- Home

- »

- Communications Infrastructure

- »

-

Base Station Antenna Market Size, Industry Report, 2030GVR Report cover

![Base Station Antenna Market Size, Share & Trends Report]()

Base Station Antenna Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Services), By Technology (4G/LTE, 5G), By Provision (Urban, Rural), By Application (Mobile Communication, Military & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-090-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Base Station Antenna Market Summary

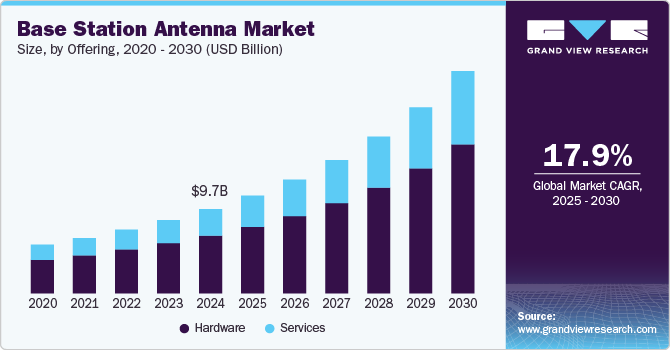

The global base station antenna market size was estimated at USD 9.71 billion in 2024 and is projected to reach USD 25.58 billion by 2030, growing at a CAGR of 17.9% from 2025 to 2030. The market growth can be attributed to the rising deployment of 5G networks, which drives the demand for advanced base station antennas capable of supporting the higher frequency bands and complex beamforming techniques associated with 5G technology.

Key Market Trends & Insights

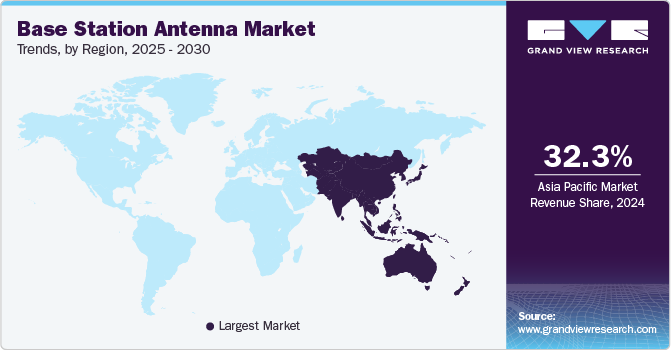

- The Asia Pacific base station antenna market accounted for 32.3% share of the overall market in 2024.

- Based on offering, the hardware segment accounted for the largest revenue share of 68.3% in 2024.

- Based on technology, the 4G/LTE segment held the largest revenue share in 2024.

- Based on provision, the urban segment dominated the market in 2024.

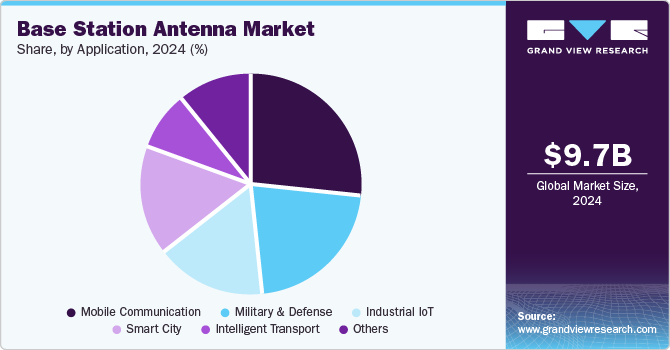

- Based on application, the mobile communication segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.71 Billion

- 2030 Projected Market USD 25.58 Billion

- CAGR (2025-2030): 17.9%

- Asia Pacific: Largest market in 2024

In addition, there is a growing emphasis on energy efficiency and sustainability, with the development of base station antennas that consume less power and integrate renewable energy sources. Furthermore, the rise of smart cities and IoT applications fuels the need for base station antennas that can handle the massive connectivity requirements of these interconnected system.

Several base station antenna solution providers across the globe are focusing on launching omnidirectional antennas for 5G networks with better connectivity. For instance, in May 2022, Pasternack Enterprises, Inc., a supplier of microwave and RF products, launched the newest line of omnidirectional outdoor antennas that support LTE, 4G, 5G, and CBRS bands. The new 5G omnidirectional antenna series provides range expansion and easy deployment for WLAN and cellular communications networks, as well as private networks. These collinear omnidirectional antennas with Type-N connections and low-cost polycarbonate or ABS choices are appropriate for SISO or MIMO operations.

5G networks rely on the massive MIMO technology, which utilizes a large number of antennas to increase capacity, enhance spectral efficiency, and improve network performance. Base station antennas with a high number of elements are being developed to support massive MIMO deployments, enabling the transmission and reception of multiple data streams simultaneously. Moreover, massive MIMO employs advanced beamforming techniques to create highly directional beams that can be steered towards specific users or areas. By focusing the signal energy towards the intended receiver and reducing interference in other directions, beamforming enhances signal quality, coverage, and overall network performance.

The increasing adoption of smartphones, coupled with the availability of high-speed mobile networks, has led to a surge in mobile data consumption. Users are increasingly relying on their mobile devices for various activities, including web browsing, social media, streaming media, online gaming, and app usage. The proliferation of data-intensive applications and content contributes to the continuous growth of mobile data traffic. Base station antennas play a critical role in expanding network capacity and coverage to accommodate the increasing data demands. The exponential growth in mobile data traffic, fueled by the rising adoption of smartphones, tablets, and other connected devices, is also driving the need for enhanced wireless communication infrastructure, thereby driving growth of the base station antenna industry.

The integration of AI and machine learning capabilities in IoT devices, enabling autonomous operation, predictive analytics, and intelligent automation is a significant factor contributing to the growth of the market. IoT devices are becoming more energy-efficient, with advancements in low-power wireless technologies, allowing for longer battery life and sustainable operation. Additionally, there is a growing emphasis on data security and privacy in IoT devices, with the integration of robust encryption, authentication, and access control mechanisms. These emerging trends in IoT devices for the base station antenna market are driving the development of advanced base station antenna solutions to support the increasing connectivity needs, data traffic, and seamless integration of IoT devices into wireless networks.

Offering Insights

Hardware segment accounted for the largest revenue share of 68.3% in 2024. The development of advanced antenna designs and technologies to meet the growing demands of 5G networks is a significant factor contributing to segment growth. This includes the use of Massive MIMO (Multiple Input Multiple Output) technology, which involves deploying antenna arrays with a large number of elements to increase capacity, enhance spectral efficiency, and improve network performance. At the same time, the integration of beamforming capabilities in base station antennas is also contributing to the segment growth. Beamforming allows for the precise targeting of wireless signals, optimizing coverage and capacity by focusing the transmission toward specific user locations. Moreover, there is a growing focus on compact and lightweight antenna designs to facilitate easier installation and reduce tower load.

The services segment is expected to grow at a significant CAGR from 2025 to 2030. The growth of the segment is attributed to the increasing demand for installation and deployment services. As network operators strive to expand their coverage and upgrade their infrastructure, there is a growing need for professional services to ensure the proper installation and integration of base station antennas. This includes site surveys, antenna installation, testing, and optimization services. Moreover, network operators are also seeking external expertise to manage their antenna systems, including monitoring, maintenance, and performance optimization. Managed service providers offer proactive monitoring, troubleshooting, and network management to ensure optimal performance and reliability of base station antennas.

Technology Insights

The 4G/LTE segment held the largest revenue share in 2024. The increasing demand for higher frequencies and wider bandwidths to accommodate the ever-growing data traffic is a significant factor contributing to the growth of the segment. Many regions and areas still rely heavily on 4G networks for wireless communication, and hence base station antennas supporting 4G/LTE are essential for providing reliable and high-speed connectivity to users. As users consume more bandwidth-intensive applications and services, there is a need for advanced base station antennas capable of handling the increased capacity requirements. In addition, the deployment of small cell solutions to enhance coverage and capacity in densely populated urban areas is fueling growth of the industry.

The 5G segment is expected to register the fastest CAGR from 2025 to 2030. The adoption of Massive MIMO (Multiple Input Multiple Output) technology in 5G base station antennas is a major factor contributing to the segment growth. At the same time, the development of mmWave (millimeter-wave) base station antennas to accommodate the higher frequencies utilized in 5G networks is contributing to the growth of the segment. These antennas operate in the millimeter-wave spectrum and provide substantially higher data throughput and reduced latency.

Provision Insights

The urban segment dominated the market in 2024. Increasing deployment of small cell solutions in urban areas is a major factor contributing to the growth of the segment. Small cells, including microcells and picocells, are being installed in dense urban environments to enhance network coverage and capacity. These compact base station antennas help address the high data demand in urban centers by offloading traffic from macrocell networks and providing localized coverage, improving network performance and user experience. Additionally, with the rise of smart cities and the Internet of Things (IoT), there is an increasing demand for base station antennas that support a wide range of wireless communication technologies and frequencies.

The rural provision is projected to grow at a significant CAGR from 2025 to 2030. One significant trend is the increasing deployment of long-range base station antennas in rural areas to improve coverage and connectivity. These antennas have higher gain and longer reach, enabling network operators to extend their network coverage to underserved rural regions. Another emerging trend is the utilization of innovative technologies like Fixed Wireless Access (FWA) and satellite-based solutions to bridge the connectivity gap in remote rural areas. Base station antennas are being designed and deployed specifically for FWA and satellite communications, providing high-speed internet access to areas where traditional wired infrastructure is not feasible. Moreover, the growing focus on energy-efficient base station antennas in rural environments drives growth of the base station antenna industry.

Application Insights

The mobile communication segment dominated the market in 2024. The rapid expansion of 5G networks and the corresponding demand for advanced base station antennas to support the increased data speeds and capacity requirements is a significant factor contributing to the segment growth. As 5G technology continues to roll out globally, there is a growing need for Massive MIMO (Multiple Input Multiple Output) antennas that can handle the high-frequency bands and enable beamforming to enhance network performance and user experience. With the proliferation of Internet of Things (IoT) devices and the coexistence of different generations of mobile networks, antennas are being developed to support multi-band and multi-technology deployments, enabling seamless connectivity and efficient spectrum utilization.

Military & defense is projected to grow at a significant CAGR from 2025 to 2030. The growing need for rugged and durable base station antennas that can resist tough settings and function in extreme situations is a crucial element driving the segment's growth. Military and defense applications frequently necessitate antennas that are robust to stress, vibration, and environmental conditions such as moisture, dust, and temperature changes. Another rising trend is the use of upgraded antenna technology to boost communication capabilities. This involves the use of high-gain antennas, beamforming, and electrically steerable arrays to improve signal range, directionality, and anti-jamming capabilities. Furthermore, there is an increasing emphasis on the integration of secure communication protocols and encryption techniques to safeguard critical military and defense communications from illegal access or surveillance.

Regional Insights

The North America base station antenna market held a significant revenue share in 2024. North America, particularly the U.S., is at the forefront of 5G technology adoption, fueling demand for sophisticated base station antennas capable of supporting high-frequency bands and advanced 5G network capabilities like beamforming and Massive MIMO. With data traffic growing at an exponential rate, network operators are looking for novel solutions to increase network performance, boost coverage, and provide high-speed access. This is encouraging the development of technologies like small cells, and carrier aggregation, which necessitate the use of specialized base station antennas for effective and reliable deployment.

U.S. Base Station Antenna Market Trends

The U.S. base station antenna market held a dominant position in 2024. The deployment of advanced technologies, such as 5G, is a significant factor driving the demand for base station antennas. The transition to 5G networks requires a denser network infrastructure with more base stations and antennas to support the higher data speeds and lower latency than 5G promises. As the U.S. continues to invest in and roll out 5G networks, the demand for specialized antennas that can handle the unique requirements of this technology is on the rise.

Europe Base Station Antenna Market Trends

The Europe base station antenna industry was identified as a lucrative region in 2024. Europe's commitment to sustainable and environmentally friendly practices contributes to the demand for base station antennas designed with energy efficiency in mind. As part of efforts to reduce the carbon footprint of telecommunication networks, there is a push for energy-efficient antennas and infrastructure. This includes the development and deployment of base station antennas that optimize power consumption without compromising performance, aligning with the region's focus on green technology and sustainable solutions.

The base station antenna market in the UK is expected to grow rapidly in the coming years due to advent of 5G technology in the UK. 5G promises faster data speeds and enhances capabilities such as massive device connectivity and ultra-low latency, making it essential to upgrade existing network infrastructure. Base station antennas designed for 5G networks need to support higher frequency bands and accommodate advanced technologies, such as beamforming and massive MIMO, enabling network operators to unlock the full potential of 5G and deliver enhanced user experiences.

Asia Pacific Base Station Antenna Industry Trends

The Asia Pacific base station antenna market accounted for 32.3% share of the overall market in 2024. The growth in the region is attributed to the rapid deployment of 5G networks in recent years. The presence of several regional manufacturers, such as Huawei and ZTE Corporation, has been central to this growth.

The base station antenna market in Japan is expected to grow rapidly in the coming years owing to the growing adoption of small-cell deployments to address urban densification challenges. For instance, SoftBank has been deploying compact and energy-efficient BSAs in metropolitan areas such as Tokyo. In addition, the collaborations between telecom operators and equipment providers, are fueling growth of the base station antenna industry in Japan.

China base station antenna market held a substantial revenue share in 2024 owing to the rapid evolution of 5G technology. The country is experiencing a surge in the deployment of smart base station antennas that leverage artificial intelligence for real-time optimization, exemplified by projects like China Mobile's 5G City initiative. In addition, there has been a notable rise in demand for compact and energy-efficient antennas to meet urban deployment challenges. Such trends in the market are expected to fuel growth of the base station antenna industry in the country.

Key Base Station Antenna Company Insights

Some key companies in the industry include Huawei Technologies Co., Ltd., Amphenol Antenna Solutions, PCTEL, Inc., Telefonaktiebolaget LM Ericsson, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Huawei Technologies Co., Ltd. is a provider of information and communications technology (ICT) solutions with a focus on telecommunications infrastructure, including base station antennas. It offers a comprehensive range of products and services that cater to mobile network operators and enterprises. The company’s base station antenna offerings are integral to its extensive portfolio, designed to support various network configurations such as 4G and 5G. These antennas are engineered for high performance, enabling efficient signal transmission and reception while optimizing coverage and capacity.

-

Amphenol Antenna Solutions is a division of Amphenol Corporation, specializing in the design and manufacturing of high-performance antennas for wireless communication networks. With a strong focus on base station antenna offerings, Amphenol provides a comprehensive range of solutions that cater to various applications, including Base Transceiver Station (BTS) and Small Cell antennas for macro, indoor distributed antenna systems (iDAS), and outdoor distributed antenna systems (oDAS).

Key Base Station Antenna Companies:

The following are the leading companies in the base station antenna market. These companies collectively hold the largest market share and dictate industry trends.

- CommScope Holding Company, Inc.

- Huawei Technologies Co., Ltd.

- Amphenol Antenna Solutions

- ACE Technologies Corp.

- Comba Telecom Systems Holdings Ltd.

- PCTEL, Inc.

- Tongyu Communication Inc.

- Radio Frequency Systems (RFS)

- Telefonaktiebolaget LM Ericsson

- Kaelus

Recent Developments

-

In October 2023, Huawei Technologies Co., Ltd. launched new base stations for the Future Railway Mobile Communications System (FRMCS) to advance intelligence in the global railway industry by providing a next-generation wireless communication solution that delivers enhanced bandwidth, low latency, high security, and high reliability. FRMCS enables real-time data transmission between trains and the control center, facilitating precise train control, efficient traffic management, and enhanced safety.

-

In May 2023, Telefonaktiebolaget LM Ericsson partnered with KDDI to deploy Japan's first underground 5G base stations, utilizing innovative sub-terrain antennas to provide robust connectivity while preserving the aesthetic appeal of urban environments.

Base Station Antenna Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.24 billion

Revenue forecast in 2030

USD 25.58 billion

Growth rate

CAGR of 17.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, technology, provision, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

CommScope Holding Company, Inc.; Huawei Technologies Co., Ltd.; Amphenol Antenna Solutions; ACE Technologies Corp.; Comba Telecom Systems Holdings Ltd.; PCTEL, Inc.; Tongyu Communication Inc.; Radio Frequency Systems (RFS); Telefonaktiebolaget LM Ericsson; Kaelus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Base Station Antenna Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global base station antenna market report based on offering, technology, provision, application and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Omni-Directional Antenna

-

Sector Antenna

-

Multibeam Antenna

-

Dipole Antenna

-

Small Cell

-

Others

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

3G

-

4G/LTE

-

5G

-

-

Provision Outlook (Revenue, USD Million, 2018 - 2030)

-

Urban

-

Semi-Urban

-

Rural

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Communication

-

Intelligent Transport

-

Industrial IoT

-

Smart City

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global base station antenna market was estimated at USD 9.71 billion in 2024 and is expected to reach USD 11.24 billion in 2025.

b. The global base station antenna market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2030 and is expected to reach USD 25.58 billion by 2030.

b. The Asia Pacific dominated the base station antenna market with a share of 32.3% in 2024. Countries in the Asia Pacific region, such as China, South Korea, and Japan, are at the forefront of 5G adoption, driving the demand for advanced base station antennas that can support the high-frequency bands and enable the ultra-fast speeds and low latency offered by 5G technology.

b. Some of the key players in the market are CommScope Holding Company, Inc.; Huawei Technologies Co., Ltd.; Amphenol Antenna Solutions; ACE Technologies Corp.; Comba Telecom Systems Holdings Ltd.; PCTEL Inc; Tongyu Communication Inc.; Radio Frequency Systems (RFS); Telefonaktiebolaget LM Ericsson and Kaelus.

b. The market growth can be attributed to the rising deployment of 5G networks, which drives the demand for advanced base station antennas capable of supporting the higher frequency bands and complex beamforming techniques associated with 5G technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.