- Home

- »

- Next Generation Technologies

- »

-

Beauty Tech Market Size And Share, Industry Report, 2030GVR Report cover

![Beauty Tech Market Size, Share & Trends Report]()

Beauty Tech Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Artificial Intelligence (AI), Augmented Reality (AR)), By Product Category (Skincare Devices, Cosmetics), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-547-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Beauty Tech Market Summary

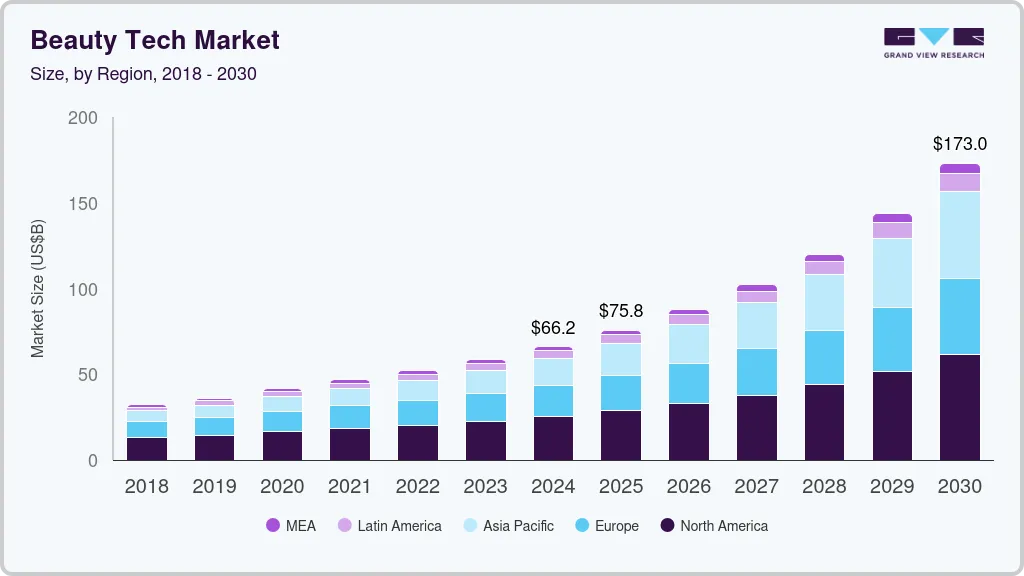

The global beauty tech market size was estimated at USD 66.16 billion in 2024 and is projected to reach USD 172.99 billion by 2030, growing at a CAGR of 17.9% from 2025 to 2030.Growth of the beauty tech industry is driven by technological advancements, shifting consumer preferences, and the increasing demand for personalized beauty solutions.

Key Market Trends & Insights

- The beauty tech industry in North America held the largest revenue share of over 38.0% in 2024.

- The beauty tech industry in the U.S. is expected to grow significantly at a CAGR of 16.0% from 2025 to 2030.

- By product category, the skincare devices segment dominated the market and accounted for a revenue share of over 38.0% in 2024.

- By technology, artificial intelligence is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 66.16 Billion

- 2030 Projected Market Size: USD 172.99 Billion

- CAGR (2025-2030): 17.9%

- North America: Largest market in 2024

As beauty brands integrate AI, AR, and IoT into their offerings, the market is evolving rapidly, providing enhanced user experiences and innovative product developments.

Another major factor propelling market growth is the rise of smart beauty devices. IoT-enabled skincare and haircare tools provide real-time tracking and personalized recommendations. Devices such as smart facial cleansers, at-home LED therapy masks, and connected hair dryers are integrating AI to optimize skincare routines. Brands like Foreo, Dyson, and NuFace have introduced smart gadgets that monitor users' skin conditions and adjust treatments accordingly, creating a new era of intelligent beauty solutions.

The growing emphasis on sustainability and clean beauty is also a significant growth driver of the beauty tech industry. Consumers are becoming increasingly aware of ethical and environmental concerns, pushing beauty brands to adopt technology-driven sustainable practices. AI-based ingredient analysis ensures safer formulations, while smart refillable packaging minimizes waste. Companies are also using blockchain and digital transparency tools to verify ethical sourcing, further boosting consumer trust in clean beauty brands.

The rapid growth of e-commerce and digital transformation is accelerating beauty tech adoption. AI-powered virtual consultations, chatbots, and recommendation engines provide customers with highly tailored product suggestions. Beauty brands are leveraging big data and machine learning to enhance online shopping experiences, improving conversion rates and customer retention. Digital beauty platforms are also expanding into social commerce, where influencers and AI-generated content drive engagement and purchases.

The integration of biotechnology in beauty is enabling the development of more effective and customized skincare solutions. AI-powered analysis of genetic data, microbiome research, and biomimetic ingredients are allowing brands to create skincare products tailored to individual needs. Companies are now leveraging biotech to develop lab-grown ingredients, cruelty-free alternatives, and enhanced anti-aging formulations, driving demand for high-performance skincare.

Technology Insights

The artificial intelligence (AI) dominated the market and accounted for a revenue share of over 34.0% in 2024 owing to personalization, virtual try-ons, and advancements in AI-powered skin analysis. Consumers are increasingly seeking tailored beauty solutions, and AI-driven personalization plays a crucial role in offering customized skincare and makeup recommendations. By analyzing data from user inputs, such as skin type, concerns, and preferences, AI algorithms can suggest the most suitable products, enhancing customer satisfaction and engagement. This level of customization is particularly appealing to millennials and Gen Z consumers, who prefer tech-driven and data-backed beauty solutions.

The augmented reality (AR) segment is anticipated to grow at a CAGR of 19.9% during the forecast period, driven by increasing consumer demand for interactive and immersive shopping experiences. Beauty brands are leveraging AR technology to allow consumers to test makeup products, such as lipsticks, eyeshadows, and foundations, in real time using their smartphones, tablets, or smart mirrors. This enhances the online shopping experience by reducing uncertainty in product selection, increasing consumer confidence, and ultimately driving higher conversion rates for beauty brands.

Product Category Insights

The skincare devices segment dominated the market and accounted for a revenue share of over 38.0% in 2024, driven by increasing consumer demand for high-tech, at-home skincare solutions. One of the primary growth drivers is the rising awareness of skin health and personalized skincare routines. Consumers are looking for advanced tools that provide professional-grade skincare treatments at home, reducing their dependence on salons and dermatologists. The skincare devices segment is further segmented into acne devices, cleansing, rejuvenation, anti-aging devices, and others.

The cosmetics segment is expected to grow at a significant CAGR over the forecast period. Voice-enabled and AI-powered beauty assistants are enhancing the cosmetics shopping experience, both online and in physical stores. Virtual assistants can analyze customer preferences, recommend makeup routines, and provide step-by-step tutorials through smart devices, making beauty routines more interactive and engaging. The skincare devices segment is further segmented into smart makeup tools, virtual makeup try-ons, and others.

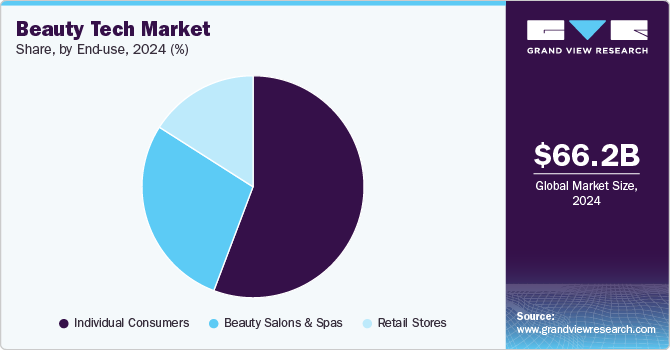

End User Insights

The individual consumers segment dominated the market and accounted for a revenue share of nearly 56.0% in 2024. The growing popularity of at-home beauty tech devices is also contributing to market expansion. With the rise of self-care and wellness trends, consumers are investing in AI-powered skincare tools, LED therapy masks, microcurrent devices, and smart cleansing brushes to achieve salon-quality results at home. These innovations cater to the increasing demand for convenient, cost-effective, and high-tech beauty treatments without the need for professional appointments.

The beauty salons and spas segment is expected to grow at a significant CAGR over the forecast period. The growing impact of beauty influencers and digital content creators is accelerating the adoption of beauty tech innovations. Many salons and spas are investing in AI-powered content creation tools, AR beauty filters, and interactive virtual consultation platforms to engage customers on social media and attract a tech-savvy audience.

Regional Insights

The beauty tech industry in North America held the largest revenue share of over 38.0% in 2024 due to the increasing adoption of AI and AR technologies by major beauty brands. Companies such as L’Oréal, Estée Lauder, and Sephora have invested heavily in AI-powered skin analysis tools and AR-based virtual try-on applications. These technologies enhance customer engagement by allowing users to try products virtually before making a purchase, thereby reducing return rates and increasing customer confidence.

U.S. Beauty Tech Market Trends

The beauty tech industry in the U.S. is expected to grow significantly at a CAGR of 16.0% from 2025 to 2030. The rise of social commerce and influencer marketing is driving digital beauty adoption as brands use data analytics to track trends and consumer behavior. The increasing emphasis on clean beauty and sustainability is also pushing companies to adopt AI-driven ingredient transparency tools. Moreover, the growth of e-commerce and direct-to-consumer (DTC) brands is accelerating the adoption of personalized beauty solutions.

Europe Beauty Tech Market Trends

The Europe beauty tech industry is anticipated to register considerable CAGR from 2025 to 2030.Europe’s market is witnessing growth due to the increasing adoption of AR and AI for virtual consultations and personalized product recommendations. The region's strong presence of luxury beauty brands and heightened consumer interest in premium beauty experiences further drive the market. Sustainability initiatives and regulations promoting eco-friendly beauty technologies are also fostering growth.

The UK beauty tech market is expected to grow rapidly in the coming years. In the UK, the beauty tech market is supported by the growing popularity of online beauty retail and e-commerce platforms offering AI-powered personalized experiences. The integration of AR for virtual try-ons and digital beauty consultations is enhancing customer engagement. Moreover, collaborations between beauty brands and tech startups are contributing to market expansion.

The beauty tech market in Germany held a substantial market share in 2024. The country’s robust research and development (R&D) landscape supports innovations in cosmetic technology, leading to the introduction of advanced at-home beauty devices. Additionally, the emphasis on sustainability and clean beauty products, often integrated with tech-enabled transparency solutions, further propels market growth.

Asia Pacific Beauty Tech Market Trends

Asia Pacific beauty tech industry is expected to register the fastest CAGR of 21.8% from 2025 to 2030. The proliferation of smartphone apps for virtual beauty experiences, coupled with the integration of AI and big data analytics for hyper-personalization, is propelling the market. Additionally, the increasing adoption of wearable skincare and haircare devices is a significant growth factor.

The Japan beauty tech market is expected to grow rapidly in the coming years. In Japan, the market is fueled by the country's advanced technological landscape and consumer preference for high-quality skincare solutions. The use of AI-powered beauty diagnostics and smart skincare devices is prevalent. Japanese beauty brands are also leveraging robotics and sensor technologies for personalized beauty treatments, driving market growth.

The beauty tech market in China held a substantial market share in 2024, driven by the booming e-commerce sector and the widespread use of social media platforms for beauty product marketing. AI-powered virtual try-on tools and live-streaming shopping experiences are increasingly popular. Additionally, the growing demand for smart skincare devices and customized beauty solutions is supporting market expansion, particularly among tech-savvy younger consumers.

Key Beauty Tech Company Insights

Key players operating in the beauty tech industry are L'Oreal S.A.; Estée Lauder Companies Inc.; Unilever PLC; Procter & Gamble Co.; and Shiseido. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

- In January 2025, Estée Lauder Companies Inc. announced a partnership with Exuud Inc. a U.S.-based platform specializing in fragrance technology, to create a smart fragrance expression platform, set to redefine olfactive innovation. As part of the agreement, ELC has invested in Exuud, recognizing the potential of its patented Soliqaire technology. This advanced fragrance delivery system allows users to customize their scent experience by adjusting intensity, duration, and frequency for a more consistent and personalized application. By blending technological innovation with luxury craftsmanship, the collaboration aims to revolutionize how consumers engage with fragrances.

- In May 2024, L’Oréal S.A., made advancements in beauty tech with a series of innovations, including bioprinted skin technology and a GenAI-powered content lab to enhance creativity. The company introduced AI-driven skin and hair diagnostics, a personal beauty assistant powered by generative AI, and CREAITECH, a specialized lab focused on transforming beauty content creation. Additionally, L’Oréal unveiled an infrared light-based hair dryer, a micro-resurfacing skincare device for enhanced performance, and an ultra-realistic human skin technology platform for scientific research and product testing, reinforcing its commitment to tech-driven beauty advancements.

Key Beauty Tech Companies:

The following are the leading companies in the beauty tech market. These companies collectively hold the largest market share and dictate industry trends.

- Amorepacific Corporation

- Avon Products, Inc.

- Dyson

- Johnson & Johnson

- Kao Corporation

- L'Oreal S.A.

- Mary Kay Inc.

- Oriflame Holding AG

- Panasonic

- Procter & Gamble Co.

- Revlon, Inc.

- Sephora (LVMH subsidiary)

- The Estee Lauder Companies Inc.

- Shiseido

- Unilever PLC

Beauty Tech Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 75.79 billion

Revenue forecast in 2030

USD 172.99 billion

Growth rate

CAGR of 17.9% from 2025 to 2030

Actual data

2018 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technology, product category, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amorepacific Corporation; Avon Products, Inc.; Dyson; Johnson & Johnson; Kao Corporation; L'Oreal S.A.; Mary Kay Inc.; Oriflame Holding AG; Panasonic; Procter & Gamble Co.; Revlon, Inc.; Sephora (LVMH subsidiary); The Estee Lauder Companies Inc.; Shiseido; Unilever PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beauty Tech Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the beauty tech market report based on technology, product category, end user, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Artificial Intelligence (AI)

-

Augmented Reality (AR)

-

Wearable Technology

-

Others

-

-

Product Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skincare Devices

-

Acne Devices

-

Cleansing

-

Rejuvenation

-

Anti-Aging Devices

-

Others

-

-

Hair Care Devices

-

Hair growth

-

Hair removal

-

Smart Hair Dryers

-

LED Hair Treatment Devices

-

-

Cosmetics

-

Smart Makeup Tools

-

Virtual Makeup Try-On

-

Others

-

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individual Consumers

-

Beauty Salons and Spas

-

Retail Stores

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beauty tech market size was estimated at USD 66.17 billion in 2024 and is expected to reach USD 75.79 billion in 2025.

b. The global beauty tech market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2030 to reach USD 172.99 billion by 2030.

b. The beauty tech market in North America held the largest share of over 38.0% in 2024 due to the increasing adoption of AI and AR technologies by major beauty brands. Companies such as L’Oréal, Estée Lauder, and Sephora have invested heavily in AI-powered skin analysis tools and AR-based virtual try-on applications.

b. Some key players operating in the beauty tech market include Amorepacific Corporation, Avon Products, Inc., Dyson, Johnson & Johnson, Kao Corporation, L'Oreal S.A., Mary Kay Inc., Oriflame Holding AG, Panasonic, Procter & Gamble Co., Revlon, Inc., Sephora (LVMH subsidiary), The Estee Lauder Companies Inc., Shiseido, Unilever PLC

b. The beauty tech market is driven by technological advancements, shifting consumer preferences, and the increasing demand for personalized beauty solutions. As beauty brands integrate AI, AR, and IoT into their offerings, the market is evolving rapidly, providing enhanced user experiences and innovative product developments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.