal segment accounted for the largest market share of 53.23% in 2022 in barrier systems market. Metals are crucial components of barrier systems, which are widely used in railways, bridges, and roads, among others. Metal barriers help in improving safety and efficiency of road transport. Further, they also used for demarcation of restricted areas for enhanced security. Moreover, Metal barriers are simple to build and need little upkeep. Metal crash barrier systems have semi-rigid qualities that minimize the impact of the collision, resulting in reduced injury to car occupants. They are robust and offer reliable protection against vehicle impact and other forces. Such benefits provided by the metal barrier systems would further supplement the growth of the segment during the forecast period.

The non-metal segment is anticipated to grow at a CAGR of 6.5% during the forecast period. Non-metal barrier systems are made from a variety of materials such as concrete, plastic, water-filled barriers, and other composite materials. Non-metal barriers are frequently utilized for temporary purposes such as road closures, construction projects, and festivities. They are typically lighter and more portable than metal barriers, making them easier to carry and install when necessary. Additionally, they are utilized in low-speed traffic regions to prevent people from entering a restricted zone. Such advantages supplied by nonmetal barrier systems would enhance the segment's expansion during the projection period.

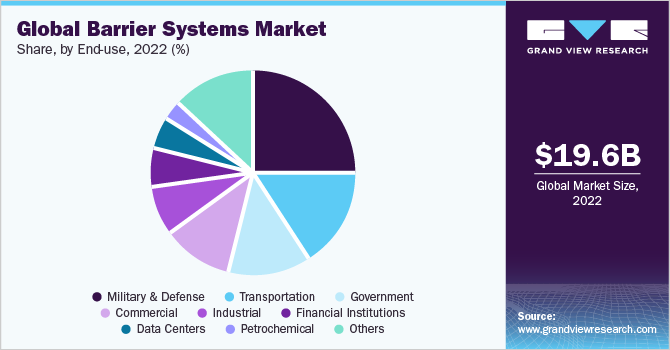

End-use Insights

The military & defense segment accounted for the largest market share of 25.40% in 2022 in barrier systems market. Military defense barriers are critical in protecting military sites and public infrastructure all around the world. Apart from their practical application in defensive systems, they also provide inhabitants in vulnerable locations with a sense of security and peace of mind. Further, they serve as pre-battle fortifications and command centers. They are used in place of regular trenches to prevent violence and explosives. They successfully protect against gunshots and bullets, lowering the number of casualties. Military barriers are transportable, easy to construct, and very effective due to their folding packing. Moreover, they also help to material recycling by using professionally welded galvanized low-carbon steel wire and geotextile fabric packing. Such benefits provided by the barrier systems would further supplement the demand for such type of safety systems in the military & defense during the forecast period.

The transportation segment is anticipated to grow at a CAGR of 7.2% during the forecast period. For transportation, the barrier systems are designed to deflect the vehicles and are less severe than the roadside hazard. Further, favorable actions promoting the implementation of road safety measures, such as rules and regulations and traffic-tracking devices, will go a long way toward favoring growth over the projection period. For instance, the federal government of the United States established the Road to Zero effort to eliminate traffic fatalities by 2050. The National Safety Council created the project, which encourages the use of safe and modern services to reduce traffic deaths. Moreover, in India, the Ministry of Road Transport and Highways has also taken steps to improve road safety and reduce accidents on National Highways. Such initiatives are expected to drive the demand for barrier systems in the transportation sector during the forecast period.

Regional Insights

North America held the major share of 32.99% of the barrier systems industry in 2022. The regional growth can be attributed to the increase in economic activities, stringent Environmental, Health and Safety (EHS) regulations, increasing need for public security, and improvement in road infrastructure. In addition to this, the rapid expansion of the automobile industry and increased infrastructure spending, would hasten the growth of the regional barrier systems market. For instance, in May 2019, Delta Scientific, the U.S.-based a manufacturer of vehicle access control equipment, designed the self-contained MP5000 mobile development vehicle crash barriers. These barriers have a weight of 7.5-ton stopping powered at 64 kph. The vehicle barrier allows all variations of vehicles to pass through check points without any incident. Such developments in the region would further drive the market during the forecast period.

Europe is anticipated to emerge as the fastest-growing region over the forecast period at a CAGR of 7.5%.With the existence of multiple businesses indicating a strong regional presence as well as a substantial end customer base, the region would continue to contribute to overall market demand. The future of road safety is uncertain, and it is not the same in many locations around the world. Europe has a mature safety approach that focuses on proactive techniques. Further, the death rate from traffic accidents in Europe is lower than the global average, it differs greatly between countries. As a result, some countries are developing safety policies to reduce the probability of such fatalities. Road safety initiatives and guidelines will maintain the demand for road safety equipment in the European Union (EU) stable.

Key Players & Market Share Insights

The key players operating in the barrier systems market include Betafence, A-Safe; BOPLAN; Ritehite.; Fabenco by Tractel. and Lindsay Corporation to broaden their product offering, companies utilize a variety of inorganic growth tactics, such as regular mergers acquisitions, and partnerships. In January 2021, Betafence announced the partnership with Master Halco, a wholesale distributor of fence security solutions. Betafence labeled Master Halco as the North American élite Prism 3-D welded wire products supplier. Through this agreement, the firms aimed to provide customers with the best security solutions. Prominent players dominating the barrier systems market include:

-

A-Safe

-

BOPLAN

-

Ritehite

-

Fabenco by Tractel

-

Lindsay Corporation

-

Valmont Industries Inc.

-

Barrier1

-

Betafence

-

Gramm Barriers

-

Hill & Smith PLC

-

CAI Safety Systems, Inc.

-

Kirchdorfer Industries

-

Tata Steel

-

Arbus

-

Avon Barrier Corporation Ltd

Barrier Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.59 billion

Revenue forecast in 2030

USD 31.18 billion

Growth Rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Regional scope

North America, Europe, Asia Pacific, Middle East & Africa, Latin America

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, U.A.E., Saudi Arabia, South Africa

Segments covered

Type, function, access control device, material, end use

Key companies profiled

A-Safe; BOPLAN; Ritehite; Fabenco by Tractel; Lindsay Corporation; Valmont Industries Inc.; Barrier1; Betafence; Gramm Barriers; Hill & Smith PLC; CAI Safety Systems, Inc.; Kirchdorfer Industries; Tata Steel; Arbus; Avon Barrier Corporation Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barrier Systems Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the barrier systems market based on type, function, access control device, material, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bollards

-

Safety Fences

-

Safety Gates

-

Guardrails

-

Barriers for Machinery

-

Others

-

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Active Barriers

-

Passive Barriers

-

-

Access Control Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biometric Systems

-

Perimeter Security Systems & Alarms

-

Token & Reader Function

-

Turnstile

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metal

-

Non-metal

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Data Centers

-

Financial Institutions

-

Government

-

Industrial

-

Petrochemical

-

Military & Defense

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global barrier systems market size was estimated at USD 19.60 billion in 2022 and is expected to reach USD 20.59 billion in 2023.

b. The global barrier systems market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 31.18 billion by 2030.

b. North America dominated the barrier systems market with a share of 32.29% in 2022. This is attributable to shifting consumer preference for robust and durable building materials, such as fences.

b. Some key players operating in the barrier systems market include A-Safe, BOPLAN , Ritehite, Fabenco by Tractel, Lindsay Corporation , Valmont Industries Inc., Barrier1, Betafence, Gramm Barriers, Hill & Smith PLC, CAI Safety Systems, Inc., Kirchdorfer Industries, Tata Steel, Arbus , and Avon Barrier Corporation Ltd

b. The barrier systems market growth can be attributed to the increase in demand for several safety solutions, such as safety gates, crash barrier systems, and safety fences, among others, rapid expansion of construction and automotive industries, and rising awareness regarding road safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.